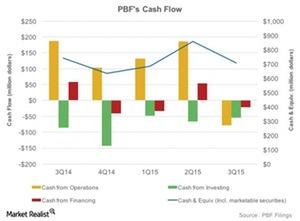

PBF’s Cash Flow Is Volatile amid Changes in Working Capital

PBF Energy has seen a fall in cash balances from 3Q14 to 3Q15. PBF’s cash balance in 3Q15 stood at $707 million, showing a 5% fall over 3Q14.

Feb. 16 2016, Updated 1:06 p.m. ET

PBF’s cash flow analysis

Earlier, we examined PBF Energy’s (PBF) leverage position. In this part, we’ll analyze PBF’s cash flow.

PBF Energy has seen a fall in cash balances, including marketable securities, from 3Q14 to 3Q15. PBF’s cash balance in 3Q15 stood at $707 million, showing a 5% fall over 3Q14. In the third quarter, PBF’s peers Western Refining (WNR), HollyFrontier (HFC), and CVR Refining (CVRR) had their cash balances standing at $709 million, $627 million, and $501 million, respectively.

PBF’s cash flow from operations and investing

PBF’s cash flow from operations has been volatile in the past few quarters on the back of changes in working capital. In 9M15, PBF’s cash from operations stood at $240 million compared to $352.9 million in 9M14.

In 3Q15, PBF’s cash outflow on account of investing activities stood at $53 million. The company has continued its focus on growth. In 9M15, PBF committed $336 million toward capital expenditure, compared to $331 million in 9M14.

PBF’s cash flow from financing

PBF Energy’s cash flow from financing activities mainly consisted of changing debt levels and dividend payments. The company raised funds and repaid debt from 3Q14 to 3Q15, adapting to the changing cash flow environment.

PBF has also consistently paid dividends. In 9M15, PBF’s cash outflow on account of dividends and distributions stood at $109.6 million compared to $146.6 million in 9M14.

For global exposure to energy sector stocks, you can consider the iShares Global Energy ETF (IXC). The ETF also has ~6% exposure to oil refining sector stocks.