CVR Refining LP

Latest CVR Refining LP News and Updates

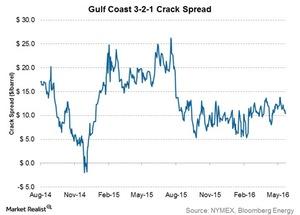

How a Fall in Crack Spreads Is Hurting Refining MLPs

The Gulf Coast 3-2-1 crack spread was $10.4 per barrel on June 16, 2016.

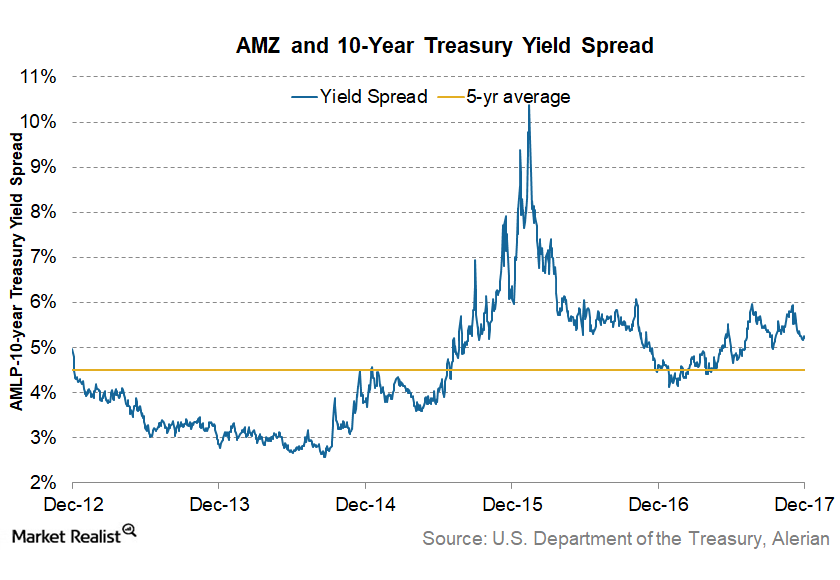

How Do These MLPs Look in 2018?

MLPs had a strong start to the new year. The Alerian MLP Index rose 5% in the first week of 2018.

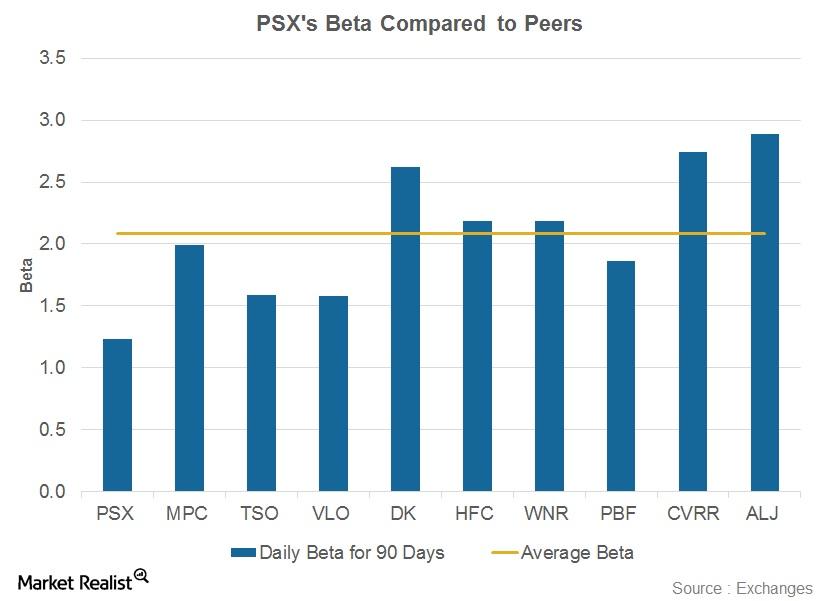

Phillips 66’s Beta: Does It Imply That PSX Is Less Volatile?

Phillips 66’s (PSX) 90-day beta stood at 1.2 on March 16, 2017, below its peer average of 2.1.

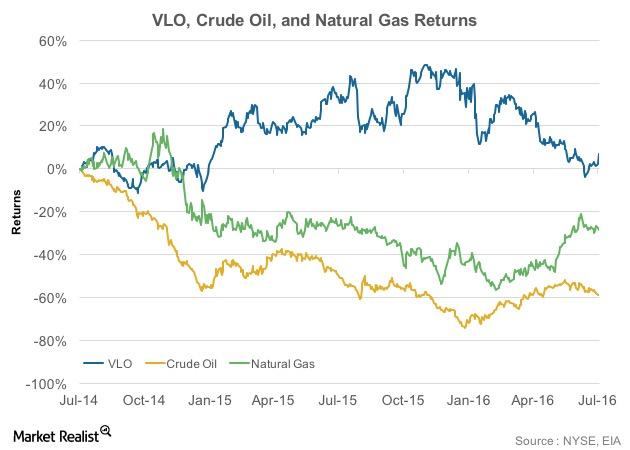

Valero’s Stock Rose 4.7% Following Its Earnings Release

Valero Energy (VLO) announced its results on July 26, 2016, before the market opened.

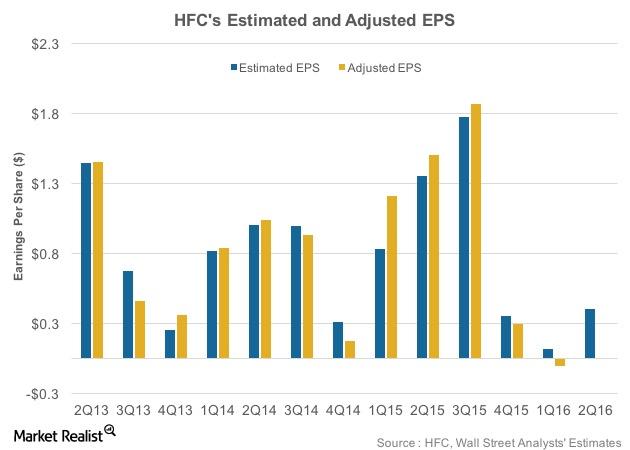

HollyFrontier’s 2Q16 Earnings Expected to Outshine Those of 1Q16

Wall Street analysts expect HollyFrontier to post EPS of $0.35, which is 76% lower than its 2Q15 adjusted EPS.

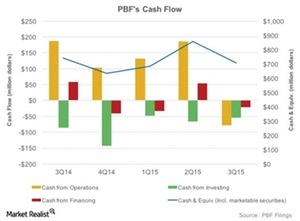

PBF’s Cash Flow Is Volatile amid Changes in Working Capital

PBF Energy has seen a fall in cash balances from 3Q14 to 3Q15. PBF’s cash balance in 3Q15 stood at $707 million, showing a 5% fall over 3Q14.