Maitali Ramkumar

Maitali, an equity research analyst, has been contributing to Market Realist since 2015. She began analyzing and writing about integrated energy and refining stocks. But later, she also ventured in the technology and auto sectors. She has more than 14 years of rich experience as a financial analyst and sell-side institutional equity research analyst.

In her stint as a sell-side institutional equity research analyst, she published research reports on numerous companies with “buy” and “sell” recommendations. She was ranked as one of the best analysts for one of her reports on an energy company. As a financial expert, she has deep experience in financial modeling, forecasting, and valuations

Maitali—with her excellent interpersonal, communication, and analytical skills—was instrumental in establishing and maintaining relationships with mutual fund managers and foreign institutional investors across the industry. She not only strengthened ties with fund managers but also conducted several conferences involving fund managers and company management.

Her strong base in equity research was developed at IDBI Capital, where she began as a junior analyst and moved up her career path. She joined the organization after topping in most of her years of undergraduate and postgraduate studies. Her love for understanding businesses led her to pursue a BMS (bachelor of management studies) and later an MBA (master in business administration) in finance.

Plus, Maitali enjoys traveling to new places and relishes natural landscapes. She also likes listening to music.

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Maitali Ramkumar

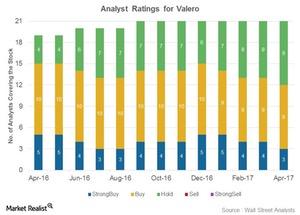

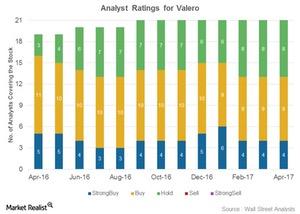

Are Valero’s Analyst Ratings Weaker or Stronger before the 1Q Results?

Of the 21 analysts covering Valero Energy (VLO), 12 (57%) analysts have assigned “buy” or “strong buy” ratings, while nine (43%) have assigned “hold” ratings.

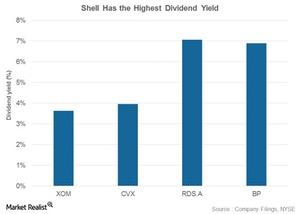

Inside Integrated Energy’s Dividend Yields: Comparing XOM, CVX, RDS.A, and BP

ExxonMobil (XOM), Chevron (CVX), Royal Dutch Shell (RDS.A), and BP (BP) have consistently given returns to shareholders in the form of dividends.

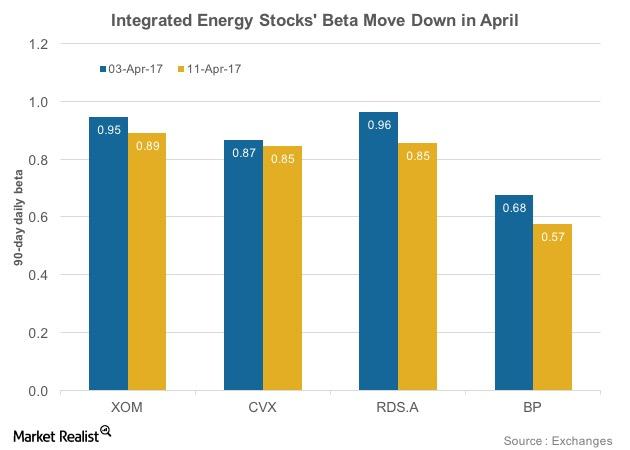

Understanding Integrated Energy Stocks’ Betas in April 2017

Royal Dutch Shell’s (RDS.A) 90-day daily beta fell from 0.96 on April 3, 2017, to 0.85 on April 11, 2017.

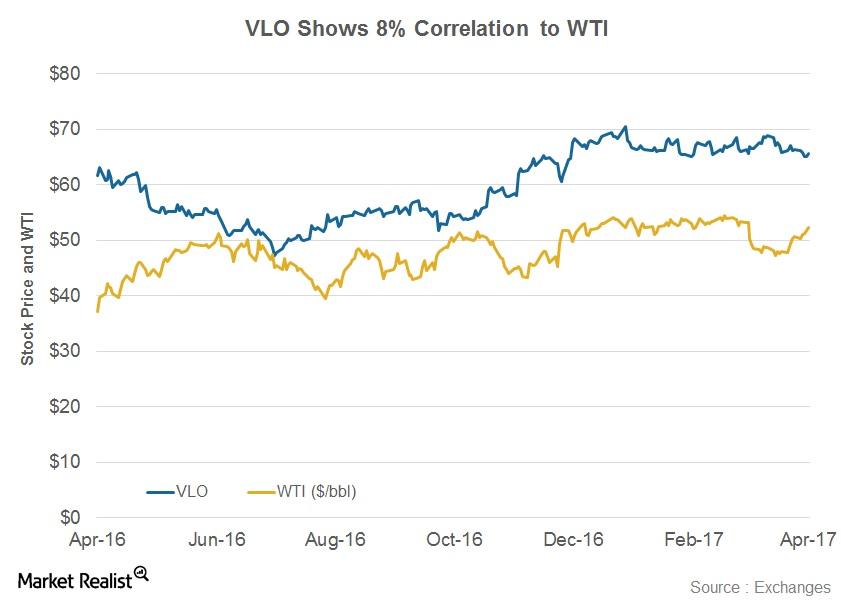

What Is the Relationship between VLO and WTI?

The correlation coefficient between VLO and WTI stands at 0.08.

Why Short Interest in Valero Soared in 2017

Valero Energy (VLO) has witnessed a rise in its short interest since mid-February 2017.

Analyst Ratings for Valero: Why the ‘Hold’ Ratings?

VLO’s mean price target of $72 per share implies around a 10% gain from its current level.

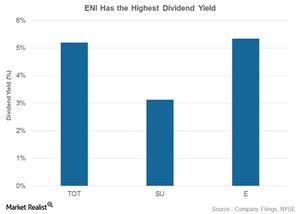

TOT, SU, E, PBR: Who Has Highest Dividend Yield?

Total (TOT), Suncor Energy (SU), ENI (E), and Petrobras (PBR) have consistently given returns to shareholders in the form of dividends.

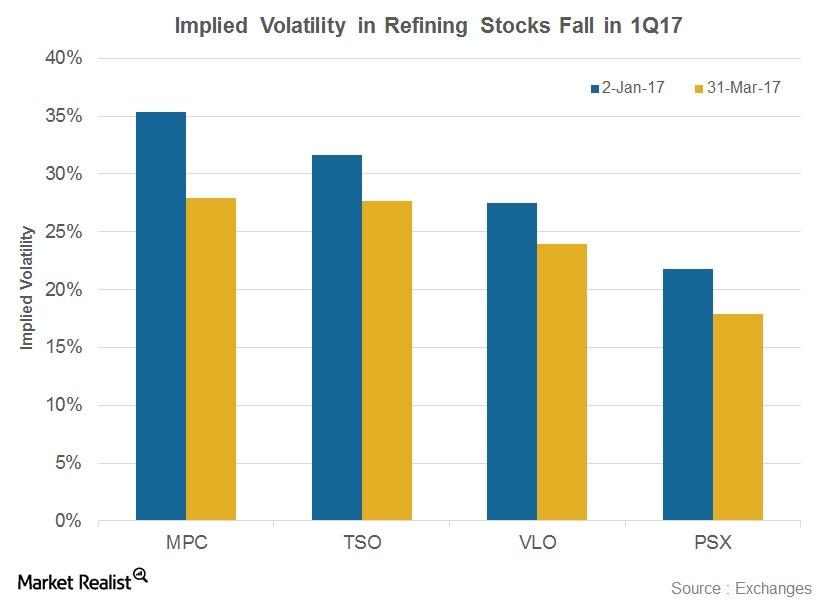

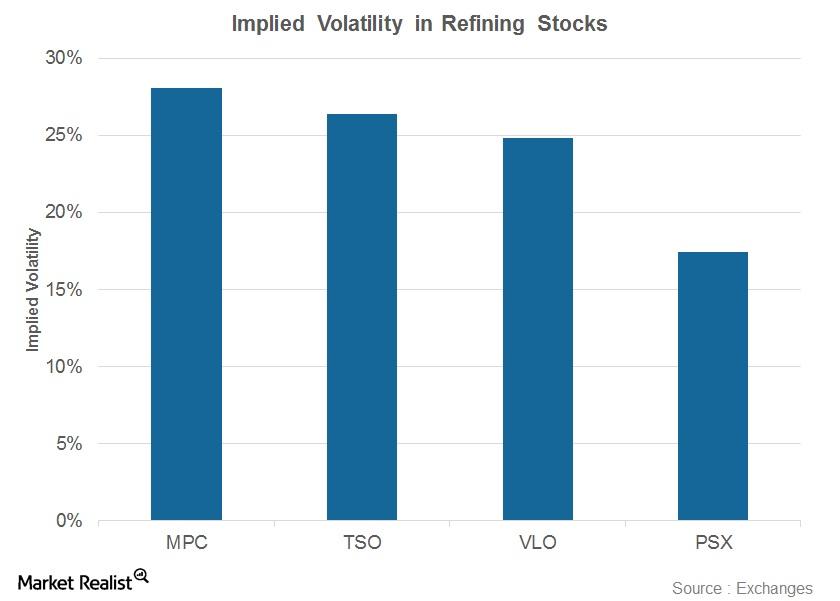

Refining Stocks’ Implied Volatilities Tumbled in 1Q17

Refining stocks’ implied volatilities have witnessed falls in 1Q17. Marathon Petroleum’s (MPC) implied volatility fell 7% to 27.9% from January 2 to March 31, 2017.

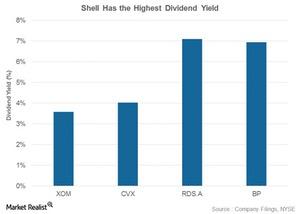

Integrated Energy Stocks: Who Stands Tall in Dividend Yield?

Shell’s dividend yield is 7.1%, the highest among the integrated energy stocks in this series.

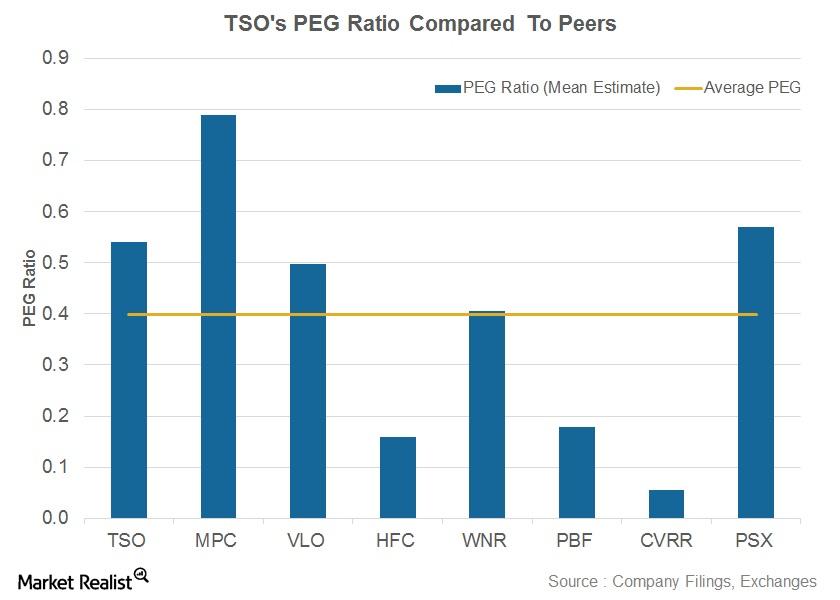

How Does Tesoro’s PEG Compare to Its Peers’?

In this article, we’ll compare Tesoro’s (TSO) PEG ratio (price-to-earnings to blended growth rate) to those of its peers. We’ve considered the mean estimate of PEG.

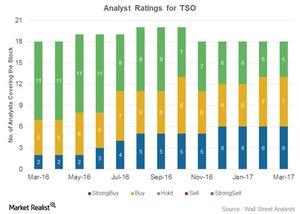

Why Most Analysts’ Ratings for Tesoro Are ‘Buys’

Thirteen out of the 18 analysts covering Tesoro (TSO) have rated it as a “buy” so far in March 2017. Another five analysts have rated TSO as a “hold.”

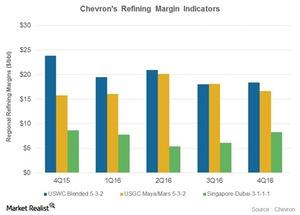

A Look at Chevron’s Refining Margin Trends

Chevron’s refining capacity Before we analyze Chevron’s (CVX) refining margin trends, le’s quickly look at its refining capacity. Chevron’s total refining capacity stands at 1.8 MMbpd (million barrels per day). Most of Chevron’s capacity, around ~1 MMbpd, is in the United States. In the international arena, Chevron has combined refining capacity of 0.3 MMbpd in South […]

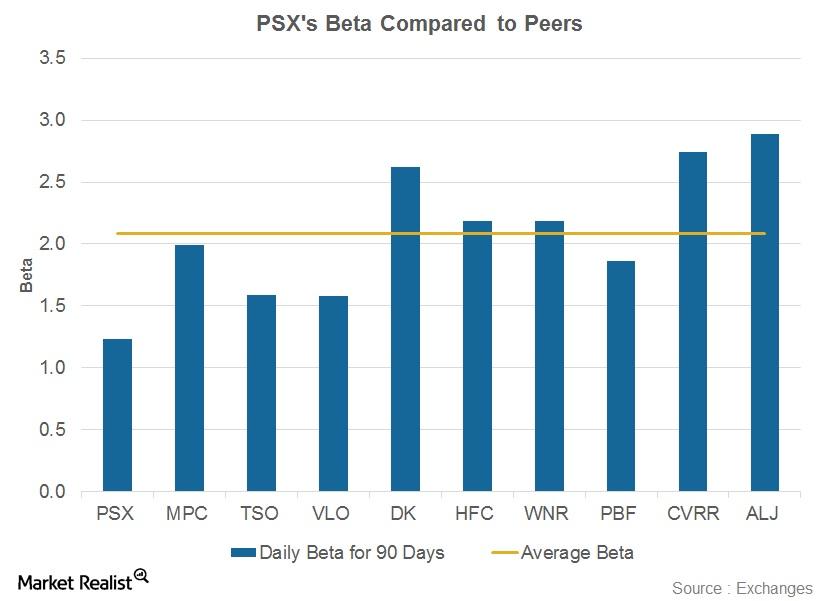

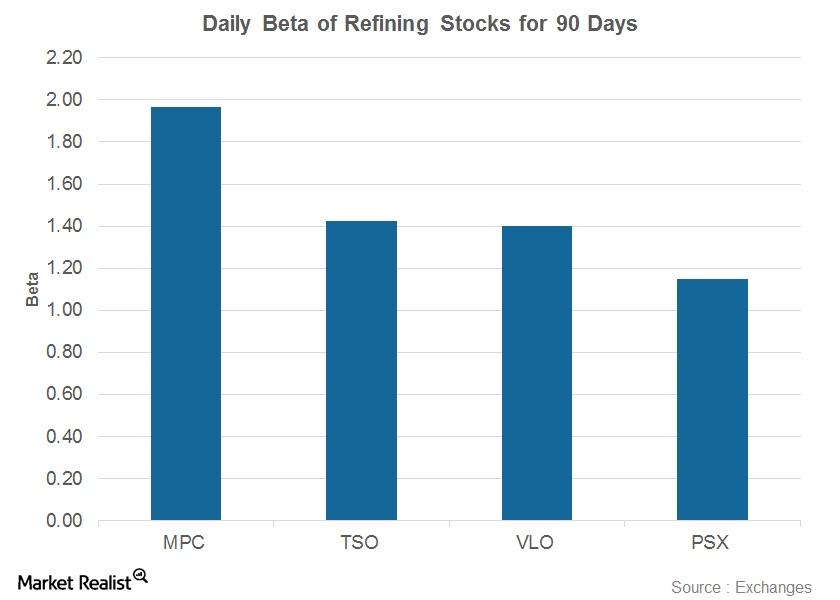

Phillips 66’s Beta: Does It Imply That PSX Is Less Volatile?

Phillips 66’s (PSX) 90-day beta stood at 1.2 on March 16, 2017, below its peer average of 2.1.

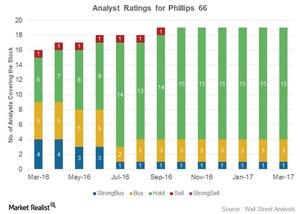

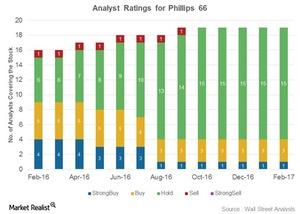

Why the Majority of Analysts Rate Phillips 66 as a ‘Hold’

Fifteen out of the 19 analysts covering Phillips 66 (PSX) rated it as a “hold” in March 2017. Another four analysts rated PSX as a “buy” or a “strong buy.”

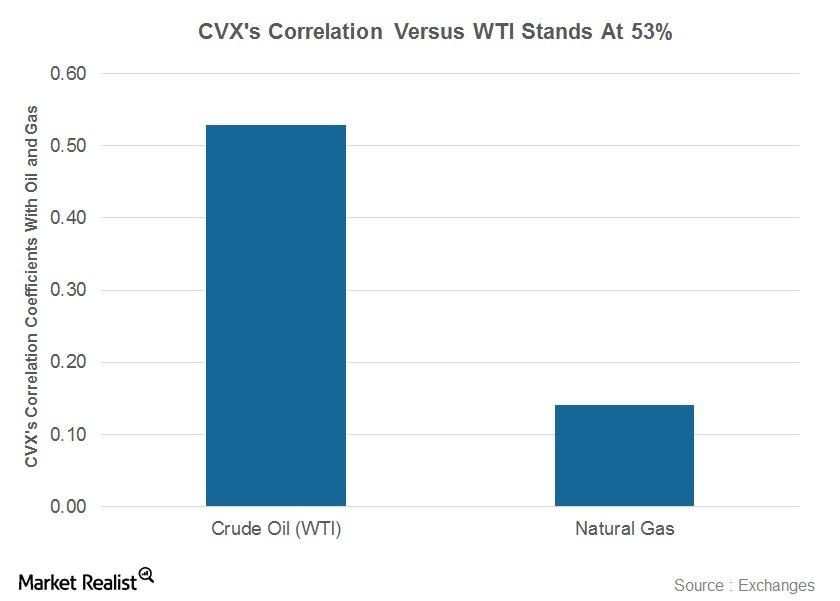

How Does Chevron’s Stock Correlate with Oil Prices?

Correlation coefficient In this series, we’ve analyzed Chevron’s (CVX) Mafumeira Sul project, stock movement, dividend yield, PEG (price-to-earnings-to-growth), ratio, beta, short interest, implied volatility, institutional holdings, and valuation. In this part, we’ll see how Chevron’s stock correlates with oil prices. The correlation coefficient shows the relationship between two variables. A correlation coefficient value of zero […]

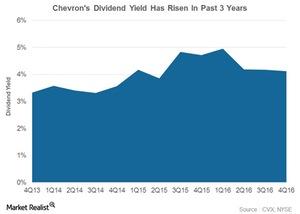

How Chevron’s Dividend Yield Has Trended

Chevron’s dividend yield Chevron (CVX) has consistently given returns to shareholders in the form of dividends. Therefore, we have evaluated its dividend yields. Yield is calculated as a ratio of the annualized dividend to stock price. Chevron’s dividend yield rose from 3.3% in 4Q13 to 4.1% in 4Q16, due to a dividend increase coupled with […]

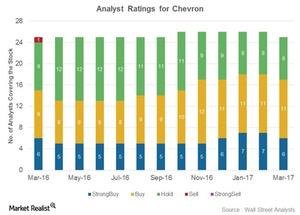

Why Most Analysts Rate Chevron a ‘Buy’

Analyst ratings for Chevron Chevron (CVX) has been rated by 25 analysts. Of the total, 17 analysts have given “buy” or “strong buy” ratings, eight have given “hold” ratings, and none have given “sell” or “strong sell” ratings on the stock. These ratings have improved from March 2016, when Chevron had fewer “buy” ratings, more […]

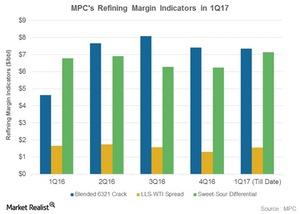

Could Marathon Petroleum’s Refining Earnings Rise in 1Q17?

Marathon Petroleum’s refining earnings are impacted by the blended LLS 6-3-2-1 crack, the sweet-sour differential, and the LLS-WTI spread.

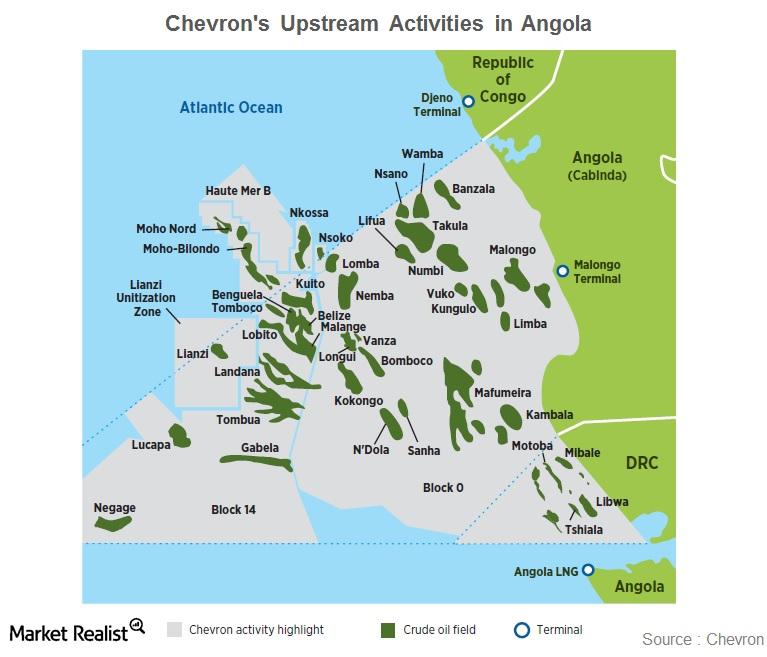

Chevron’s Mafumeira Sul Project Kick-Starts Production

In this series, we’ll provide updates on Chevron’s market performance. We’ll examine CVX’s latest stock performance, analyst ratings, dividend yield, PEG (price-to-earnings-to-growth) ratio, beta, short interest position, institutional ownership status, and implied volatility movement.

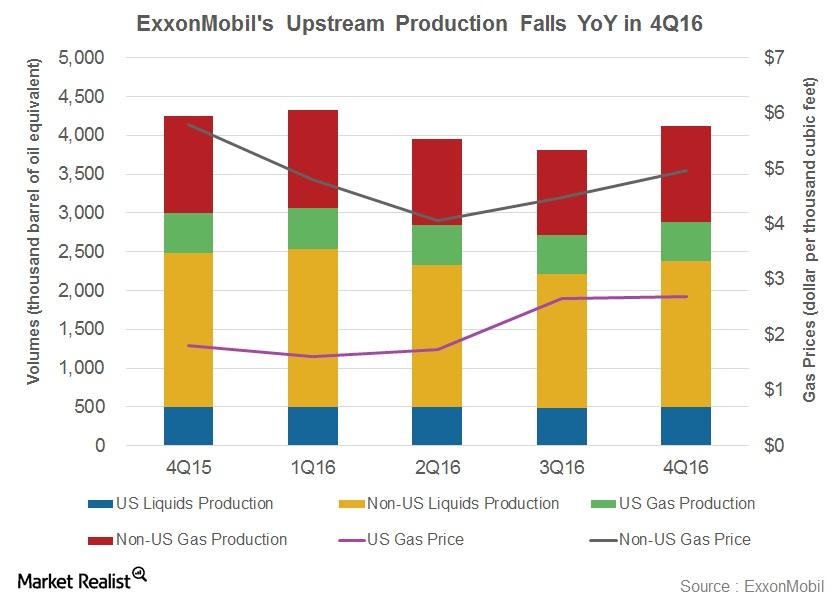

ExxonMobil’s Robust Upstream Portfolio: Poised for Growth

ExxonMobil (XOM) produced 4.1 MMboepd (million barrels of oil equivalent per day) from its worldwide operations in 4Q16.

ExxonMobil Focuses on Integrated Growth, Reveals the Path Forward

In its latest analyst meeting, ExxonMobil (XOM) announced that it had plans to concentrate on an integrated earnings model, capturing value at every stage of the energy chain.

Understanding the Latest Implied Volatility in Refining Stocks

Marathon Petroleum’s implied volatility currently stands at 28%—the highest level among peers Valero, Tesoro, and Phillips 66.

Refining Stock Betas: Who Could Pop?

On March 2, 2017, Marathon Petroleum’s 90-day beta stood at 2.0—the highest among peers Valero, Tesoro, and Phillips 66.

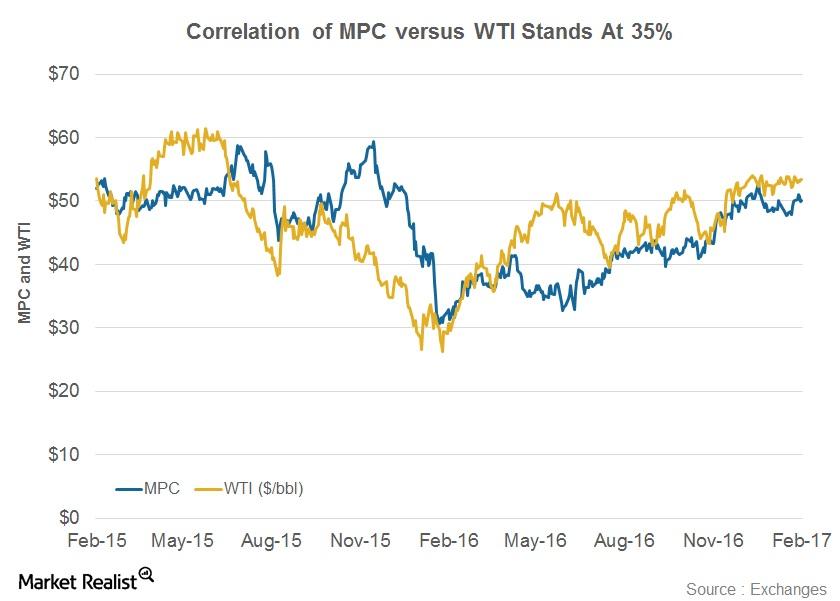

Understanding the Correlation between MPC’s Stock and Oil Prices

The correlation coefficient of Marathon Petroleum and WTI stands at 0.35—a positive but feeble correlation.

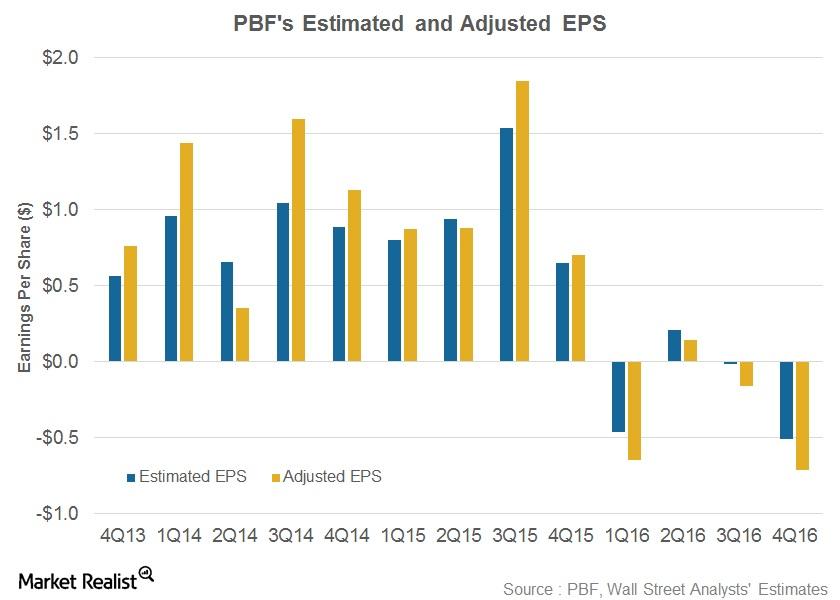

PBF Energy’s 4Q16 Results: Earnings Take a Nosedive

PBF Energy (PBF) released its 4Q16 results on February 16, 2017. The earnings results weren’t very encouraging for this petroleum refiner.

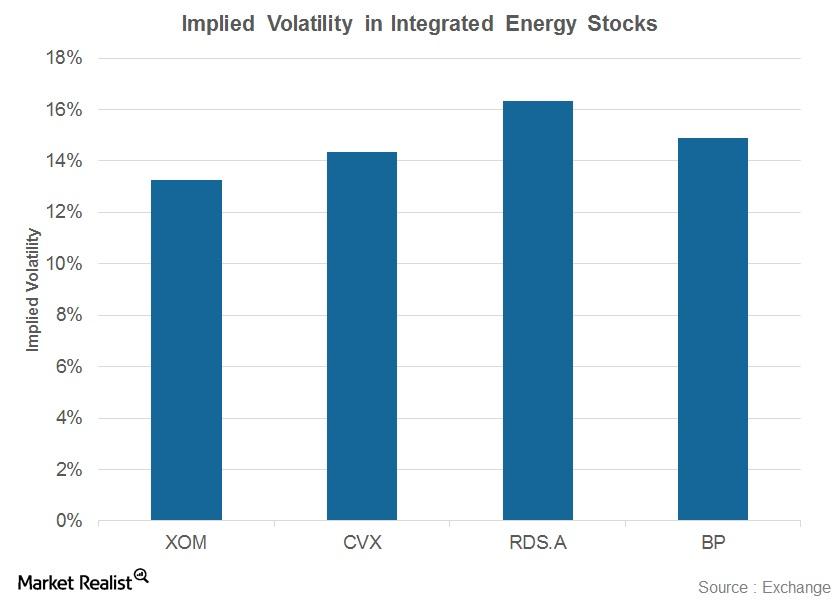

Where Do Implied Volatilities in Integrated Energy Stocks Stand?

Implied volatility in Royal Dutch Shell (RDS.A) currently stands at 16%, which is the highest compared to peers ExxonMobil (XOM), Chevron (CVX), and BP (BP).

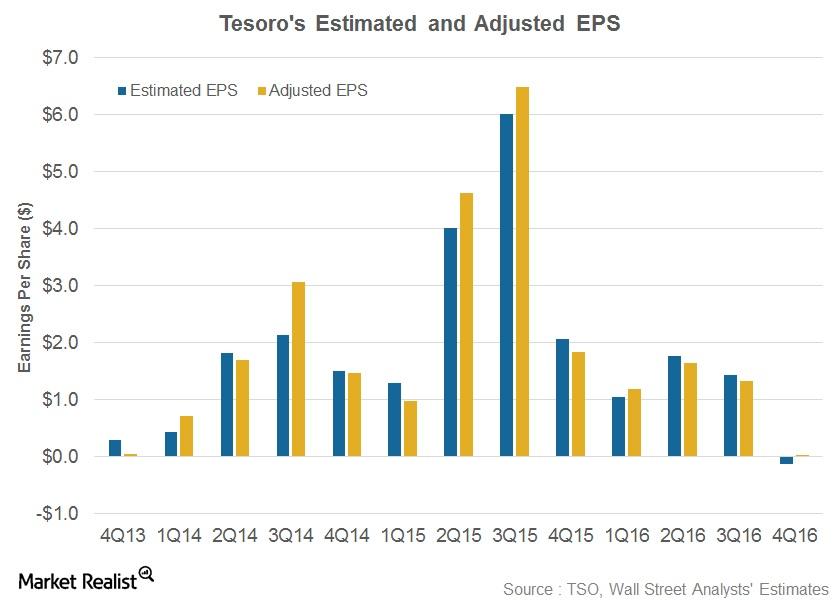

Tesoro Stayed Positive despite the Fall in Its 4Q16 Earnings

Tesoro (TSO) posted its 4Q16 results on February 6, 2017. It reported revenues of $6.6 billion, which missed Wall Street analysts’ estimates.

Phillips 66’s Recommendations: What the Analysts Are Saying Now

After its 4Q16 results, four of 19 analysts assigned “buy” or “strong buy” recommendations to Phillip’s 66 stock, while 15 assigned “holds.”

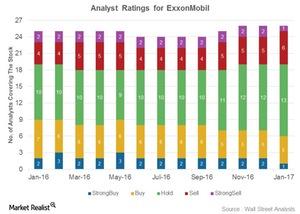

Analysts’ Ratings for ExxonMobil after Its Earnings

Six analysts gave ExxonMobil a “buy” rating, 13 analysts gave it a “hold” rating, and seven analysts gave it a “sell” rating after its 4Q16 earnings.

How Has ExxonMobil’s Upstream Production Trended?

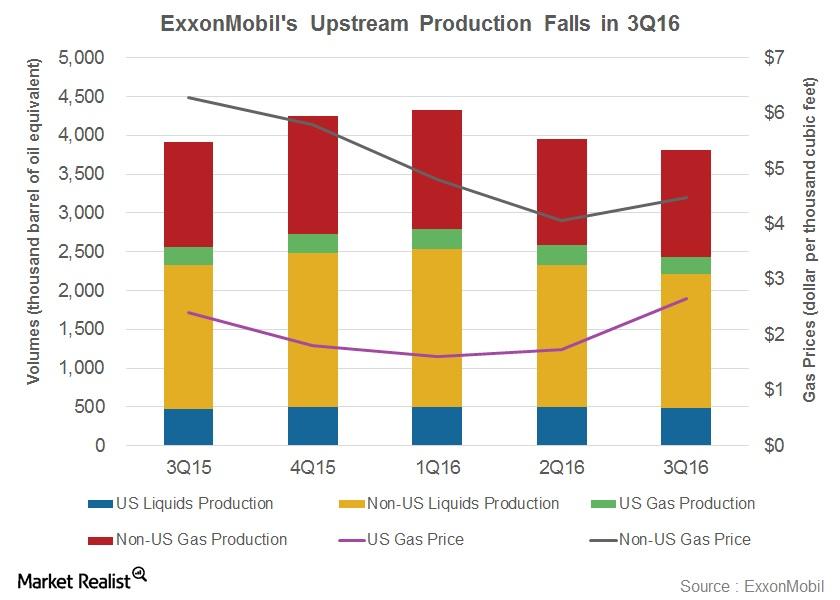

ExxonMobil (XOM) produced 3.8 MMboepd (million barrels of oil equivalent per day) from its worldwide operations in 3Q16.

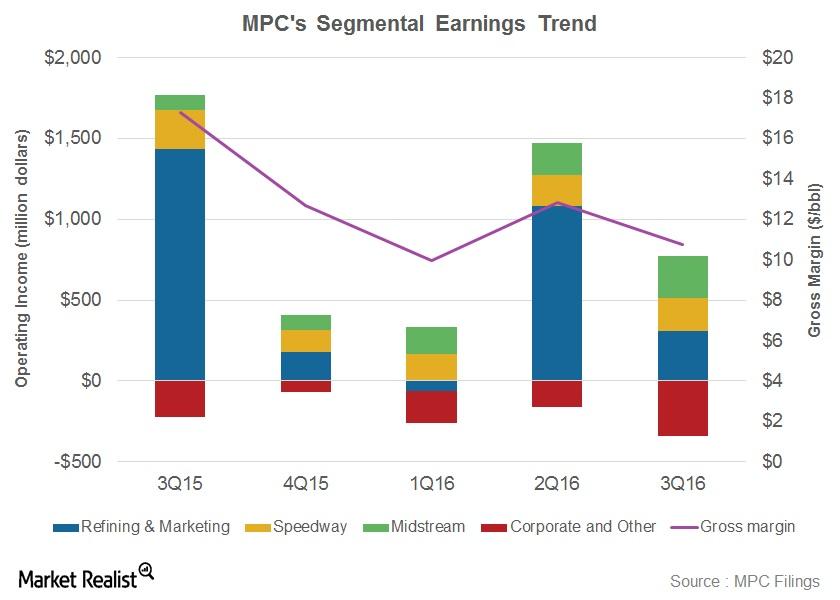

Marathon Petroleum’s Refining Margin Outlook for 4Q16

Marathon Petroleum’s (MPC) operating income fell 72% over 3Q15 to $435 million in 3Q16.

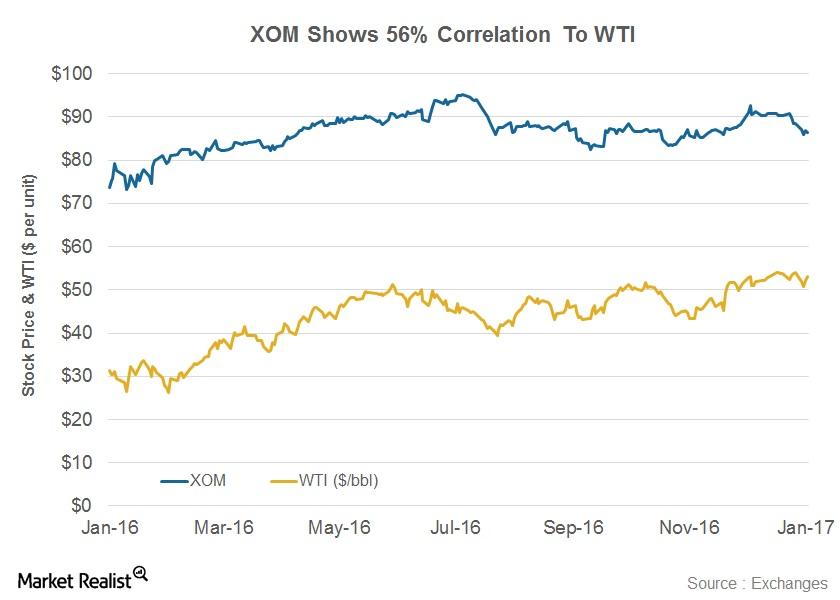

What’s the Correlation Between XOM and WTI?

Integrated energy companies such as ExxonMobil are affected to varying degrees by volatility in crude oil prices. XOM’s correlation coefficient with WTI stands at 0.56.

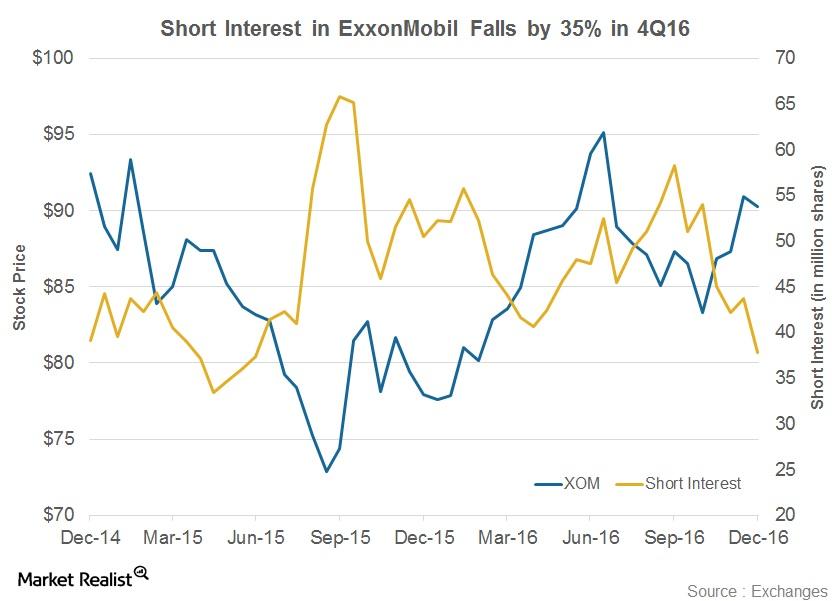

Has Short Interest in ExxonMobil Fallen?

ExxonMobil (XOM) has witnessed a 35% fall in its short interest volumes since September’s end 2016.

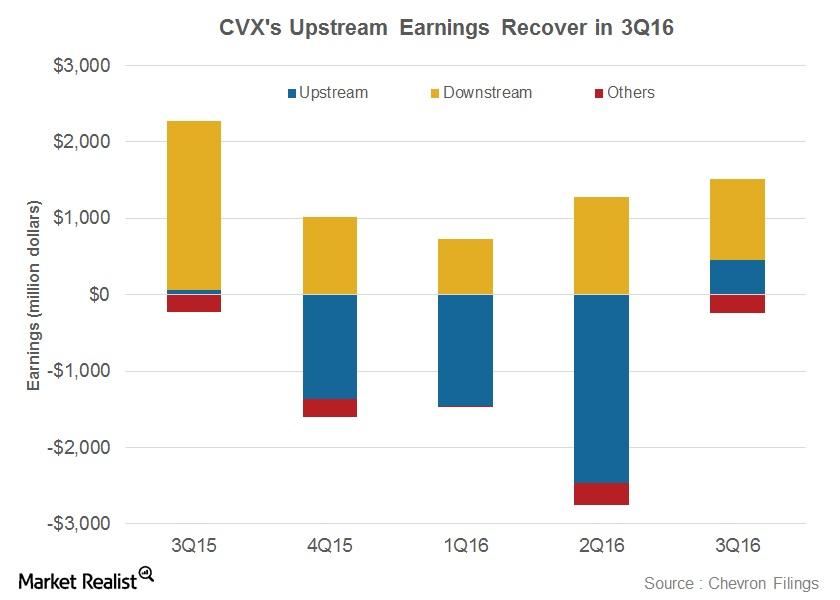

Chevron’s 4Q16 Segmental Outlook: Is It Positive?

Chevron’s (CVX) Downstream segment saw its earnings fall 52% YoY to ~$1.1 billion in 3Q16.

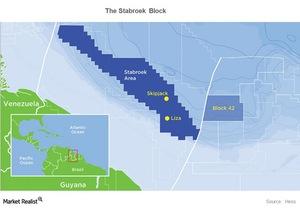

Once Again, ExxonMobil Discovers Oil in Guyana

ExxonMobil (XOM) has found oil in the Payara-1 Well in the Stabroek Block, positioned 120 miles offshore Guyana. This is the company’s second discovery in the block.

What’s the Correlation between Valero Stock and WTI?

The correlation coefficient of Valero (VLO) and WTI stands at 0.15. The correlation value for Valero’s stock and oil price show that they have a positive but feeble correlation.

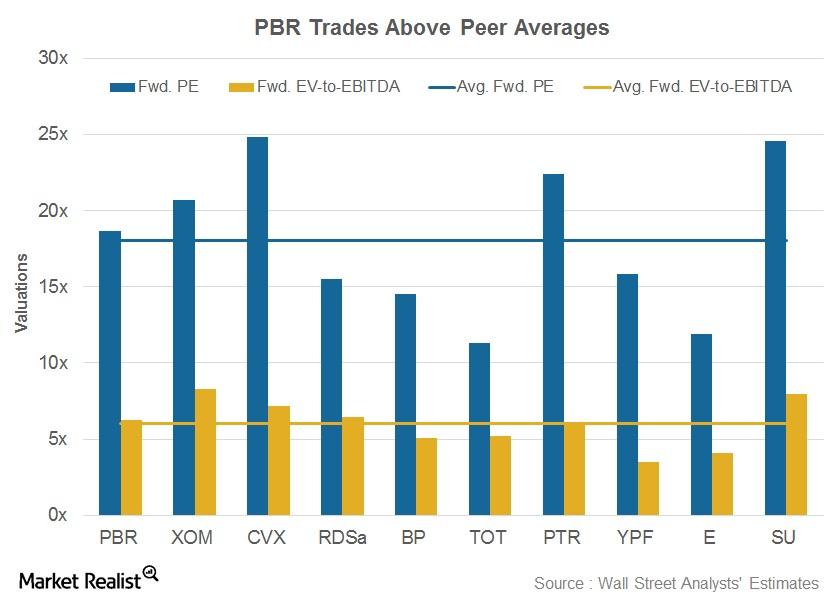

Why Is Petrobras’s Valuation Higher Than Peer Average?

After its production update news, Petrobas’s forward PE and EV-to-EBITDA stood at 18.7x and 6.3x, respectively.

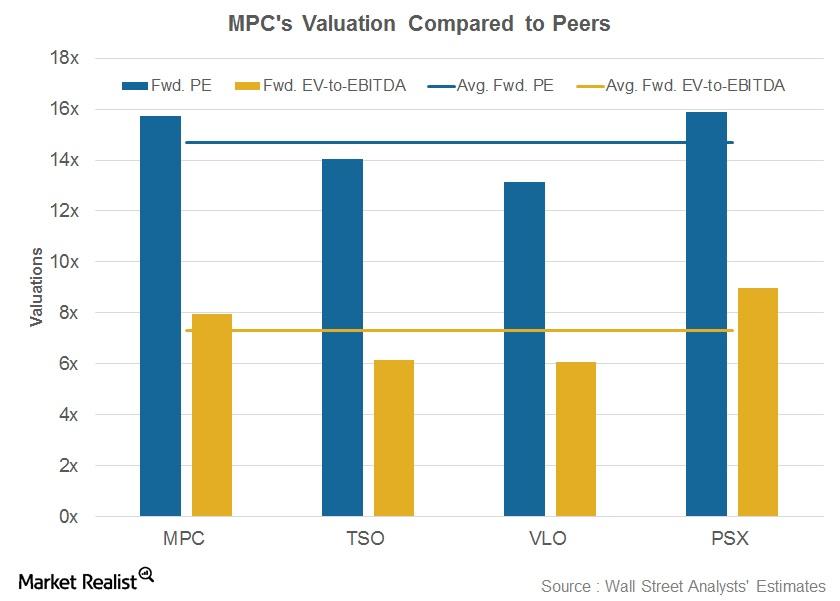

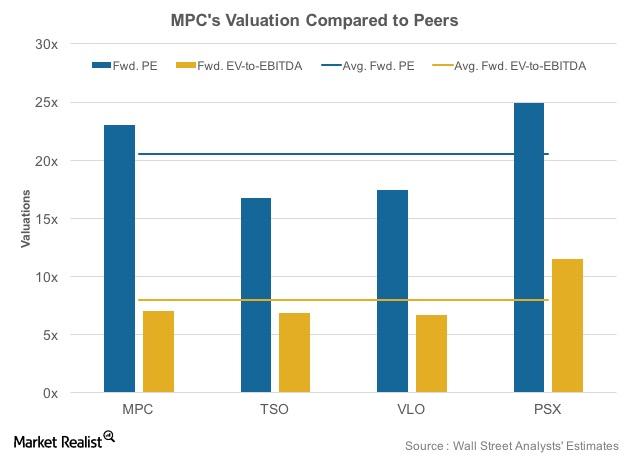

MPC’s Dropdown Plans: Where Do Its Valuations Stand?

After MPC proposed the dropdown plan, MPC’s forward price-to-earnings (or PE) and EV-to-EBITDA stood at 15.7x and 8x, respectively.

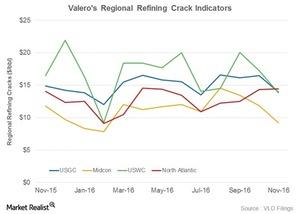

Analyzing Cracks to Predict Valero’s Refining Margin in 4Q16

Now, let’s analyze the refining margin indicators published by Valero Energy (VLO). These indicators point toward VLO’s likely margin trend in 4Q16.

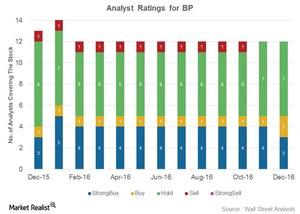

Why Do a Majority of Analysts Rate BP as a ‘Hold’?

BP (BP) plans to rebalance its sources and uses of cash by 2017 at an oil price level of $50–$55 per barrel.

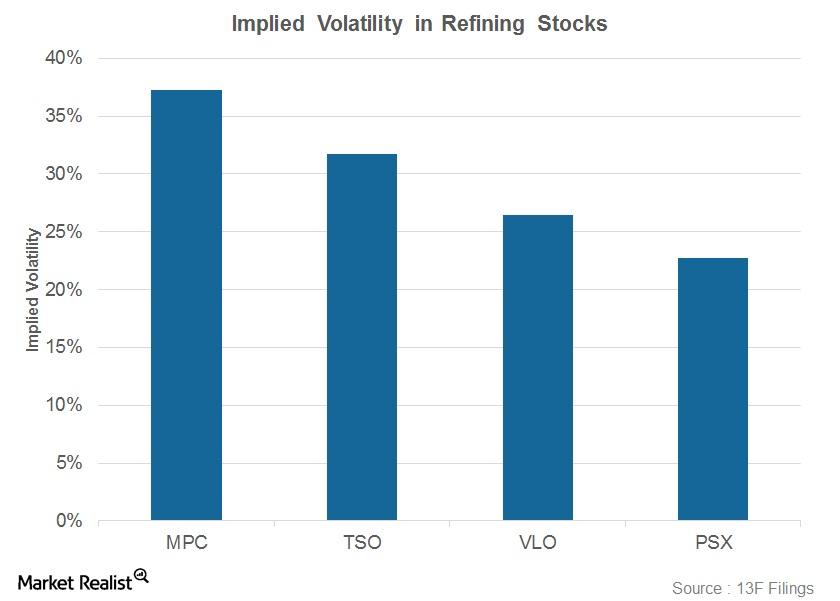

Where Are Refining Stocks’ Implied Volatilities Positioned?

Marathon Petroleum’s (MPC) implied volatility currently stands at 37%, the highest among its peers.

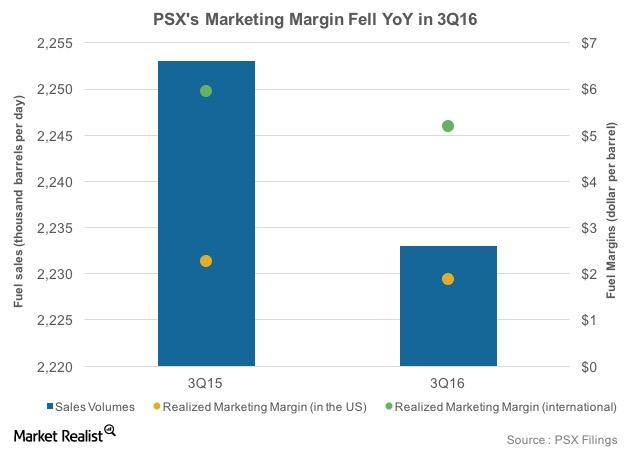

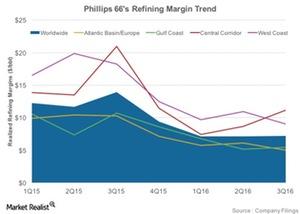

How Did Phillips 66’s Marketing Segment Perform in 3Q16?

Phillips 66’s adjusted EBITDA from its Marketing segment fell 22% from 3Q15 to $429 million in 3Q16 due to weaker marketing margins and lower volumes.

Elliott’s Recommendation: Where Does Marathon’s Valuation Stand?

After Elliott Management’s recommendations, Marathon Petroleum’s forward EV-to-EBITDA multiple stood at 23.1x.

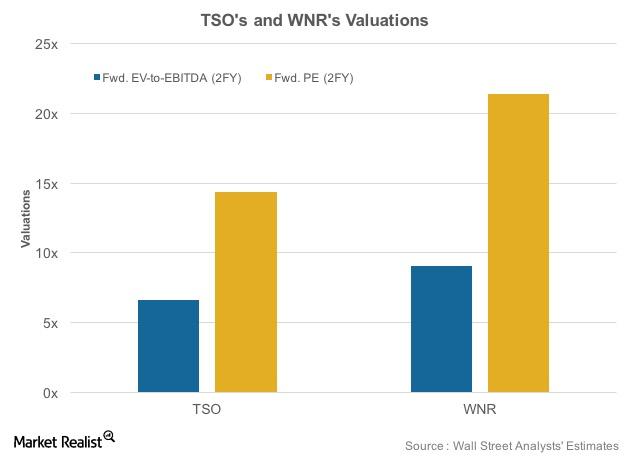

TSO to Acquire WNR: Where Do Their Valuations Stand?

In this article, we’ll look at Tesoro’s (TSO) and Western Refining’s (WNR) valuations following the news of TSO’s acquisition of WNR.

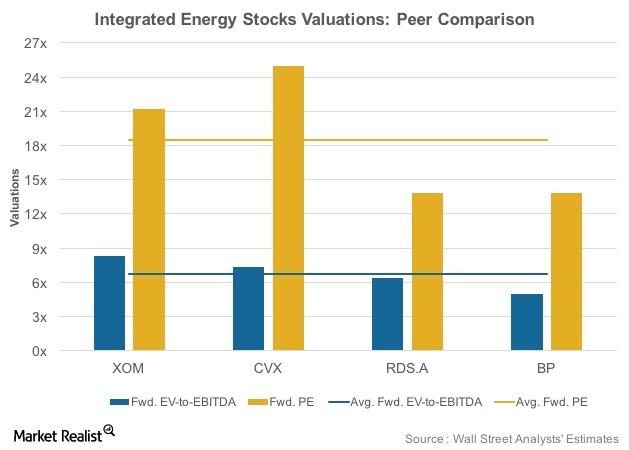

Integrated Energy Stocks’ Post-3Q16 Forward Valuations

XOM trades at 8.3x forward EV-to-EBITDA and 21.2x forward price-to-earnings, both above its peer averages.

How Refining Margins Are Key Indicators of Refining Profitability?

Refining margins are dependent on input crude oil cost, product slate, and prices of refined products and are indicators of overall profitability.

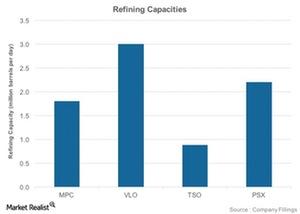

What Key Factors Impact Refining Profitability?

The key factors influencing refining profitability include refining capacity, complexity, and utilization rates.

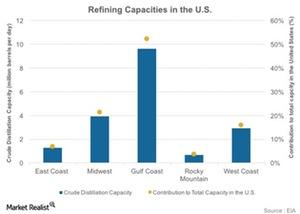

US Gulf Coast: The Largest Refining Region in the Country

The Gulf Coast, a key US refining region, accounted for 9.6 MMbpd of total refining capacity, which represents 52% of the total refining strength in the US.

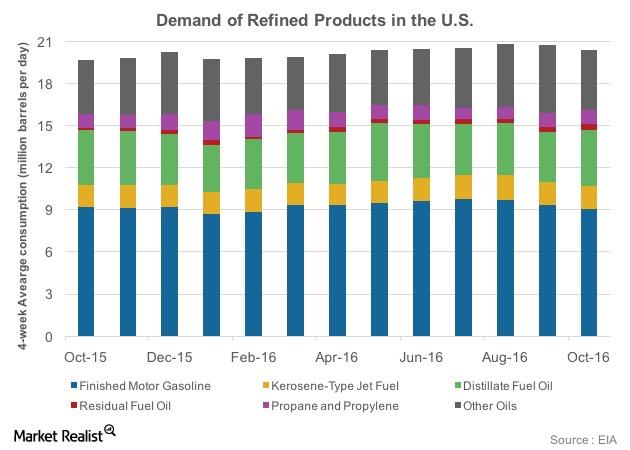

Refined Products in the US: Which Product Is Consumed Most?

Of the total consumption of 20.2 MMbpd, in October 2016, gasoline accounts for around 9.1 MMbpd. Distillate fuel oil accounts for 4.1 MMbpd of the total.

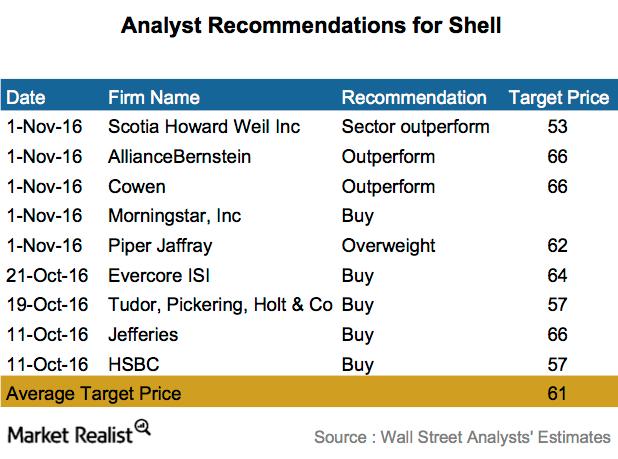

Analysts’ Recommendations for Shell: Most Say ‘Buy’

Shell’s highest and lowest 12-month price targets stand at $66 and $53. It indicates a 27% and 2% rise from its current levels, respectively.