Sarah Collins

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Sarah Collins

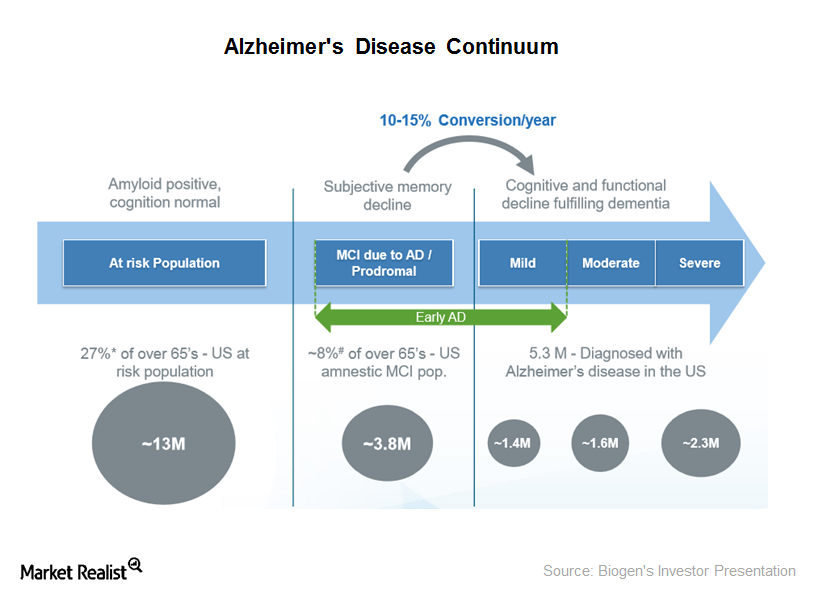

Market Cheers FDA’s Fast Tracking of BIIB’s Alzheimer’s Treatment

The U.S. Food and Drug Administration (or FDA) recently awarded the fast track status to aducanumab following the positive results of Biogen’s pre-clinical research.

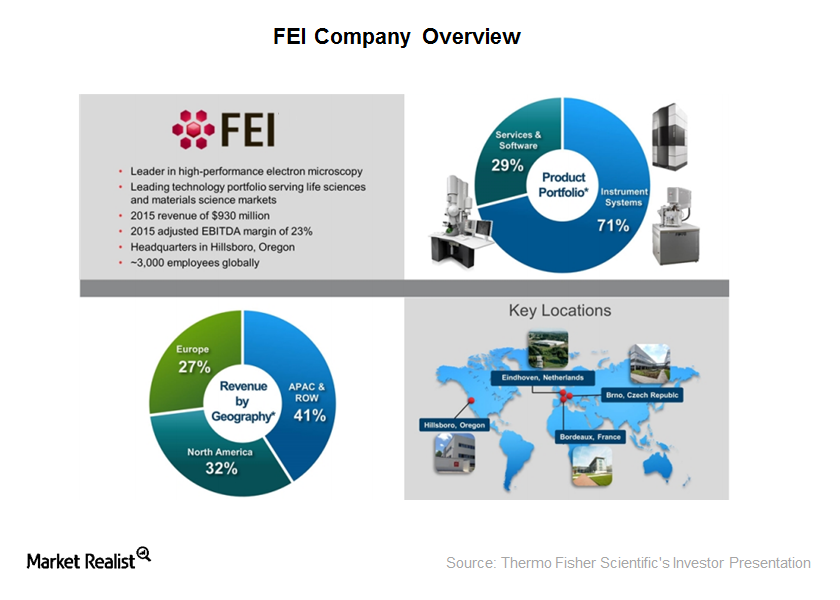

How the FEI Acquisition Will Benefit Thermo Fisher Scientific

Thermo Fisher Scientific believes that the FEI acquisition is a strategic fit for the company due to its strong product portfolio.

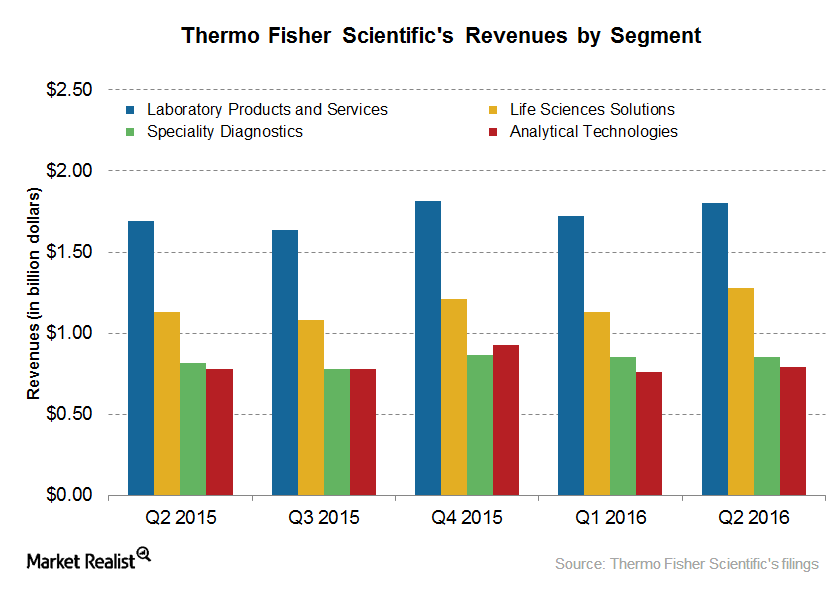

Thermo Fisher Scientific’s Key Growth Strategy

Thermo Fisher Scientific reported ~$4.5 billion in revenues in 2Q16, representing YoY (year-over-year) growth of ~6%.

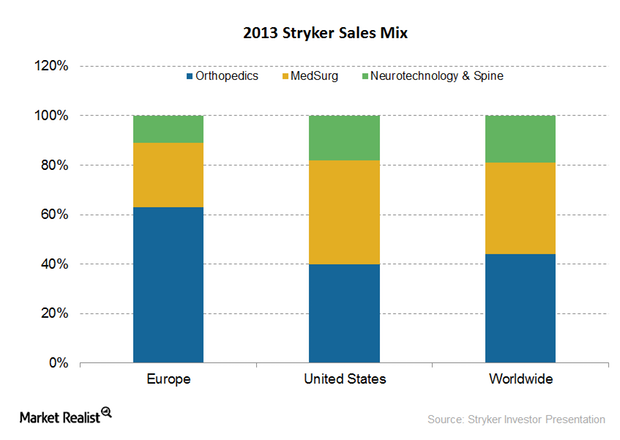

How Stryker Plans to Leverage the Under-Tapped Europe Opportunity

Europe represents a potential growth opportunity for Stryker, as the company currently has a low market share in Europe compared to other developed markets.

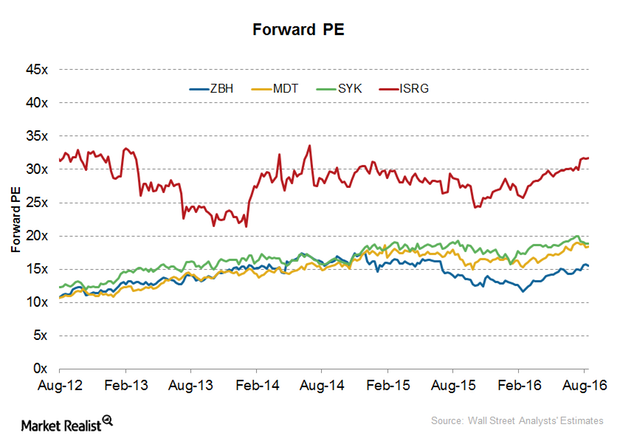

A Look at Zimmer Biomet’s Latest Valuation

After the release of its 2Q16 earnings results on July 28, 2016, Zimmer Biomet Holdings (ZBH) was trading at a forward price-to-earnings multiple in the range of 15.5x–16.2x.

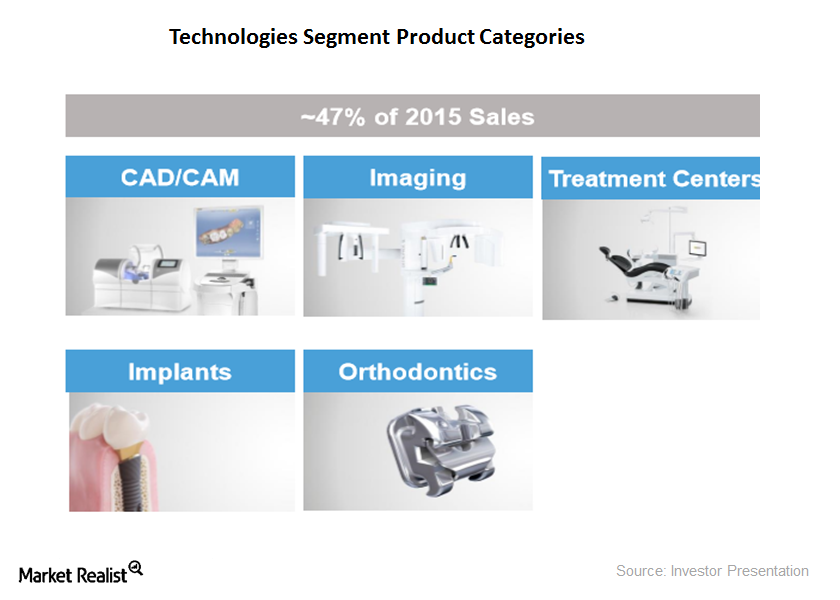

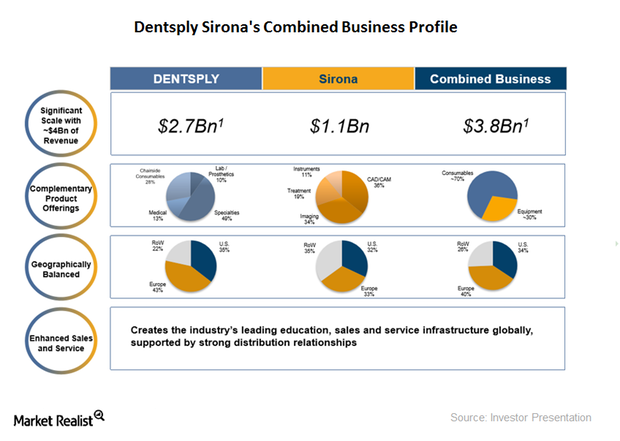

A Brief Look at the Technologies Segment Sales in 2Q16

In 2Q16, Dentsply Sirona’s leading position in the Digital Sensor category and rebound in the Lab business drove its Technologies segment sales.

Can Thermo Fisher’s PPI Business System Continue to Drive Growth in 2016?

The PPI system has helped nourish strong top-line growth across Thermo Fisher’s businesses while boosting margins.

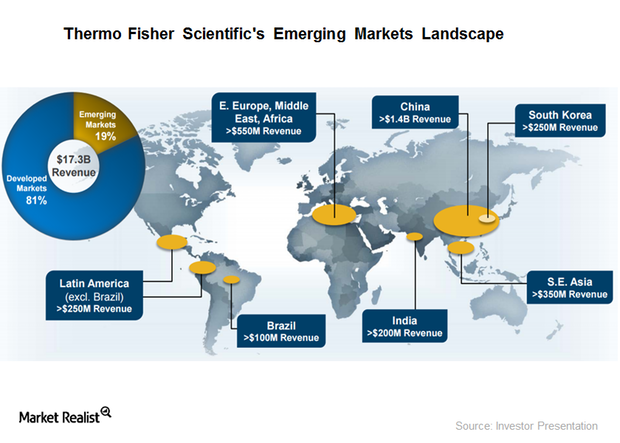

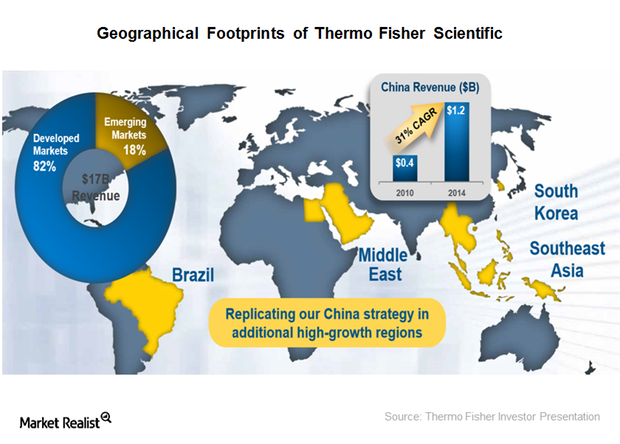

Inside Thermo Fisher Scientific’s Emerging Markets Strategy

Thermo Fisher has a presence in more than 50 countries. It generates ~19% of its revenues from emerging markets and the rest from developed markets.

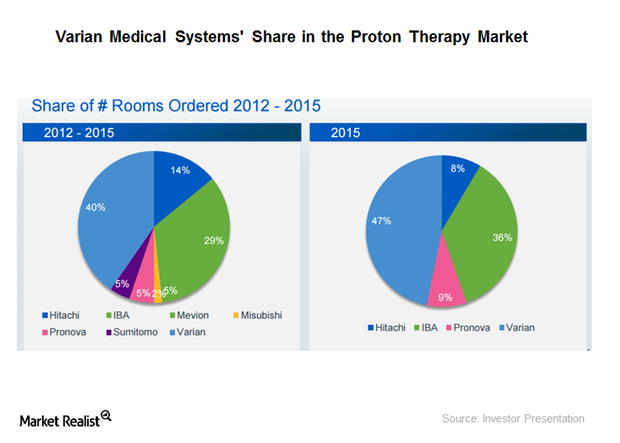

How Is Varian Positioned in the Particle Therapy Business?

Varian Medical Systems (VAR) had gross orders value of $310 million in 2015.

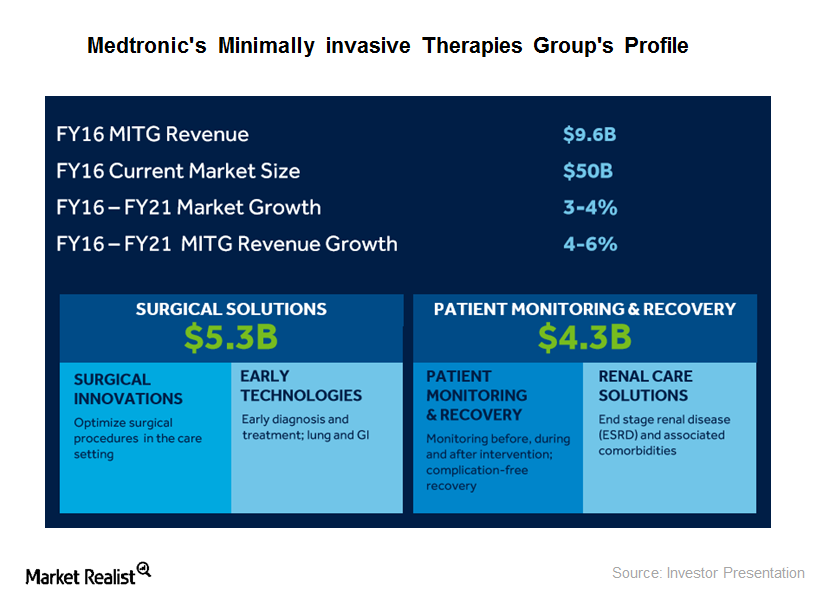

Medtronic’s Minimally Invasive Therapies Group: Major Drivers

Medtronic plans to launch more than 80 products over the next three years.

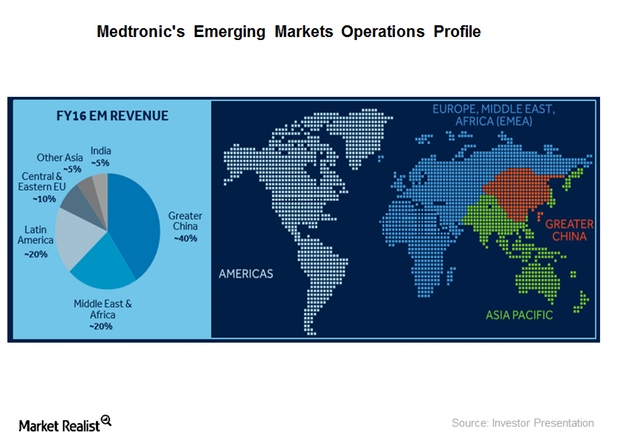

A Look at Medtronic’s Geographic Strategy in 2016

Globalization is one of Medtronic’s (MDT) key growth strategies.

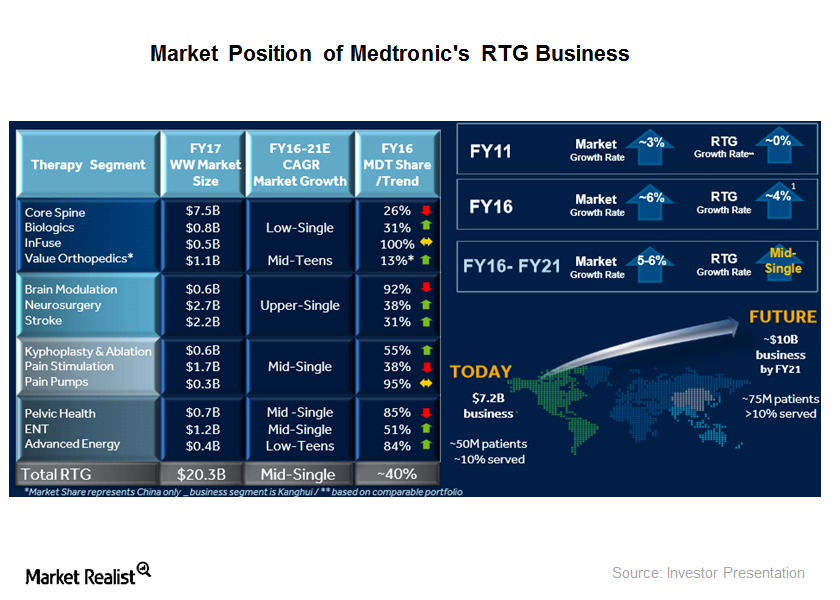

What Drives Medtronic’s Restorative Therapies Group’s Growth?

Medtronic’s (MDT) Restorative Therapies Group (or RTG) segment, formed around seven years ago, has a strong market position today.

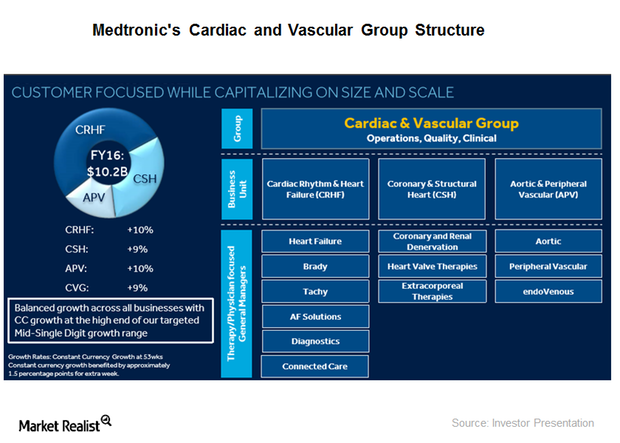

What Drives Medtronic’s Cardiac Vascular Group’s Revenues?

Medtronic’s (MDT) Cardiac and Vascular Group (or CVG) is its largest segment.

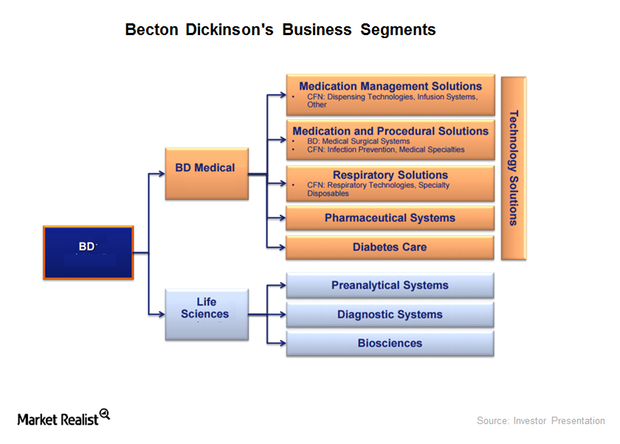

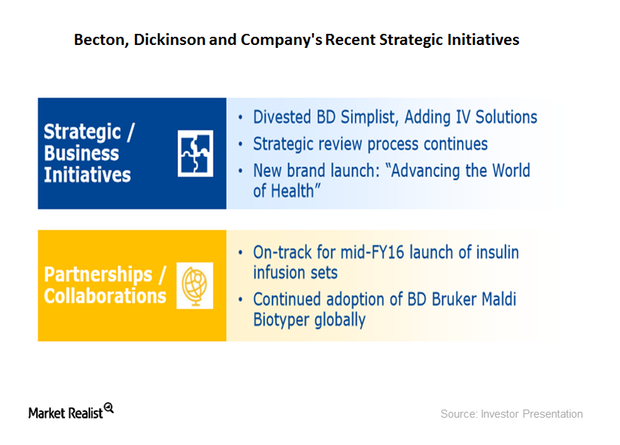

What’s the Verdict on Becton Dickinson’s Strategic Portfolio Review?

Becton Dickinson (BDX) completed its annual strategic review of its portfolio, which was initiated after the acquisition of CareFusion.

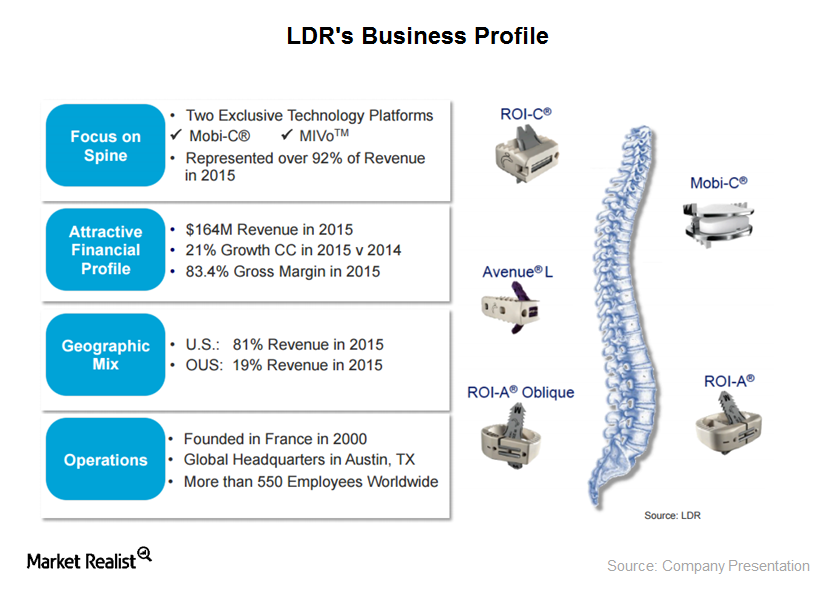

Zimmer Biomet to Strengthen its Spine Business through LDR Acquisition

Zimmer Biomet Holdings (ZBH) will buy LDR Holding (LDRH) for approximately $1 billion to expand in the spine treatment device market.

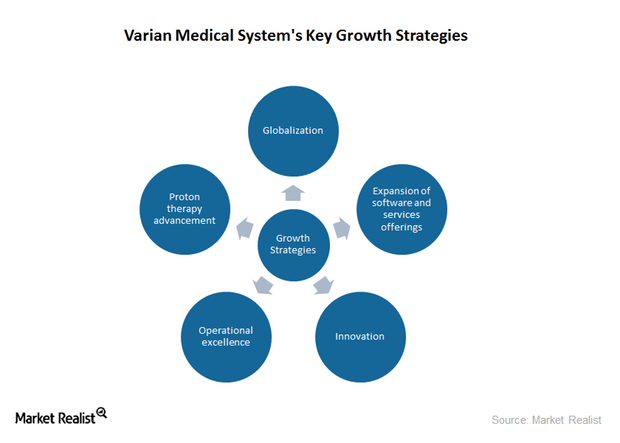

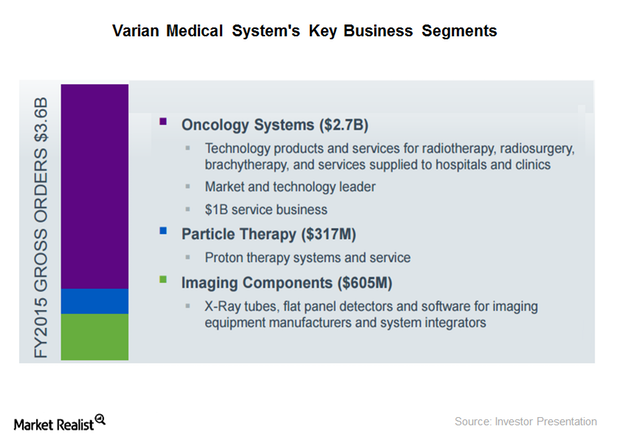

Growth Strategies Driving Varian Medical Systems’ Revenue

Varian Medical Systems has ventured into the proton therapy business and has a huge product pipeline in this area. The company generated approximately $300 million through its proton therapy business in 2015.

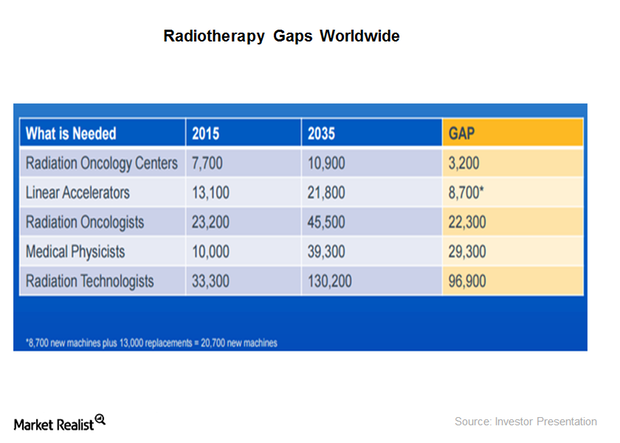

Varian Medical Systems’ Growth Potential in Radiation Oncology

Varian Medical Systems’ next big technology innovation will be high-definition radiotherapy, which is an intelligent treatment delivery system that aims to achieve 100% radiation exposure for the tumor.

Where Does Varian Medical Systems Get Most of Its Revenue?

Varian Medical Systems’ Imaging Components segment accounts for approximately 19% of the company’s total revenue. The segment reported a revenue decline of ~10% in 2015.

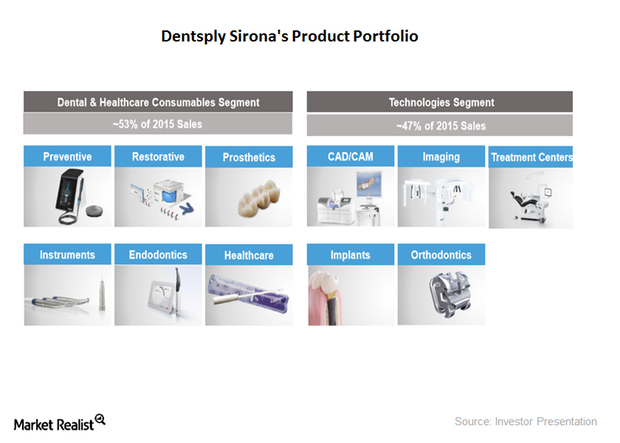

A Brief Look at Dentsply Sirona’s Business Model

Dentsply Sirona (XRAY) offers a broad portfolio of dental equipment and consumables that have urological and surgical applications.

Introducing Dentsply Sirona, a Leading Dental Products Manufacturer

Dentsply Sirona (XRAY) is the largest manufacturer of dental equipment and technologies in the world. The company was formed in February 2016.

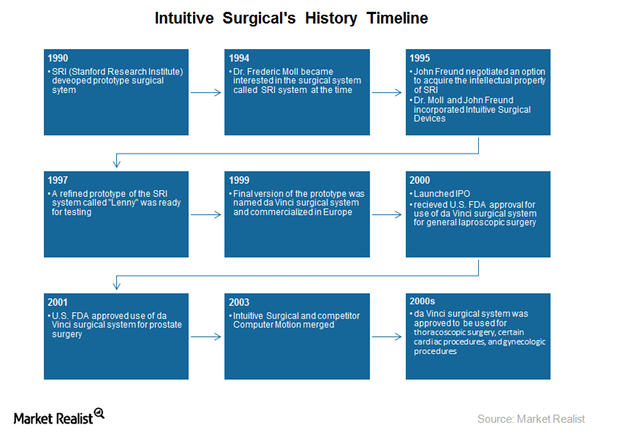

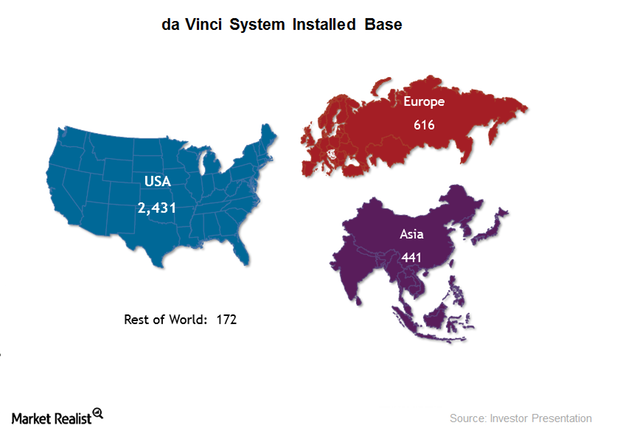

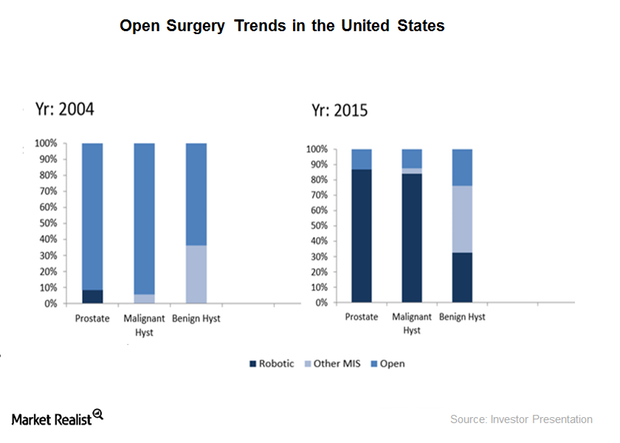

Company Overview: An Introduction to Intuitive Surgical

Intuitive Surgical is a pioneer of minimally invasive robotic surgery. It develops and manufactures da Vinci surgical systems and related instruments.

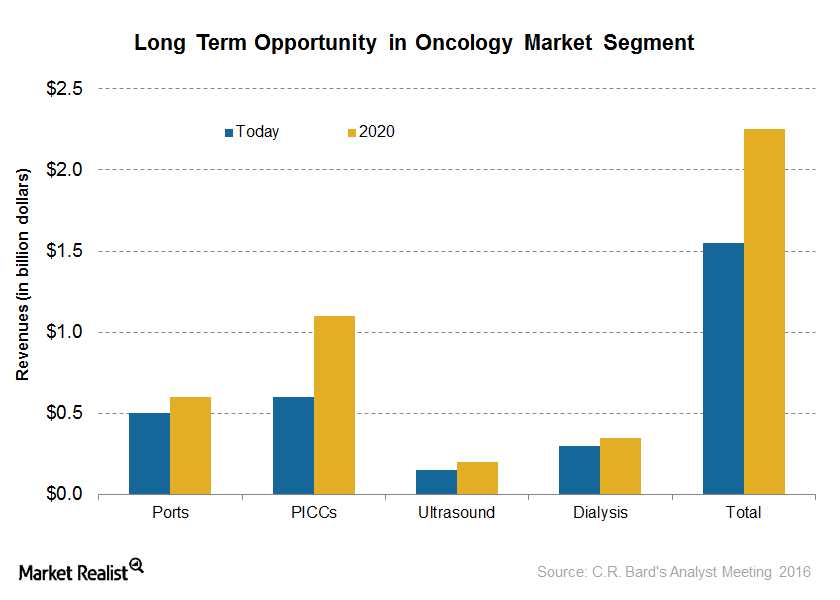

A Look at C. R. Bard’s Oncology Business Segment

C. R. Bard’s (BCR) Oncology segment contributes around 27% of the total revenues of the company.

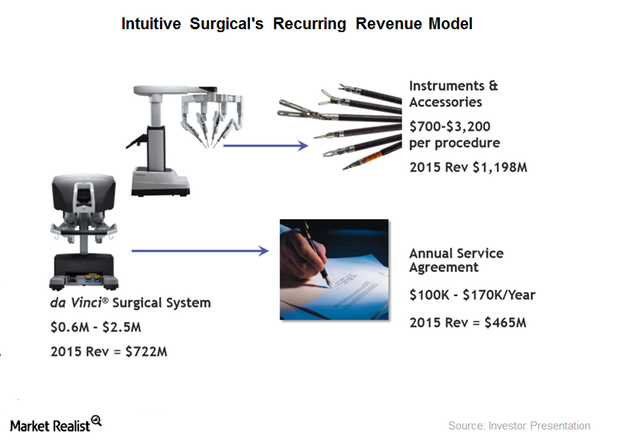

What Does Intuitive Surgical’s Business Model Look Like?

Intuitive Surgical (ISRG) defines its business model as a “razor/razor blade” model. What does this mean?

Exploring Intuitive Surgical’s Sales Model

Intuitive Surgical follows a diversified sales strategy and doesn’t generate more than 10% of its revenue through any one customer.

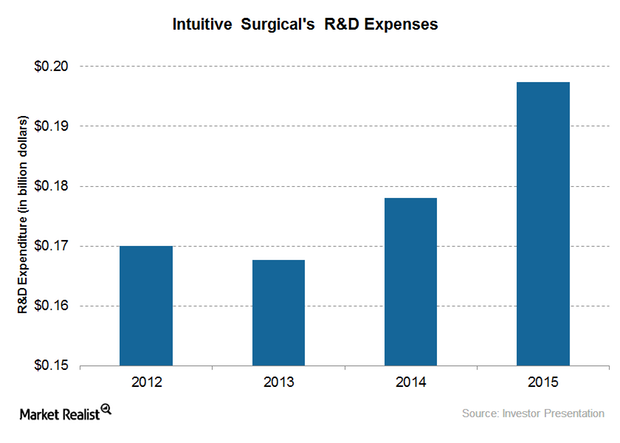

Analyzing Intuitive Surgical’s R&D Strategy and Innovations

Intuitive Surgical is continuously enhancing its product offerings, enabling more efficient procedures through internal research and development (or R&D).

A Closer Look at Intuitive Surgical’s Business Strategy

Intuitive Surgical aims to include a larger patient population under its MIS treatments and to provide better surgery outcomes and lower recovery times.

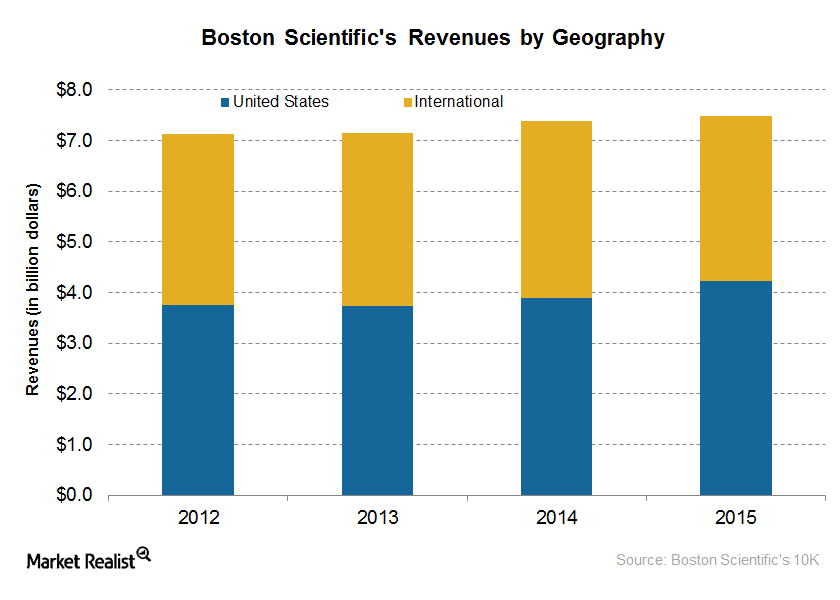

How Is Boston Scientific’s Geographic Strategy Driving Growth?

Boston Scientific has strategically expanded in these geographies through organic as well as inorganic strategies.

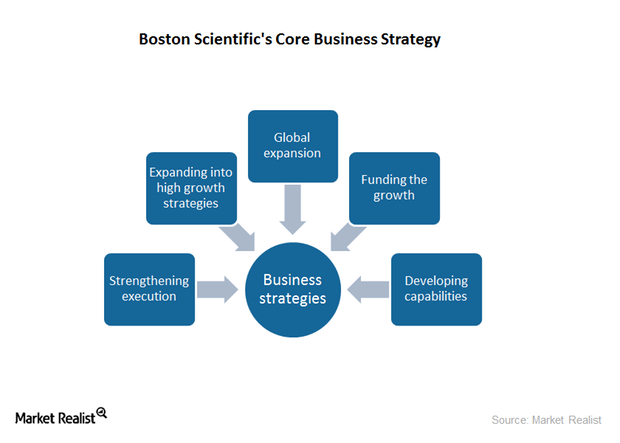

The Business Strategies Driving Boston Scientific’s Growth

Boston Scientific registered emerging market sales growth of approximately 13% in 2015, representing a steady growth in international markets.

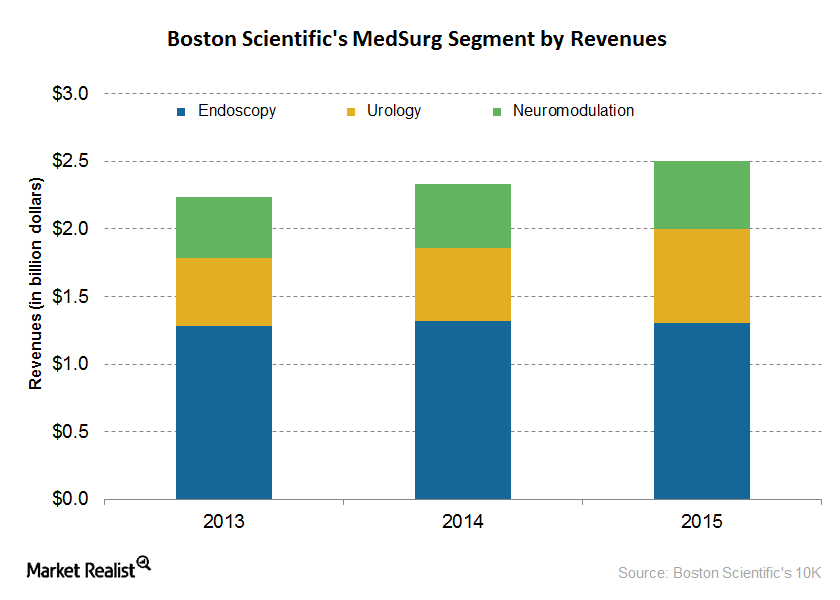

Understanding Boston Scientific’s MedSurg Segment

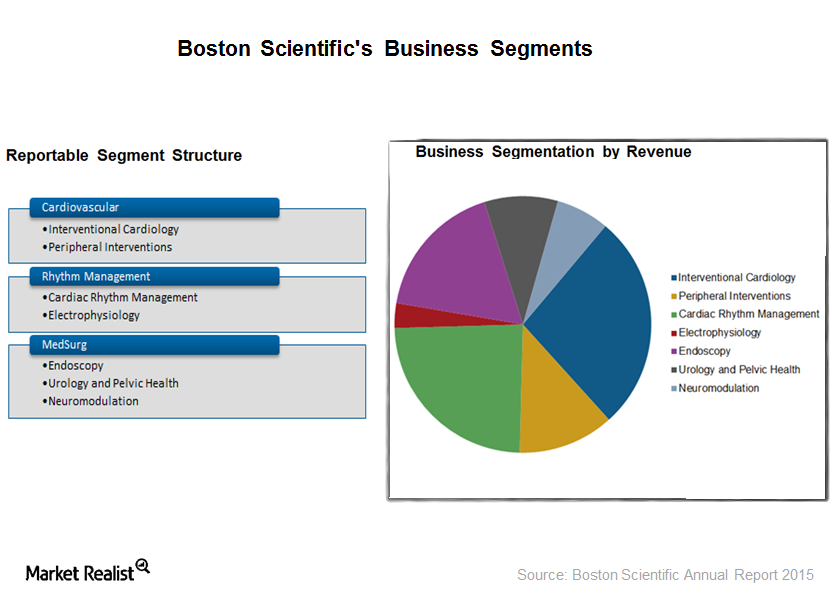

Boston Scientific’s (BSX) MedSurg segment contributes around 33% to the company’s total revenues and is the company’s second-largest segment.

A Brief Look at Boston Scientific’s Business Model

Boston Scientific’s (BSX) Cardiovascular segment consists of minimally invasive technologies to treat patients with a wide range of heart and vascular diseases. It is BSX’s largest business segment and generated ~39% of the company’s total revenues in 2015.

Overview of Boston Scientific, a Leading Medical Device Company

Starting in 2011, Boston Scientific (BSX) has undertaken cost-cutting programs and reorganization efforts to turn the company’s battered financials around. In 2014, BSX started registering positive growth and profitability.

How Did Edwards Lifesciences’ Critical Care Segment Fare in 1Q16?

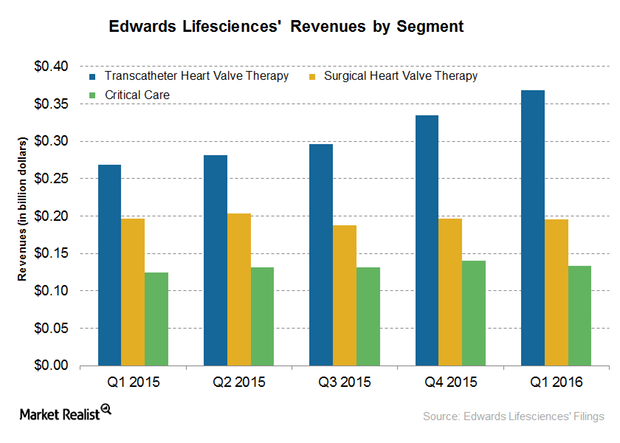

Edwards Lifesciences (EW) reported ~$697 million in total revenue in 1Q16. Of that, ~$134 million was contributed by the company’s Critical Care segment.

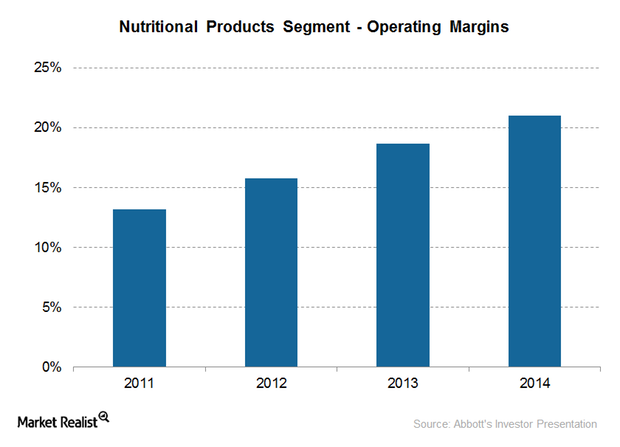

Why Abbott Laboratories Is a Leader in Nutritional Products

Abbott Laboratories’ Nutritional Products segment is the company’s leading segment, growing at a fast pace, with rapidly increasing margins and revenues.

Zimmer Biomet’s Competition in the Hip Implant Market

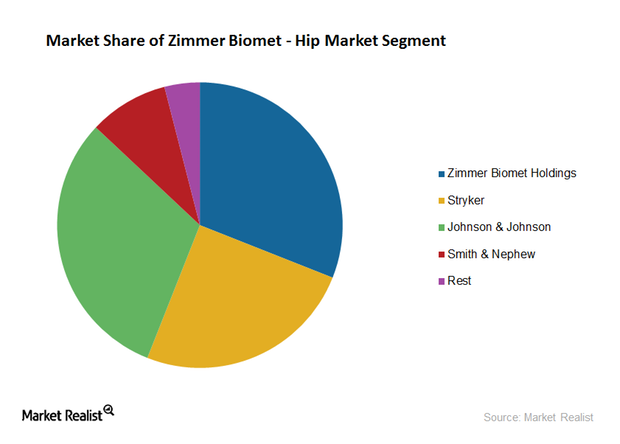

Zimmer Biomet (ZBH) is one of the leading hip implant providers in the United States, with approximately 31% market share.

Zimmer Biomet Faces Market Share Erosion in the Knee Implant Market

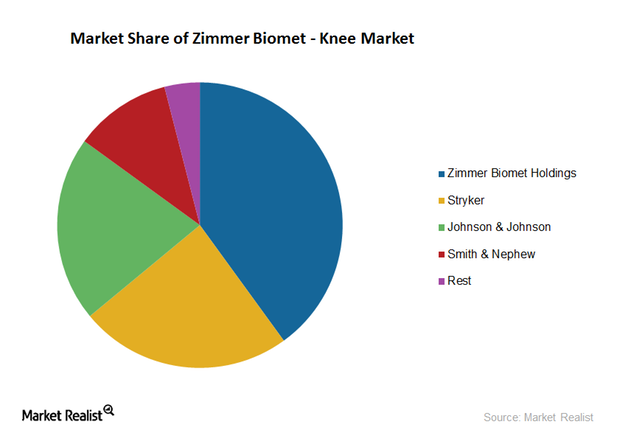

Zimmer Biomet (ZBH) is the leading provider of knee implants in the United States. It has approximately 40% market share, followed by Stryker, Johnson & Johnson, and Smith & Nephew.

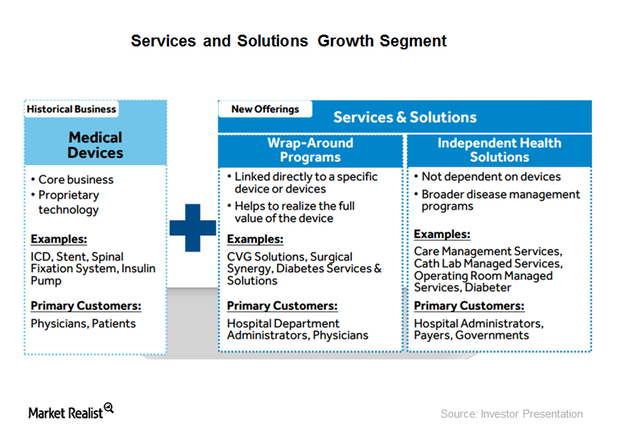

Why Medtronic Is Diversifying beyond Medical Devices

Medtronic established a services and solutions growth vector as one of its core strategies. It contributed ~20 basis points to Medtronic’s growth in 3Q16.

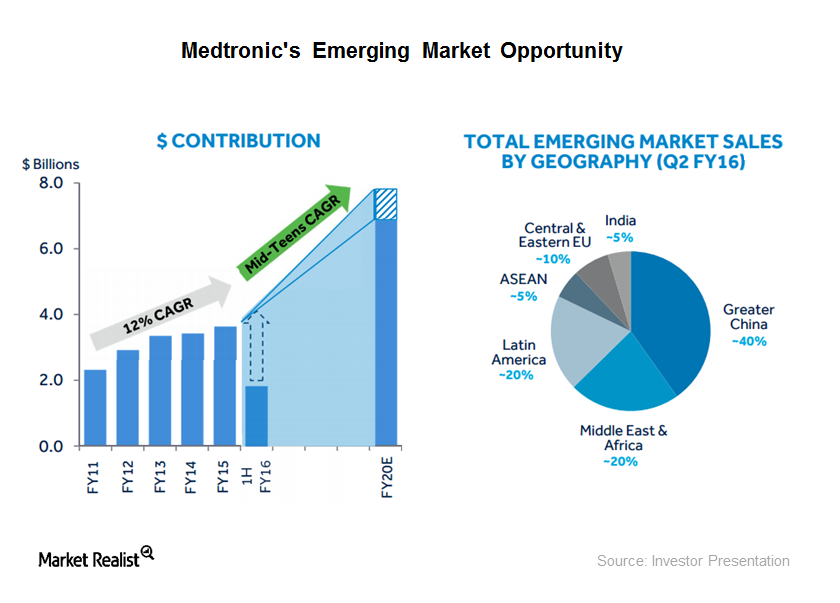

How Is Medtronic’s Globalization Strategy Driving Its Growth?

Medtronic’s (MDT) growth is driven by three of the company’s core strategies—therapy innovation, globalization, and economic value.

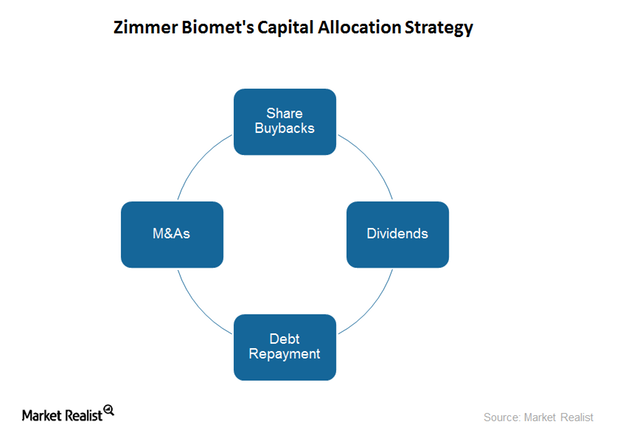

Zimmer Biomet’s Capital Allocation Strategy and Shareholder Value

Zimmer Biomet has spent $125 million in share repurchases so far in 2016. In February, it authorized up to $1 billion of the company’s common stock for share repurchases.

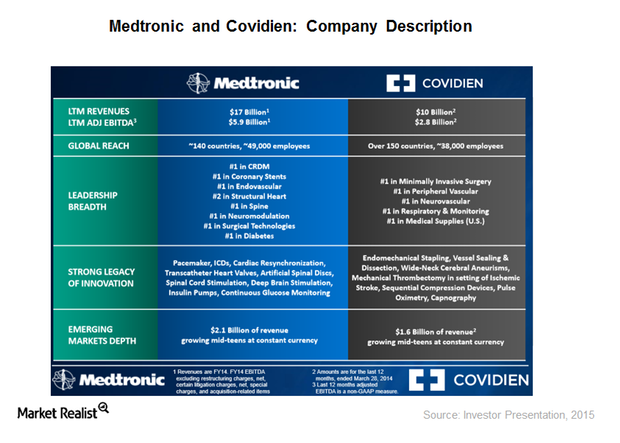

Sizing up Medtronic-Covidien, the Biggest Deal in the Medical Device Industry

On January 26, Medtronic completed the acquisition of Covidien for $42.9 billion in cash and Medtronic stocks and assumed Covidien’s debt of ~$5 billion.

Behind Becton Dickinson’s Strategic Restructuring and Business Consolidation

To better position itself amid the changing medical device environment, Becton Dickinson has come to focus on restructuring and business model evolution.

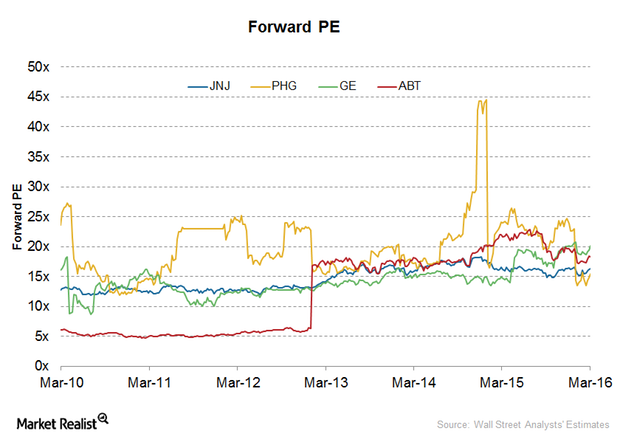

How Do Johnson & Johnson’s Valuations Compare to Peers?

On March 17, 2016, Johnson & Johnson (JNJ) was trading at a forward PE (price-to-earnings) multiple of ~16.5x compared to the industry average of ~19.6x.

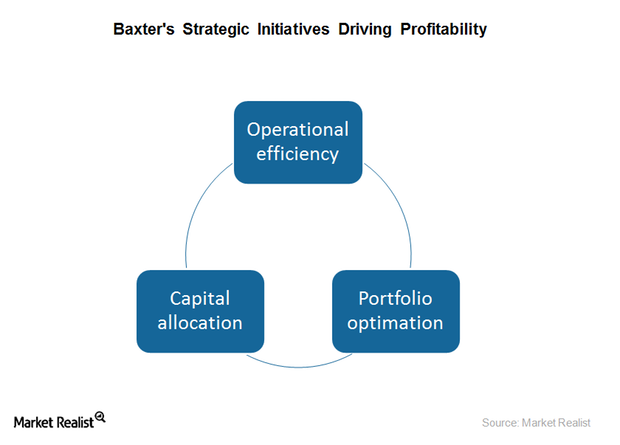

How Baxter’s Biosciences Spin-off into Baxalta Improved Its Valuation

On July 1, 2015, Baxter separated its Biosciences division into a new entity named Baxalta in an effort to divest risky segments and streamline operations.

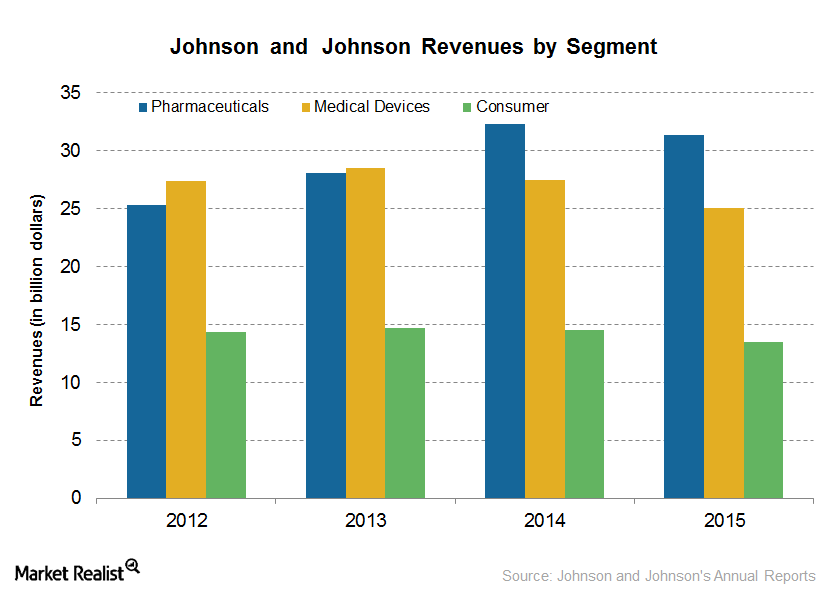

How Johnson & Johnson Hopes to Boost Its Medical Device Segment

Johnson and Johnson’s (JNJ) medical device business segment comprises of cardiovascular, diabetes care, orthopedics, surgery, and vision care divisions.

Growth and Profitability: How Does Stryker Do It?

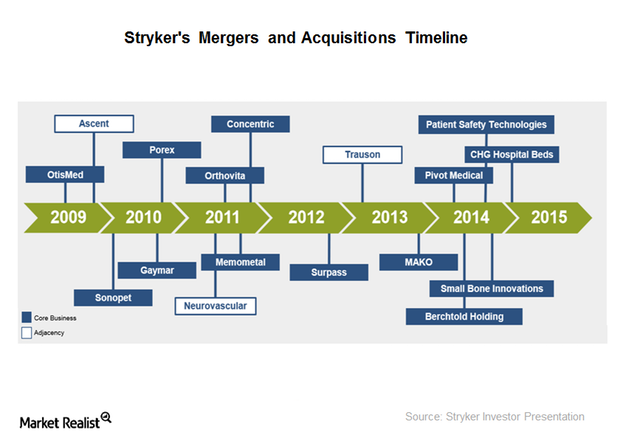

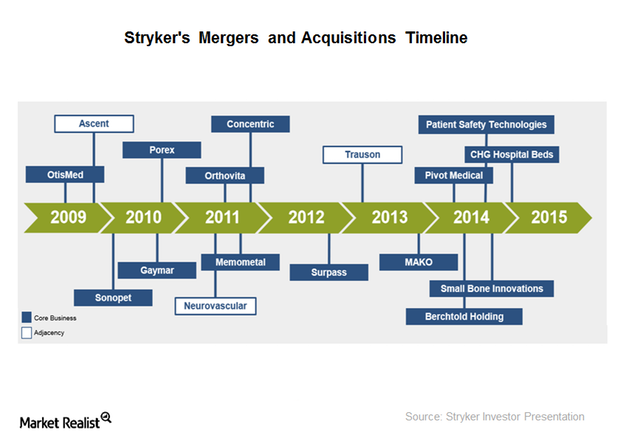

Between 2012 and 2014, Stryker (SYK) entered into a number of mergers and acquisition deals, investing ~$3.4 billion.

The Geographic Strategy of Thermo Fisher Scientific

Thermo Fisher Scientific is a global company, but the majority of its revenues are generated from the developed markets. The US is its largest market, generating ~48% of the company’s total revenues.

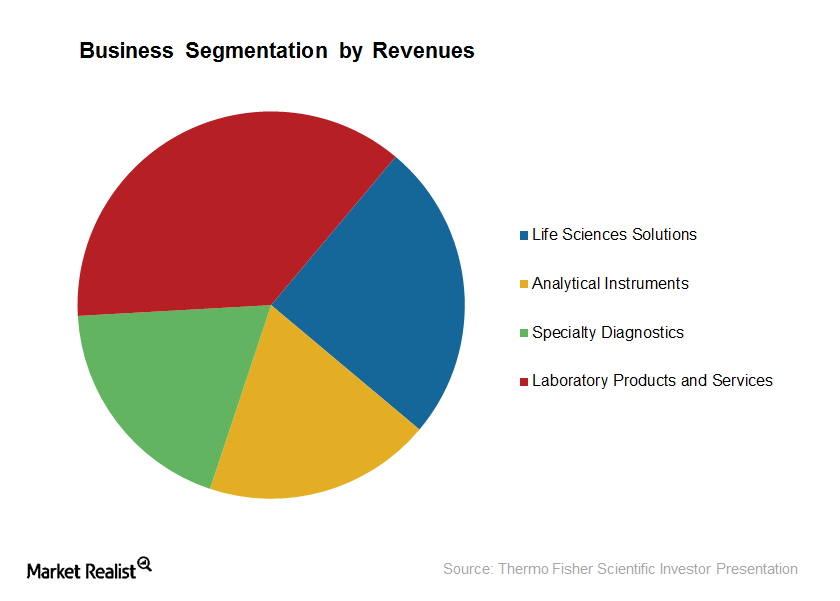

An Overview of Thermo Fisher Scientific’s Business Model

Thermo Fisher Scientific (TMO) has made a number of acquisitions over the years, resulting in the expansion of the company’s product portfolio with the inclusion of a number of premium brands.

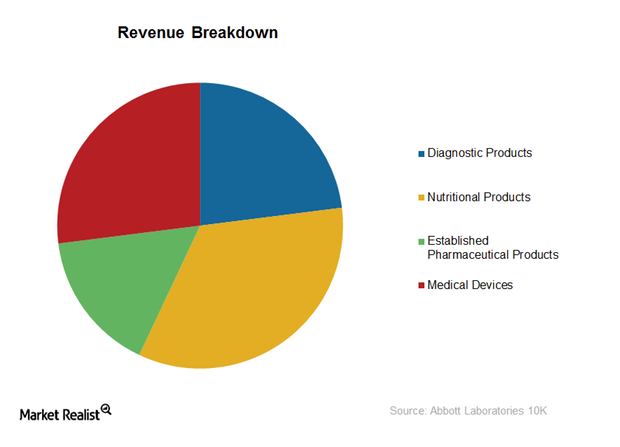

Dissecting Abbott Laboratories: A Key Business Model Analysis

Since 2013, Abbott Laboratories has generated revenues from a diversified healthcare business spanning across geographies and four primary segments.

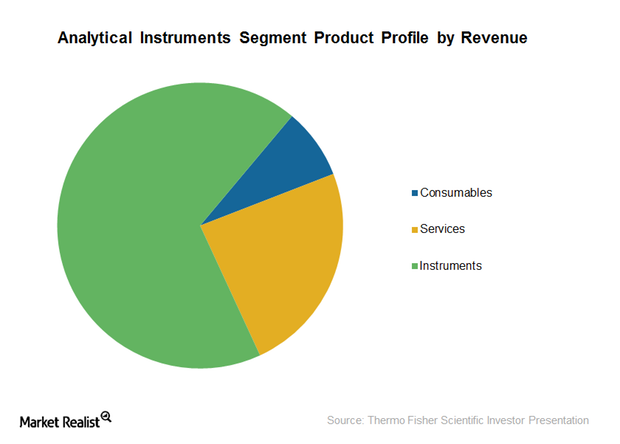

Thermo Fisher Scientific’s Analytical Instruments Business Segment

Thermo Fisher Scientific’s Analytical Instruments segment earned revenues of ~$3.3 billion in 2014, representing organic growth of around 4%.

How Inorganic Growth Strategy of Stryker Is Driving Growth

Stryker has expanded its portfolio and geographic reach through mergers and acquisitions and product development. It saw a 7.3% sales growth in 2014.

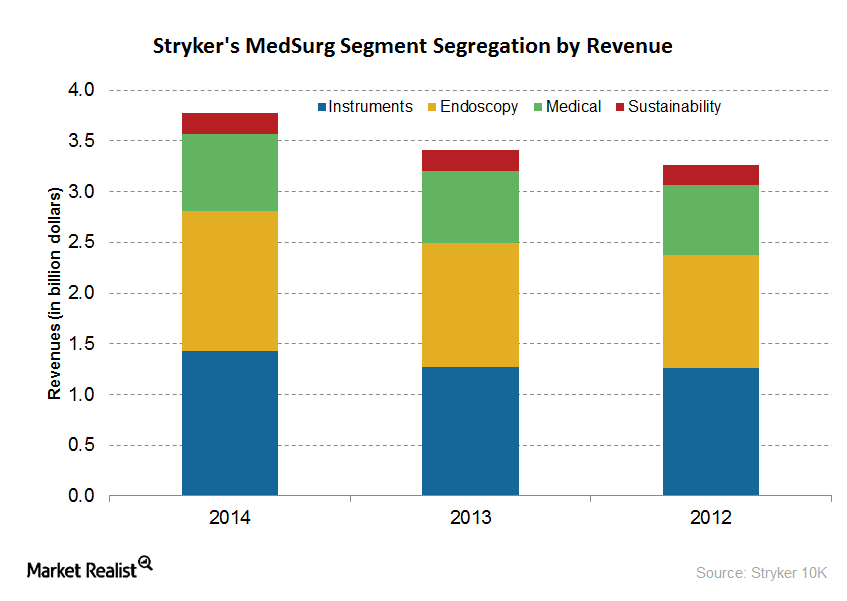

Breaking down Stryker’s MedSurg Segment

Stryker’s MedSurg segment reported an increase of 10.8% in net sales in 2014, driven by increased demand in instruments, medical products, and acquisitions.