Sarah Collins

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Sarah Collins

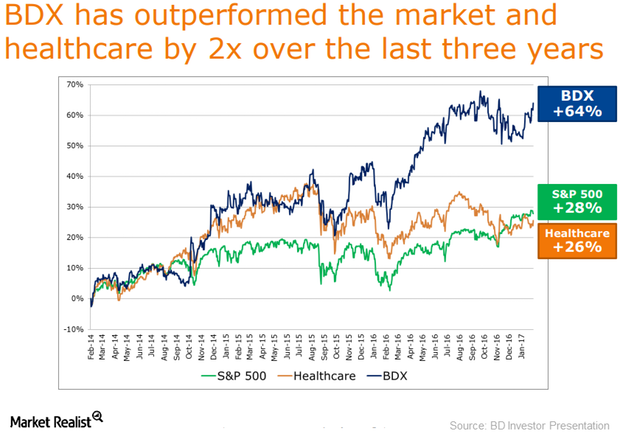

BD Stock Fell 2.7% on September 13: Should Investors Worry?

Becton, Dickinson and Company (BDX) closed at $196.62 on September 13, 2017.

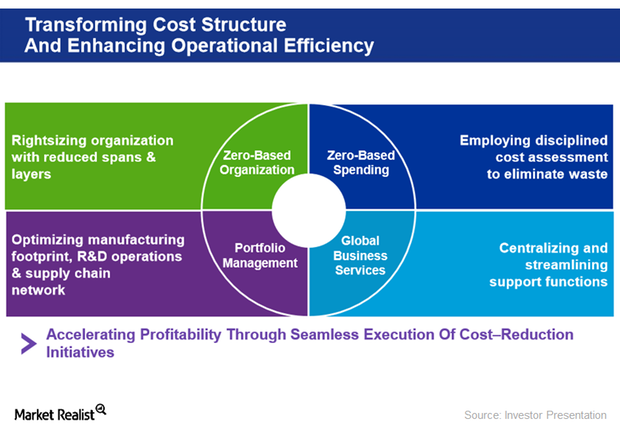

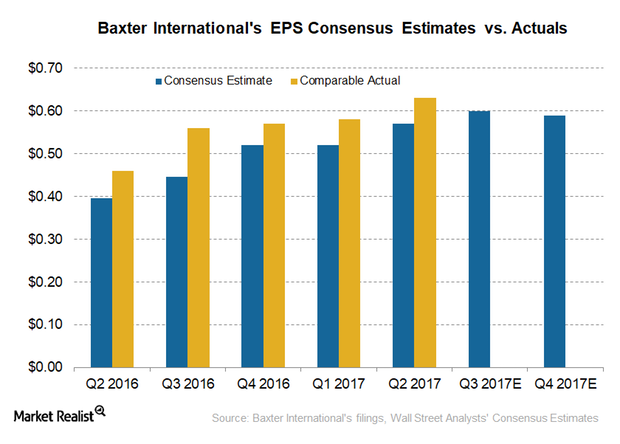

Management Changes at Baxter International: What You Should Know

Baxter International (BAX) has been going through a cost transformation and reorganization process for some time. The initiative includes some leadership and management changes.

Inside Baxter International’s Stock Price Performance

On September 7, 2017, BAX stock closed at $62.84 per share. It has a 50-day moving average of $61.15 and a 200-day moving average of $57.14.

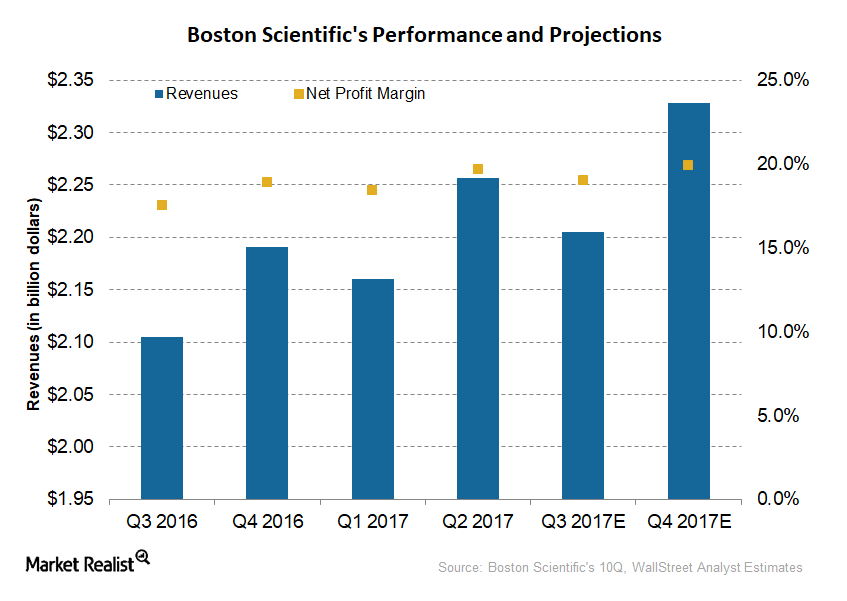

Boston Scientific’s Updated 2017 Guidance

Boston Scientific (BSX) expects to register 2017 revenues of $8.9 billion–$9.0 billion compared to its previous guidance of $8.8 billion–$8.9 billion.

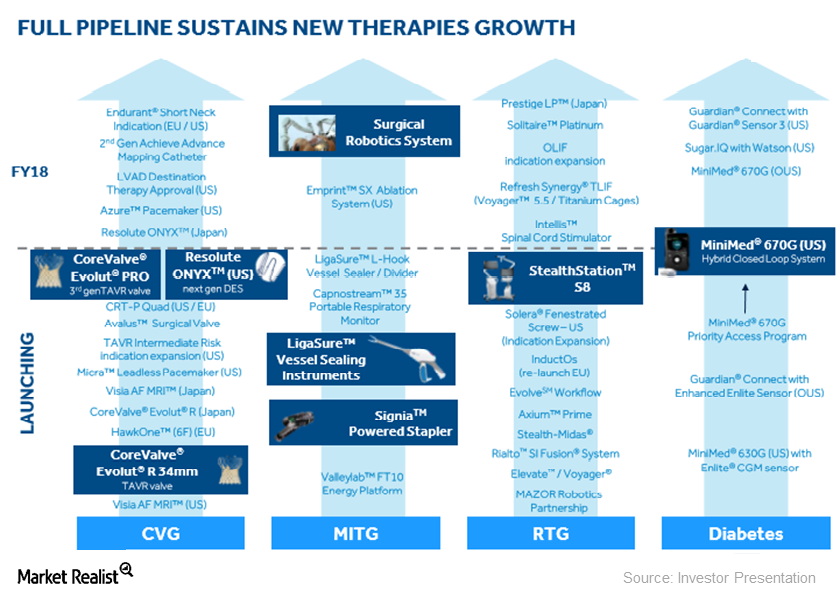

Medtronic’s Robust Product Pipeline

On May 1, 2017, Medtronic announced the FDA approval of its Resolute Onyx DES (drug eluting stent) for adult patients suffering from coronary artery disease.

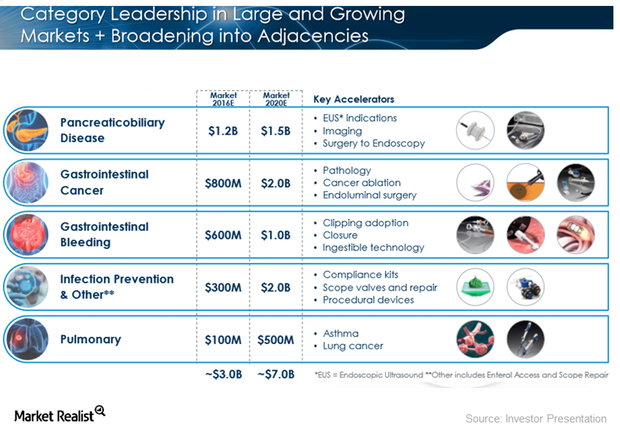

Boston Scientific Is Accelerating Category Leadership Strategy

Boston Scientific (BSX) currently has a global market opportunity of $40.0 billion, which is expected to grow to $50.0 billion by fiscal 2020.

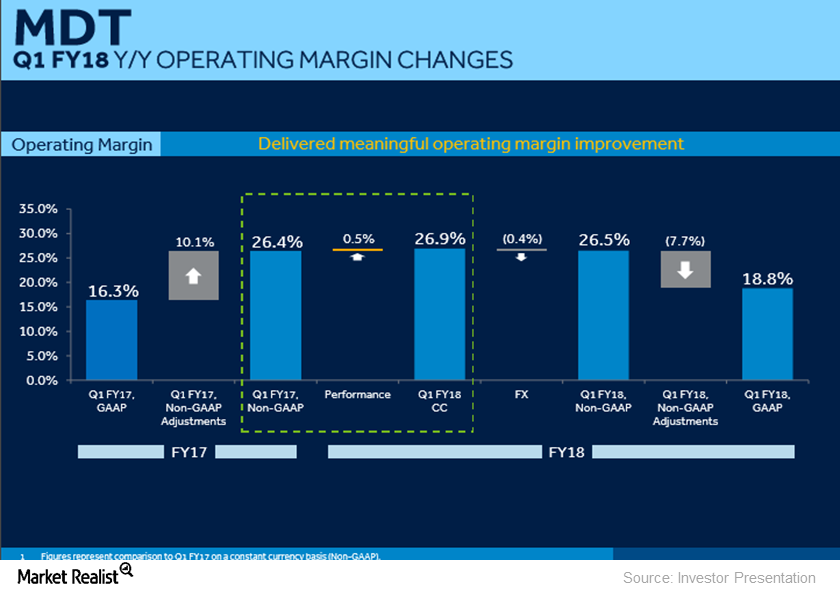

What’s behind Medtronic’s Accelerating Margin Expansion?

In fiscal 1Q18, Medtronic (MDT) reported ~26.9% of operating margin on a constant currency basis. This represented year-over-year growth of ~50 basis points.

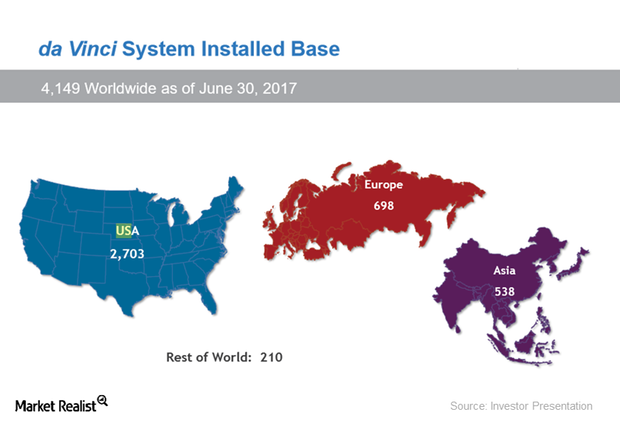

Intuitive Surgical Plans to Expand in Europe and Asia

Although Intuitive Surgical leads the surgical robotics market, there are competitive threats from other major players in the market.

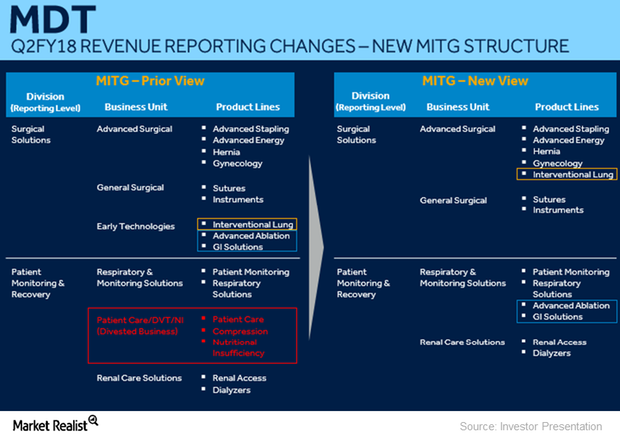

Divestiture of a Part of Medtronic’s PMR Business to Cardinal Health

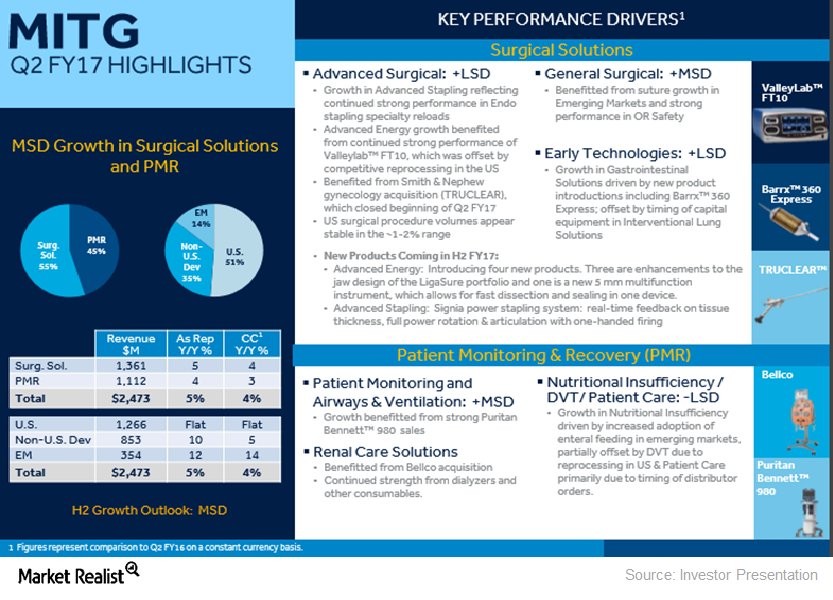

Medtronics’ MITG (Minimally Invasive Therapies Group) business is expected to grow 3.5%–4.5%.

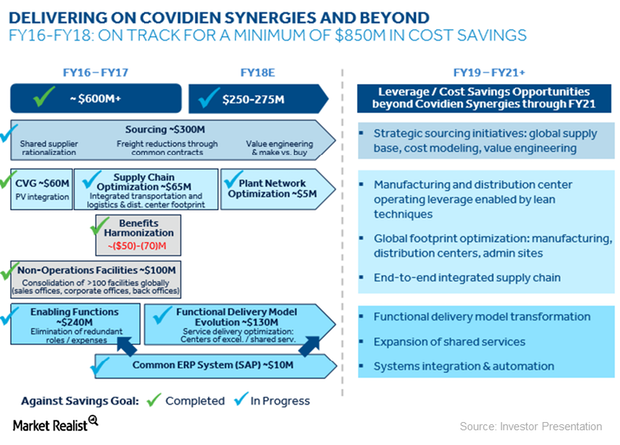

How Medtronic Is Delivering on Its Covidien Synergies

In January 2015, Medtronic (MDT) acquired Covidien for ~$43 billion in cash and MDT stock in a tax inversion deal.

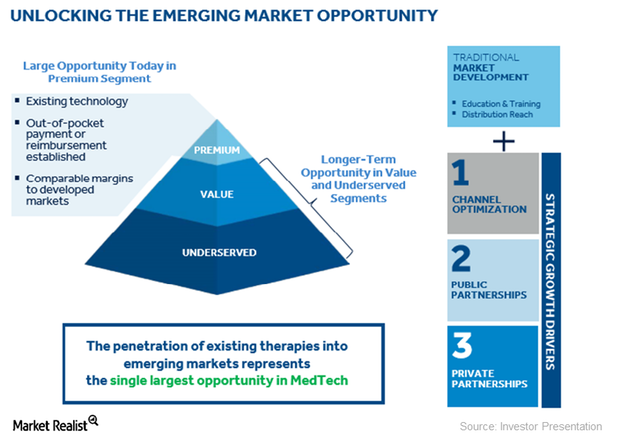

Medtronic’s Emerging Market Position and Opportunities for Fiscal 2018

Medtronic (MDT) registered revenues of ~$1.0 billion revenues from emerging markets in fiscal 1Q18, which represents YoY (year-over-year) sales growth of ~11% in that market.

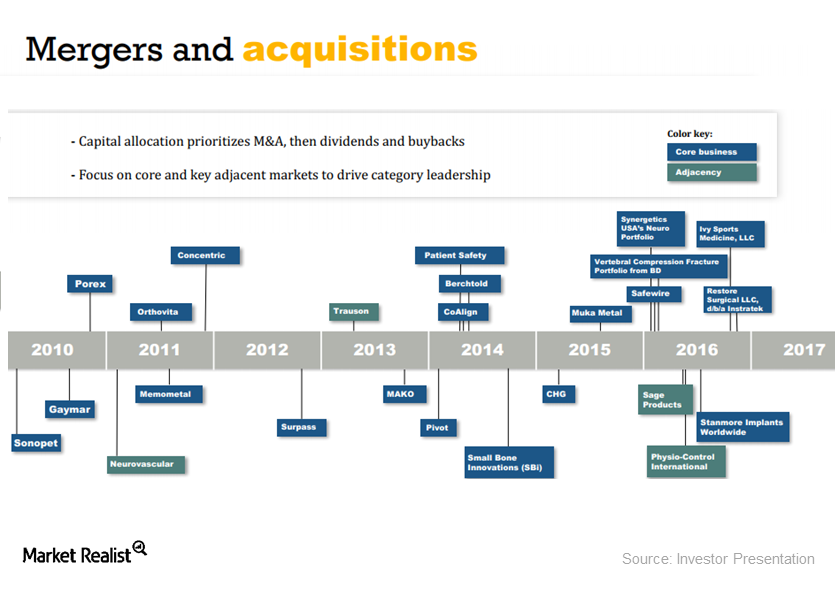

Stryker Stock Falls Due to the Impact of the Sage Products Recall

On August 23, Stryker (SYK) announced a voluntary product recall of specific lots of oral care products that form part of the company’s Sage business unit.

What Zimmer Biomet’s Leadership Transition Could Mean for Its Core Growth Strategy

In July 2017, David Dvorak stepped down as chief executive officer and president of Zimmer Biomet (ZBH) and resigned from its board of directors.

How Medtronic Is Accelerating Its Economic Value Growth Strategy

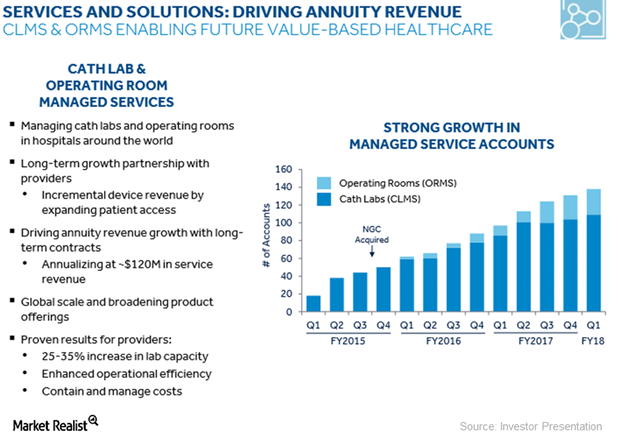

Medtronic’s (MDT) Hospital Solutions segment registered double-digit growth in fiscal 1Q18.

How Is Becton Dickinson Progressing with Emerging Market Growth?

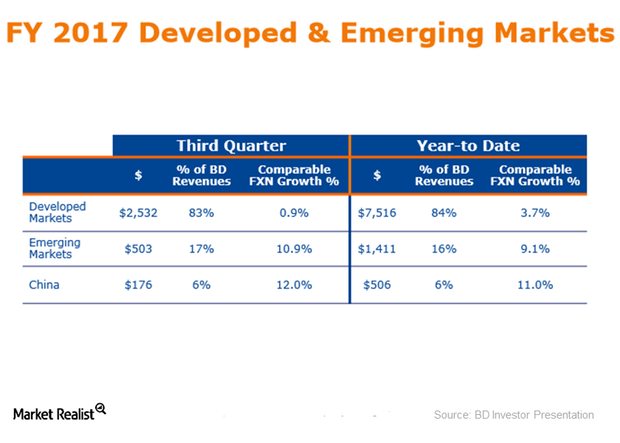

Becton Dickinson’s (BDX) emerging markets registered a strong double-digit growth of 10.9% in 3Q17.

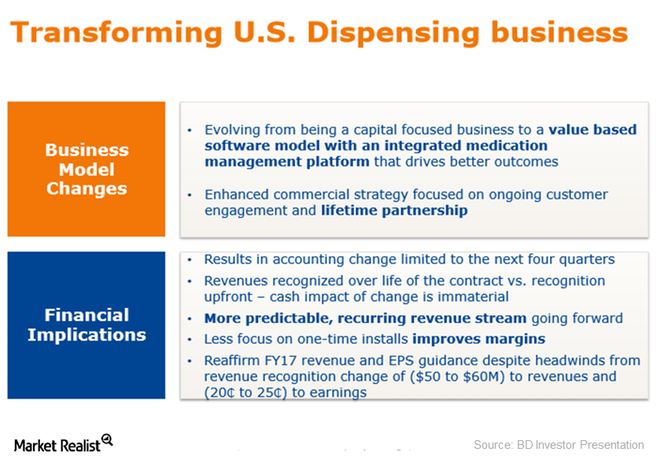

Headwind for Becton Dickinson: US Dispensing Business

Becton Dickinson (BDX) is the leading player in the US dispensing business. Its Pyxis system sales contribute significantly to the company’s total revenues.

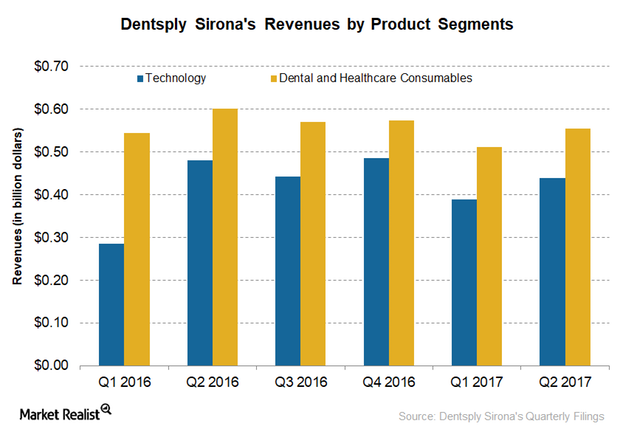

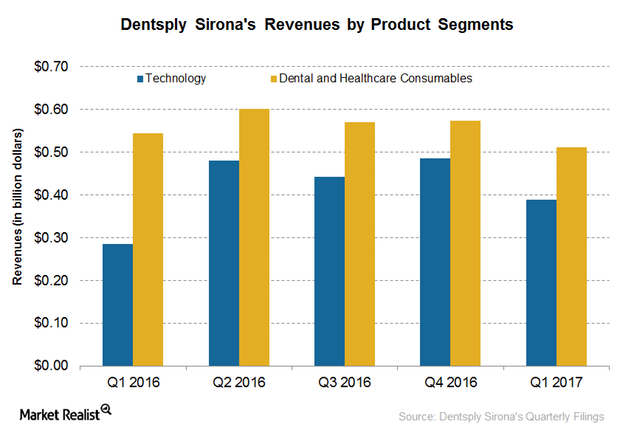

Dental and Healthcare Consumables Grew but Missed Expectations in 2Q17

In 2Q17, Dentsply Sirona’s (XRAY) Dental and Healthcare Consumables business contributed ~56% to the company’s total revenues and registered sales of ~$554 million.

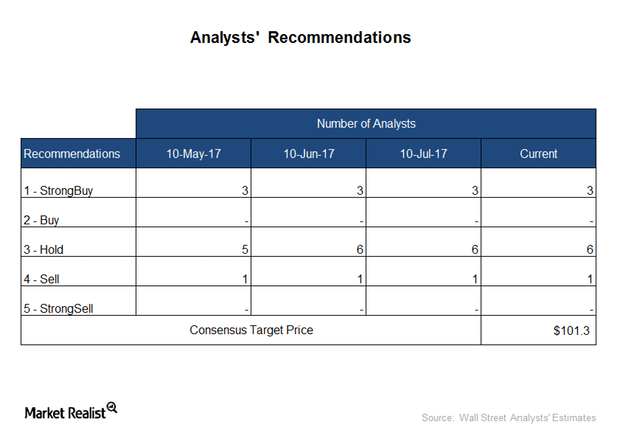

Analysts’ Recommendations for Varian Medical Systems

With the spin-off of its Imaging Components business, Varian Medical Systems (VAR) is now more aligned with its core capabilities. In this series, we’ll discuss the company’s dynamics after the Varex spin-off.

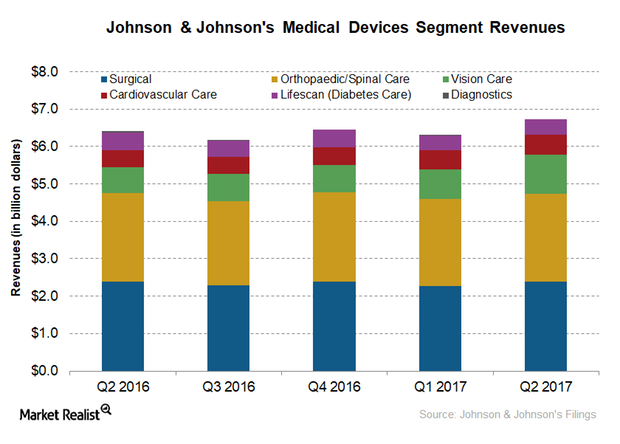

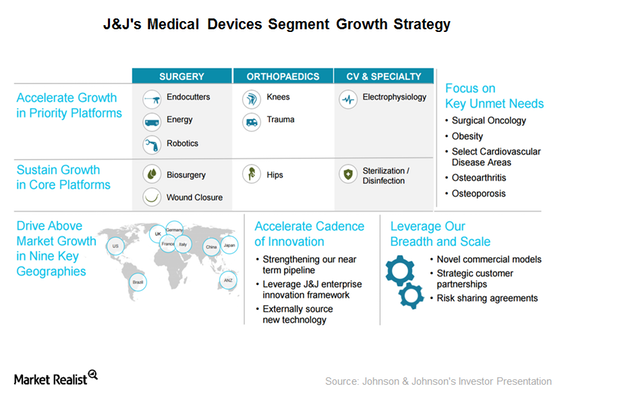

Behind the Major Drivers of JNJ’s Medical Device Growth

Johnson & Johnson (JNJ) reported Medical Devices segment sales of ~$6.7 billion in 2Q17, compared with $6.4 billion in 2Q16.

Thermo Fisher Scientific Accelerates Its Semiconductor Sequencing

On June 29, 2017, Thermo Fisher Scientific (TMO) announced the addition of three new products to its semiconductor failure analysis workflows portfolio.

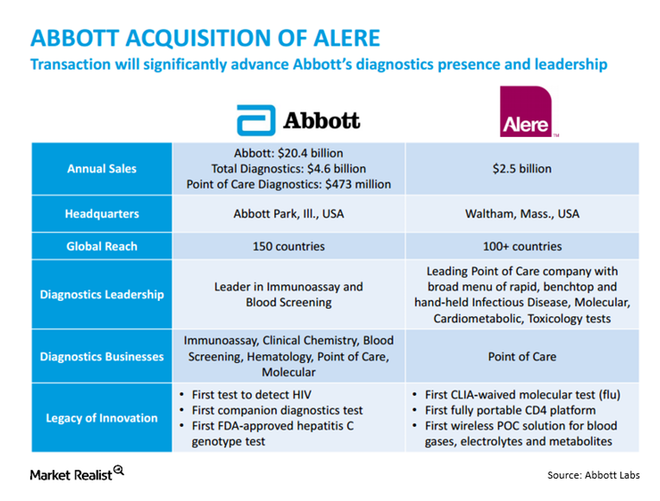

Abbott’s Acquisitions Are Its Major Growth Drivers

Abbott Laboratories completed the acquisition of St. Jude Medical in January 2017. The integration has been on track.

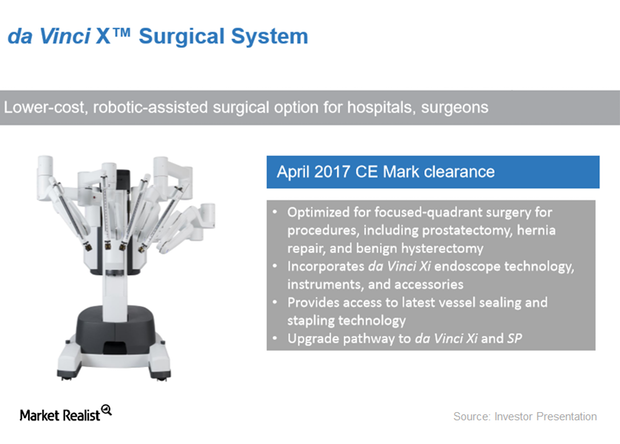

ISRG Expands across Low-Cost Markets with Da Vinci X Launch

On May 30, 2017, Intuitive Surgical (ISRG) announced that it received FDA (US Food and Drug Administration) approval of its new da Vinci X robotic surgical system.

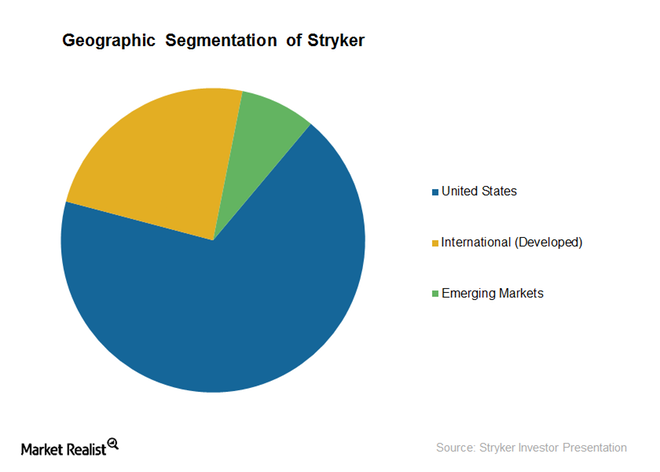

How Stryker Plans to Capture the International Markets

Most of Stryker’s emerging market sales are from China. However, Europe and emerging markets sales have witnessed high growth in recent quarters.

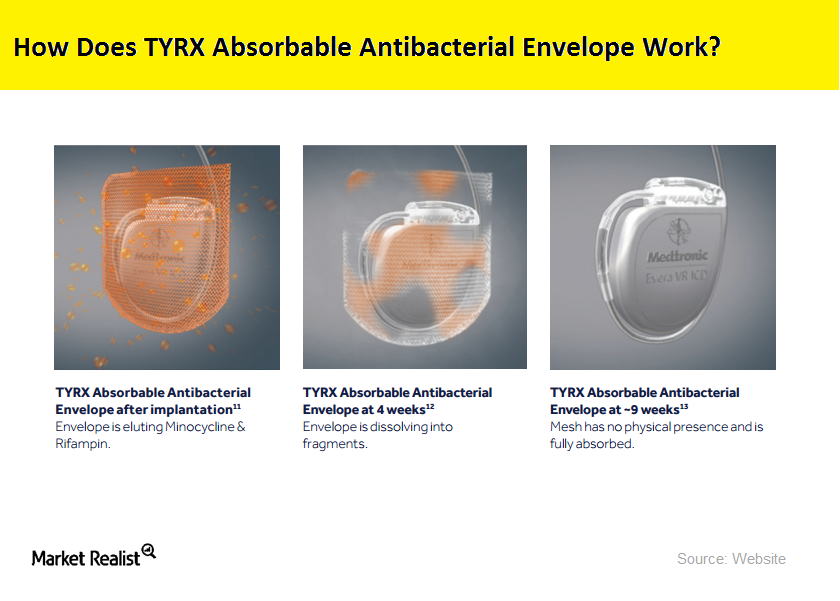

Medtronic’s Agreement Will Expand the Use of Its Tyrx Envelopes

Medtronic’s (MDT) Tyrx envelope is an antibacterial and fully-absorbable device that helps prevent surgical site infections.

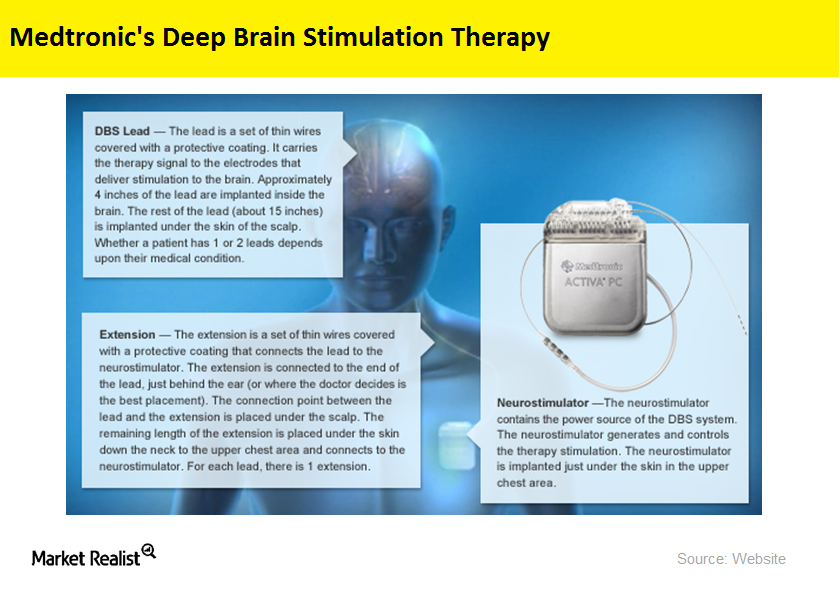

Medtronic Received Health Canada License for SureTune3

On June 6, 2017, Medtronic (MDT) received the Health Canada license for its SureTune3 software for DBS (deep brain stimulation) therapy.

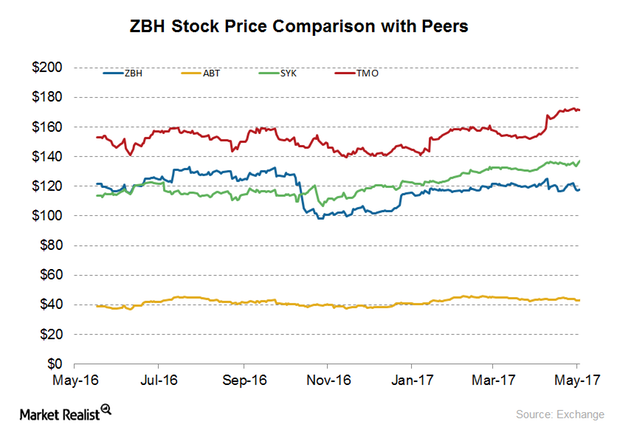

How Zimmer Biomet Stock Has Performed Recently

Zimmer Biomet Holdings (ZBH) was trading at $118.40 on May 30, 2017. It has a 50-day moving average of $119.70 and a 200-day moving average of $114.20.

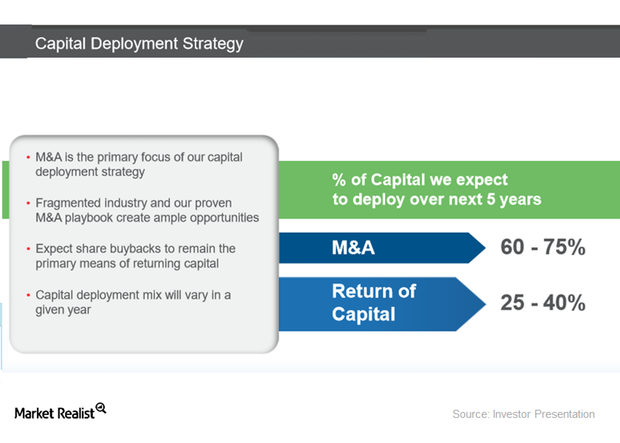

Understanding Thermo Fisher’s Capital Deployment Strategy

Thermo Fisher Scientific expects to deploy 60%–75% of its capital toward M&As (mergers and acquisitions).

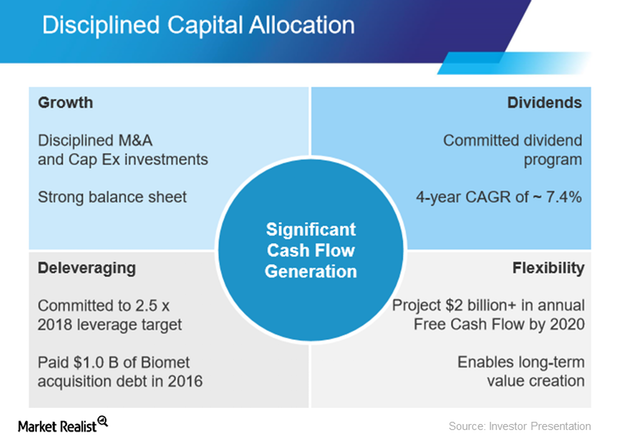

Zimmer Biomet’s Capital Allocation Strategy to Create Value

In February 2016, Zimmer Biomet authorized up to $1.0 billion of the company’s common stock for share repurchases, all of which remains authorized to date.

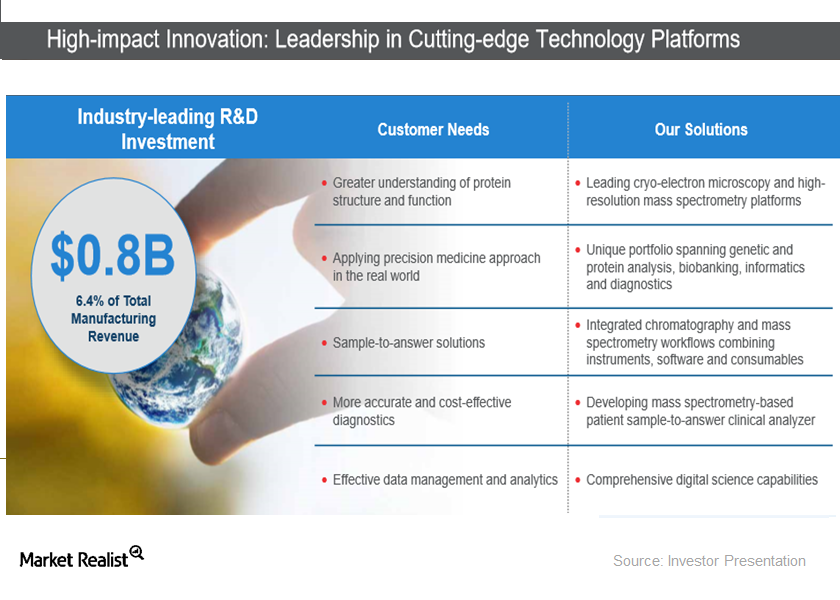

Understanding Thermo Fisher’s Growth Strategy

Thermo Fisher Scientific (TMO) has always focused on innovation as a key growth strategy.

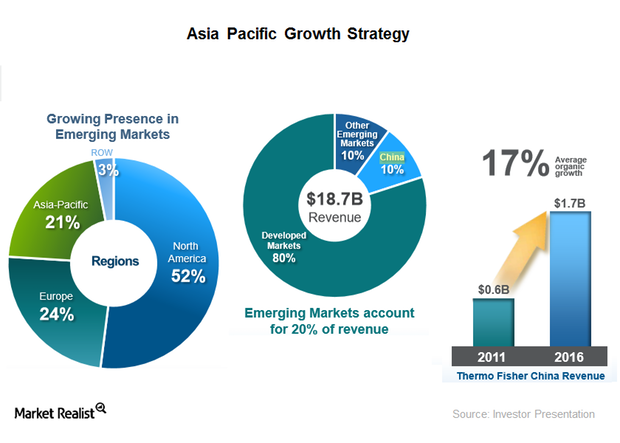

How Long Can Thermo Fisher Scientific’s Asia-Pacific Growth Momentum Last?

Thermo Fisher Scientific (TMO) has a presence around the globe, but around 80% of its revenues are generated from developed markets.

How Medtronic’s CVG Segment Performed in Fiscal 4Q17

Medtronic (MDT) reported ~$7.9 billion in worldwide revenues in fiscal 4Q17.

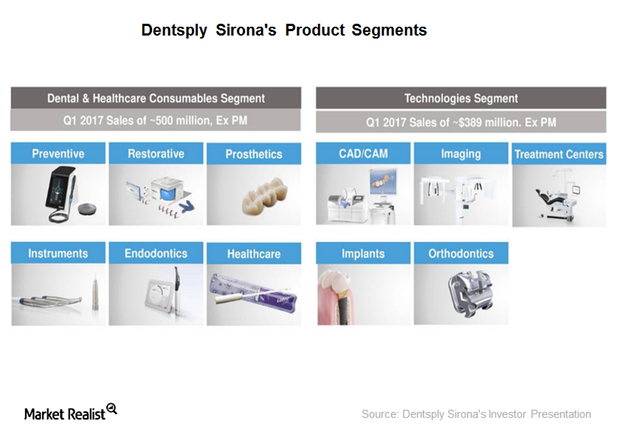

Dentsply Sirona’s New Growth Strategy to Accelerate Digital Dentistry Penetration

Dentsply Sirona is the largest dental equipment and solutions manufacturer in the United States. Digital dentistry is a megatrend in the market.

What Dragged Down Technology Business Sales in 1Q17?

Dentsply Sirona’s Technology segment sales Dentsply Sirona (XRAY) reported ~$900 million of revenues worldwide in 1Q17. Of that, ~$389 million was generated through Dentsply Sirona’s Technology segment, which contributed ~43.2% to Dentsply Sirona’s total revenues. On a constant currency basis, the Technology segment’s sales declined by approximately 8.1%. The segment’s sales were flat in Europe. The […]

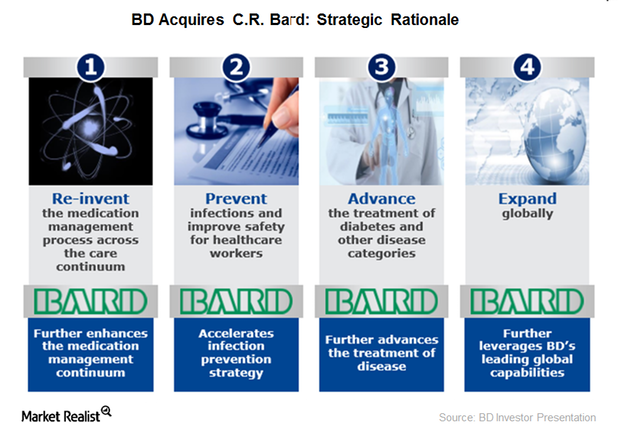

A Look at BD’s Deal Rationale in Its C.R. Bard Acquisition

BD’s acquisition of C.R. Bard is aimed at providing a comprehensive product portfolio to customers at more reasonable costs and enhanced efficiency.

How Zimmer Biomet Is Driving Growth through Acquisitions

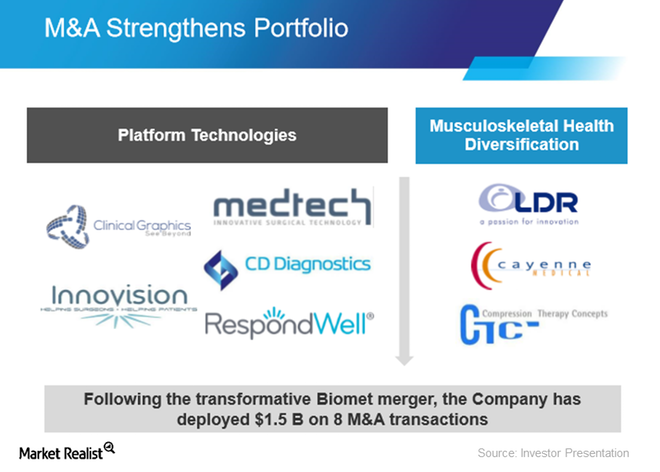

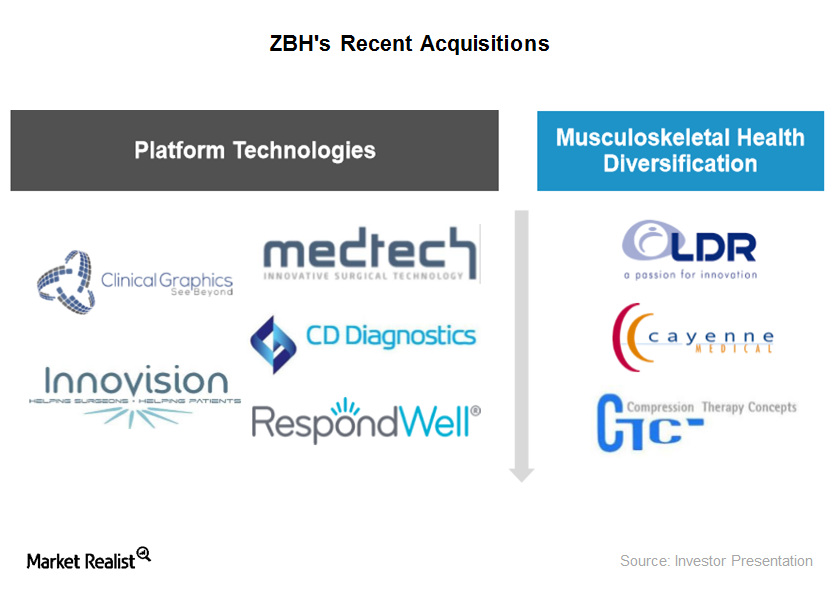

Zimmer Holdings acquired Biomet in 2015. Following the $14 billion merger, ZBH has deployed approximately $1.5 billion on eight M&A (merger and acquisition) deals.

Johnson & Johnson’s Expandable Cage Acquisition to Accelerate the Spine Division

On January 3, DePuy Synthes, a subsidiary of Johnson & Johnson (JNJ), entered into an asset purchase and development agreement with Interventional Spine.

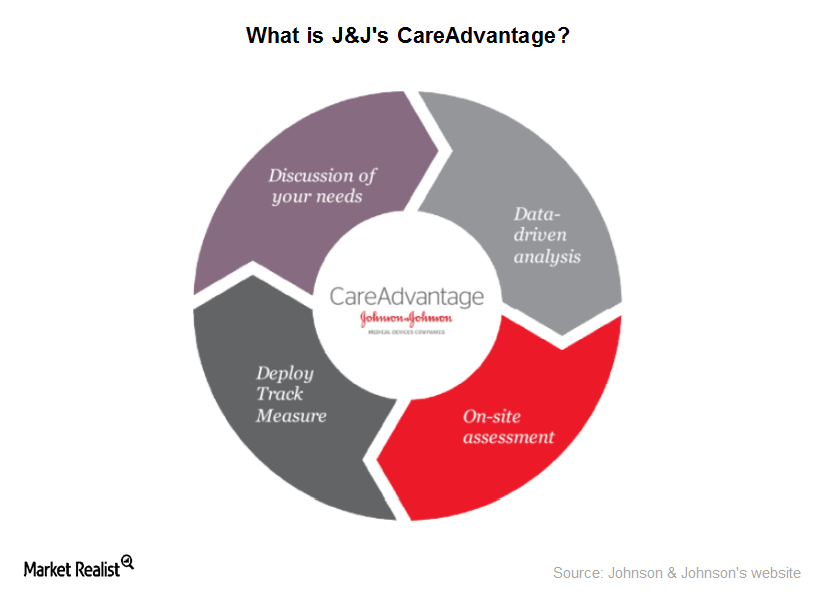

Inside the Latest Capability Advancement in Johnson & Johnson’s Orthopedics

On January 9, JNJ’s Medical Device division announced its Orthopedic Episode of Care Approach, a data-driven program that will accelerate value-based care.

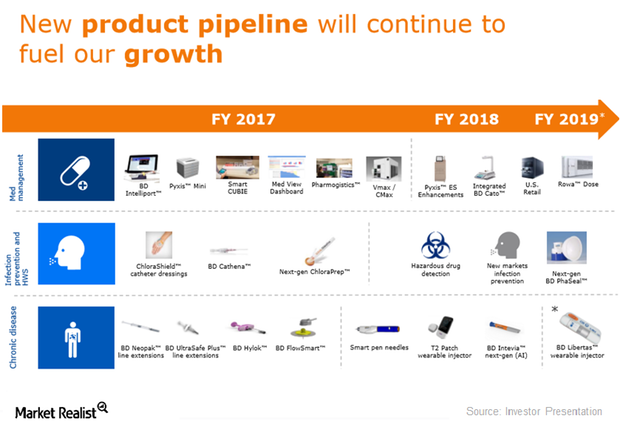

Analyzing the BD Medical Segment’s Product Pipeline

Becton, Dickinson and Company (BDX) generates ~$1 billion from its Infection Prevention business.

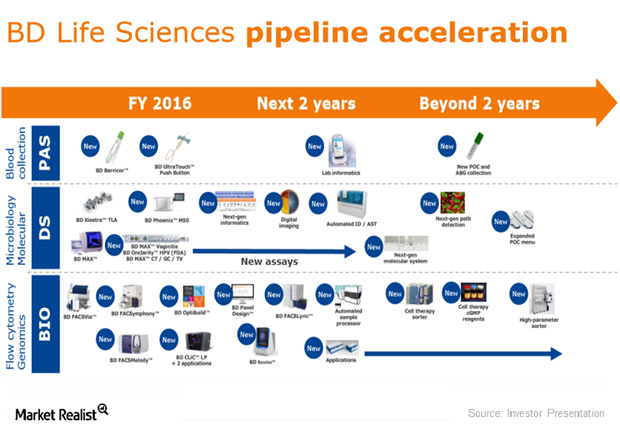

BD Lifesciences’s Product Pipeline Could Boost Its Fiscal 2017 Growth

Becton, Dickinson and Company (BDX) recently launched BD Barricor and BD Ultra Touch Push Button under its Pre-Analytical Systems division.

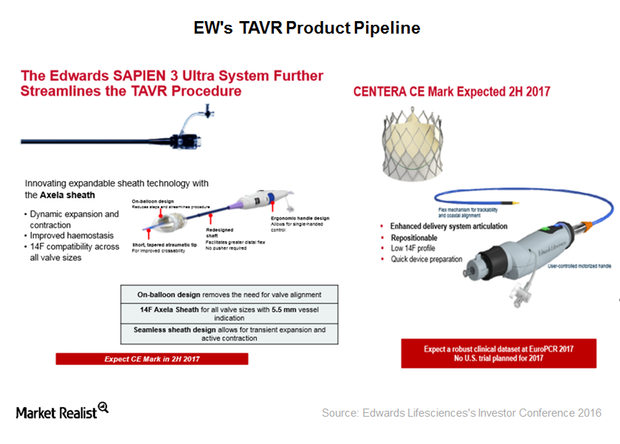

Inside Edwards Lifesciences’ THV Product Pipeline and Future Growth Estimates

Edwards Lifesciences (EW) has a robust product pipeline in its THV (transcatheter heart valve) segment, with Sapien 3 as the segment’s leading product.

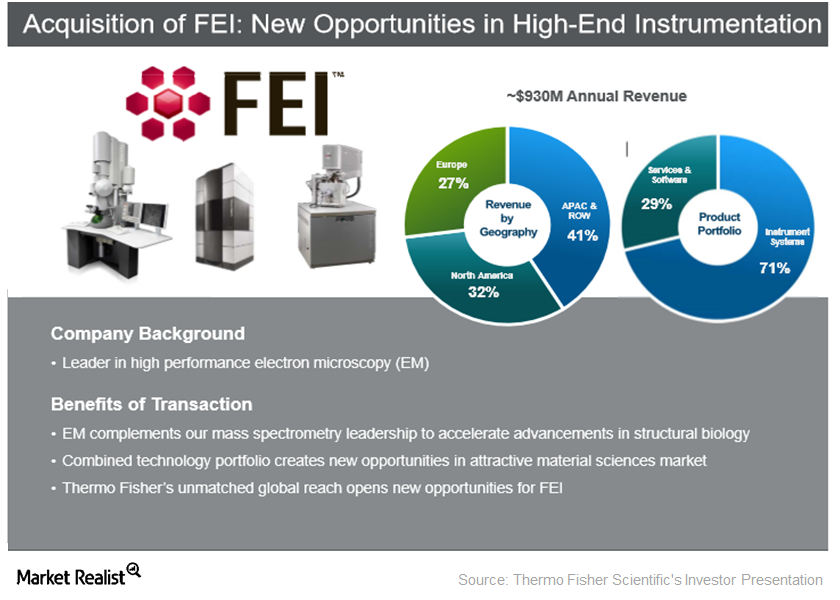

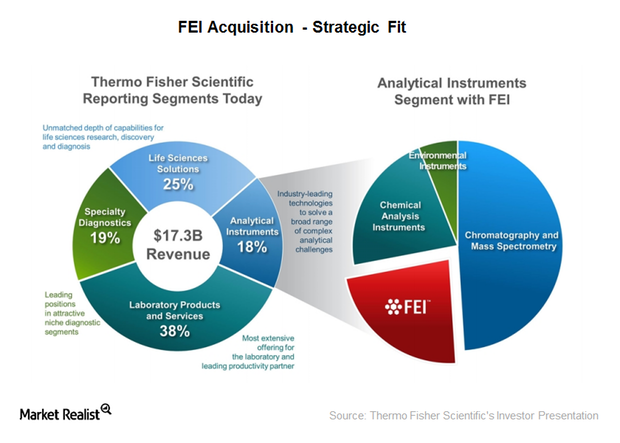

How Is Thermo Fisher Scientific’s FEI Integration Process Going?

Thermo Fisher Scientific (TMO) completed the acquisition of FEI Company on September 19, 2016.

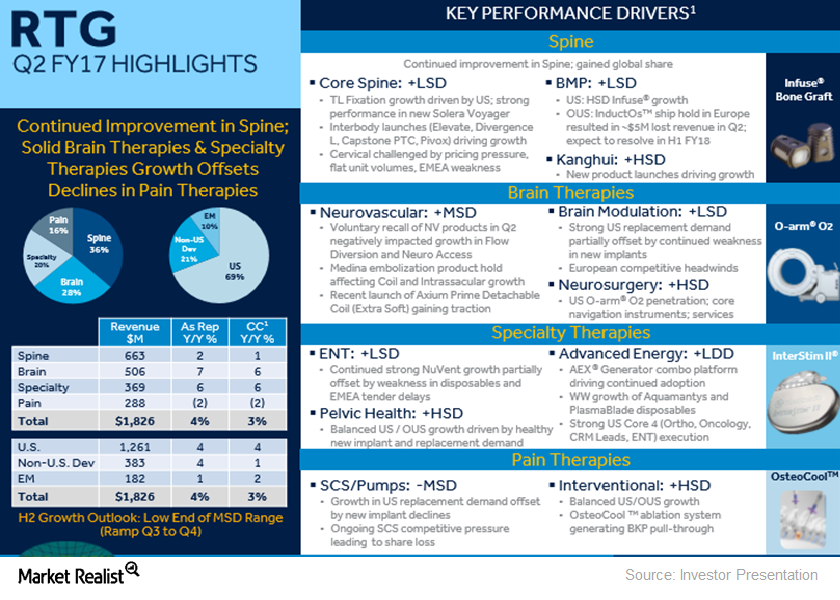

Medtronic’s RTG Sales in Fiscal 2Q17: The Brain and Restorative Therapies Story

Of Medtronic’s ~$7.3 billion in worldwide revenue in fiscal 2Q17, ~$1.8 billion came from its RTG segment, representing ~25% of the company total.

Here’s What’s Driving Medtronic’s MITG Segment

Of Medtronic’s ~$7.3 billion in worldwide revenues in fiscal 2Q17, ~$2.5 billion came from Medtronic’s MITG segment, representing ~34% of the company’s total revenues.

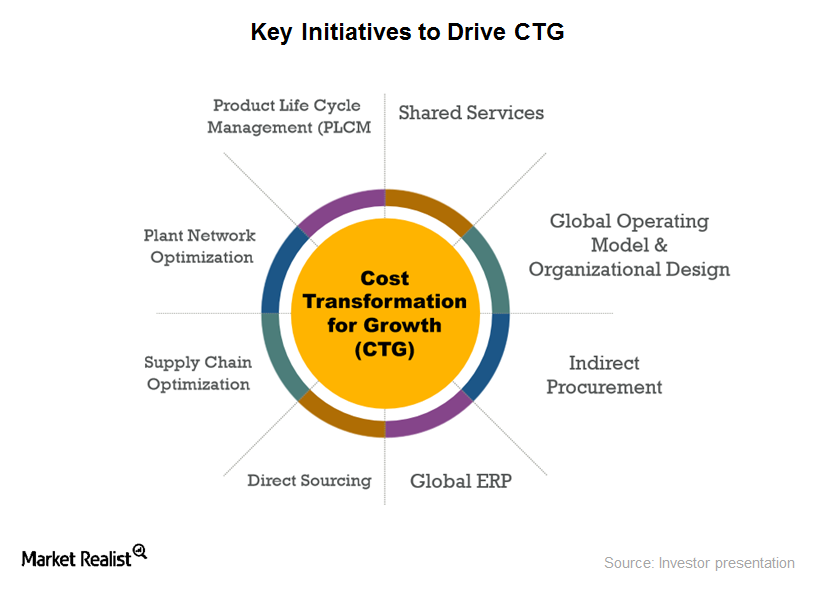

Exploring the Nuances of Stryker’s Cost Transformation for Growth

Cost transformation growth is one of Stryker’s key strategies for driving growth. The company has come a long way from its decentralized structure prior to 2010.

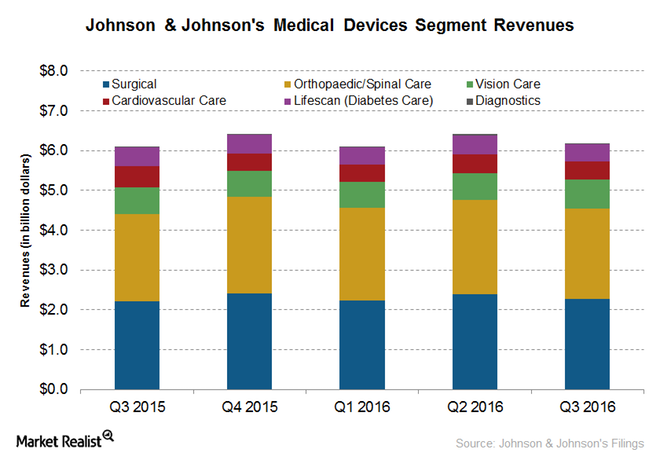

JNJ Moved to Restructure Its Medical Devices Business in 3Q16

Johnson & Johnson (JNJ) registered sales of ~$6.2 billion in its Medical Devices segment in 2Q16. The Vision Care business reported the highest growth in the quarter, which came in at ~8.2%.

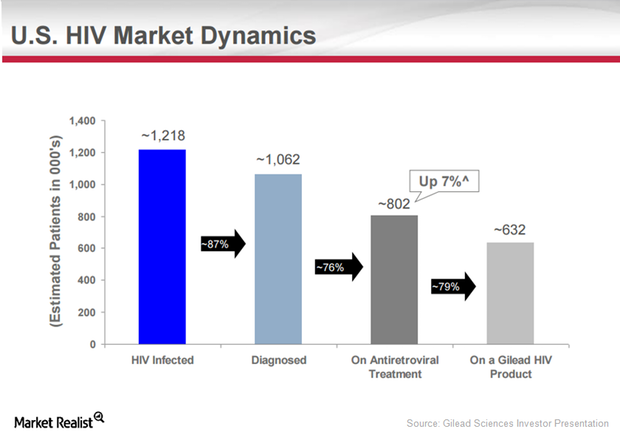

How GILD Plans to Battle through Impending HIV Patent Cliff

Gilead Sciences (GILD) is the leading biotechnology player in the global HIV market.

Thermo Fisher Scientific Completed the FEI Acquisition

On September 19, 2016, Thermo Fisher Scientific (TMO) announced the strategic acquisition of FEI Company (FEIC) for $4.2 billion, or for $107.50 per share in cash.

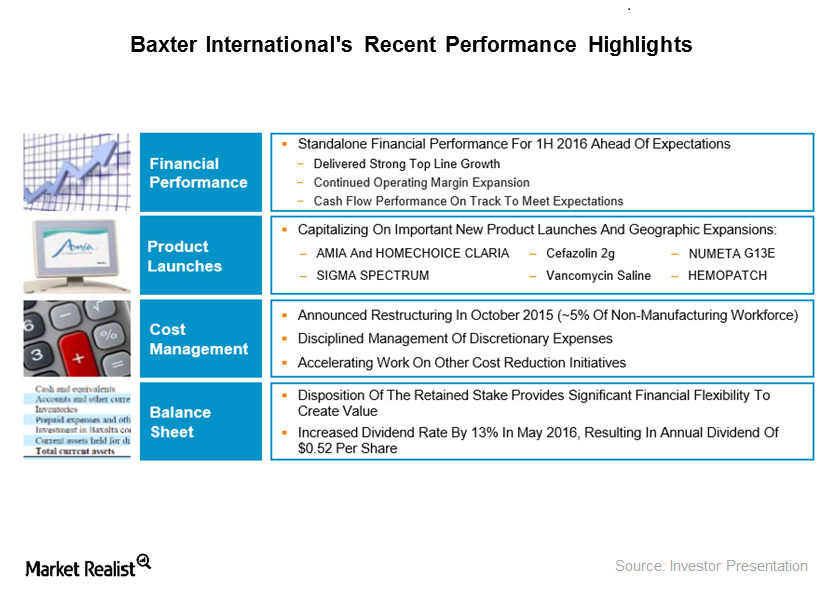

Baxter International’s Recent Product Launches and Partnerships

Baxter International’s R&D investments were around $150 million in 2Q16, which represents a YoY (year-over-year) increase of around 1%.

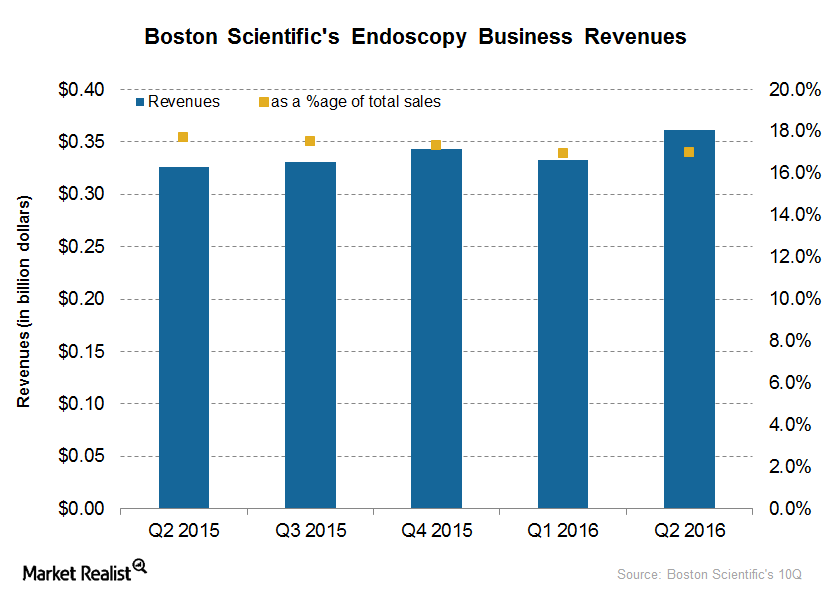

Boston Scientific’s Acquisition of EndoChoice: Must-Know Details

On September 27, 2016, Boston Scientific (BSX) announced the acquisition of EndoChoice Holdings for $210 million.

The Rationale behind Johnson & Johnson’s Acquisition of Abbott Medical Optics

On September 16, 2016, Johnson & Johnson announced the acquisition of Abbott Medical Optics, a subsidiary of Abbott Laboratories, and its stock fell ~0.3%.