What Key Factors Impact Refining Profitability?

The key factors influencing refining profitability include refining capacity, complexity, and utilization rates.

Nov. 14 2016, Published 3:02 p.m. ET

Factors impacting refining profitability

The key factors influencing refining profitability include the following:

- refining capacity

- complexity

- utilization rates

Refining capacity refers to the amount of oil a plant can refine. Complexity determines the type of crude oil consumed and the quality of refined products produced. Utilization rates show how much of refining capacity is used to refine oil, which can depend on things like efficiency, maintenance, and turnaround activities in the unit.

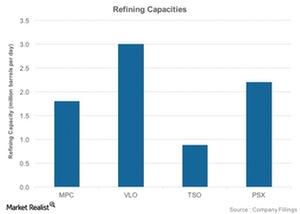

The above chart shows four leading American companies’ refining capacities. Valero Energy (VLO) has the highest refining capacity of 3 MMbpd (million of barrels per day) among US downstream companies, followed by Phillips 66 (PSX), whose refining capacity stands at 2.2 MMbpd. The refining capabilities of Marathon Petroleum (MPC) and Tesoro (TSO) are 1.8 MMbpd and 0.88 MMbpd, respectively.

The higher the refining capacity and utilization rates, the higher the production of refined products, and so refining capacities and utilization rates directly impact the revenues of refining segments.

Notably, the utilization rates for VLO, TSO, and PSX stood at 95%, 94%, and 97%, respectively, in the latest quarter. For indirect exposure, investors can consider the iShares Global Energy ETF (IXC), which has ~7% in oil refining and marketing sector stocks.

Significance of refinery complexity

Refinery complexity impacts the cost as well as revenue for refiners, and so it impacts the profitability of a refining company. The cost of crude oil processed by a refinery depends on market prices for crude oil. Crude oils can be classified as heavy or light, and sweet or sour, depending on the density, viscosity, and sulfur content. Lighter and sweet crude oils are expensive and trade at a premium over heavier and sour oils.

For example, Brent currently trades at ~$46 per barrel, which represents a premium of ~$4 per barrel over the OPEC (Organization of the Petroleum Exporting Countries) Crude Oil Reference Basket. And the higher the refinery complexity, the heavier the crude it can process. So a high-complexity refinery will have lower costs than a low-complexity refinery because it can process cheaper crude oil. Refinery complexity also affects the output of the refinery unit, usually referred to as “product slate” or “refining yields.”

In the next part, we’ll examine refining yields in terms of types of products produced and their price realizations.