Fairholme Capital Exits Stake in KKR

For the fourth quarter of 2014, KKR reported a net loss of $0.6 million, compared to net income of $277.9 million in 4Q13.

March 20 2015, Updated 5:05 p.m. ET

Fairholme and KKR

In its 4Q14 13F filing, Fairholme Capital disclosed that it had exited its position in KKR & Co. (KKR) by selling its remaining stake of ~101,500 shares. The position had accounted for 0.03% of the fund’s portfolio during the third quarter.

Company profile

KKR is a global investment firm that manages funds for entities including:

- endowments

- family offices

- financial institutions

- foundations

- high net worth individuals.

- insurance companies

- pensions

- private banking platforms

- sovereign wealth funds

Its investment vehicles are structured as a partnership. A partnership structure has a general partner who makes investment and operational decisions, as well as limited partners who commit capital toward the fund to be deployed in qualifying investments during the investment period.

KKR manages investment funds that invest for long-term capital appreciation, either through strategic minority positions or through controlling the ownership of the companies.

Business segments

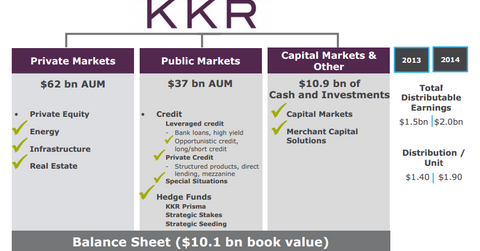

KKR’s operations fall under the following business segments:

- Private Markets, a private equity business that covers sector-specific and agnostic funds

- Public Markets, which covers credit and hedge fund businesses

- Capital Market and Principal Activities, which is the financial advisory or investment banking division involved in advisory related to capital markets ad underwriting of debt or equity issues

KKR faces competition in the private equity business from major alternative asset managers such as The Blackstone Group (BX), The Carlyle Group (CG), and Apollo Global Management (APO).

Traditional asset managers such as BlackRock (BLK), Bank of New York Mellon Asset Management (BK), and Franklin Resources (BEN) together make up 3.73% of the Financial Select Sector SPDR Fund (XLF).

Earnings miss expectations

KKR’s total distributable earnings fell to $376.3 million from $510.4 million in 4Q13, due to deflation in the value of its investments in oil and gas production and exploration companies. For the fourth quarter, the company reported a net loss of $0.6 million, compared to net income of $277.9 million in 4Q13.

KKR’s economic net income, which factors in mark-to-market valuation, fell from $789.6 million in 4Q13 to $86.6 million, translating to post-tax economic net income per adjusted unit of $0.05, against average analyst forecast of 45 cents.