Bank Of America Corp.

Latest Bank Of America Corp. News and Updates

An Overview of the US Banking Sector

The banking sector plays a pivotal role in our daily lives. This series explores the sector, its driving factors, and its key indicators and latest trends.

JPMorgan and Bank of America: Time to Buy Stocks

In August, JPMorgan Chase (JPM) and Bank of America Merrill Lynch (BAC) suggested that investors not buy just yet. Their opinions are now changing.

Investors’ Obsession with Yield Curve Inversion

You’ve likely heard about it in the financial press recently: this ominous, notorious thing called the “yield curve inversion.”

Kudlow Doesn’t See a Recession, Trump Might Fear One

White House economic advisor Larry Kudlow doesn’t see a looming recession. However, recession fears grew as the yield curve inverted last week.

Berkshire Hathaway 13F: Warren Buffett Played It Safe

There weren’t any real surprises in Berkshire Hathaway’s 13F for the second quarter. In some ways, the 13F replicated the first quarter.

Bank of America Posts Mixed Q2 Results Amid Rate Cut Concerns

On Wednesday, Bank of America (BAC) reported mixed second-quarter results. The bank’s profitability beat analysts’ expectation.

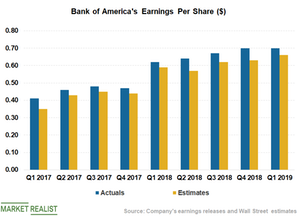

Bank of America’s Asset Quality, Efficiency, and Earnings

Bank of America’s (BAC) credit quality across its consumer and commercial portfolios remained stable at the end of the first quarter.

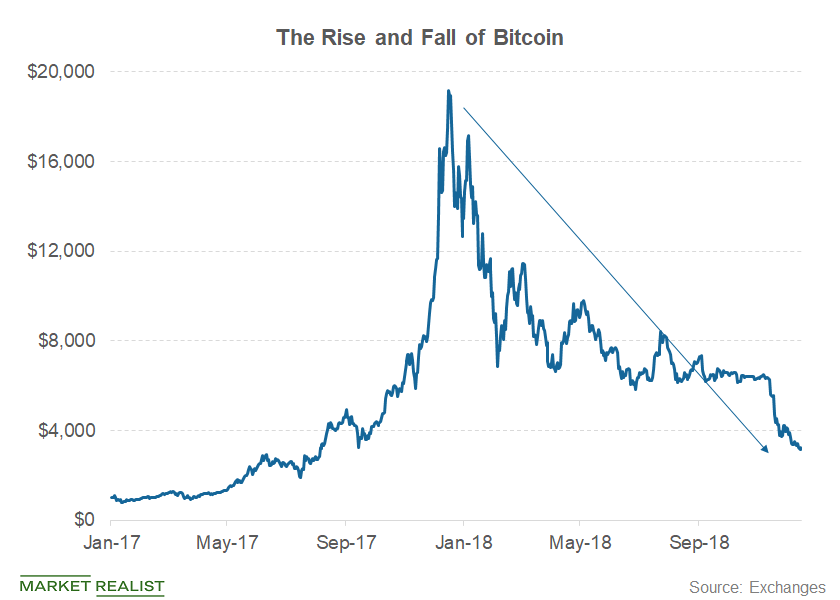

Could Warren Buffett’s Views on Bitcoin Change?

Berkshire Hathaway (BRK-B) chair Warren Buffett has never been a fan of cryptocurrencies like bitcoin.

Bank of America Stock: Analyzing the Uptrend

Bank of America (BAC) has impressed investors with its financial performance. We expect Bank of America to sustain the momentum in 2019.

Wells Fargo to Cut Over 600 Jobs amid Mortgage Business Slowdown

On August 23, Wells Fargo (WFC) announced that it planned to terminate the jobs of 638 employees in its home mortgage division.

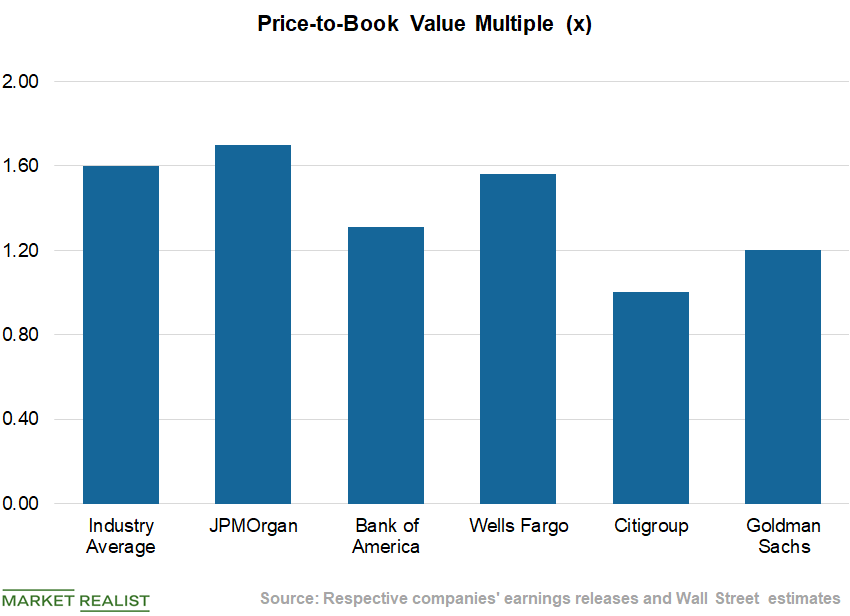

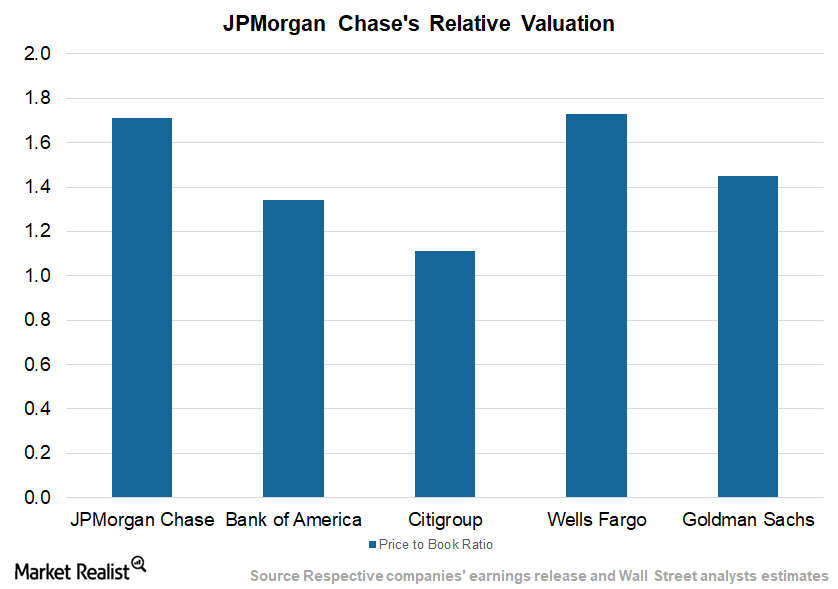

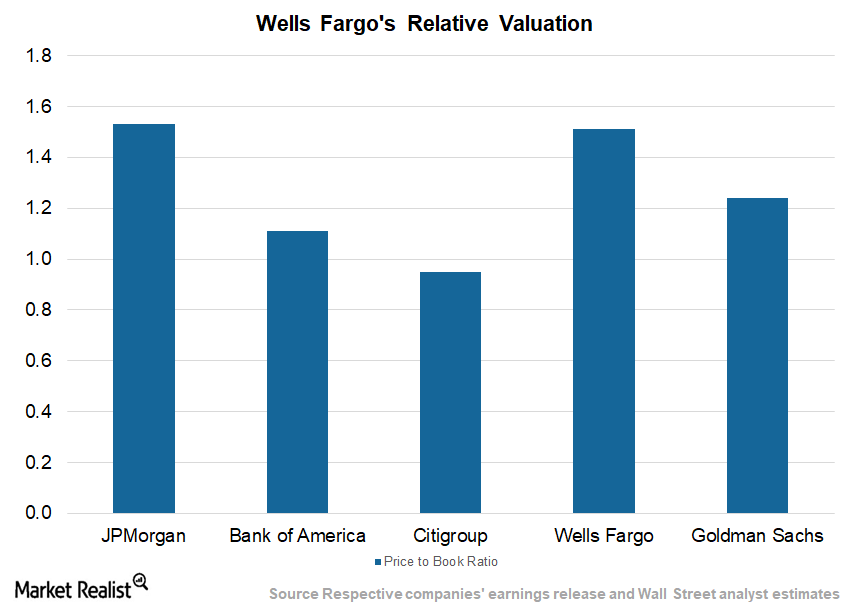

A Look at the Top Five US Banks’ Valuations

On a TTM basis, JPMorgan Chase trades at a price-to-book ratio of 1.7x, while the industry average stands at 1.6x.

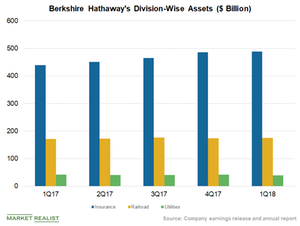

How Will Berkshire Deploy Its Cash Pile of over $100 Billion?

Berkshire Hathaway (BRK.B) was sitting on liquidity of $118 billion at the end of the first quarter.

What’s JPMorgan Chase’s Valuation?

JPMorgan Chase (JPM) stock has generated a return of 21.0% in the last six months and 31.3% over the past year.

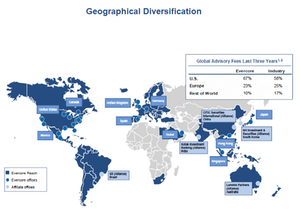

A Look at Evercore’s Business Model

Evercore generated 25% of its fees from its technology, media, and telecom sector, 20% from its energy sector, and 17% from its financials sector in 4Q17.

A Look at Bank of America’s Key Growth Drivers

Bank of America’s dividend yield of 1.5% and PE of 20.6x compares to a sector average dividend yield of 2% and PE of 20.7x.

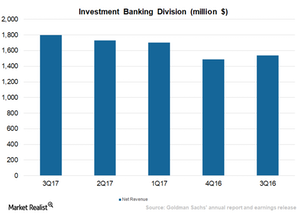

Goldman Sachs and Its Commanding Investment Banking Division

Goldman Sachs’s (GS) Investment Banking segment generated revenues of $1.8 billion in 3Q17, which was a 4% rise compared to 2Q17.

What’s Wells Fargo’s Valuation?

Wells Fargo (WFC) stock has risen 13.0% over the past six months and 10.1% over the past year.

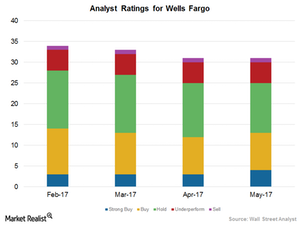

What Do Analysts’ Ratings Suggest for Wells Fargo in 2017?

In May, 13 of the 31 analysts covering Wells Fargo rated the stock as a “buy,” 12 analysts rated it as a “hold,” and six analysts rated it as a “sell.”

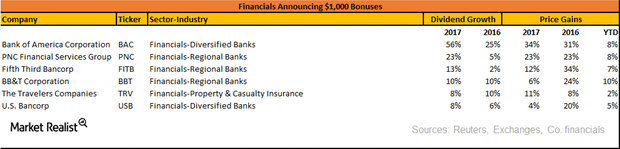

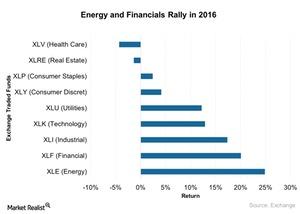

2016 US Sector Performance: Top Performers in Energy and Financials

The US GDP growth outlook is near its potential at ~3%, with increased investment in infrastructure.

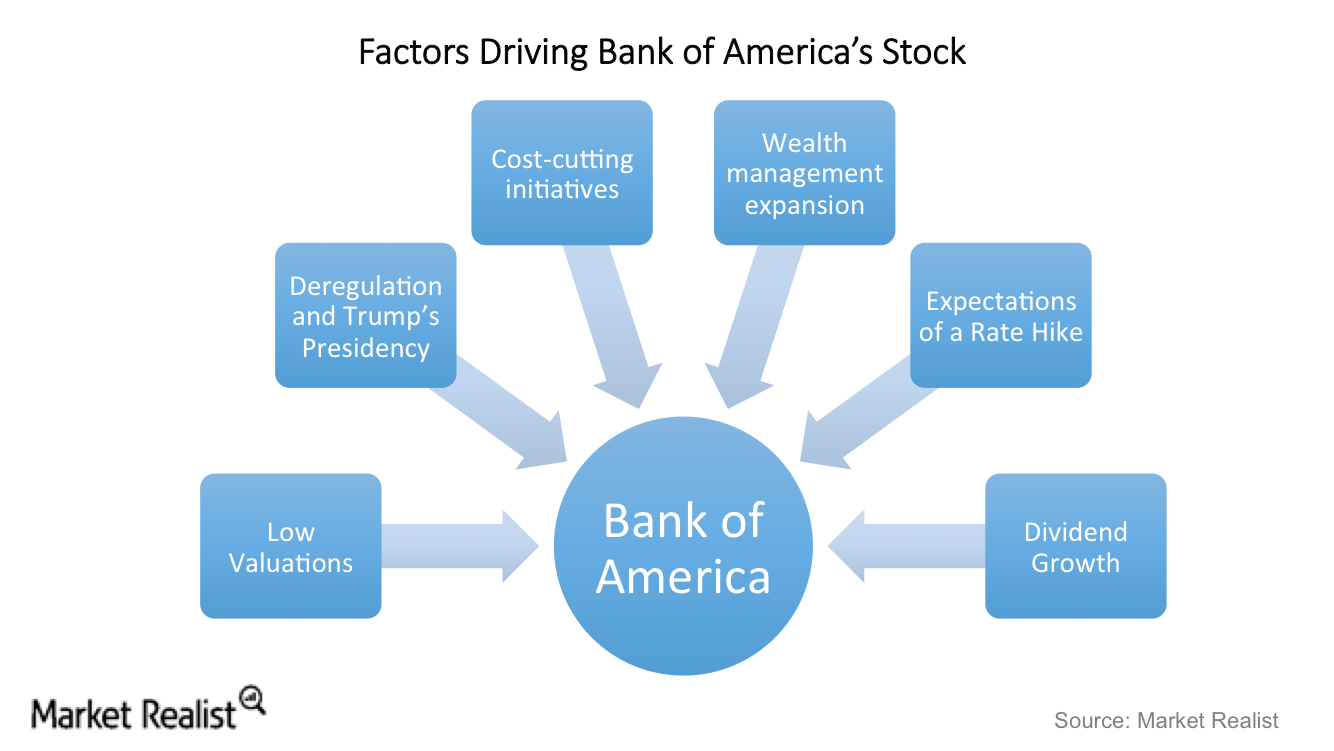

What Are Bank of America’s 2017 Growth Drivers?

Bank of America’s CEO has repeatedly discussed the importance of cost controls and how such measures could significantly boost BAC’s earnings over the next few years.

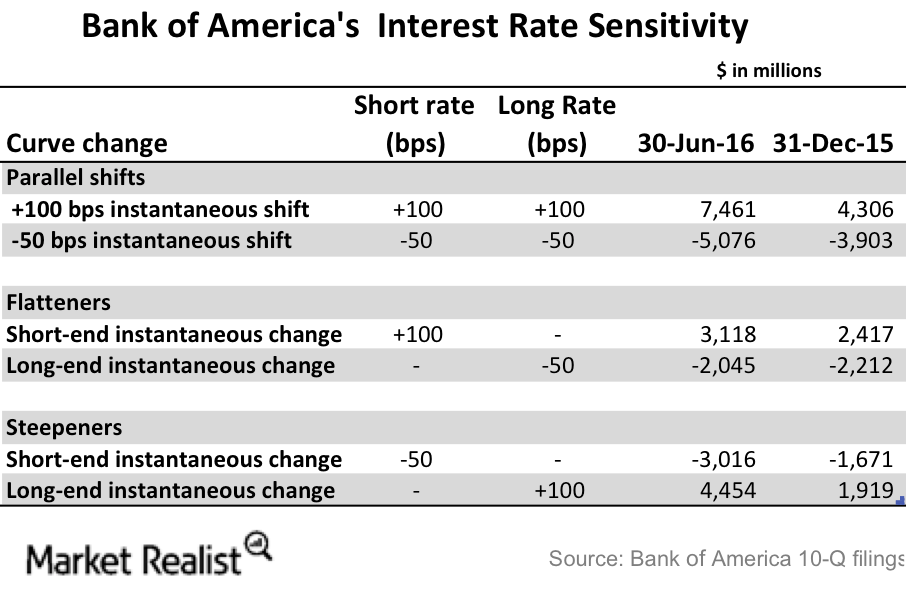

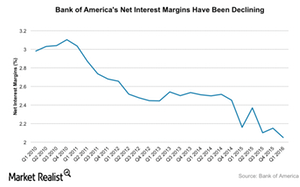

What’s Bank of America’s Interest Rate Risk?

Bank of America (BAC) is extremely sensitive to interest rate changes. Its latest 10-Q filing shows that its asset sensitivity has risen in 2Q15.

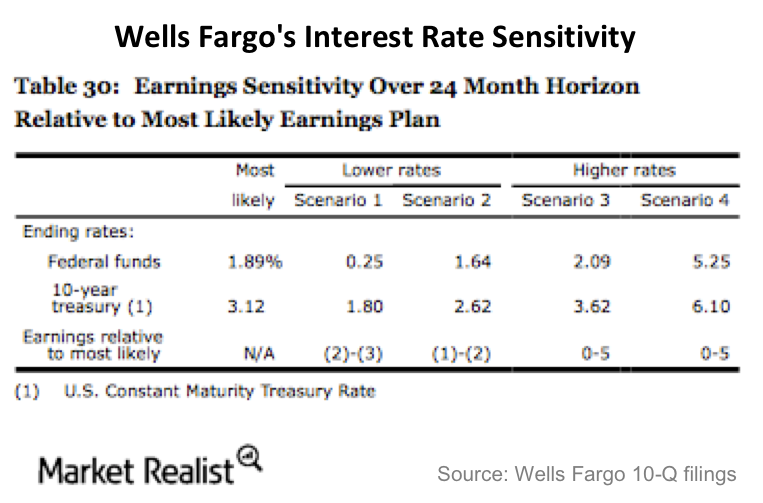

How Sensitive Are Wells Fargo’s Earnings to Interest Rates?

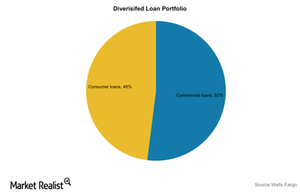

Wells Fargo has the largest loan portfolio among US banks (XLF). As of 2Q16, the bank has a loan portfolio of $952 billion.

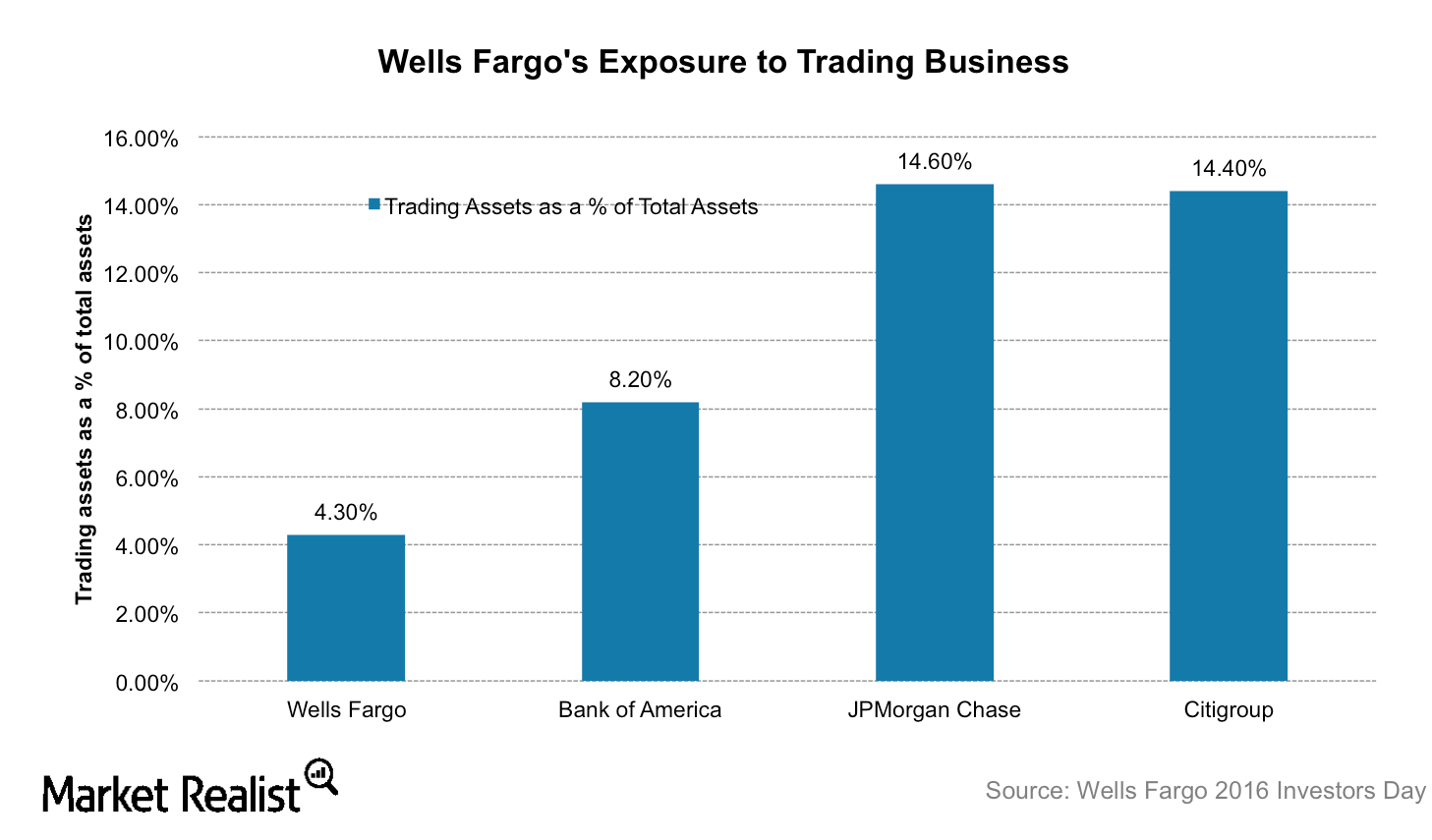

Why Wells Fargo Has a Less Risky Business Model than JPMorgan Chase

Wells Fargo (WFC) is less exposed to the risky investment banking and trading business than its peers JPMorgan Chase (JPM), Citigroup (C), and Bank of America (BAC).

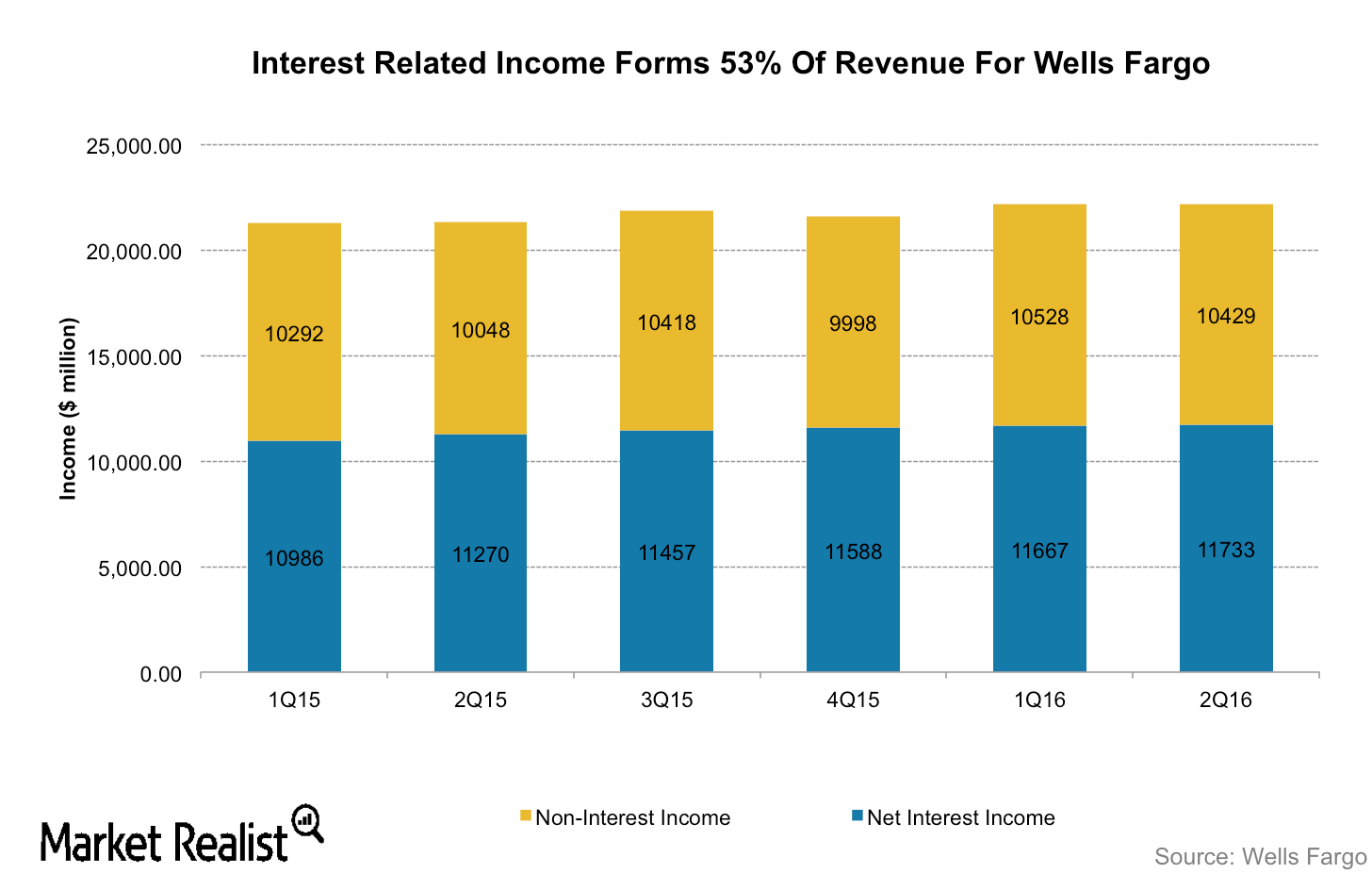

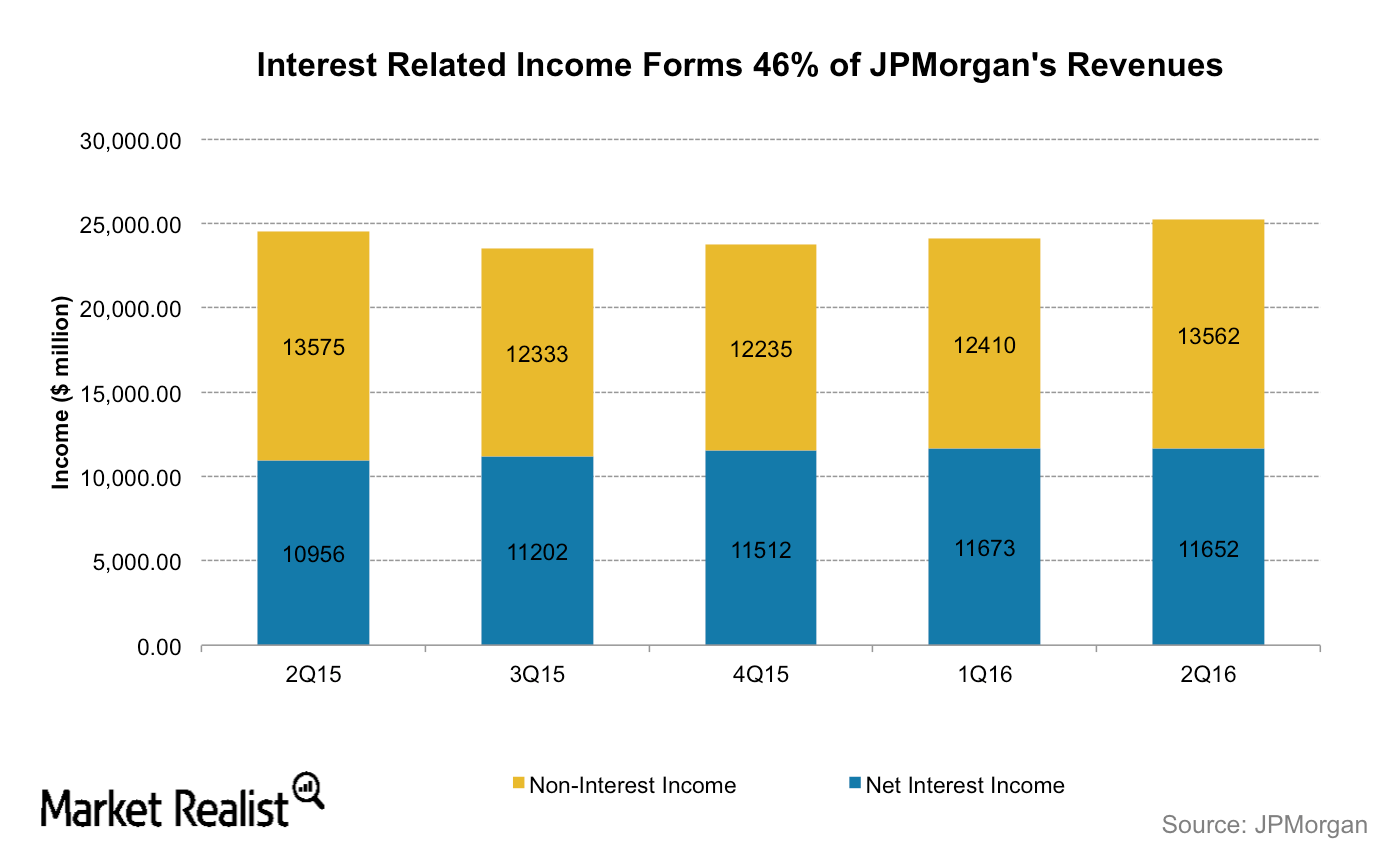

Interest Rate Sensitivity: JPMorgan Chase versus Wells Fargo

For Wells Fargo, net interest income makes up 53% of its total income while for JPMorgan Chase (JPM), net interest income makes up 46% of its total income.

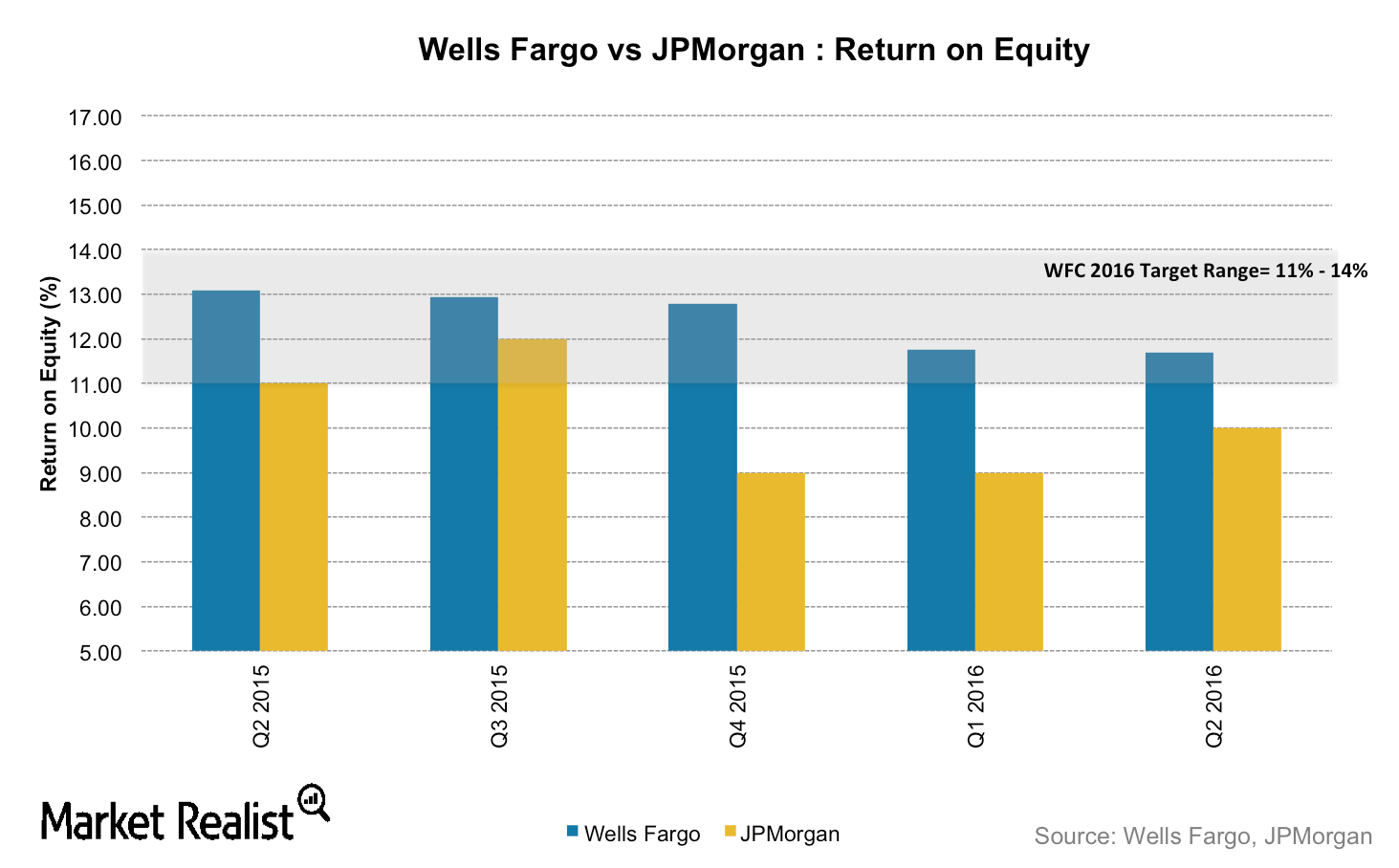

How Does Wells Fargo Compare with JPMorgan Chase on Profitability?

JPMorgan Chase (JPM) and Wells Fargo (WFC) reported profits of $6.2 billion and $5.6 billion, respectively, in the most recent quarter.

Why BAC Is Better Positioned to Gain from a Rate Hike Than JPM

Bank of America (BAC) is better positioned to gain from an interest rate hike than JPMorgan Chase (JPM). It’s more sensitive to interest rate changes.

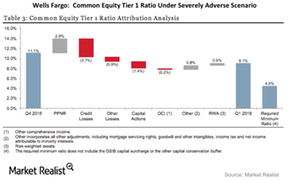

Did Wells Fargo Pass the Fed’s Stress Test?

The Federal Reserve’s stress test results indicate that Wells Fargo (WFC) has sufficient capital to absorb the estimated $25 billion in losses it is projected to incur under the test’s worst-case scenario.

Wells Fargo: What Sets It Apart from Its Peers?

Wells Fargo (WFC) is the largest mortgage lender in the US, operating primarily as a retail and commercial bank. It is been the most profitable bank in its peer group, posting a return of 10% on shareholder’s equity and ~1.3% on assets in 2015.

Wells Fargo Benefits from a Solid Business Model

Wells Fargo (WFC) has been considered the strongest and most steady among the “too big to fail” banks in the United States for years.

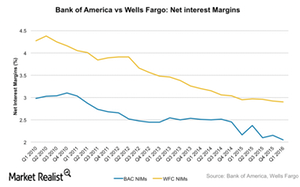

Comparing Wells Fargo and Bank of America’s Profitability

In 1Q16, Wells Fargo’s revenue grew 4% to $22.2 billion. Bank of America’s (BAC) revenue fell 7% YoY (year-over-year) to $19.5 billion.

How Sensitive to Interest Rates Has Bank of America Really Become?

Bank of America’s (BAC) earnings are extremely sensitive to interest rate changes. Low interest rates have weighed on the bank’s top line.

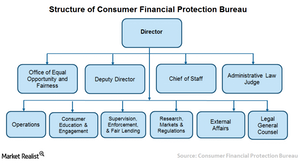

A Look at the Role of the Consumer Financial Protection Bureau

The Consumer Financial Protection Bureau was established to protect consumers’ interests by implementing federal consumer financial laws.

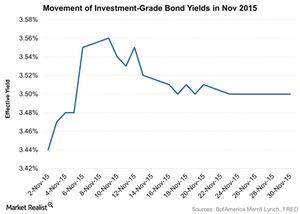

Macroeconomic Factors Affecting Investment-Grade Bond Yields

Investment-grade bond yields rose 8 basis points month-over-month and ended at 3.5% on November 30 due to high expectations of an interest rate hike in the December policy meeting.

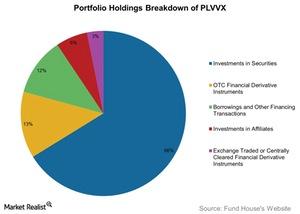

A Detailed Holdings Analysis of PLVVX

PLVVX holds fixed income securities in both long and short positions. The fund also holds derivative forward, future, and swap agreements on government securities, indexes, and currencies.

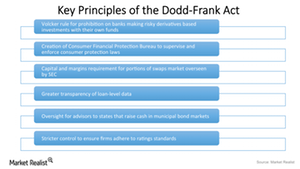

What Is the Dodd-Frank Act?

Analysts who favor the Dodd-Frank Act believe it will protect the investing community and consumers. Critics believe it will hamper economic growth and hurt competitiveness.

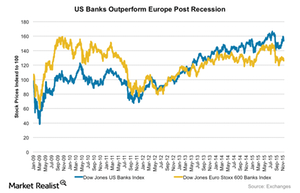

US Banks Played a Pivotal Role in the 2008 Financial Crisis

During the period between September 2008 and March 2009, US stock markets plunged, and the financial sector fell 60% in value.

What Is the Dodd-Frank Act?

The Dodd-Frank Act is a financial reform legislation passed in an attempt to prevent events similar to the 2009 financial crisis from occurring again.

Understanding the Fed’s Financial Regulations Post-2008 Crisis

Since the financial crisis, the Fed has enforced regulations for the capital strength and liquidity of 16 systematically important financial institutions.

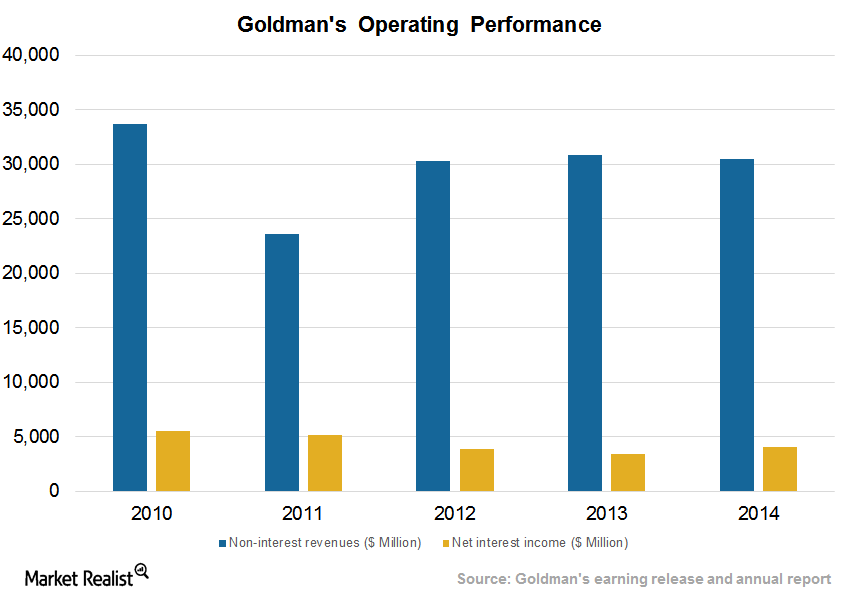

Goldman Sachs’ Revenue Model

Goldman Sachs engages in asset management, investment banking, wealth management, institutional sales, and trading activities across asset classes as well as regions.

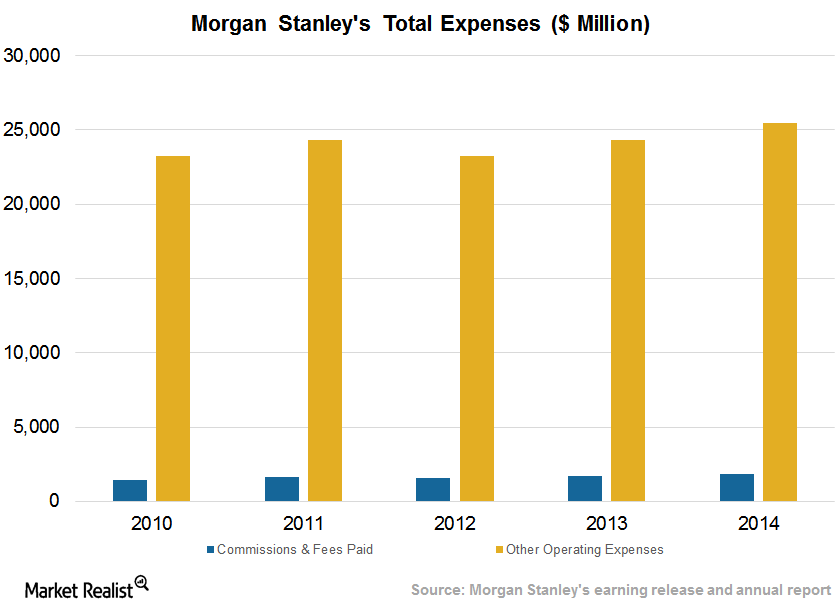

Morgan Stanley’s Careful Attention to Compensation Expenses

Morgan Stanley divides its non-interest expenses into compensation and non-compensation. It’s compensation expenses (and benefits) are ~80% of this class.

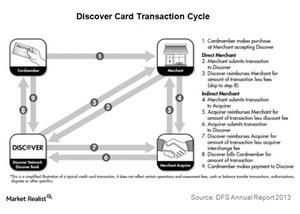

Analyzing Discover Financial’s business segments

Discover Financial Services (DFS) has two operating segments: Direct Banking and Payment Services. Payment Services is comparatively small.

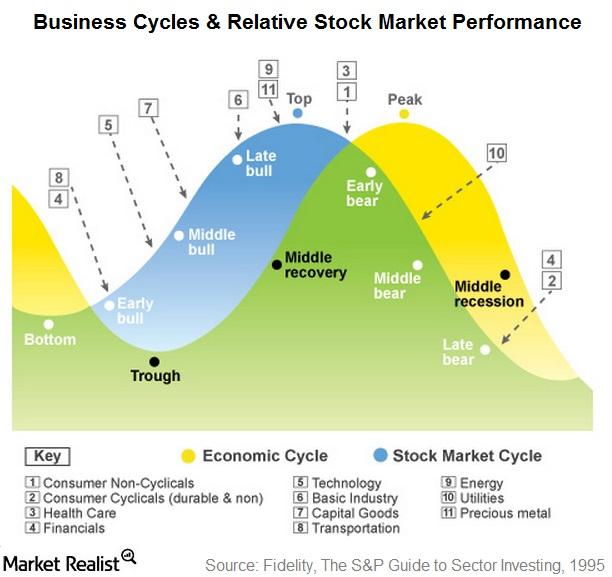

ETFs That Outperform in Late Stage, Recession, and Trough

Certain industries typically outperform at various phases of business cycles. This provides important clues to investors and helps them manage their portfolios.

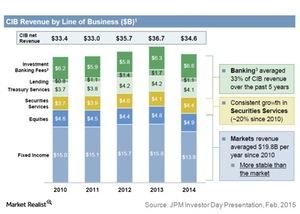

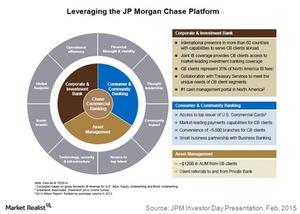

How J.P. Morgan Ranks in Corporate and Investment Banking

In the US, J.P. Morgan competes with Bank of America (BAC), Goldman Sachs (GS), and Morgan Stanley (MS), the leading players in investment banking.

J.P. Morgan: Commercial Banking and Firm-Wide Synergies

J.P. Morgan Commercial Banking clients can access the Consumer and Community Banking segment’s commercial credit cards, payments services, and branch network.

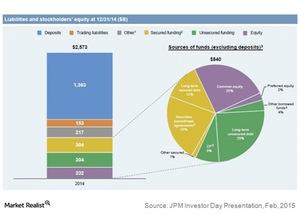

J.P. Morgan and Its Diversified Funding Sources

Banks like US Bancorp (USB) and Wells Fargo (WFC) have an advantage over J.P. Morgan in terms of debt rating. Both banks secure higher ratings.

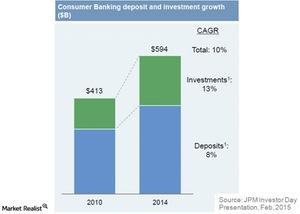

J.P. Morgan Looks to Deepen Customer Relationships

The number of J.P. Morgan active mobile customers has more than tripled since 2010. As a result, the bank is adapting its digital capabilities.

J.P. Morgan’s 4 Operating Segments

Consumer and Community Banking is the biggest of J.P. Morgan’s four segments. Corporate and Investment Banking follows, with 34% of revenues.

J.P. Morgan: The Banking Giant

In this series, you’ll learn what value J.P. Morgan holds for its shareholders, about its various businesses, and how it compares with other big banks.

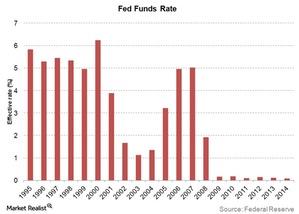

Why Are Interest Rates at an All-time Low?

The quantitative easing policy adopted by the Federal Reserve at the end of 2008 to boost economic growth included a drastic reduction in interest rates.

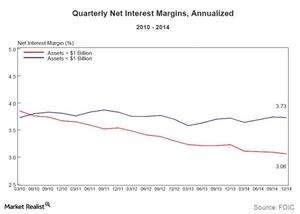

Why Lower Funding Costs Impact Net Interest Margins

Lower funding costs determine a bank’s net interest margin. A bank has funding cost advantage when it pays less interest on borrowed funds and deposits.