Financial Select Sector SPDR® ETF

Latest Financial Select Sector SPDR® ETF News and Updates

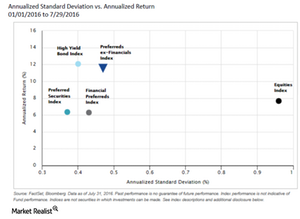

Ex-Financial Preferreds’ Attractive Risk-to-Return Trade-Off

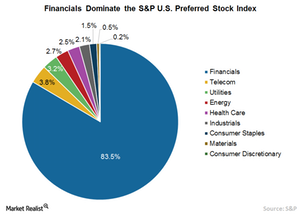

Financials (XLF) have a heavy concentration in preferred securities. Consequently, financials have a significant influence on returns.

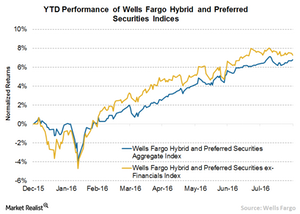

Why Ex-Financial Preferreds Offer Competitive Yield Potential

Preferred securities are some of the few investment avenues that still have the potential to provide attractive yields to investors.

Why Preferred Securities Attract Investors

Preferred securities (PFXF) are some of the most popular investments around. They appeal to investors seeking higher yields in a world of falling and even negative interest rates.

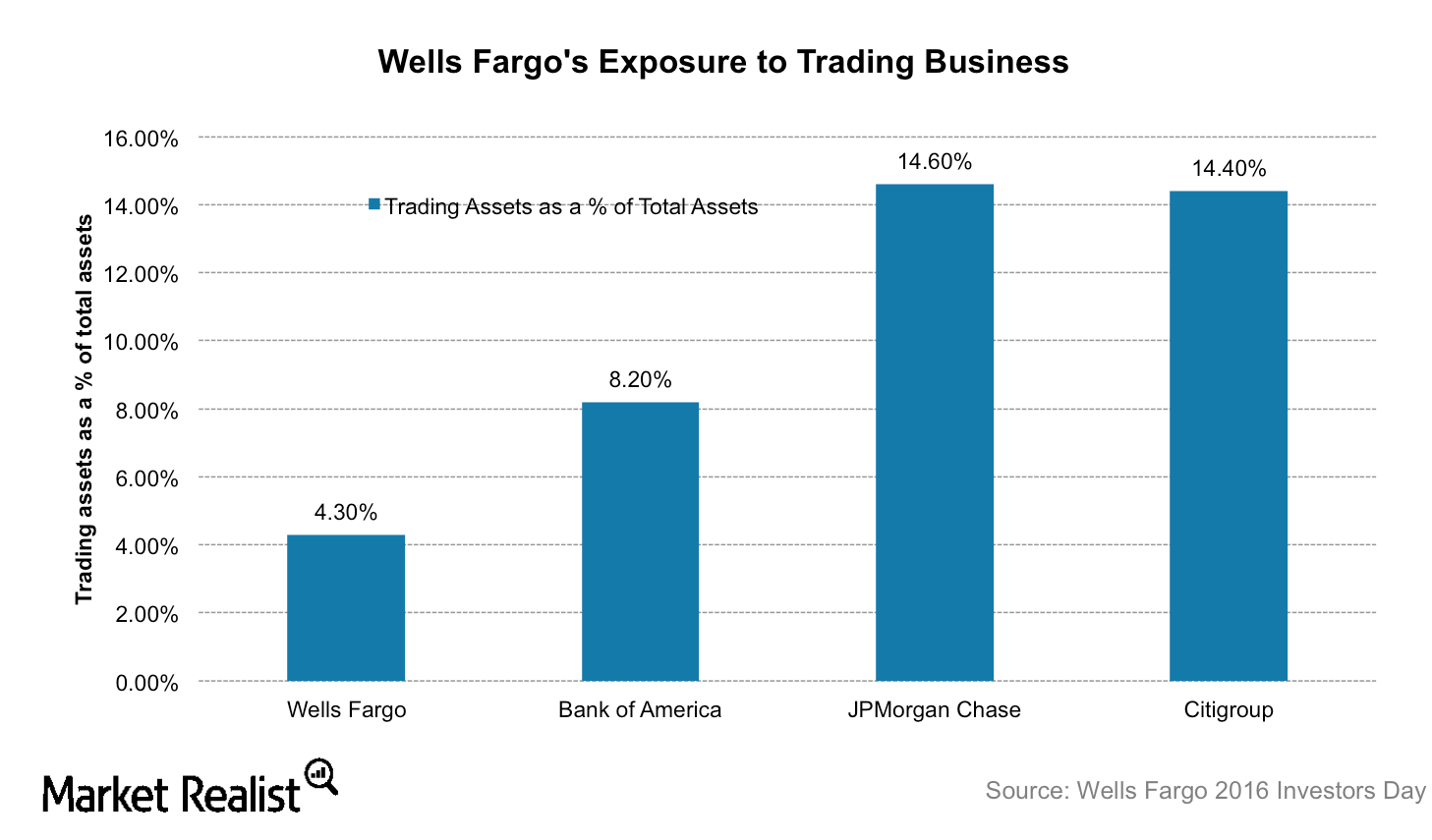

Why Wells Fargo Has a Less Risky Business Model than JPMorgan Chase

Wells Fargo (WFC) is less exposed to the risky investment banking and trading business than its peers JPMorgan Chase (JPM), Citigroup (C), and Bank of America (BAC).

Interest Rate Sensitivity: JPMorgan Chase versus Wells Fargo

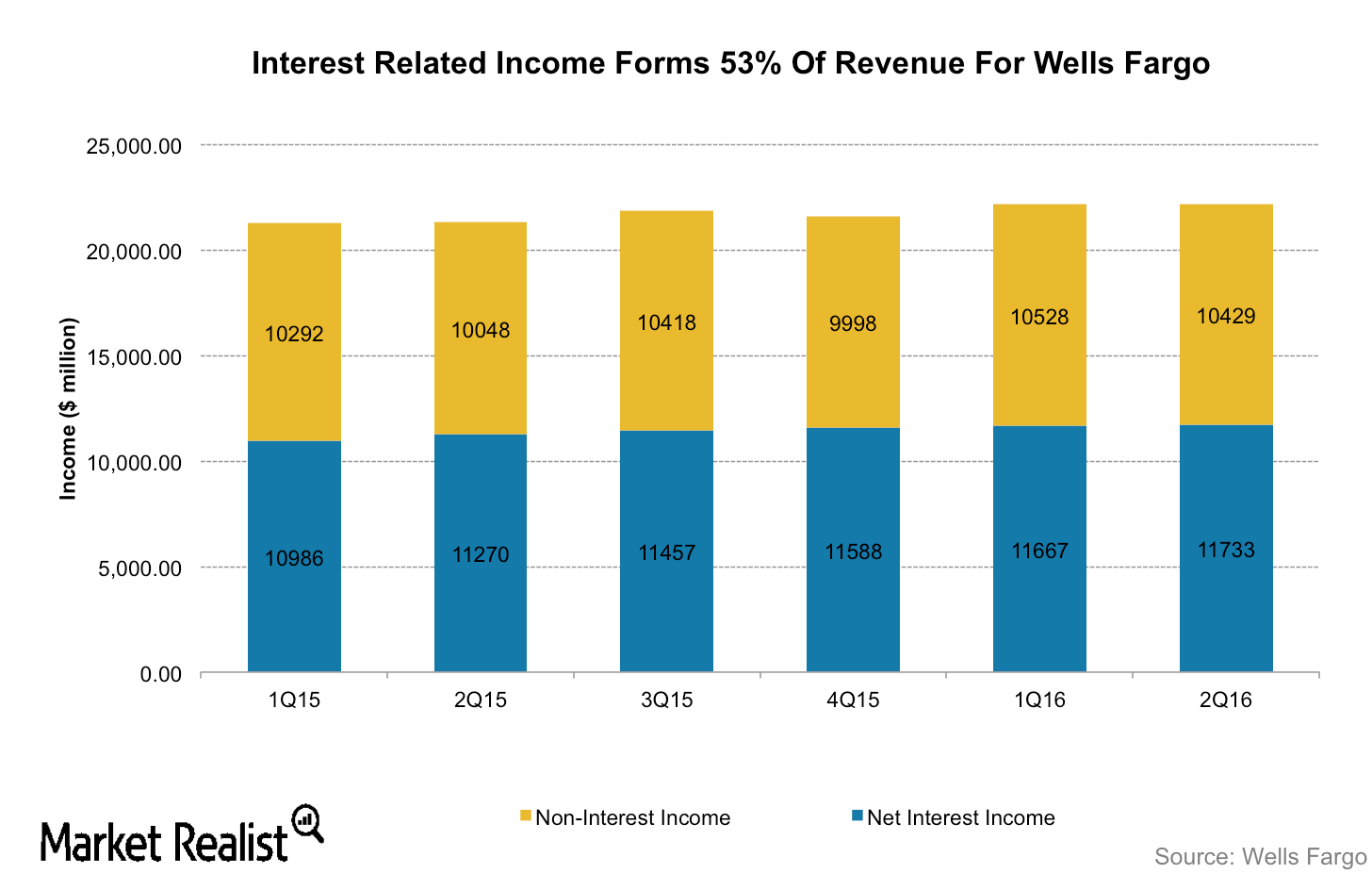

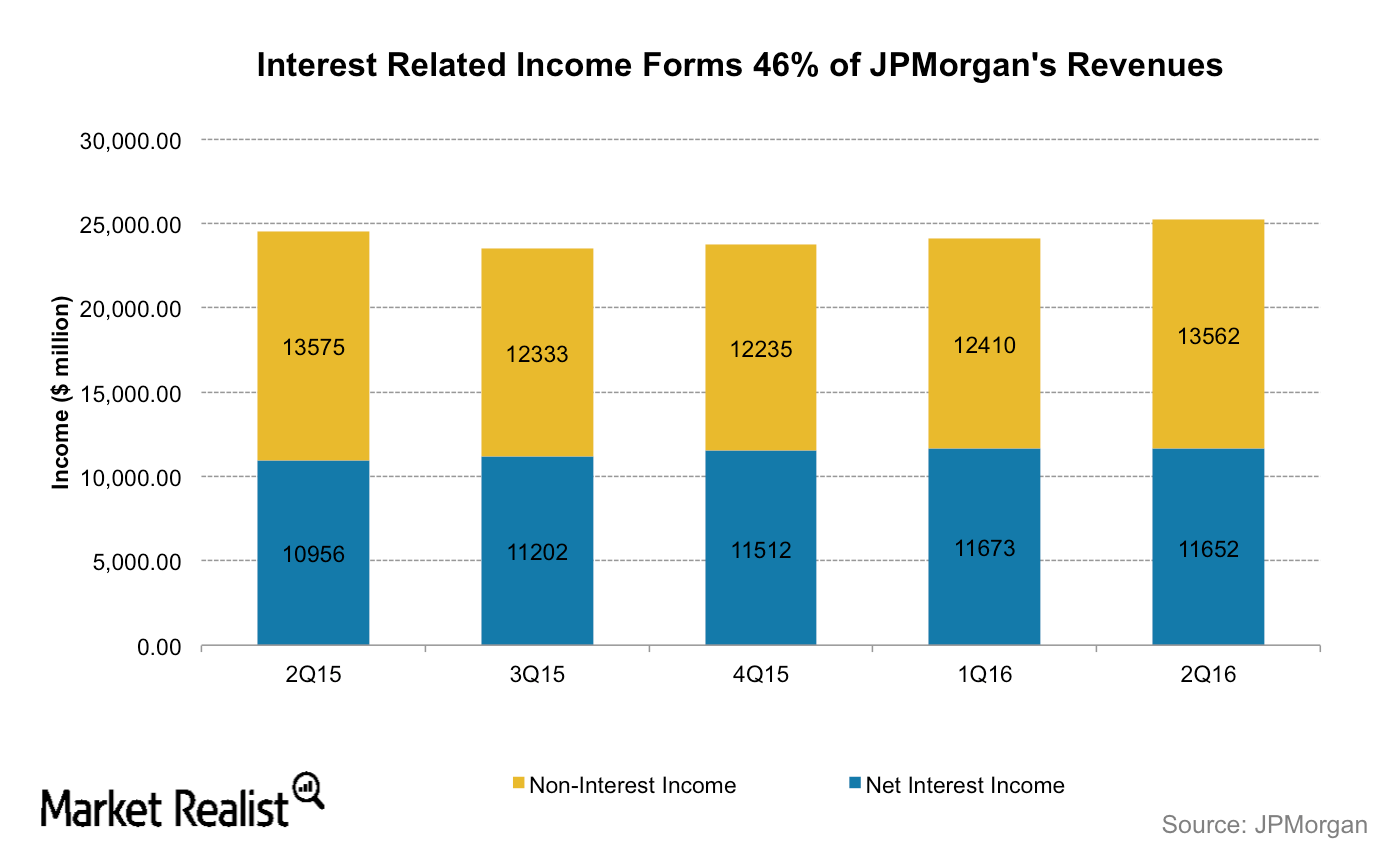

For Wells Fargo, net interest income makes up 53% of its total income while for JPMorgan Chase (JPM), net interest income makes up 46% of its total income.

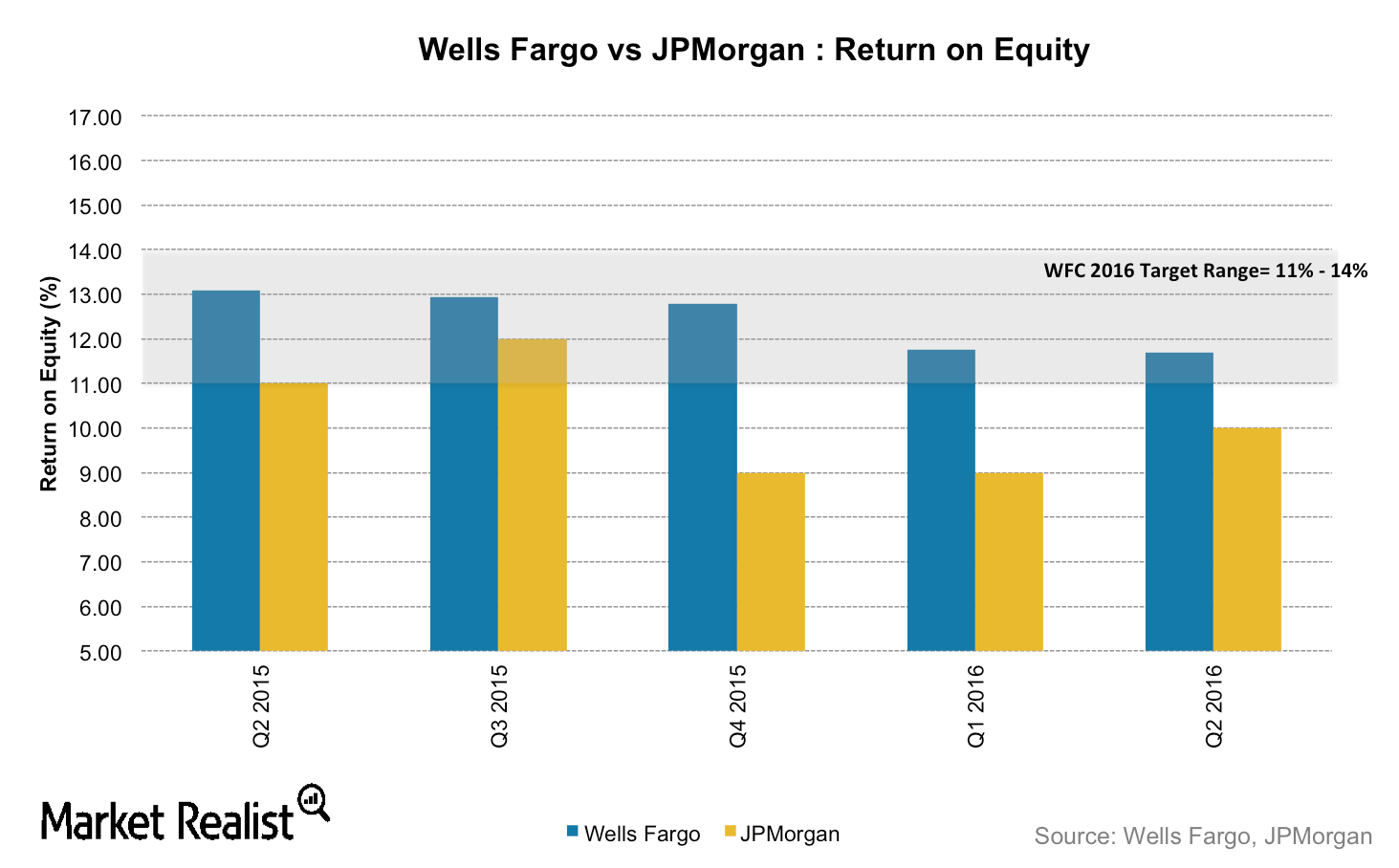

How Does Wells Fargo Compare with JPMorgan Chase on Profitability?

JPMorgan Chase (JPM) and Wells Fargo (WFC) reported profits of $6.2 billion and $5.6 billion, respectively, in the most recent quarter.

Why BAC Is Better Positioned to Gain from a Rate Hike Than JPM

Bank of America (BAC) is better positioned to gain from an interest rate hike than JPMorgan Chase (JPM). It’s more sensitive to interest rate changes.

Comparing Wells Fargo and Bank of America’s Profitability

In 1Q16, Wells Fargo’s revenue grew 4% to $22.2 billion. Bank of America’s (BAC) revenue fell 7% YoY (year-over-year) to $19.5 billion.

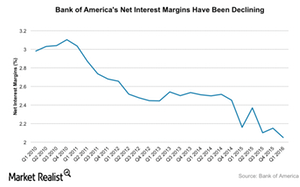

How Sensitive to Interest Rates Has Bank of America Really Become?

Bank of America’s (BAC) earnings are extremely sensitive to interest rate changes. Low interest rates have weighed on the bank’s top line.

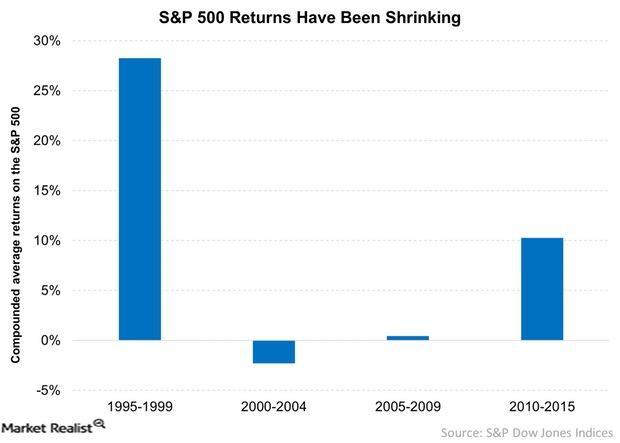

Why Your Portfolio Needs More Carry

Since 2009, equities have staged a comeback. Between 2010 and 2015, the S&P 500 index has risen 10.3% on a CAGR basis. Most of the comeback is due to multiple expansion.

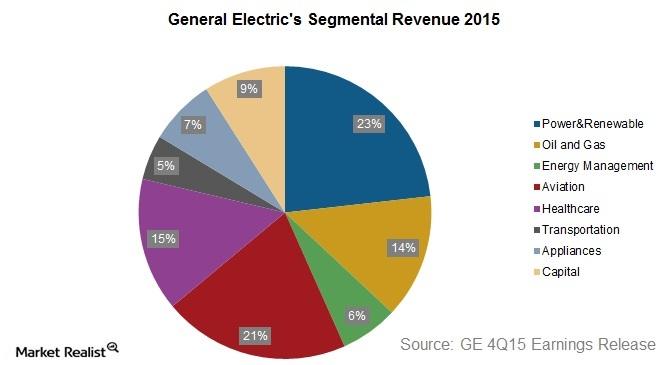

Why General Electric Is Focusing on Industrials?

Originally incorporated in 1892, General Electric is one of the largest and most diversified industrials and financial services corporations in the world.

What Is the Dodd-Frank Act?

Analysts who favor the Dodd-Frank Act believe it will protect the investing community and consumers. Critics believe it will hamper economic growth and hurt competitiveness.

Analyzing US and European Banks’ Leverage Ratios

On average, European banks have higher leverage than US banks. An excess buildup of leverage increases a bank’s exposure to the risk of bankruptcy.

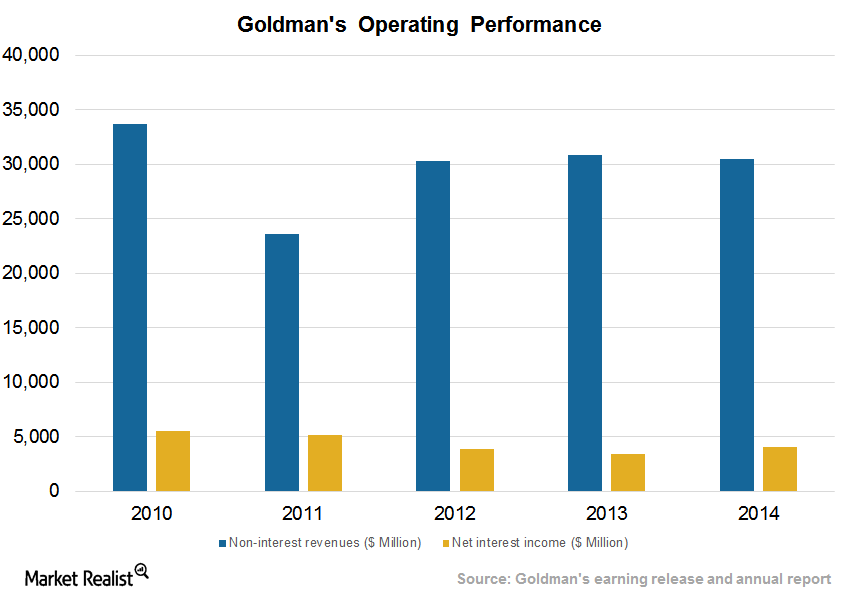

Goldman Sachs’ Revenue Model

Goldman Sachs engages in asset management, investment banking, wealth management, institutional sales, and trading activities across asset classes as well as regions.

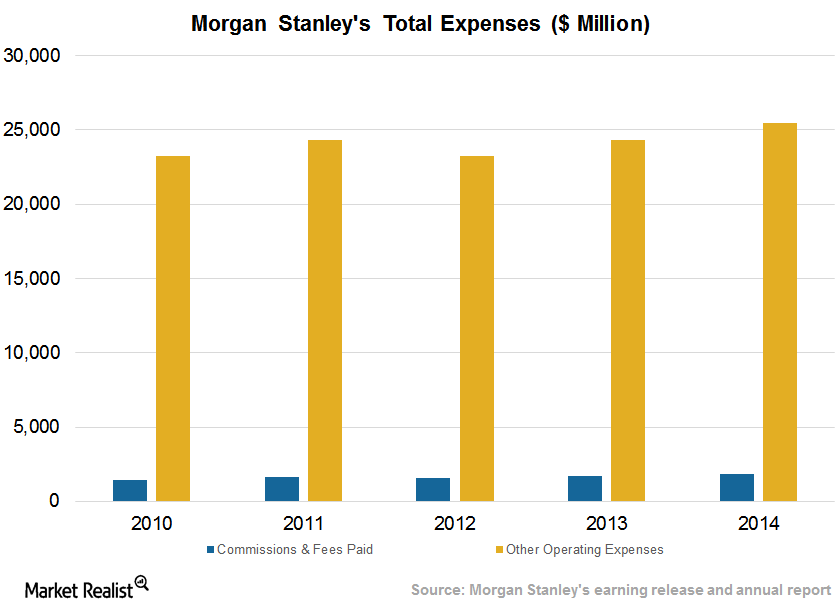

Morgan Stanley’s Careful Attention to Compensation Expenses

Morgan Stanley divides its non-interest expenses into compensation and non-compensation. It’s compensation expenses (and benefits) are ~80% of this class.

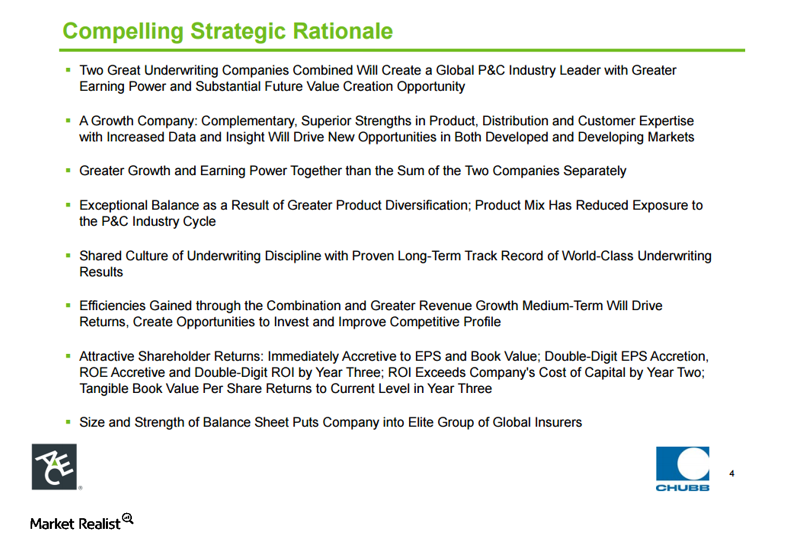

What Is the Rationale for the ACE–Chubb Merger?

The biggest rationale for the ACE–Chubb merger is the potential for cost-cutting. By combining with Chubb, ACE Limited is creating a leading player in property and casualty insurance.

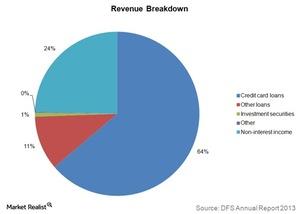

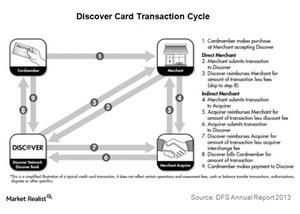

What investors should know about Discover Financial Services

Discover Financial Services (DFS) is a direct bank and electronic payment services company in the US. It offers an array of banking products.

Analyzing Discover Financial’s business segments

Discover Financial Services (DFS) has two operating segments: Direct Banking and Payment Services. Payment Services is comparatively small.

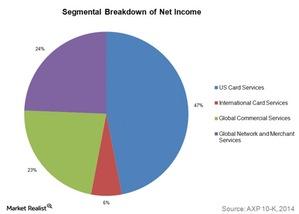

American Express and Its Four Operating Segments

Of the four American Express segments, the Global Network and Merchant Services segment has shown the highest growth over the last two years.

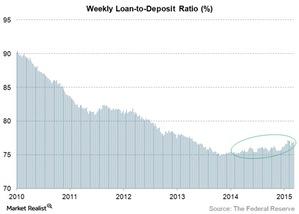

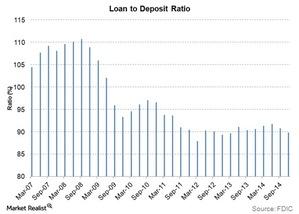

Loan-to-Deposit Ratio Moves in the Right Direction for Banks

The ideal loan-to-deposit ratio for a bank depends on the bank’s business model. Some banks that focus on core banking, like U.S. Bancorp (USB), have high loan-to-deposit ratios.

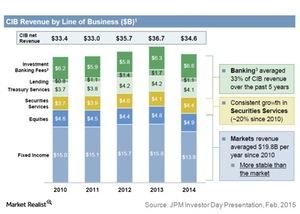

How J.P. Morgan Ranks in Corporate and Investment Banking

In the US, J.P. Morgan competes with Bank of America (BAC), Goldman Sachs (GS), and Morgan Stanley (MS), the leading players in investment banking.

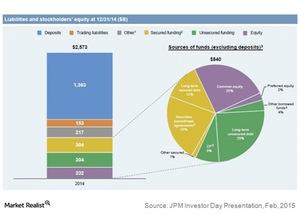

J.P. Morgan and Its Diversified Funding Sources

Banks like US Bancorp (USB) and Wells Fargo (WFC) have an advantage over J.P. Morgan in terms of debt rating. Both banks secure higher ratings.

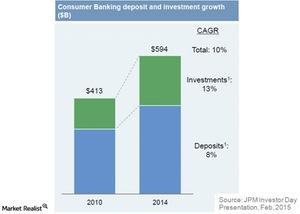

J.P. Morgan Looks to Deepen Customer Relationships

The number of J.P. Morgan active mobile customers has more than tripled since 2010. As a result, the bank is adapting its digital capabilities.

J.P. Morgan’s 4 Operating Segments

Consumer and Community Banking is the biggest of J.P. Morgan’s four segments. Corporate and Investment Banking follows, with 34% of revenues.

J.P. Morgan: The Banking Giant

In this series, you’ll learn what value J.P. Morgan holds for its shareholders, about its various businesses, and how it compares with other big banks.

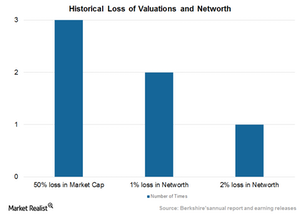

Warren Buffet’s 50-Year Vision for Berkshire Hathaway

Berkshire Hathaway has doubled its earnings and balance sheet potential since the financial crisis of 2007.

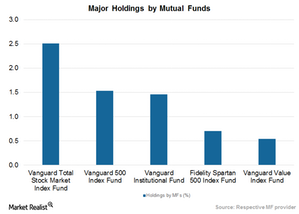

Mutual Funds Own 18% of Berkshire Hathaway

Major mutual funds prefer Berkshire Hathaway (BRK-B) over private equity firms and asset managers like Blackstone (BX) and BlackRock (BLK).

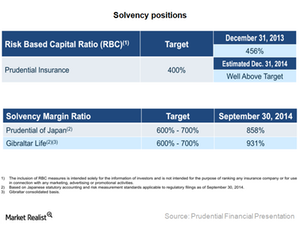

Prudential Financial Enjoys Strong Solvency Ratios

Prudential has comfortable solvency positions in its subsidiaries. In the US, Prudential Insurance’s solvency ratio was well above the target ratio of 400%.

Why Is the Loan-to-Deposit Ratio Declining for US Banks?

The industrywide loan-to-deposit ratio has declined over the last few years, largely due to the increase in non-interest-bearing bank deposits.

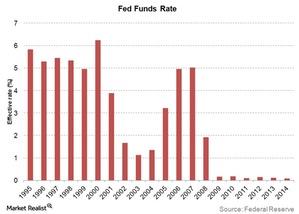

Why Are Interest Rates at an All-time Low?

The quantitative easing policy adopted by the Federal Reserve at the end of 2008 to boost economic growth included a drastic reduction in interest rates.

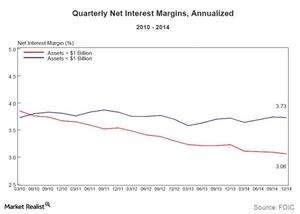

Why Lower Funding Costs Impact Net Interest Margins

Lower funding costs determine a bank’s net interest margin. A bank has funding cost advantage when it pays less interest on borrowed funds and deposits.

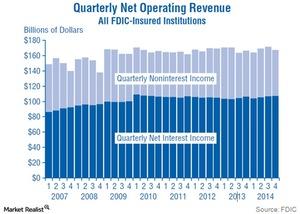

Why Is Interest Income Important to Banks?

Interest income typically contributes more than 60% to a bank’s total operating income.

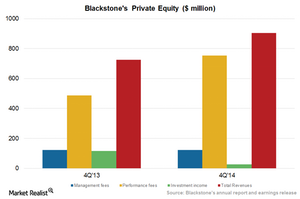

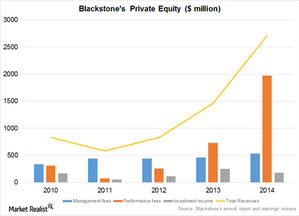

Blackstone’s Dominant Performance in Private Equity Space

Blackstone (BX) generated revenues of $2.7 billion and economic income of $1.8 billion for the year, backed by strong performance of BCP V and BCP VI.

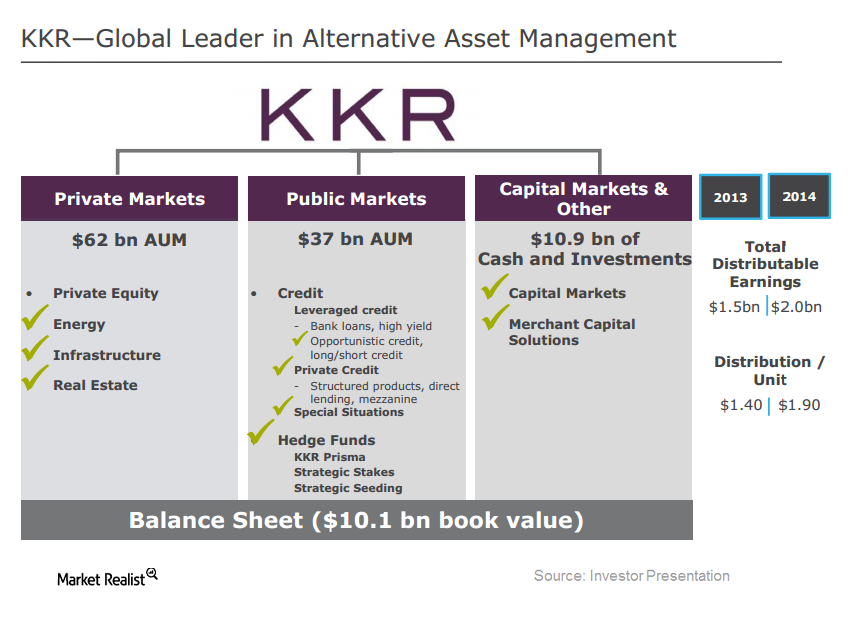

Fairholme Capital Exits Stake in KKR

For the fourth quarter of 2014, KKR reported a net loss of $0.6 million, compared to net income of $277.9 million in 4Q13.

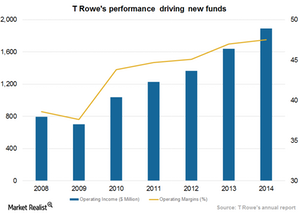

T. Rowe Price Group: It Takes Seed Capital to Build New Funds

The length of time seed capital is held in a portfolio depends on various factors such as how long it takes to generate cash flow from unrelated investors.

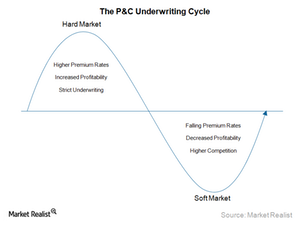

How Underwriting Cycles Impact the Top Line and the Bottom Line

The underwriting cycle moves between hard and soft market conditions, which have different sets of characteristics that determine the profitability of the insurance industry.

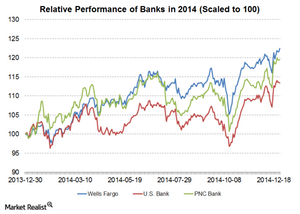

Valuation of PNC Bank is close to historical mean

PNC stock was trading at a PBV ratio of 0.75 in November 2012. Since then, the stock has seen a smart move up and trades at a PBV multiple of ~1.08.

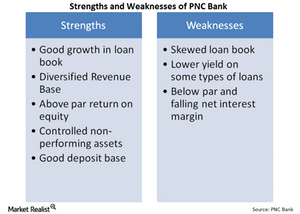

PNC Bank’s financial strengths outweigh its weaknesses

PNC Bank has done a good job at reducing its non-interest expenses, but the bank’s efficiency ratio still remains above 60%.

KKR Capstone: An institutionalized process of creating value

KKR has institutionalized the process of creating value in its portfolio companies through KKR Capstone.

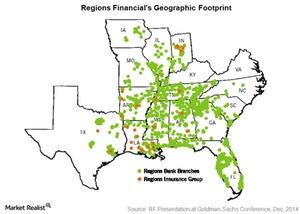

What investors should know about Regions Financial Corporation

Regions Financial Corporation is a leading regional bank in the southeastern US. It’s the 17th largest bank in the US—based on assets.

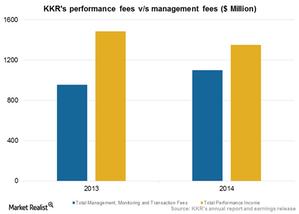

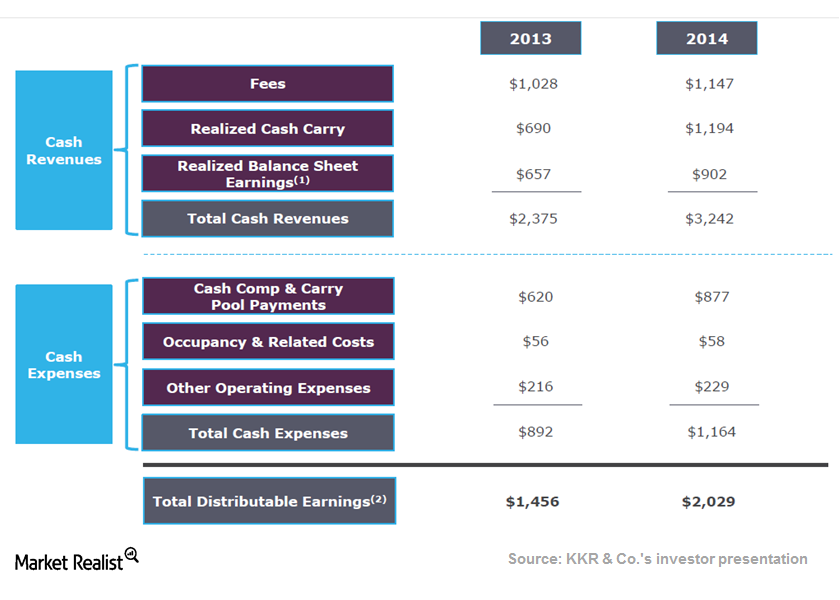

What does KKR’s revenue model look like?

KKR has a diverse revenue model, making fees for providing investment management to its funds, investment vehicles, managed accounts, and finance companies.

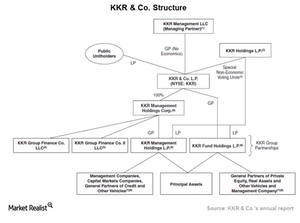

How KKR structures its investment vehicles

KKR structures its investment vehicles as a partnership or combination of domestic and overseas partnerships that contribute capital toward the fund.

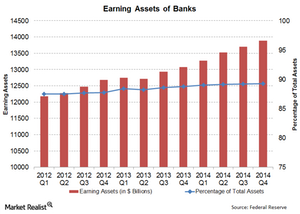

Why earning assets are an important indicator for the banking sector

The banking sector has shown a trend of increasing earning assets, because banks have focussed on becoming leaner and improving operational efficiency.

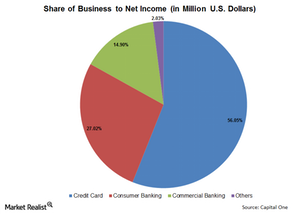

Analyzing Capital One’s business segments

Capital One (COF) can be understood best by breaking it into different business segments—Credit Card, Consumer Banking, and Commercial Banking.

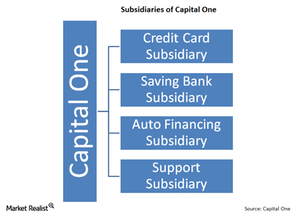

What are Capital One’s three main subsidiaries?

Capital One is organized into subsidiaries. Capital One’s principal subsidiary is a limited purpose credit card bank. It’s chartered in Virginia.

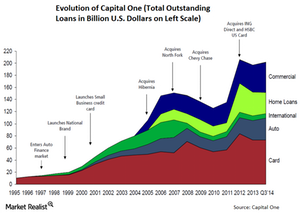

Capital One’s history: From credit cards to a diversified bank

Capital One’s history is shorter than other banks. In 1994, Signet Financial Corp. spun off its credit card business into a separate subsidiary—Capital One.

A summary of Caxton Associates’ key 4Q14 holdings

Caxton Associates’ portfolio fell from $3.04 billion in 3Q14 to $1.29 billion in 4Q14.

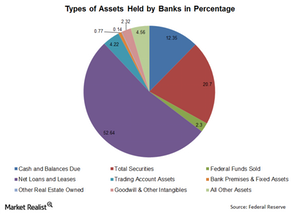

Why the composition of banking assets matters

The two main types of banking assets are loans and securities held.

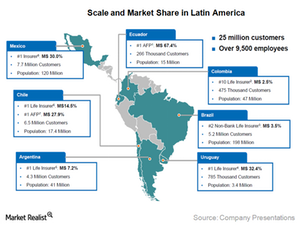

MetLife is the largest player in Latin America

MetLife plans to grow its retail and group business in Latin America, capitalizing on the growing middle class, affluent class, and corporate needs.

Blackstone relies on private equity division to drive growth

Blackstone (BX) manages a total of $73 billion assets in the private equity segment and has generated an annual return of 16% since its inception.