Maitali Ramkumar

Maitali, an equity research analyst, has been contributing to Market Realist since 2015. She began analyzing and writing about integrated energy and refining stocks. But later, she also ventured in the technology and auto sectors. She has more than 14 years of rich experience as a financial analyst and sell-side institutional equity research analyst.

In her stint as a sell-side institutional equity research analyst, she published research reports on numerous companies with “buy” and “sell” recommendations. She was ranked as one of the best analysts for one of her reports on an energy company. As a financial expert, she has deep experience in financial modeling, forecasting, and valuations

Maitali—with her excellent interpersonal, communication, and analytical skills—was instrumental in establishing and maintaining relationships with mutual fund managers and foreign institutional investors across the industry. She not only strengthened ties with fund managers but also conducted several conferences involving fund managers and company management.

Her strong base in equity research was developed at IDBI Capital, where she began as a junior analyst and moved up her career path. She joined the organization after topping in most of her years of undergraduate and postgraduate studies. Her love for understanding businesses led her to pursue a BMS (bachelor of management studies) and later an MBA (master in business administration) in finance.

Plus, Maitali enjoys traveling to new places and relishes natural landscapes. She also likes listening to music.

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Maitali Ramkumar

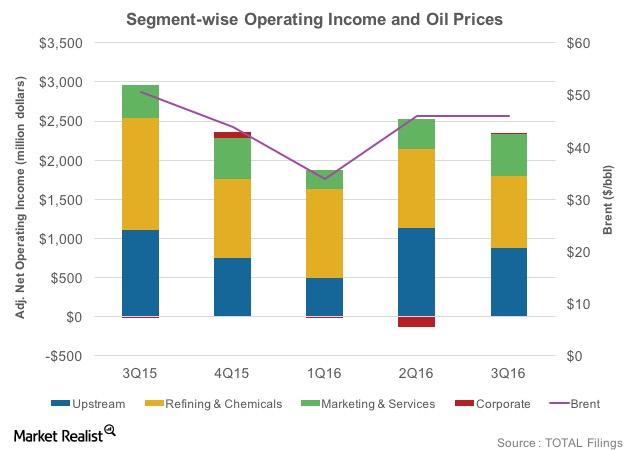

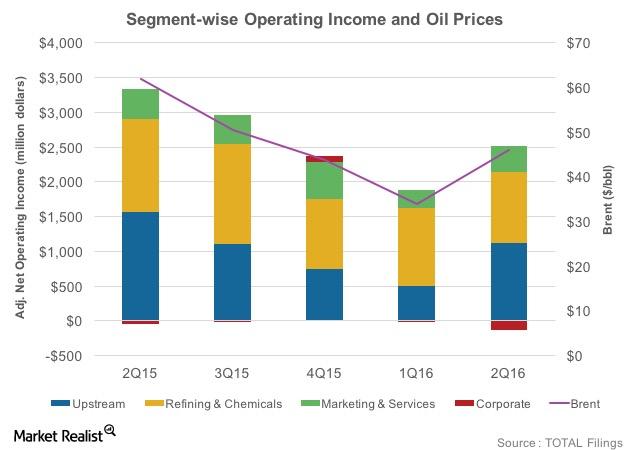

Analyzing Total’s Segmental Earnings in 3Q16

Total’s net adjusted operating earnings from the Upstream segment fell 21% from 3Q15 to $877 million in 3Q16 due to lower crude oil prices.

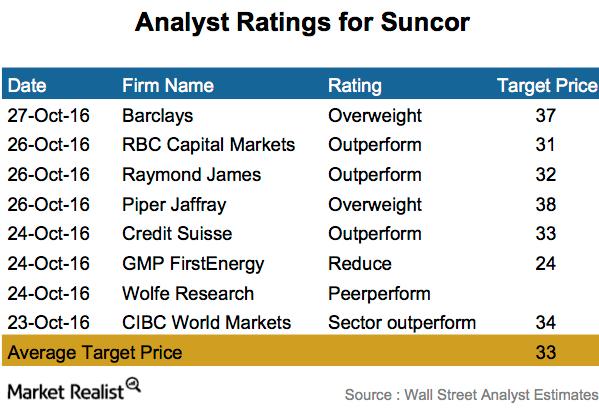

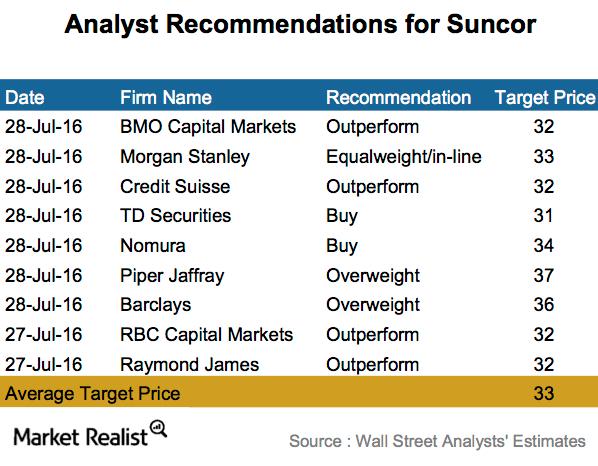

Suncor: How Analysts Are Rating the Stock after Earnings

An analyst survey shows that six out of eight companies surveyed rated Suncor Energy (SU) an “overweight” or “outperform.”

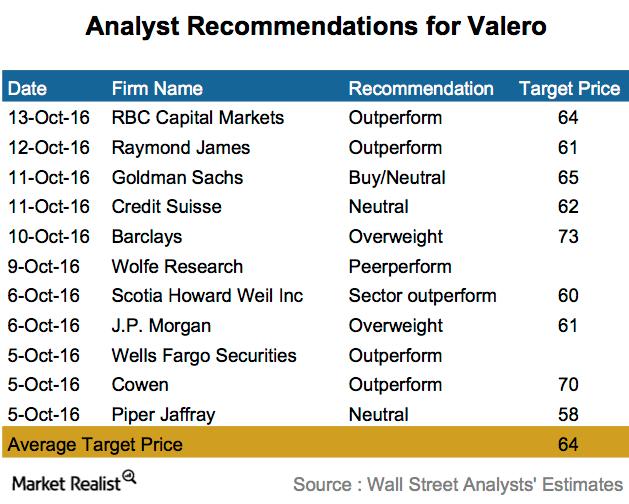

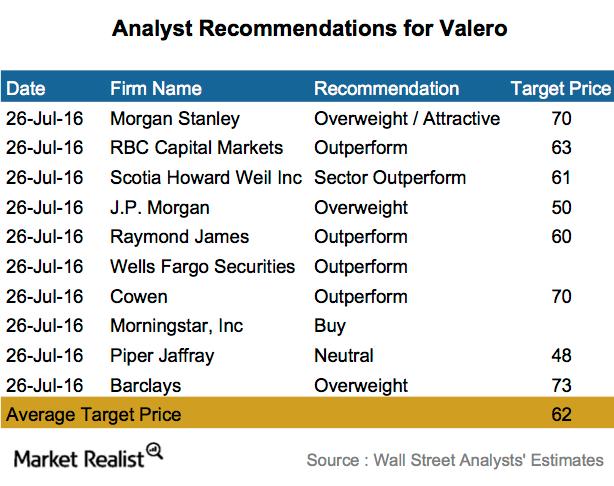

How Analysts Are Rating Valero ahead of Its 3Q16 Earnings

Eight of the 11 firms rated Valero as a “buy,” “overweight,” or “outperform,” with a high 12-month price target of $73, indicating a potential 35% gain.

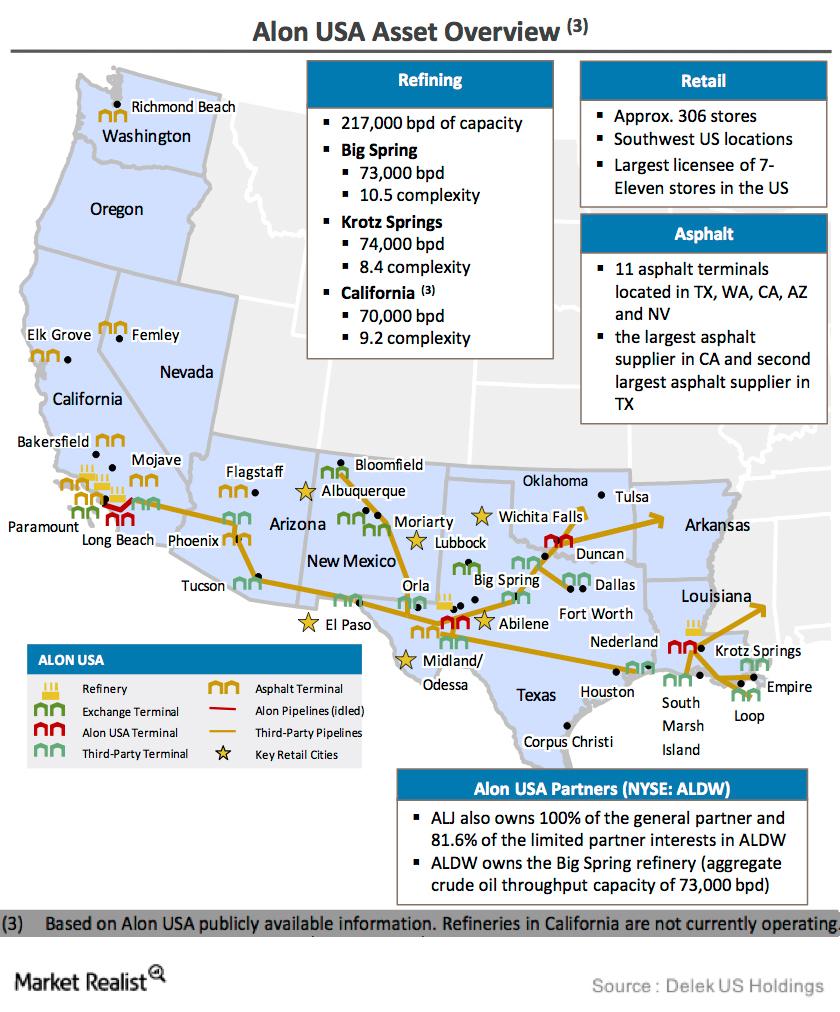

Can Delek US Fully Acquire Alon USA?

Delek US Holdings will be transformed if it succeeds in the acquisition of the remaining stake in Alon USA Energy.

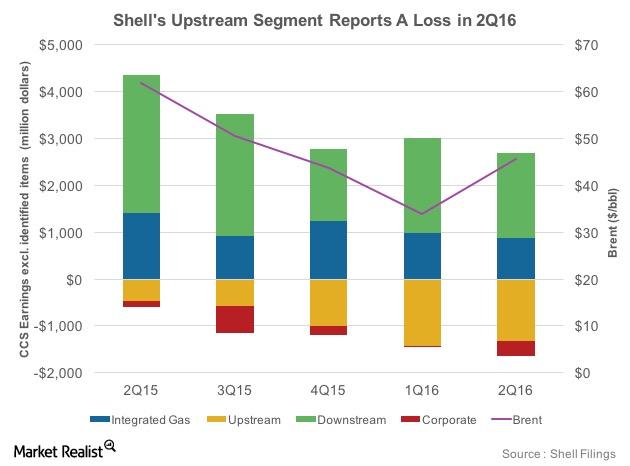

Shell’s Segments: Upstream Continues to Report Losses

Falling crude oil prices have changed the segmental dynamics within integrated energy companies such as Royal Dutch Shell (RDS.A).

Chevron’s Downstream Value Chains: Is It the Focus Area?

Chevron (CVX) is focusing on expanding its high-return sectors like Petrochemicals, Additives, and Lubricants.

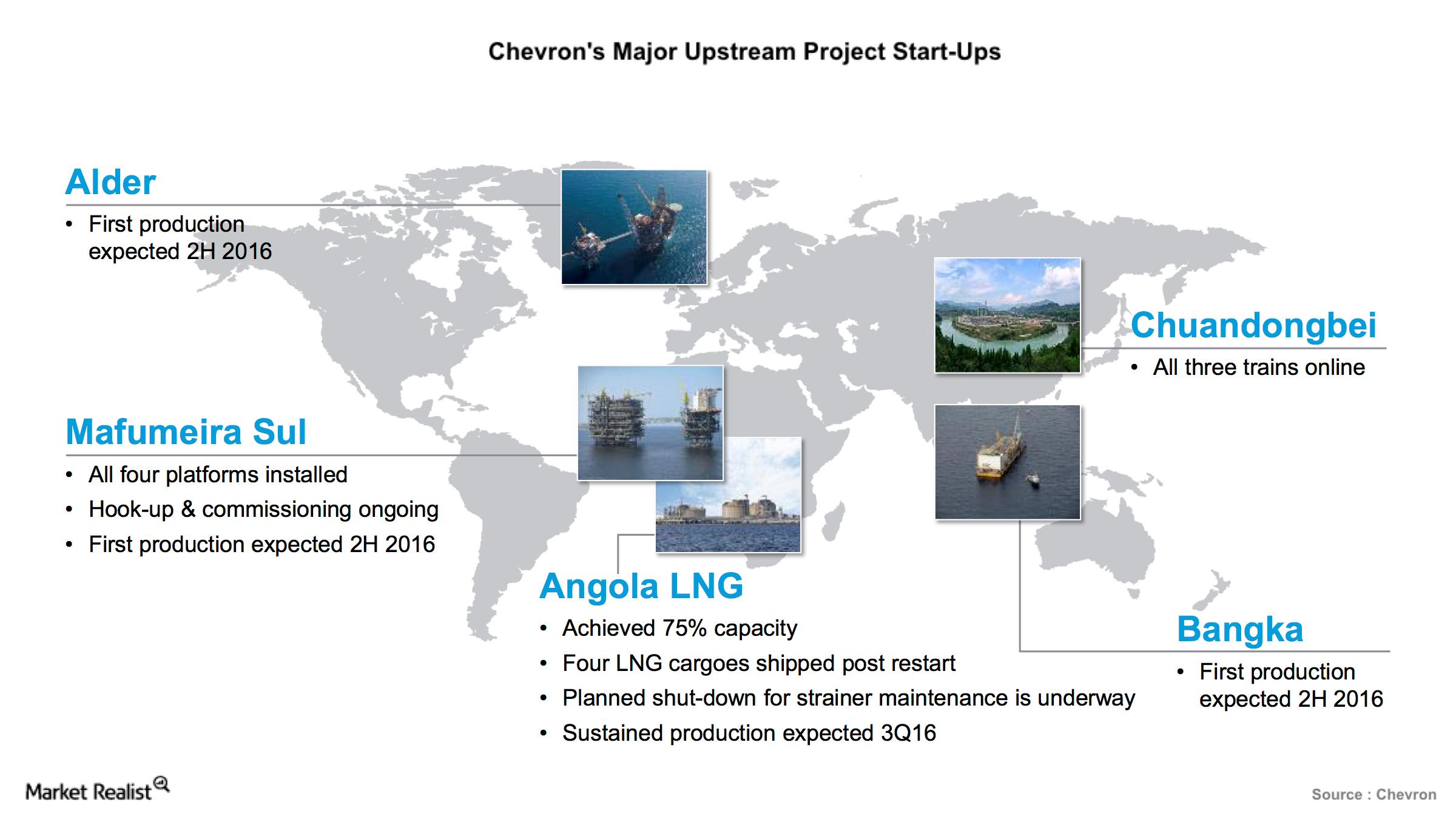

Chevron’s Upstream Portfolio: Major Projects to Start in 2016–2017

Chevron’s (CVX) Upstream segment production is poised to grow, with some of the major projects starting up in 2016–2017.

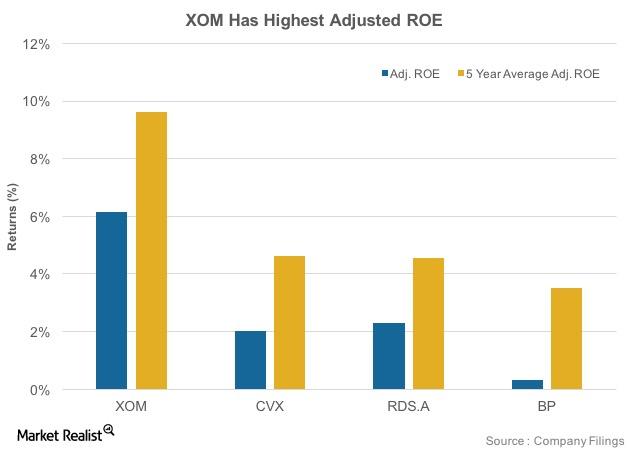

Look to This Energy Company for the Best ROE

Battered by falling oil prices, the 2Q16 ROE numbers for ExxonMobil (XOM), Chevron, Royal Dutch Shell, and BP were lower than their five-year average historical ROE figures.

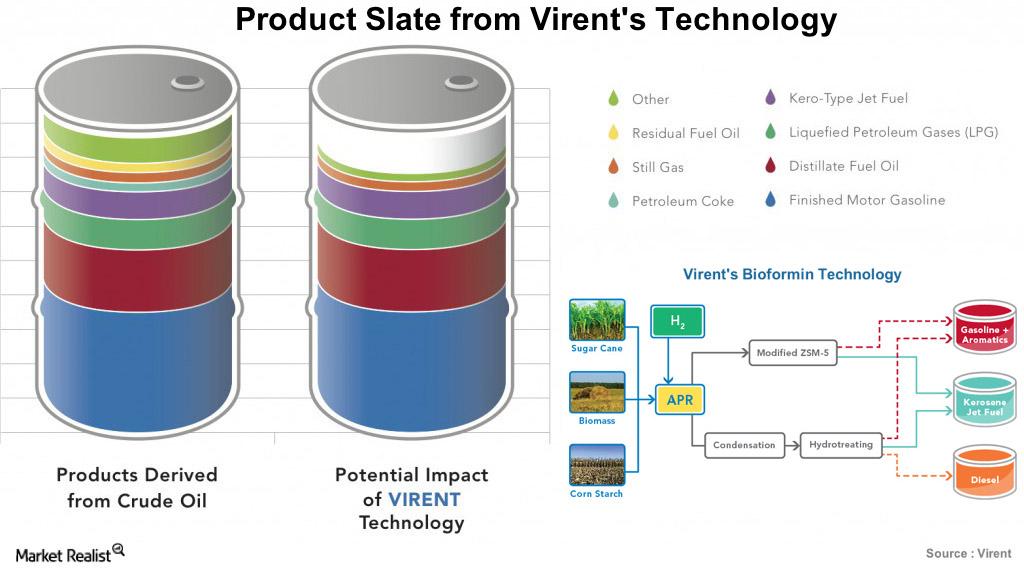

Tesoro’s Acquisition of Virent Helps It Focus on Biofuels

In a bid to foster its biofuels business, Tesoro (TSO) has agreed to acquire Virent. The company is expected to operate as Tesoro’s wholly owned subsidiary.

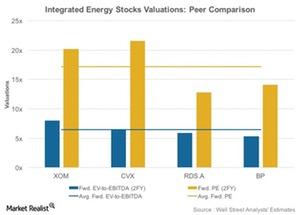

Looking 2 Years Out, Energy Stocks Trade at Respectable PEs

ExxonMobil (XOM) trades at an 8.1x EV-to-EBITDA multiple and a 20.2x price-to-earnings ratio, both above its peers’ averages.

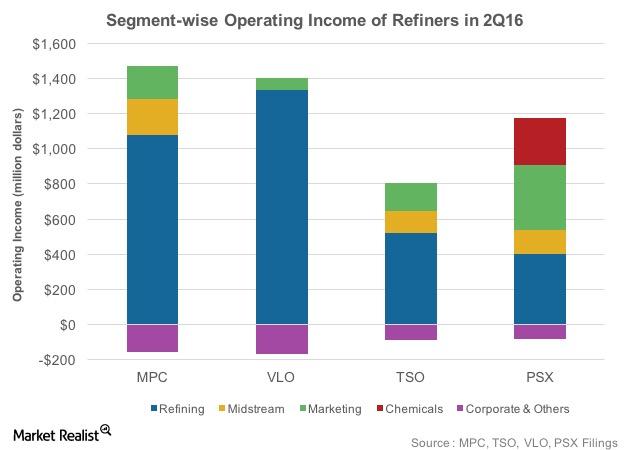

How PSX’s Operating Income Differs from Those of MPC, VLO, TSO

Refiners such as PSX, MPC, VLO, and TSO are now focusing on diversifying their earnings models to shield themselves from the volatile refining environment.

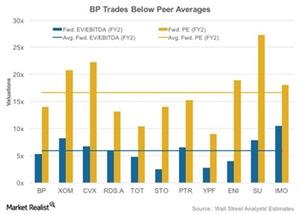

BP’s Forward Valuations: A Peer Comparison

In this article, we’ll consider BP’s forward valuations compared to those of its peers. BP’s market cap stands at ~$105 billion.

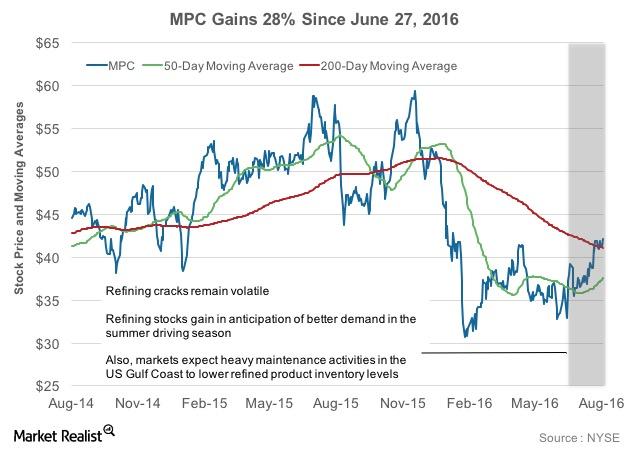

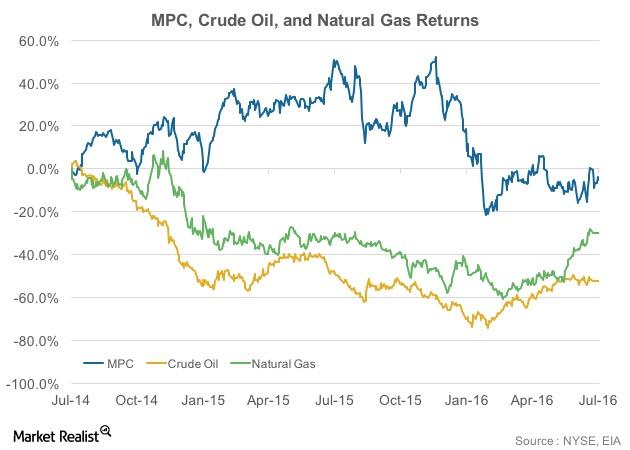

Marathon Petroleum’s Stock Performance: Up by 28% since June 30

Since the end of June, Marathon Petroleum’s (MPC) stock has risen by 28%. MPC has crossed over its 50-day and its 200-day moving averages during this period.

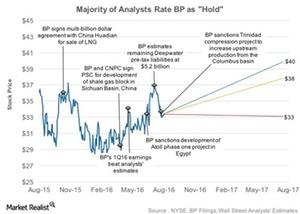

Why Most Analysts Recommend ‘Holds’ on BP

Analysts’ ratings for BP (BP) show that 31% of those covering the stock rate it as a “buy,” and 61% rate it as a “hold.”

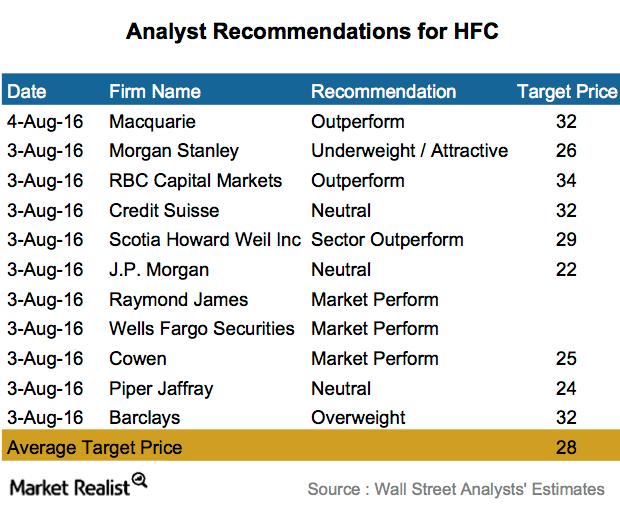

What Are Analysts’ Recommendations for HollyFrontier?

The analysts’ survey shows that six out of the 11 companies surveyed rated HollyFrontier (HFC) as “neutral” or “market perform.”

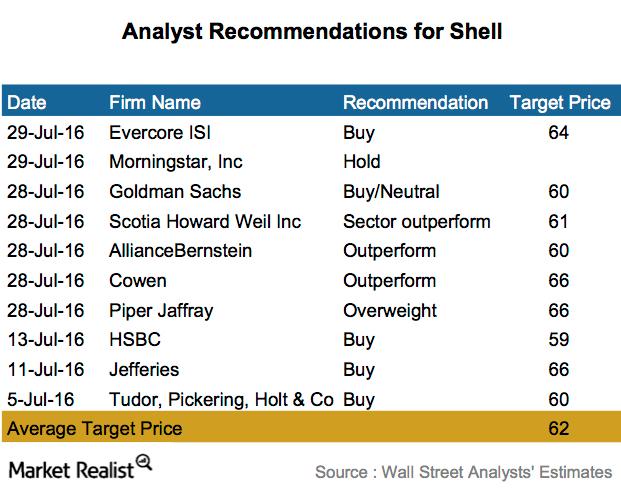

Majority of Analysts Rate Shell as a ‘Buy’ Post-2Q16 Earnings

Nine out of the ten companies surveyed rated Royal Dutch Shell (RDS.A) a “buy,” “overweight,” or “outperform.”

Majority of Analysts Rate Suncor a ‘Buy’ after 2Q16 Earnings

Analyst surveys show that eight of the nine analysts surveyed rated Suncor (SU) a “buy,” “overweight,” or “outperform.”

Total’s Segments: Upstream Earnings Plunge but Stay Positive

Changing oil prices have changed the dynamics for Total’s segments. Although upstream earnings have declined in 2Q16 YoY, they stayed positive in the quarter.

What Do Analysts Recommend for Valero after 2Q16 Earnings?

Nine out of ten companies surveyed rated Valero (VLO) a “buy,” “overweight,” or “outperform.”

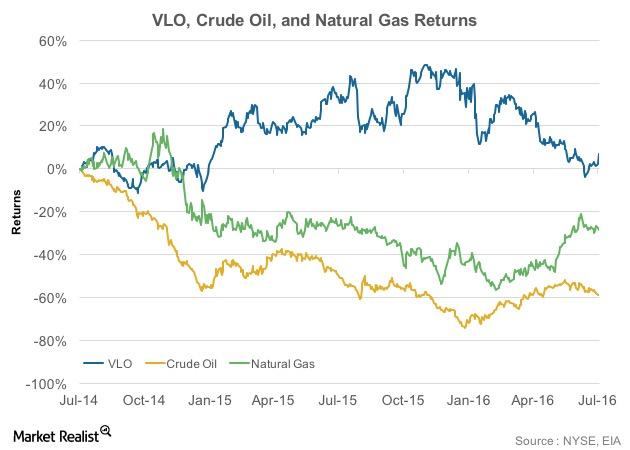

Valero’s Stock Rose 4.7% Following Its Earnings Release

Valero Energy (VLO) announced its results on July 26, 2016, before the market opened.

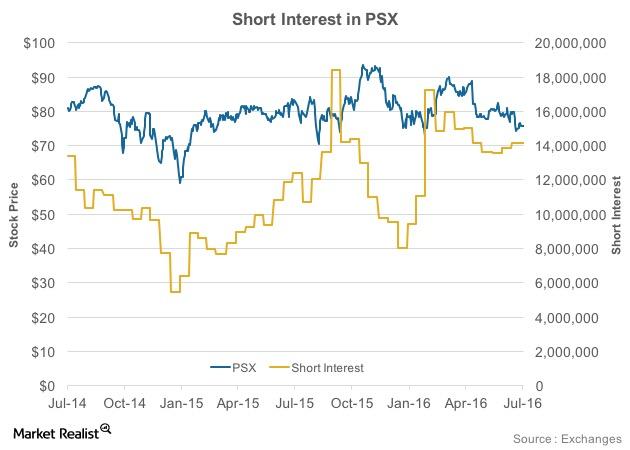

What Does an Analysis of PSX’s Short Interest Reveal?

Since mid-February 2016, Phillips 66 (PSX) has witnessed an 18% fall in its short interest.

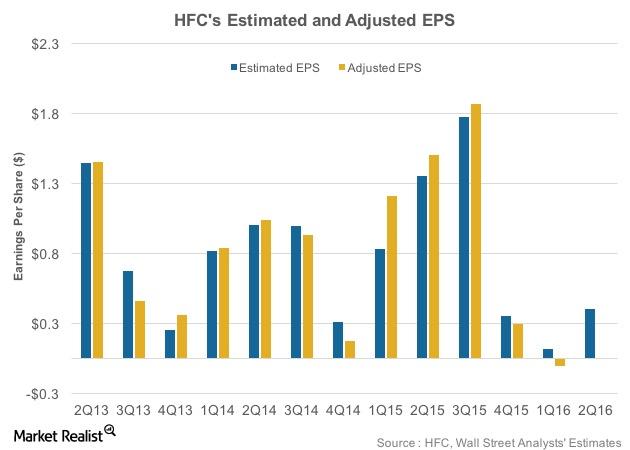

HollyFrontier’s 2Q16 Earnings Expected to Outshine Those of 1Q16

Wall Street analysts expect HollyFrontier to post EPS of $0.35, which is 76% lower than its 2Q15 adjusted EPS.

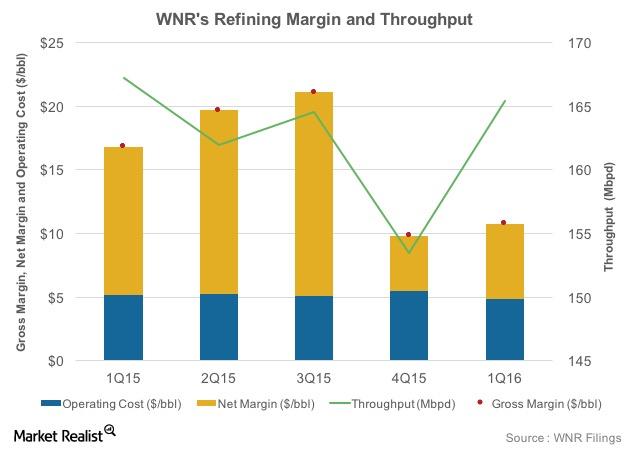

Will WNR’s Refining Margin Trend Higher This Quarter?

Western Refining (WNR) recorded a fall in gross refining margins, from $16.80 per barrel in 1Q15 to $10.80 per barrel in 1Q16.

What Does Suncor’s Short Interest Analysis Reveal?

Suncor Energy (SU) has witnessed a 34% rise in its short interest since April 2016.

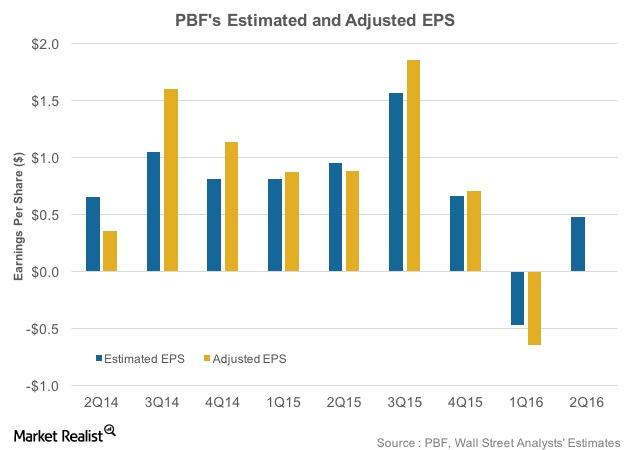

What Do Analysts Expect from PBF Energy’s 2Q16 Earnings?

In 1Q16, PBF Energy’s revenues surpassed Wall Street analyst estimates by 12%. PBF’s 1Q16 adjusted EPS was -$0.65, as compared to the estimated -$0.47.

How Has Marathon Petroleum Stock Performed Pre-Earnings?

Between July 2014 and November 2015, Marathon Petroleum (MPC) stock rose 51%. But after that, the stock fell until early 2016.

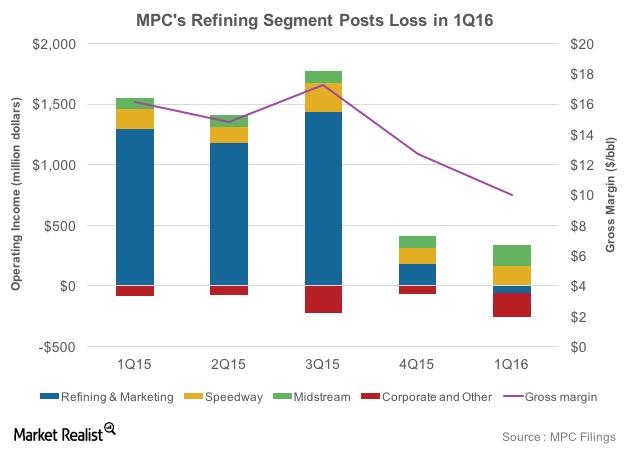

How Will Marathon Petroleum’s Refining Earnings Shape Up in 2Q16?

Marathon Petroleum’s (MPC) refining segment’s operating income plunged to -$62 million in 1Q16 due to a fall in its gross refining and marketing margin.

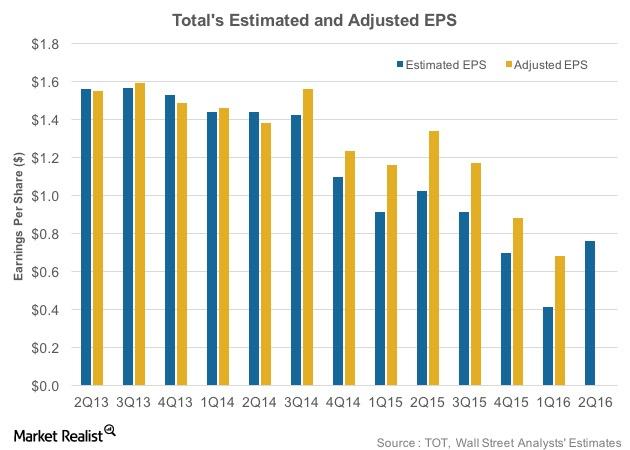

Total’s 2Q16 Earnings Outlook: Will It Beat Estimates?

Total SA (TOT) is expected to post its 2Q16 results on July 28, 2016. In 1Q16, TOT’s revenues of $27.5 billion surpassed Wall Street estimates.

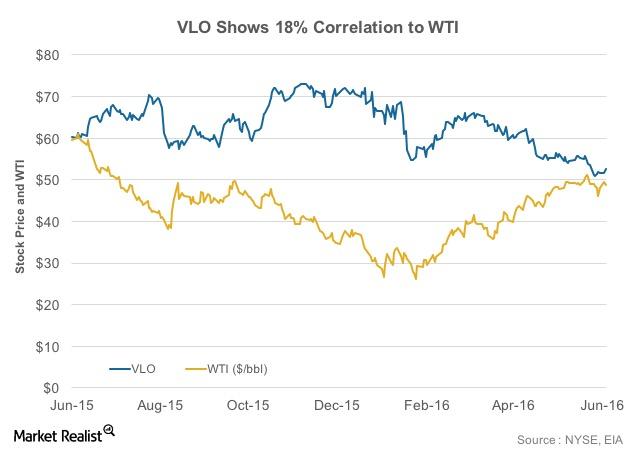

What’s the Correlation between Valero Stock and Oil Prices?

The correlation value for Valero stock and the price of oil shows they have a positive but feeble correlation. Valero stock moves in line with WTI prices only to a certain extent.

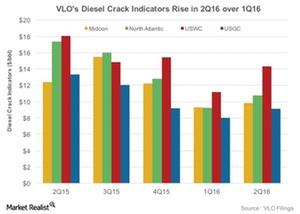

What Can We Expect from Valero’s Diesel Crack Indicators in 2Q16?

Valero’s diesel crack indicators have been rising in 2Q16 compared to 1Q16. The US West Coast, where VLO has 0.3 MMbpd refining capacity, saw the largest rise of $3.20 per barrel.

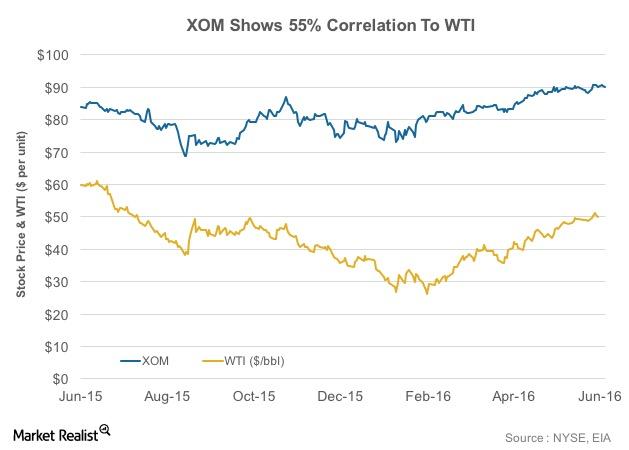

What’s the Correlation between XOM’s Stock and Crude Oil?

Integrated energy companies such as ExxonMobil (XOM) are affected by volatility in crude oil prices. To what degree? This varies from company to company.

What Does a Fall in Shell’s Short Interest Mean?

Shell has witnessed a 49% fall in its short interest volumes since February 10, 2016. This indicates that the bearish sentiment for the stock is weakening.

Why ExxonMobil’s Valuations Are Higher Than Historical Averages

ExxonMobil’s price-to-earnings (or PE) ratio has generally shown an uptrend in the past two years. In 1Q16, the stock traded at a PE of 26.4x.

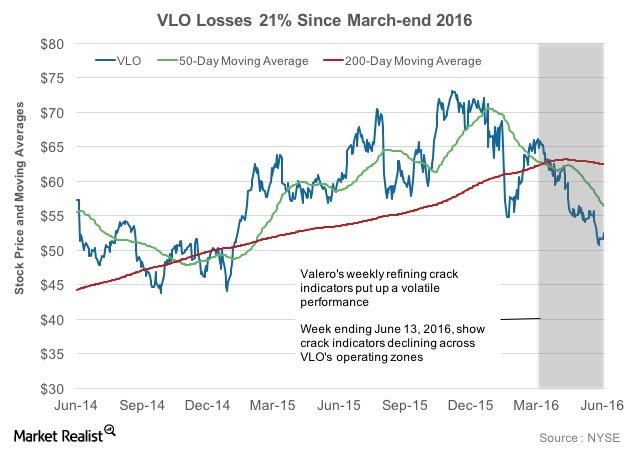

Why Has Valero Stock Fallen 21% since the End of March?

Amid stock price volatility, Valero rose 20% from February 8–March 28, 2016, and crossed over its 50-day and 200-day moving averages.

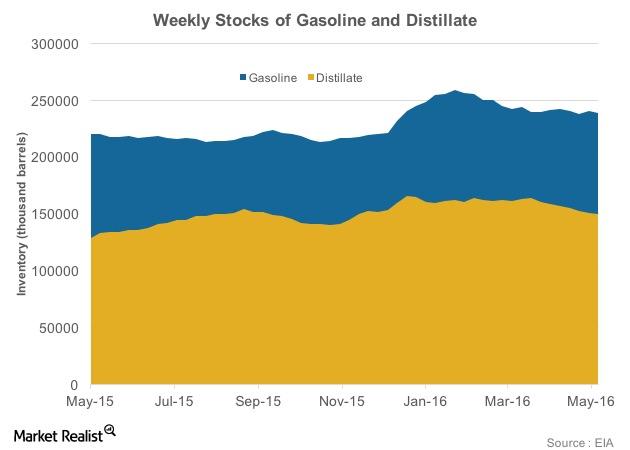

Factors Affecting Refining Margin: Trend in 2Q16

According to the EIA, gasoline and distillate stocks fell by a massive 15.4 million barrels and 12.2 million barrels, respectively, on June 3, 2016 from their highs of February 26, 2016.

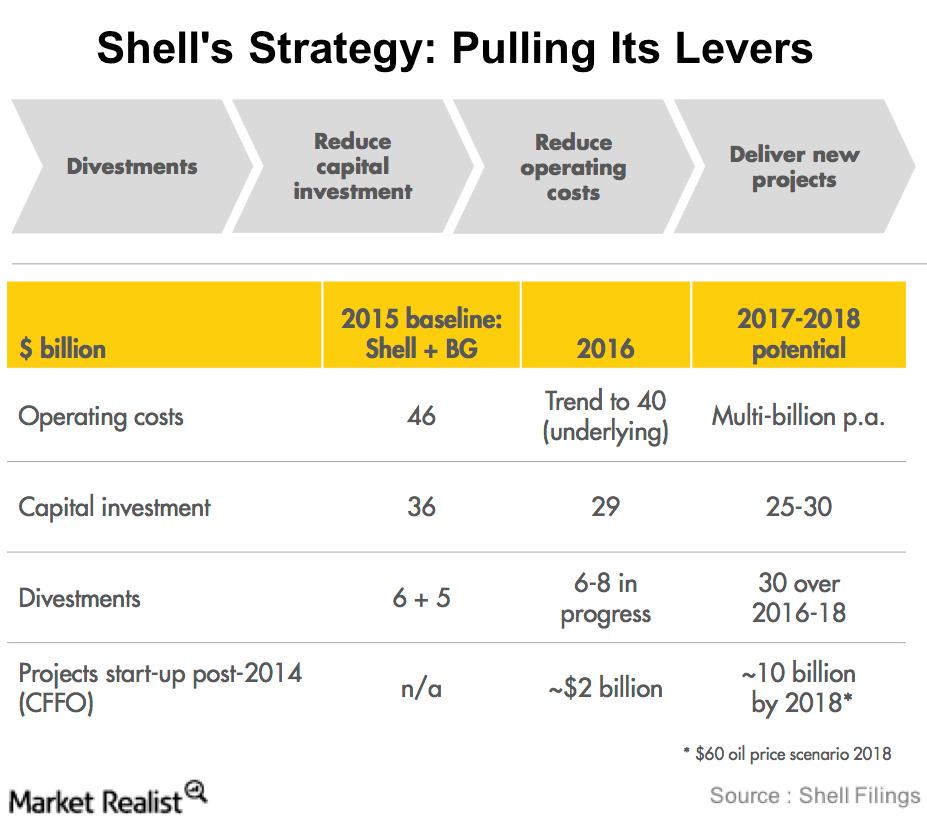

Shell’s Strategy: Pulling Its Levers

Shell plans to restructure itself to become more resilient to lower oil prices and more focused in terms of assets. To do this, it plans to use four levers.

A Forward Valuation Comparison of BP’s Competitors

BP’s market cap stands at ~$100 billion. Among the company’s peers, ExxonMobil (XOM) has the highest market cap of ~$371 billion.

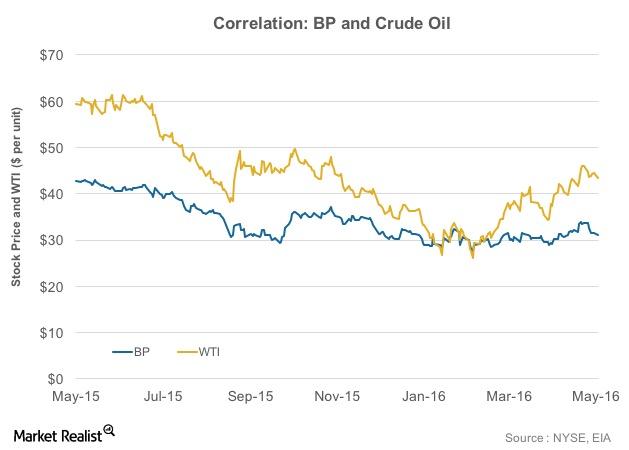

How Do BP’s Stock and Crude Oil Prices Correlate?

To what degree are integrated energy companies such as BP affected by volatility in crude oil prices? This varies from company to company.

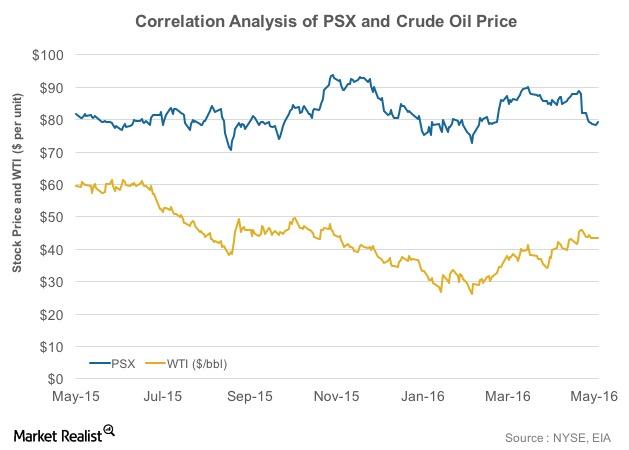

Phillips 66 and the Price of Crude Oil: A Correlation Analysis

The correlation value of Phillips 66 (PSX) and crude oil prices shows that the price of PSX stock moves in line with WTI prices to a certain extent.

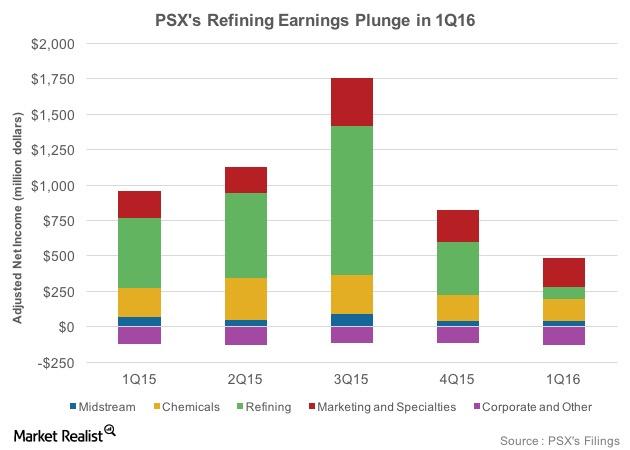

Phillips 66 Segments: A Fully Integrated Downstream Model

Phillips 66 (PSX) has segments in refining, midstream, chemicals, and marketing. In 1Q16, the refining segment contributed $86 million, or 24%, to its adjusted net income.

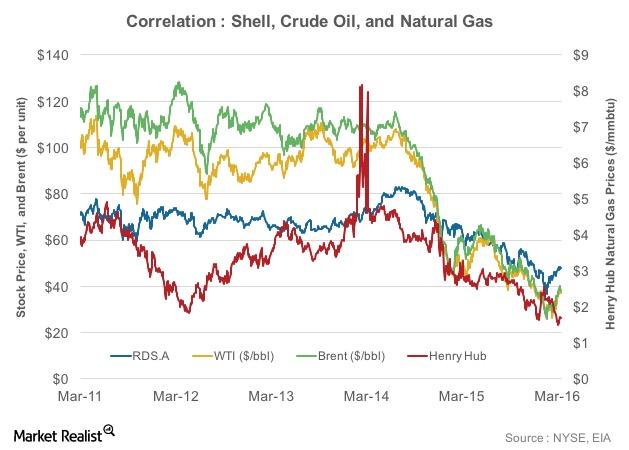

Correlation Analysis: Shell and Oil Price

Shell’s stock price has largely moved in-line with crude oil prices. This is reflected in the results of a correlation test.

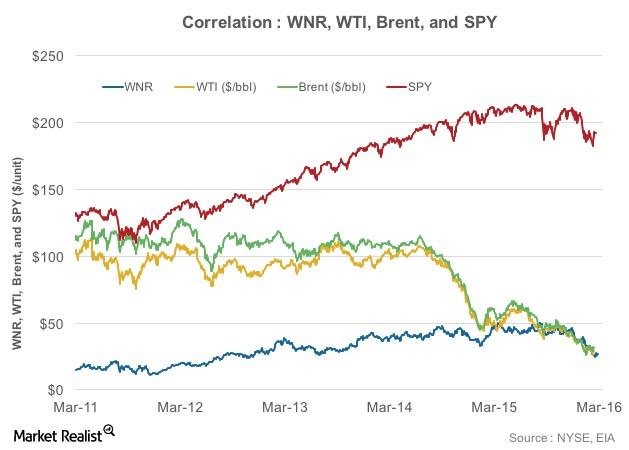

What’s the Relationship between WNR, Crude Oil Prices, and SPY?

The correlation coefficient of Western Refining versus WTI and Brent stands at -0.53 and -0.64, respectively.

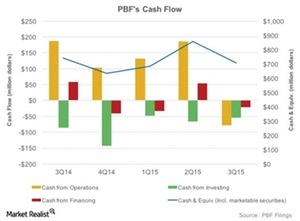

PBF’s Cash Flow Is Volatile amid Changes in Working Capital

PBF Energy has seen a fall in cash balances from 3Q14 to 3Q15. PBF’s cash balance in 3Q15 stood at $707 million, showing a 5% fall over 3Q14.

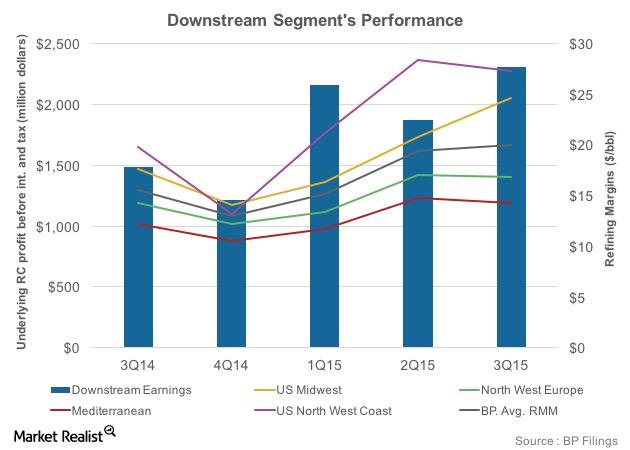

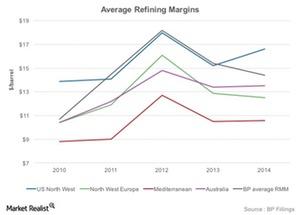

Overview of BP’s Refining Segment and Margins

BP’s refining segment has 2.0 million barrels per day of refining capacity worldwide. In the United States, it has around 0.74 MMbpd of refining capacity.

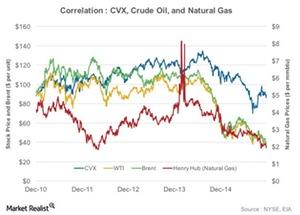

The Correlation of Chevron’s Stock to Oil and Natural Gas Prices

The integrated energy model provides Chevron’s insulation from oil and natural gas price volatility. This is reflected in the results of the correlation test.

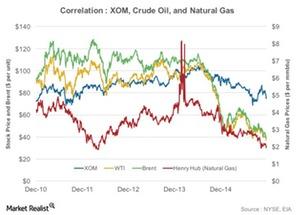

Correlation Analysis: ExxonMobil’s Crude Oil, Natural Gas prices

The correlation coefficients of ExxonMobil to Brent, West Texas Intermediate, and Henry Hub natural gas prices stand at 0.22, 0.35, and 0.36, respectively.

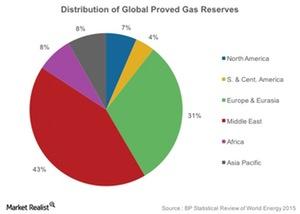

A Vital Resource: Which Region Has the Most Natural Gas Reserves?

Total global natural gas reserves stand at 6,606 trillion cubic feet, of which 43% are in the Middle East.

What Are the Key Indicators of Refining Profits?

Investors should track the GRM and crack spread of a region where a company’s refinery is located.

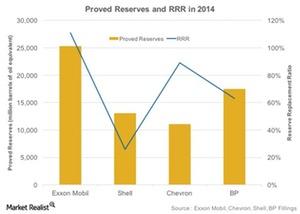

Why Is Reserve Replacement Ratio Important to the Upstream Sector?

RRR reflects how many barrels of oil equivalent the company adds to its reserves in replacement of ones that are produced.