Sarah Collins

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Sarah Collins

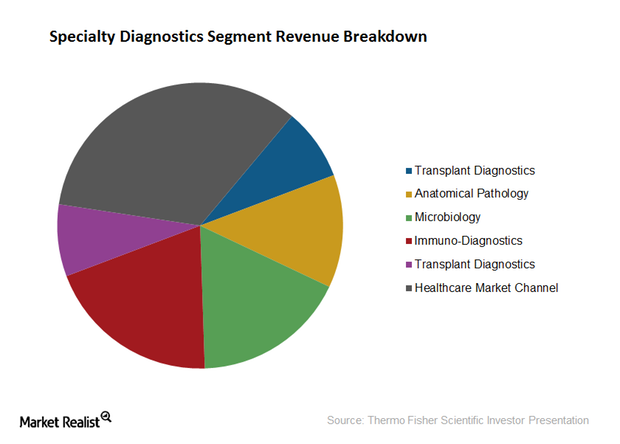

Specialty Diagnostics Segment of Thermo Fisher Scientific

A leading provider of diagnostic products and services, Thermo Fisher Scientific (TMO) has witnessed strong recurring revenues and high margins in the Specialty Diagnostics Segment over the years.

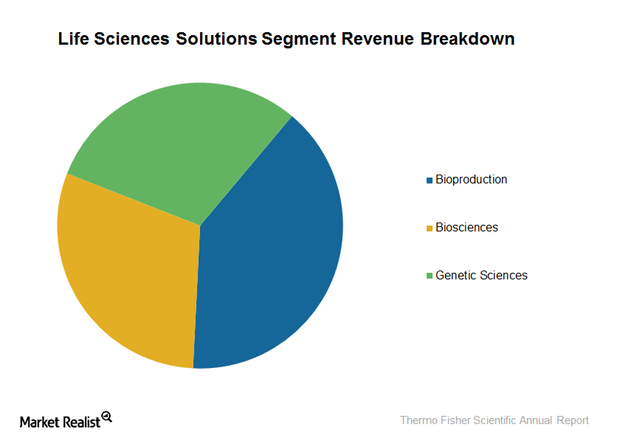

The Life Sciences Solutions Segment of Thermo Fisher Scientific

Thermo Fisher Scientific’s Life Sciences Solutions segment earned revenues of ~$4.2 billion in 2014, representing organic growth of around 4%.

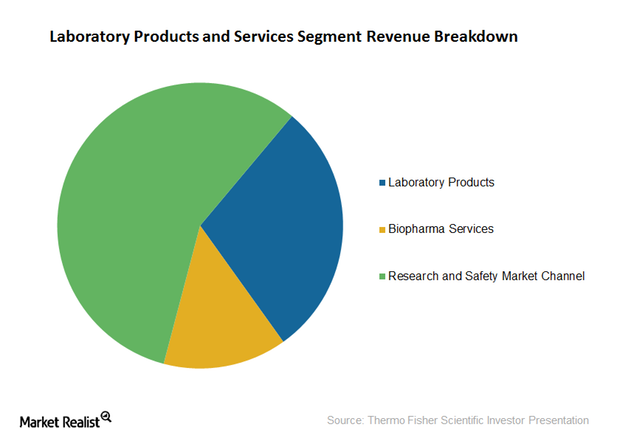

Thermo Fisher Scientific’s Laboratory Products and Services Segment

Thermo Fisher Scientific’s Laboratory Products and Services segment earned revenues of approximately $6.6 billion in 2014, representing organic growth of around 5%.

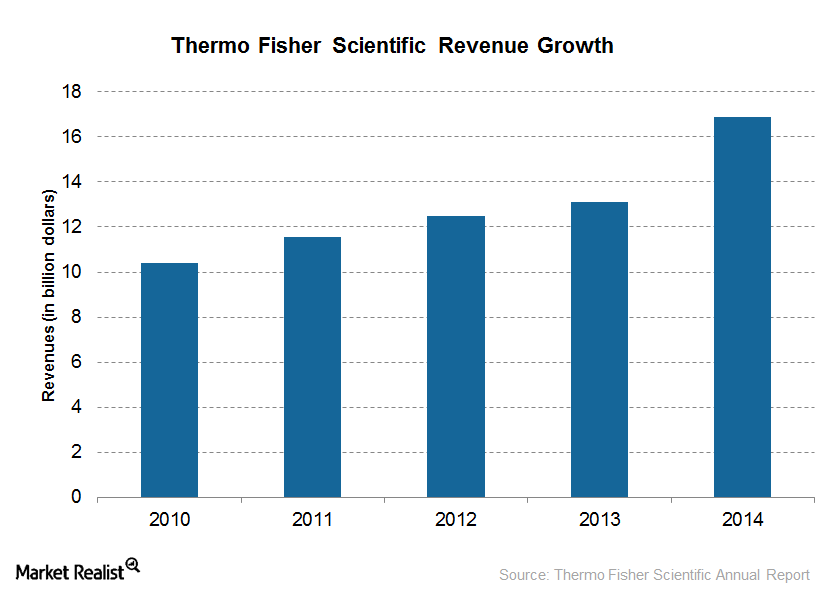

Thermo Fisher Scientific: A Leading Medical Technology Company

Thermo Fisher Scientific (TMO) is one of the leading medical technology companies in the world, providing a broad portfolio of laboratory equipment and services.

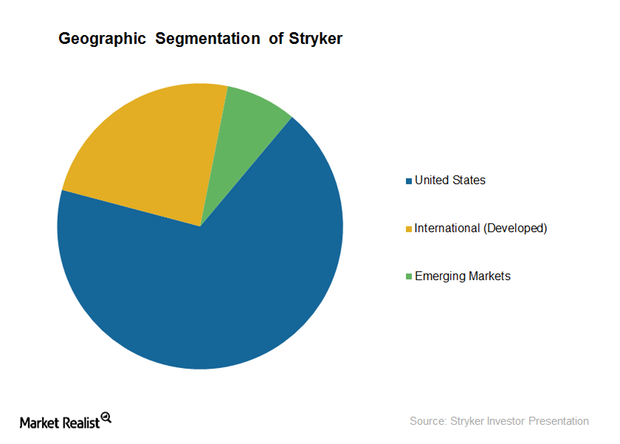

Understanding the Geographical Segmentation of Stryker

While Stryker is a global medical tech company focused on expanding its presence across international markets, the US makes up ~68% of its total revenues.

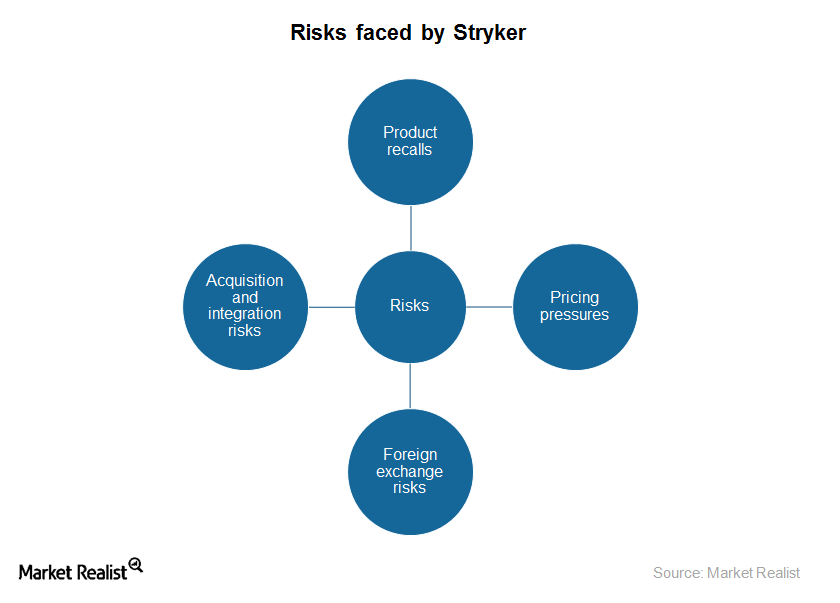

Assessing Stryker’s Major Risks at the Dawn of 2016

Stryker is a leading medical technology company and subject to big challenges impacting the medical technology industry, both systematic and unsystematic.

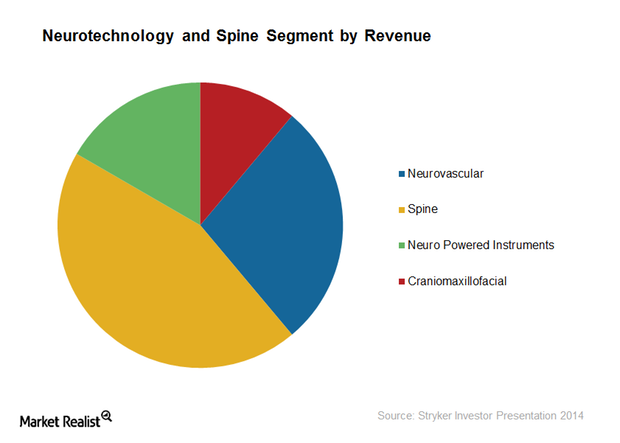

Understanding Stryker’s Neurotechnology and Spine Segment

Stryker’s Neurotechnology and Spine segment reported an increase of 5% in net sales in 2014, driven by increased demand for neurotechnology products.

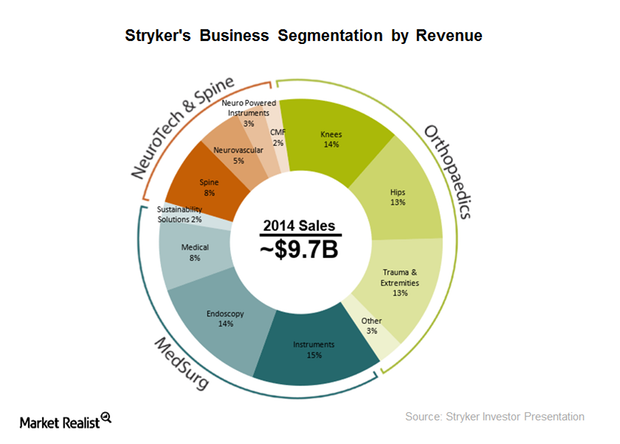

Sizing up Stryker’s Business Model in 2015

Stryker offers a diversified portfolio of more than 60,000 products and services, with a focus on quality outcomes at lower costs through collaborations.

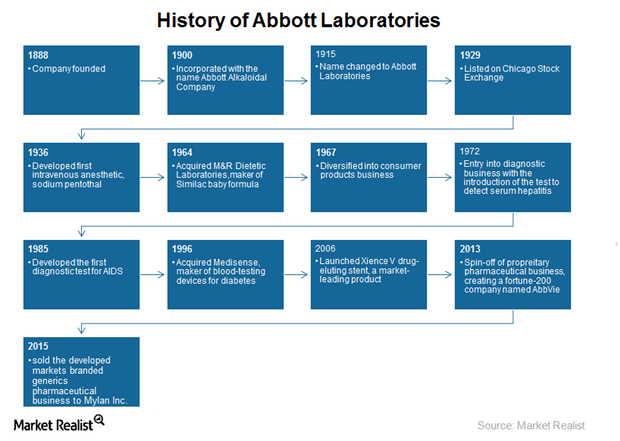

A Key Look at Abbott Laboratories’ Acquisitions and Divestments

Inorganic growth through acquisitions has led to the expansion of Abbott Laboratories across geographies and to the broadening of its product portfolio.

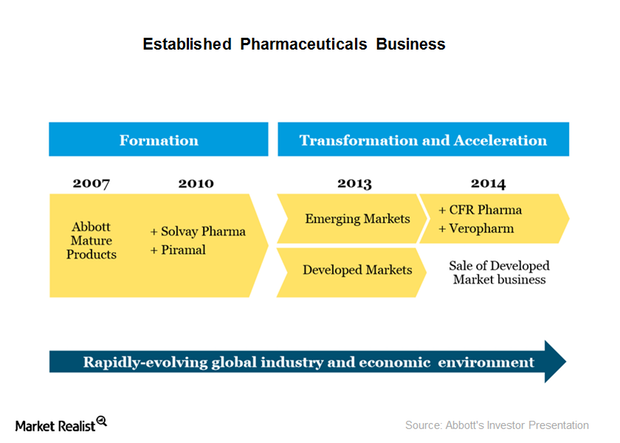

Established Pharmaceuticals Segment of Abbott Laboratories

Abbott’s Established Pharmaceuticals segment is a consumer-oriented segment with a consumer mix of around 75% self-pay consumers and 25% third-party payers.

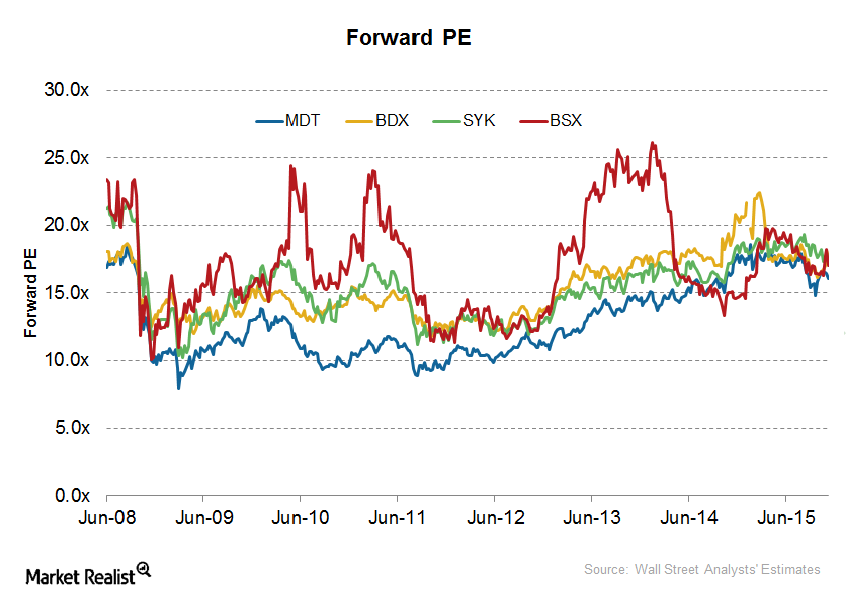

A Look at Becton, Dickinson and Company’s Valuation

Becton, Dickinson and Company is one of the five biggest medical device companies in the United States.

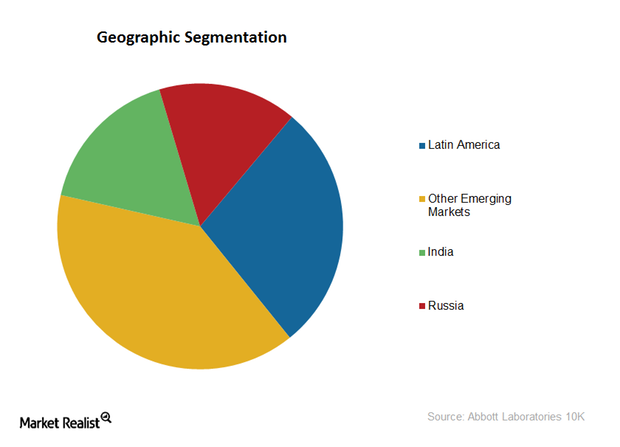

Mapping Abbott Laboratories’ Geographic Strategy

Abbott Laboratories is a global healthcare company that sees 70% of its total revenues generated in markets outside the United States.

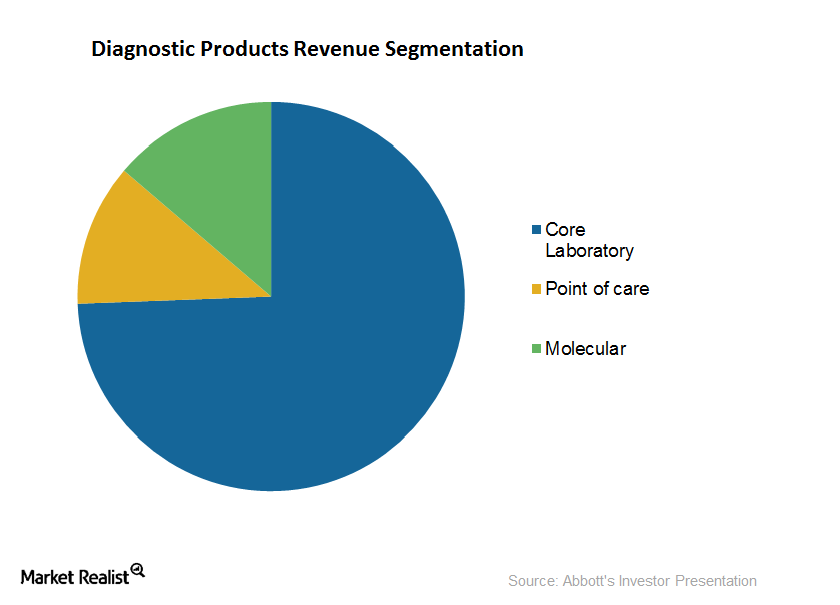

A Rundown of Abbott Laboratories’ Diagnostic Products Segment

Abbott Laboratories is one of the leading companies in the diagnostic products space in the United States, with sales of around $4.7 billion in 2014.

Introducing Abbott Laboratories, a Leading Global Healthcare Company

Abbott Laboratories operates across more than 150 countries, employs over 73,000 people, and is the global leader in the nutrition subsector.

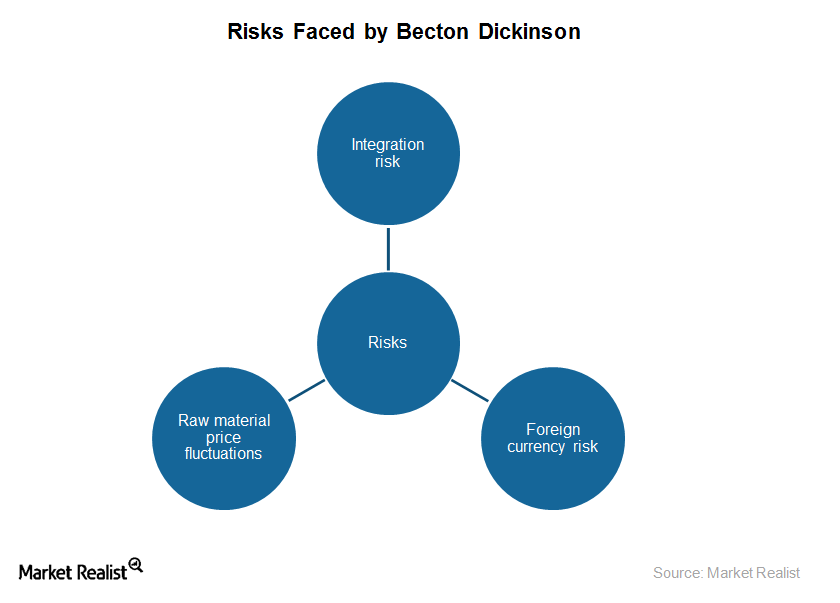

Risks Faced by Becton, Dickinson and Company

As it is susceptible to industry risks, Becton, Dickinson and Company (BDX), or BD, is transforming its business model.

Becton, Dickinson and Company’s Acquisitions and Collaborations

Becton, Dickinson and Company’s (BDX), or BD’s, growth strategy includes acquisitions and collaborations.

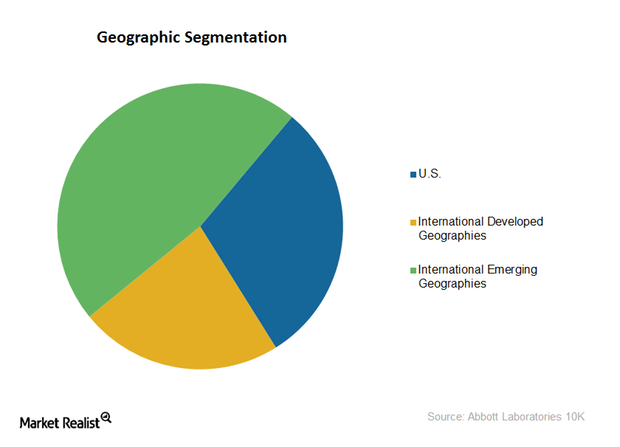

Analyzing Becton, Dickinson and Company’s Geographic Strategy

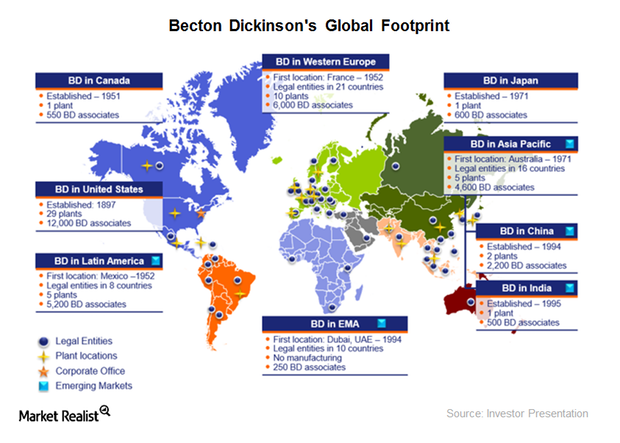

Becton, Dickinson and Company (BDX), or BD, has operations across the globe, with more than 50% of its 2015 revenues coming from international markets.

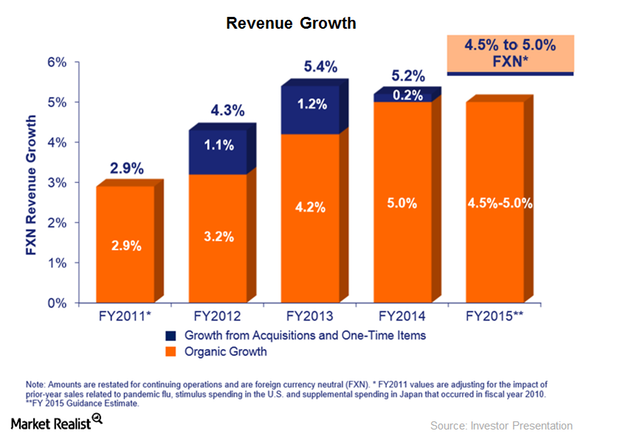

Becton, Dickinson and Company: A Leading Global Medical Device Company

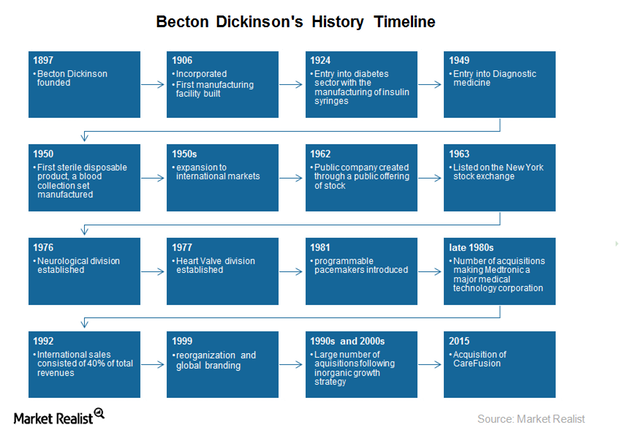

Becton, Dickinson and Company, or BD, headquartered in Franklin Lakes, New Jersey, is one of the leading medical technology companies in the United States.

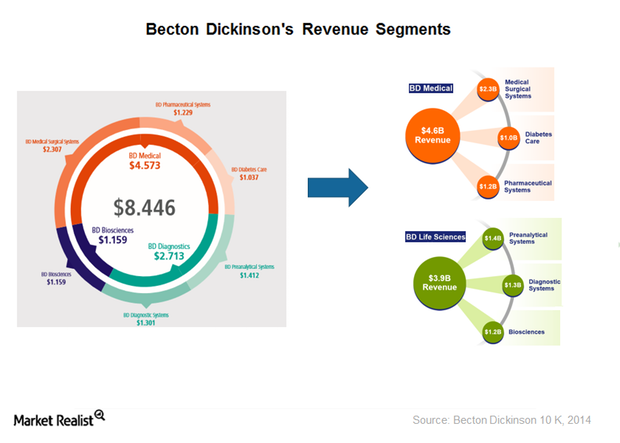

An Overview of Becton, Dickinson and Company’s Business Model

On October 1, 2015, BD underwent organizational restructuring to better align its business model to the strategic vision and goals of the company.

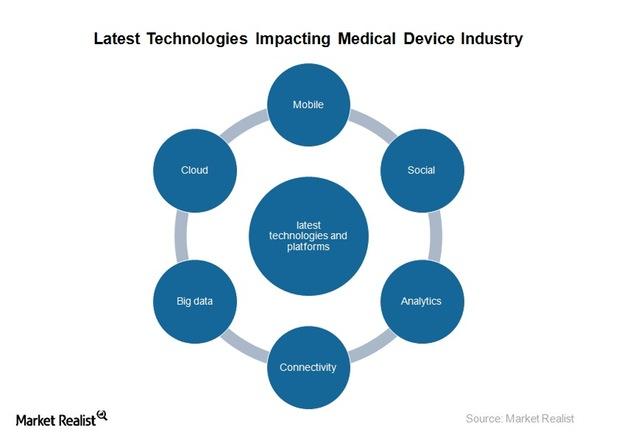

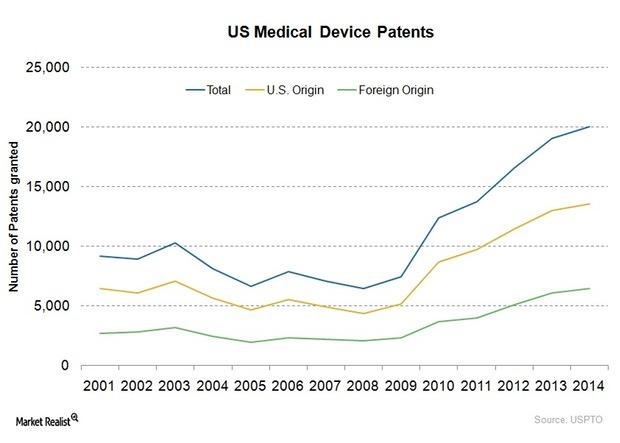

Why Technology Is a Key Driver in the US Medical Device Industry

Traditionally, the United States has been home to the most advanced technological inventions in the medical device industry.

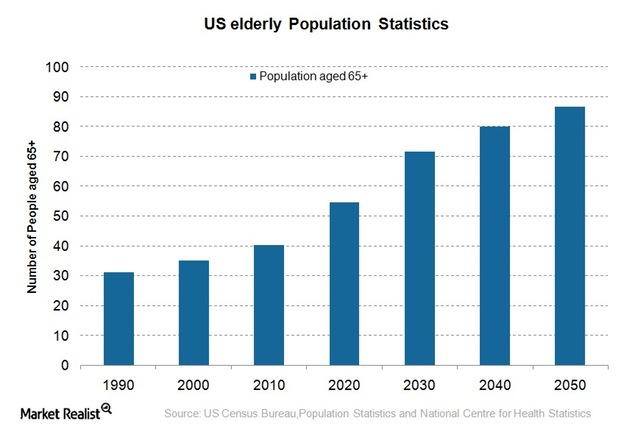

How Economic and Demographic Factors Affect Medical Device Industry

Though the medical device sector displays significant resilience towards changes in the economic environment, economic factors do impact short-term demand substantially.

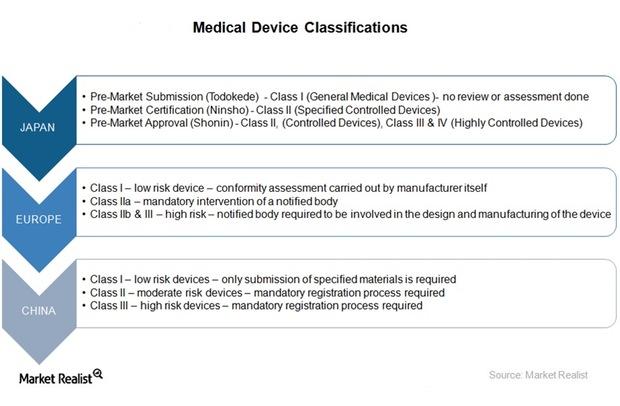

What Are the Medical Device Approval Processes in Major Markets?

In most countries, the approval process varies across different categories of devices classified as per their risk profiles.

Why Are Patents Necessary for Medical Device Companies?

Medical device companies are driven by innovation and inventions that involve high research and development (or R&D) costs.

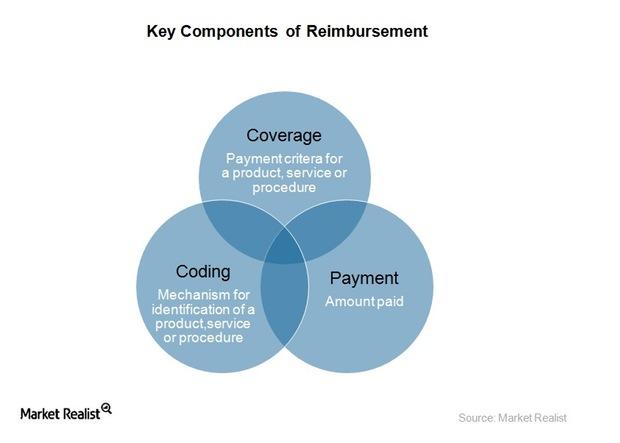

How Reimbursement Models Impact the Medical Device Industry

Coverage, coding, and payment are essential elements to obtaining adequate reimbursement for a new medical device.

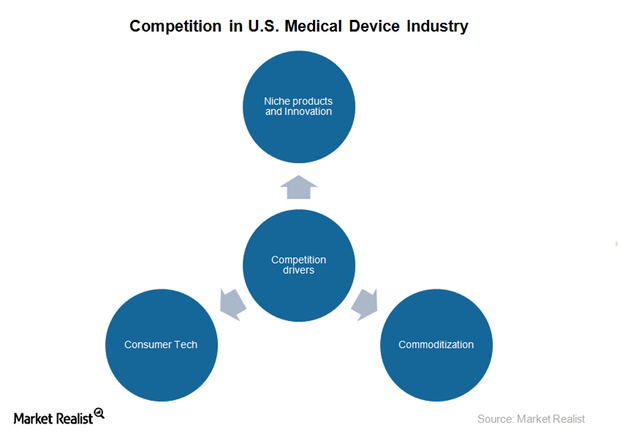

Analyzing the Competitive Landscape of the Medical Device Industry

The medical device industry in the US consists of a few big players and a large number of small and medium enterprises.

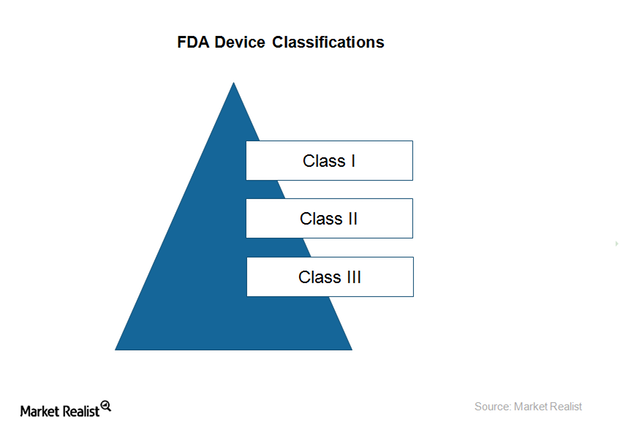

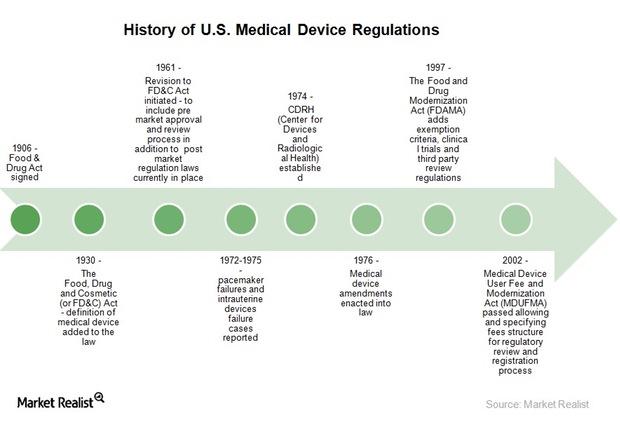

How Does the FDA Classify Medical Devices?

Medical devices are classified as per the level of control required by the Food, Drug, and Cosmetic Act (or FD&C Act).

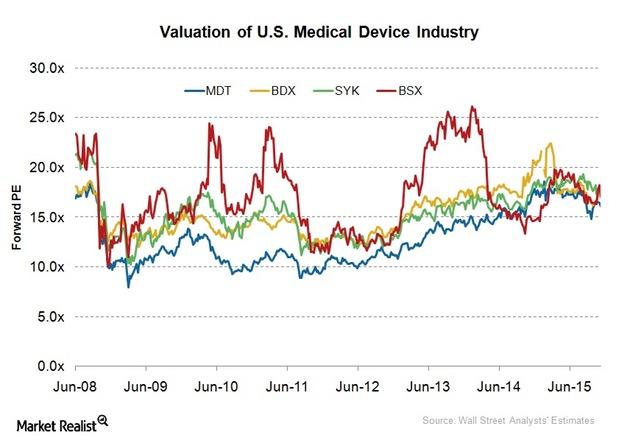

How Is the US Medical Device Industry Valued?

The US medical device industry has rebounded sharply since its 2008 decline, and it is trading at a high PE of 21.9x.

How Do Commodity Prices Impact the Medical Device Industry?

Medical device manufacturers source various medical components and parts from suppliers in order to assemble or develop medical devices.

What Are the Major Sources of Capital for Medical Device Companies?

Venture capital is one of the major sources of capital for the US medical device industry.

Analyzing Cost Structure for Medical Device Companies

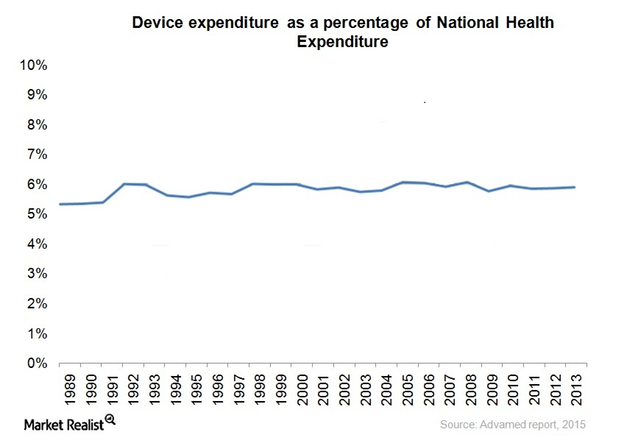

As per the US Census, spending on medical devices in the US has been constant for over a decade between 2005 to 2015.

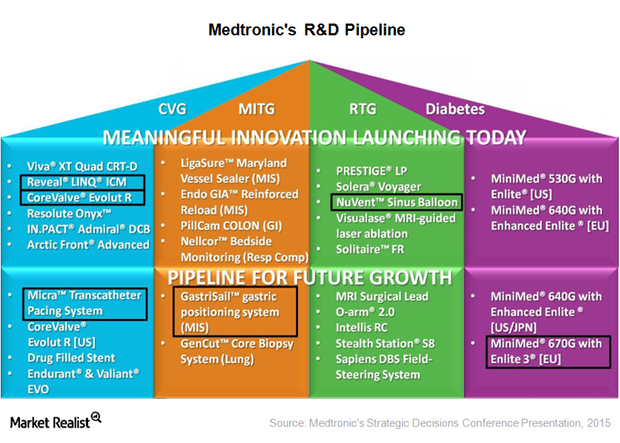

Probing Medtronic’s Research and Development Pipeline

Medtronic spent ~$1.6 billion—approximately 8.1% of its total sales—on research and development programs in fiscal 2015.

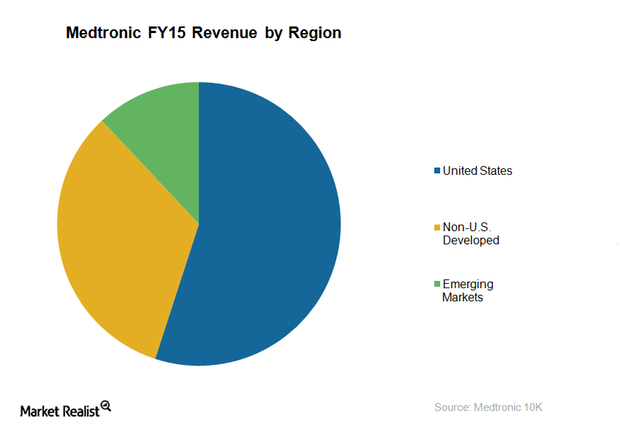

Gauging Medtronic’s Geographic Strategy in 2015

Medtronic’s US market YoY growth rate was 22% in 2015, compared to a 2% growth in 2014, whereas its emerging markets have grown by 23% in 2015.

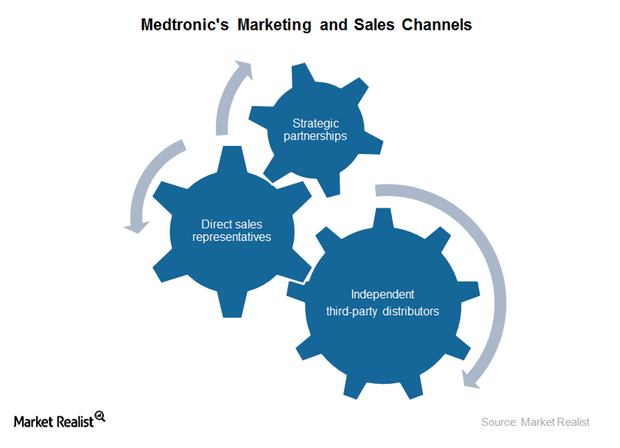

Assessing Medtronic’s Marketing and Sales Strategy in 2015

To extend cost-effective, high-quality medical devices and therapies, Medtronic aims to organize its marketing and sales teams around physician preferences.

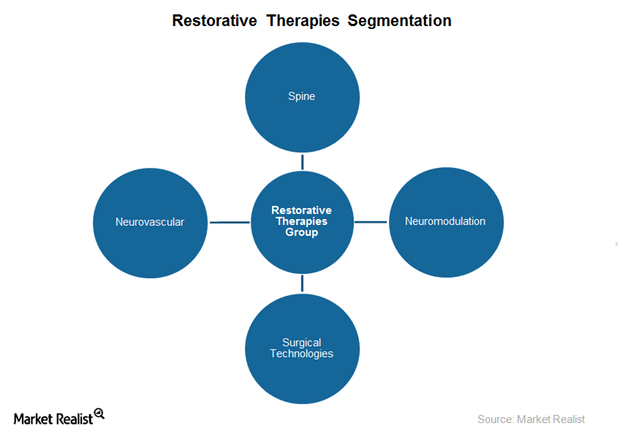

Analyzing Medtronic’s Restorative Therapies Group Segment

Medtronic’s Restorative Therapies Group’s net sales in fiscal 2015 reached ~$6.8 billion, which represents an increase of 4% over the prior fiscal year.

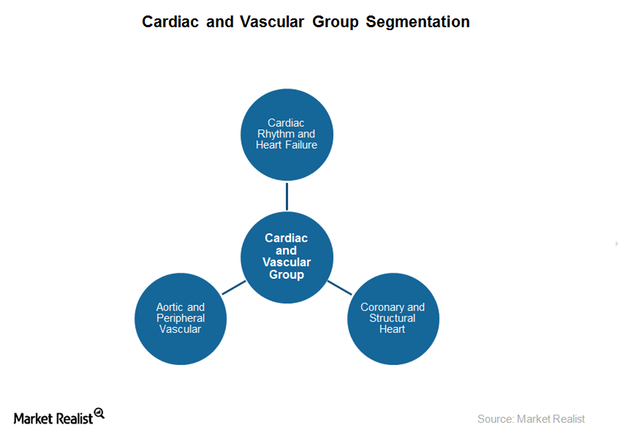

Evaluating Medtronic’s Cardiac and Vascular Devices Segment

Medtronic’s Cardiac and Vascular segment consists of Cardiac Rhythm and Heart Failure, Coronary and Structural Heart, and Aortic and Peripheral Vascular.

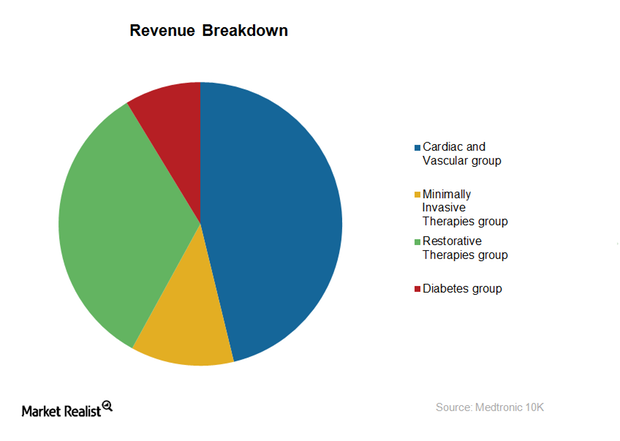

A Key Breakdown of Medtronic’s Business Model

Medtronic generates revenue through four segments: Cardiac and Vascular Group, Minimally Invasive Therapies, Restorative Therapies, and the Diabetes Group.

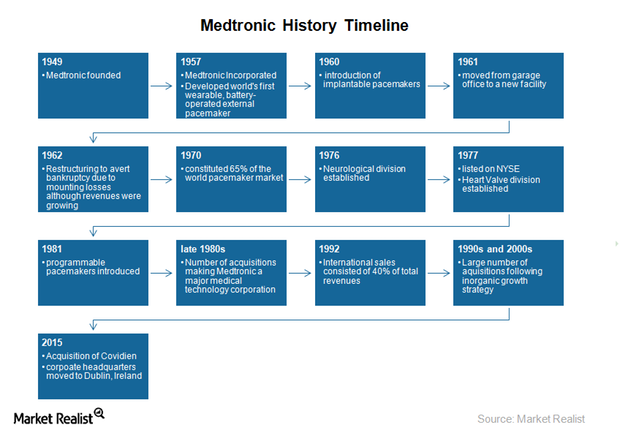

Introducing Medtronic, a Leading Medical Device Company

Headquartered in Minnesota, Medtronic is the world’s largest pure-play medical device company, with operations in 160 countries and over 85,000 employees.

Key Regulations that Affect Medical Device Companies

The US Food and Drug Administration’s Center for Devices for Radiological Health (or USFDA/CDRH) regulates the medical device industry in the United States.

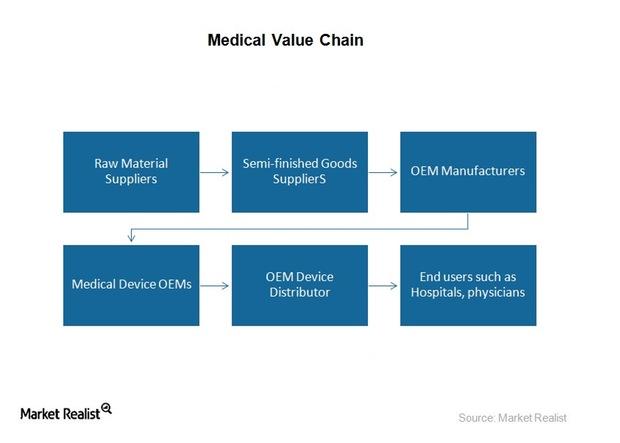

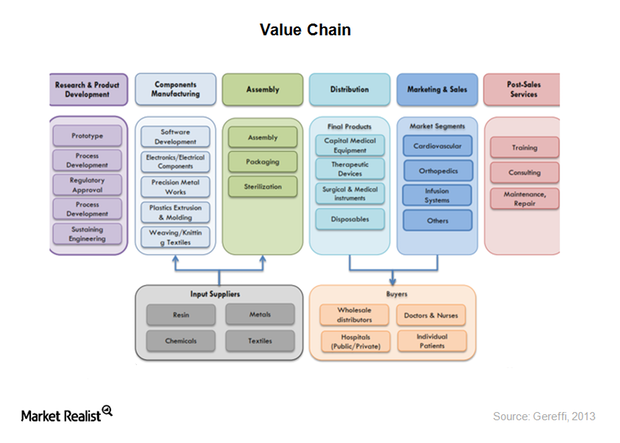

Analyzing Value Chain and Business Models in Medical Device Industry

The US medical device industry has been working on traditional business models based on R&D and innovation where physicians have been the target audience.

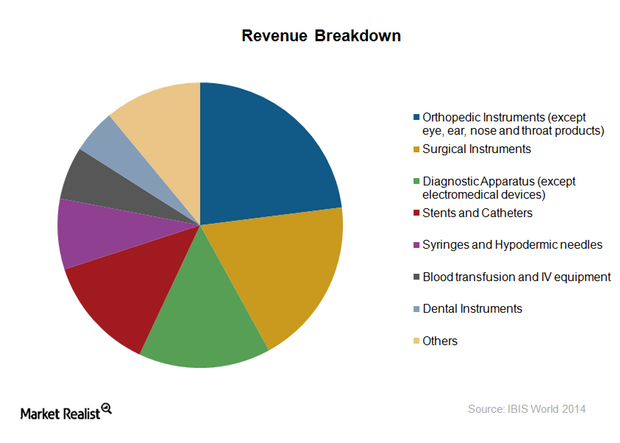

How Is the Medical Device Industry Segmented?

The US medical devices industry can be categorized according to the field of medicine in which a device is used.

A Must-Read Overview of the Medical Device Industry

The US medical device market is projected to grow at a compound annual growth rate of 6.1% between 2014 and 2017.