Maitali Ramkumar

Maitali, an equity research analyst, has been contributing to Market Realist since 2015. She began analyzing and writing about integrated energy and refining stocks. But later, she also ventured in the technology and auto sectors. She has more than 14 years of rich experience as a financial analyst and sell-side institutional equity research analyst.

In her stint as a sell-side institutional equity research analyst, she published research reports on numerous companies with “buy” and “sell” recommendations. She was ranked as one of the best analysts for one of her reports on an energy company. As a financial expert, she has deep experience in financial modeling, forecasting, and valuations

Maitali—with her excellent interpersonal, communication, and analytical skills—was instrumental in establishing and maintaining relationships with mutual fund managers and foreign institutional investors across the industry. She not only strengthened ties with fund managers but also conducted several conferences involving fund managers and company management.

Her strong base in equity research was developed at IDBI Capital, where she began as a junior analyst and moved up her career path. She joined the organization after topping in most of her years of undergraduate and postgraduate studies. Her love for understanding businesses led her to pursue a BMS (bachelor of management studies) and later an MBA (master in business administration) in finance.

Plus, Maitali enjoys traveling to new places and relishes natural landscapes. She also likes listening to music.

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Maitali Ramkumar

ExxonMobil Tops the Charts with Strong Financials

ExxonMobil (XOM) has the lowest percentage of debt in its capital structure compared to its peers. In the first quarter, ExxonMobil’s total debt-to-capital ratio stood at 17%.

How Strong is ExxonMobil’s Debt Position?

ExxonMobil’s (XOM) net debt-to-adjusted EBITDA ratio was 1.0x in the first quarter—below the industry average of 1.2x.

Has Shell’s Dividend Yield Risen?

Shell’s dividend payments have stayed steady in the past few years. In the second quarter, Shell will pay a dividend of $0.94 per share.

Marathon Petroleum Expands with Its Capex and Acquisition

Marathon Petroleum (MPC) continues to march on its growth trajectory with its organic capex activities.

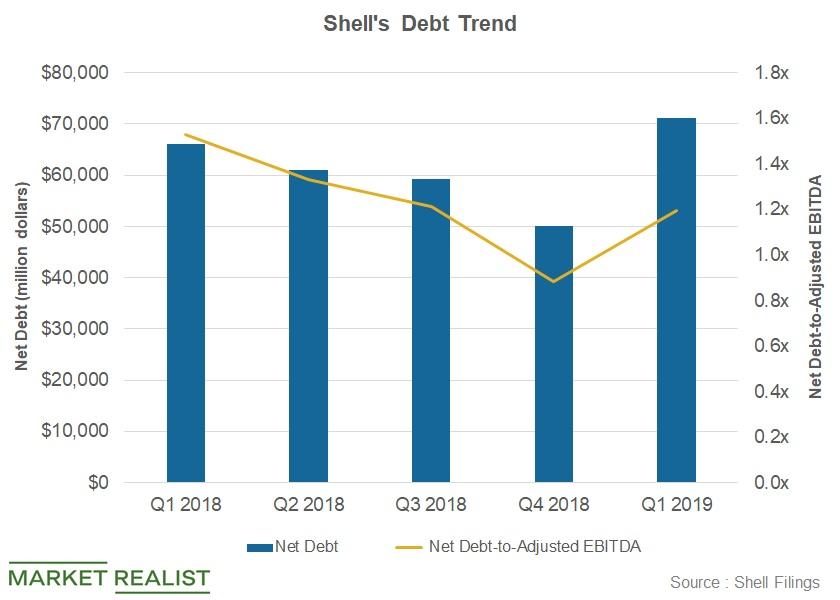

Does Shell Have a Comfortable Debt Position?

Royal Dutch Shell’s (RDS.A) net debt-to-adjusted EBITDA ratio was 1.2x in the first quarter—in line with the average industry ratio of 1.2x.

Does Valero Have a Comfortable Debt Position?

Valero Energy’s (VLO) net debt-to-EBITDA ratio was 1.2x in the first quarter of 2019, lower than the peer average of 1.6x.

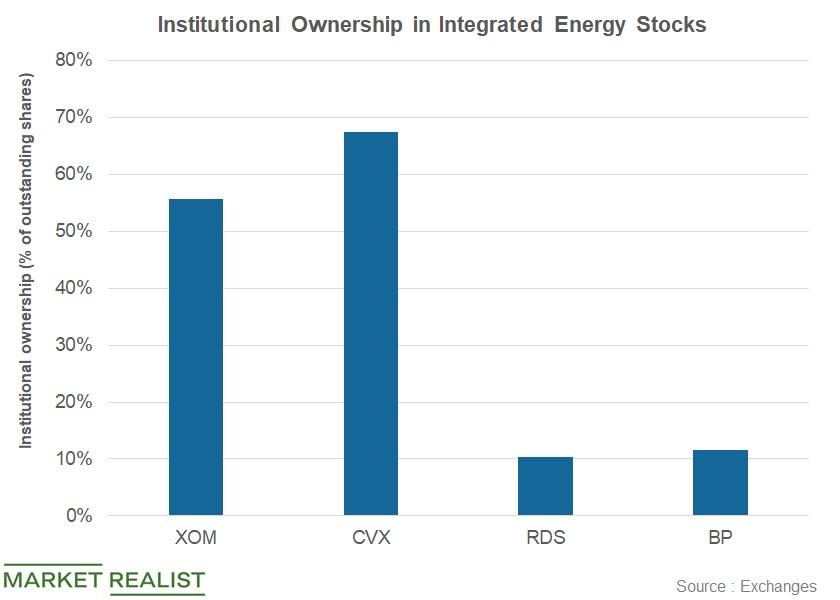

Which Institutions Raised Holdings in Integrated Stocks?

Institutional ownership in ExxonMobil and BP stands at ~56% and ~12%, respectively.

Are Analysts Gaining Confidence in BP?

Analysts seem to be gaining confidence in BP due in part to its expected upstream production growth.

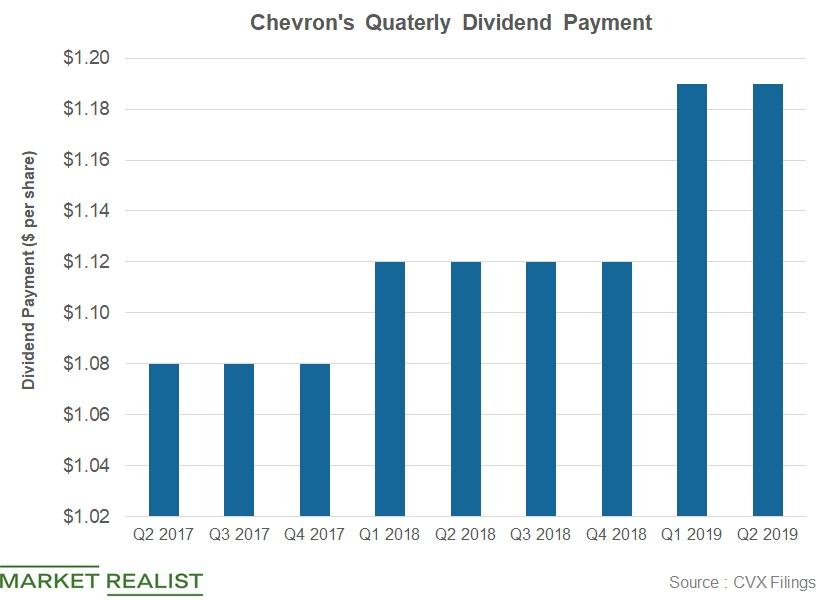

How Will Chevon’s Dividend Payment Trend in Q2?

Chevron (CVX) released its first-quarter earnings on April 26. The company paid $2.2 billion in dividends in the first quarter.

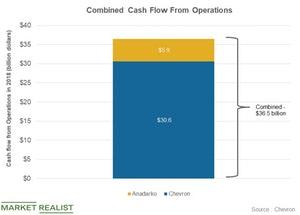

How Will the Anadarko Acquisition Benefit Chevron?

Chevron (CVX) has agreed to acquire Anadarko (APC) in a cash and equity deal.

How’s ExxonMobil’s Downstream Segment Positioned?

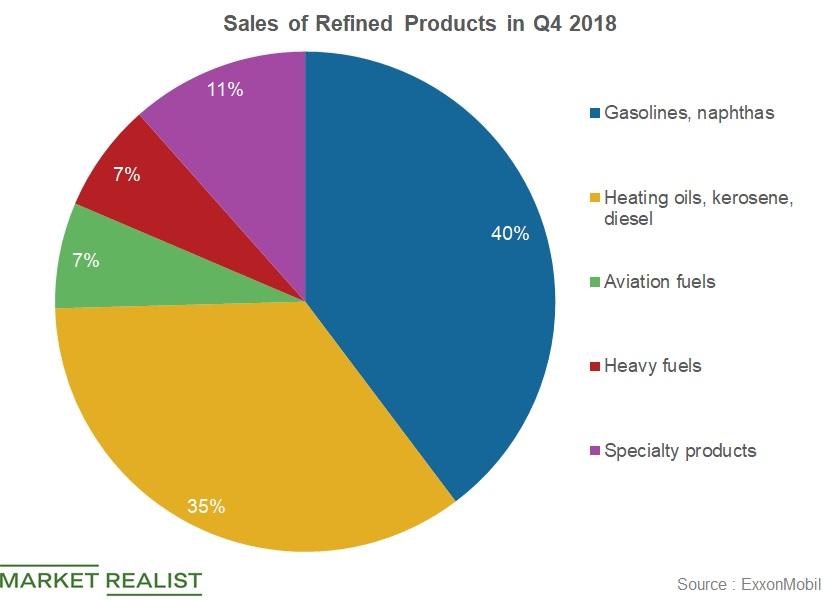

In the fourth quarter, ExxonMobil’s refined products sales fell 2.3% YoY to 5.5 MMbpd. The company’s gasoline sales fell 7.2% YoY.

How Has Phillips 66’s Dividend Yield Trended?

Phillips 66’s dividend payments have risen in the past few years. In the first quarter, the company will pay a dividend of $0.8 per share on March 1.

XOM, CVX, Shell, BP: What Do Moving Averages Suggest?

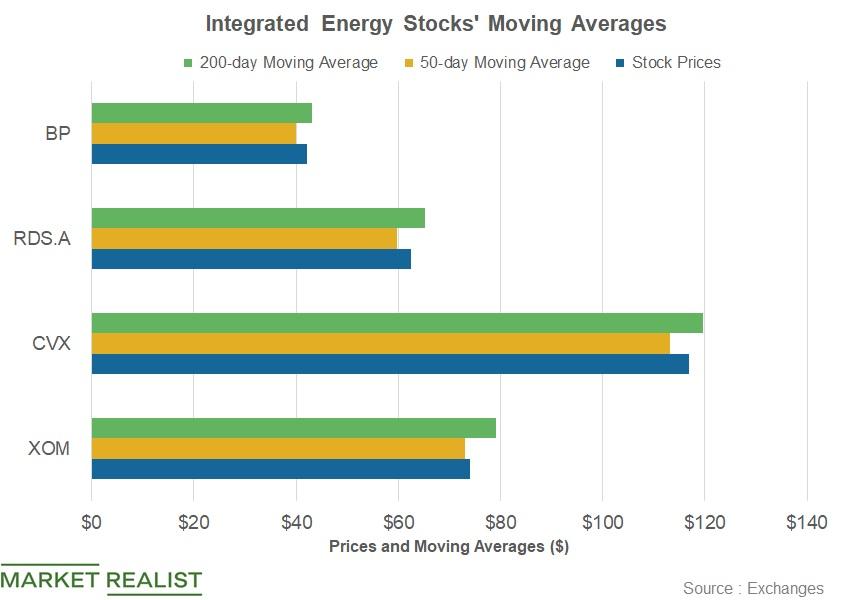

In the first quarter so far, integrated energy stocks ExxonMobil (XOM), Chevron (CVX), Royal Dutch Shell (RDS.A), and BP (BP) have risen due to the rise in oil prices.

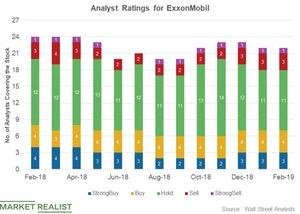

ExxonMobil: Analysts’ Recommendations

In the fourth quarter, ExxonMobil’s earnings rose and beat the estimates. ExxonMobil continued to take advantage of its integrated business model.

Chevron: Analysts Expect Higher Q3 Earnings

Chevron (CVX) is expected to post its third-quarter results on November 2. Chevron is expected to post an EPS of $2.1 in the third quarter.

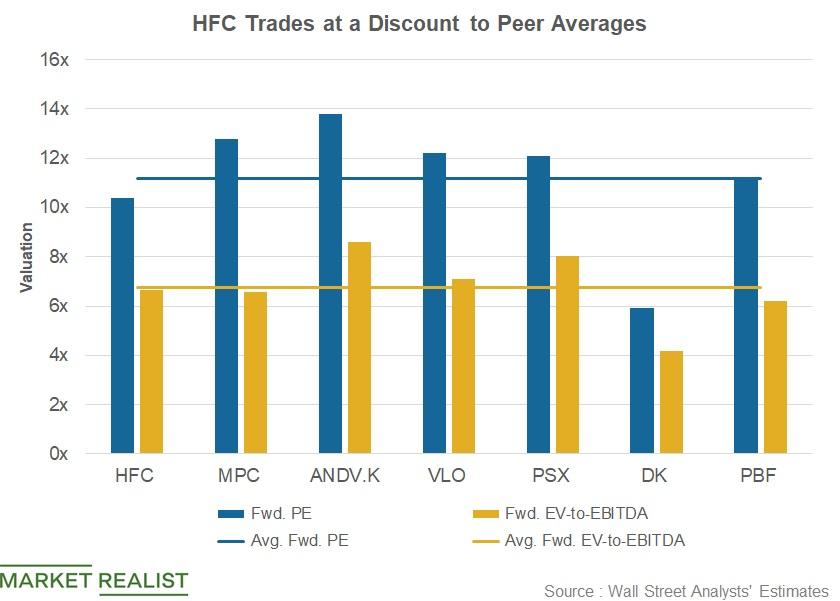

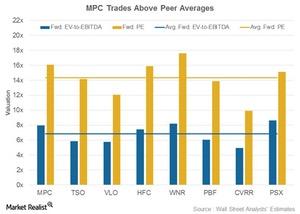

Comparing HollyFrontier’s Valuation with Peers’

HollyFrontier’s (HFC) forward PE ratio is 10.4x, below peers’ average of 11.2x. Marathon Petroleum’s (MPC), Andeavor’s (ANDV), and Phillips 66’s (PSX) forward PE ratios are higher than the average, at 12.8x, 13.8x, and 12.1x, respectively.

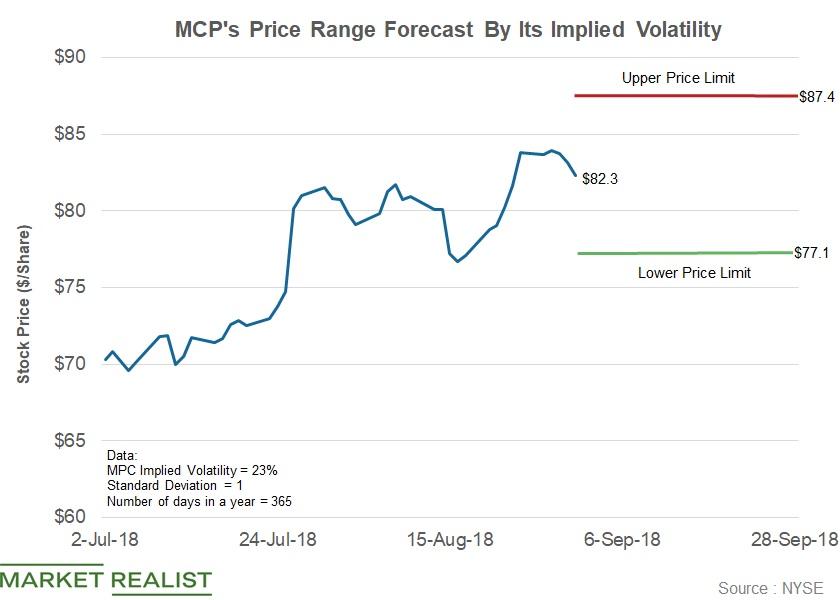

Marathon Petroleum Stock: Price Range until September 28

The implied volatility in Marathon Petroleum has fallen by eight percentage points since July 2 to the current level of 23%.

How Andeavor Stock Has Performed ahead of Q2 2018 Earnings

In the earlier two parts of this series, we looked at Andeavor’s (ANDV) earnings estimates and expected refining margin for Q2 2018.

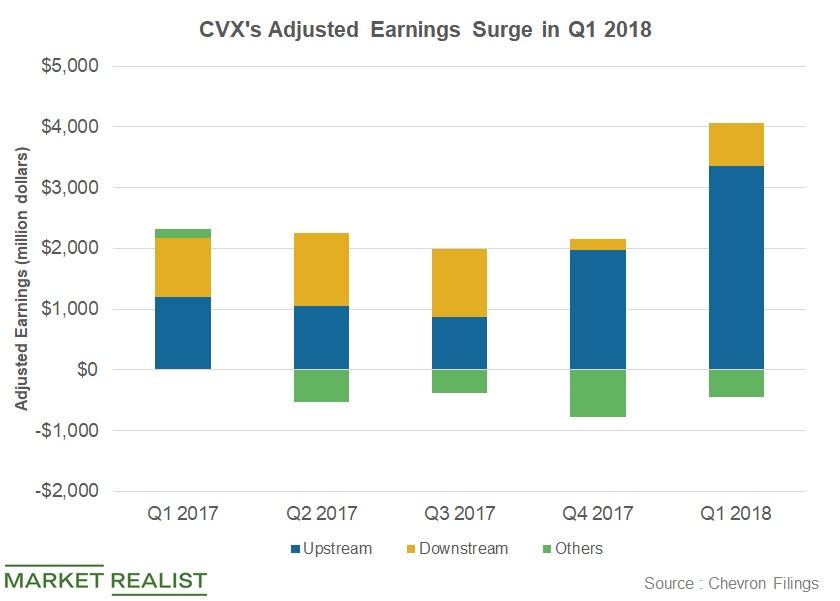

Will Chevron’s Upstream and Downstream Earnings Rise in Q2 2018?

Before we proceed with Chevron’s (CVX) second-quarter segmental outlook, let’s briefly look at its first-quarter segmental performance.

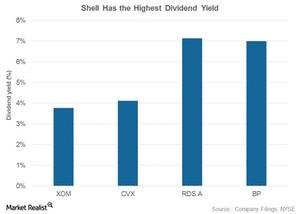

Integrated Energy Stocks: The Top Eight Dividend Yielders

In this series, we’ll look at eight integrated energy stocks and rank them on dividend yields. Royal Dutch Shell (RDS.A) holds the top spot.

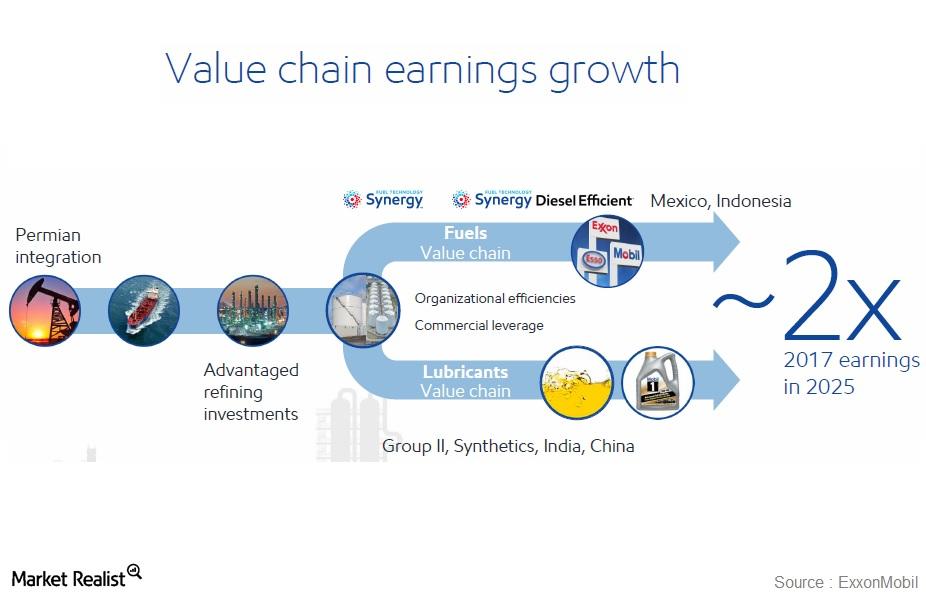

ExxonMobil’s Potential in Downstream and Chemicals

ExxonMobil expects its downstream earnings to double by 2025 over 2017.

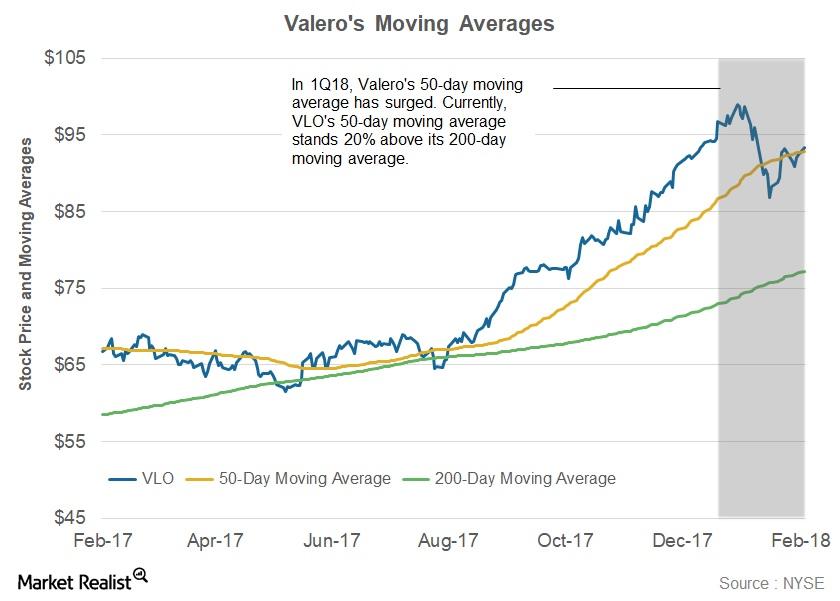

What Does Valero’s Moving Average Suggest?

In 1Q18, VLO’s 50-day moving average remained above its 200-day moving average.

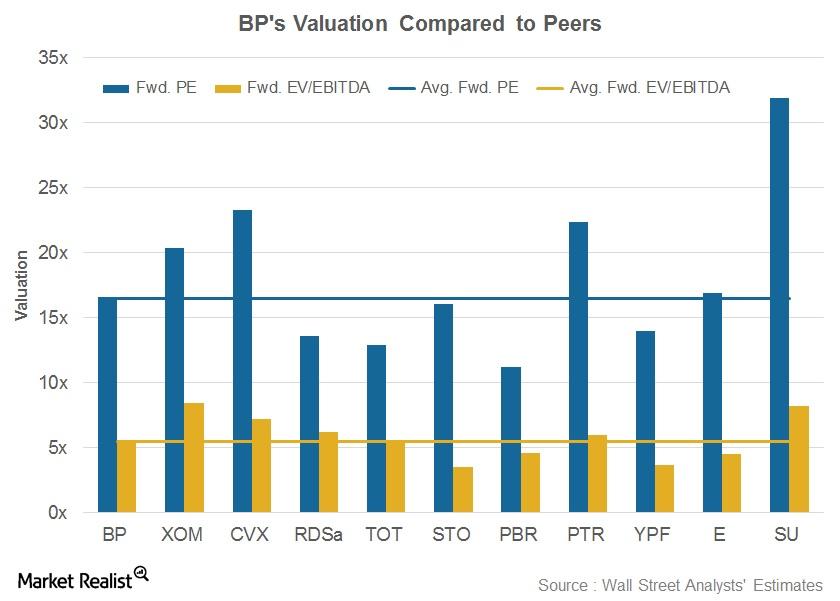

What’s BP’s Valuation?

BP (BP) is now trading at a forward PE (price-to-earnings ratio) of 16.6x, above its peer average of 16.5x.

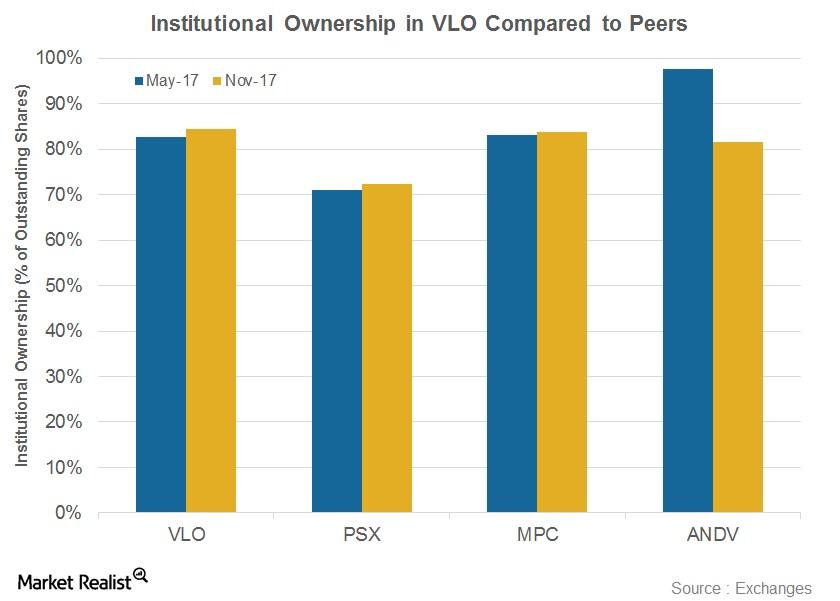

Valero’s Institutional Ownership Trends

What is institutional ownership? In this part, we’ll look at changes in institutional ownership in Valero Energy (VLO). Institutional ownership is a measure of how many shares of a company are owned by institutions such as banks and mutual funds. Institutional ownership suggests these institutions’ confidence level in a stock. Usually, everything else being equal, higher […]

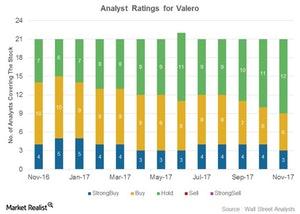

Analysts’ Views on Valero

Analysts’ ratings for Valero Previously, we looked at analysts’ expectations for Valero Energy’s (VLO) dividend payment next quarter. In this part, we’ll look at analysts’ ratings for Valero. As shown in the chart above, nine (or 43%) of the 21 analysts covering VLO have rated it a “buy.” The remaining 12 analysts have rated Valero a “hold,” and […]

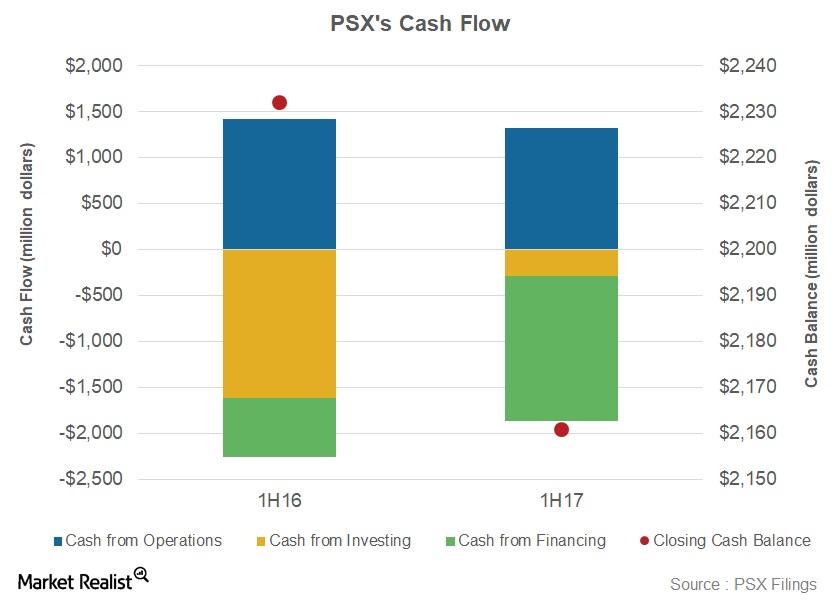

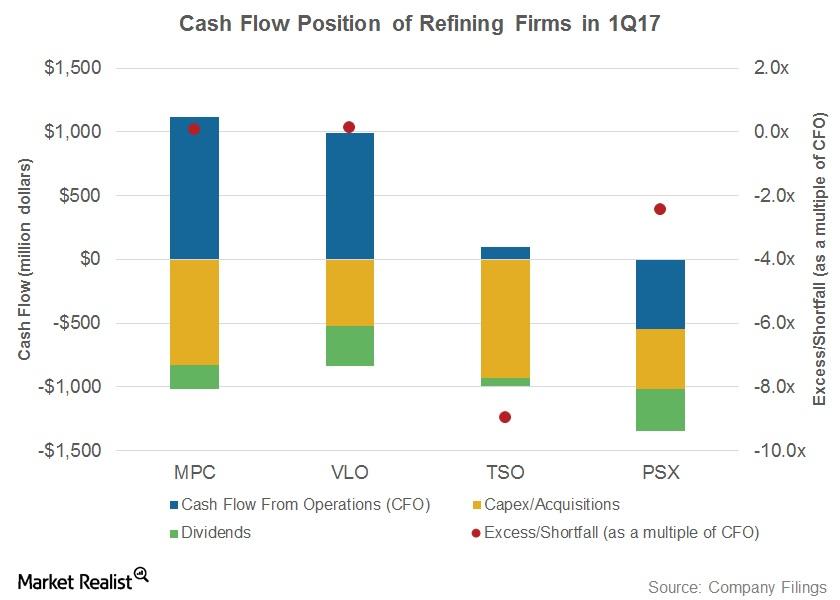

Understanding Phillips 66’s Cash Flow

In 1H17, Phillips 66 saw its cash from operations fall 7% YoY to ~$1.3 billion. This was due to negative cash flow in 1Q17, led by seasonal inventory build-up.

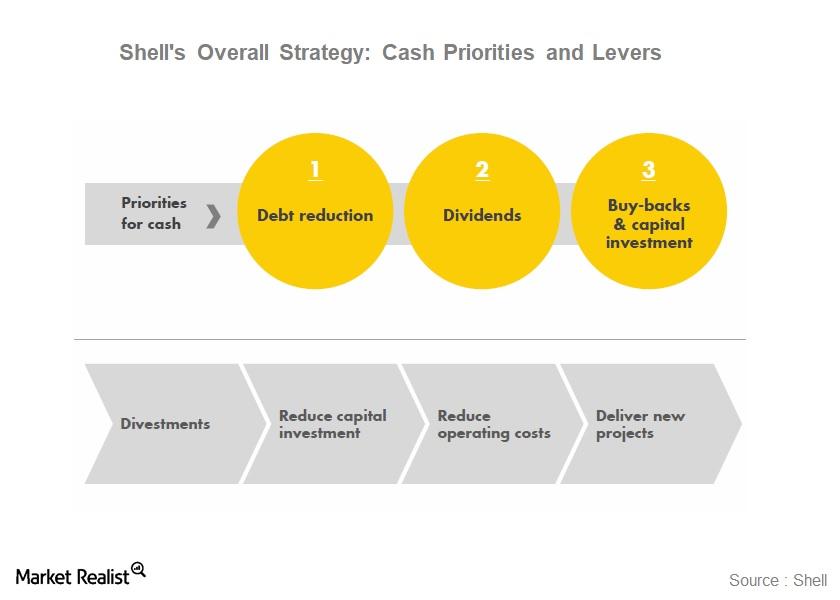

How Shell’s Levers Could Help It Achieve Its Priorities

Royal Dutch Shell (RDS.A) intends to become more resilient to lower oil prices.

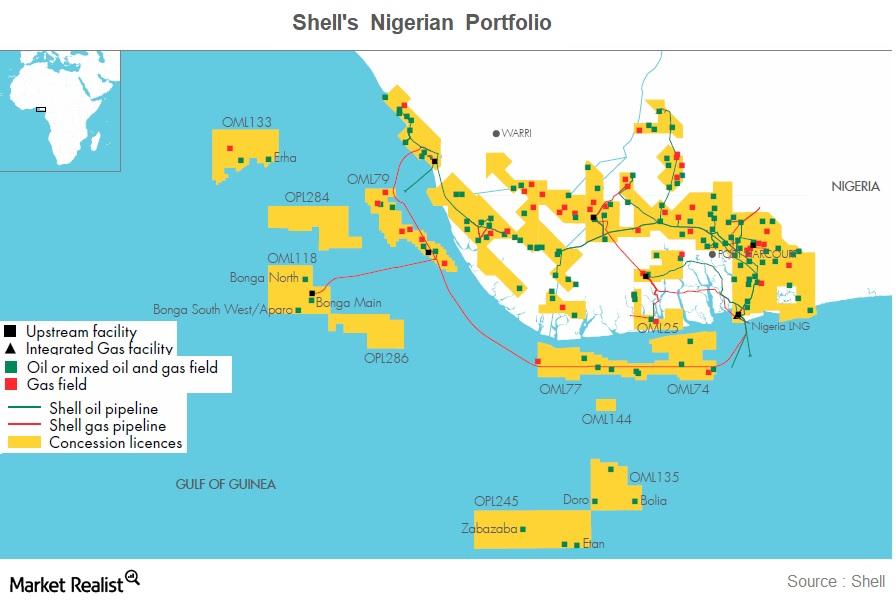

Why Shell’s Gbaran-Ubie Project Is Vital to Upstream Portfolio

In this series, we’ll look at Shell’s overall performance, its robust upstream portfolio, its changing downstream portfolio, and the company’s overall strategy.

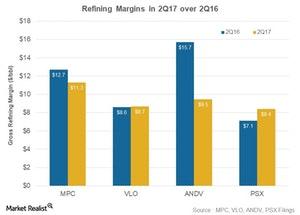

Refining Margins in 2Q17: A Comparison

Refining margins in 2Q17 In this part, we’ll compare leading US downstream companies’ GRMs (gross refining margins). Marathon Petroleum (MPC) had the widest GRM in 2Q17, followed by Andeavor (ANDV), Phillips 66 (PSX), and Valero Energy (VLO). The companies saw mixed GRM trends in 2Q17—let’s look at them more closely. Marathon Petroleum’s refining margin MPC’s gross […]

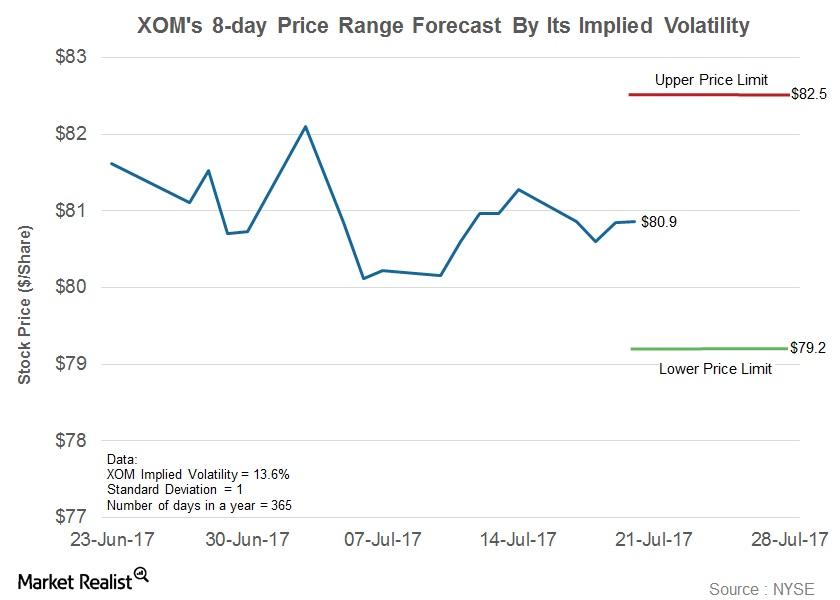

What’s the Forecast for ExxonMobil’s Stock Price?

Implied volatility in ExxonMobil has fallen from 14.9% on April 3, 2017, to 13.6% to date.

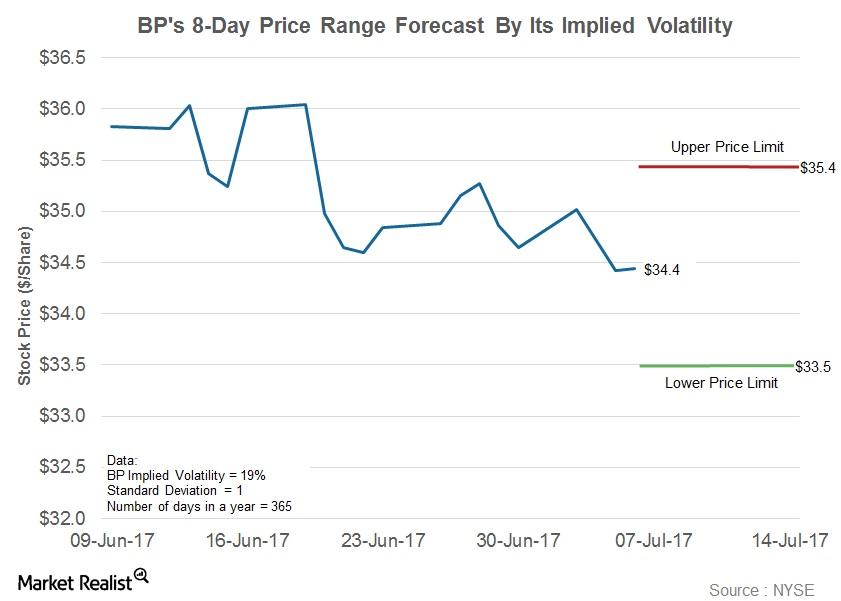

Estimating BP’s Stock Price Using Implied Volatility

What is implied volatility? Volatility gauges changes in a stock’s return over a period. When estimated based on historical stock prices, it is called historical volatility. We can estimate the future volatility, or implied volatility, of security using an option pricing model. A high implied volatility would indicate that a stock price is expected to move […]

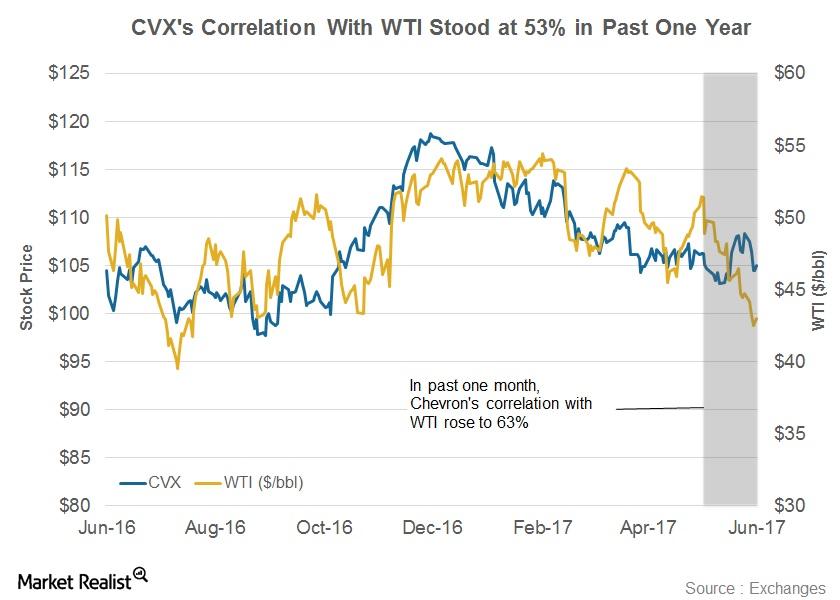

Correlation of Chevron Stock with WTI Crude Oil

The correlation coefficient of Chevron (CVX) versus WTI stood at 0.53 in the last one-year period.

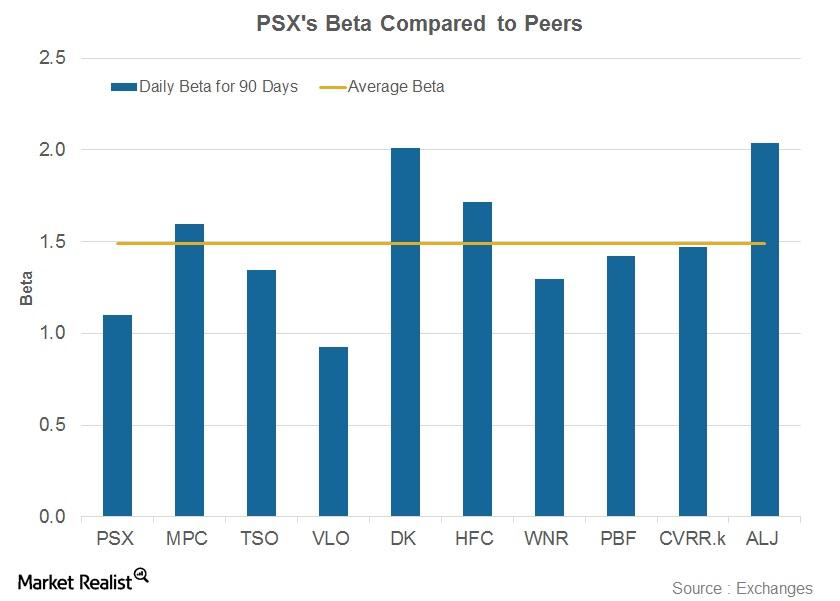

Phillips 66’s Beta: Does It Imply the Company Is Less Volatile?

Phillips 66’s 90-day daily beta stands at 1.1, which is below its peer average of 1.5.

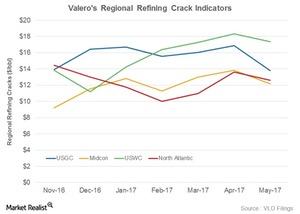

What Valero Needs to Soar in 2Q17

Valero’s crack indicators have fallen in all of these areas in May 2017 (as of May 23) as compared to April 2017.

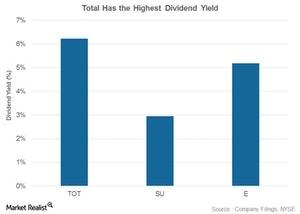

TOT, SU, E, and PBR: Comparing Their Dividend Yields

Total (TOT), Suncor Energy (SU), ENI (E), and Petrobras (PBR) have provided steady returns to their shareholders in the form of dividends.

How Major Refiners’ Cash Flows Fared in 1Q17

Refiners’ cash flows have turned volatile over the past few quarters due to volatile refining earnings.

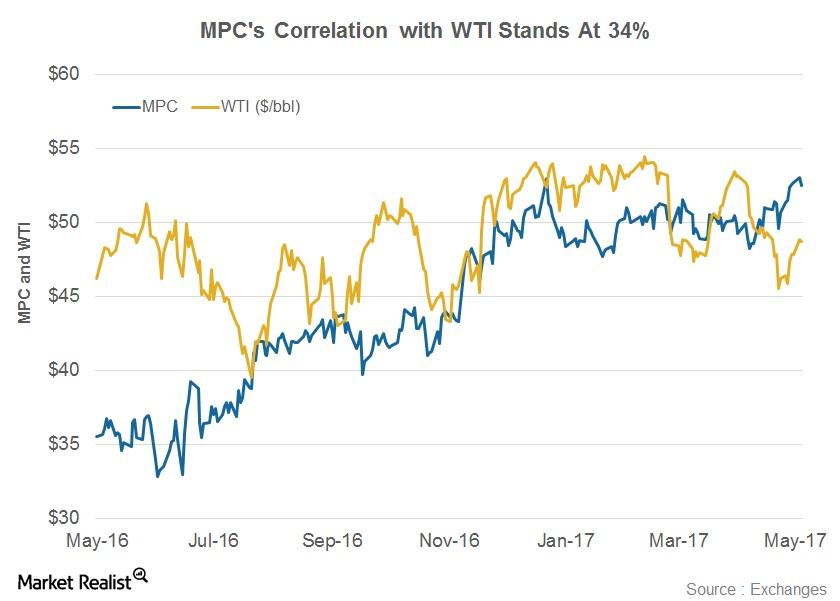

How Does MPC Stock Correlate with WTI?

Marathon Petroleum’s correlation with WTI stands at 0.34. This value shows that the two have a positive but relatively weak correlation.

Why MPC’s Valuation Commands a Premium over the Peer Average

MPC’s valuations are above the peer averages likely because it’s now in the process of restructuring its organization to unlock value.

Energy Stock Valuations and Their Historical Averages

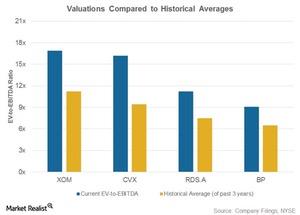

EV-to-EBITDA multiples in 1Q17 for ExxonMobil (XOM), Chevron (CVX), Royal Dutch Shell (RDS.A), and BP (BP) were above their historical averages.

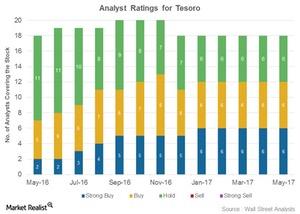

How Analysts Rated Tesoro on Its 1Q17 Earnings Day

Tesoro (TSO) has been rated by 18 analysts. Of those, 12 have assigned the stock a “buy” or “strong buy” rating.

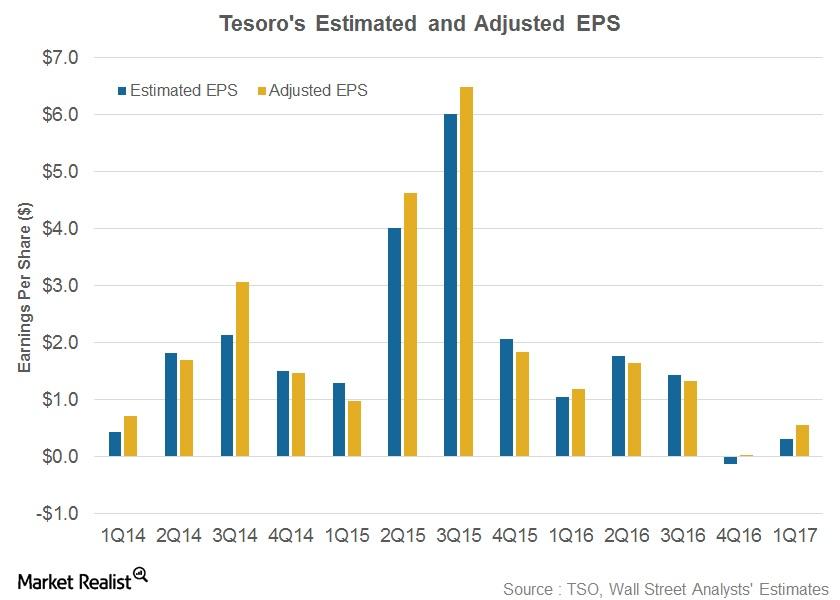

Tesoro Beats 1Q17 Earnings

Tesoro (TSO) posted its 1Q17 results on May 8, 2017. Revenues missed analysts’ estimate, but adjusted EPS of $0.55 surpassed the estimate of $0.31.

Who Has Higher Dividend Yields: RDS.A, XOM, CVX, or BP?

Shell has the highest dividend yield of 7.1% among the integrated energy stocks we’re covering in this series.

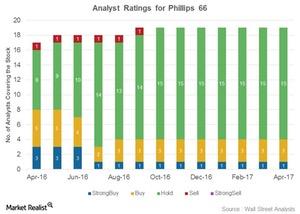

Analysts’ Ratings for Phillips 66 after Its 1Q17 Earnings

After its earnings, Phillips 66 was rated by 19 analysts. Four analysts gave it a “buy,” 15 gave it a “hold,” and no analysts gave it a “sell.”

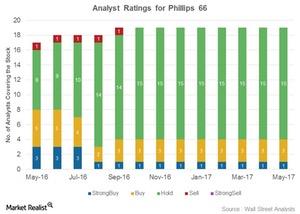

Where Do Analysts Ratings for Tesoro Stand Pre-Earnings?

In this series, we’ve examined Tesoro’s (TSO) 1Q17 estimates, refining margin outlook, and stock performance ahead of its earnings release expected on May 8, 2017.

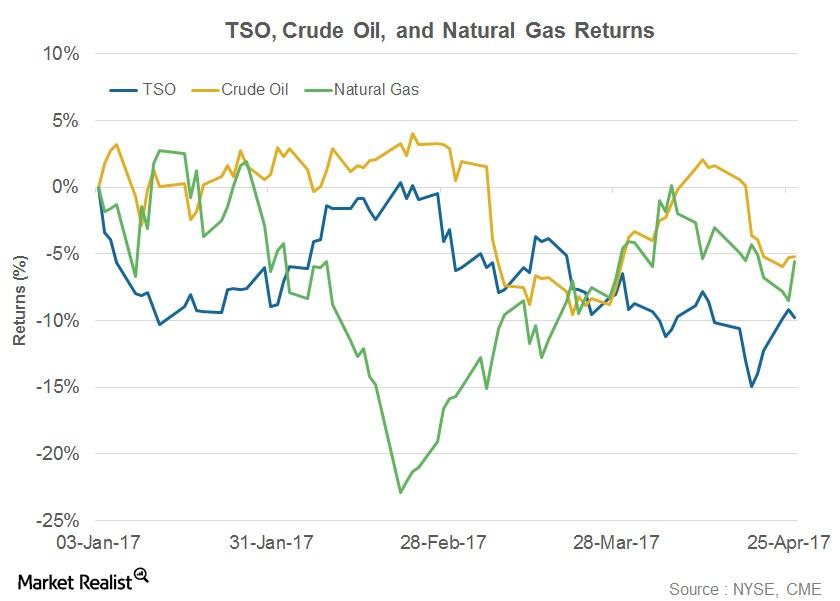

How Did Tesoro’s Stock Perform Pre-1Q17 Earnings?

Since January 3, 2017, TSO stock has fallen 9.8%. Comparatively, crude oil prices have fallen 5.2%, and natural gas prices have fallen 5.6% year-to-date.

How Are Analysts Rating Phillips 66 before Its 1Q17 Earnings?

Phillips 66 has been rated by 19 analysts. Of those, four (or 21.0%) have given it a “buy” or “strong buy” rating.

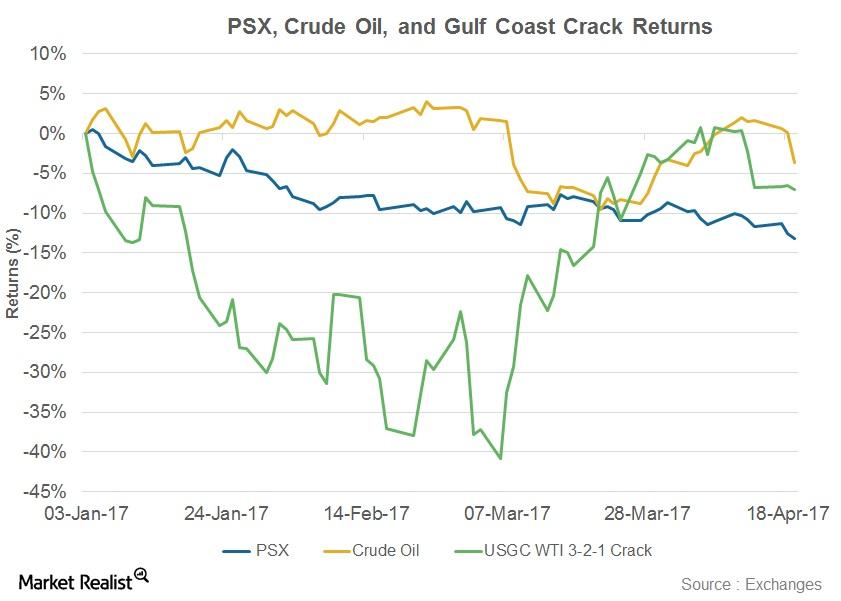

A Look at Phillips 66 Stock before Its 1Q17 Earnings Release

Since January 3, 2017, Phillips 66 (PSX) stock has fallen 13.2%. Crude oil prices have fallen 3.6%.

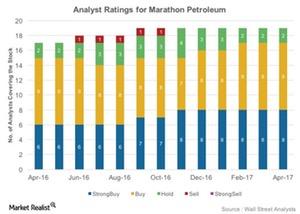

Marathon Petroleum on the Street: What’s Changed among Analysts?

Of the 19 analysts covering MPC, 17 (89%) analysts have assigned “buy” or “strong buy” ratings, while two (11%) have assigned “hold” ratings.

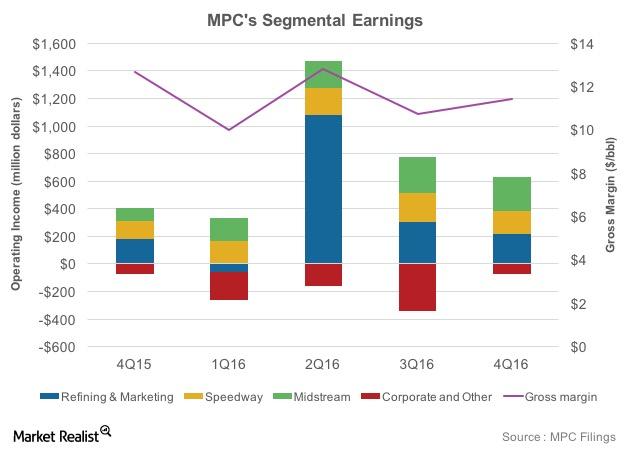

Which Way Will MPC’s Refining Earnings Swing in 1Q17?

MPC’s operating income rose 64% YoY to $553 million in 4Q16. The Refining segment’s operating income rose to $219 million in 4Q16 from $179 million in 4Q15.

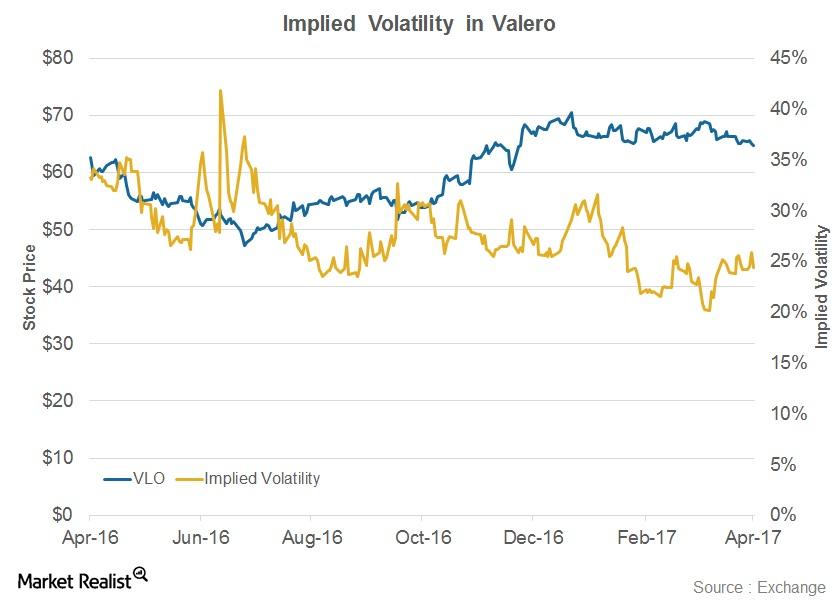

Behind Valero’s Implied Volatility ahead of the 1Q17 Results

The implied volatility of Valero Energy (VLO) stock now stands at 24%. This level is equal to VLO’s 30-day average implied volatility.