Franklin Resources Inc

Latest Franklin Resources Inc News and Updates

The salient features of mutual funds

There are investors who are willing to take on higher risk to generate above-average market returns. For these investors, active funds offer the optimal investment avenue.

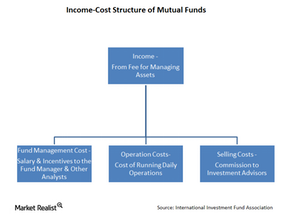

Show it: How mutual funds make money

In return for investing a client’s money, mutual funds charge a fee, generally an annual fee set as a percentage of the client’s assets. This fee is the only source of income for a mutual fund-focused asset manager.

A Look at T. Rowe Price’s Assets under Management

Asset classes In its investor presentation on February 21, 2018, T. Rowe Price (TROW) stated that its core business is helped by the allocation of its AUM (assets under management) in different asset classes and its strong client base. However, the company also believes that targeting new opportunities is crucial for its core business. Of its total AUM, […]

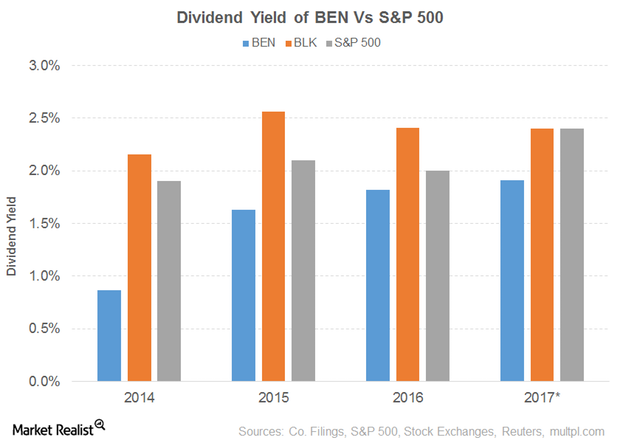

Dividend Yield of Franklin Resources

Franklin Resources (BEN) has recorded consistent growth in dividends since at least March 1982.

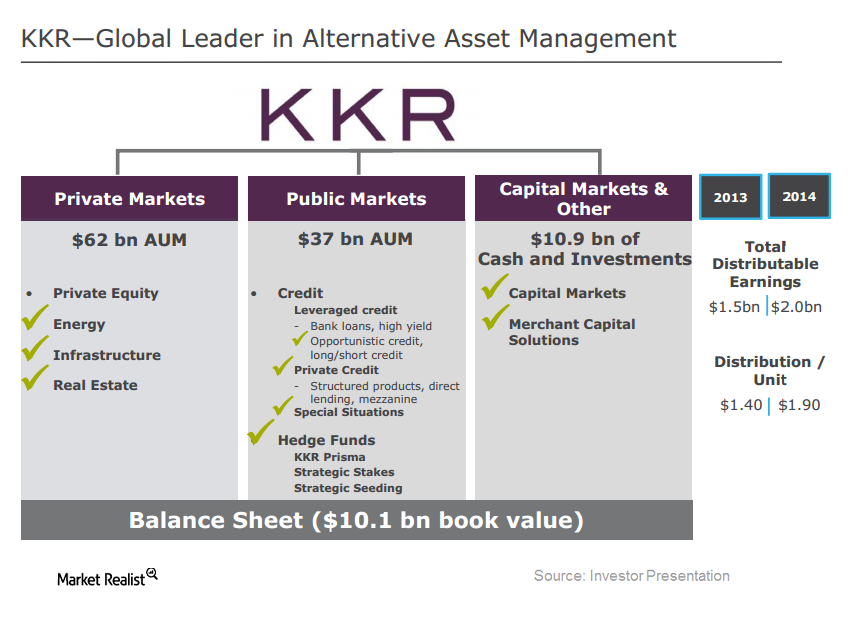

Fairholme Capital Exits Stake in KKR

For the fourth quarter of 2014, KKR reported a net loss of $0.6 million, compared to net income of $277.9 million in 4Q13.

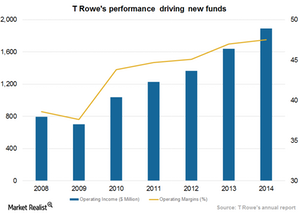

T. Rowe Price Group: It Takes Seed Capital to Build New Funds

The length of time seed capital is held in a portfolio depends on various factors such as how long it takes to generate cash flow from unrelated investors.