Delek US Holdings Inc

Latest Delek US Holdings Inc News and Updates

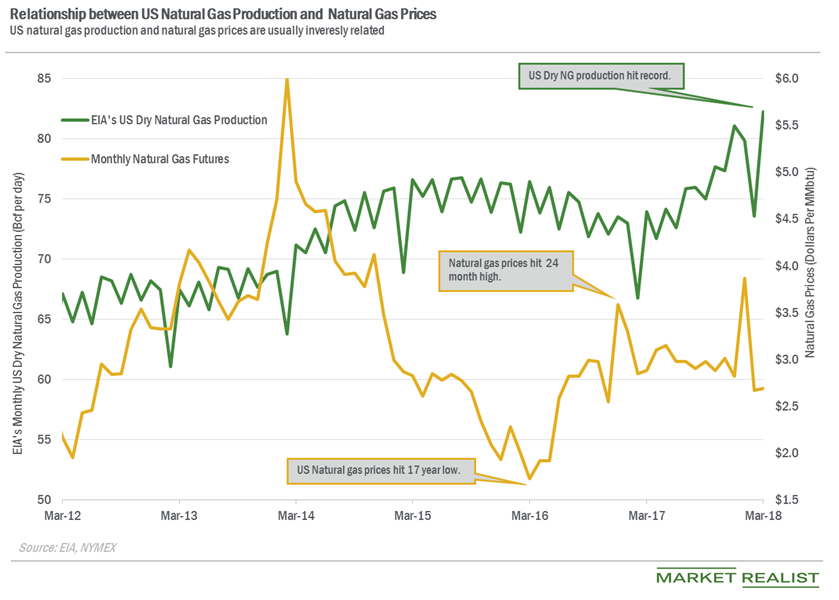

Decoding US Natural Gas Consumption Trends

PointLogic estimates that US natural gas consumption rose ~2.1% to 57.8 Bcf (billion cubic feet) per day from May 31 to June 6.

Understanding Valero’s Stock Performance Prior to the 1Q17 Results

Since February 2017, downstream stocks have been hit by volatile crack conditions and changing inventory levels. VLO has also witnessed volatility in its stock price.

Refining Crack Spread Overview: All You Ever Wanted to Know

The crack spread is a major component that drives refiners’ valuation. In this article, we’ll look at the metric’s different aspects.

Best Oil Refining Stocks: MPC, VLO, PSX, HFC, PBF, and DK

Oil refining and marketing stocks have been on investors’ radar. Valero Energy (VLO) and Phillips 66 (PSX) have risen 29.0% and 29.7%, respectively, YTD.

MPC: Elliott Ups Stake by 86% in Marathon Petroleum

In the third quarter, Elliott Management raised its stake in Marathon Petroleum by about 86%. Elliott has criticized MPC’s management on several occasions.

Valero or Marathon Petroleum: Which Is a Better Buy?

Valero (VLO) and Marathon Petroleum’s (MPC) stocks have fallen 2.9% and 0.7%, respectively, so far in Q3. Here, we review which refiner is a better buy.

Why MPC Stock Fell despite Earnings Beat

MPC stock performed in line with the equity market and its peers on Thursday. The SPDR S&P 500 ETF (SPY), which represents the S&P 500 Index, fell 0.9%.

Why Is Delek Stock Falling?

Analysts expect Delek’s EPS to fall by 38% YoY and 45% quarter-over-quarter to $0.84 in the second quarter of 2019.

How Has Phillips 66’s Dividend Yield Trended?

Phillips 66’s dividend payments have risen in the past few years. In the first quarter, the company will pay a dividend of $0.8 per share on March 1.

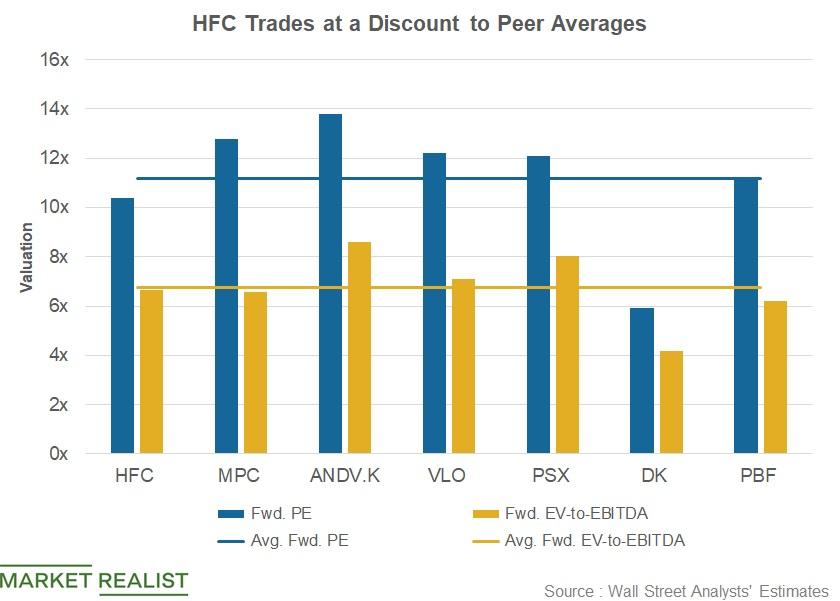

Comparing HollyFrontier’s Valuation with Peers’

HollyFrontier’s (HFC) forward PE ratio is 10.4x, below peers’ average of 11.2x. Marathon Petroleum’s (MPC), Andeavor’s (ANDV), and Phillips 66’s (PSX) forward PE ratios are higher than the average, at 12.8x, 13.8x, and 12.1x, respectively.

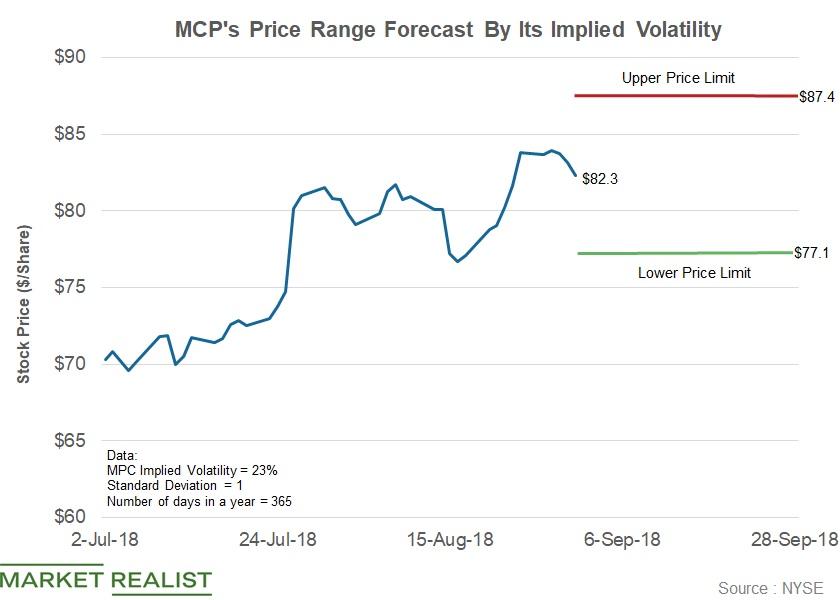

Marathon Petroleum Stock: Price Range until September 28

The implied volatility in Marathon Petroleum has fallen by eight percentage points since July 2 to the current level of 23%.

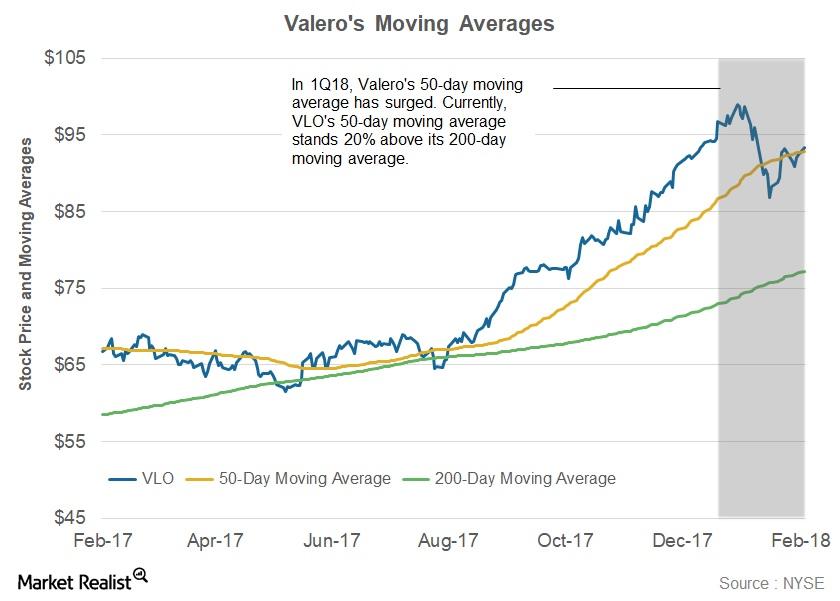

What Does Valero’s Moving Average Suggest?

In 1Q18, VLO’s 50-day moving average remained above its 200-day moving average.

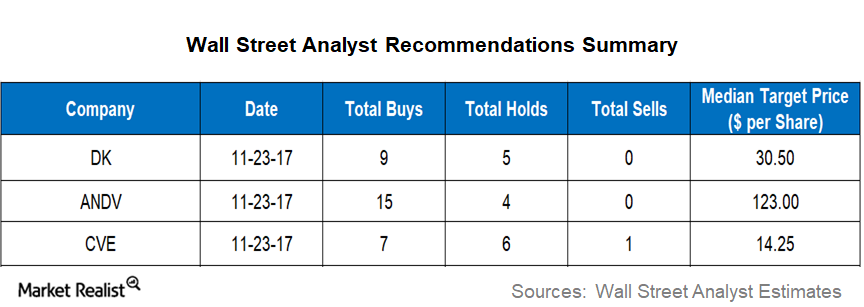

Analyzing Wall Street Targets for DK, ANDV, and CVE

As of November 23, 2017, four of the 14 analysts covering Delek US Holdings (DK) stock gave it a “strong buy” recommendation, and five gave it a “buy.”

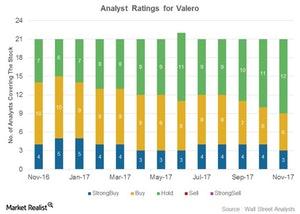

Analysts’ Views on Valero

Analysts’ ratings for Valero Previously, we looked at analysts’ expectations for Valero Energy’s (VLO) dividend payment next quarter. In this part, we’ll look at analysts’ ratings for Valero. As shown in the chart above, nine (or 43%) of the 21 analysts covering VLO have rated it a “buy.” The remaining 12 analysts have rated Valero a “hold,” and […]

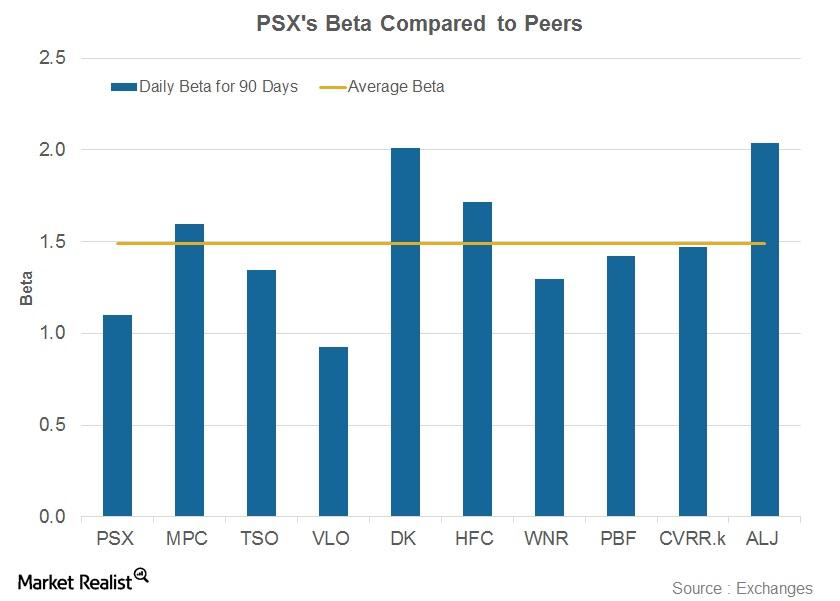

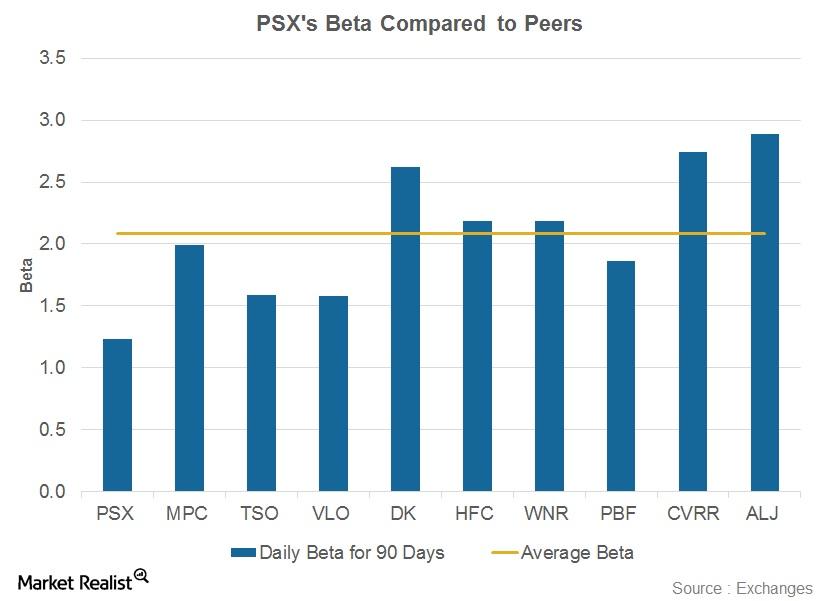

Phillips 66’s Beta: Does It Imply the Company Is Less Volatile?

Phillips 66’s 90-day daily beta stands at 1.1, which is below its peer average of 1.5.

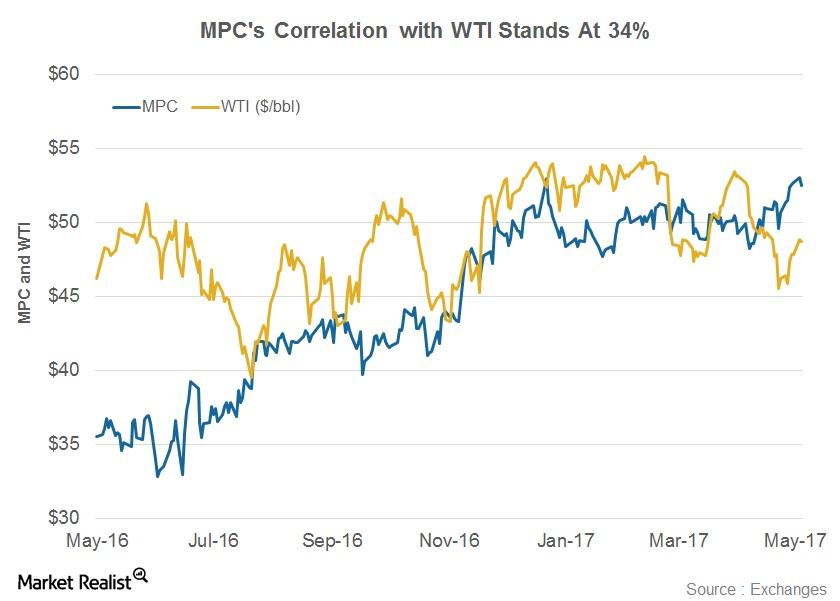

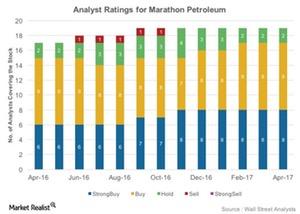

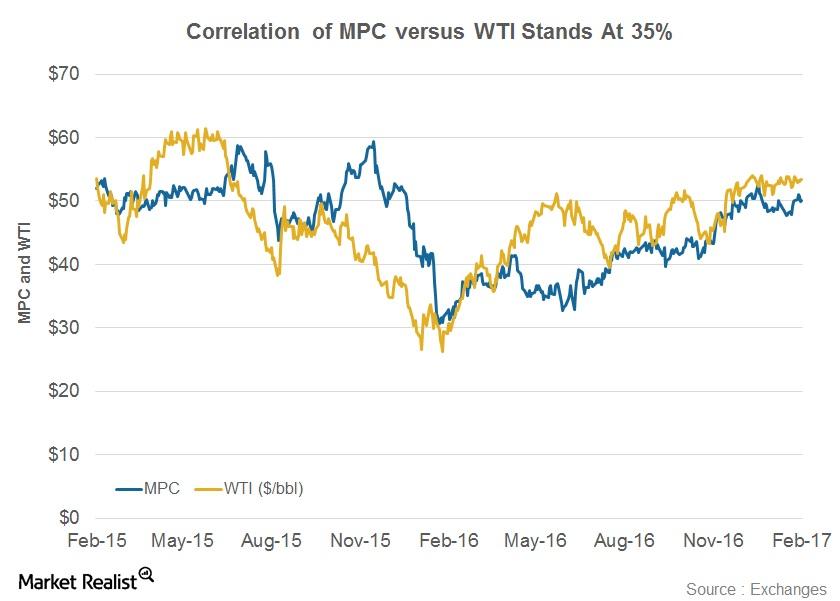

How Does MPC Stock Correlate with WTI?

Marathon Petroleum’s correlation with WTI stands at 0.34. This value shows that the two have a positive but relatively weak correlation.

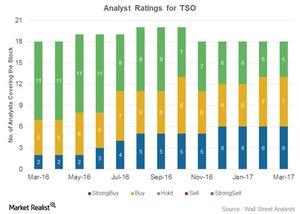

Where Do Analysts Ratings for Tesoro Stand Pre-Earnings?

In this series, we’ve examined Tesoro’s (TSO) 1Q17 estimates, refining margin outlook, and stock performance ahead of its earnings release expected on May 8, 2017.

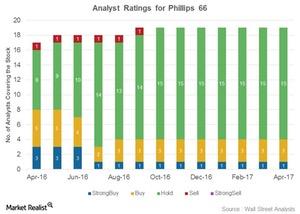

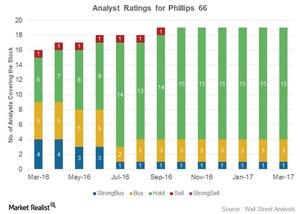

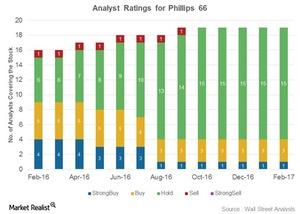

How Are Analysts Rating Phillips 66 before Its 1Q17 Earnings?

Phillips 66 has been rated by 19 analysts. Of those, four (or 21.0%) have given it a “buy” or “strong buy” rating.

Marathon Petroleum on the Street: What’s Changed among Analysts?

Of the 19 analysts covering MPC, 17 (89%) analysts have assigned “buy” or “strong buy” ratings, while two (11%) have assigned “hold” ratings.

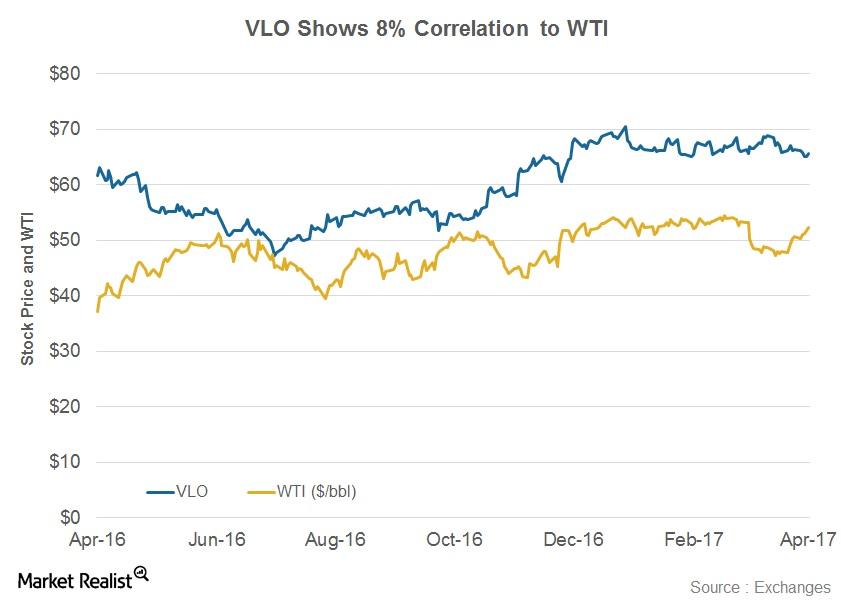

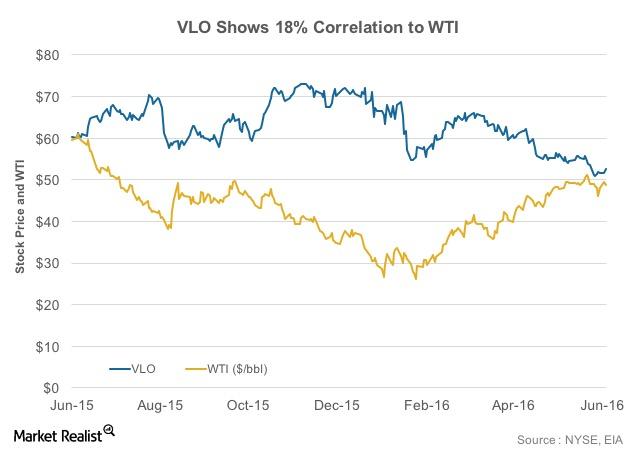

What Is the Relationship between VLO and WTI?

The correlation coefficient between VLO and WTI stands at 0.08.

Why Most Analysts’ Ratings for Tesoro Are ‘Buys’

Thirteen out of the 18 analysts covering Tesoro (TSO) have rated it as a “buy” so far in March 2017. Another five analysts have rated TSO as a “hold.”

Phillips 66’s Beta: Does It Imply That PSX Is Less Volatile?

Phillips 66’s (PSX) 90-day beta stood at 1.2 on March 16, 2017, below its peer average of 2.1.

Why the Majority of Analysts Rate Phillips 66 as a ‘Hold’

Fifteen out of the 19 analysts covering Phillips 66 (PSX) rated it as a “hold” in March 2017. Another four analysts rated PSX as a “buy” or a “strong buy.”

Understanding the Correlation between MPC’s Stock and Oil Prices

The correlation coefficient of Marathon Petroleum and WTI stands at 0.35—a positive but feeble correlation.

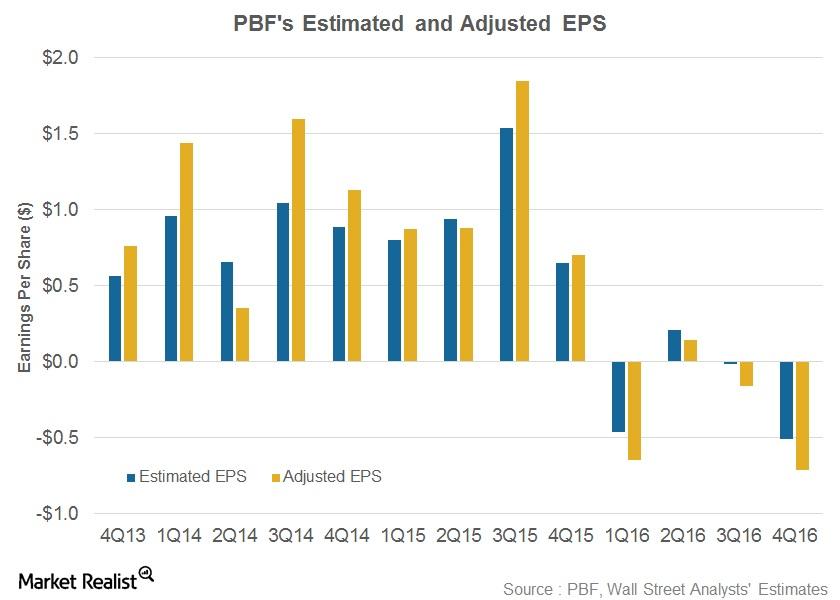

PBF Energy’s 4Q16 Results: Earnings Take a Nosedive

PBF Energy (PBF) released its 4Q16 results on February 16, 2017. The earnings results weren’t very encouraging for this petroleum refiner.

Phillips 66’s Recommendations: What the Analysts Are Saying Now

After its 4Q16 results, four of 19 analysts assigned “buy” or “strong buy” recommendations to Phillip’s 66 stock, while 15 assigned “holds.”

What’s the Correlation between Valero Stock and WTI?

The correlation coefficient of Valero (VLO) and WTI stands at 0.15. The correlation value for Valero’s stock and oil price show that they have a positive but feeble correlation.

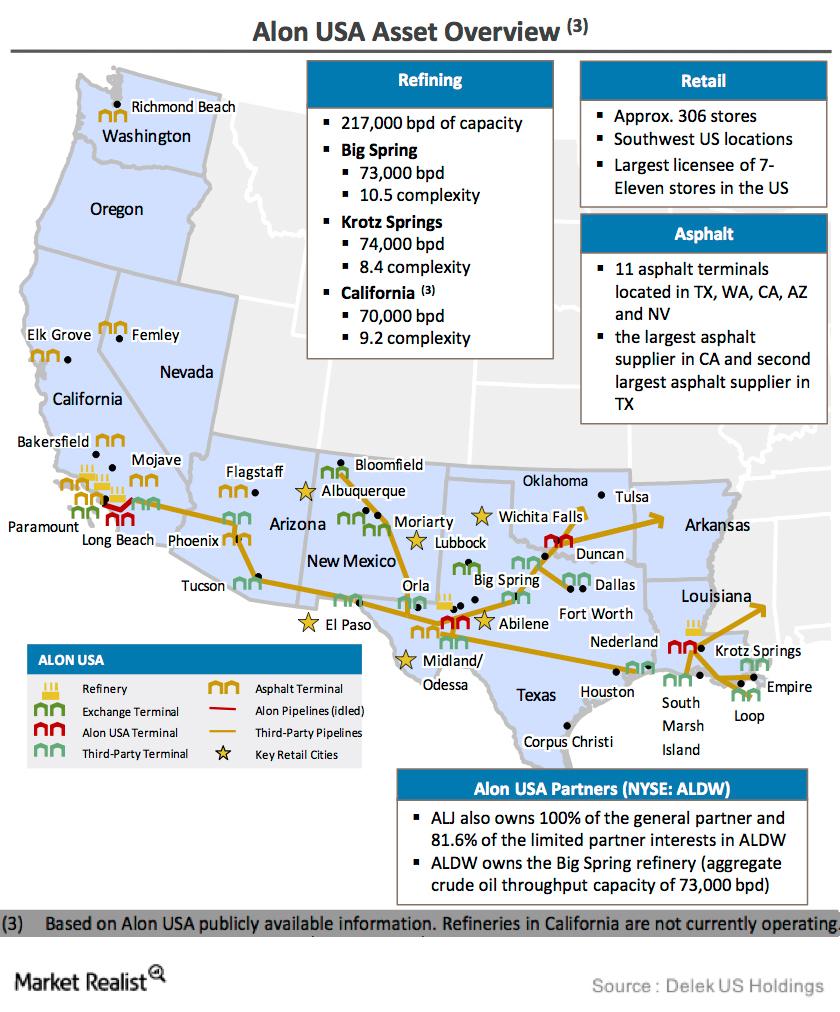

Can Delek US Fully Acquire Alon USA?

Delek US Holdings will be transformed if it succeeds in the acquisition of the remaining stake in Alon USA Energy.

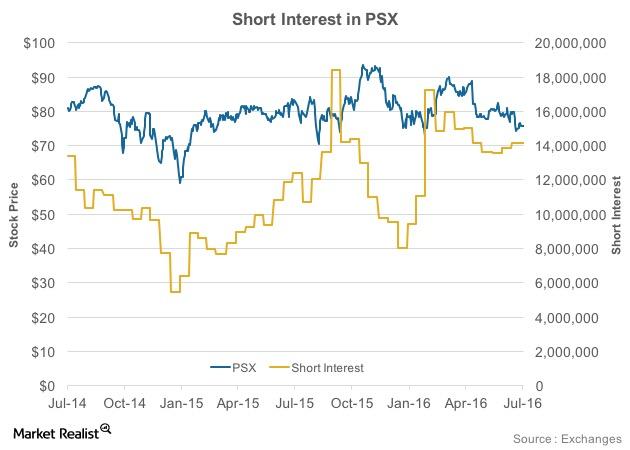

What Does an Analysis of PSX’s Short Interest Reveal?

Since mid-February 2016, Phillips 66 (PSX) has witnessed an 18% fall in its short interest.

What’s the Correlation between Valero Stock and Oil Prices?

The correlation value for Valero stock and the price of oil shows they have a positive but feeble correlation. Valero stock moves in line with WTI prices only to a certain extent.