Bank Of America Corp.

Investment bank and financial services company Bank of America was founded in San Francisco in 1922 and was acquired in 1998 by NationsBank of Charlotte, where it is headquartered today. It is the second-largest banking institution in the United States, preceded only by JPMorgan Chase, and is the eighth-largest bank in the world.

In January 2009, BoA received $20 billion and a guarantee of $118 billion in potential losses from the U.S. government through the Troubled Asset Relief Program, in addition to the $25 billion it received in 2008 from TARP. Bank of America repaid the entire $45 billion it received in December 2009.

In 2018, Bank of America has a market cap of $313.5 billion and currently employs over 200,000 people.

Location: Charlotte, NC

Industry: Major International Banks

Sector: Financial Services

Traded on: NYSE

CEO: Brian Moynihan

Valuation: $449 billion

Latest Bank Of America Corp. News and Updates

Bank of America Text Message Scams Are on the Rise – How to Spot Them

If you received a text message from Bank of America alerting you of a recent transfer or that your account has been locked, it could be a scam.

Was Bank of America Hacked? Scam Signs to Watch Out For

Bank of America customers may worry about hackers, as they often target bank customers. Did Bank of America get hacked? Rumors have been going around.

Bank of America’s No Down Payment Mortgage Program, Explained

Bank of America is testing a new program that grants mortgages with no down payment for some people of color. Here’s how it works.

Anne Finucane Retiring as Bank of America’s Vice Chair

What’s Anne Finucane’s net worth? Learn more about the Bank of America executive. She's stepping down as the bank’s vice chair at the end of 2021.

Bank of America Picks Three EV Supplier Stocks to Play the EV Theme

Investors are still excited about the shift to EVs in the long-term despite a pullback in EV names in 2021. Bank of America offers picks to play this theme.

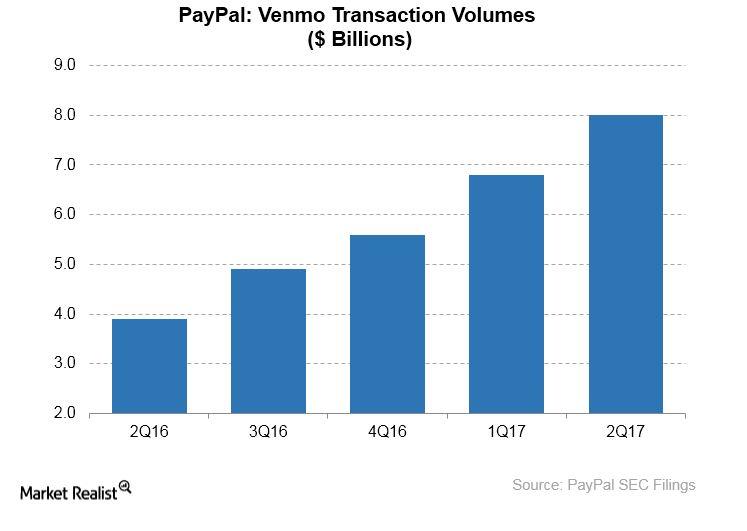

Why BTIG Is Bullish on PayPal

PayPal (PYPL) could have bright prospects despite the competitive threat it faces from Square and Apple in the online payment market, according to equity research firm BTIG.

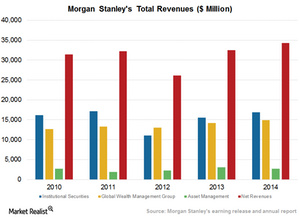

Morgan Stanley’s Strong Revenue Model

Morgan Stanley charges fixed fees and performance fees for asset management services, products and services, and administration of accounts.

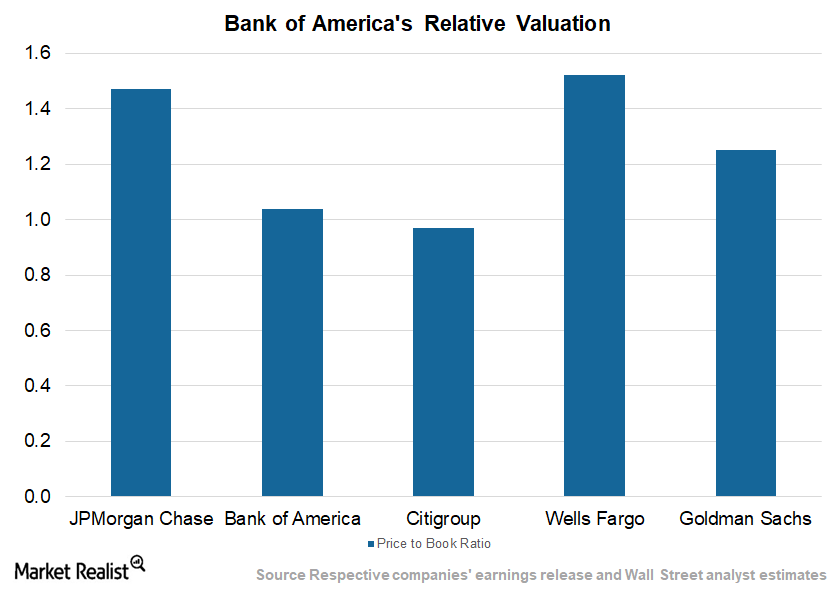

What Goldman Sachs Thinks about Bank of America

Bank of America (BAC) is currently trading at $25.26. Its 52-week high is $25.80 and 52-week low is $12.05.

Why JPMorgan and Wells Fargo Are Trading at High Multiples

In spite of a rather weak performance, Wells Fargo (WFC) commands the highest premium due to its strong franchise, mortgage concentration, and high net interest margins.Financials Why Wells Fargo leads in loans

The bank has always focused on its bread and butter revenue-earning stream: loans. Over the years, Wells Fargo slowly realized its goal of achieving a strong market share in lending.

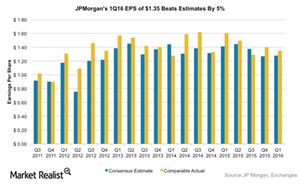

JPMorgan Chase Gained 4% after Its 1Q16 Earnings: Was It That Good?

On April 13, JPMorgan Chase reported 1Q16 earnings of $1.35 per share. It beat consensus estimates of $1.28. Its shares rallied 4.2% after the earnings beat.

US Banking Sector: Key Trends and Outlook

Changes in technology have reshaped the banking sector. Banks are increasingly collaborating with fintech firms to improve their customer service.Financials Why Wells Fargo has the highest net interest margin

Maintaining a high net interest margin has always been part of Wells Fargo’s (WFC) strategy. Wells Fargo has consistently been better than the industry’s average net interest margin.

BofA Cut Boeing Target Price Due to Rising MAX Uncertainty

On Monday, Bank of America analyst Ronald Epstein lowered his target price on Boeing stock by $10 to $360. However, he maintained his “neutral” rating.

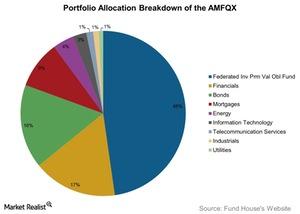

AMFQX: More Than 60% Exposure to Derivative Securities

AMFQX is an alternative mutual fund that seeks to generate positive absolute returns with a low correlation to the returns of broad stock and bond markets.

Paul Singer Increased His Holdings in NXP Semiconductor in 3Q17

Paul Singer, the CEO of Elliott Management, increased his holdings in NXP Semiconductor (NXPI) in 3Q17, according to a recent 13F filing report.Financials Must-know: Is Wells Fargo making boring attractive for investors?

Wells Fargo’s (WFC) broad operation level strategy over the long run can be described by two words—slow and steady. It doesn’t take many risks. It’s stable and boring.

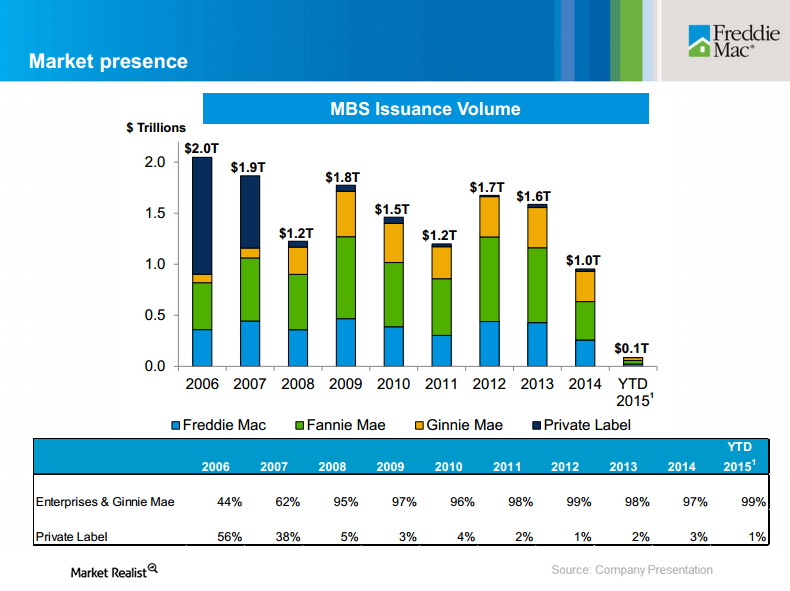

An Update on Fairholme’s Positions in Fannie Mae and Freddie Mac

Berkowitz believes that Fannie Mae and Freddie Mac entities are highly valuable and expects them to generate earnings of at least~$21 billion a year.

Morgan Stanley and Goldman have bigger bond exposure than Bank of America and Citi

Bond underwriting exposure could be risky for investment banking departments, as interest rates begin to rise and refinancing slows.

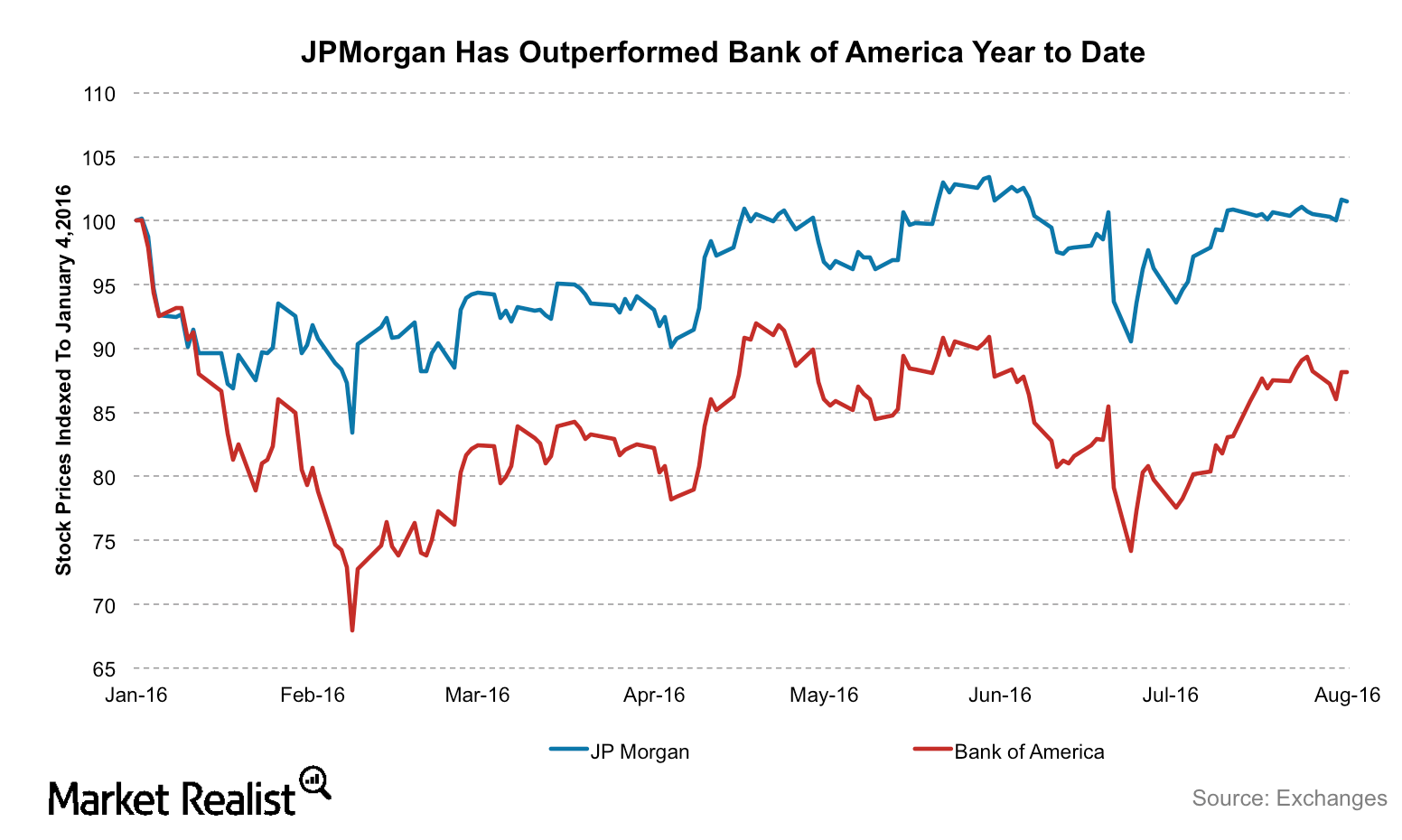

Why Deutsche Bank Prefers Bank of America over J.P. Morgan

In this series, we’ll compare Bank of America and J.P. Morgan on the basis of their 2Q earnings, profitability, cost-cutting initiatives, and interest rate sensitivities.Financials Why low funding cost is an advantage for Wells Fargo

If a bank is able to keep its cost of deposits low, it will have a competitive advantage. Wells Fargo has the lowest cost of deposits among its peers—despite having a very high deposit base.

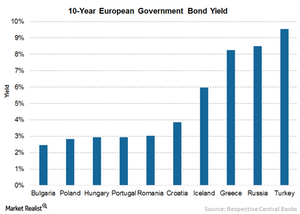

Why Does Fixed Income Look Promising?

Under the current uncertain economic circumstances, investors searching for higher yield might turn to fixed income.Financials Why Wells Fargo focuses on non-interest income

Wells Fargo wants to maintain a balance between its interest income from loans and non-interest income. Non-interest income accounts for nearly 49% of Wells Fargo’s revenues.Financials Why cross-selling is part of Wells Fargo’s strategy

Wells Fargo’s (WFC) first, and possibly the most important, operational strategy is focusing on cross-selling. It’s the most important pillar of its operational strategy.

Understanding Banks’ Market and Reputational Risks

All banks face risks. Two key areas to understand are banks’ market risk and reputational risk. Here’s a summary of each type.Financials Why Wells Fargo uses human resources as a strategic tool

Wells Fargo (WFC) believes that people are a competitive advantage source. Integrating sound human resource practices lies at the core of Wells Fargo’s strategy.

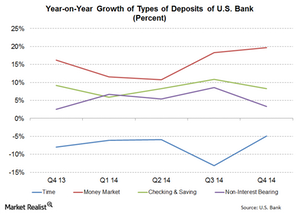

Low-cost deposit growth is a key strength for U.S. Bank

U.S. Bank does well in increasing its low-cost deposit base. In 4Q14, money market deposits grew the fastest at 19.7%—compared to 4Q13.

Is Bank of America Going Out of Business?

Many businesses have closed due to uncertainty amid the COVID-19 pandemic. Even financial mainstays like Bank of America have been feeling the pressure.

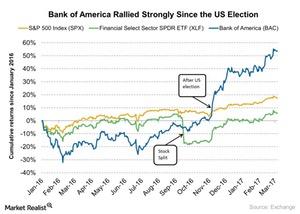

Bank of America and Wells Fargo: Comparing Interest Rate Exposure

Since Donald Trump’s presidential victory, Wall Street analysts have raised their forecasts for the major banks’ (XLF) net interest margins as they anticipate rising interest rates and economic growth.

How to Make Money with Dividend Investing

If you’re an income investor, I’ve got a strategy for you. Dividend investing is a time-tested way to grow your account over the long haul.

Is It Pointless to Look at Big Banks’ Q1 Earnings?

JPMorgan Chase will announce its first-quarter results before the markets open on April 14. Analysts expect the bank to post revenues of $29.7 billion.

Was 2019 a “Nightmare” for Warren Buffett and Berkshire?

Warren Buffett underperformed the stock markets last year. Berkshire Hathaway’s returns versus the S&P 500 were the worst since 2009.

Goldman Sachs’ Best Stock Picks for 2020

Strategists at Goldman Sachs (GS) project Netflix (NFLX), T-Mobile (TMUS), and Coca-Cola (KO) to be among the best stock picks for 2020.

Ray Dalio, the Role of Credit, and the Economic Machine

Credit is the most important part of the economy, leading to increased spending, increased income levels, higher GDP, and faster productivity growth.

What Berkshire Hathaway Really Does, Says Buffett

Berkshire Hathaway is a huge conglomerate with diverse operations. The company’s operations are complex, so let’s take an easy-to-understand approach.

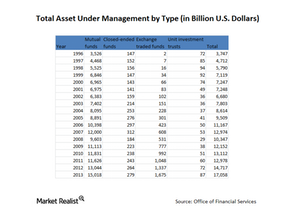

How big is the asset management industry?

Audited and verified annual figures at the end of 2013 indicate that total assets under management of US registered investment companies equalled nearly $17.1 trillion.

Citigroup globally established in emerging markets

Citigroup’s exposure in emerging markets is mainly to investment-grade global multinationals through its institutional businesses.Financials How close is the FOMC to achieving its dual mandate?

We’ve talked about the dual mandate and factors constraining the Federal Reserve from achieving this mandate. Let’s now assess how close the Fed has come to achieving its macroeconomic objectives.

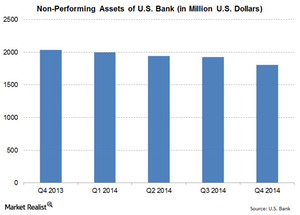

U.S. Bank’s non-performing assets declined in 4Q14

U.S. Bank’s (USB) non-performing assets were $1,808 million at the end of 4Q14. The ratio declined by 11.24%—compared to 4Q13.

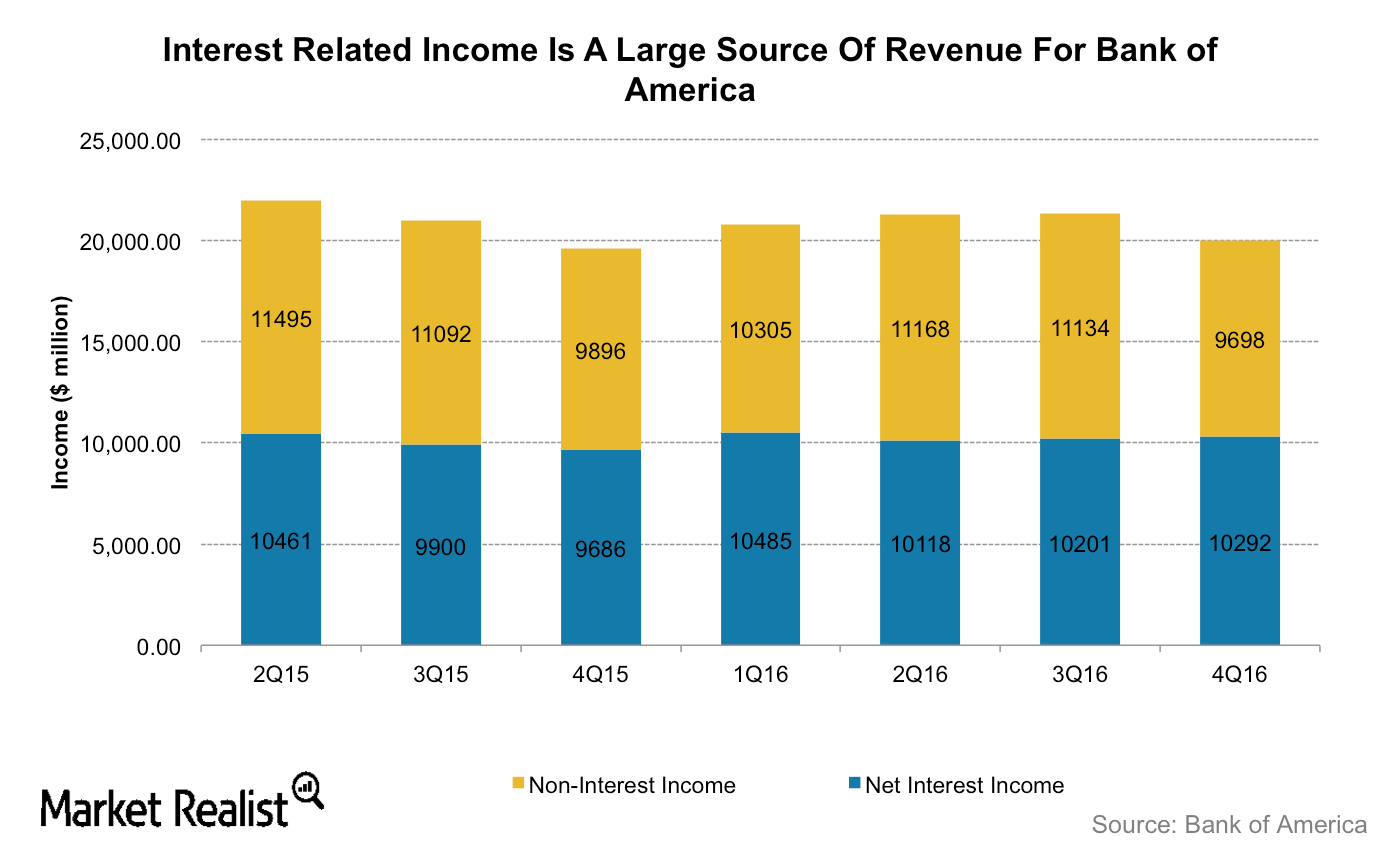

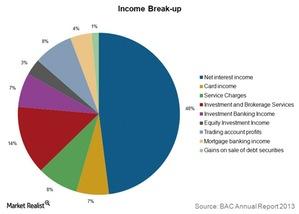

How does Bank of America make money?

Net interest income contributes about half of Bank of America’s total income. Investment and brokerage services contribute the most to noninterest income.

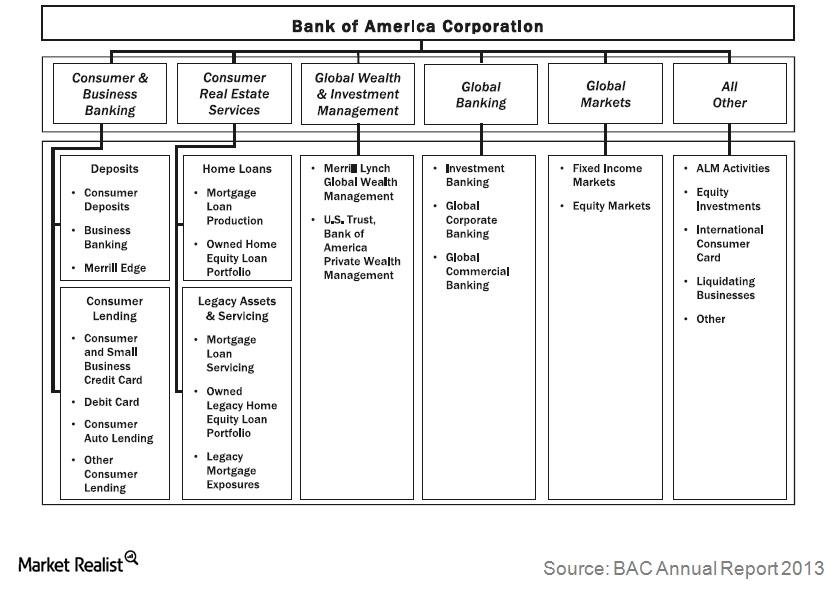

Bank of America’s six operating segments

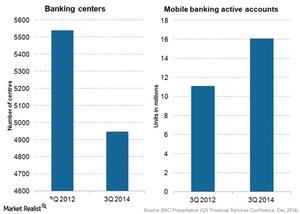

Bank of America operates through five major segments. Its Consumer and Business Banking segment contributes a third of the bank’s total revenues.

Bank of America: The second-largest US banking operation

Bank of America Corporation’s (BAC) banking operations are the second-largest in the United States by assets.

Why consumer banking is important for Bank of America

Consumer and Business Banking is Bank of America Corporation’s (BAC) largest segment. It contributes about a third of the bank’s total revenues.

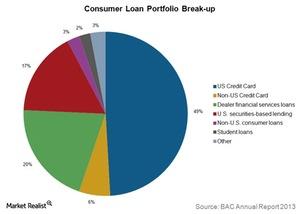

Card loans rule Bank of America’s consumer loan portfolio

Credit card loans account for more than half of Bank of America’s total consumer loan portfolio.

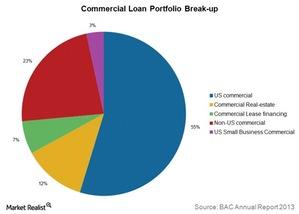

Why Bank of America’s commercial loan portfolio is diversified

In addition to assessing the credit profile of the borrower, Bank of America ensures that loans aren’t too concentrated by industry, geography, or customer.

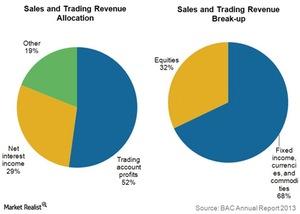

Bank of America’s Global Markets operations

Bank of America’s (BAC) Global Markets segment offers sales and trading services across asset classes to institutional clients.

A brief overview of U.S. Bank

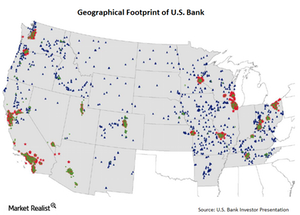

We’ll provide an overview of U.S. Bank. It’s the fifth largest retail bank in the US—by deposits and assets. At the end of September 2014, it held $391 billion in assets.

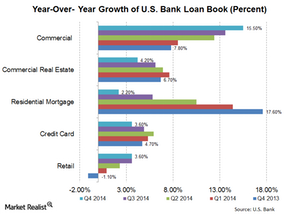

Why U.S. Bank’s loan growth showed interesting trends

You need to understand loan categories better in order to see some very interesting trends in U.S. Bank’s loan growth. Its loans are divided into five main categories.

Bank of America Stock: Analysts Are Upbeat

Most of the analysts covering Bank of America stock recommend a “buy.” On Tuesday, Atlantic Equities upgraded the stock to “overweight” from “neutral.”

Soros Exits, Buffet Increases: Who Is Right on Apple?

In Q4 2018, legendary investor George Soros sold all his holding in Apple (AAPL). In Q3 2018, Apple represented around 0.2% of his total portfolio.