Where Does Varian Medical Systems Get Most of Its Revenue?

Varian Medical Systems’ Imaging Components segment accounts for approximately 19% of the company’s total revenue. The segment reported a revenue decline of ~10% in 2015.

June 20 2016, Updated 11:25 a.m. ET

An overview of Varian Medical Systems’ business

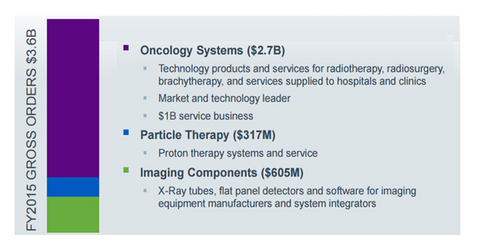

Varian Medical Systems (VAR) generates its revenue through the following reportable business segments: Oncology Systems, Imaging Components, and the Other segment, which includes the Ginzton Technology Center and the VPT (Varian Particle Therapy) business.

Oncology Systems

The Oncology Systems segment consists of a portfolio of conventional and advanced technologies for the treatment of cancer. It also offers data-enabled software for comprehensive patient care. The Oncology Systems segment is the company’s largest business and accounts for around 77% of the company’s total revenues. The segment reported a 2% decline in revenue, whereas revenue grew by ~6% on a constant currency basis in 2015.

Imaging Components segment

The Imaging Components segment consists of a portfolio of X-ray components for radiographic imaging, mammography, tomography, computer-aided diagnostics, and industrial applications. The segment accounts for approximately 19% of the company’s total revenue. The segment reported a revenue decline of ~10% in 2015.

Other primary businesses

Varian Medical Systems also manufactures products for the treatment of cancer through proton therapy under the company’s VPT business. Further, the company has a scientific research facility named the Ginzton Technology Center, which develops technologies and products to expand the company’s portfolio of products across its business segments. In 2015, Varian Medical Systems witnessed an increase in VPT projects. The company reported six proton therapy gross orders in 2015 as compared to three in 2014.

Some of Varian Medical Systems’ major competitors are Elekta, Mitsubishi Electric, Hitachi America, Philips Medical Systems, C R Bard (BCR), Intuitive Surgical (ISRG), and Accuray (ARAY). For diversified exposure to Varian Medical Systems, you can invest in the Guggenheim S&P 500 Equal Weight ETF (RSP), which has approximately 0.20% of its holdings in VAR.

In the next part of this series, we’ll take a look at the company’s future opportunities and growth potential in the radiation oncology business.