Accuray Inc

Latest Accuray Inc News and Updates

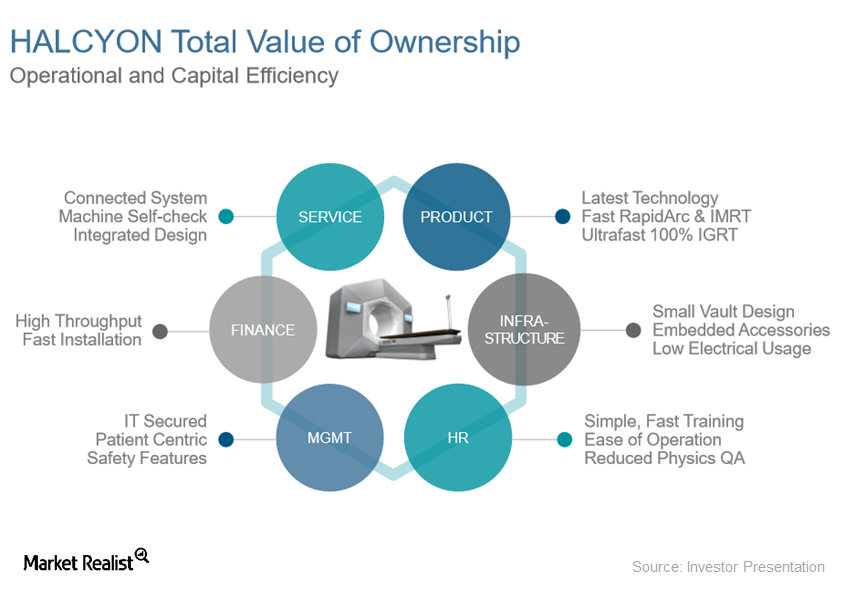

Varian’s Halcyon Treatment System Sees Emerging Market Demand

Halcyon The Halcyon system, Varian Medical Systems’ (VAR) recently launched cancer treatment device, aims to simplify and enhance IMRT (image-guided volumetric intensity modulated radiotherapy). The device has received clearance by the FDA (US Food and Drug Administration). By next year, Varian expects to receive regulatory approvals for the device in China and Japan. For more information […]

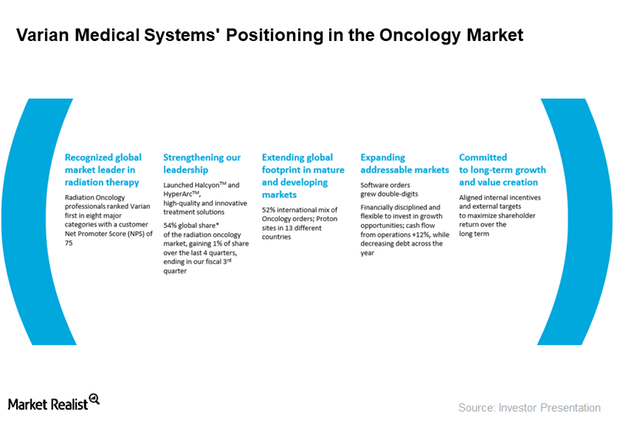

A Look at Varian Medical Systems’ Long-Term Objectives

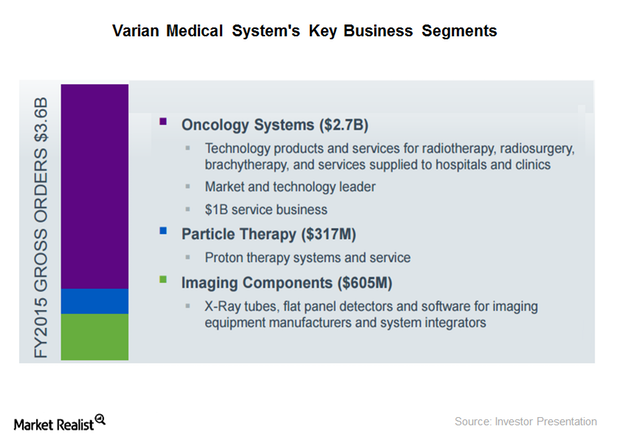

Varian Medical Systems (VAR) spun off its imaging components business into Varex Imaging in January 2017, thus strengthening its positioning in the oncology market.

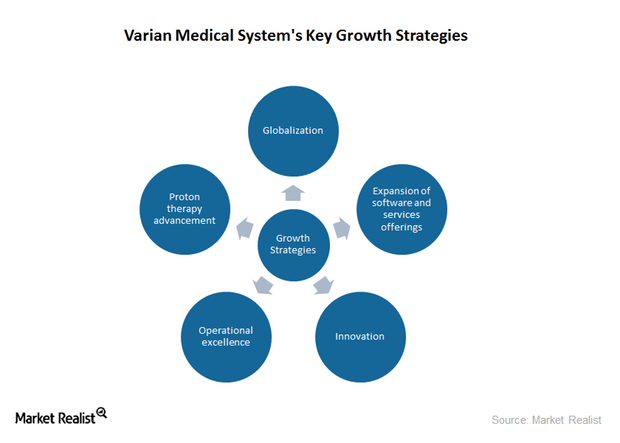

Growth Strategies Driving Varian Medical Systems’ Revenue

Varian Medical Systems has ventured into the proton therapy business and has a huge product pipeline in this area. The company generated approximately $300 million through its proton therapy business in 2015.

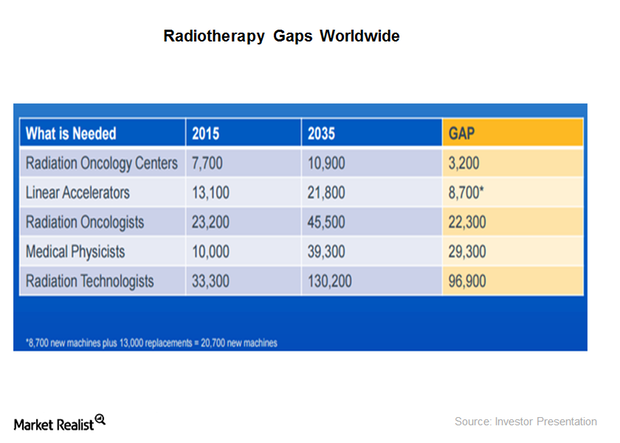

Varian Medical Systems’ Growth Potential in Radiation Oncology

Varian Medical Systems’ next big technology innovation will be high-definition radiotherapy, which is an intelligent treatment delivery system that aims to achieve 100% radiation exposure for the tumor.

Where Does Varian Medical Systems Get Most of Its Revenue?

Varian Medical Systems’ Imaging Components segment accounts for approximately 19% of the company’s total revenue. The segment reported a revenue decline of ~10% in 2015.