Intuitive Surgical Inc

Latest Intuitive Surgical Inc News and Updates

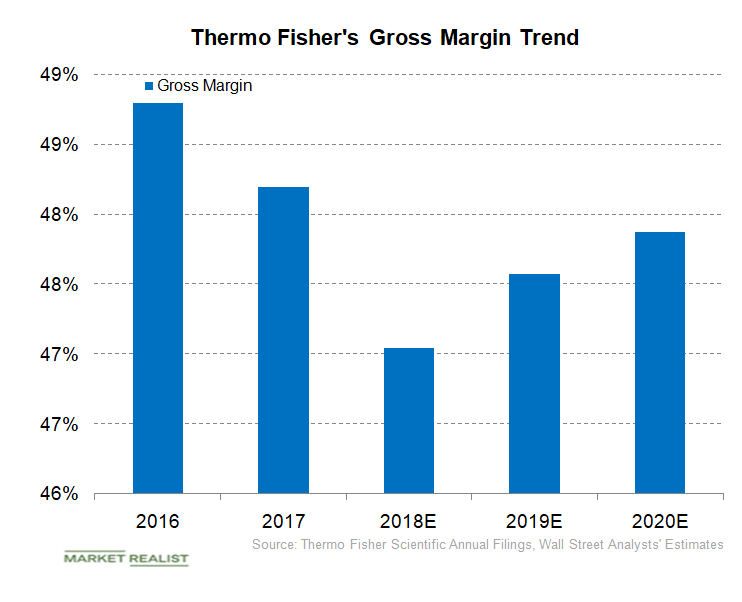

Thermo Fisher Scientific’s Gross Margin Trends

In fiscal 2018 and fiscal 2019, Thermo Fisher Scientific (TMO) is expected to generate revenue of $24.08 billion and $25.19 billion, respectively, compared with revenue of $20.92 billion in fiscal 2017.

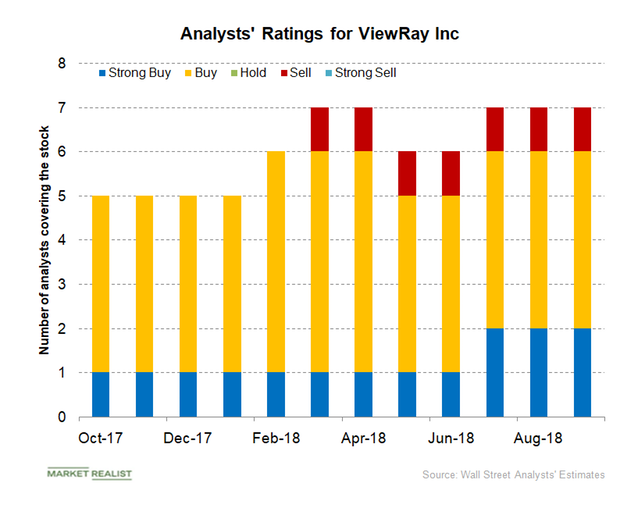

What ViewRay’s Valuation Trend Indicates

In September, of the seven analysts covering ViewRay (VRAY), six have given its stock “buy” or higher ratings, and one analyst has given it a “sell” rating.

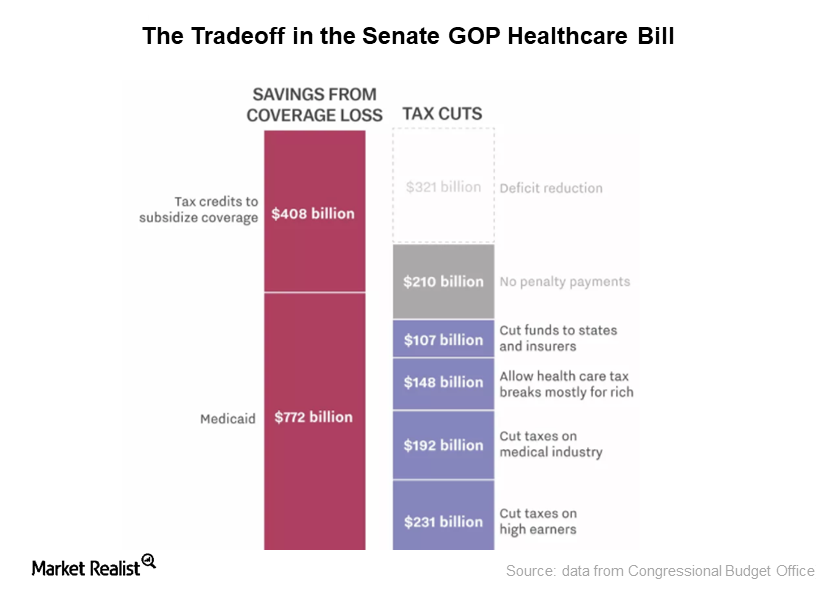

How the Corporate Tax Rate Cut Could Affect R&D in the Medtech Industry

The repeal of the tax deduction for high medical expenses may reduce the number of taxpayers opting for costly medical technologies and services.

How the Medical Expense Tax Deduction Affects the Healthcare Industry

According to AARP, around 75% the population claiming these medical expense deductions from their income are 50 years or older.

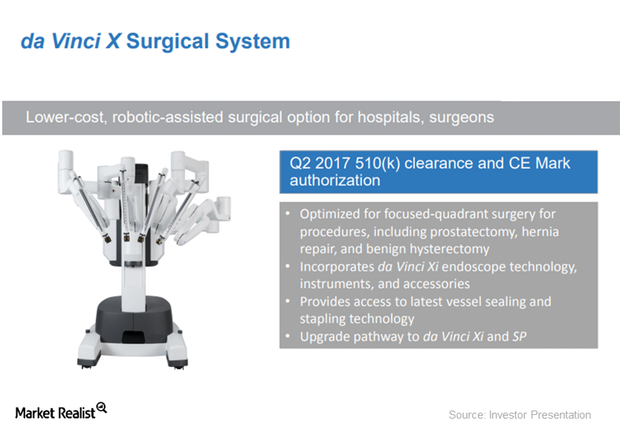

How Intuitive Surgical Is Expanding Its Da Vinci X Systems Worldwide

Intuitive Surgical’s (ISRG) Da Vinci X received early FDA approval in May 2017 and was given a CE Mark in Europe in April 2017.

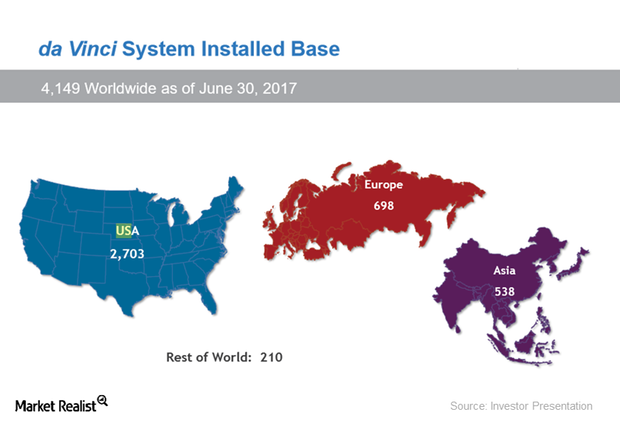

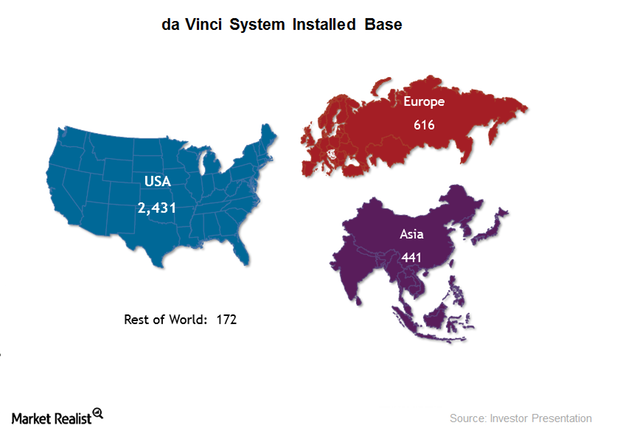

Intuitive Surgical Plans to Expand in Europe and Asia

Although Intuitive Surgical leads the surgical robotics market, there are competitive threats from other major players in the market.

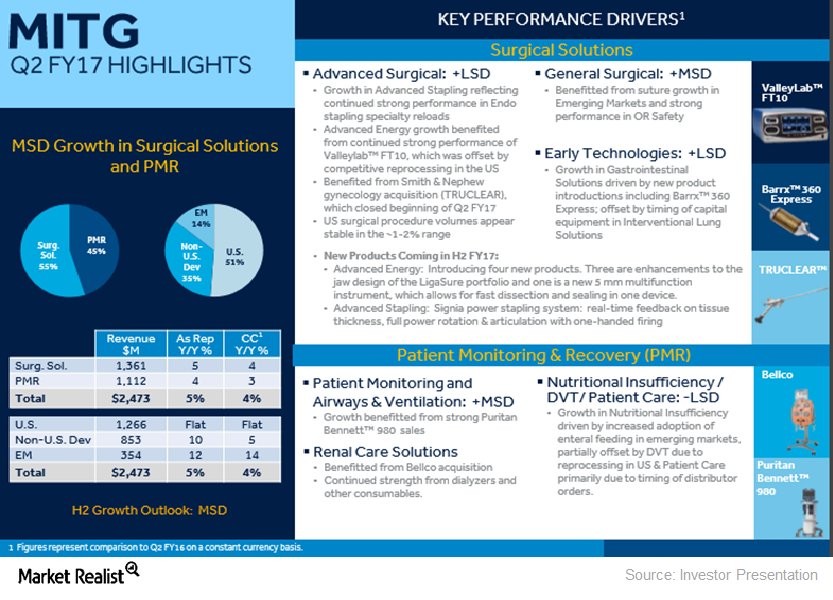

Here’s What’s Driving Medtronic’s MITG Segment

Of Medtronic’s ~$7.3 billion in worldwide revenues in fiscal 2Q17, ~$2.5 billion came from Medtronic’s MITG segment, representing ~34% of the company’s total revenues.

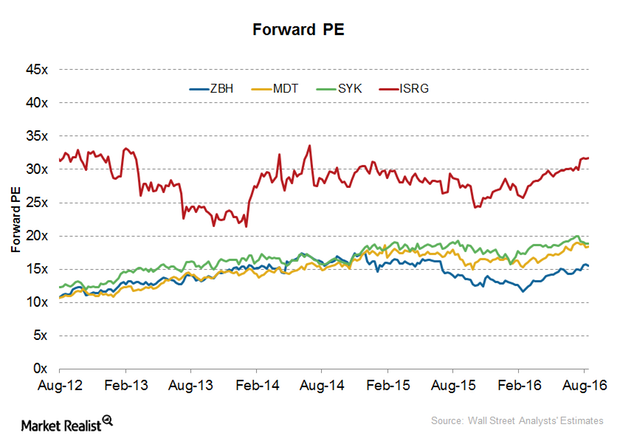

A Look at Zimmer Biomet’s Latest Valuation

After the release of its 2Q16 earnings results on July 28, 2016, Zimmer Biomet Holdings (ZBH) was trading at a forward price-to-earnings multiple in the range of 15.5x–16.2x.

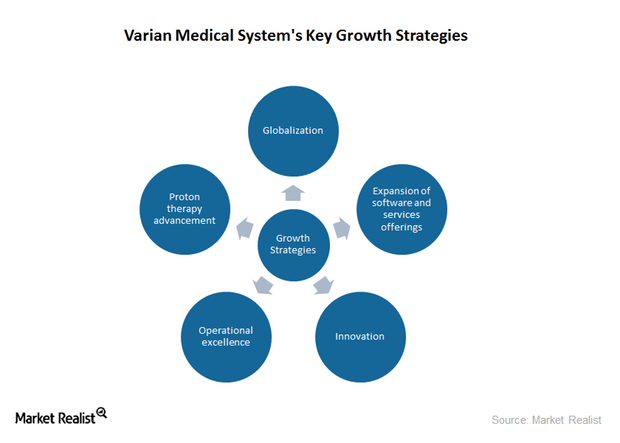

Growth Strategies Driving Varian Medical Systems’ Revenue

Varian Medical Systems has ventured into the proton therapy business and has a huge product pipeline in this area. The company generated approximately $300 million through its proton therapy business in 2015.

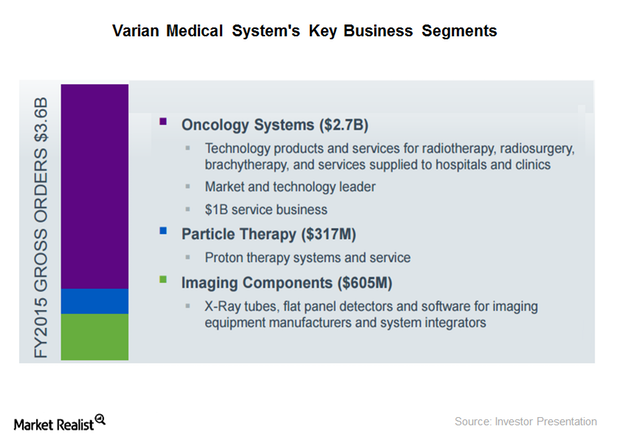

Where Does Varian Medical Systems Get Most of Its Revenue?

Varian Medical Systems’ Imaging Components segment accounts for approximately 19% of the company’s total revenue. The segment reported a revenue decline of ~10% in 2015.

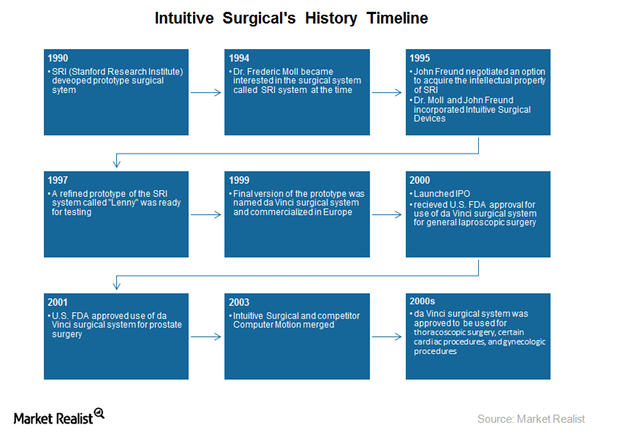

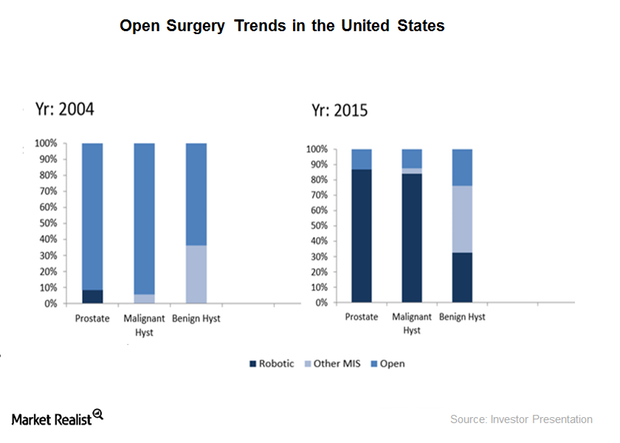

Company Overview: An Introduction to Intuitive Surgical

Intuitive Surgical is a pioneer of minimally invasive robotic surgery. It develops and manufactures da Vinci surgical systems and related instruments.

What Does Intuitive Surgical’s Business Model Look Like?

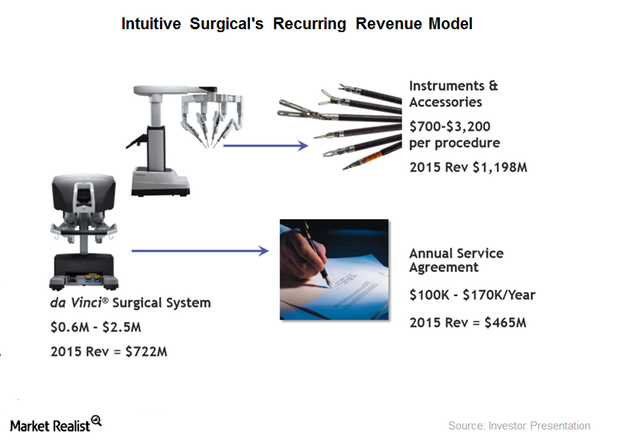

Intuitive Surgical (ISRG) defines its business model as a “razor/razor blade” model. What does this mean?

Exploring Intuitive Surgical’s Sales Model

Intuitive Surgical follows a diversified sales strategy and doesn’t generate more than 10% of its revenue through any one customer.

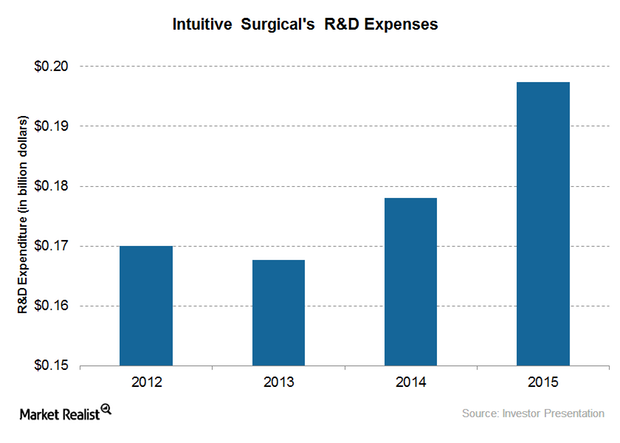

Analyzing Intuitive Surgical’s R&D Strategy and Innovations

Intuitive Surgical is continuously enhancing its product offerings, enabling more efficient procedures through internal research and development (or R&D).

A Closer Look at Intuitive Surgical’s Business Strategy

Intuitive Surgical aims to include a larger patient population under its MIS treatments and to provide better surgery outcomes and lower recovery times.

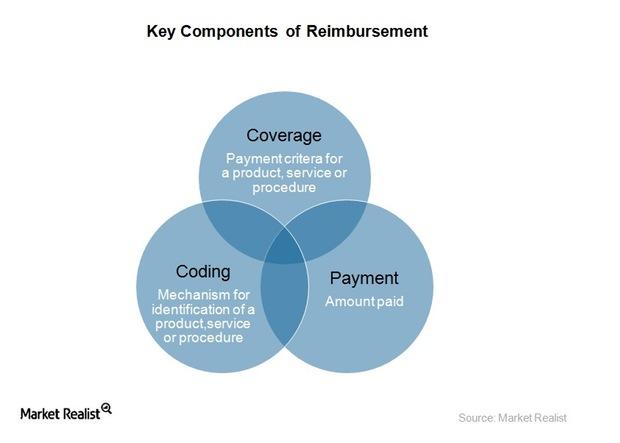

How Reimbursement Models Impact the Medical Device Industry

Coverage, coding, and payment are essential elements to obtaining adequate reimbursement for a new medical device.