Kurt Gallon

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Kurt Gallon

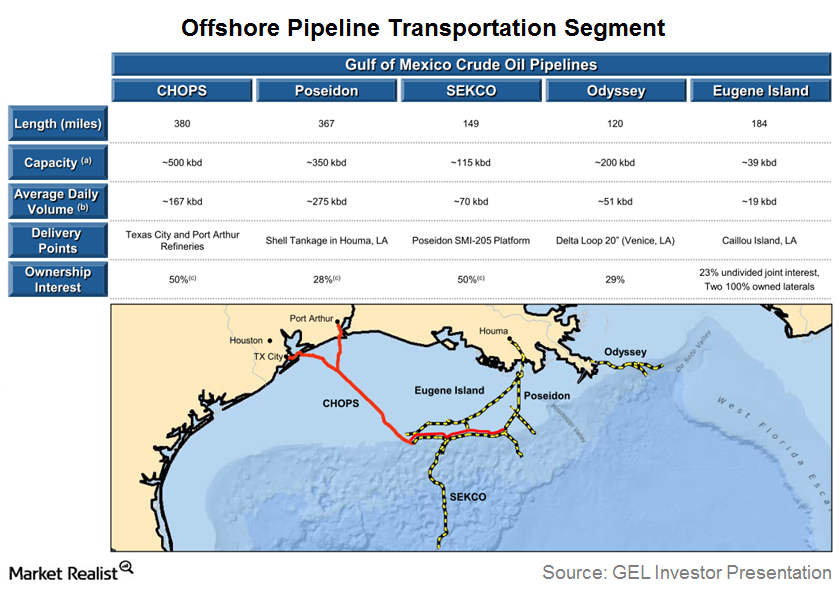

An Overview of Genesis Energy’s Offshore Pipeline Segment

Until recently, Genesis Energy’s Offshore Pipeline segment owned interest in ~1200 miles of offshore pipelines spread across five pipeline systems.

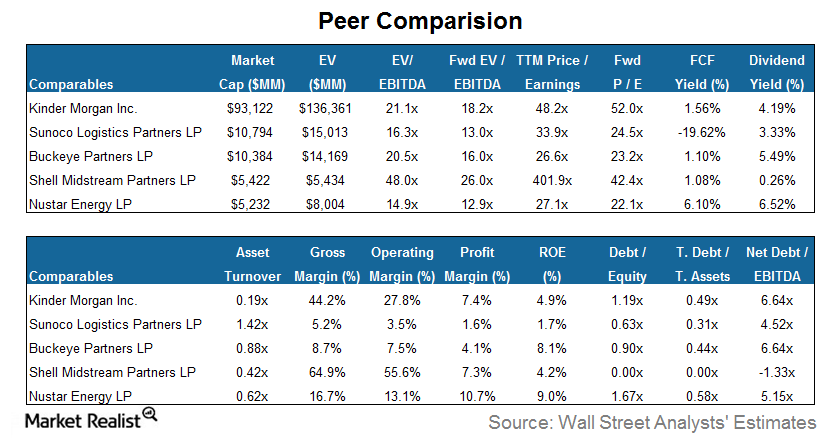

Why Sunoco Logistics Has the Lowest Profit Margins

Sunoco Logistics has the lowest profit margin and ROE among its peers. Its profit margin and ROE of 1.6% and 1.7%, respectively, are well below the group average.

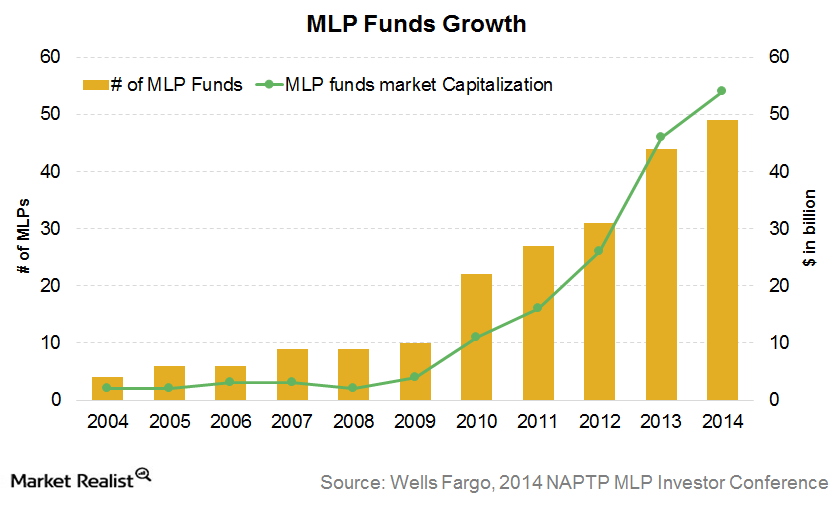

4 Methods of Investing in MLPs

There are four methods of investing in MLPs. The MLP funds’ market cap reached $54 billion as of April 30, 2014. The number of MLP-focused funds reached 49.

Chesapeake Bankruptcy Rumors Take a Toll on Williams Companies

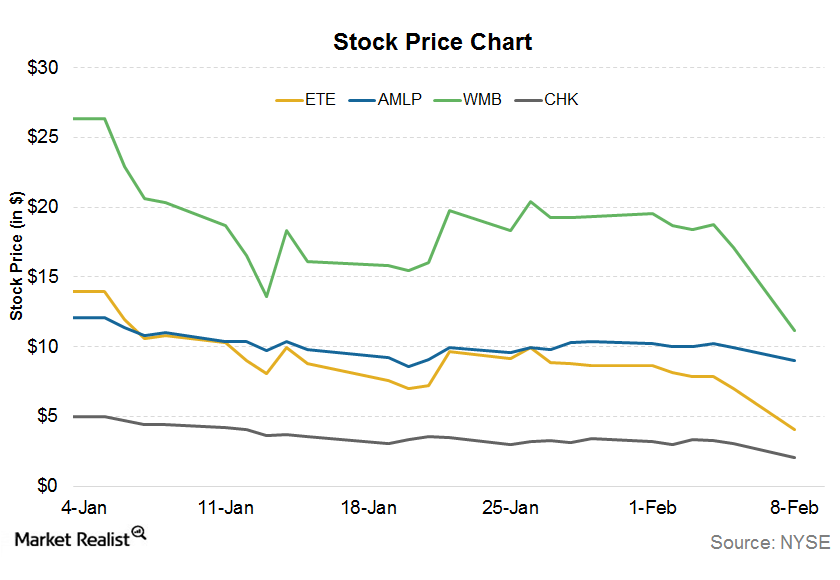

Chesapeake Energy (CHK) opened 50% lower in yesterday’s early trading on the rumor that the company is working with advisors to pursue bankruptcy.

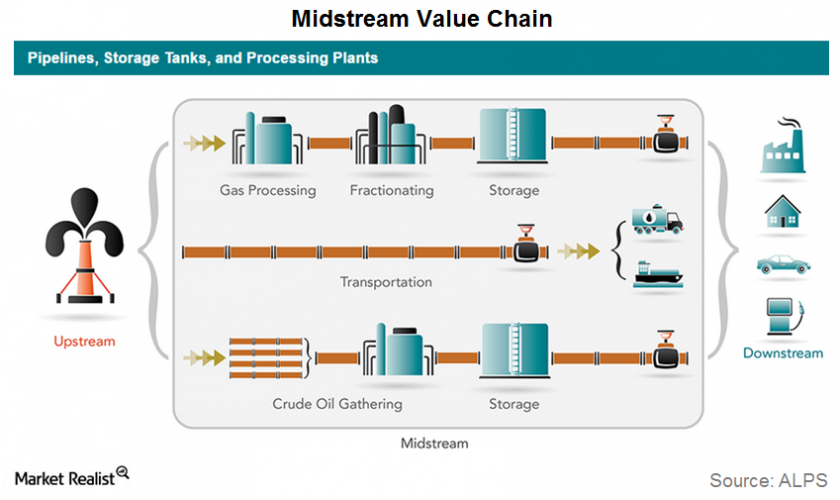

MLPs: How They Operate in the Midstream Energy Industry

Most MLPs operate in the midstream energy industry. They’re mainly involved in gathering, processing, storing, and transporting energy commodities.

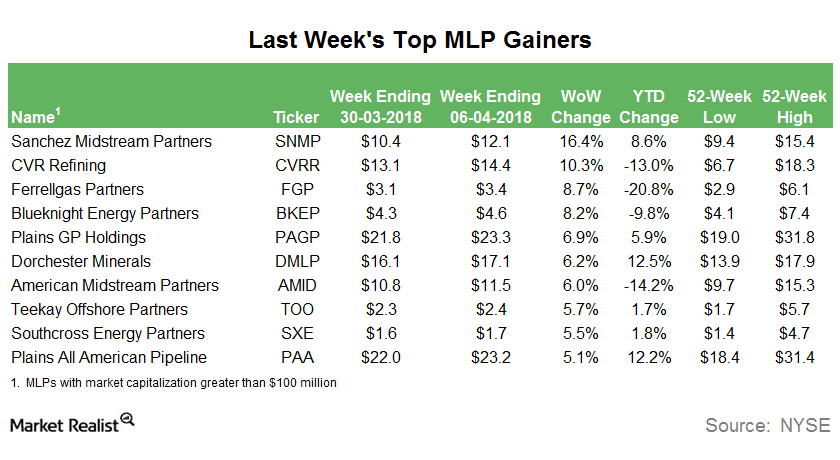

Top MLP Gainers in the Week Ending April 6

Sanchez Midstream Partners was the top MLP gainer in the week ending April 6, 2018. Sanchez Midstream Partners rallied 16.4%.

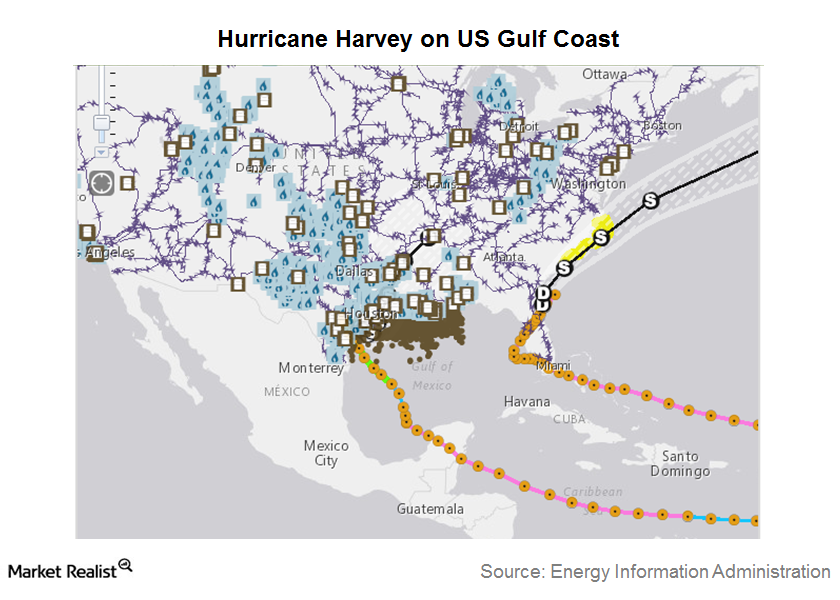

Hurricane Harvey Impacted Energy MLPs

Hurricane Harvey hit the US Gulf Coast last week. The US Gulf Coast is a major destination for US refineries and energy infrastructure.

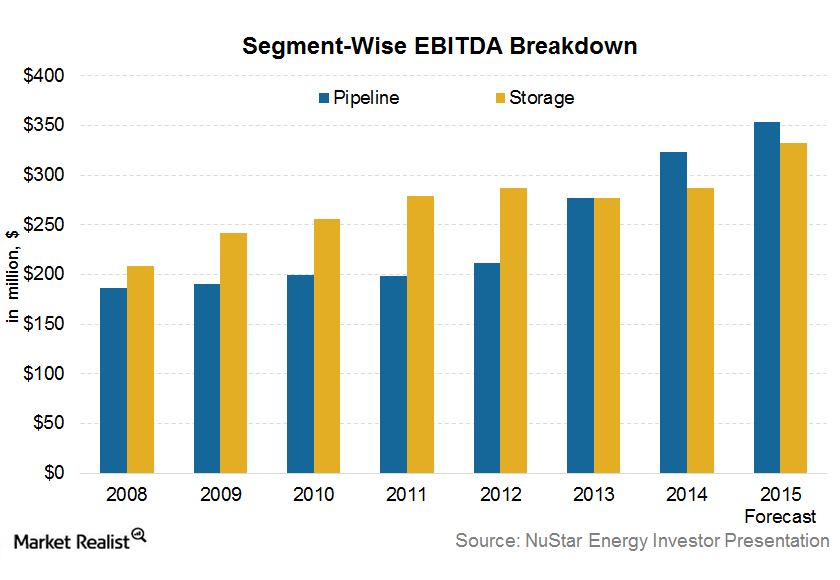

Pipeline Segment Will Drive NuStar Energy’s 4Q15 Performance

The pipeline segment is NuStar’s largest business segment in terms of the EBITDA. It accounted for 50% of the total segment EBITDA in the first nine months of 2015.

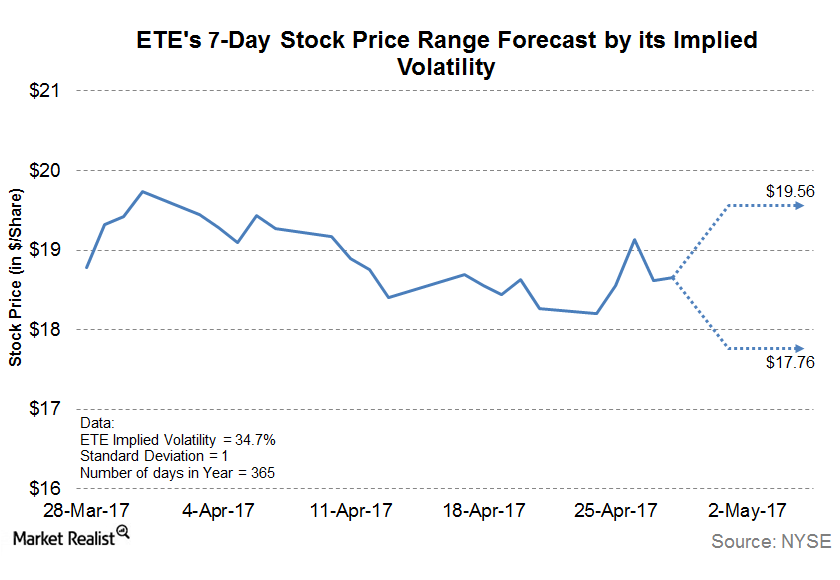

Will Energy Transfer Equity Build on Last Week’s Gains This Week?

Energy Transfer Equity (ETE) recently went below its 50-day simple moving average driven by the decline in the last two trading sessions of last week.

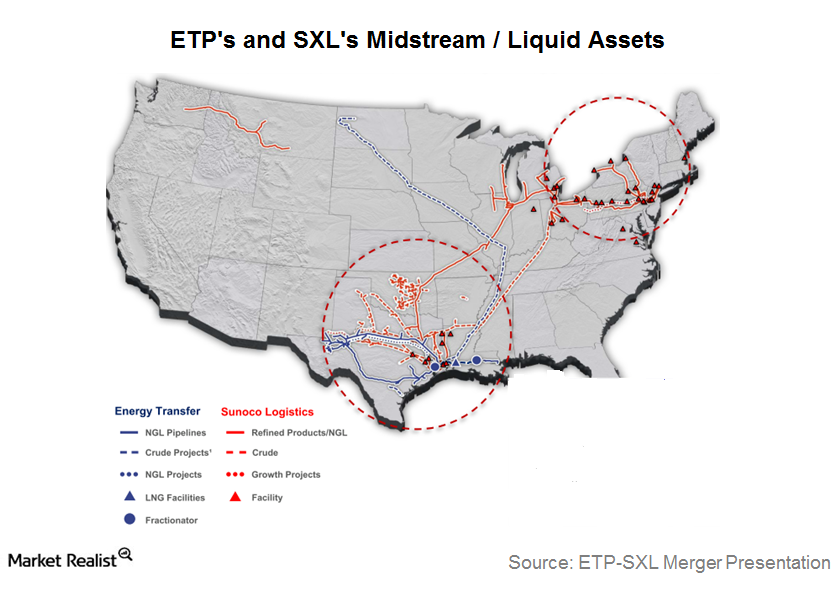

How Sunoco Logistics Could Benefit from Liquids Integration

SXL has remained bullish on its NGL growth story, which has been supported by strong NGL supply growth from the liquids-rich Marcellus and Utica Shales.

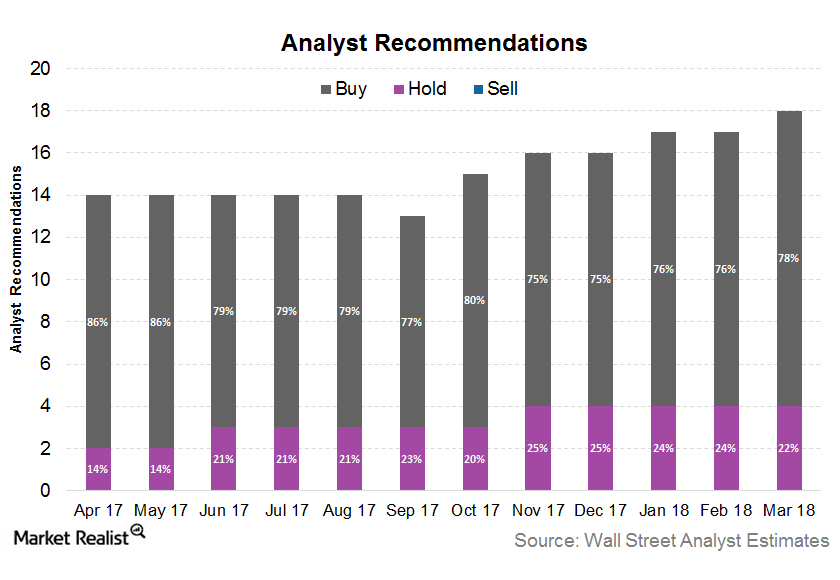

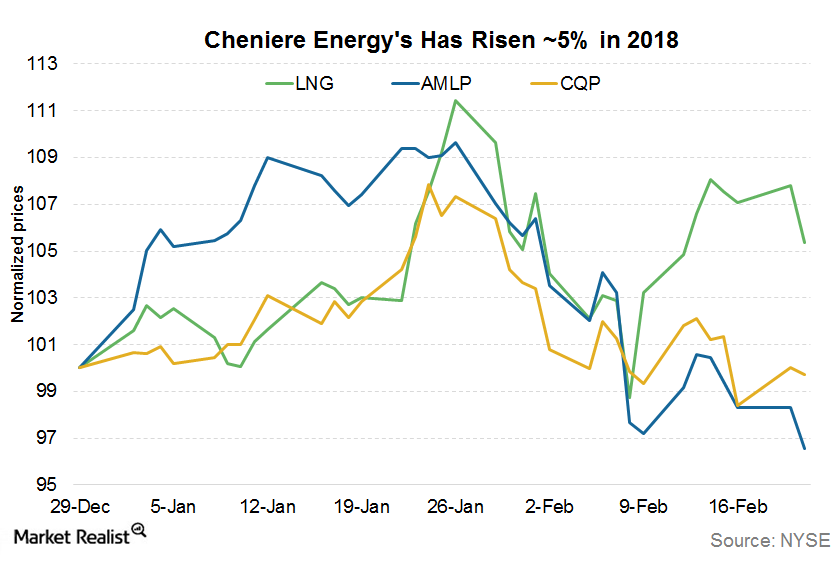

Cheniere Energy: What Analysts Recommend

Currently, 78% of the analysts surveyed by Reuters rate Cheniere Energy as a “buy” as of March 22, 2018, while the remaining 22% rate it as a “hold.”

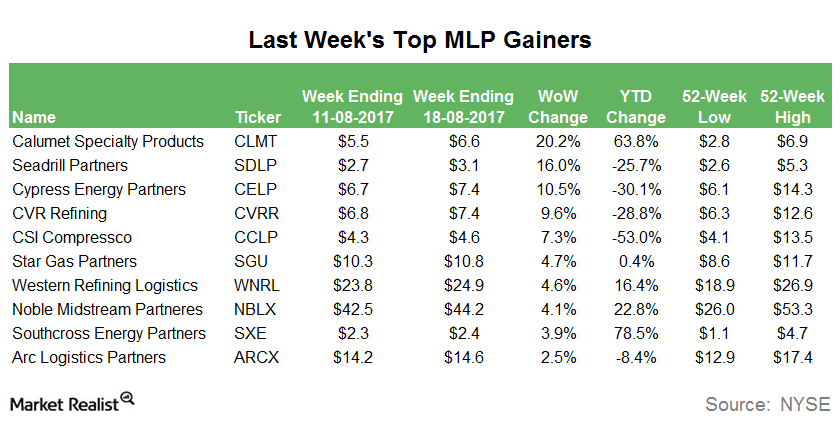

These MLPs Came out on Top on August 18

Calumet Specialty Products Partners (CLMT) was the top-performing MLP (master limited partnership) last week (ended August 18).

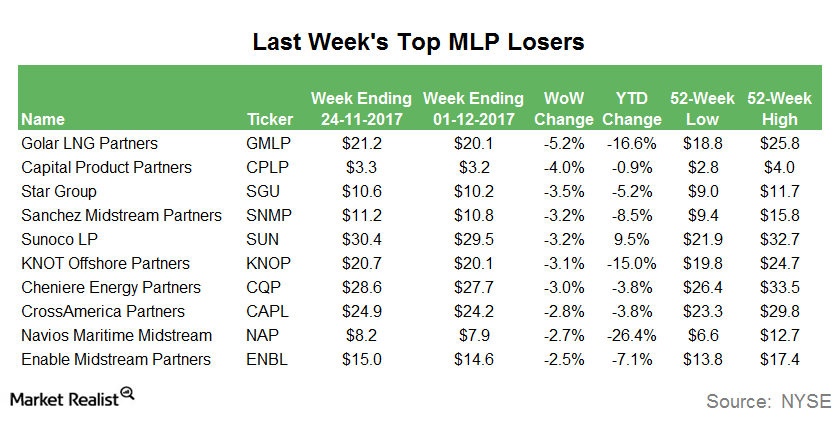

Who Were the Top MLP Losers Last Week?

Four of the top MLP losers last week were marine transportation MLPs, including GMLP, CPLP, KNOP, and NAP.

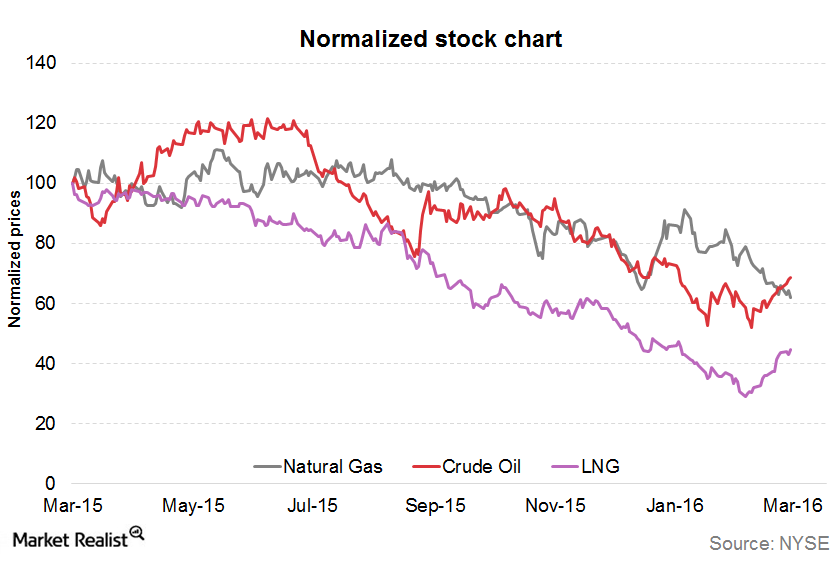

Analyzing Cheniere Energy’s Commodity Price Exposure

The correlation between Cheniere Energy’s stock price and crude oil (USO) resulted in a correlation coefficient of 0.87 during the past year.

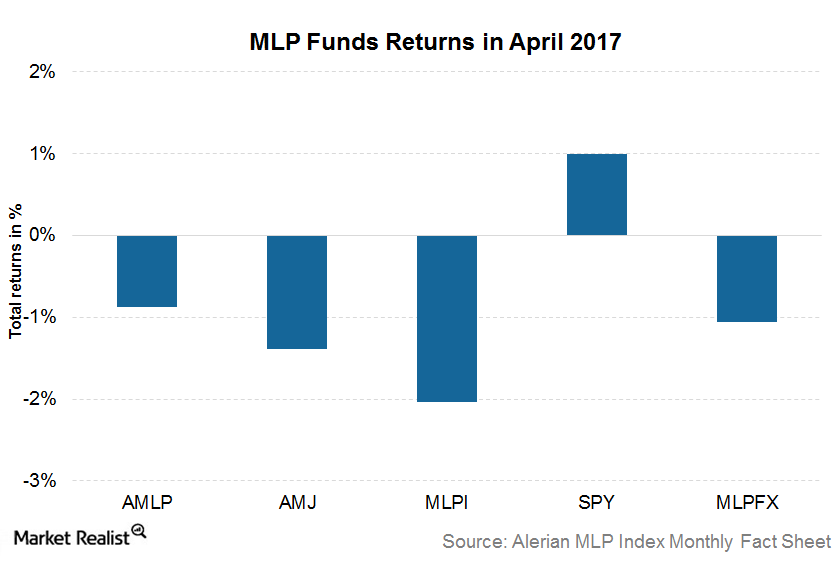

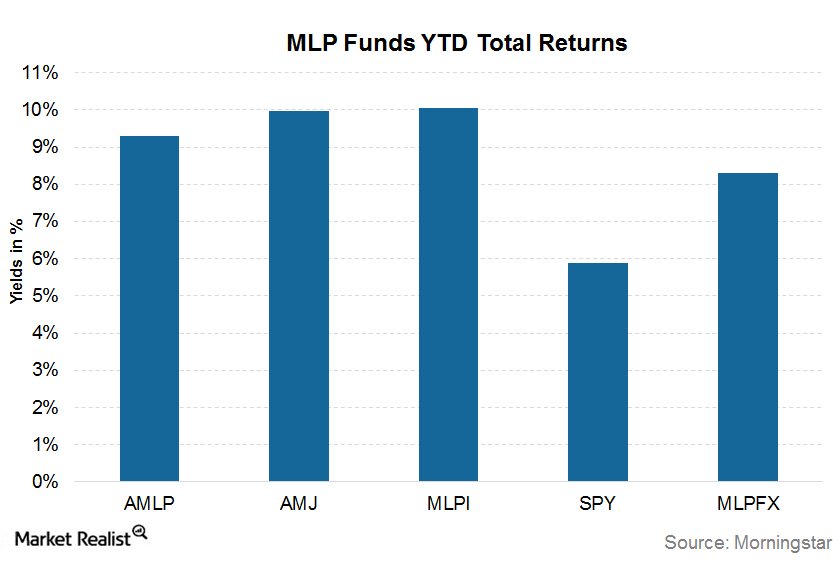

How MLP Funds Performed in April 2017

Among MLP funds, ETFs were the top performers in terms of total returns in April, while ETNs were the bottom performers.

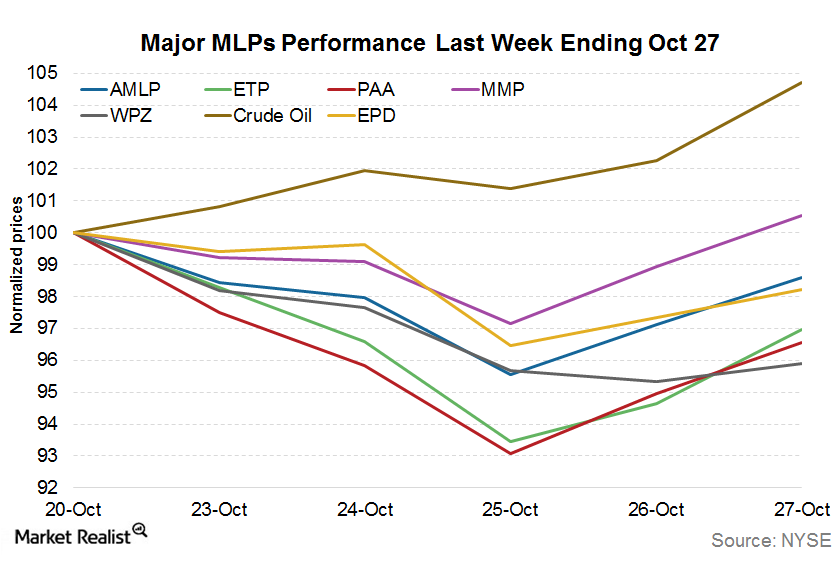

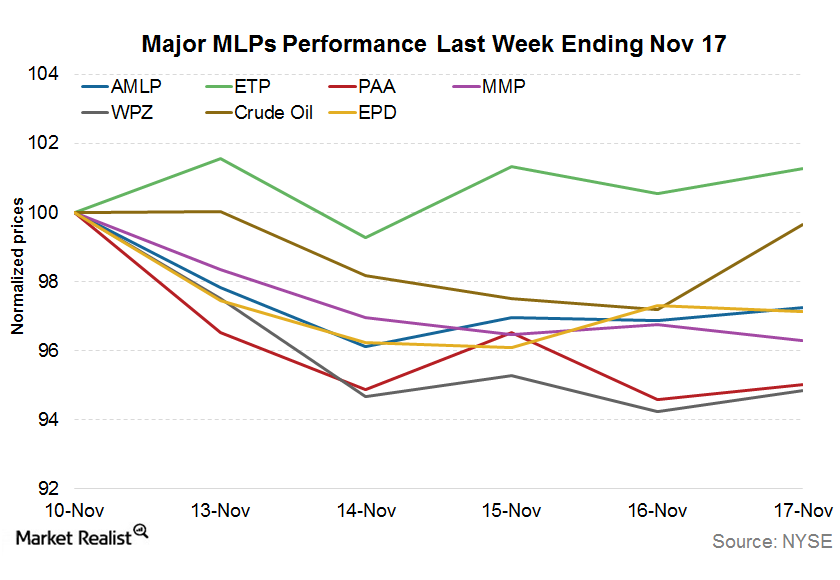

Why MLPs’ Sluggishness Continued Last Week

MLPs’ sluggishness continued last week despite strong crude oil. The Alerian MLP Index (^AMZ), which tracks the performance of 50 energy MLPs, fell 1.2% last week.

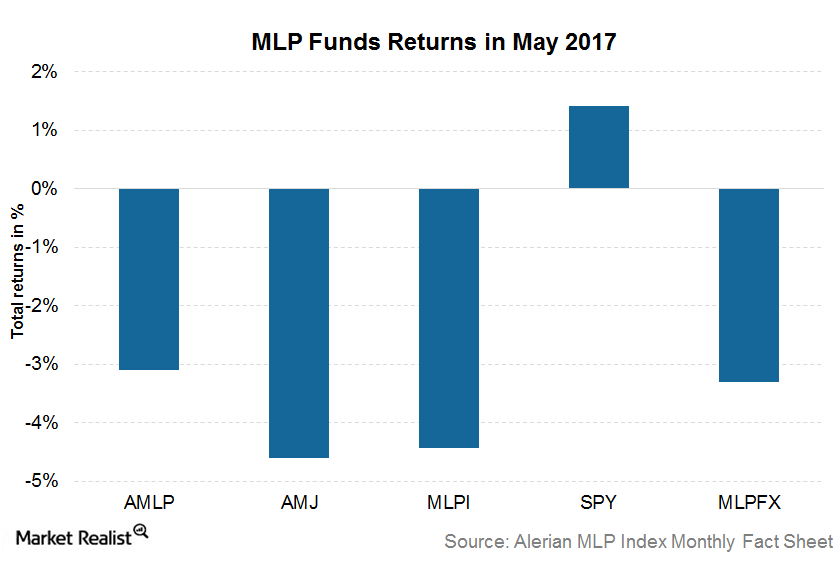

How MLP-Focused Funds Performed in May 2017

Among MLP funds, exchange-traded notes fell the most while the exchange-traded funds declined the least.

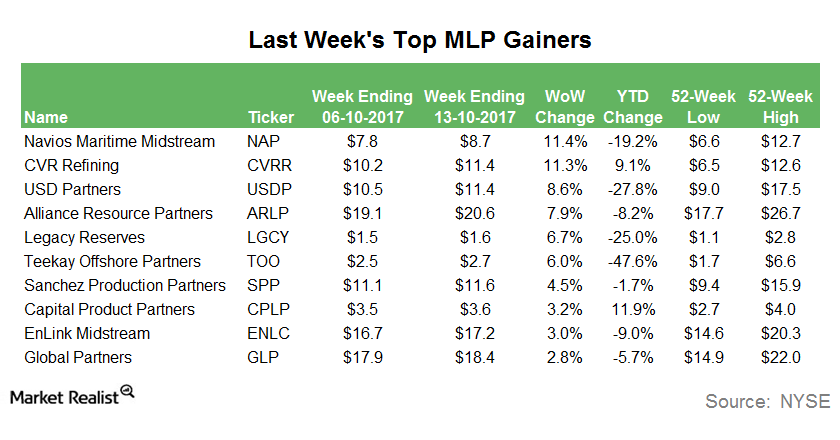

Top MLP Gainers in the Week Ending October 13

Navios Maritime Midstream Partners (NAP) was the highest MLP gainer in the week ending October 13. It rose 11.4% during the week.

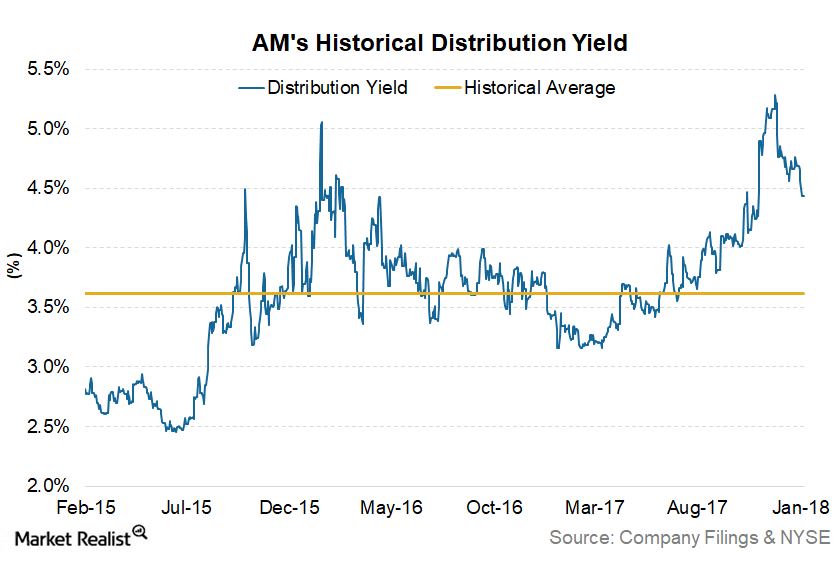

Could Antero Midstream Partners Benefit from Strong Earnings?

Antero Midstream Partners fell 6% last year. However, it had a strong start to the new year. It has risen 6.8% in 2018.

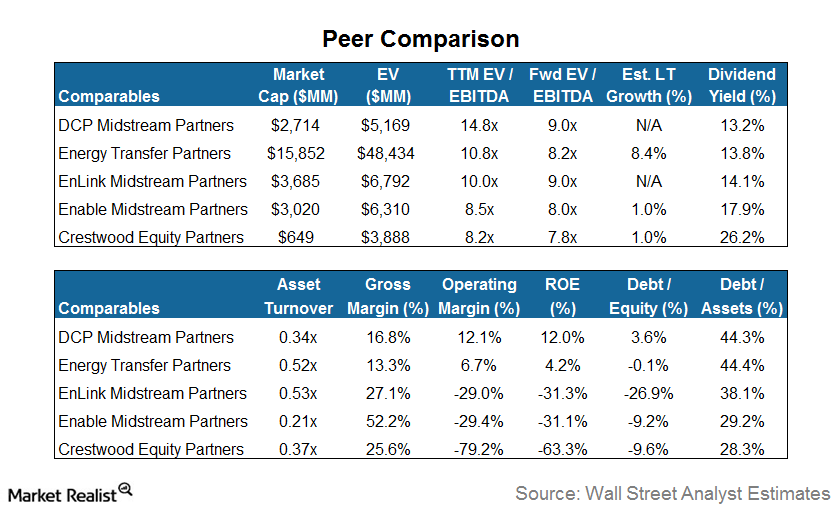

Where Does DCP Midstream Stand Compared to Its Peers?

DCP Midstream Partners (DPM) has an enterprise value of $2.7 billion.

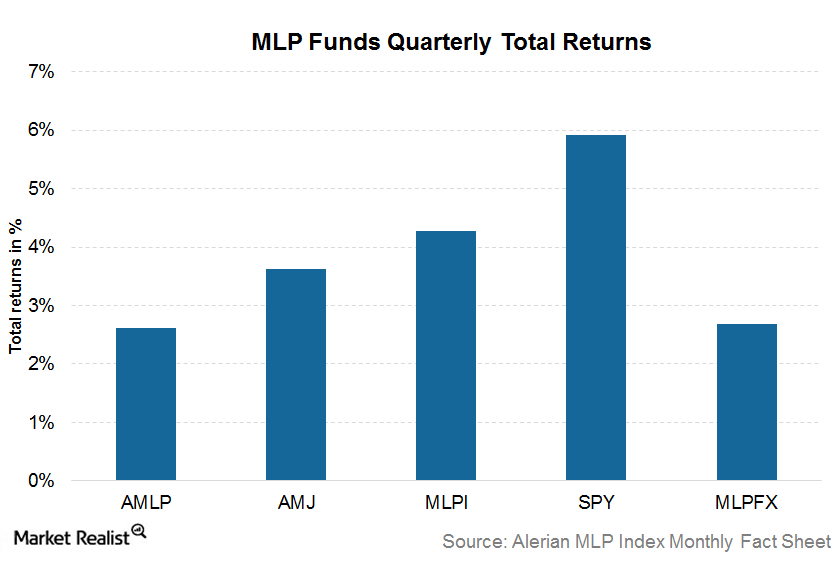

How MLP-Focused ETNs Performed in 1Q17

MLP-focused funds underperformed the SPDR S&P 500 ETF (SPY) in the recent quarter.

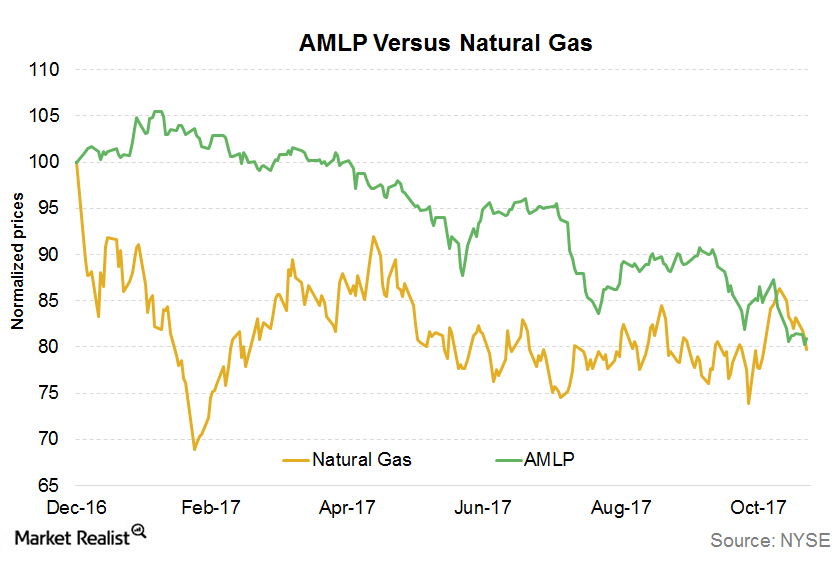

These MLPs Have the Highest Correlations with Natural Gas

In this series, we’ll look at the MLPs that have the highest correlations with natural gas amid the volatility in natural gas prices.

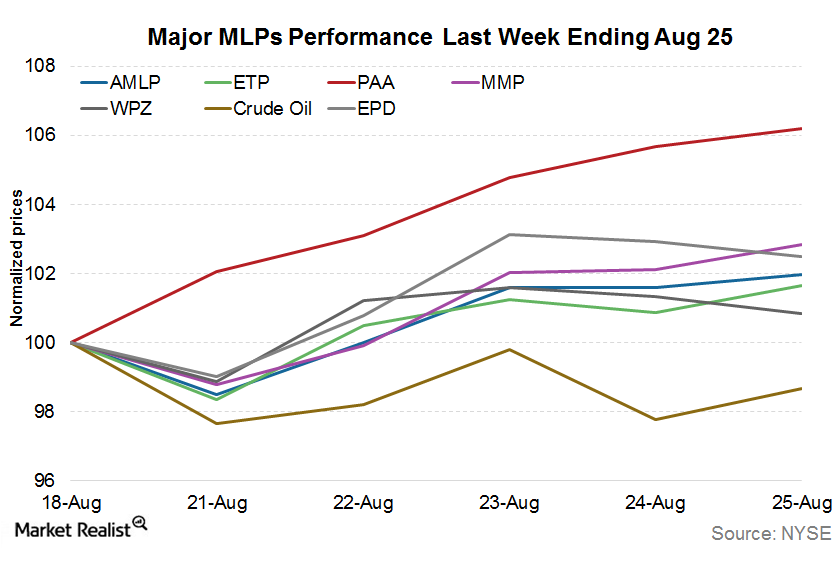

Rose Rock Midstream: Top Midstream MLP Loser on August 25

Rose Rock Midstream (RRMS) was the top loser among midstream MLPs at the end of trading on Tuesday, August 25. It fell 4.71% in a single trading session.

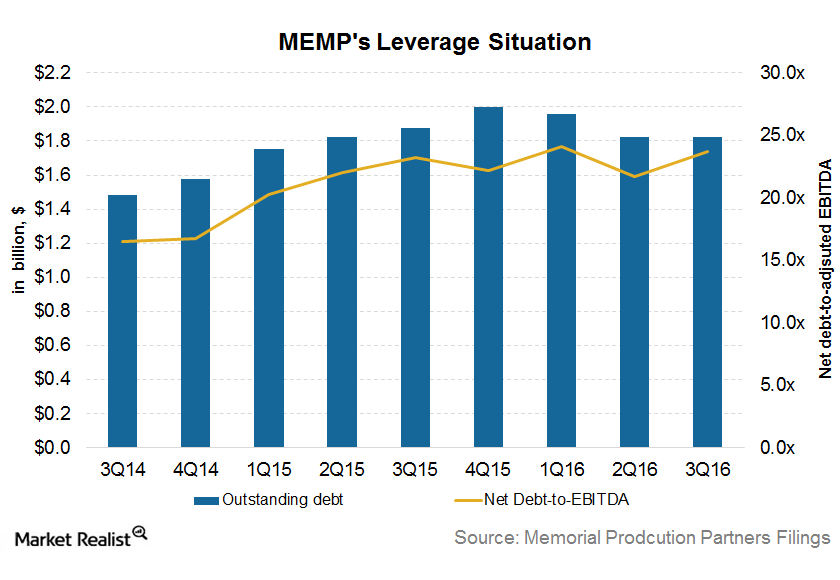

What Led to Memorial Production Partners’ Bankruptcy?

MEMP’s earnings improved in the recent quarter, but prior shortfalls were high and couldn’t be covered without a restructuring under Chapter 11 bankruptcy.

MLPs Recovered Slightly in the Week Ending August 25

MLPs recovered slightly in the week ending August 25—possibly due to an overcorrection in the first three weeks of the month.

MLP Focused ETNs Are Top Performers in 2016: Key Insight for Investors

Among MLP funds, ETNs are top performers in terms of total returns, while the closed-end funds are the bottom performers.

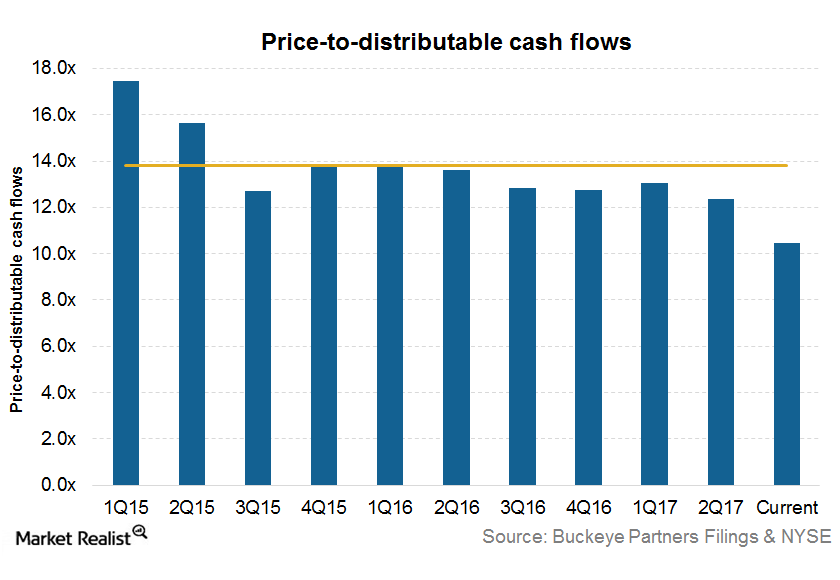

What Buckeye Partners’ Current Valuation Indicates

On October 31, 2017, Buckeye Partners (BPL) was trading at a price-to-distributable-cash-flow multiple of 10.4x, which is significantly below the historical ten-quarter average of 13.8x.

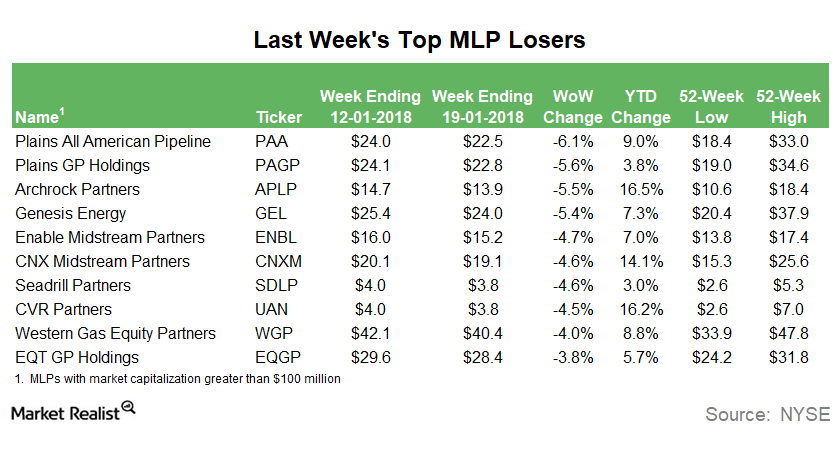

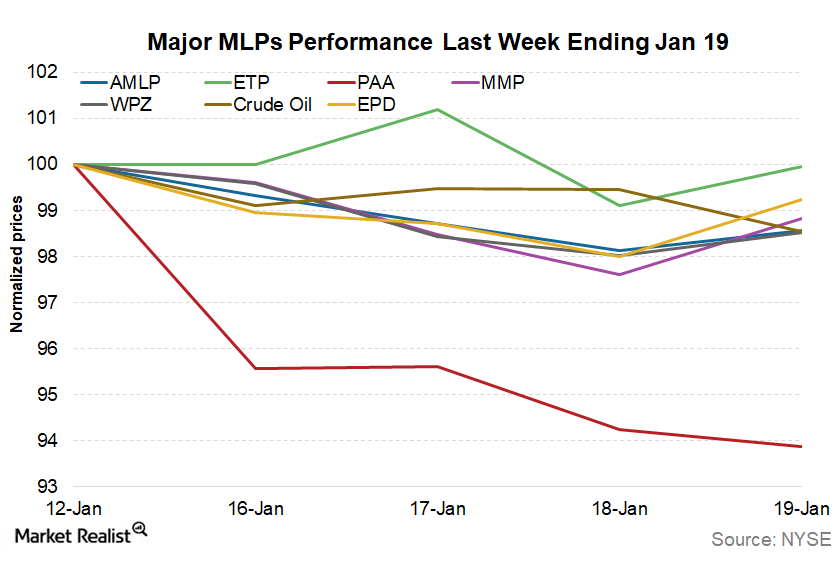

Why PAA Was the Biggest MLP Loser Last Week

Plains All American Pipeline (PAA) was the biggest MLP loser last week, which ended on January 19, 2018. The partnership ended the week 6.1% lower.

Why MLPs Saw a New 52-Week Low Last Week

MLPs went through some carnage last week. The Alerian MLP Index (^AMZ), which tracks the performance of 50 energy MLPs, saw a new 52-week low of 258.45.

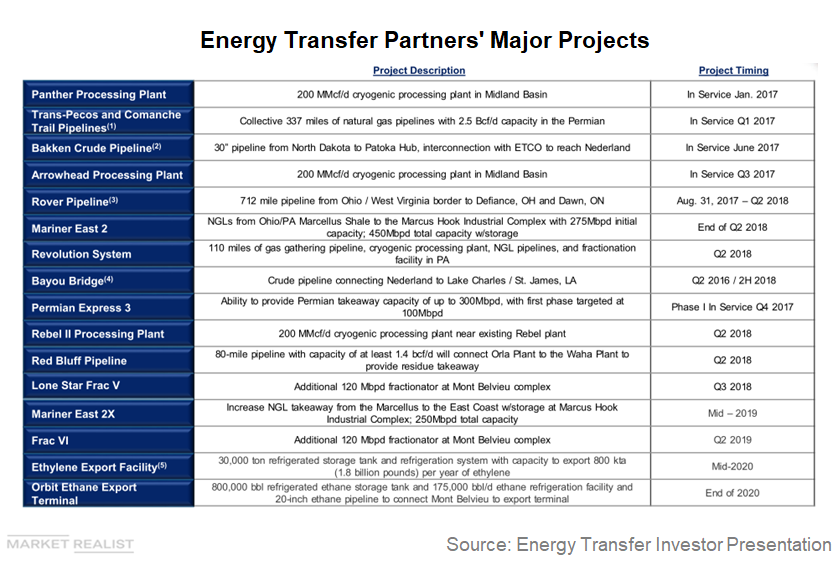

A Quick Update on Energy Transfer Partners’ Major Projects

Energy Transfer Partners remains optimistic about its recently announced projects despite the rise in global trade tensions.

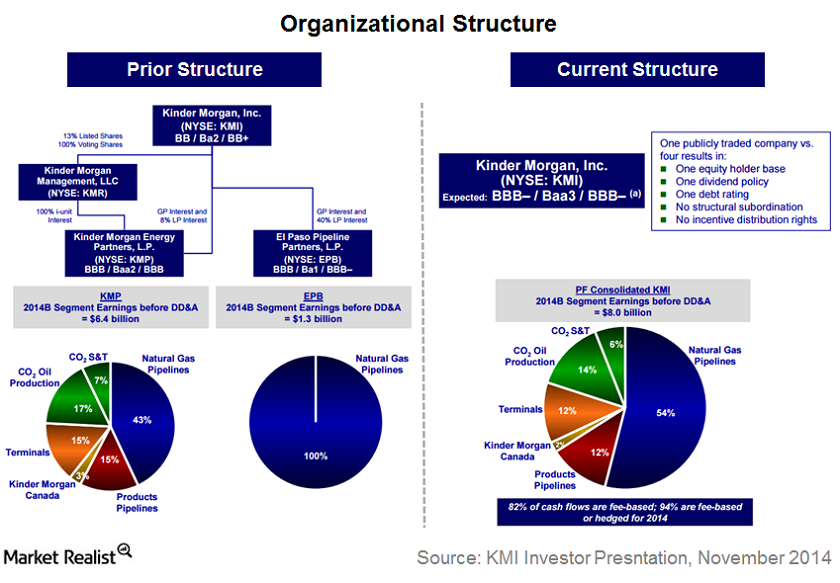

Kinder Morgan Consolidation: What It Means for the MLP Market

On November 26, 2014, Kinder Morgan acquired all of its equity interests in Kinder Morgan Partners, El Paso, and Kinder Morgan Management.

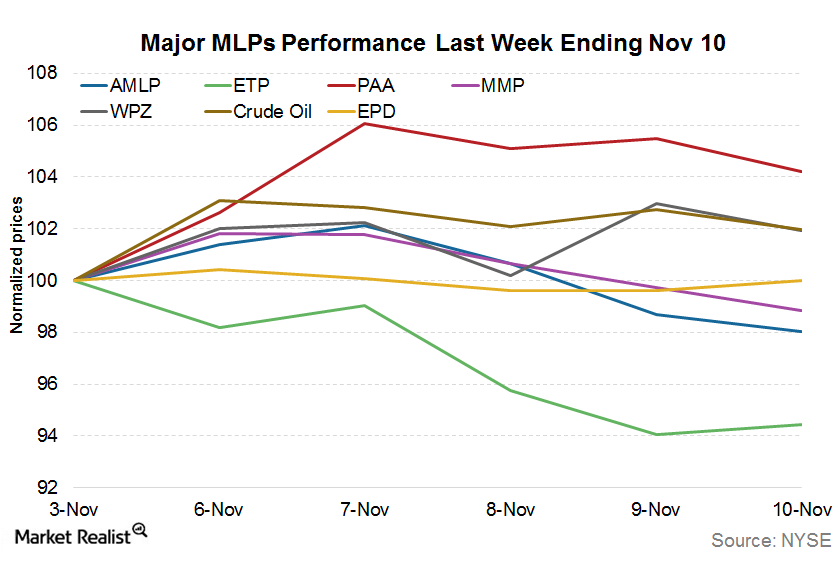

What’s behind MLP Performances for the Week Ended November 10?

Of the total 95 MLPs, 62 ended last week in the red, 30 ended in the green, and the remaining three ended flat. Energy Transfer Partners (ETP) fell 5.5%.

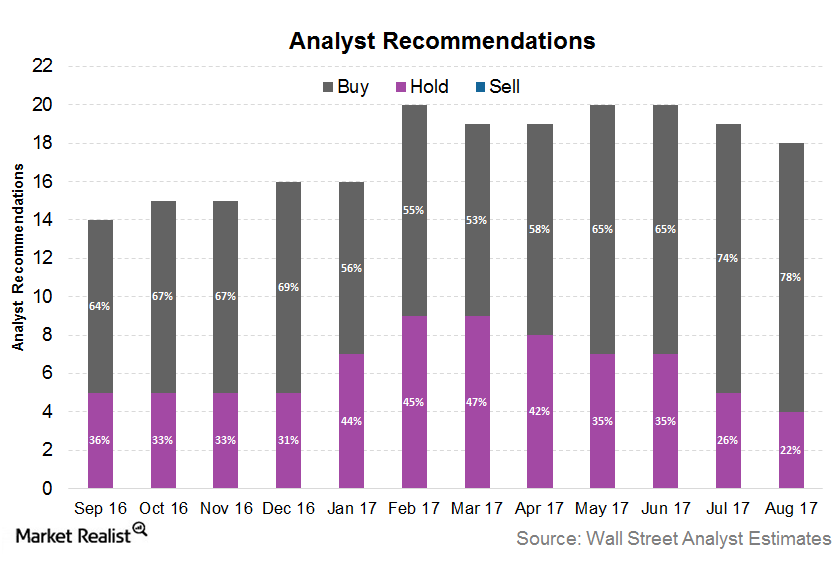

Are Analysts Bullish on Williams Companies?

About 78.0% of analysts rate Williams Companies (WMB) a “buy,” while the remaining 22.0% rate it a “hold” as of August 21, 2017.

These Midstream Players Have Created Maximum Wealth for Investors

In this series, we’ll look at the historical outliers in midstream energy, which have generated massive wealth amid turbulent times.

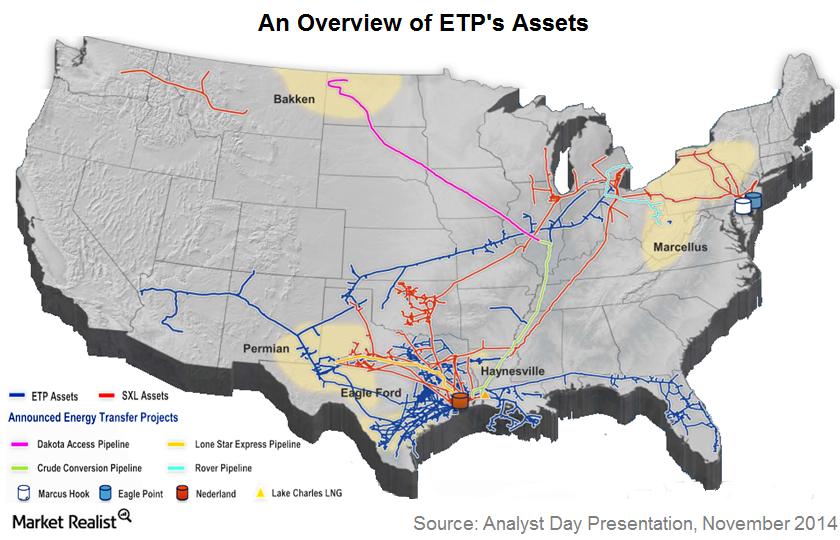

A Review of Energy Transfer Partners’ Business Segments

ETP operates primarily through its six business segments by leveraging its huge asset base.

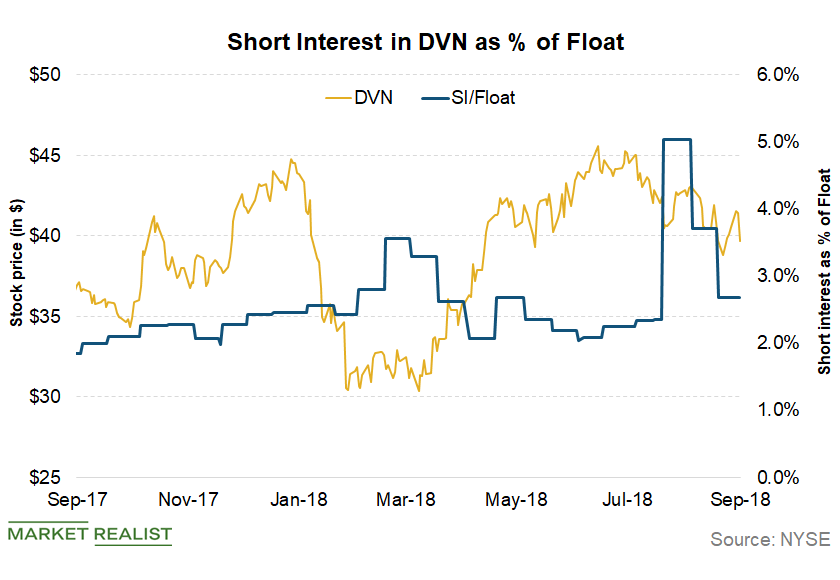

What Devon Energy’s Technical Indicators Tell Us

Devon Energy (DVN) continues to trade below its short-term (50-day) moving average.

Capital World Investors Sold a Major Position in NBL in Q2

So far in this series, we’ve looked at institutional investments in five major oil-weighted E&P (exploration and production) stocks: ConocoPhillips (COP), EOG Resources (EOG), Occidental Petroleum (OXY), Anadarko Petroleum (APC), and Pioneer Natural Resources (PXD).

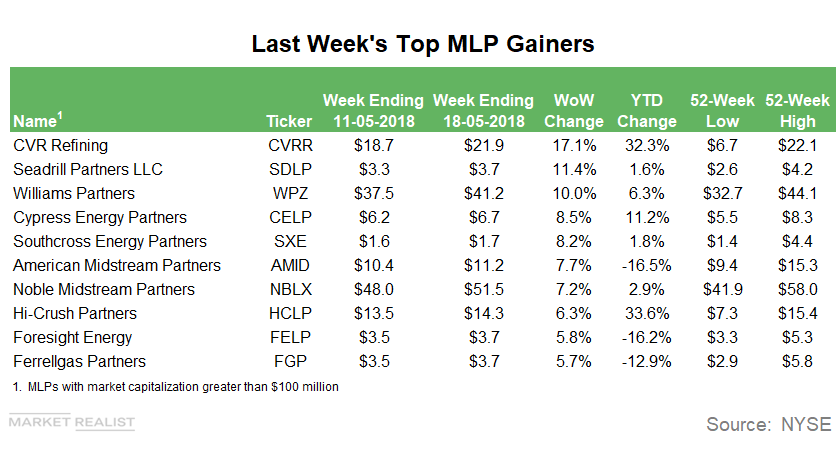

Top MLP Gainers in the Week Ending May 18

CVR Refining (CVRR), a downstream MLP involved in crude oil refining, was the top MLP gainer last week. CVR Refining rose 17.1%.

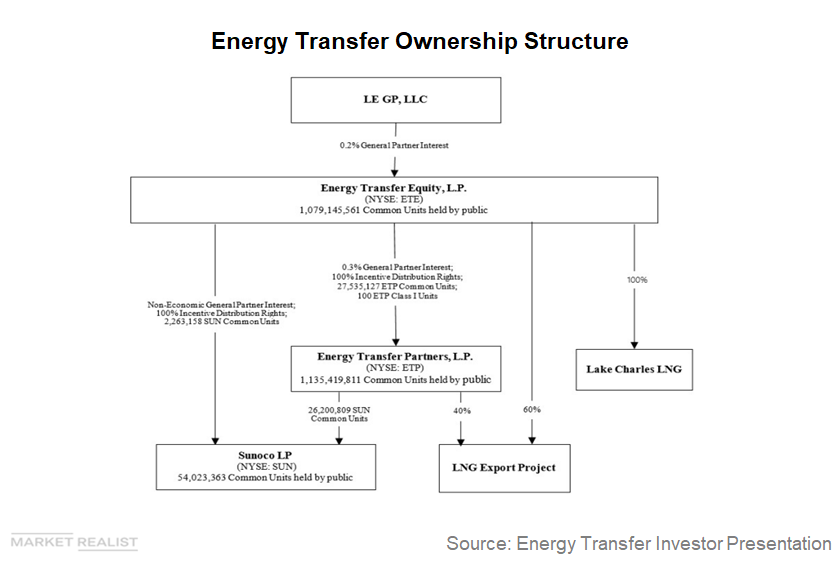

Is Energy Transfer Partners Exploring a C Corporation Structure?

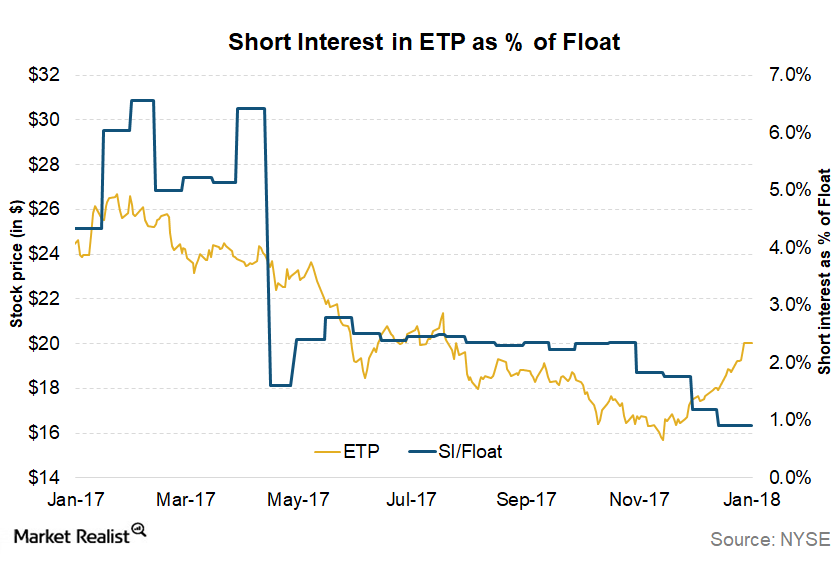

High leverage and a complex capital structure have been a drag on Energy Transfer Partners’ market performance.

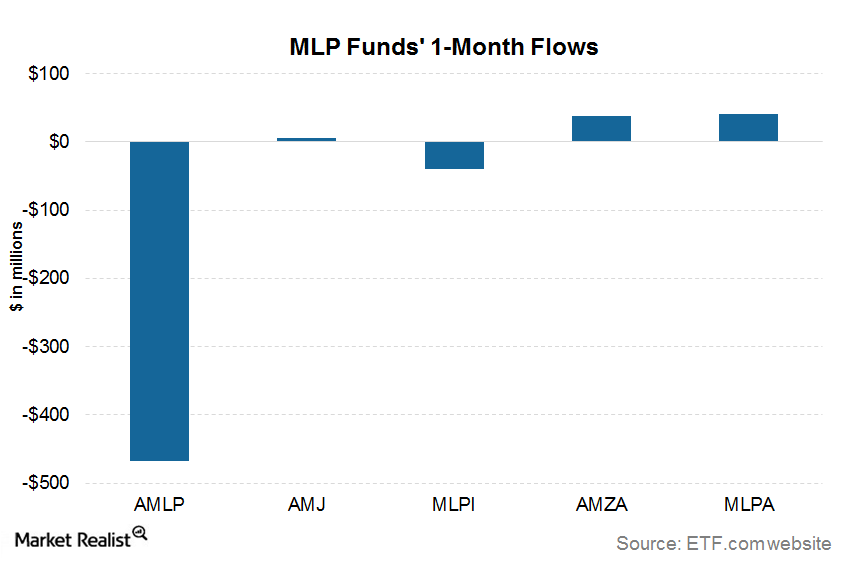

What Do the MLP Funds Flows Indicate?

AMLP has seen a net outflow of $467.8 million over the past one-month period ended March 16, 2018.

Why MLPs Underperformed the Energy Sector Last Week

MLPs underperformed the energy sector and the broader US markets last week. Let’s take a look.

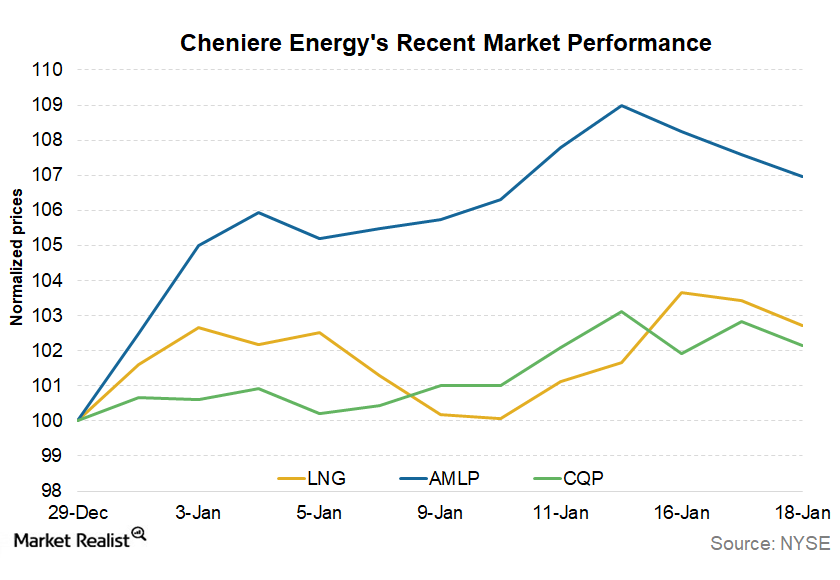

Cheniere Energy Stock after Its 4Q17 Earnings

Cheniere Energy is trading 4.4% above its 50-day simple moving average and 18.0% above its 200-day simple moving average.

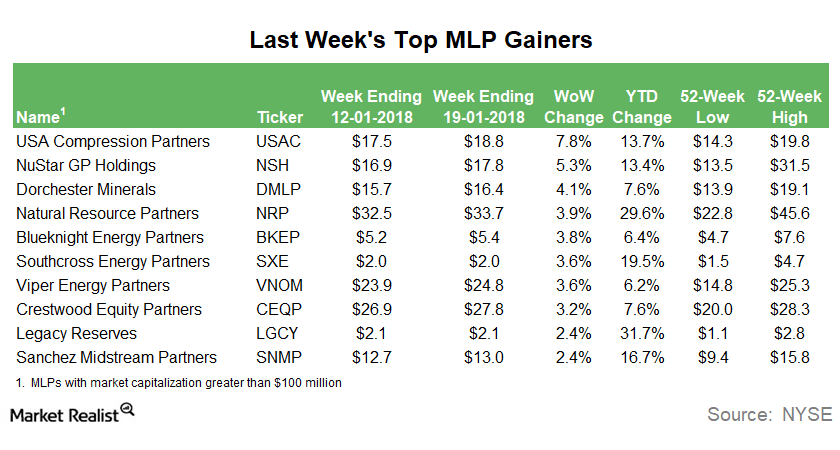

Why USAC Was the Top MLP Last Week

USA Compression Partners (USAC), a midstream MLP involved in natural gas contract compression services, was the top MLP gainer last week with WoW (week-over-week) gains of 7.8%.

MLPs Cool Off after a Strong 2-Week Rally

MLPs (master limited partnerships) cooled off last week, which ended on January 19, after two weeks of a strong rally.

Where Cheniere Energy Could Trade in the Next 7 Days

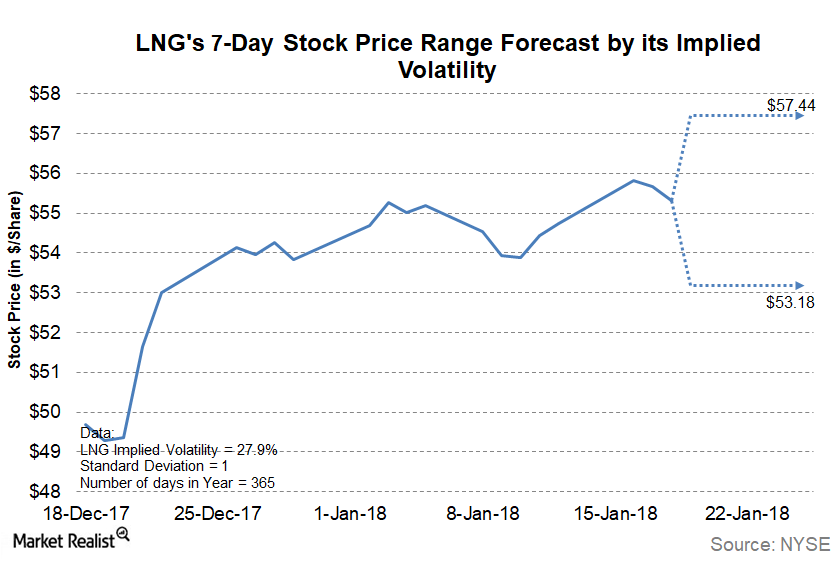

Cheniere Energy’s (LNG) 30-day implied volatility was 27.9% on January 18, 2018, which is slightly higher than its 15-day average of 27.8%.

How the Recent Trafigura Deal Could Boost Cheniere Energy’s Stock

Cheniere Energy’s subsidiary, Cheniere Marketing, recently entered into a long-term SPA (sale and purchase agreement) with Trafigura.

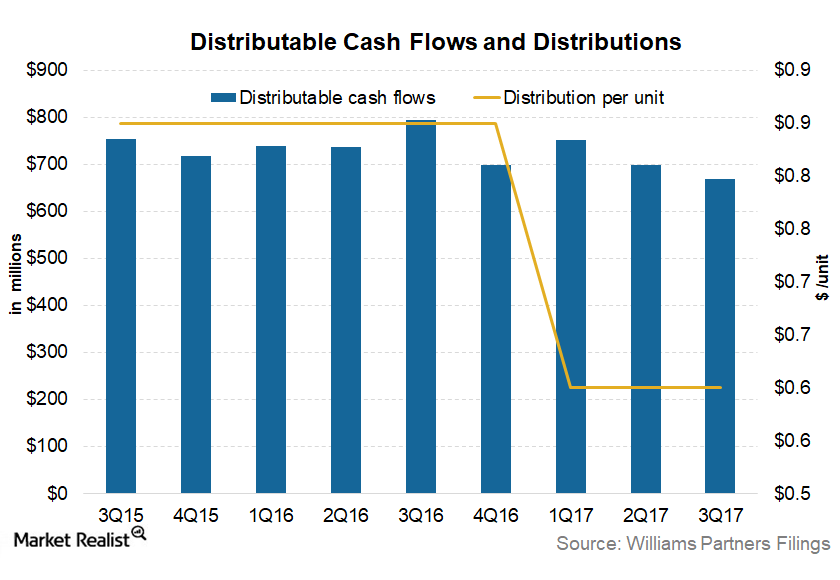

Williams Partners’ Distribution Growth Plans

Williams Partners (WPZ) expects its 2017 distributable cash flow to lie between $2.6 and $2.8 billion. At the midpoint, this range represents a ~9.0% YoY (year-over-year) decline.

How USAC Deal Could Boost ETP’s Market Performance

Energy Transfer Partners (ETP) had a strong start to the year with a rise of ~6.5% in 2018 YTD (year-to-date).

MLPs Continue to Outperform Broader US Markets in 2018

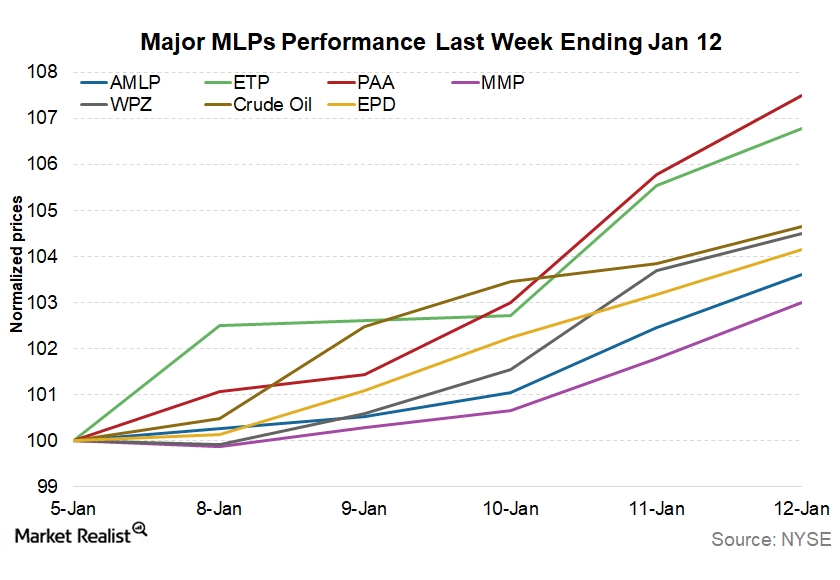

MLPs maintained their winning streak in the second week of 2018. The Alerian MLP Index (^AMZ) rose 4.6% last week and ended at 300.5.

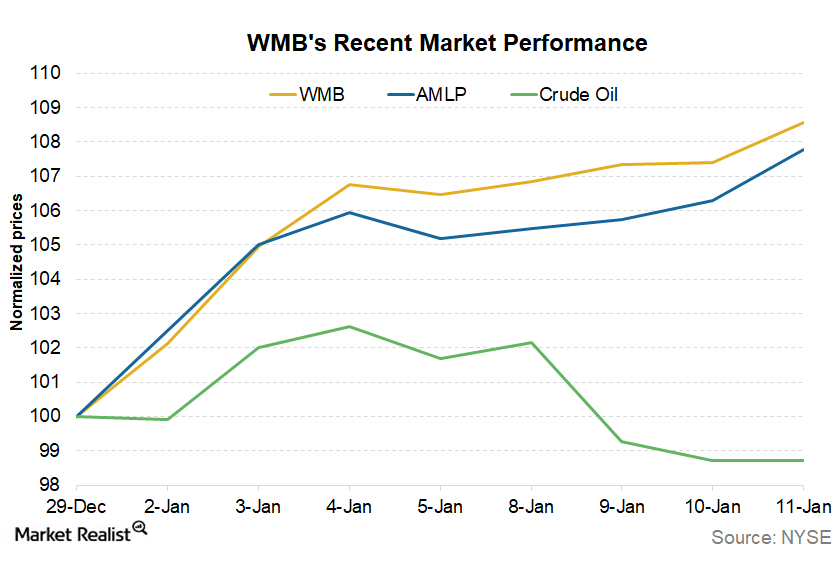

WMB Has Risen ~9% in 2018 So Far: Can the Gains Continue?

Williams Companies (WMB) has had a massive start to the year. It’s risen nearly 9% in seven trading sessions in 2018. Overall, the C corporation GP (general partner) has risen ~14% since the start of December 2017.