Bank of New York Mellon Corp

Latest Bank of New York Mellon Corp News and Updates

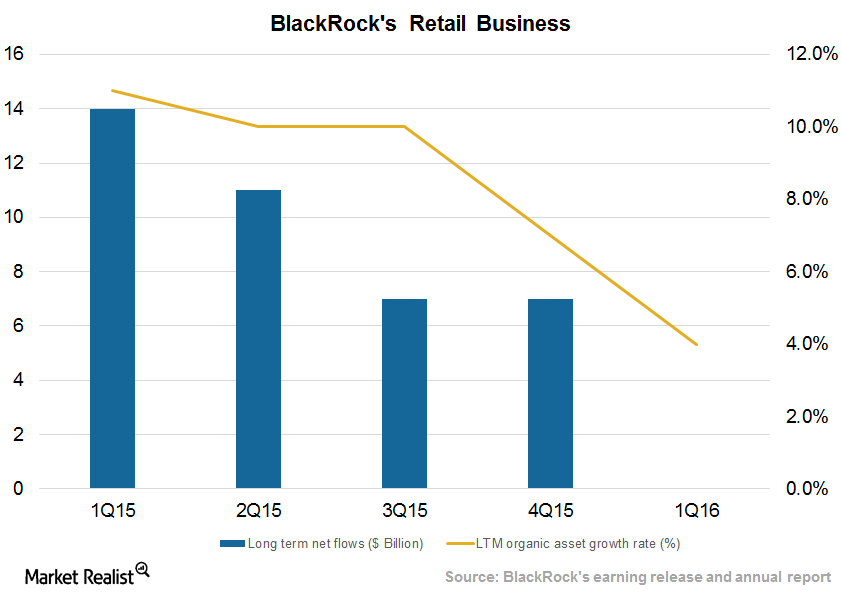

BlackRock’s Retail Continues to Attract New Clients across Classes

BlackRock’s (BLK) retail business had assets under management (or AUM) of $542 billion as of March 31, 2016.

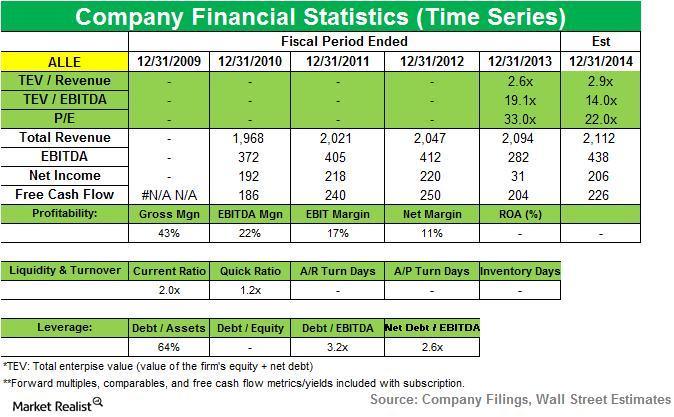

Trian Fund lowers its position in Allegion

Allegion provides security solutions for homes and businesses, employing more than 8,000 people and selling products in more than 120 countries across the world. Allegion reported third-quarter 2014 net revenues of $546.7 million, up 3.3% compared to the previous year.

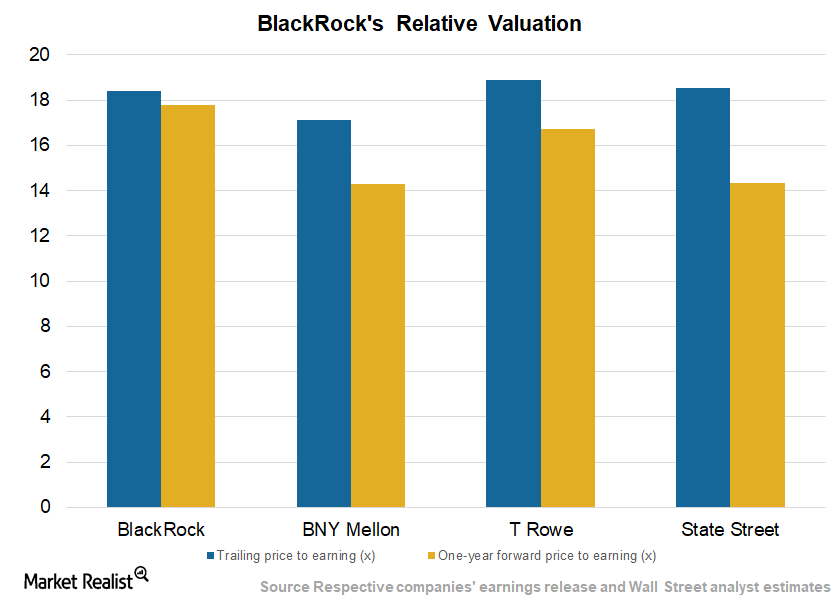

BlackRock’s Valuations Stable amid Strong Operating Performance

BlackRock is currently trading at a forward price-to-earnings ratio of 17.6x, compared with the industry average of 18.6x.

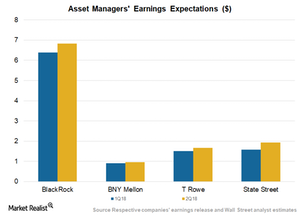

BlackRock and Competitors Look at Strong 1Q18 Numbers

Among the major asset managers, BlackRock (BLK) is expected to post sequential and year-over-year growth in earnings per share to $6.38 in 1Q18 and $6.83 in 2Q18.

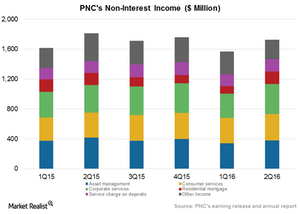

PNC Financials’ Non-Interest Income Ratio Continues to Expand

PNC Financial’s non-interest income for 2Q16 increased by 10% over the previous quarter, mainly due to higher fee income growth.

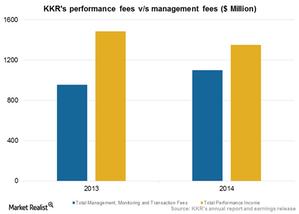

KKR Capstone: An institutionalized process of creating value

KKR has institutionalized the process of creating value in its portfolio companies through KKR Capstone.

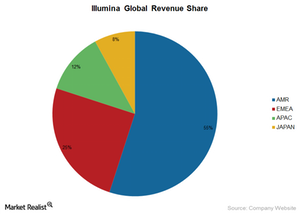

Why Illumina’s outlook is so bright

Illumina’s outlook is outstanding, as it has posted excellent 3Q14 results and its earnings continue to be bullish.Financials Overview: What makes custodian banks different from other banks?

Custodian banks like a warehouse and store other financial institutions’ and individuals’ assets—they help in keeping financial instruments safe.