Bank Of America Corp.

Latest Bank Of America Corp. News and Updates

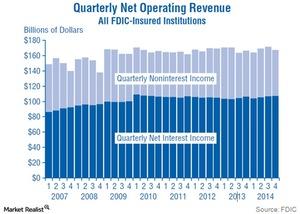

Why Is Interest Income Important to Banks?

Interest income typically contributes more than 60% to a bank’s total operating income.

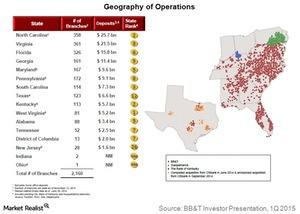

BB&T Corporation Is a Leading Bank in the Southeast Region

BB&T Corporation (BBT) is a financial holding company. It conducts its operations primarily through its bank subsidiary—Branch Bank.

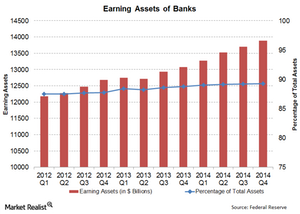

Why earning assets are an important indicator for the banking sector

The banking sector has shown a trend of increasing earning assets, because banks have focussed on becoming leaner and improving operational efficiency.

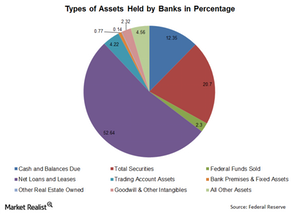

Why the composition of banking assets matters

The two main types of banking assets are loans and securities held.

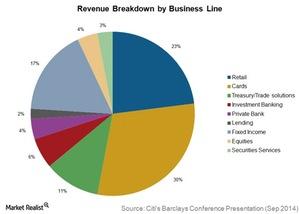

Citigroup: Number 3 US bank has $1.9 trillion in assets

Citigroup provides a broad range of financial products and services, including consumer banking, corporate and investment banking, among other things.

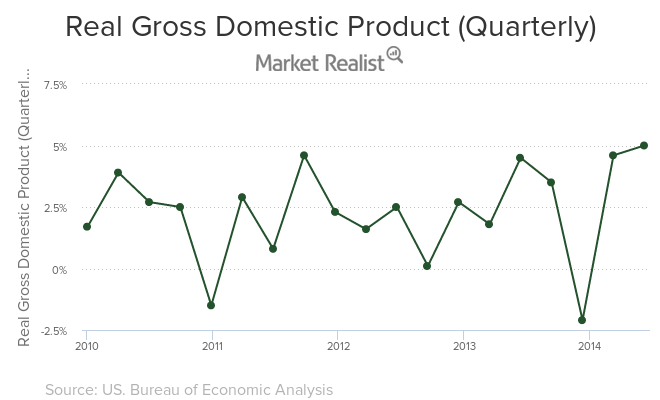

What 2 factors drive real GDP growth?

According to Jeffrey Lacker, two fundamental factors contribute to GDP growth in the long term—population growth and real GDP per worker.Financials Must-know: Wells Fargo is strongly capitalized for future growth

A bank’s growth can be limited if it doesn’t have enough regulatory capital. If the bank doesn’t have enough capital, it will be forced to dilute its equity to raise capital.Financials Why Wells Fargo’s strategy is different from other banks

“Strategy” can be defined in many ways. Generally, strategy is a long-term plan. There are two main aspects to strategy—operational level strategy and human resource level strategy.Financials Why commercial lending is important to Wells Fargo strategy

The bank’s strategy is to not focus on any particular segment of industry. This helps it mitigate risk because the bank’s earnings and delinquencies are not dependent on any particular sector.Financials Must-know: Basel III’s shortcomings

Basel III addresses most of Basel II and II.5’s deficiencies. But it still has some shortcomings. Firstly, the increased regulatory capital required under Basel III will increase barriers to enter into the sector.Financials Must-know: Why capital ratio is an important bank ratio

Capital ratio is also known as capital adequacy ratio or capital-to-risk-weighted assets ratio. Capital ratio is nothing but the ratio of capital a bank has divided by its risk-weighted assets. The capital includes both tier one and tier two capital.