CR Bard Inc

Latest CR Bard Inc News and Updates

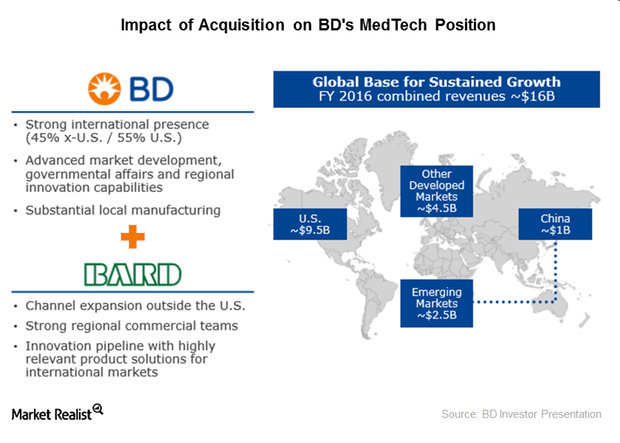

How BD-Bard Acquisition Will Strengthen International Presence

C.R. Bard (BCR) has grown significantly outside the United States in recent years, driven by its international channel expansion strategy.

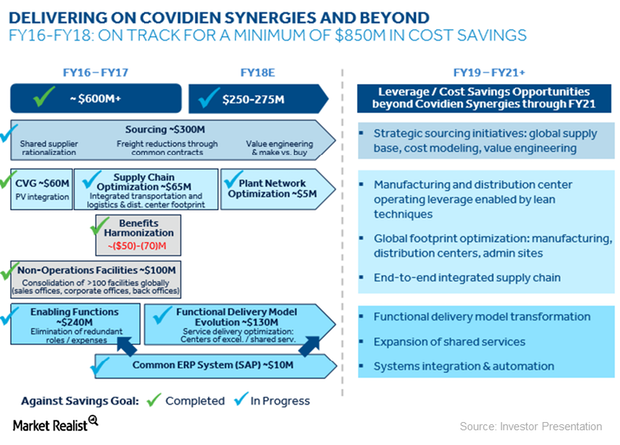

How Medtronic Is Delivering on Its Covidien Synergies

In January 2015, Medtronic (MDT) acquired Covidien for ~$43 billion in cash and MDT stock in a tax inversion deal.

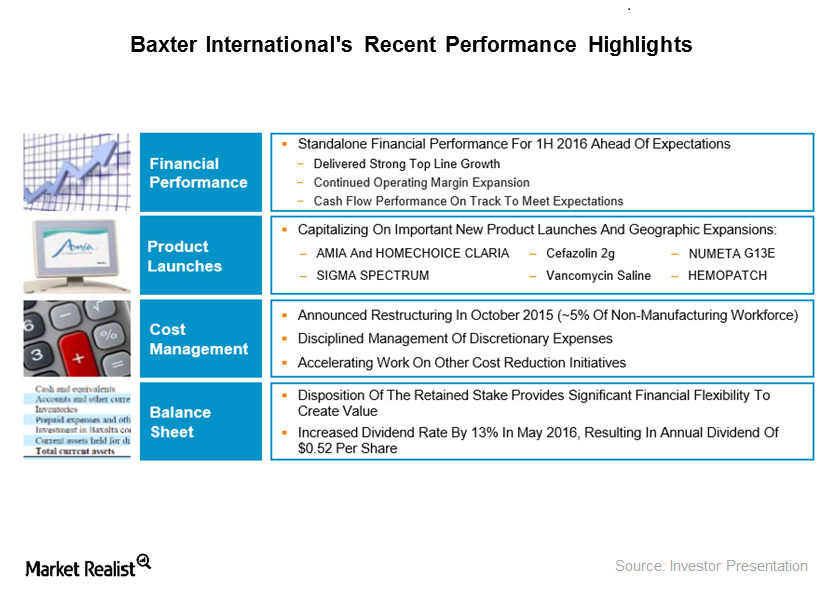

Baxter International’s Recent Product Launches and Partnerships

Baxter International’s R&D investments were around $150 million in 2Q16, which represents a YoY (year-over-year) increase of around 1%.

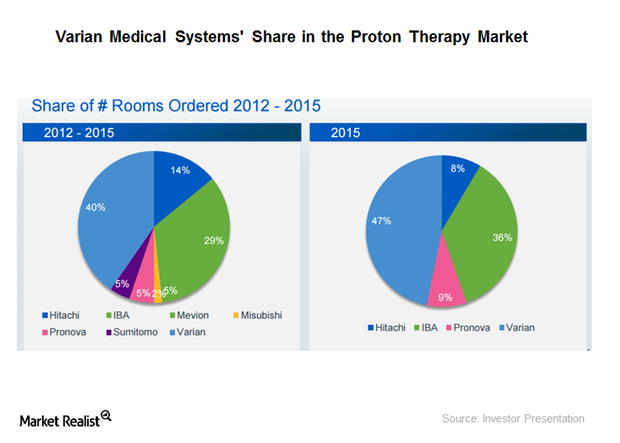

How Is Varian Positioned in the Particle Therapy Business?

Varian Medical Systems (VAR) had gross orders value of $310 million in 2015.

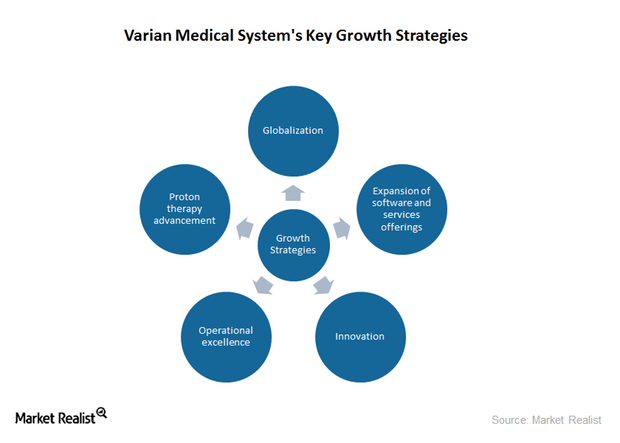

Growth Strategies Driving Varian Medical Systems’ Revenue

Varian Medical Systems has ventured into the proton therapy business and has a huge product pipeline in this area. The company generated approximately $300 million through its proton therapy business in 2015.

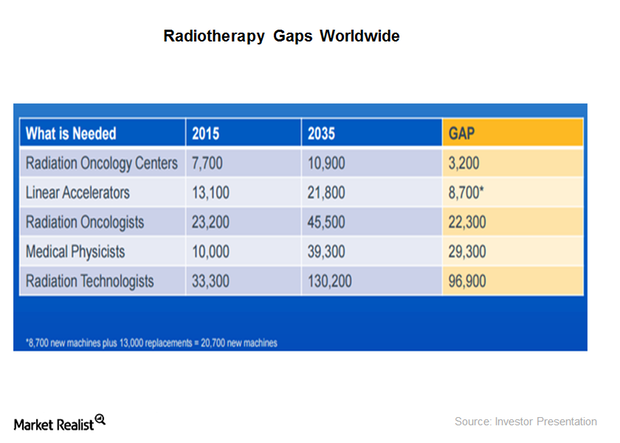

Varian Medical Systems’ Growth Potential in Radiation Oncology

Varian Medical Systems’ next big technology innovation will be high-definition radiotherapy, which is an intelligent treatment delivery system that aims to achieve 100% radiation exposure for the tumor.

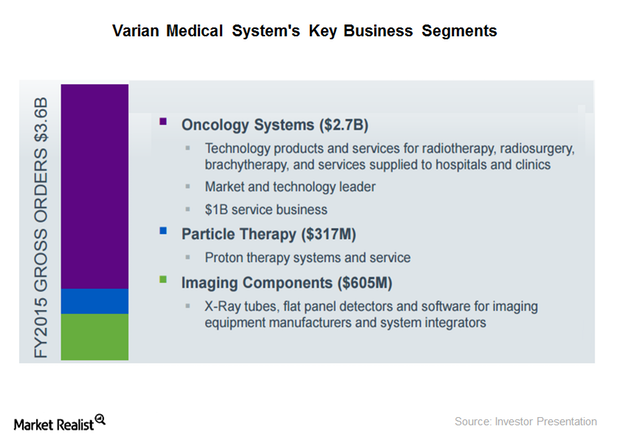

Where Does Varian Medical Systems Get Most of Its Revenue?

Varian Medical Systems’ Imaging Components segment accounts for approximately 19% of the company’s total revenue. The segment reported a revenue decline of ~10% in 2015.

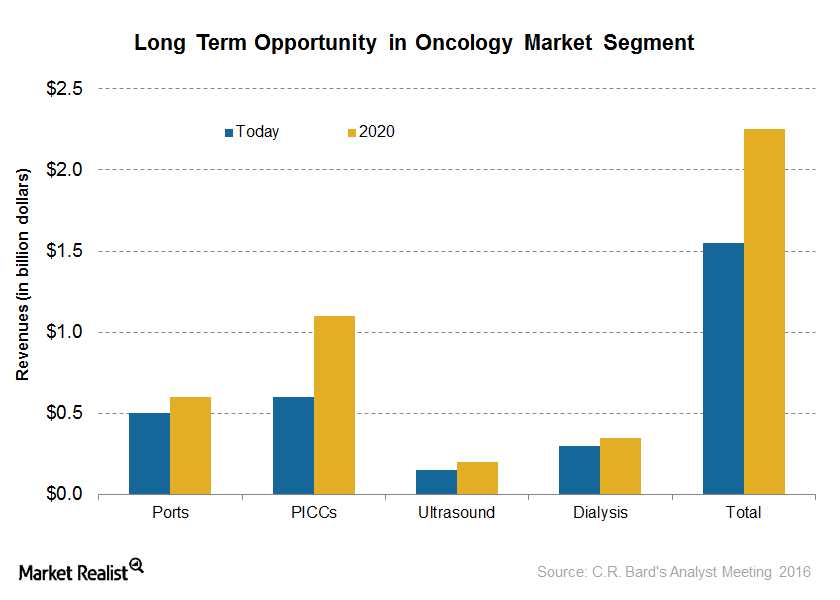

A Look at C. R. Bard’s Oncology Business Segment

C. R. Bard’s (BCR) Oncology segment contributes around 27% of the total revenues of the company.

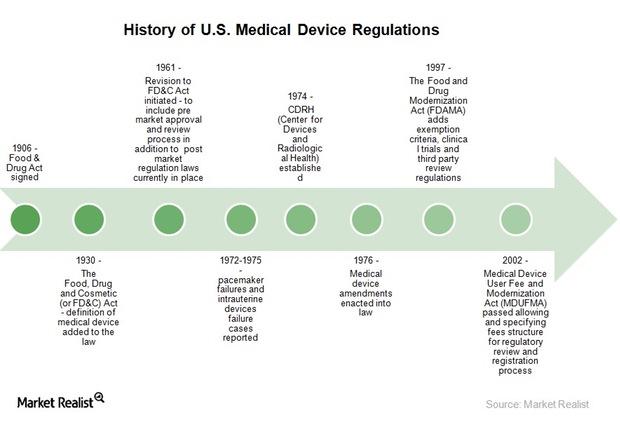

Key Regulations that Affect Medical Device Companies

The US Food and Drug Administration’s Center for Devices for Radiological Health (or USFDA/CDRH) regulates the medical device industry in the United States.