Financial Select Sector SPDR® ETF

Latest Financial Select Sector SPDR® ETF News and Updates

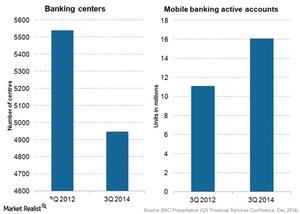

Why consumer banking is important for Bank of America

Consumer and Business Banking is Bank of America Corporation’s (BAC) largest segment. It contributes about a third of the bank’s total revenues.

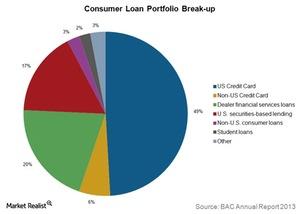

Card loans rule Bank of America’s consumer loan portfolio

Credit card loans account for more than half of Bank of America’s total consumer loan portfolio.

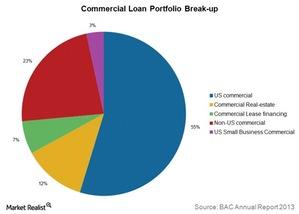

Why Bank of America’s commercial loan portfolio is diversified

In addition to assessing the credit profile of the borrower, Bank of America ensures that loans aren’t too concentrated by industry, geography, or customer.

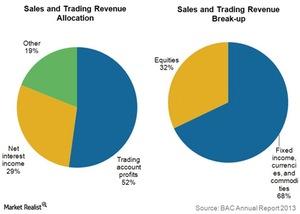

Bank of America’s Global Markets operations

Bank of America’s (BAC) Global Markets segment offers sales and trading services across asset classes to institutional clients.

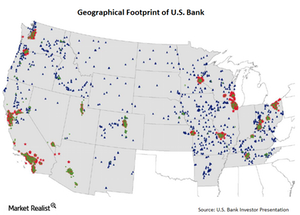

A brief overview of U.S. Bank

We’ll provide an overview of U.S. Bank. It’s the fifth largest retail bank in the US—by deposits and assets. At the end of September 2014, it held $391 billion in assets.

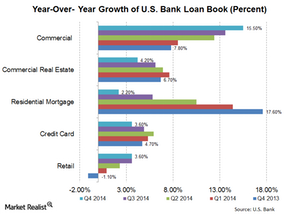

Why U.S. Bank’s loan growth showed interesting trends

You need to understand loan categories better in order to see some very interesting trends in U.S. Bank’s loan growth. Its loans are divided into five main categories.

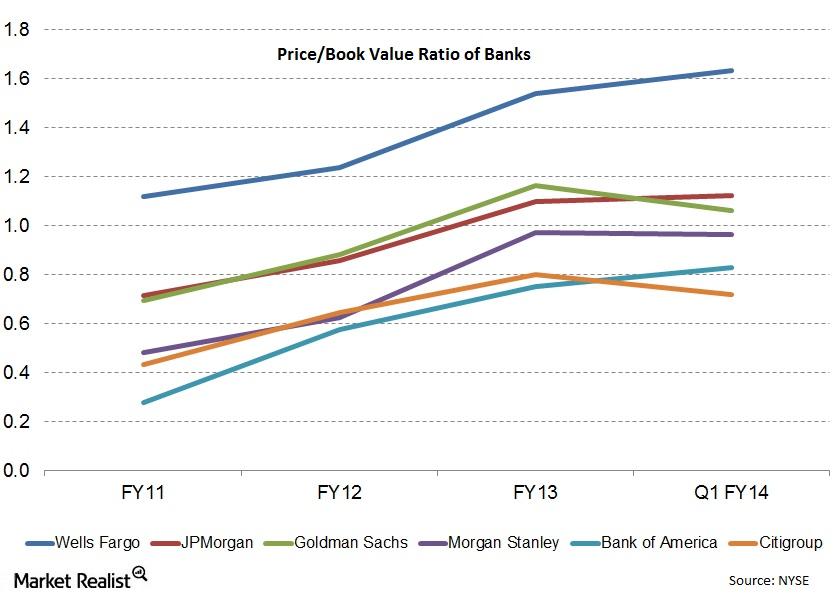

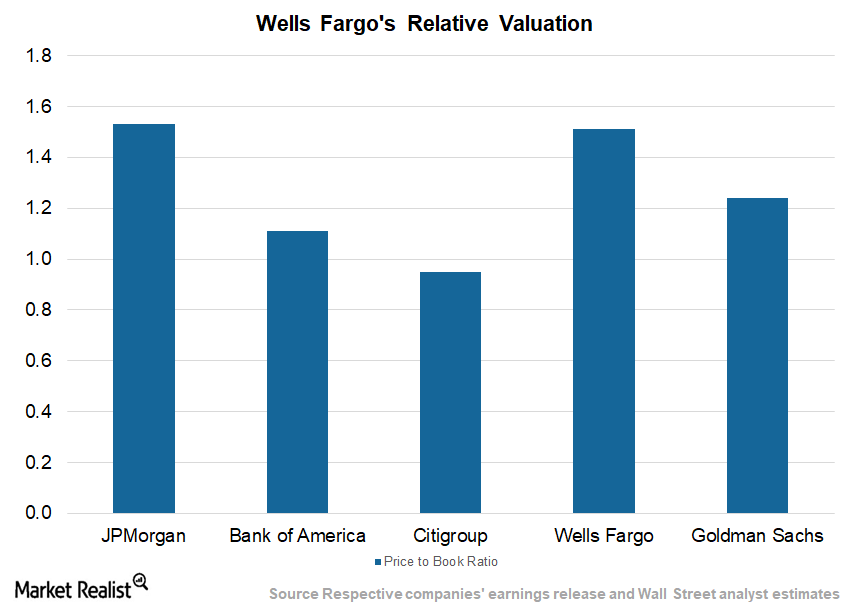

Why the price-to-book value ratio’s the most used valuation

The price-book value ratio is the ratio of the market value of equity to the book value of equity. Price stands for the current market price of a stock. Book value is the total assets minus liabilities, or net worth, which is the accounting measure of shareholders’ equity in the balance sheet.

Must-Know: Credit and Liquidity Risks in Banking

The top risks that every bank faces are credit risk and liquidity risk. We’ll look at the banks that managed this risk safely, and those that didn’t.

Bank of America Stock: Analyzing the Uptrend

Bank of America (BAC) has impressed investors with its financial performance. We expect Bank of America to sustain the momentum in 2019.

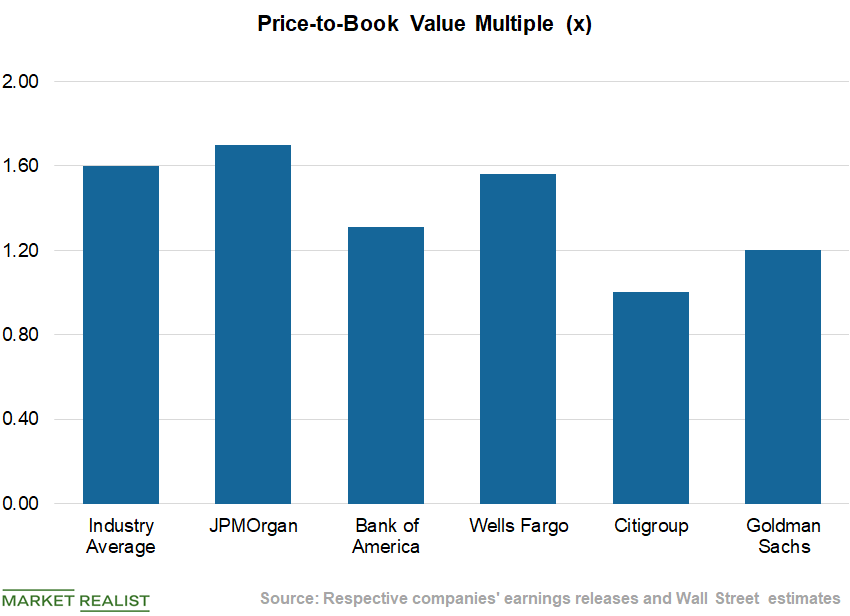

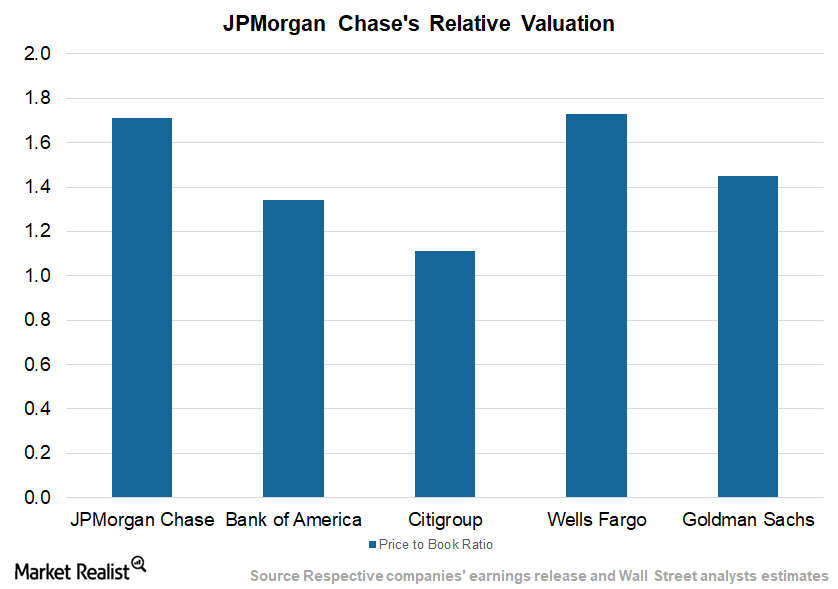

A Look at the Top Five US Banks’ Valuations

On a TTM basis, JPMorgan Chase trades at a price-to-book ratio of 1.7x, while the industry average stands at 1.6x.

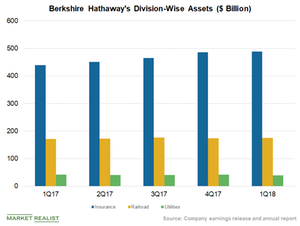

How Will Berkshire Deploy Its Cash Pile of over $100 Billion?

Berkshire Hathaway (BRK.B) was sitting on liquidity of $118 billion at the end of the first quarter.

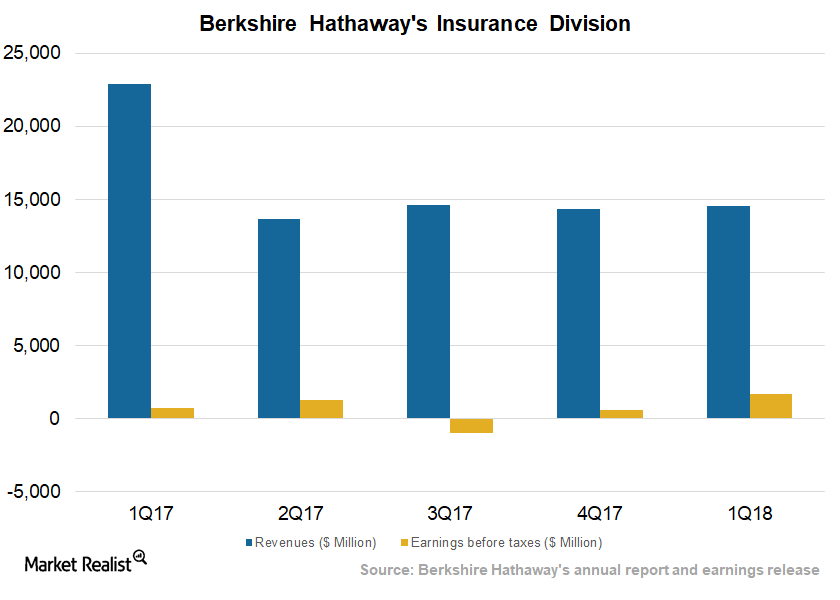

Berkshire’s Insurance Segment Benefits From Fewer Claims

In 1Q18, Berkshire Hathaway’s (BRK.B) insurance revenue fell YoY (year-over-year) to $14.6 billion from $22.9 billion.

What’s JPMorgan Chase’s Valuation?

JPMorgan Chase (JPM) stock has generated a return of 21.0% in the last six months and 31.3% over the past year.

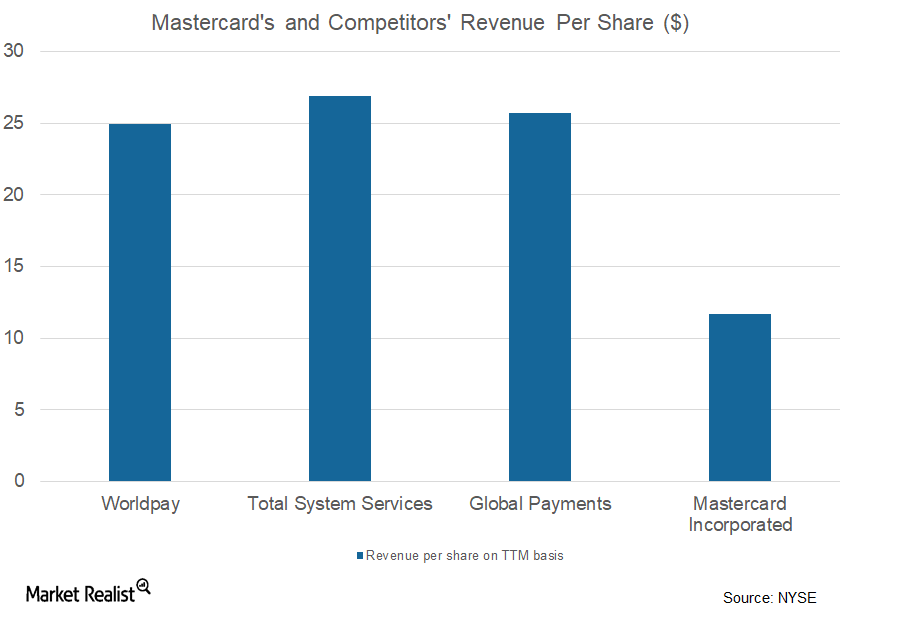

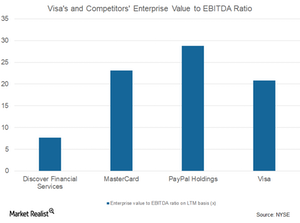

What Are Mastercard’s Growth Strategies?

Over the past few years, Mastercard’s (MA) revenues have remained consistent.

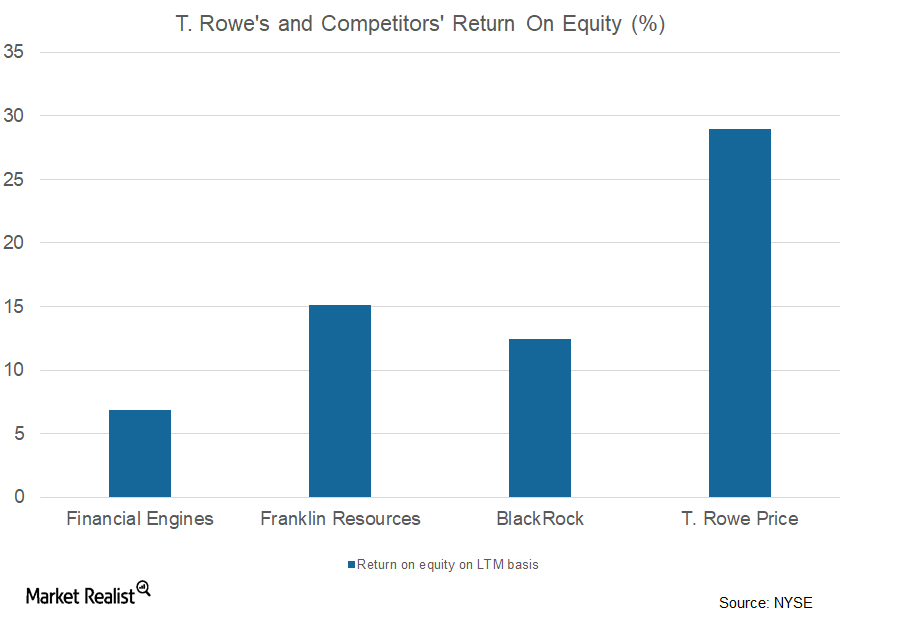

A Look at T. Rowe Price’s Assets under Management

Asset classes In its investor presentation on February 21, 2018, T. Rowe Price (TROW) stated that its core business is helped by the allocation of its AUM (assets under management) in different asset classes and its strong client base. However, the company also believes that targeting new opportunities is crucial for its core business. Of its total AUM, […]

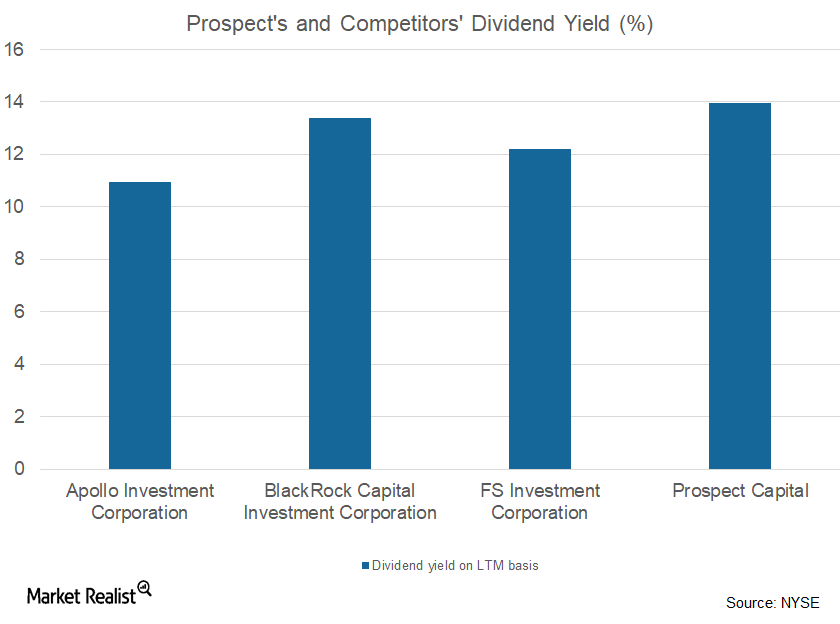

Why Prospect’s Investment Income Fell

In fiscal 2Q18, Prospect Capital’s (PSEC) total investment income was $162.4 million compared to $183.4 million a year earlier.

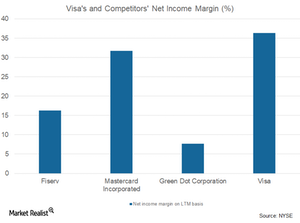

Inside Visa’s Operating Expenses

Visa (V) saw a rise of 13% in total operating expenses on a YoY (year-over-year) basis in fiscal 1Q18. It incurred $1.5 billion in expenses in fiscal 1Q18 compared to $1.4 billion a year earlier.

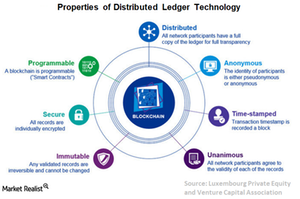

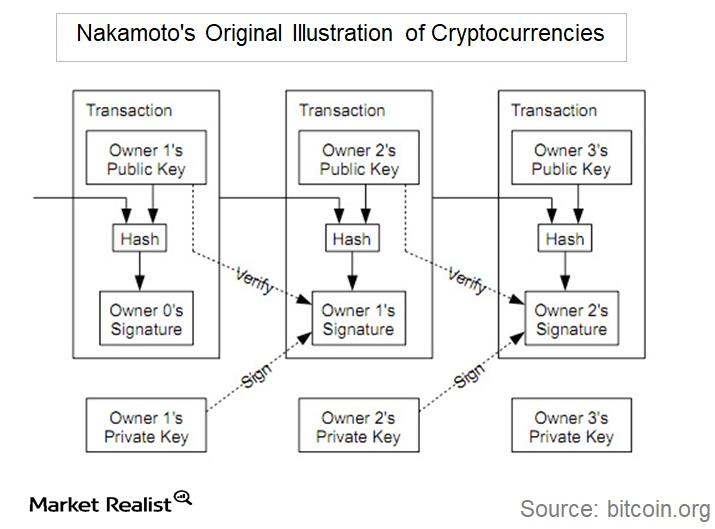

What Imparts Transparency to Digital Assets?

Digital assets based on DLT (distributed ledger technology) allows users to initiate and verify their own transactions without any central authority such as banks.

Blockchain and Bitcoin: But What Else Is Blockchain Used For?

Deutsche Bank is planning to use blockchain technology in currency settlement, trade processing, and derivative contracts.

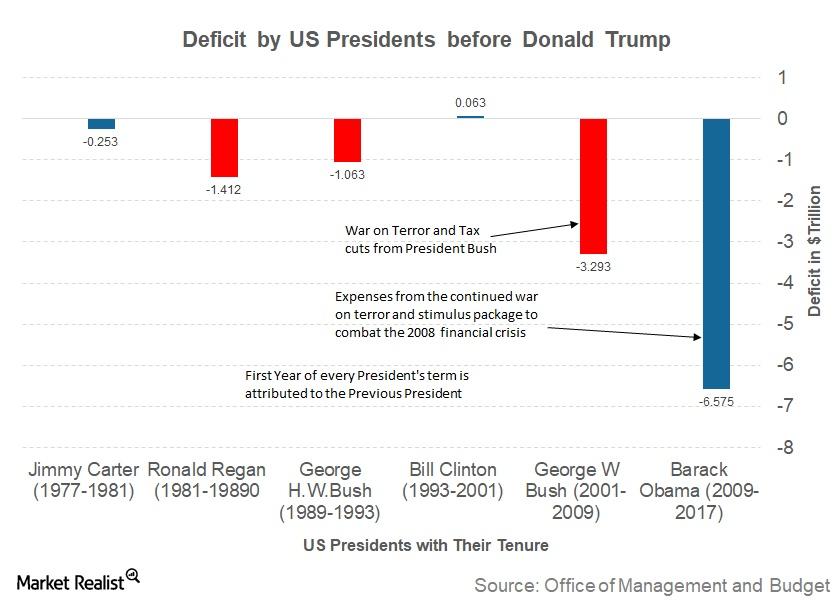

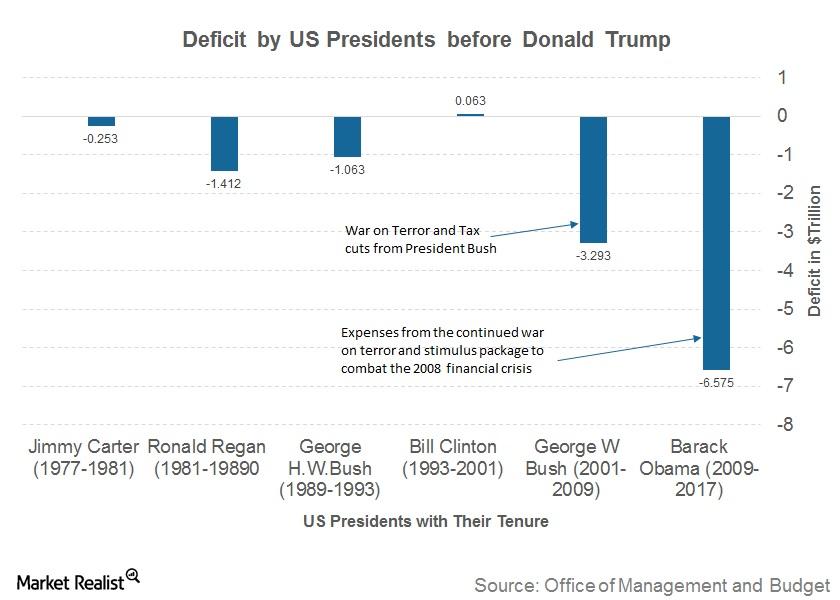

Why Is US Debt So High?

Most countries tend to issue debt to fund their deficits and keep paying interest on these borrowings. These revenues are generated through taxes from companies and individuals.

What November Job Openings Say about US Economy

As per the January JOLTS report, there were 5.9 million job openings at the end of November.

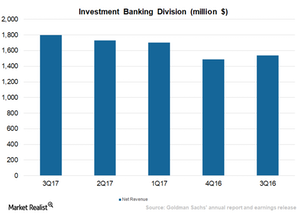

Goldman Sachs and Its Commanding Investment Banking Division

Goldman Sachs’s (GS) Investment Banking segment generated revenues of $1.8 billion in 3Q17, which was a 4% rise compared to 2Q17.

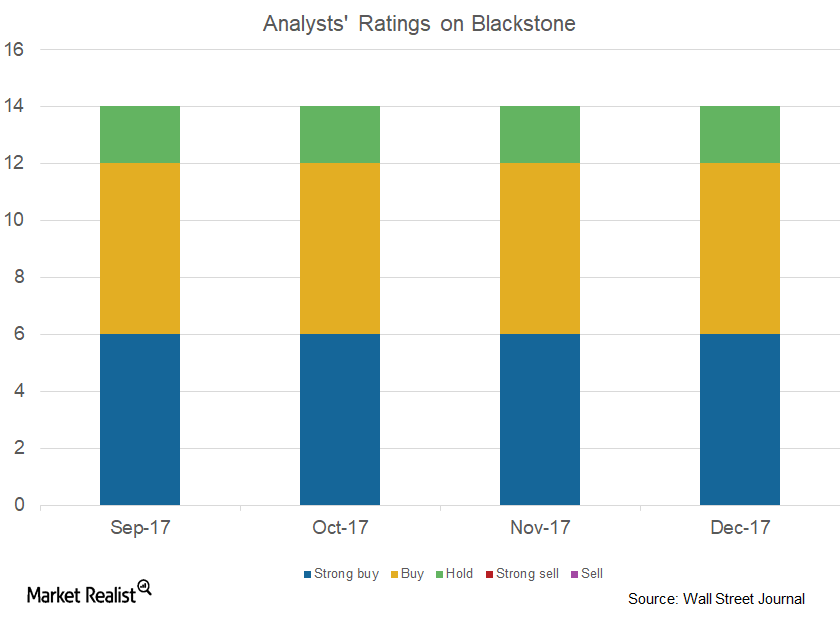

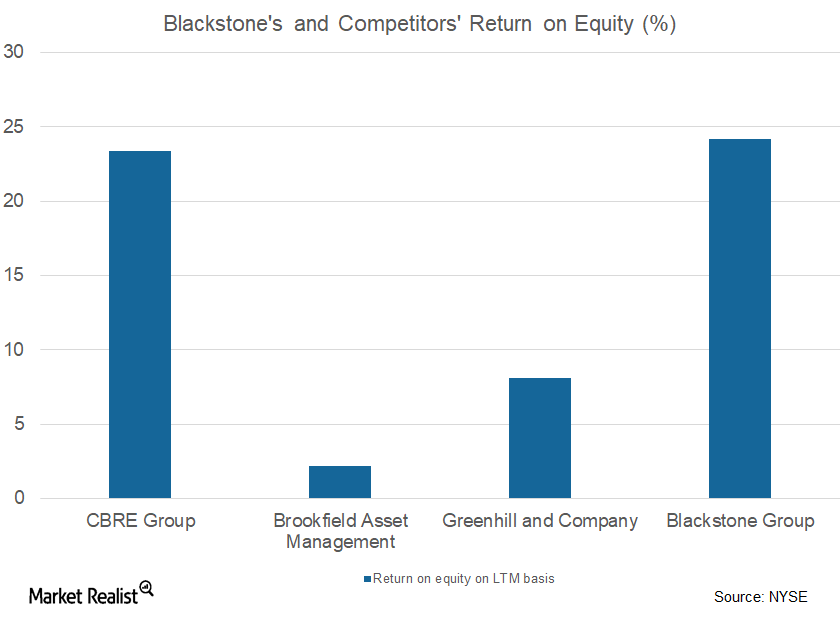

How Analysts View Blackstone

The Blackstone Group (BX) is being tracked by 14 analysts in December 2017. Six have given it “strong buy” ratings, two have suggested “hold” ratings, and six have recommended “buys.”

Blackstone’s Private Equity Division Saw a Strong Performance

The Blackstone Group’s (BX) private equity division posted total revenue of $1.4 billion in the first nine months of 2017, compared to $895.3 million in the first nine months of 2016.

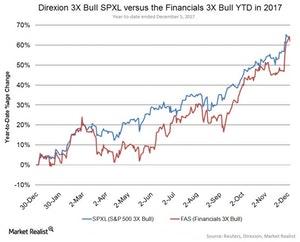

What Helped the Financial Sector in 2017?

Interestingly for all the talk about financials this year, the S&P 500 GICS Level 1 Financial Sector is only up 19% vs. 17%+ for the S&P500 as a whole.

What’s Wells Fargo’s Valuation?

Wells Fargo (WFC) stock has risen 13.0% over the past six months and 10.1% over the past year.

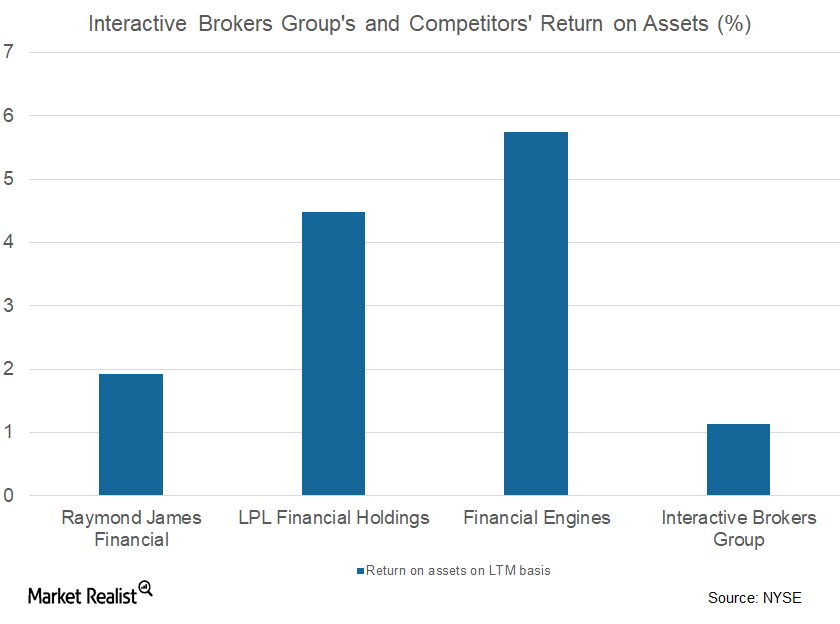

What Happened with Interactive Brokers’ Market-Making Business

Loss witnessed Interactive Brokers Group’s (IBKR) market-making business saw pre-tax income of -$35 million in the first three quarters of 2017, compared with $32 million in the same period of the prior year, primarily due to lower net revenue. Whereas the division’s trading gains fell from $124 million to $26 million, its other income rose to $14 […]

How the First Bitcoin Was Created

Satoshi Nakamoto is considered to be the founder of bitcoin, but the actual identity of Satoshi Nakamoto is not known.

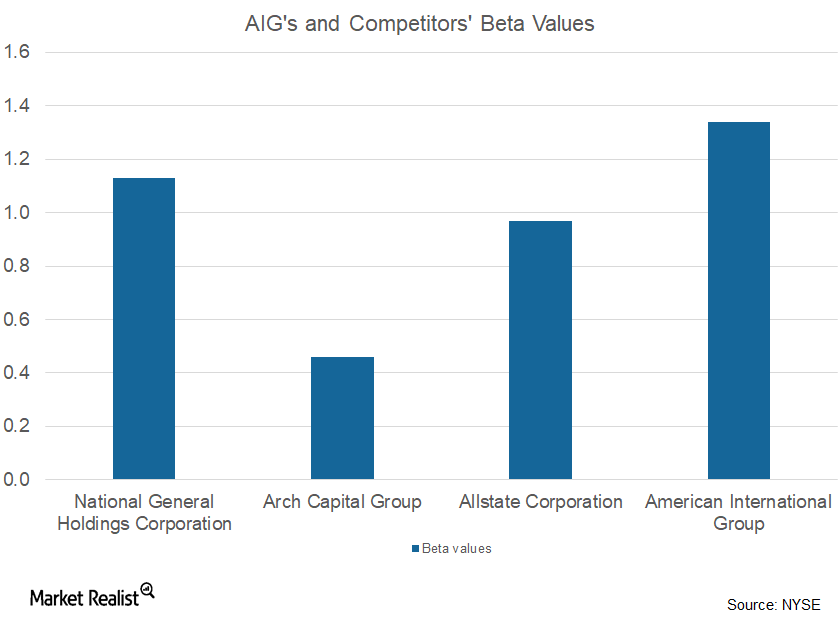

How AIG’s Consumer Insurance Division Performed in 3Q17

Marginal fall American International Group’s (AIG) consumer insurance division’s total operating revenue fell 1% from $6 billion in 3Q16 to $5.9 billion in 3Q17. The marginal fall was mainly due to lower net investment income and premiums. The division’s premiums fell 2% to $3.2 billion in 3Q17 from $3.3 billion in 3Q16. Whereas AIG has a beta of […]

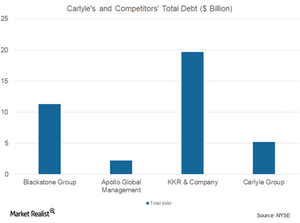

Carlyle Group’s Corporate Private Equity Division

In 3Q17, the Carlyle Group’s (CG) Corporate Private Equity division saw a marginal decline in distributable earnings, from $209 million in 3Q16 to $207 million in 3Q17.

Did Job Openings Rise in September?

The Job Openings and Labor Turnover Survey (or JOLTS) report for September came out on November 7. Job openings remained unchanged at 6.1 million as of the last business day in September.

Analyzing Visa’s Assets and Liabilities

As of September 30, 2016, Visa (V) has reported a total asset balance of $64.03 billion. As of June 30, 2017, the company managed to report a total asset balance of $64.00 billion.

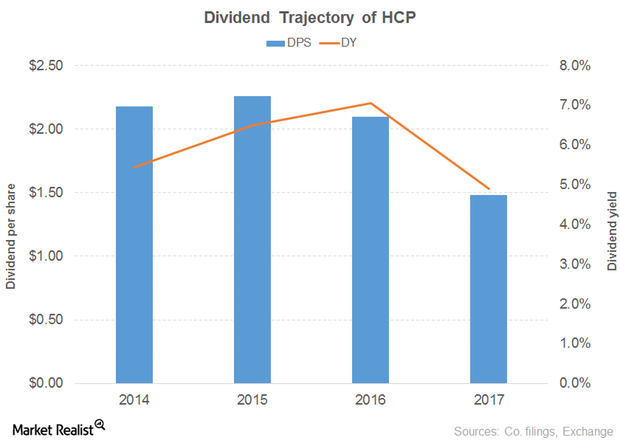

Why HCP’s Dividend Yield Is Moving South

Revenue and earnings HCP (HCP) is a healthcare REIT specializing in US healthcare property investment. In 2016, the company’s revenue growth slowed to 10% from 19% in 2015. The growth was driven by its senior housing operating portfolio, life science segment, and medical office segment, and partially offset by its senior housing triple-net segment. Rental and […]

Stocks with High Dividend Yields in the Financial Sector

In this series, we’ll look at 11 S&P 500 companies offering high dividend yields.

How the US’s Debt Has Become So Big

The US debt-to-GDP ratio now stands at 106.1%, which means that the total US debt is more than the annual US GDP.

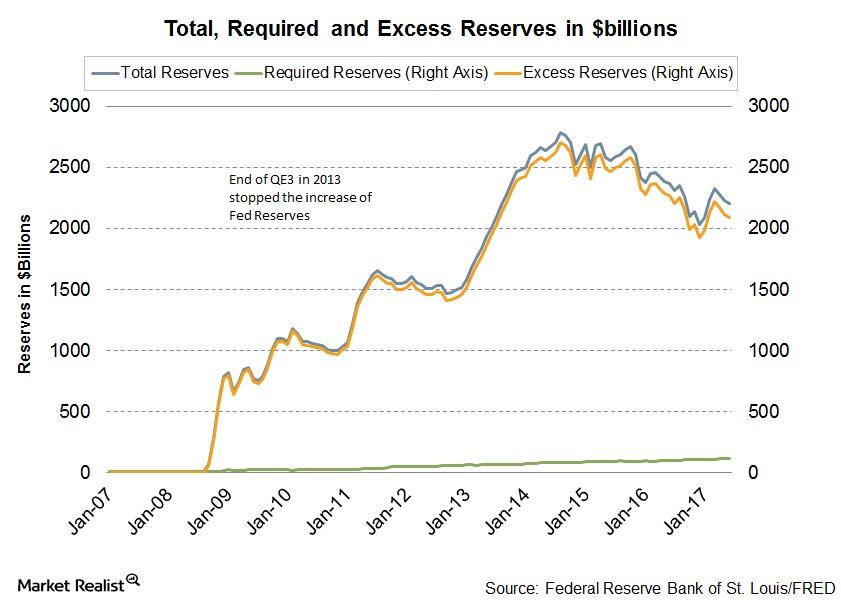

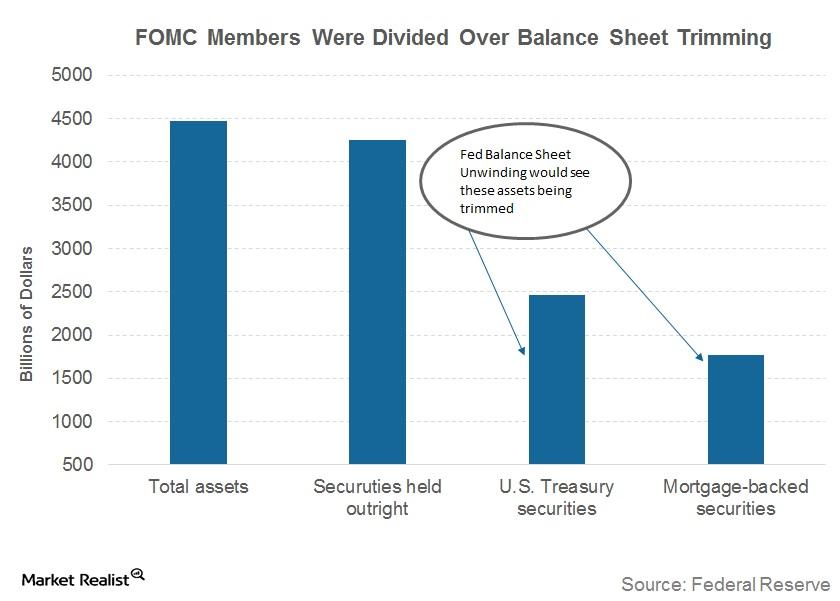

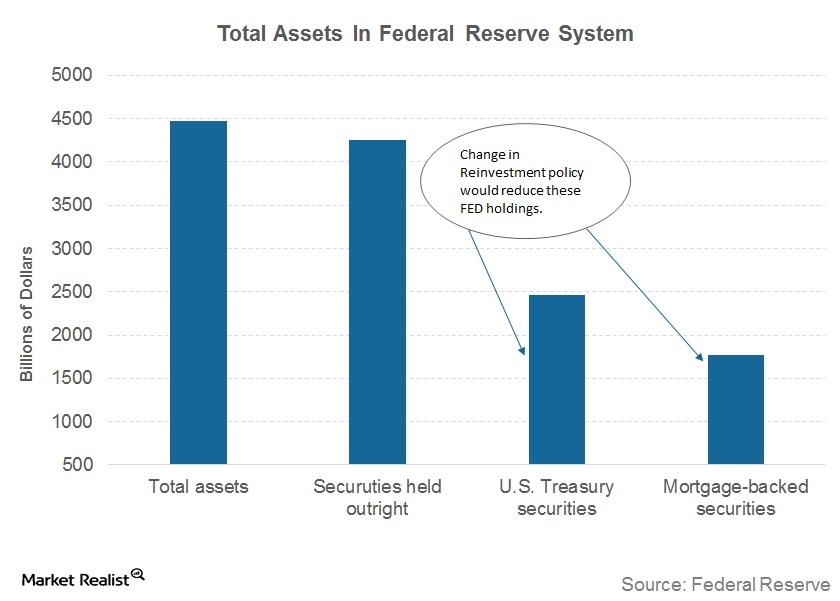

Will Market Shocks Really Be Minimal to Balance Sheet Unwinding?

In its June policy meeting, the Fed has signaled that it will stop replacing maturing securities and slowly reduce the size of its balance sheet.

Why FOMC Members Were Divided about Balance Sheet Shrinking

The FOMC June meeting minutes that were released on July 5, 2017, indicated that the FOMC members were divided over when to begin shrinking the Fed’s bloated balance sheet.

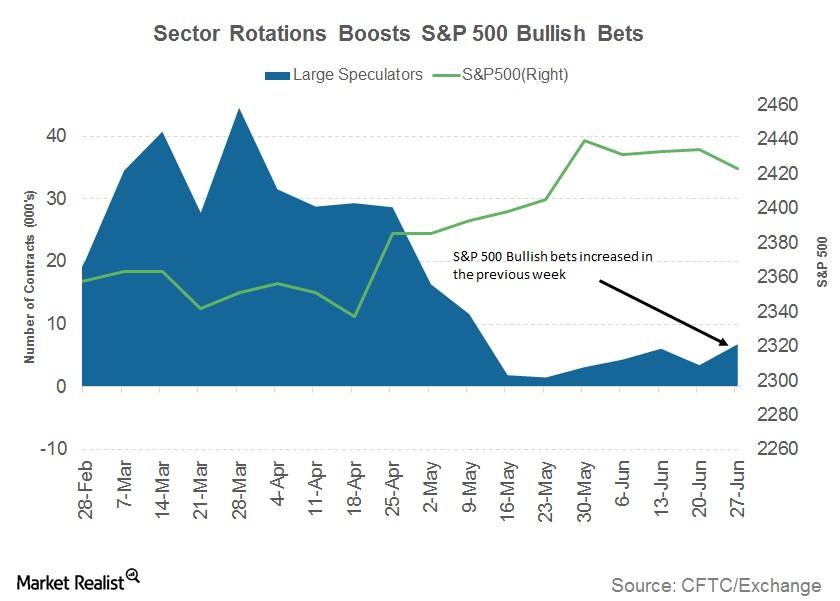

Sector Rotation Could Be the New Theme for the S&P 500

According to the latest Commitment of Traders report, large speculators have increased their net bullish positions in the S&P 500 futures.

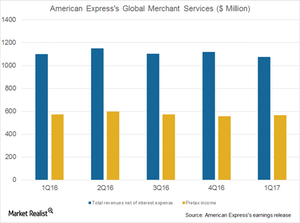

Inside American Express’s Global Merchant Services Segment

American Express’s (AXP) Global Merchant Services segment is expected to see a marginal increase in its net income in 2Q17.

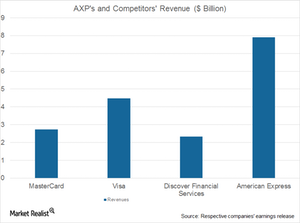

American Express to Ride on Partnerships, Digitization

American Express (or Amex) (AXP) has entered into digital partnerships with Airbnb, Facebook (FB), and Uber in order to offset the revenue loss from Costco (COST).

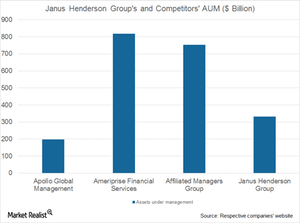

Janus-Henderson Merger: The Wait Is Over

The merger of Janus Capital Group (JNS) and Henderson Group (HGG), announced in late 2016, was finalized on May 30, 2017. It’s said to be a merger of equals.

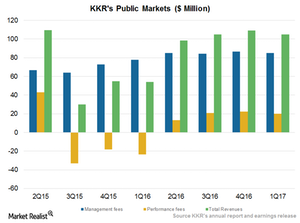

What Could Lead KKR’s Public Market Segment to Rise or Fall?

KKR has seen a decline in its base fees to $85.5 million in 1Q17 compared to $86.7 million in 4Q16.

Does the Financials Sector Sweat the Summer More?

The big winner since the US elections has been the financial sector, which is up 14% as of May 8, 2017.

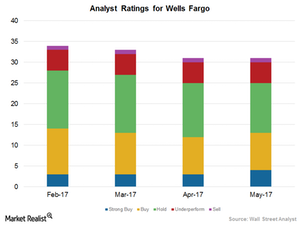

What Do Analysts’ Ratings Suggest for Wells Fargo in 2017?

In May, 13 of the 31 analysts covering Wells Fargo rated the stock as a “buy,” 12 analysts rated it as a “hold,” and six analysts rated it as a “sell.”

Inside the Fed’s Balance Sheet (The Biggest in the World)

The Fed has started the rate normalization process only recently and has a long way to go before the rates come back to pre-Lehman-collapse levels.

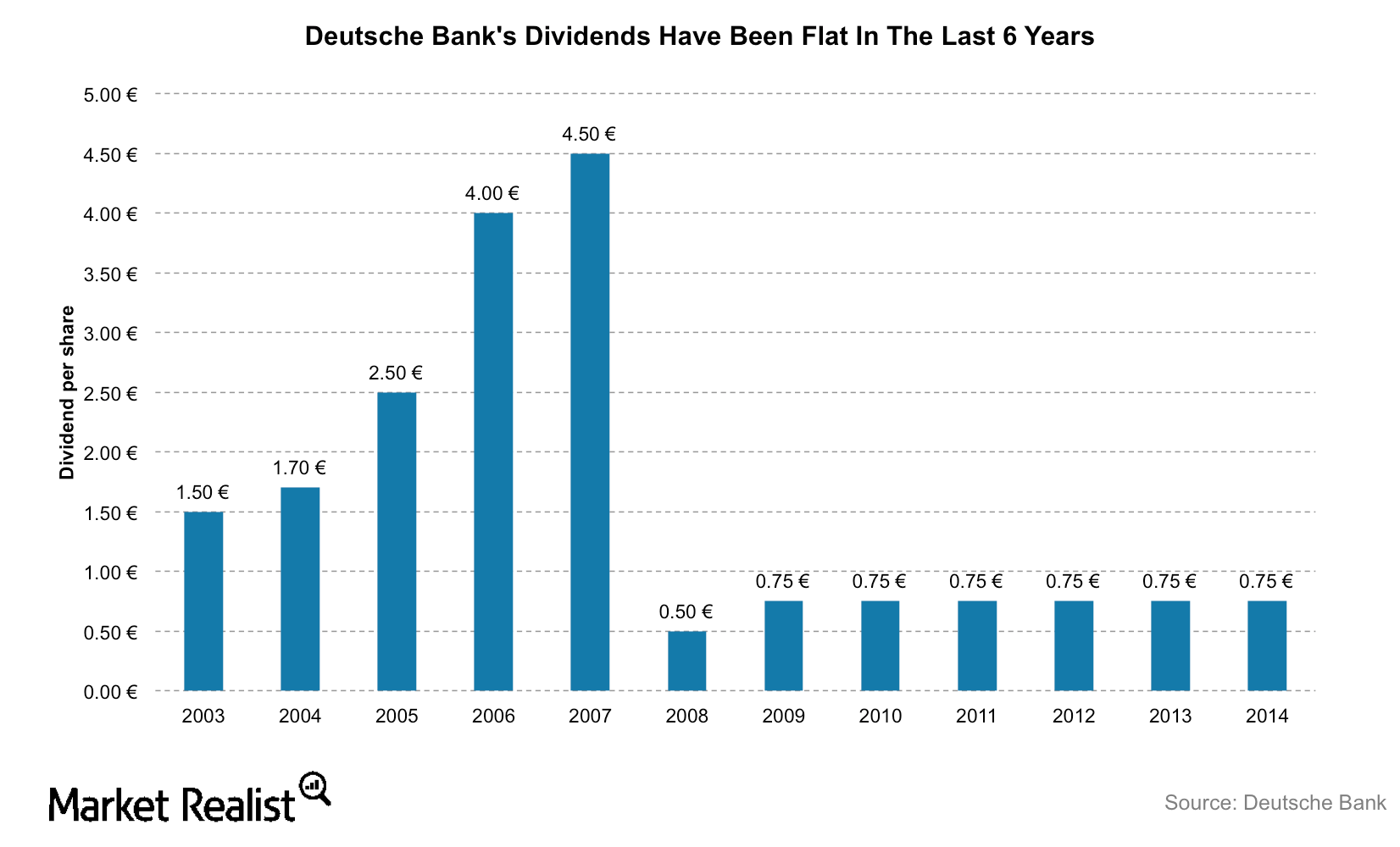

Why Deutsche Bank Scrapped Dividends in 2016

Germany-based Deutsche Bank (DB) announced plans to cut dividend payments for 2015 and 2016 as part of its plans to strengthen the bank’s capital.

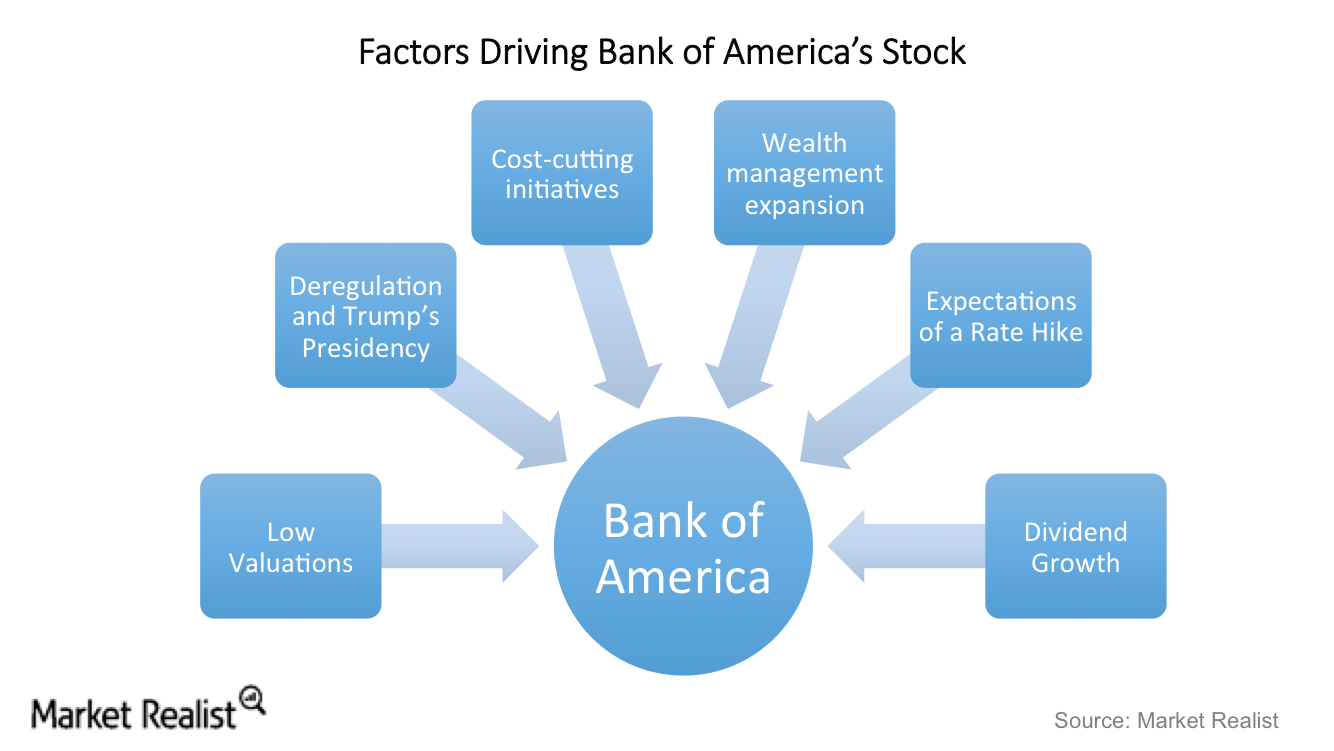

What Are Bank of America’s 2017 Growth Drivers?

Bank of America’s CEO has repeatedly discussed the importance of cost controls and how such measures could significantly boost BAC’s earnings over the next few years.

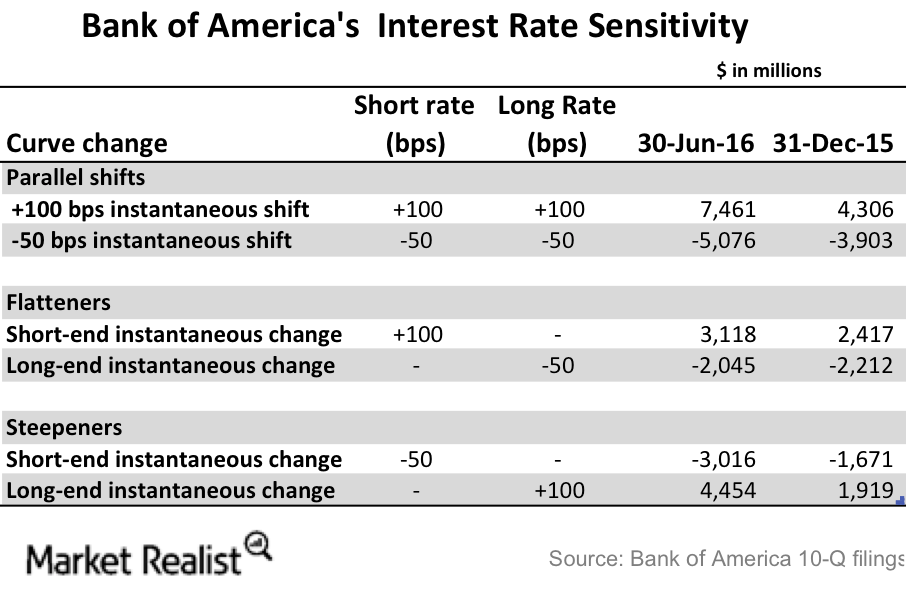

What’s Bank of America’s Interest Rate Risk?

Bank of America (BAC) is extremely sensitive to interest rate changes. Its latest 10-Q filing shows that its asset sensitivity has risen in 2Q15.

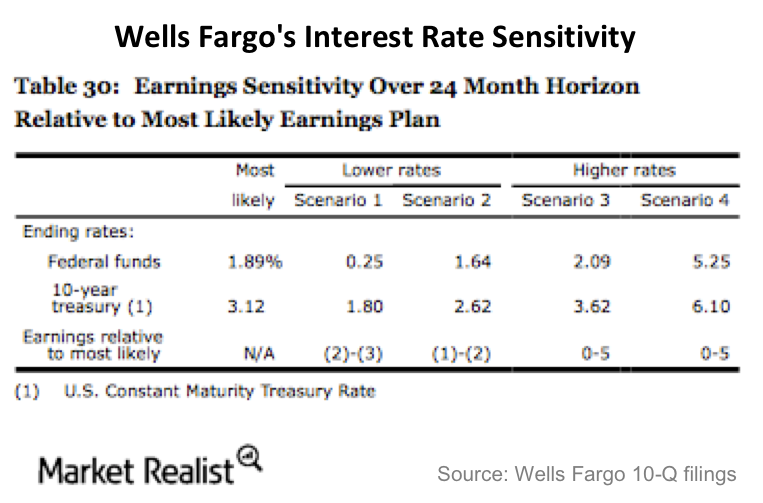

How Sensitive Are Wells Fargo’s Earnings to Interest Rates?

Wells Fargo has the largest loan portfolio among US banks (XLF). As of 2Q16, the bank has a loan portfolio of $952 billion.

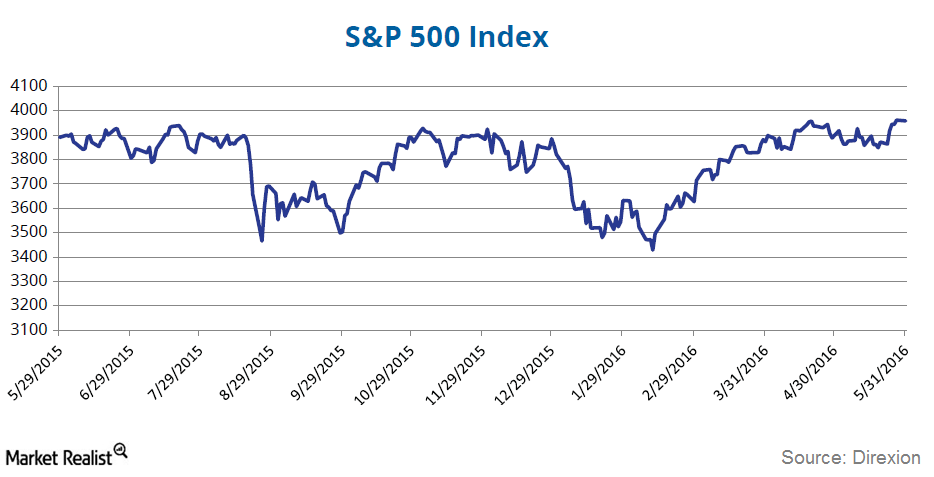

Where Is the Market Headed: Double Bottom? Triple Top?

Double bottom? From a technical standpoint, the current environment may have been viewed as either bullish or bearish. Those on the bull side of the equation took heart in a technical indicator known as the double bottom. The double bottom reversal is a bullish reversal pattern that traders use to anticipate possible upside movements. As its […]