Kurt Gallon

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Kurt Gallon

How Do These MLPs Look in 2018?

MLPs had a strong start to the new year. The Alerian MLP Index rose 5% in the first week of 2018.

What’s Driving Cheniere Energy’s Recent Rally?

Cheniere Energy (LNG) has risen 9.7% in the last six trading sessions. It rose 12.1% in December 2017 alone.

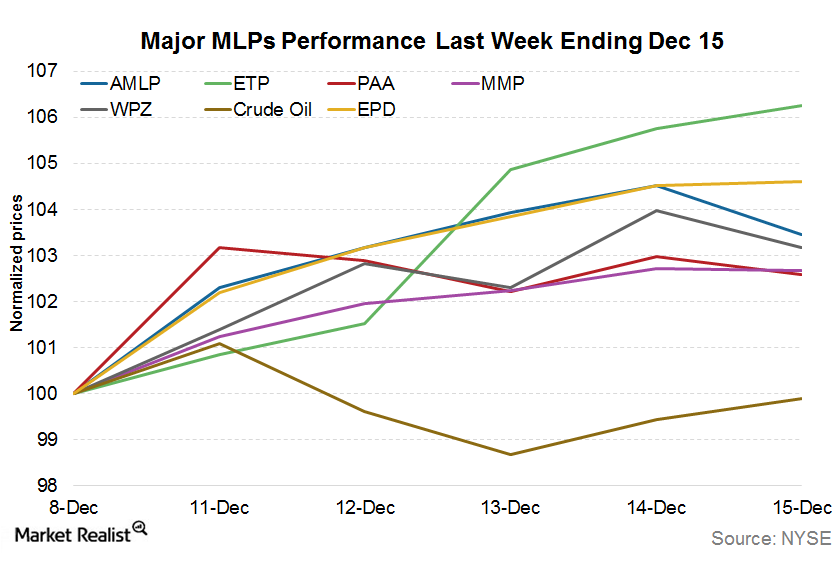

What Drove MLPs in the Week Ending December 15?

MLPs were strong in the week ending December 15, 2017. The Alerian MLP Index (^AMZ) had a strong start last week although it fell slightly on Friday.

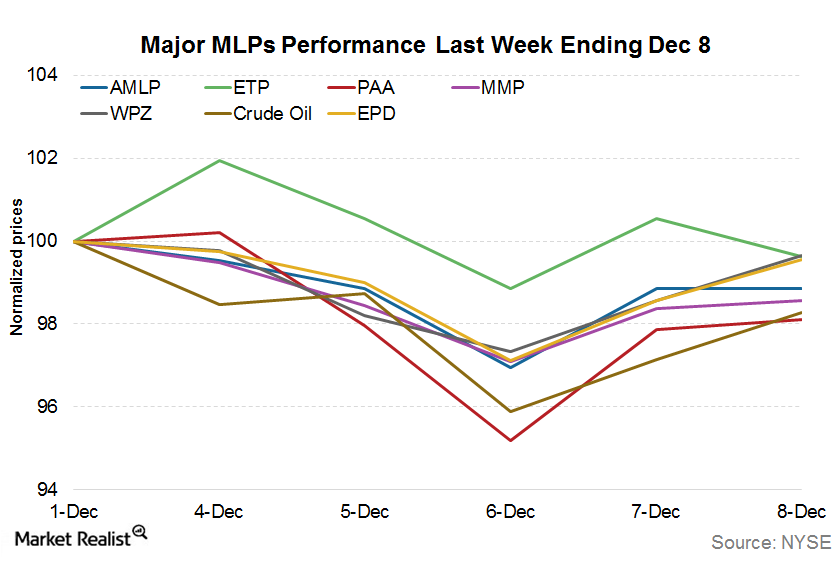

What’s Been Impacting MLP Performances as of December 8?

Most MLPs (master limited partnerships) closed the week ended December 1 in the red, after seeing some gains earlier in the week.

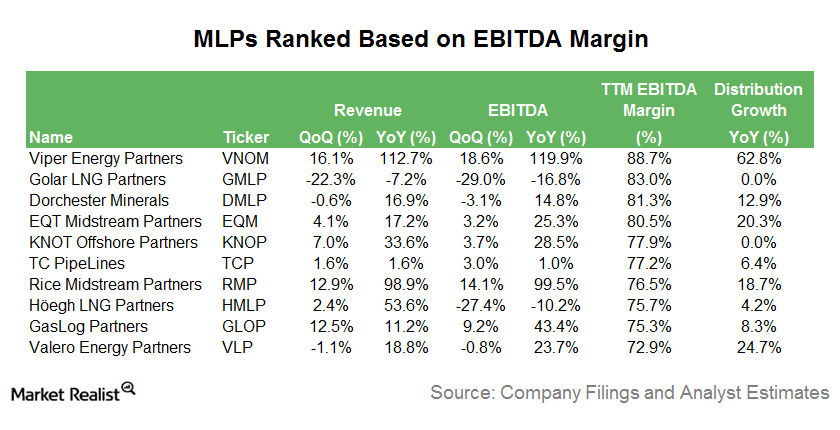

These MLPs Have the Highest Earnings Margins Today

In this series, we’ll assess the performances of the MLPs with the highest EBITDA (earnings before interest, tax, depreciation, and amortization) margins.

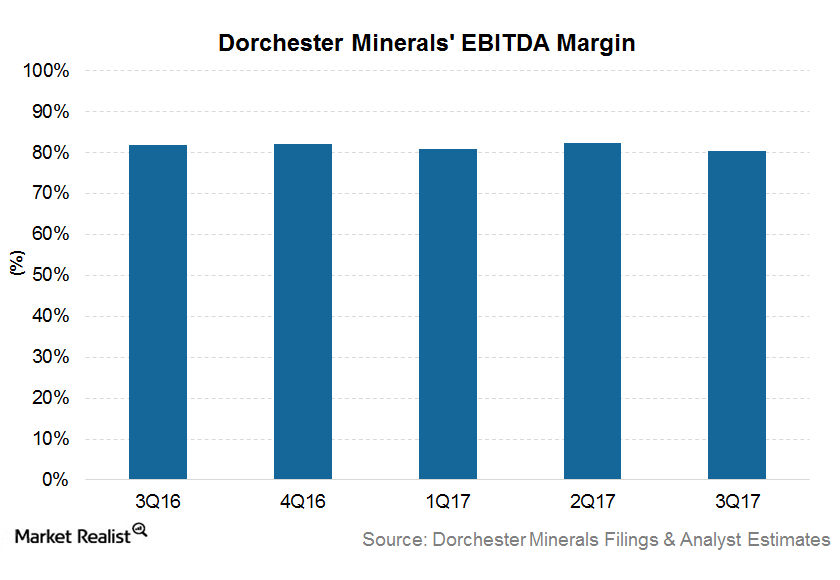

Where DMLP’s Earnings Margin Stands among Top MLPs

Dorchester Minerals, a mineral interest MLP (master limited partnership), has the third-best EBITDA margin among MLPs today.

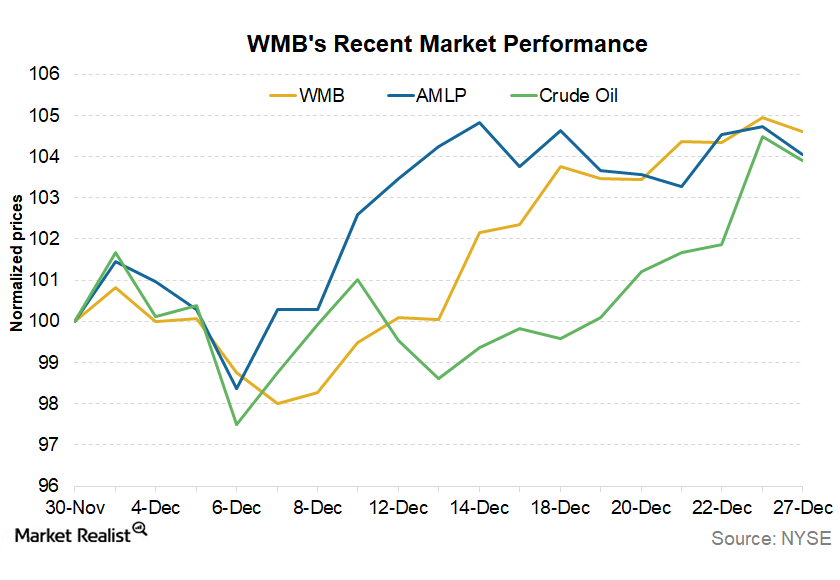

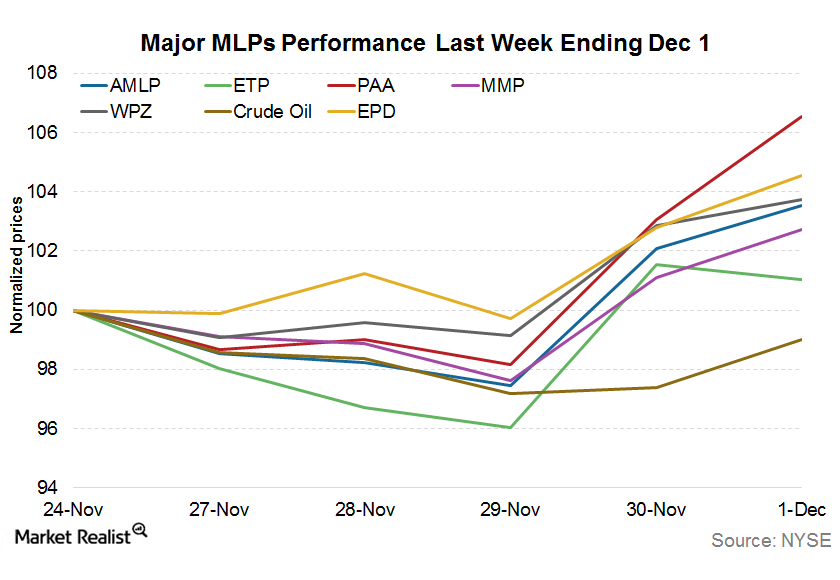

Understanding the Slight Recovery among MLPs Last Week

MLPs (master limited partnerships) recovered slightly last week (ended December 1, 2017), after three weeks of sluggishness.

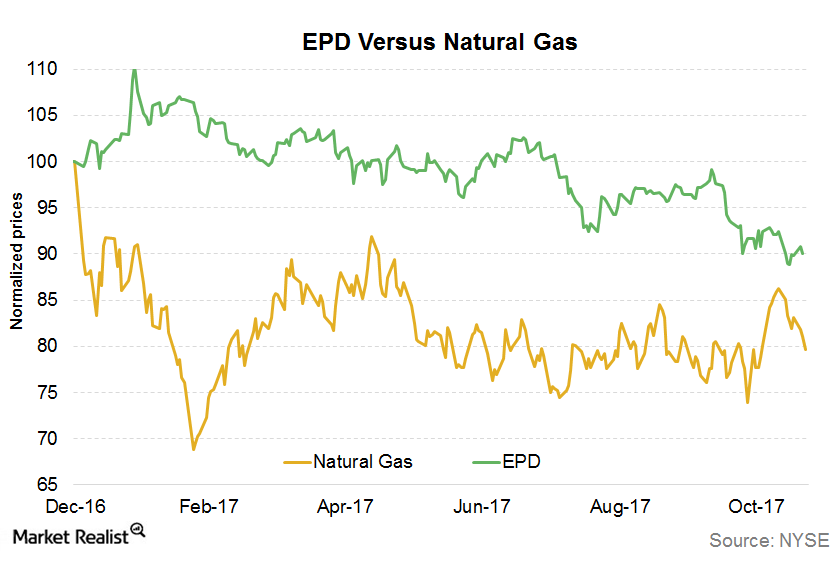

What’s EPD’s Correlation with Natural Gas?

In this article, we’ll look into the commodity price exposure of the MLP at the seventh spot, Enterprise Products Partners (EPD).

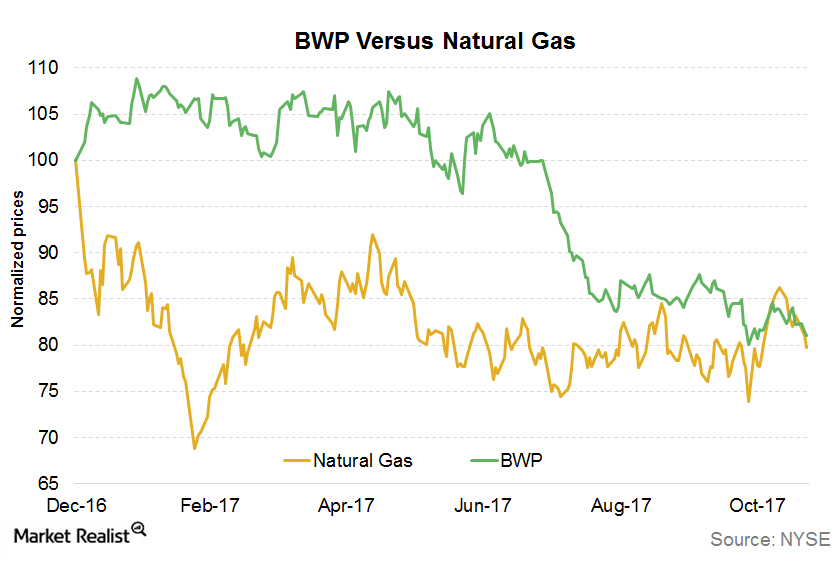

How BWP Correlates with Natural Gas

Boardwalk Pipeline Partners (BWP), a midstream MLP mainly involved in natural gas and NGLs transportation and storage, ranks second among MLPs in terms of correlation with natural gas.

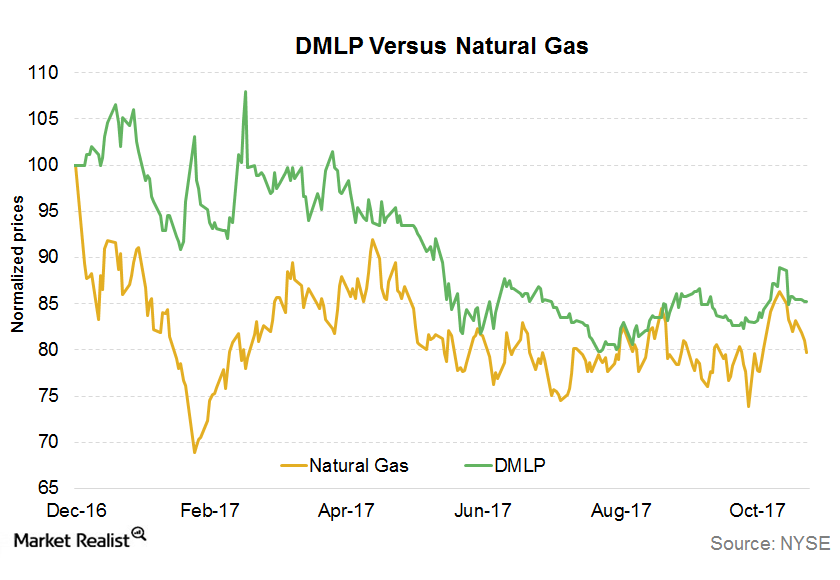

What’s Driving DMLP’s Correlation with Natural Gas?

Dorchester Minerals (DMLP), a royalty interest owner MLP, is in third place in terms of its correlation with natural gas.

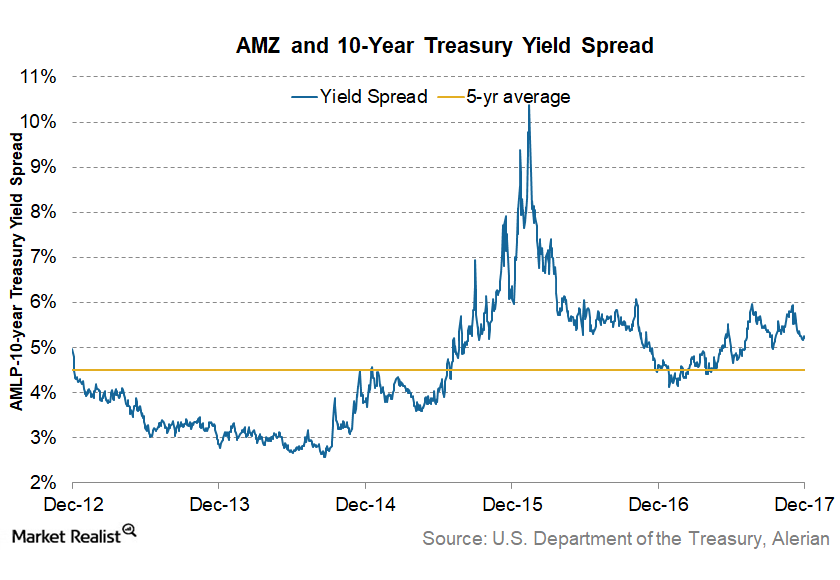

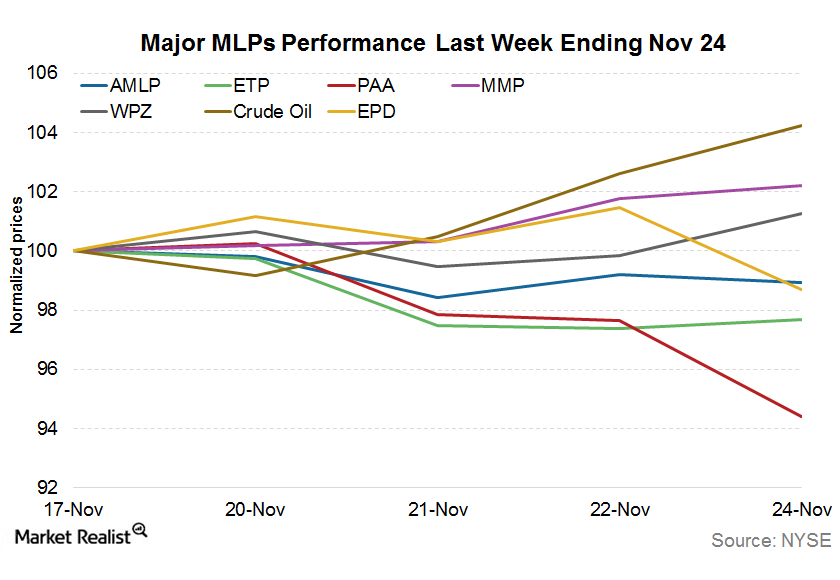

MLPs Were Sluggish despite Strong Crude Oil Last Week

Despite strong crude oil, MLPs’ sluggishness continued last week. The Alerian MLP Index (^AMZ) saw a new 52-week low of $256.7 last week.

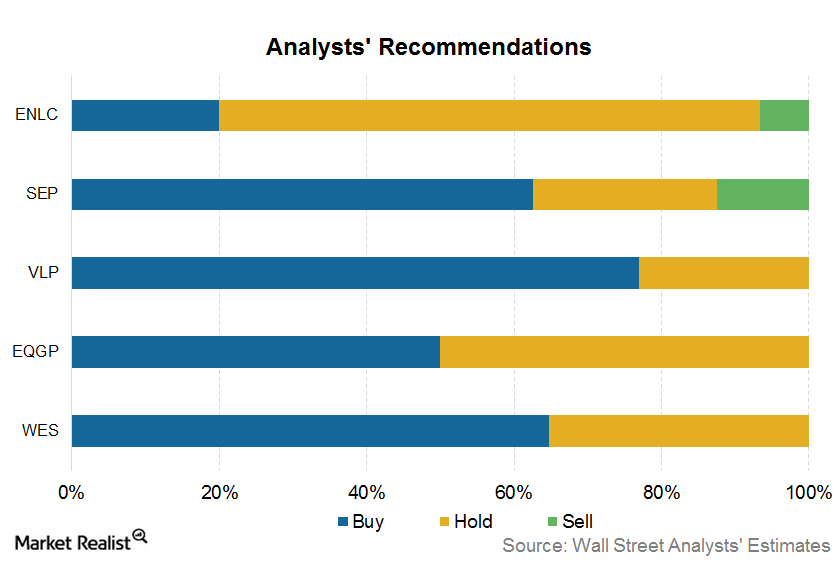

MLP Rating Updates Last Week

EnLink Midstream LLC (ENLC), the GP (general partner) of EnLink Midstream Partners (ENLK), was raised by UBS to a “buy.”

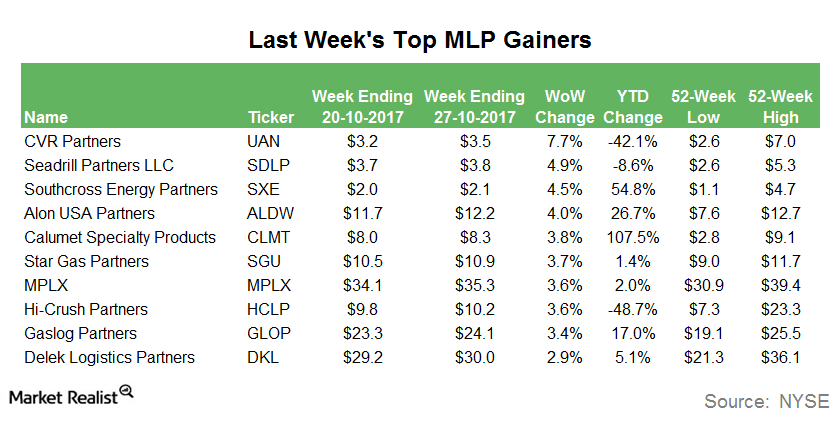

Last Week’s Top MLP Gainers

CVR Partners (UAN), the MLP mainly involved in the production of nitrogen fertilizers, was the top MLP gainer last week. CVR Partners rose 7.7%.

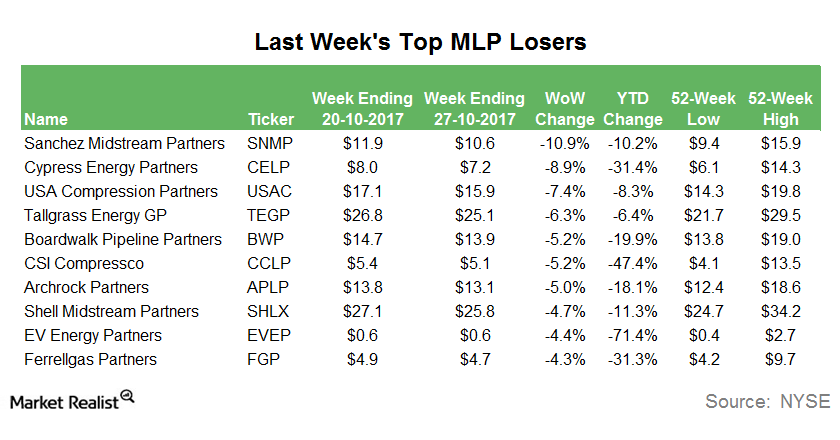

Last Week’s Biggest MLP Losers

Sanchez Production Partners (SNMP), the midstream MLP involved mainly in natural gas gathering, compression, and processing, was the biggest MLP loser last week.

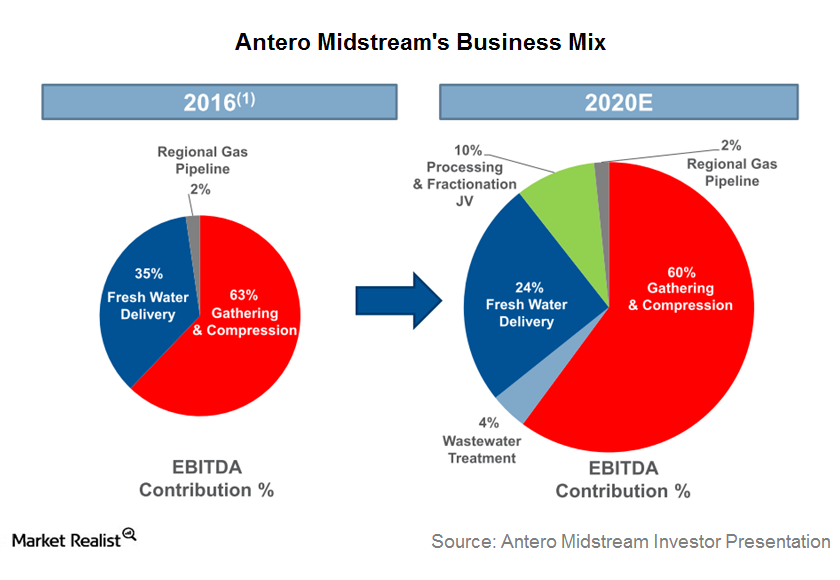

How Antero Midstream’s Business Mix Could Evolve

Antero Midstream Partners (AM) expects its business mix to evolve from current gathering and compression activities to the inclusion of natural gas processing and fractionation activities over the coming years.

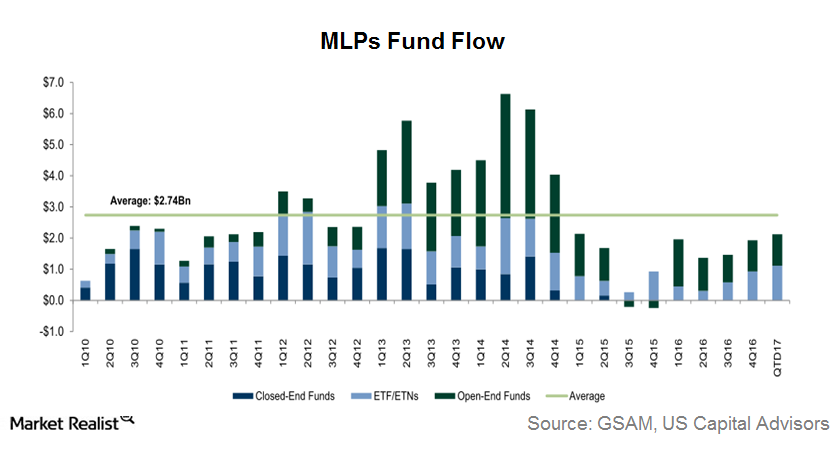

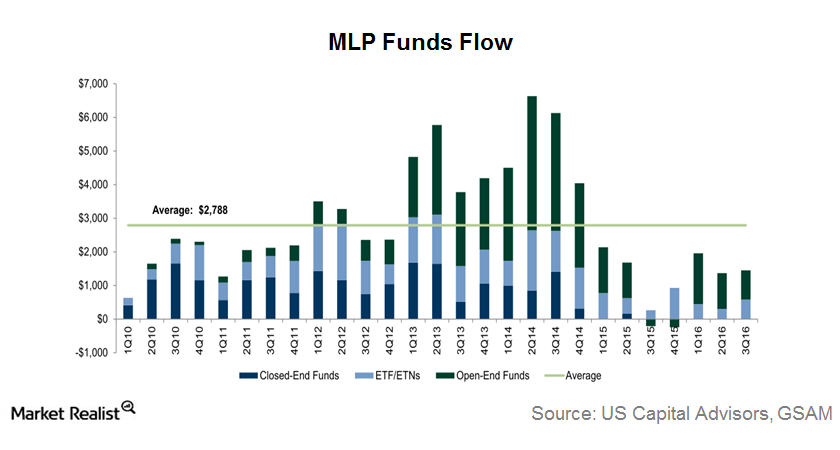

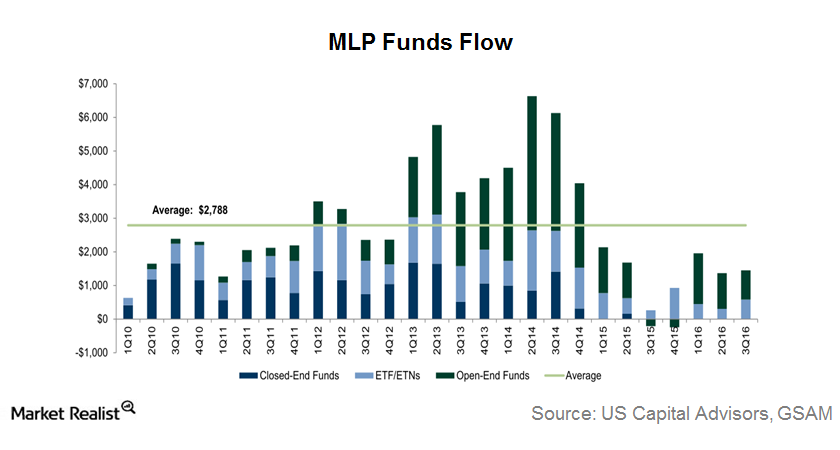

How MLP Funds’ Capital Inflow Improved in 1Q17

MLP funds’ capital inflow has recovered slightly in recent quarters compared to the second half of 2015.

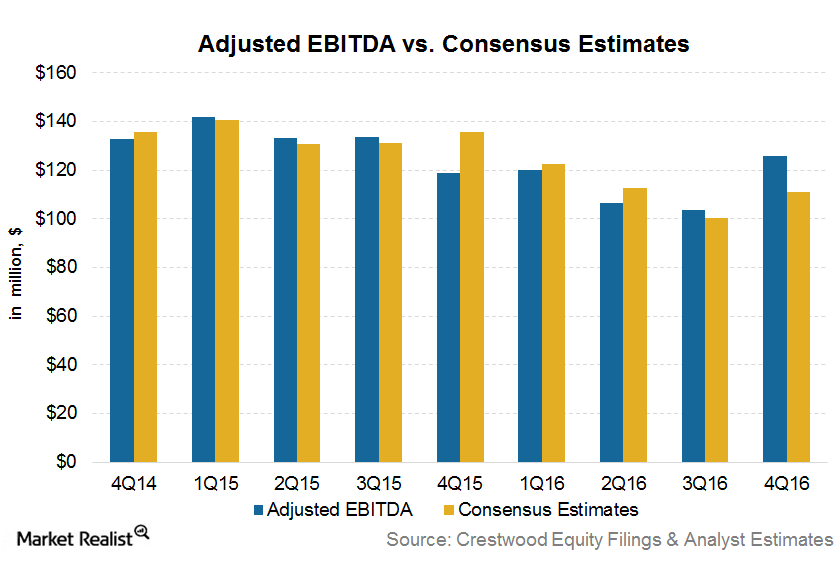

What Drove Crestwood Equity Partners’s 4Q16 EBITDA Growth?

Crestwood Equity Partners (CEQP) reported its 4Q16 earnings on February 21, 2017. Its 4Q16 adjusted EBITDA increased to $125.6 million from $118.9 million in 4Q15, a year-over-year increase of 5.6%.

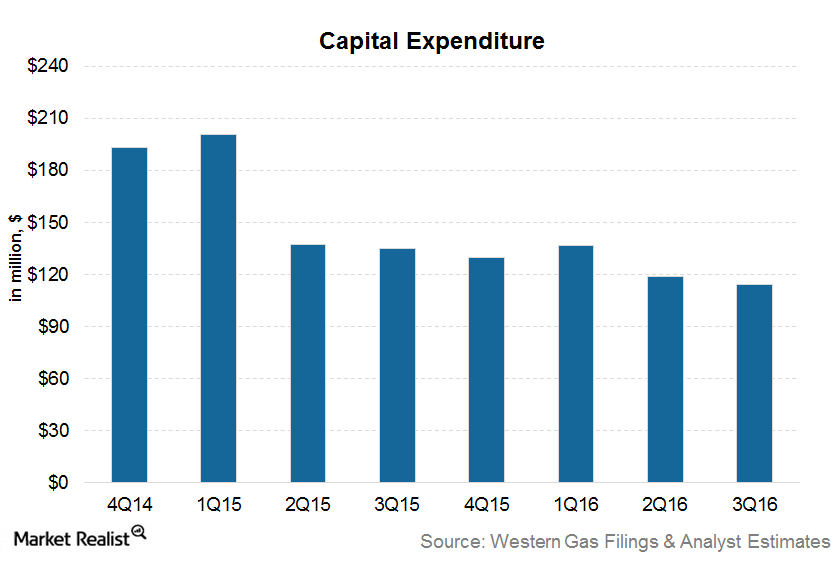

Why Western Gas’s Capital Spending Could Recover in 2017

Western Gas Partners’ (WES) growth capital spending started to decline at the beginning of the rout in energy prices.

Why Institutional Investors Seem Bullish on MLPs in 2017

MLP funds’ capital inflow recovered slightly in 2016 compared to their levels during the second half of 2015.

What Does the MLP Funds Market Look Like?

MLP funds’ capital inflows have recovered slightly in 2016 compared to 2H15. However, their overall capital inflow is still lower than their seven-year average.

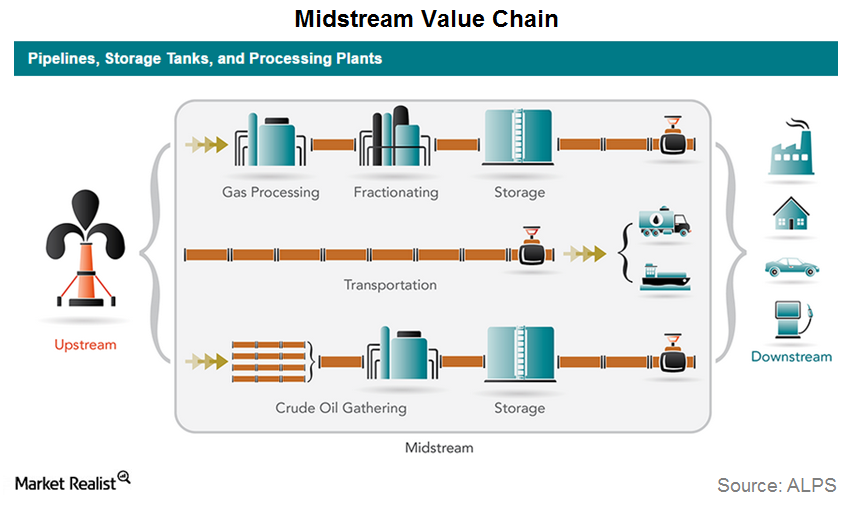

A Look at the Midstream Energy Value Chain

Liquids pipelines and terminaling MLPs, as the name suggests, are involved in crude oil, refined product, and NGLs (natural gas liquids) transportation and storage.

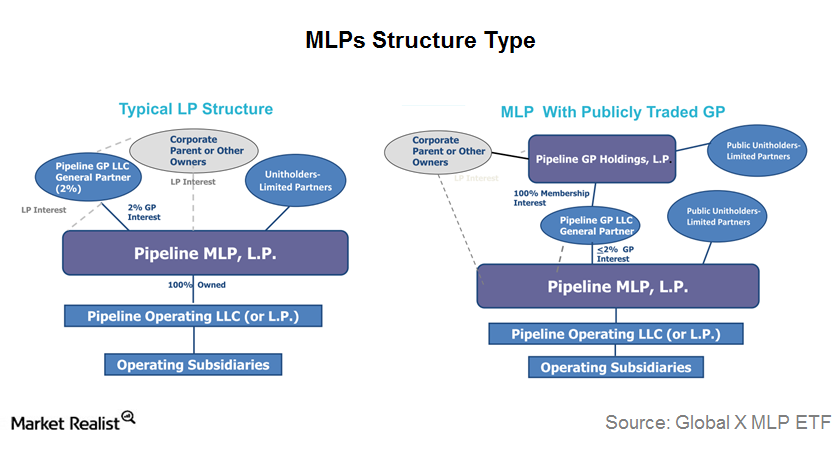

Do MLPs Benefit from the LP-GP Model?

MLPs generally have an LP-GP (limited partner and general partner) model structure in which the LP is a publicly traded entity and owns the majority of the operating assets.

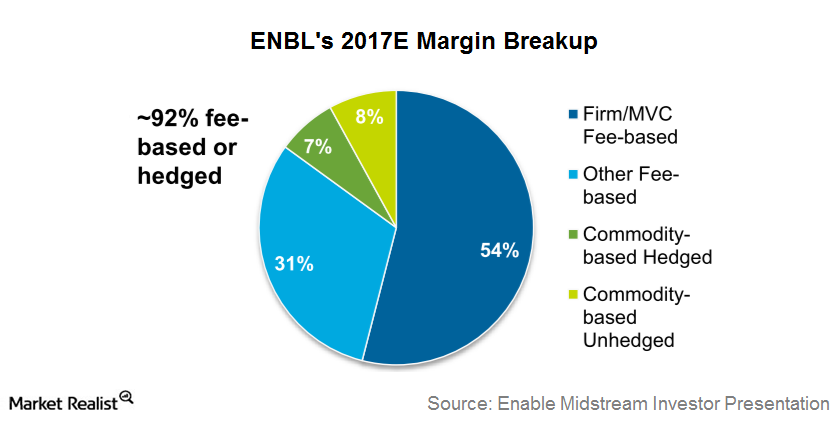

Getting Familiar with MLP Contracts

In this article, we’ll look at types of MLP contracts for midstream MLPs. Midstream MLPs generally have fixed-fee contracts.

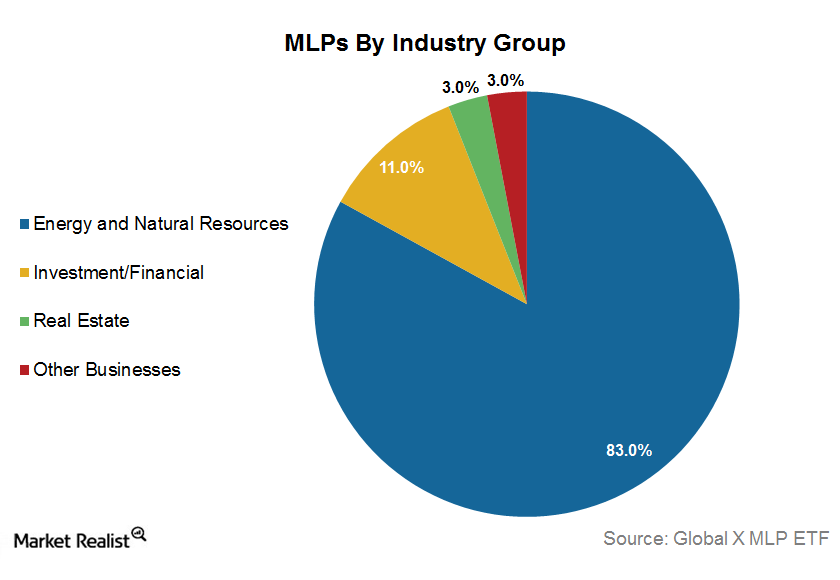

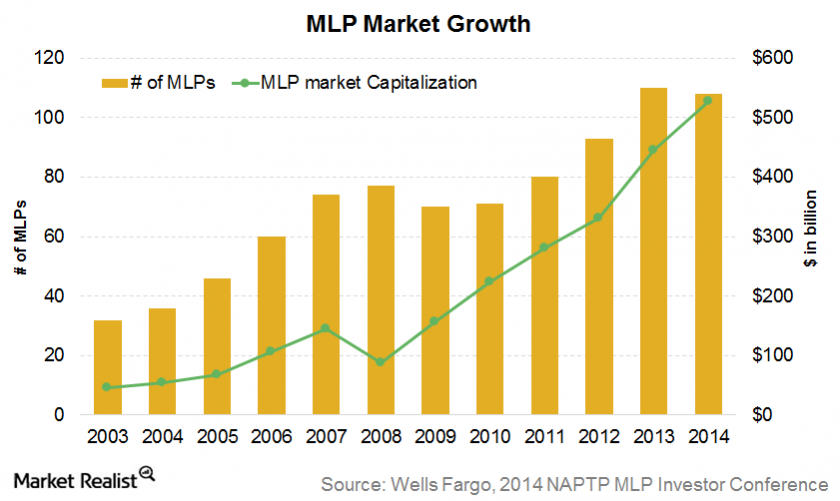

What You Should Know about Master Limited Partnerships

The number of MLPs has risen from a mere 32 in 2003 to 117 as of November 2016. 83% of total MLPs are energy and natural resources–related.

How Much Have MLP Fund Inflows Improved in 2016?

MLP funds’ capital inflows have recovered in 2016 from levels in 2H15. But overall capital inflows are lower than the seven-year average of $2.8 billion.

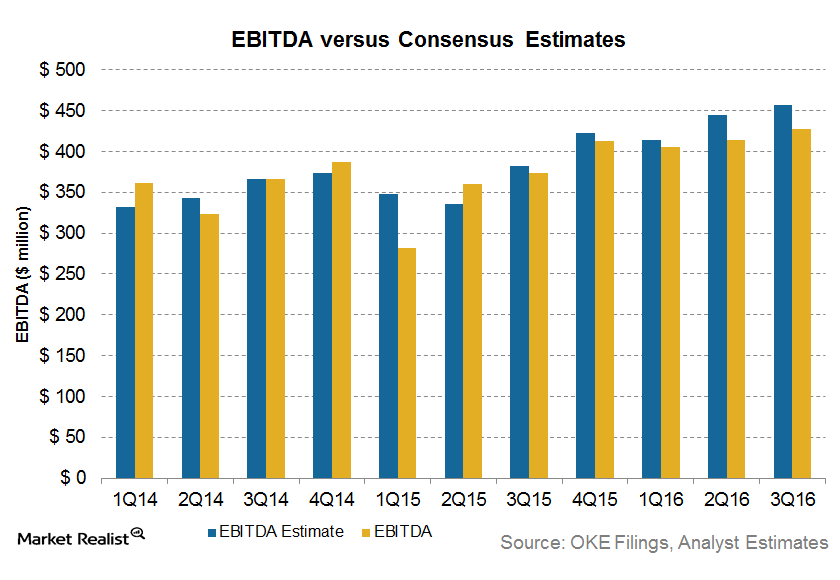

What Drove ONEOK’s 3Q16 Earnings Growth?

ONEOK (OKE) reported its 3Q16 results on November 1, 2016, after the market closed. Its 3Q16 analyst-adjusted earnings before interest, tax, depreciation, and amortization rose 14.4% from 3Q15.

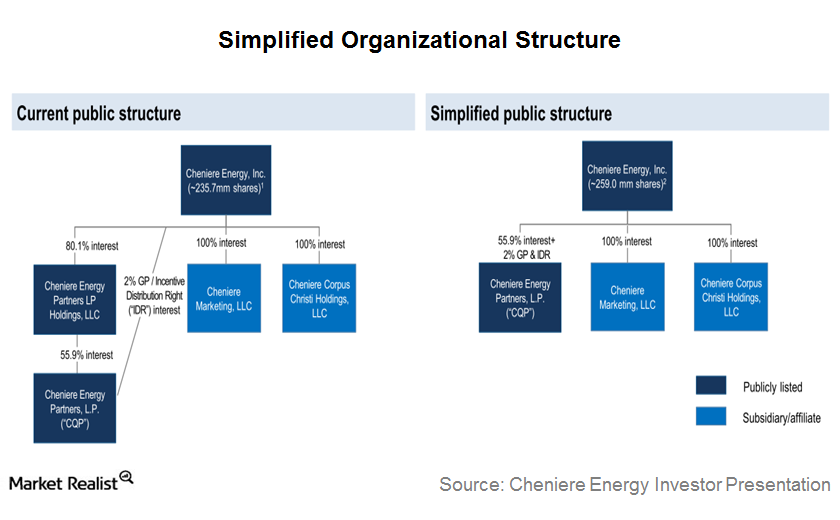

Cheniere Energy to Buy Remaining Stake in CQH for ~$1 Billion

Cheniere Energy (LNG) is looking to simplify its organizational structure by acquiring its remaining stake in Cheniere Energy Partners LP Holdings (CQH).

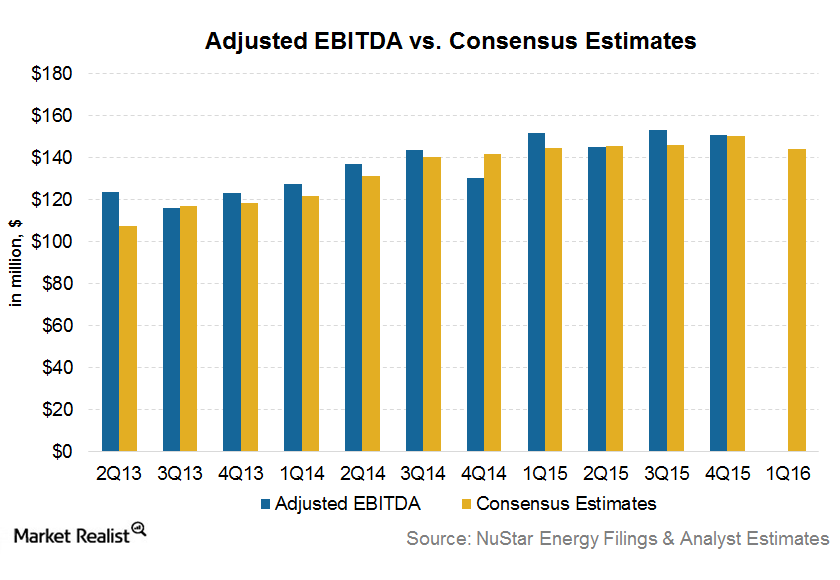

Analyzing NuStar Energy’s 1Q16 EBITDA Estimates

NuStar Energy is expected to release its 1Q16 earnings on April 27. Wall Street analysts’ 1Q16 consensus EBITDA estimate for NuStar Energy is $144.3 million.

Where Does Kinder Morgan Stand Compared to Its Peers?

Kinder Morgan (KMI) is the largest company in the peer group by enterprise value (or EV).

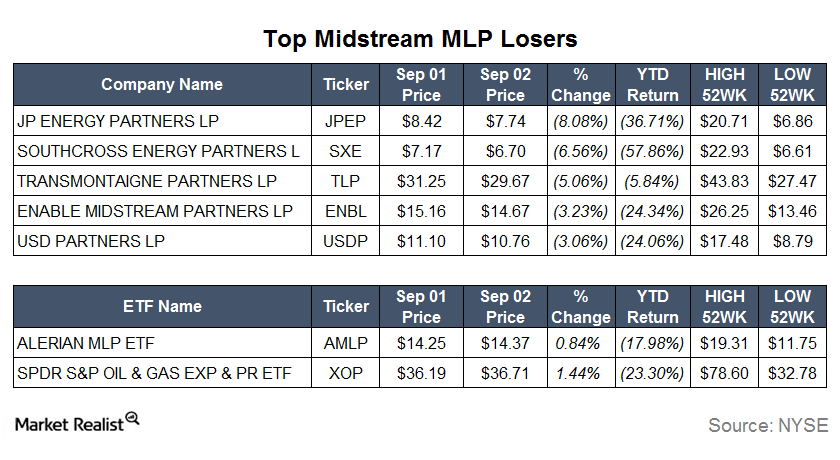

JP Energy Partners: Top Midstream MLP Loser on September 2

JP Energy Partners (JPEP) was the top loser among midstream MLPs at the end of trading on September 2, falling 8.08%. JPEP stock has been on a roller coaster ride for the past few days.

An Overview of Breitburn Energy

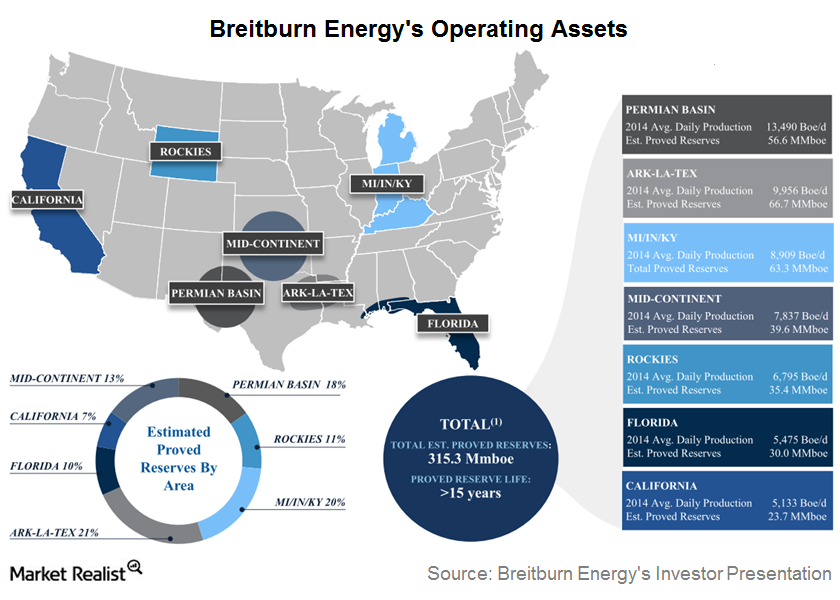

Breitburn Energy completed a few acquisitions in late 2014 to boost its total production. In November 2014, the partnership completed its merger with QR Energy.

Kinder Morgan’s Outlook for the Rest of 2015

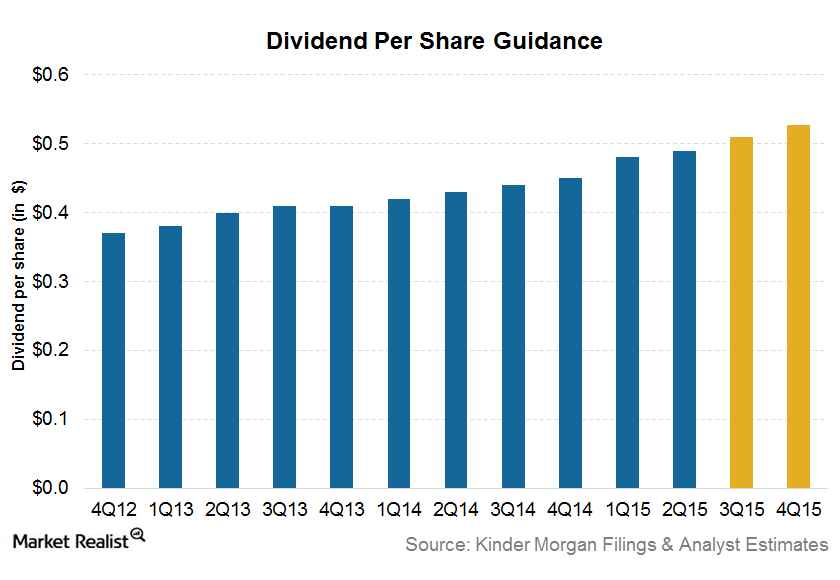

According to Wall Street analysts’ consensus outlook, Kinder Morgan’s (KMI) dividend is expected to grow by ~15.3% year-over-year by the end of 2015.

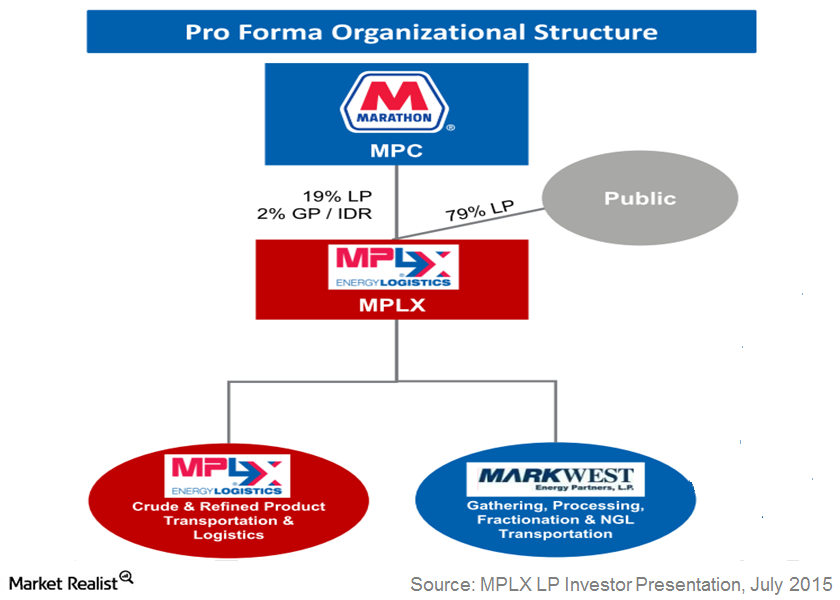

MarkWest-MPLX Merger: Big News for the Midstream Energy Sector

In a press release published on July 13, 2015, MarkWest Energy Partners (MWE) and MPLX LP (MPLX) announced that the two MLPs have agreed to merge.

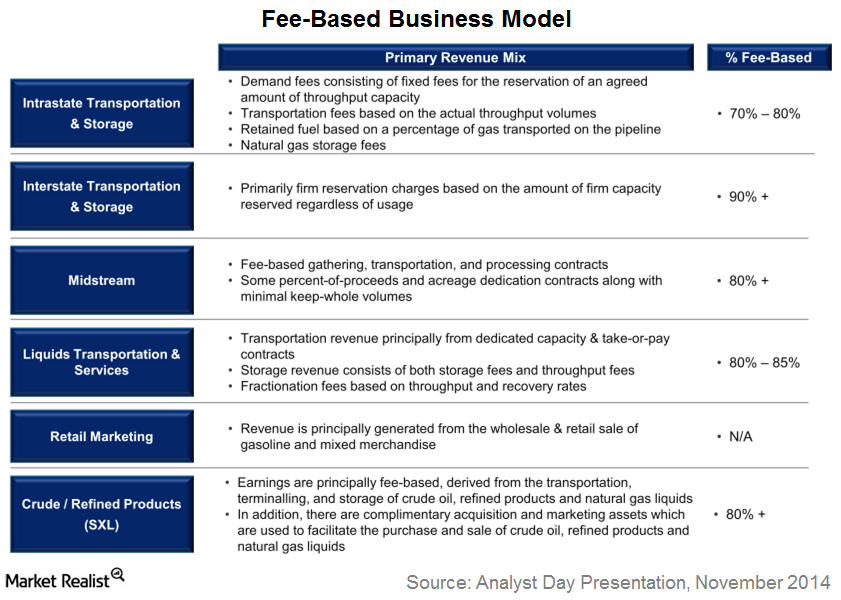

Energy Transfer Partners’ Fee-Based Model Drives Performance

Considering the rock solid performance of ETP during the slump in energy prices, it is clear that ETP has more fee-based contracts.

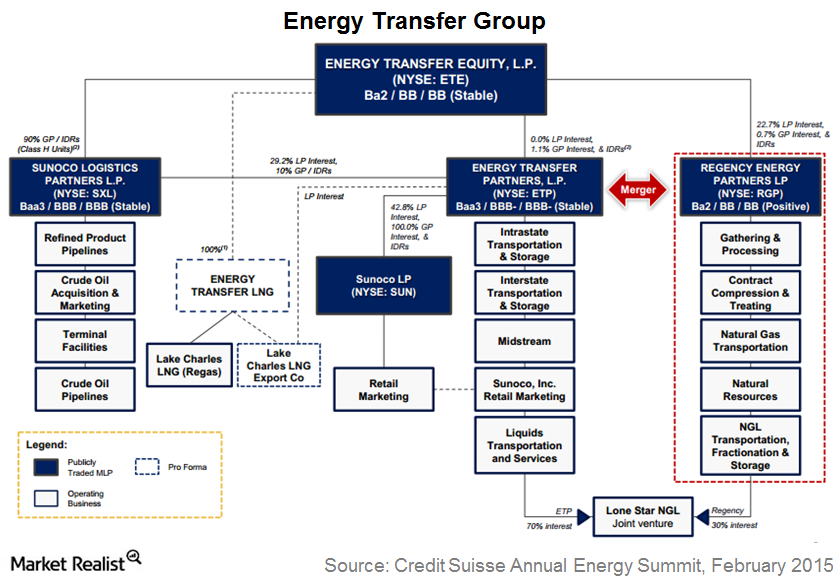

A Must-Know Overview of Energy Transfer Partners

Energy Transfer Partners (ETP) is one of the largest publicly traded master limited partnerships in the US in terms of equity market capitalization.

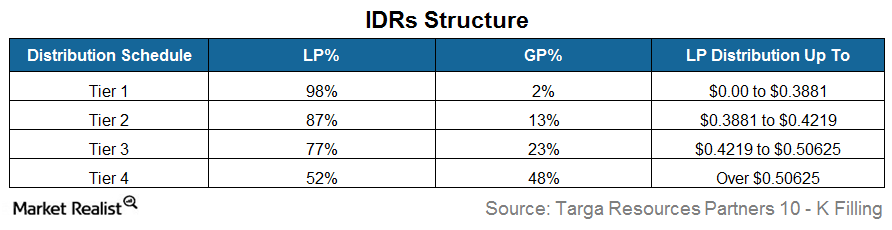

IDRs: How Do They Impact MLPs?

IDRs entitle the GP to receive a higher percentage of incremental cash distributions after certain target distribution levels have been achieved for the LP unitholders.

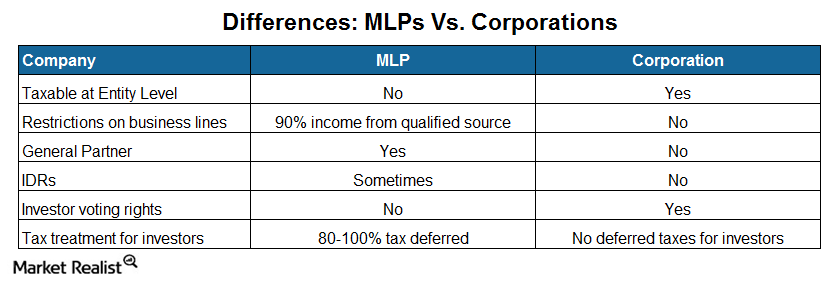

Analyzing the Differences: MLPs versus C Corporations

MLPs’ tax structure is the major difference that separates them from C Corps. MLPs’ earnings aren’t taxed at the partnership level. The taxes are passed to the unitholders.

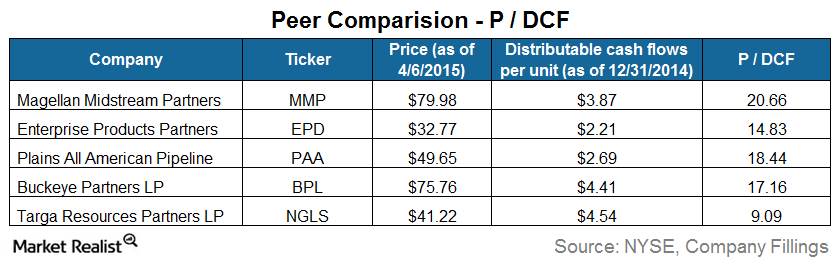

Valuing MLPs: Price-to-Distributable Cash Flow Ratio

MLPs’ valuations are different from other stocks. To value MLPs, the widely used PE ratio isn’t as useful as the PDCF ratio.

What Investors Need to Know about MLPs

MLPs are engaged in the production, transportation, storage, and processing of natural resources like oil, natural gas, and NGLs. They’re public companies.