Tesoro Stayed Positive despite the Fall in Its 4Q16 Earnings

Tesoro (TSO) posted its 4Q16 results on February 6, 2017. It reported revenues of $6.6 billion, which missed Wall Street analysts’ estimates.

Feb. 8 2017, Updated 5:36 a.m. ET

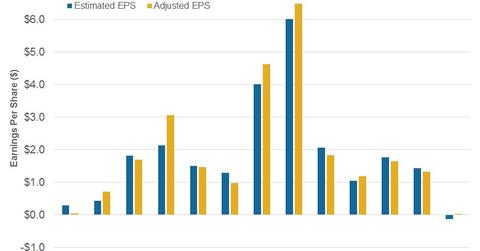

Tesoro’s 4Q16 estimated and actual performance

Tesoro (TSO) posted its 4Q16 results on February 6, 2017. It reported revenues of $6.6 billion, which missed Wall Street analysts’ estimates. However, the company’s 4Q16 adjusted EPS (earnings per share) stood at $0.03—compared to its estimated EPS of -$0.14. Tesoro’s 4Q16 EPS was 98% and 97% lower than its EPS in 4Q15 and 3Q16, respectively.

Tesoro’s 4Q16 earnings review

In 4Q16, Tesoro’s net income from continuing operations rose from $54 million in 4Q15 to $78 million in 4Q16. During the quarter, the operating income rose 18% YoY (year-over-year) to $335 million. It rose due to the YoY rise in the Refining and the Logistics, or Tesoro Logistics (TLLP), segments’ operating income. It was partially offset by a YoY fall in the Marketing segment’s operating income. During the quarter, Tesoro registered an inventory valuation (lower of cost or market) gain combined with other gains like insurance proceeds, refunds, and dispute settlement.

Income from the Refining segment rose to $43 million in 4Q16—compared to $12 million in 4Q15. The income rose due to a better gross refining margin and higher throughput and refined product sales volumes.

Tesoro Logistic’s operating income rose 27% YoY to $123 million in 4Q16 due to higher revenues on terminaling and pipeline transportation. Terminaling revenues rose due to higher throughput combined with better average revenue per barrel.

Tesoro’s Marketing segment’s operating income fell 3% compared to 4Q15 to $169 million in 4Q16. It fell due to a drop in fuel margins and sales volumes in 4Q16—compared to 4Q15. Tesoro’s retail stations rose 4% YoY to 2,492 in 2016.

In comparison, Marathon Petroleum (MPC), Phillips 66 (PSX), and Valero Energy’s (VLO) EPS fell 48%, 88%, and 55% in 4Q16 compared to 4Q15, respectively. Delek US Holdings (DK) and Alon USA Energy (ALJ) are expected to post losses in 4Q16. For exposure to small-cap stocks, you can consider the iShares Russell 2000 Value ETF (IWN) (RUT-INDEX). IWN has ~6% exposure to energy sector stocks including Delek US Holdings and Alon USA Energy.

In the next part, we’ll analyze Tesoro’s refining margin.