Maitali Ramkumar

Maitali, an equity research analyst, has been contributing to Market Realist since 2015. She began analyzing and writing about integrated energy and refining stocks. But later, she also ventured in the technology and auto sectors. She has more than 14 years of rich experience as a financial analyst and sell-side institutional equity research analyst.

In her stint as a sell-side institutional equity research analyst, she published research reports on numerous companies with “buy” and “sell” recommendations. She was ranked as one of the best analysts for one of her reports on an energy company. As a financial expert, she has deep experience in financial modeling, forecasting, and valuations

Maitali—with her excellent interpersonal, communication, and analytical skills—was instrumental in establishing and maintaining relationships with mutual fund managers and foreign institutional investors across the industry. She not only strengthened ties with fund managers but also conducted several conferences involving fund managers and company management.

Her strong base in equity research was developed at IDBI Capital, where she began as a junior analyst and moved up her career path. She joined the organization after topping in most of her years of undergraduate and postgraduate studies. Her love for understanding businesses led her to pursue a BMS (bachelor of management studies) and later an MBA (master in business administration) in finance.

Plus, Maitali enjoys traveling to new places and relishes natural landscapes. She also likes listening to music.

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Maitali Ramkumar

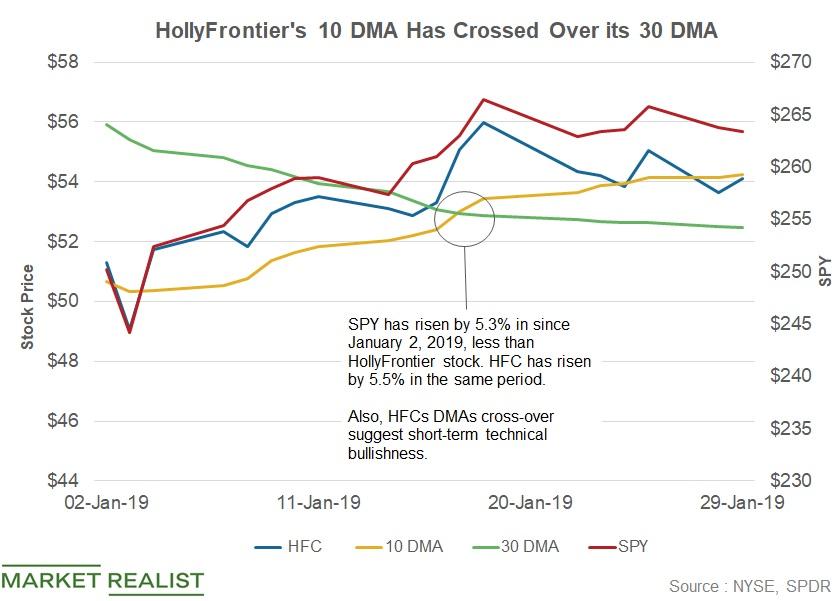

HollyFrontier Stock Has Recovered 5.5% in 2019

HollyFrontier (HFC) stock has risen 5.5% since January 2. The stock has risen less than its peers Marathon Petroleum (MPC) and Valero (VLO).

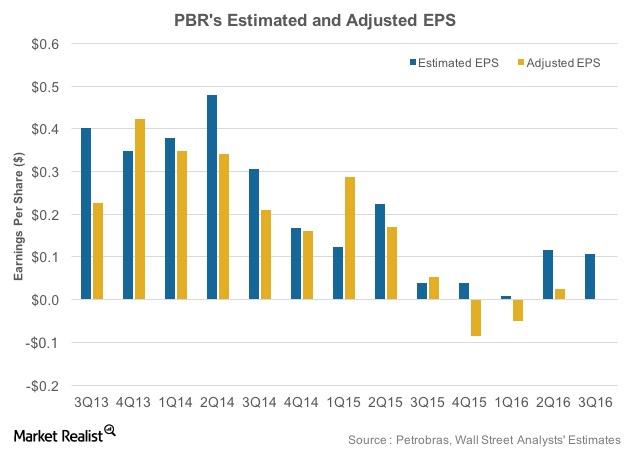

Petrobras’s Upcoming 3Q16 Results: Where Are Earnings Headed?

Petrobras (PBR) is expected to post its 3Q16 results on November 10, 2016. In 2Q16, it had adjusted EPS of $0.03 compared to analysts’ estimates of $0.12.

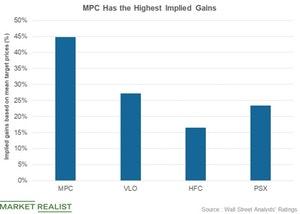

HFC and PSX: Which Company Could Post the Most Gains?

After HollyFrontier’s earnings, RBC lowered its target price on the stock from $68 to $66.

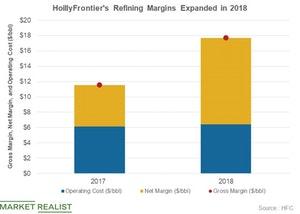

Analyzing HollyFrontier’s Refining Margin in 2018

HollyFrontier’s refining segment is critical for its overall earnings. The refining segment’s adjusted EBITDA rose 127% to $1.7 billion in 2018.

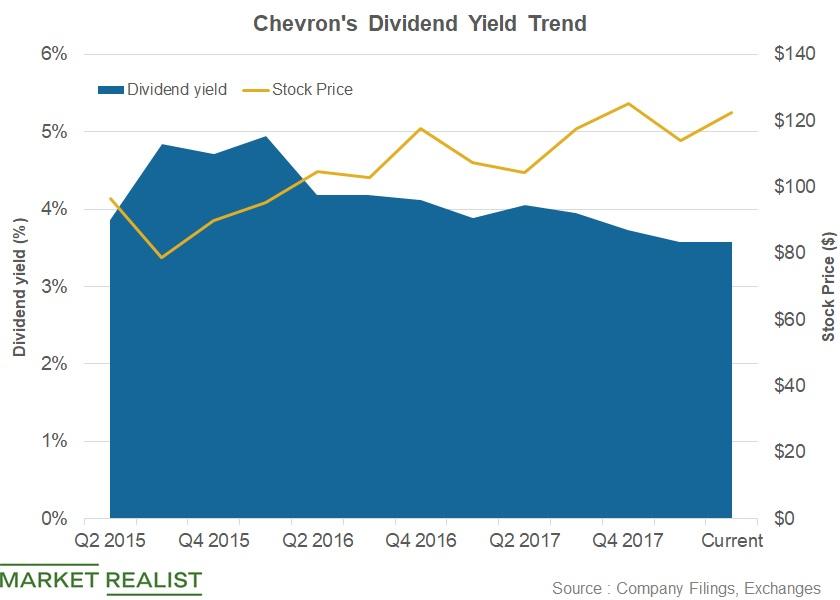

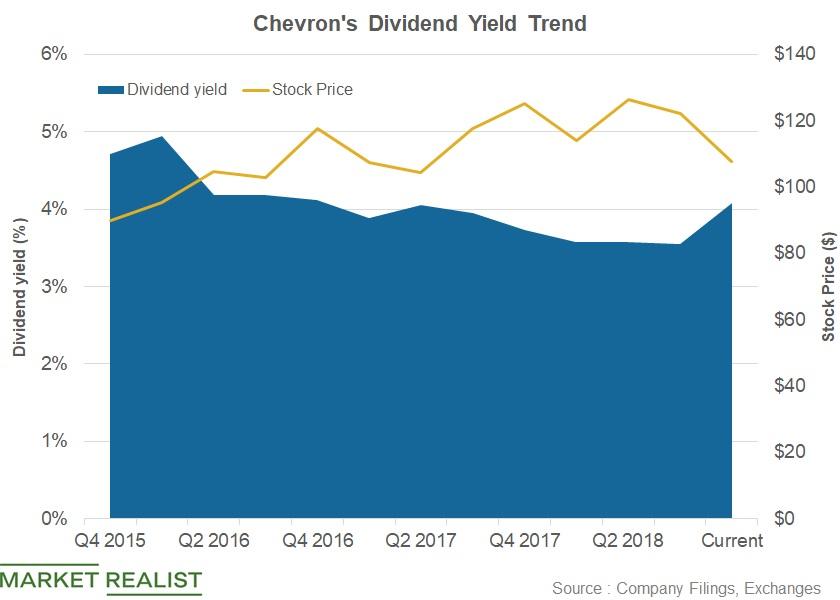

Chevron’s 3.6% Dividend Yield Ranks Sixth with High Valuations

Chevron (CVX) is the sixth stock on our list of the top eight dividend-yielding stocks.

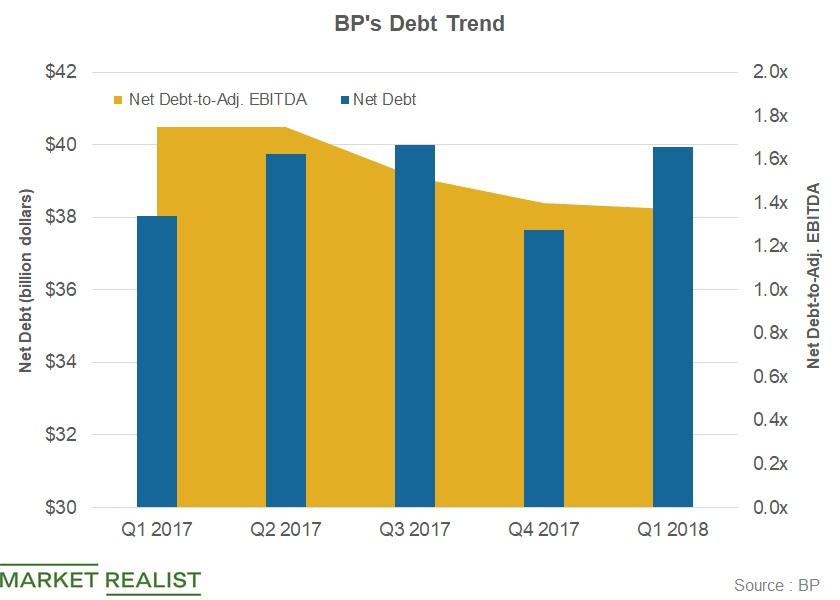

How BP’s Debt Position Compares

In this part, we’ll review whether BP’s (BP) debt position has improved. Let’s begin by comparing BP’s debt position with peers’.

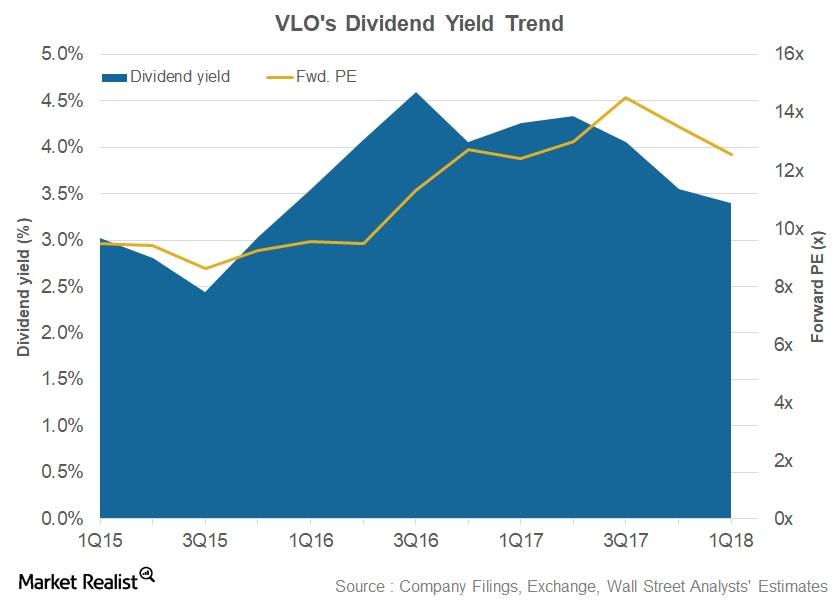

Valero Ranks 2nd in Dividend Yield and Market Capitalization

Valero Energy (VLO) is the second-highest dividend-yielding stock among the seven refining stocks we’re looking at in this series.

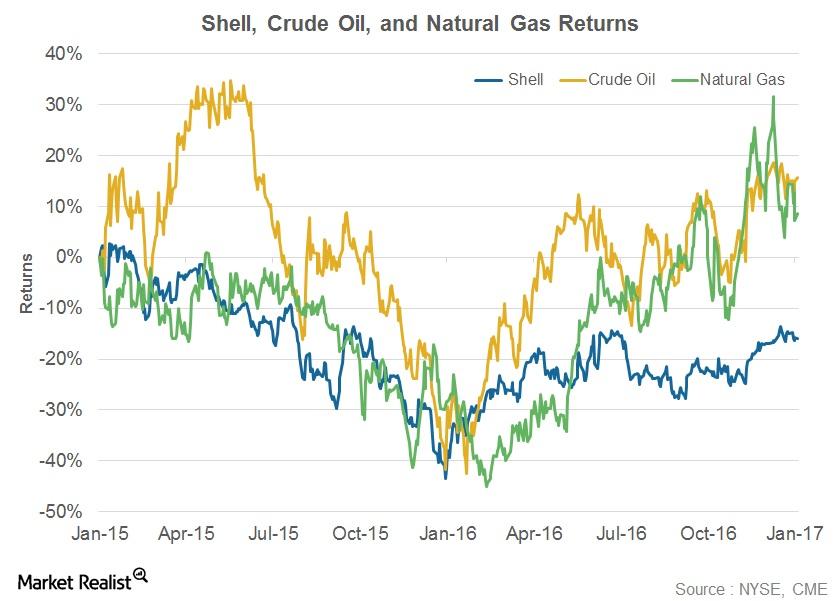

How Has Shell’s Stock Performed ahead of Its 4Q16 Earnings?

On January 20, 2016, Shell began recuperating from the falls it had experienced in the previous year. Shell has risen 49% since January 20, 2016.

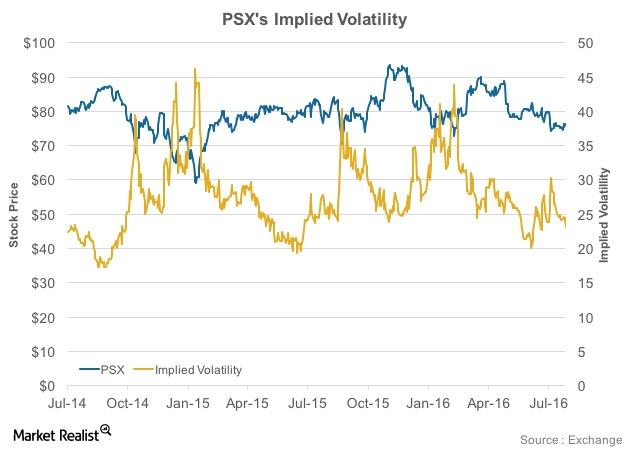

How PSX’s Implied Volatility Trended Post-Earnings

Phillips 66 (PSX) posted its earnings on July 29, 2016. On the day, PSX’s implied volatility fell by 5% to 23.2 compared to the previous day.

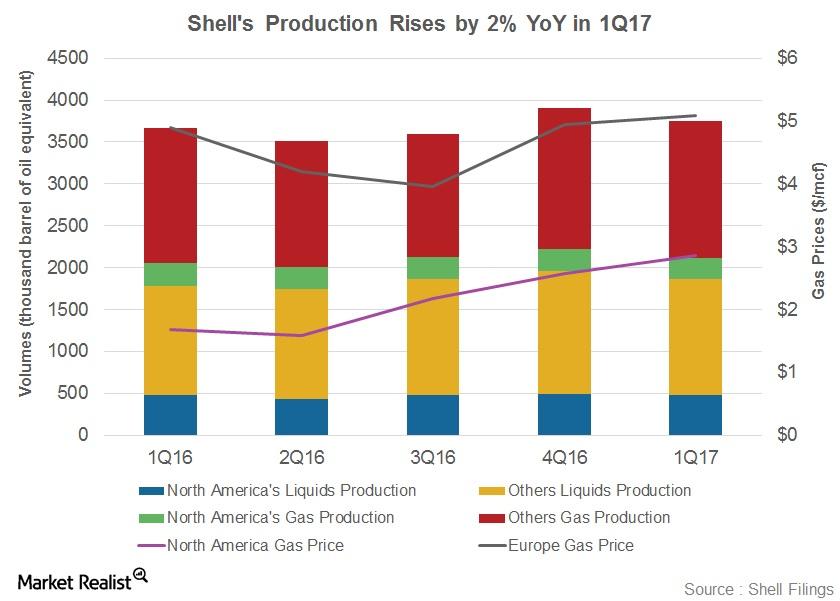

Shell’s Upstream Portfolio: Is it Poised to Grow?

Royal Dutch Shell (RDS.A) produced 3.8 MMboepd in 1Q17 from its worldwide operations, compared to 3.7 MMboepd in 1Q16.

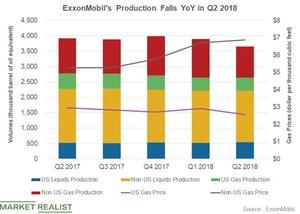

How Was ExxonMobil’s Upstream Performance in Q2 2018?

ExxonMobil (XOM) produced 3.7 MMboepd (million barrels of oil equivalent per day) from its worldwide operations in the second quarter.

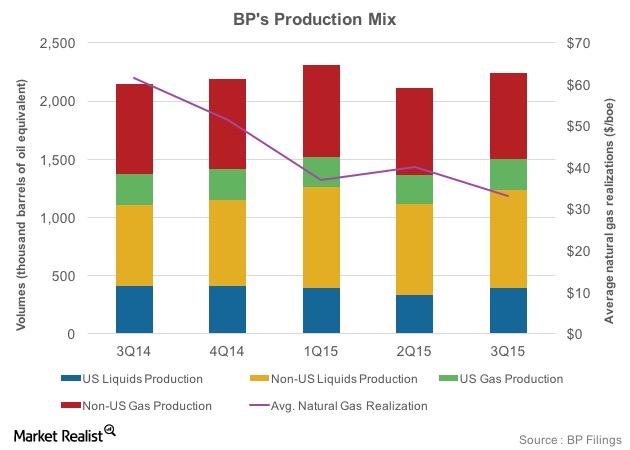

BP’s Upstream Segment: Large Upcoming Gas Projects

BP has a strong pipeline of projects in its upstream portfolio. These projects are expected to result in 800,000 barrels per day of new production by 2020.

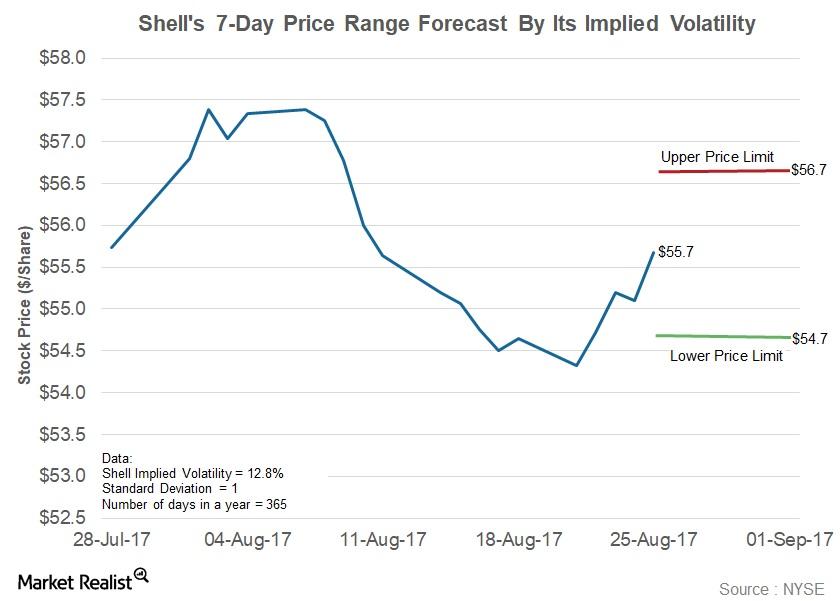

What’s the Forecast for Shell Stock for the Next 7 Days?

Implied volatility in Royal Dutch Shell (RDS.A) has fallen 4.9% since July 3, 2017, to the current level of 12.8%.

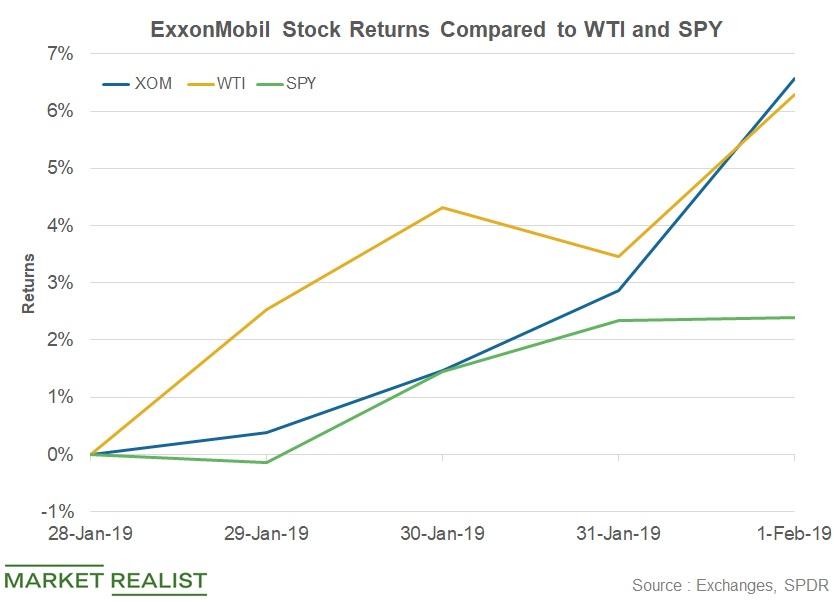

ExxonMobil Stock Rose 4% after Its Q4 Earnings

ExxonMobil (XOM) announced its fourth-quarter earnings on February 1. ExxonMobil stock opened at $74.9 per share on February 1.

Chevron Ranks Second-Last in Terms of Its Dividend Yield

In terms of its dividend yield, Chevron (CVX) is the fifth-best performer among the six stocks under review.

How Is ExxonMobil’s Upstream Portfolio Positioned?

Before we review ExxonMobil’s key growth assets, let’s briefly look at the company’s production expectations for the current year.

XOM, CVX, RDS.A, BP: Are They Underperforming the S&P 500?

So far in 1Q18, Chevron (CVX) stock fell 13.9%, the highest among its peers ExxonMobil (XOM), BP (BP), and Royal Dutch Shell (RDS.A).

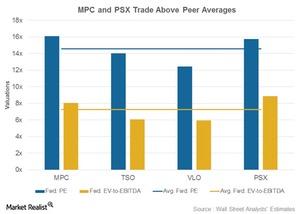

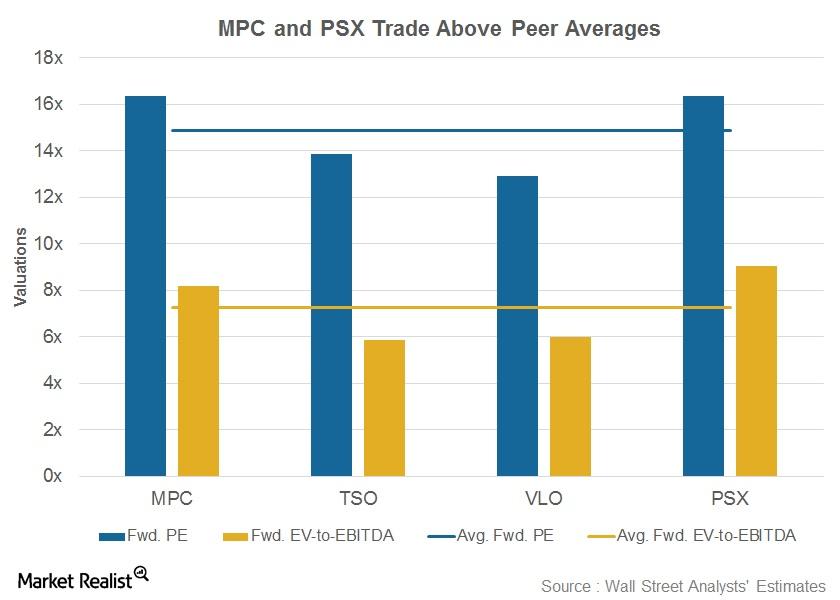

MPC, TSO, VLO, PSX: Which Refining Stock Is Trading at a Premium?

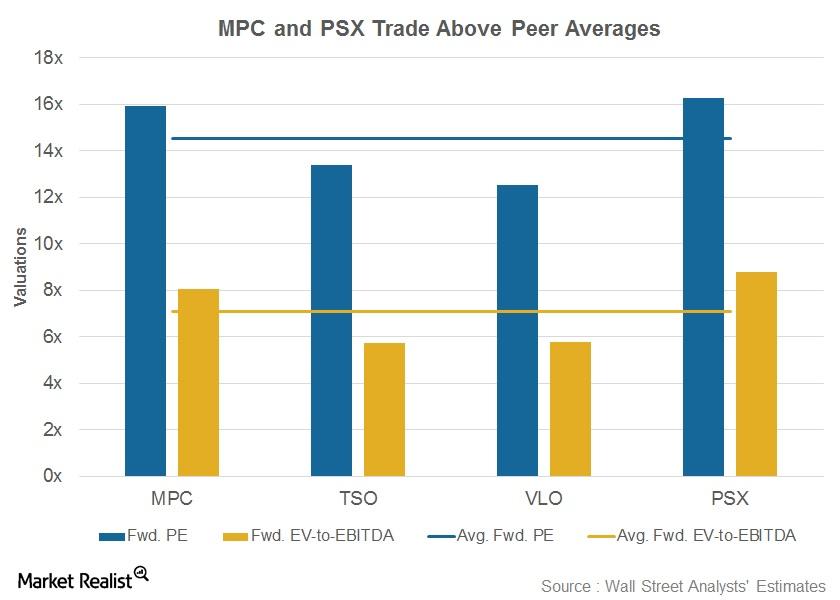

Now, let’s look at the forward valuations of Marathon Petroleum (MPC), Tesoro (TSO), Valero Energy (VLO), and Phillips 66 (PSX).

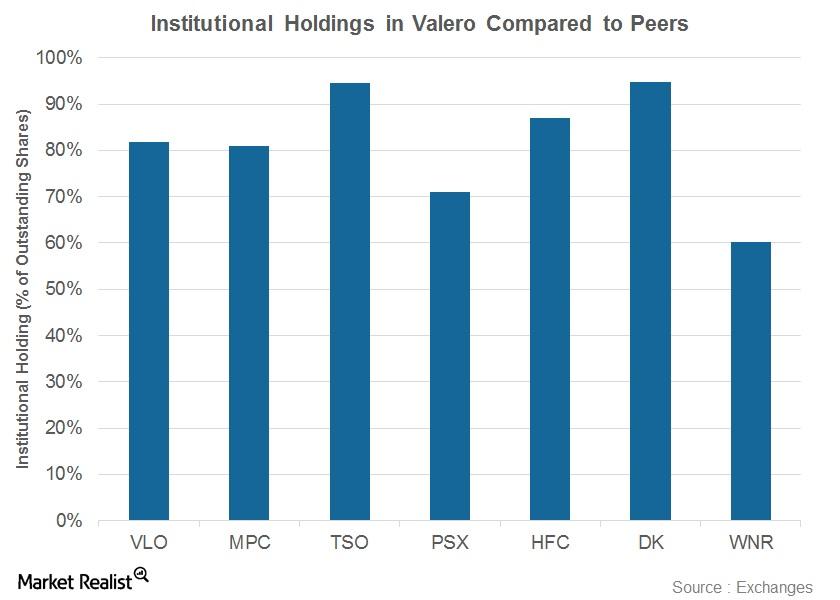

Valero’s Institutional Holdings before the 1Q17 Results

The institutional holdings in Valero Energy (VLO) are higher than the institutional holdings in Marathon Petroleum (MPC), Phillips 66 (PSX), and Western Refining (WNR).

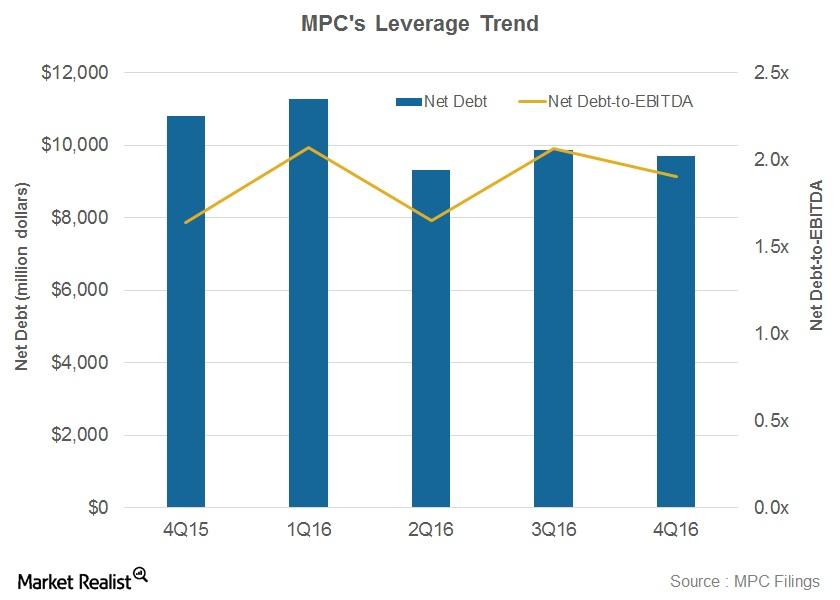

Marathon Petroleum’s Debt Is Lower than Industry Averages

Marathon Petroluem’s net debt-to-EBITDA ratio stood at 1.9x in 4Q16. It’s lower than the average industry ratio of 2.8x.

Goldman Sachs Favors Chevron Compared to ExxonMobil

Chevron and ExxonMobil stocks have provided almost flat returns in the current quarter. As a result, Goldman Sachs favors Chevron over ExxonMobil.

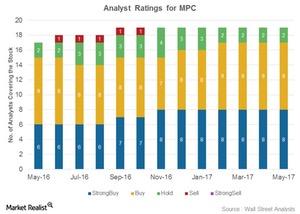

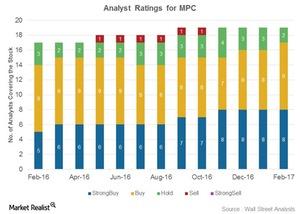

Why Most Analysts Are Calling Marathon Petroleum a ‘Buy’

Marathon Petroleum (MPC) has been rated by 19 Wall Street analysts. Seventeen analysts (or 89%) have rated it as a “buy” so far in May 2017.

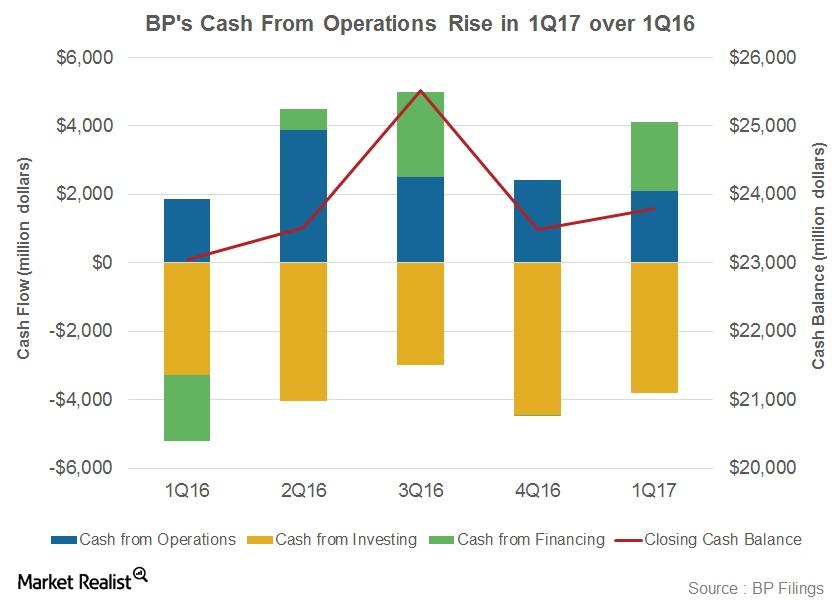

Is BP’s Cash Flow Slated for Growth?

Rising oil prices have given BP some hope that its cash flows could improve. The robust upstream project pipeline is also likely to result in higher production.

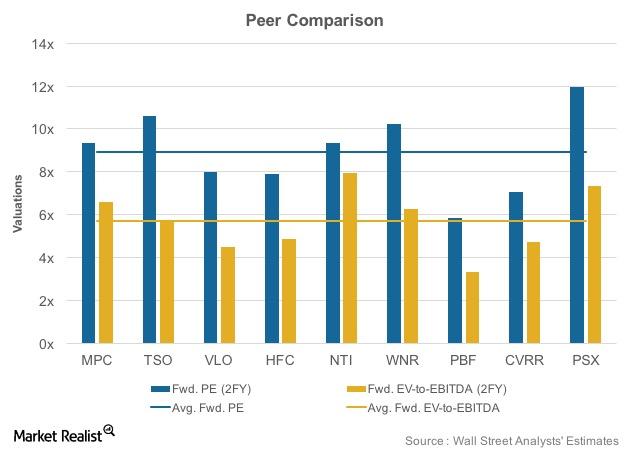

Comparing MPC’s, TSO’s, VLO’s, and PSX’s Valuation

Average valuation multiples Earlier, we discussed refining stocks’ performance in 1Q17 and compared their dividend yields. In this part, we’ll look at Marathon Petroleum’s (MPC), Tesoro’s (TSO), Valero Energy’s (VLO), and Phillips 66’s (PSX) forward valuation. The average forward EV-to-EBITDA (enterprise value to earnings before interest, tax, depreciation, and amortization) multiples and average forward PE […]

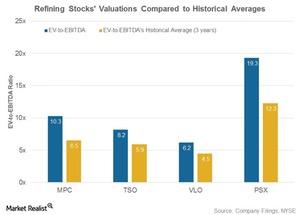

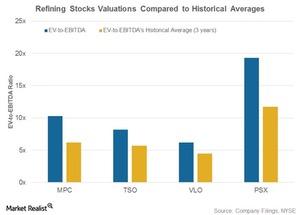

How Refining Stocks’ Historical Valuation Compares

Refining stocks’ valuation In this part, we’ll compare refining stocks’ EV-to-EBITDA (enterprise value to earnings before interest, tax, depreciation, and amortization) ratios with their three-year averages. Marathon Petroleum (MPC), Valero Energy (VLO), Phillips 66 (PSX), and Tesoro (TSO) are trading higher than their historical valuation. MPC was trading at a 10.3x EV-to-EBITDA ratio in 1Q17, compared […]

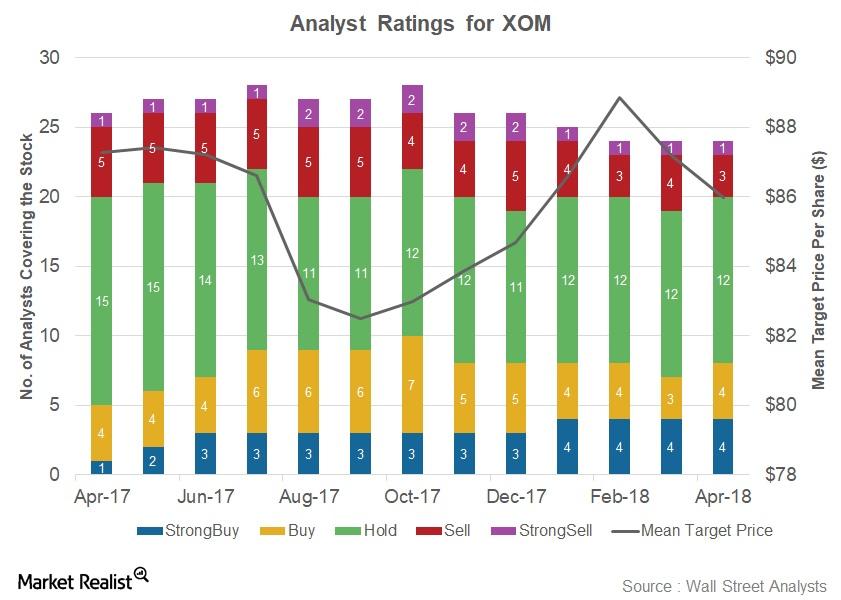

How Analysts Rate XOM

The graph above shows that eight out of the 24 analysts covering XOM have rated it a “buy” in April 2018.

Understanding Valero’s Stock Performance Prior to the 1Q17 Results

Since February 2017, downstream stocks have been hit by volatile crack conditions and changing inventory levels. VLO has also witnessed volatility in its stock price.

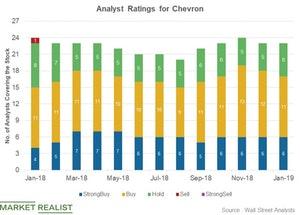

Chevron: Analysts’ Recommendations

In January, 23 analysts rated Chevron (CVX). Among the analysts, 17 (or 74%) recommended a “buy” or “strong buy.”

How Refining Stocks’ Valuations Compare to Historical Averages

In this article, we’ll look at refining stocks’ EV-to-EBITDA (enterprise value to earnings before interest, tax, depreciation, and amortization) ratios compared to their three-year historical averages.

S&P 500 Index Nears Record High amid Earnings Season

The S&P 500 Index, represented by the SPDR S&P 500 ETF (SPY), rose 0.3% on October 23, nearing the all-time high it saw in July.

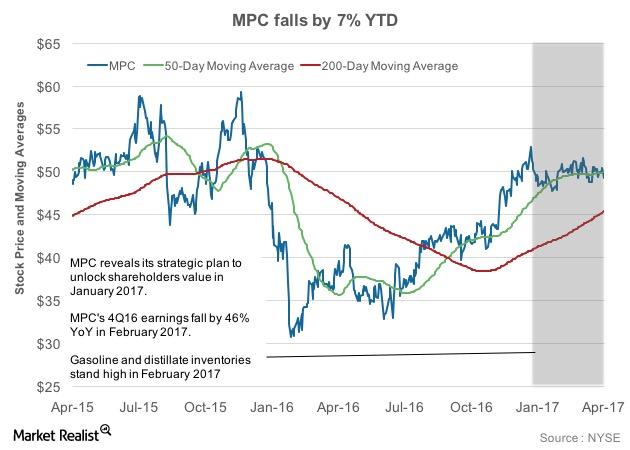

Marathon Petroleum Stock: Performance ahead of the 1Q17 Earnings

Marathon Petroleum stock has plunged 7% year-to-date. Due to its falling price in 1Q17, the stock has broken below its 50-day moving average.

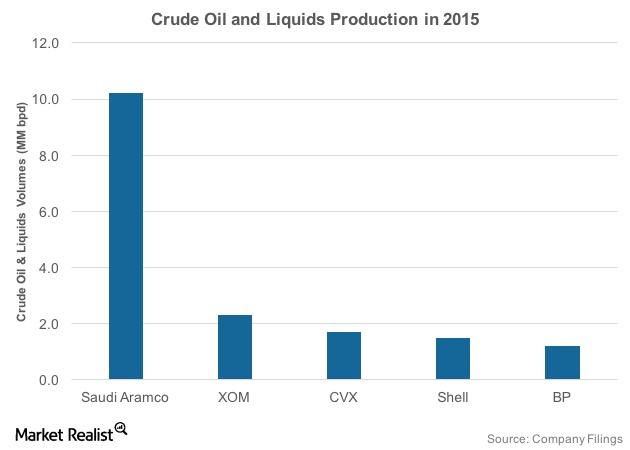

How Does Saudi Aramco’s Production Compare to Its Peers?

Saudi Aramco’s production accounted for 27% of OPEC’s average production in 2015. After Saudi Arabia, Iraq and Iran have the highest production in OPEC.

Why So Many Analysts Are Rating Marathon Petroleum as a ‘Buy’

Exactly 17 out of the 19 analysts covering Marathon Petroleum (MPC) have rated it a “buy” in February 2017.

These Refining Stocks Are Trading at a Premium

PSX is trading at 9x its forward EV-to-EBITDA ratio and at 16.4x its forward PE ratio, which is above the peer averages.

Tesla Stock Surge: Who are the Winners and Losers?

Tesla (TSLA) has been on a rising spree since its earnings. In October, Tesla stock surged by 31%. The stock rose on the back of third-quarter profits.

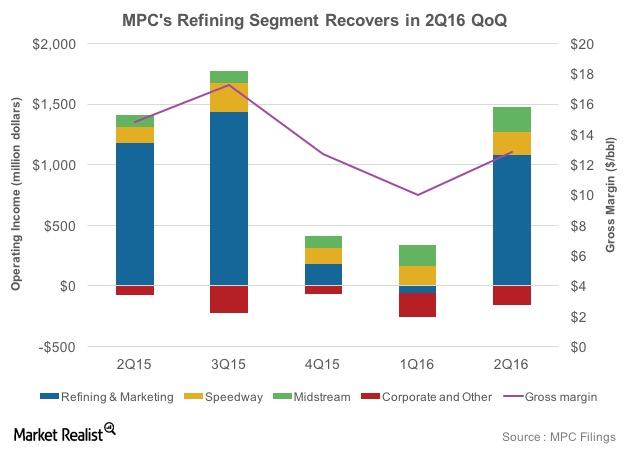

How Will Marathon Petroleum’s Refining Earnings Fare in 3Q16?

According to MPC, a dollar-per-barrel change in the blended LLS 6-3-2-1 crack spread affects its annual net income by $450 million.

What Do Refining Stock Valuations Reveal?

With respect to the price-to-earnings ratio, larger players Marathon Petroleum (MPC), Tesoro (TSO), and Phillips 66 (PSX) trade higher than the average valuations.

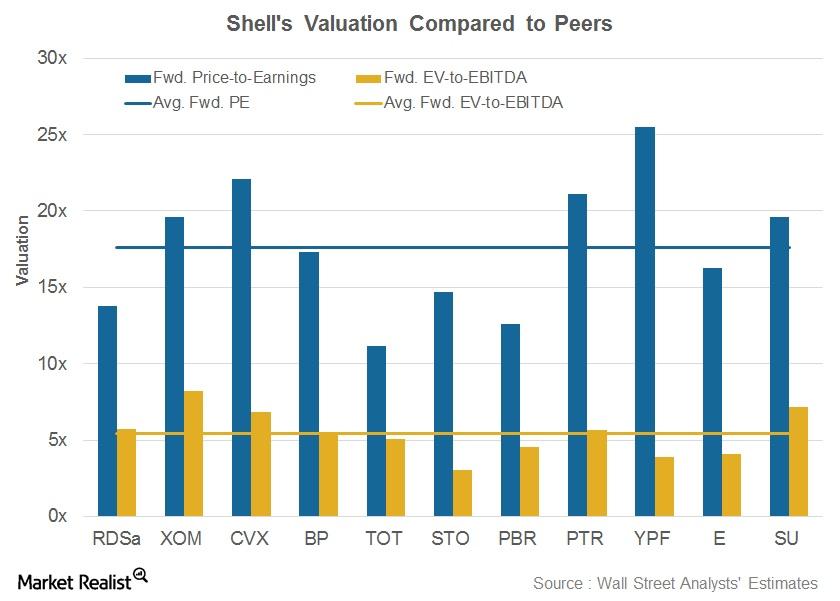

Shell’s Valuation Compared to Its Peers

Shell is trading at a forward PE of 13.8x, below its peer average of 17.6x.

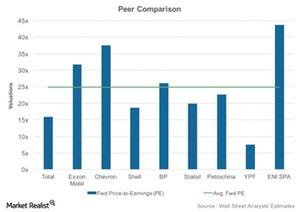

Total’s Forward Valuation: Peer Comparison

In the previous part of this series, we discussed Total’s historical valuation trends. Now we’ll compare its forward valuation with that of its peers.

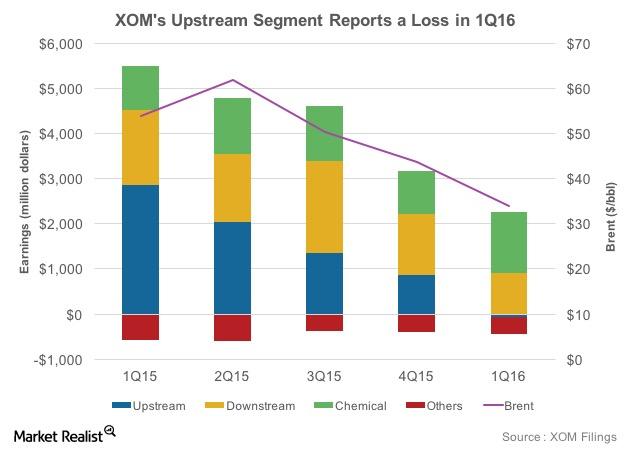

ExxonMobil’s Segmental Analysis: Pre-earnings Review

Changing oil prices have altered segment dynamics for ExxonMobil (XOM). Earnings from the company’s upstream segment have fallen steeply.

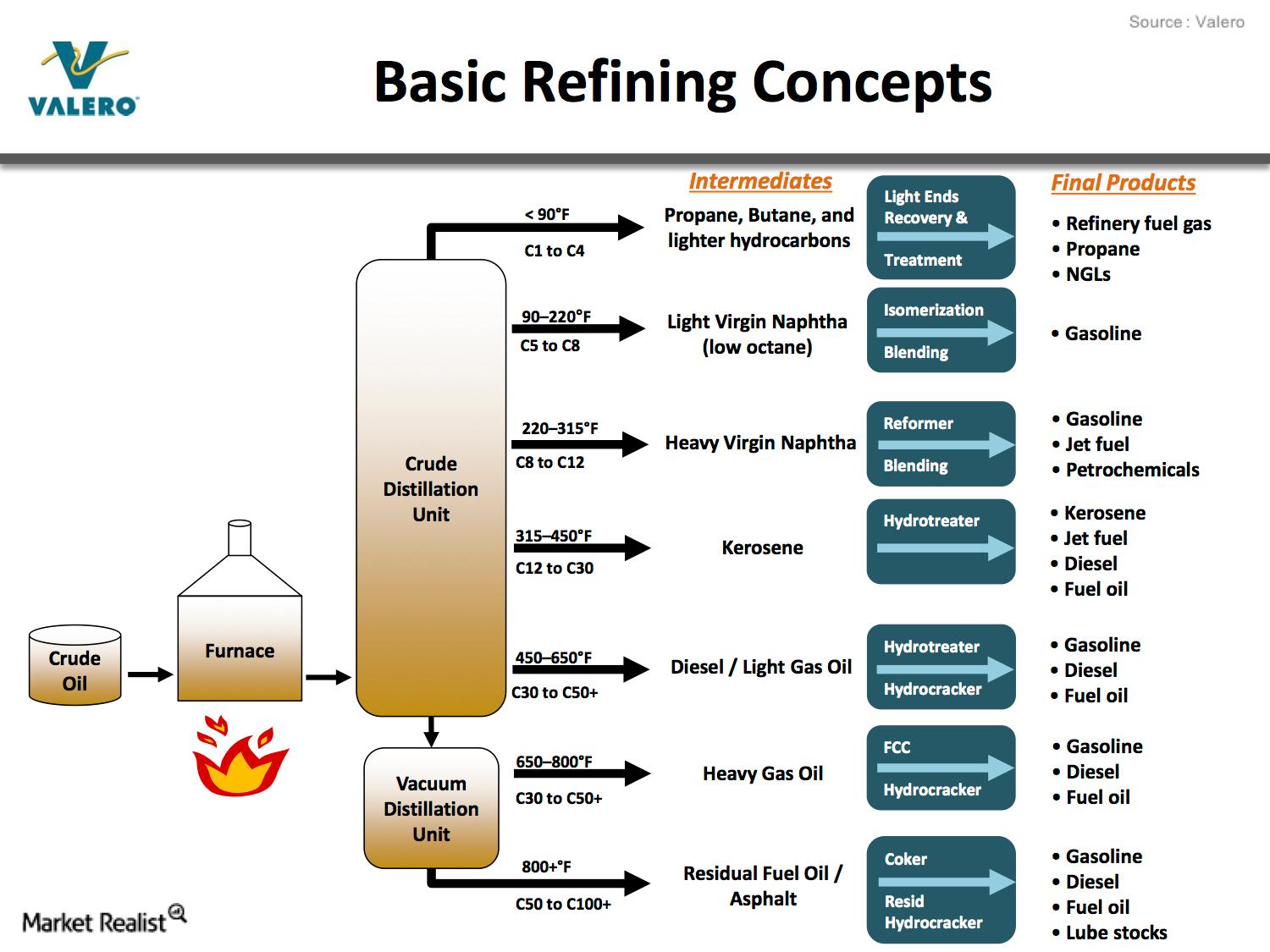

What Is Crude Oil Refining and How Does It Work?

This series will provide you a complete overview of the refining industry as well as a quick snapshot of downstream sector stocks in the US.

Best Refining Stocks: Comparing MPC, VLO, PSX, HFC

Refining stocks’ performance was mixed in the fourth quarter. While Marathon Petroleum and HollyFrontier fell, Valero Energy and Phillips 66 rose.

Do Technical Indicators Hint at Strength for BP Stock?

BP stock has had almost flat returns in 2019, and its stock is up 0.3% year-to-date. Lower oil prices have impacted the stock’s performance.

Valero Stock Rises 12% before IMO 2020

Valero Energy (VLO) stock has risen 11.6% sequentially. The stock has risen due to stronger refining conditions in the current quarter.

How Is Tesla Stock Positioned for 2020?

Tesla stock had quite a year in 2019. Tesla went from loss to profit, and from lower deliveries to record deliveries. What lies ahead for 2020?

How the Puma Energy Acquisition Fits Chevron’s Strategy

Chevron agreed to acquire Puma Energy Australia Holdings for 425 million Australian dollars. Chevron expects to close the acquisition in mid-2020.

VLO, MPC, and PSX: Are Refining Cracks, Oil Spreads Rising?

The refining industry, including cracks and oil spreads, is going through a massive change in the current quarter. The change resulted in sharp changes in refining stocks’ prices. Notably, the industry seems to be ready for IMO 2020. While Valero Energy (VLO) and Phillips 66 (PSX) stocks have risen by 11.6% and 13.6% sequentially, Marathon […]

MPC Stock Forecast until the End of 2019

Marathon Petroleum’s (MPC) stock price has fallen 6.0% so far in Q4, likely influenced by the uncertainty regarding the company’s strategic path.

Tesla Stock: Is the ‘Dean of Valuation’ Wrong on TSLA?

Tesla (TSLA) stock has risen by 46% quarter-to-date. The rise in TSLA stock has been due to the company’s surprise set of third-quarter numbers.

Refining Crack Spread Overview: All You Ever Wanted to Know

The crack spread is a major component that drives refiners’ valuation. In this article, we’ll look at the metric’s different aspects.