Materials Select Sector SPDR® ETF

Latest Materials Select Sector SPDR® ETF News and Updates

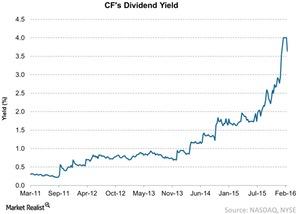

Is This Why CF’s Stock Has Rallied?

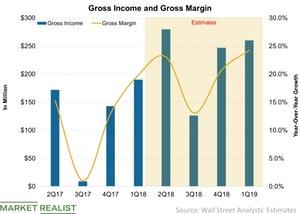

Like CF Industries’ (CF) sales, its margins are also expected to expand YoY (year-over-year) in Q2 2018 and the next four quarters.

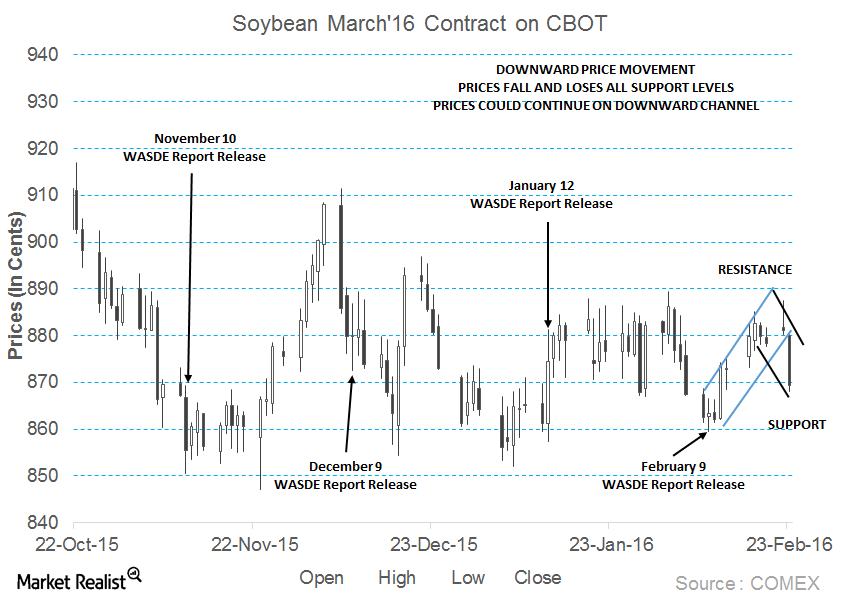

Soybean Prices Might Continue on the Downward Channel

March soybean futures contracts were trading near the support level of $8.70 per bushel on February 23. Prices fell for the second consecutive trading day.

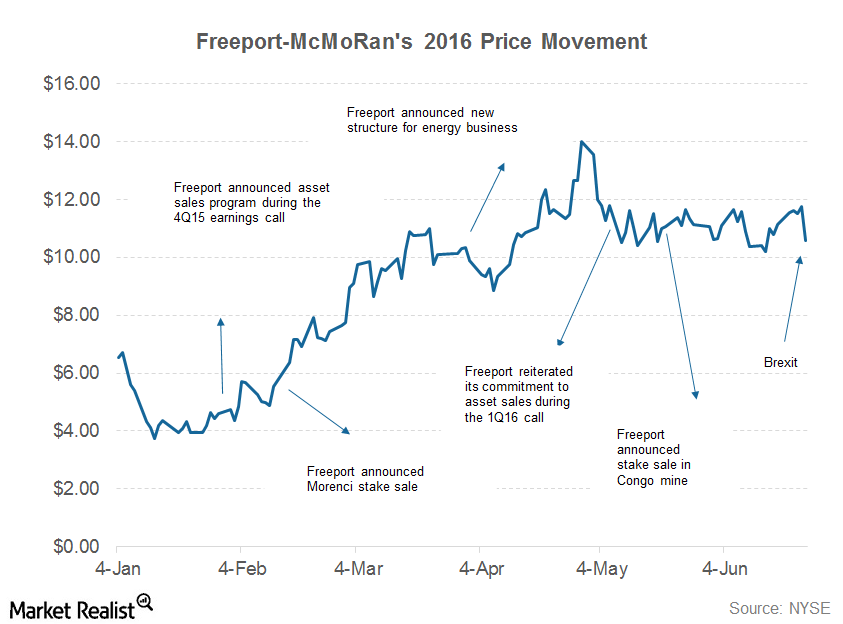

Can Freeport-McMoRan’s 2Q16 Earnings Justify Its Rally?

Freeport-McMoRan (FCX) is expected to release its 2Q16 earnings on July 26. In this series, we’ll explore what Wall Street analysts expect from FCX’s 2Q16 earnings.

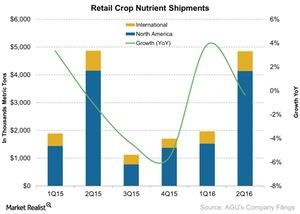

How Did Agrium’s Retail Shipments Perform in 2Q16?

Agrium’s (AGU) Retail segment’s shipments declined by 0.03% to 4.84 million tons in 2Q16, down from 4.86 million tons in 2Q15.

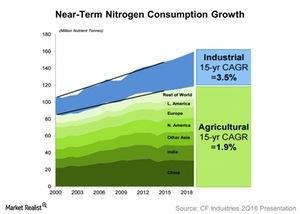

How Much Demand Will There Be for Nitrogen in the Near Term?

According to CF Industries, nitrogen prices could remain under pressure as new capacities come online in 2017. However, the company believes that things should improve in 2018.

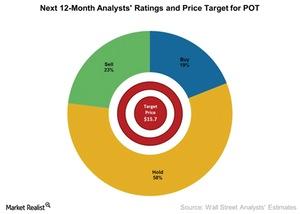

PotashCorp’s Price Target before It Reports Its 2Q16 Earnings

Since the beginning of 2016, analysts have revised their next-12-month price target for PotashCorp downward. The consensus price target now stands at $15.70.

Fertilizer Affordability Pressure Eased Last Week

While the Fertilizer Affordability Index was below one, it’s still higher compared to the average levels observed since January 2016.

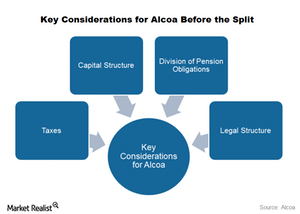

Must Know: What Value Can Elliott Management Add to Alcoa?

Elliott Management noted that it plans to engage in a “constructive dialogue” with Alcoa’s (AA) board regarding Alcoa’s split transaction and “additional available opportunities to maximize shareholder value.”

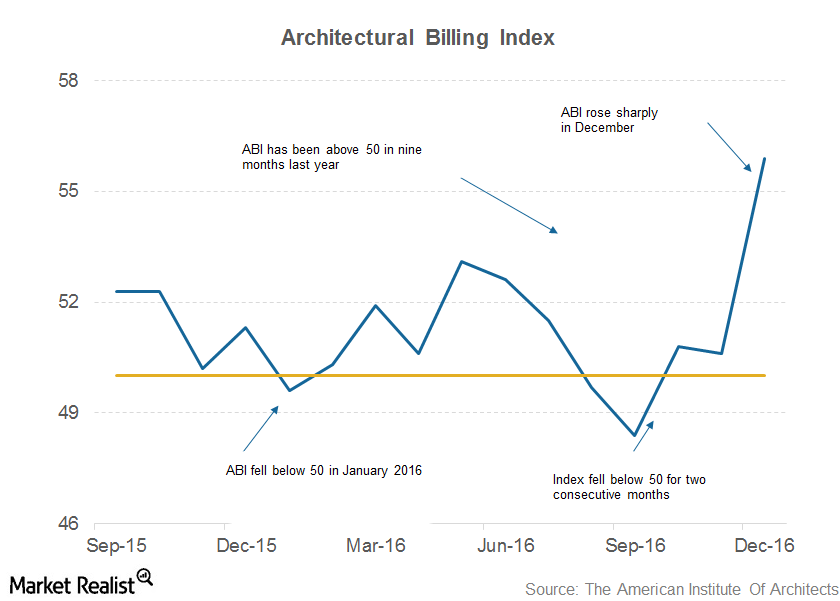

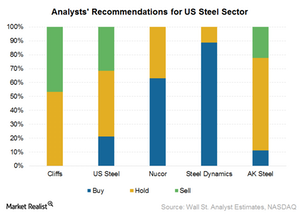

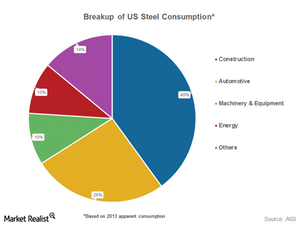

US Steel Demand: The Latest Indicators

Steel demand is a key driver of steel companies’ performances, and the construction sector accounts for almost 40% of US steel demand.

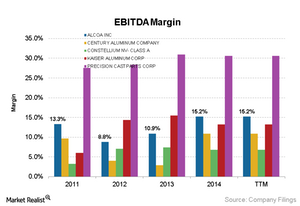

Why Profit Margins Vary across the Aluminum Value Chain

The profit margins vary across the aluminum value chain. Upstream aluminum producers’ earnings depend on their position on the cost curve.

Who Are the Biggest Players in the Fertilizer Industry?

There’s a handful of big players in the agricultural fertilizer industry. Setting up business requires huge capital, which makes for a high barrier to entry.

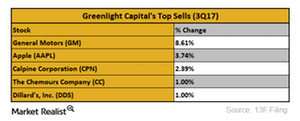

Analyzing David Einhorn’s Top Sells in 3Q17

Although General Motors has been the top holding of Einhorn’s portfolio for a long time, he reduced some of his position in the stock in 3Q17.

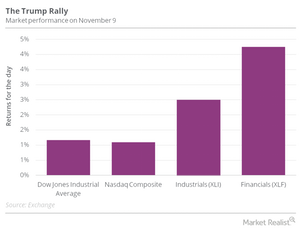

Gundlach: Invest in Industrials, Materials, Financial Sectors

“Industrials, materials, and financials are the sectors. . .you want to be invested in,” said Jeffrey Gundlach recently in a CNBC interview.

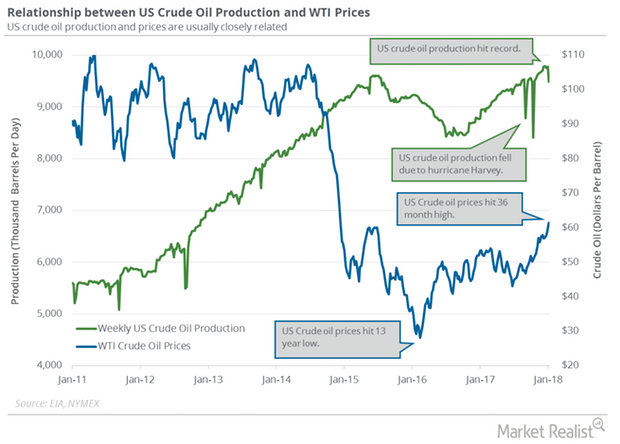

Will US Oil Production Pressure Crude Oil Futures?

February WTI crude oil futures contracts fell 0.9% to $63.73 per barrel on January 16. Brent oil futures fell 1.6% to $69.15 per barrel on the same day.

Air Products and Chemicals Completes Acquisition of ACP Europe SA

In a press release today, Air Products and Chemicals (APD) announced that it had completed its acquisition of ACP Europe SA.

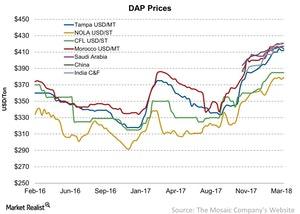

Are DAP Prices Outside the US Reversing?

DAP (diammonium phosphate) prices have been rising lately.

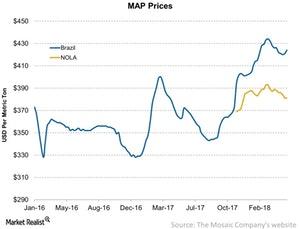

Monoammonium Phosphate Prices and Mosaic’s Views on Brazil

Like DAP (diammonium phosphate) prices last week, MAP (monoammonium phosphate) prices were broadly flat to positive WoW (week-over-week) but stayed higher YoY (year-over-year).

How Did DAP Prices Move Last Week?

Last week, the DAP prices in the NOLA region rose by 53 basis points to $344 per metric ton from $342 per metric ton.

Reviewing Albemarle’s Stock Performance since 3Q17

Albemarle (ALB) is set to announce its 4Q17 results after the market closes on February 27, 2018.

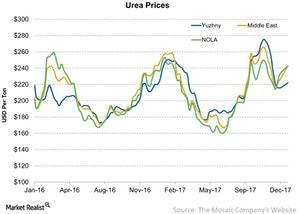

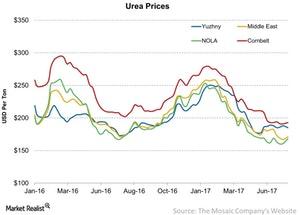

Urea Prices Saw Good Start to 2018

In the week ending January 5, the prices for granular as well as prilled urea were broadly higher week-over-week.

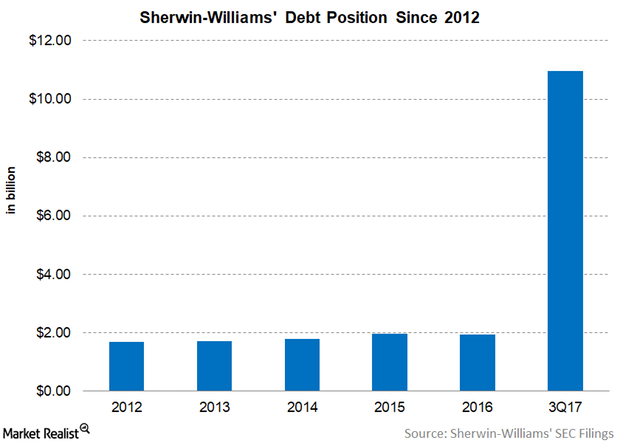

Sherwin-Williams’ Debt at All Time High: Should Investors Worry?

At the end of 3Q17, Sherwin-Williams (SHW) debt was at an all-time high of $11.0 billion.

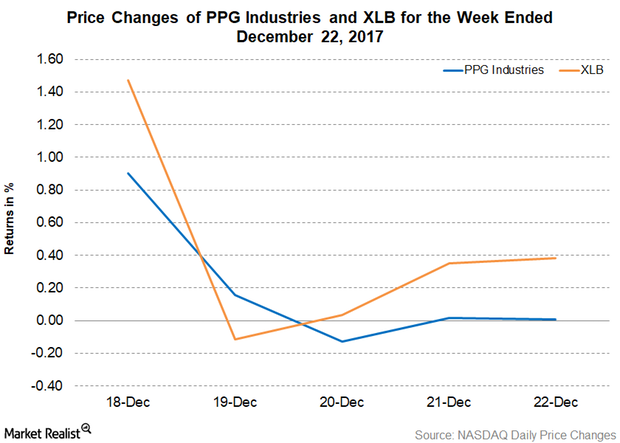

PPG Industries Increases Precipitated Silica Product Prices

On December 19, 2017, PPG Industries (PPG) announced that it’s increasing the prices of sodium silicate and all precipitated silica by up to 6%.

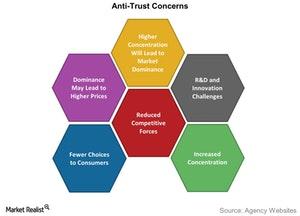

The Bayer-Monsanto Merger Concerns

Some anti-trust agencies have pushed back their merger approval deadlines over anti-competitive concerns the deal will likely create.

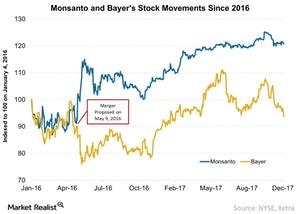

The Bayer-Monsanto Merger Deal: An Update

On September 14, 2016, Bayer signed an agreement with Monsanto (MON) to acquire it for $66 billion, or $128 per share. The offer represented a 44% premium over Monsanto’s stock price.

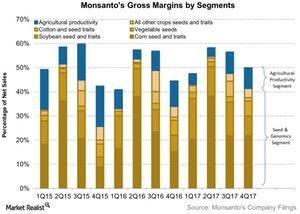

Monsanto’s 4Q17 Gross Margins by Segment

The Seed and Genomics segment’s gross margins expanded from 34.0% in 4Q16 to 41.4% in 4Q17.

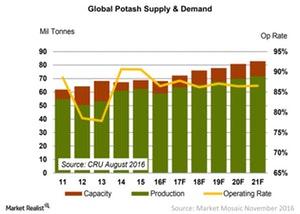

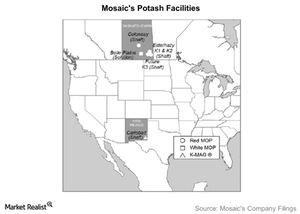

The Potash Capacity and Demand Landscape for 2017 and Beyond

The market environment for potash has seen a better recovery than nitrogen and phosphate fertilizers have seen.

Granular Urea versus Prilled Urea Last Week

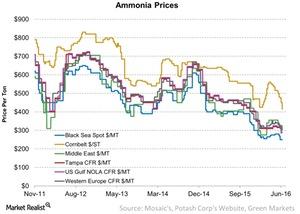

Last week, granular urea prices moved higher, which helped bring some relief to urea producers. But the falling global ammonia prices remained a challenge.

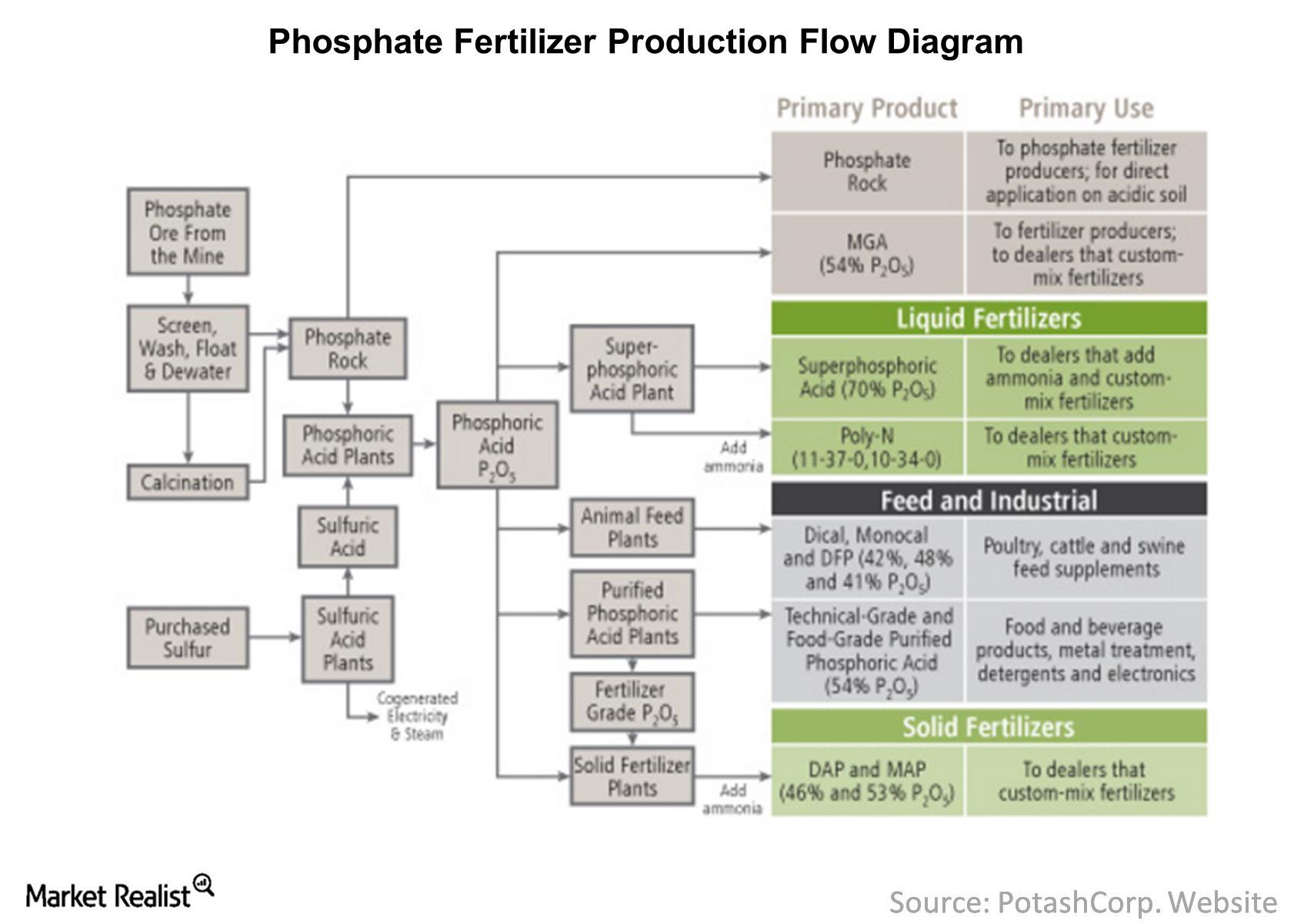

Phosphate Fertilizer Cost Drivers and Production Flow

Since phosphate rock is one of the major costs of production, companies such as Mosaic (MOS) have an integrated production process.

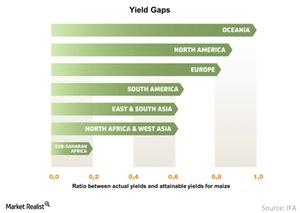

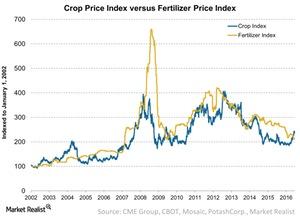

Fertilizers: A Key Part of Increasing Crop Yields

Increasing crop yield on available farmland could be the best solution to the problem of increasing crop production.

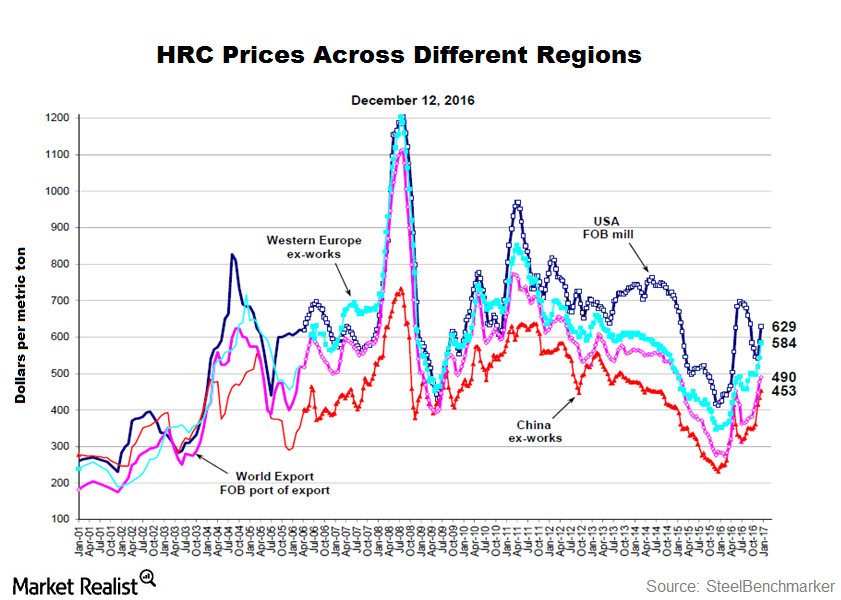

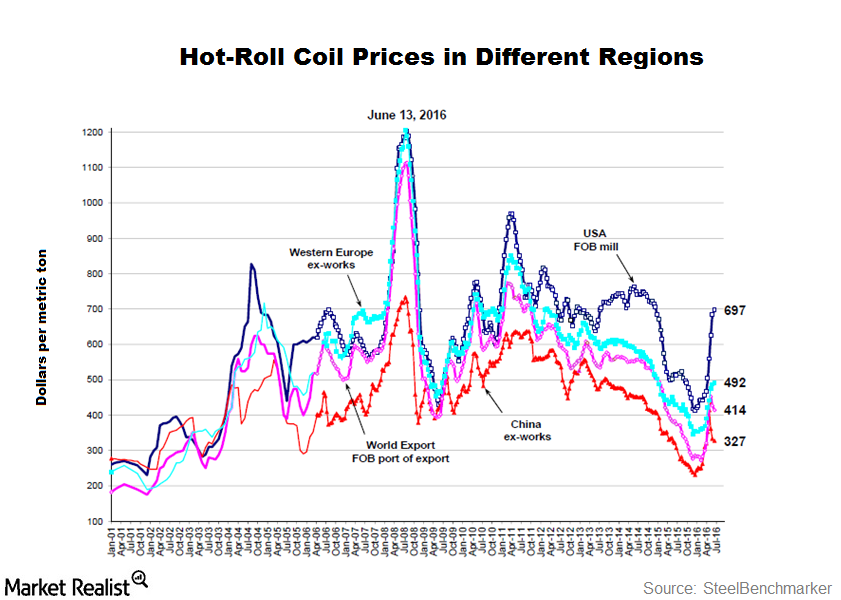

Why U.S. Steel Investors Should Look at Steel Price Spreads

The United States is the largest steel importer globally. Steel companies such as U.S. Steel Corporation frequently blame steel imports for the US steel industry’s woes.

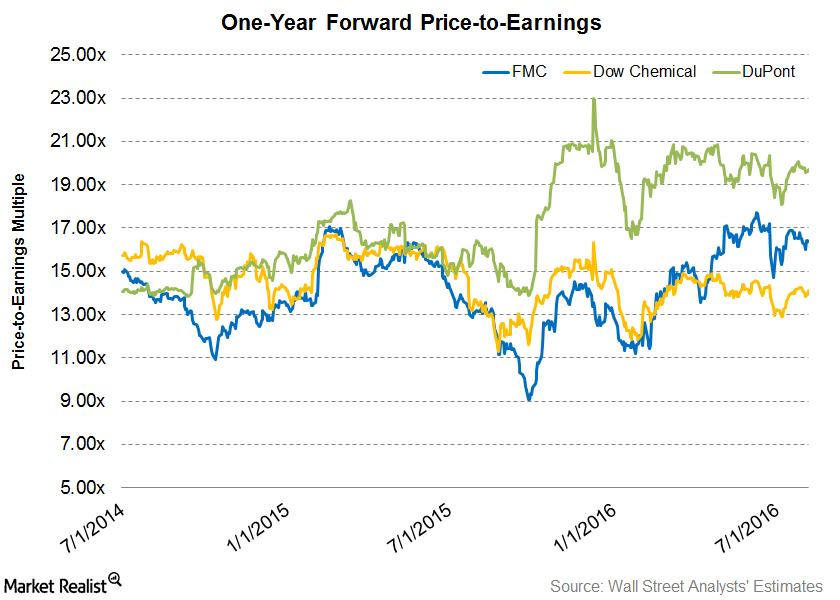

Where Do FMC’s Valuations Stand after Its 2Q16 Earnings?

Forward price-to-earnings (or PE) is a relative valuation method that considers a company’s future earnings for calculation.

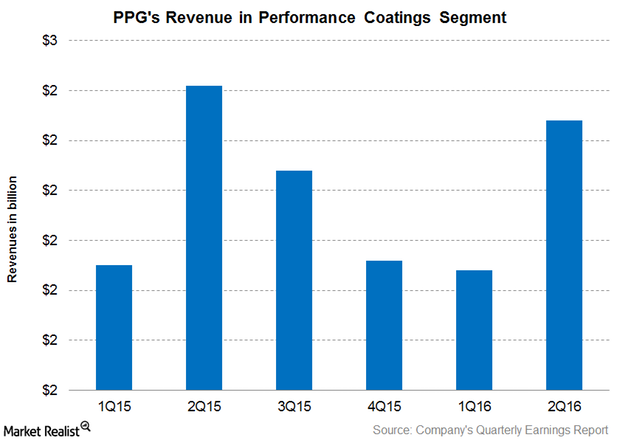

Why PPG Industries’ 2Q16 Revenue from Performance Coatings Fell

In 2Q16, PPG Industries’ Performance Coatings segment, the largest revenue contributor, accounted for approximately 57.5% of PPG’s total revenues.

Why Do Ammonia Prices Keep Falling?

Ammonia prices in the Southern Plains had the steepest fall of 10.5% last week, continuing the previous week’s trend.

Could Brexit Shake the European Steel Industry?

The EU hasn’t been able to act decisively against higher Chinese steel imports. European steel production has fallen much steeper this year.

Agricultural Chemical Companies: Crop and Fertilizer Price Impact

Investors in the fertilizer industry (XLB) must actively track the relationship between crop prices and fertilizer prices. This, in turn, impacts agricultural chemical companies.

An Overview of Mosaic’s Potash Segment Operations

Mosaic’s Potash segment generated $2.5 billion in net sales, excluding intersegment sales, in 2015. This accounted for 28% of the company’s total net sales.

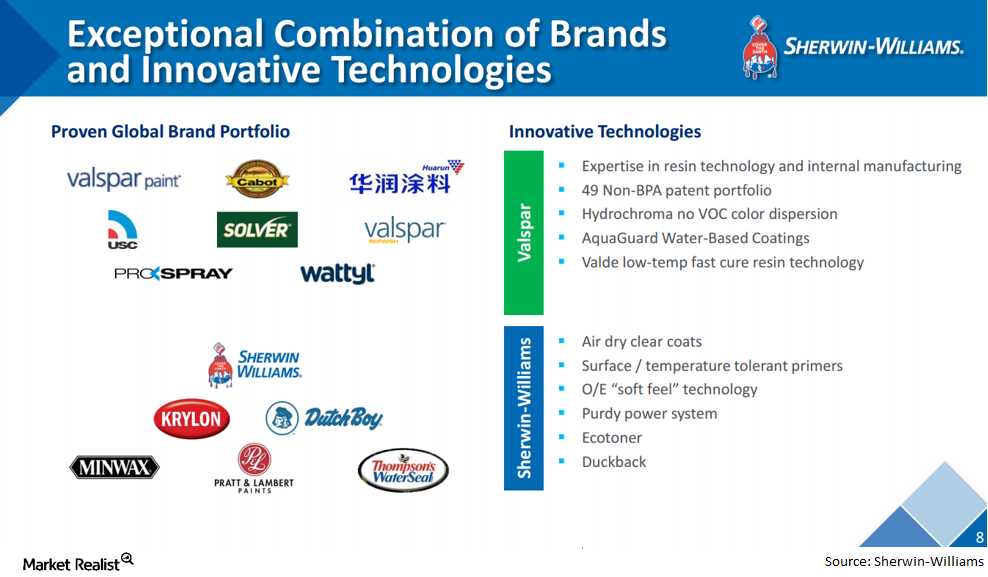

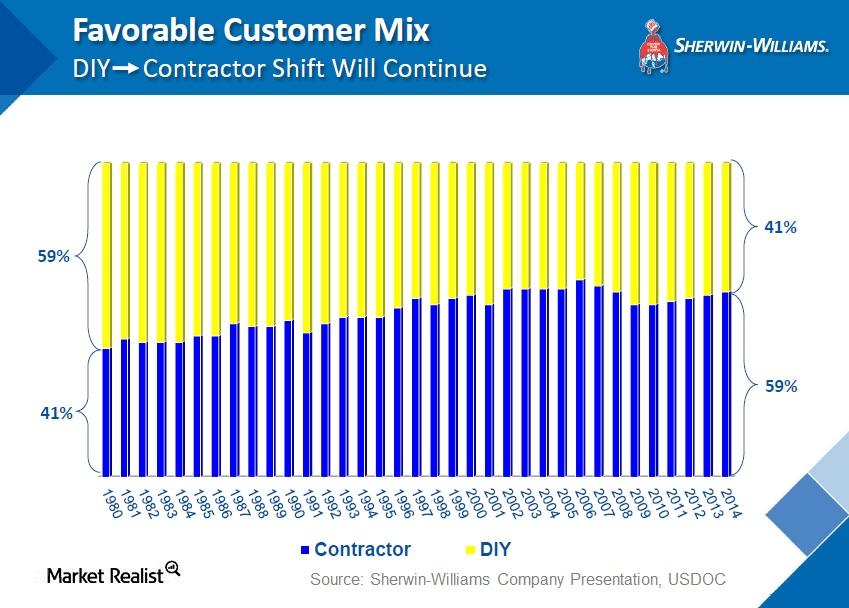

What’s the Rationale for the Valspar and Sherwin-Williams Merger?

Sherwin-Williams is buying coatings manufacturer Valspar in a $11.3 billion cash transaction. The companies stress that this is a complementary transaction.

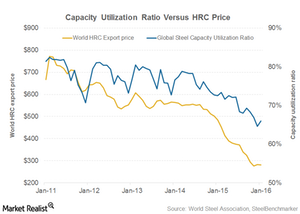

Will Global Overcapacity Weigh Heavy on Steel Prices?

The excess global steel capacity will take a lot of time to balance out. The capacity closures in China, if they happen at all, will be gradual.

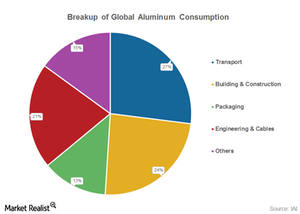

Will Aluminum Demand Grow 6% as Alcoa Is Projecting?

There are valid reasons for aluminum producers to feel upbeat about aluminum demand growth.

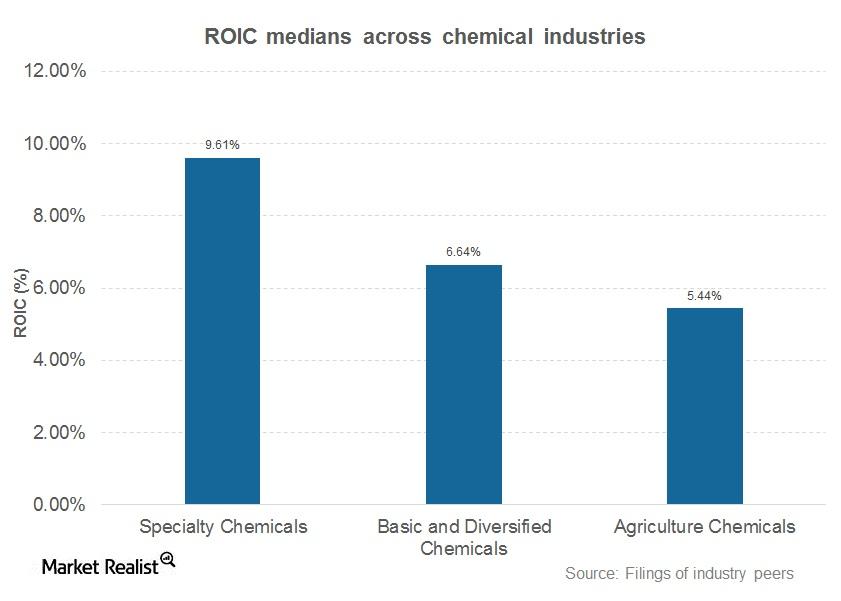

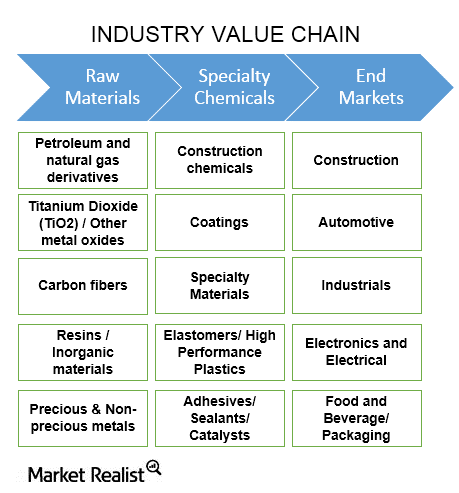

Assessing Returns in the Specialty Chemical Industry

The proprietary products and processes developed by specialty chemical firms command a premium and have enabled companies to post high returns on capital.

Why Paint Companies Are Posting Their Best Gross Margins

Paint companies benefit significantly when titanium dioxide prices enter recessionary cycles.

Introducing the Specialty Chemicals Industry: What You May Not Yet Know

The specialty chemicals industry caters to diverse sectors through innovative products that are tailored to the specific requirements of end markets.

Checking in with CF Industries’ Dividend Yield

As of February 19, CF Industries pays a quarterly dividend of $0.3 per share. In 2015, it paid an annual dividend per share of $3.6—down from $5 in 2014.

Cliffs Natural Resources: 4Q15 Market Expectations

Of 15 analysts covering Cliffs Natural Resources, eight have given it a “hold” recommendation, and seven have given it a “sell” recommendation.

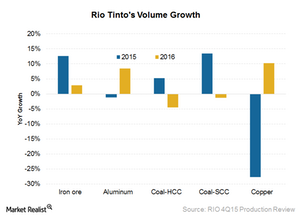

Rio Tinto Reported Overall Strong Production Results for 4Q15

Rio Tinto’s copper production was a slight miss, falling short ~1% of the fiscal 2015 guidance. This was mainly due to weaker throughput at Escondida.

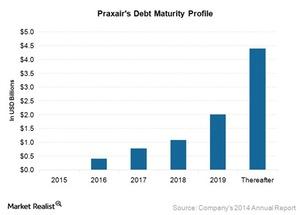

Does Praxair Have a Sustainable Debt Maturity Profile?

Praxair’s total debt has increased significantly, rising from $6.6 billion in 2011 to $9.3 billion in 2014.

It’s Beginning to Look a Lot like a US Steel Consumption Cool Down

If the Fed continues to raise rates in 2016, we could see the impact on the housing and automotive sectors, which would only add to steel’s woes.

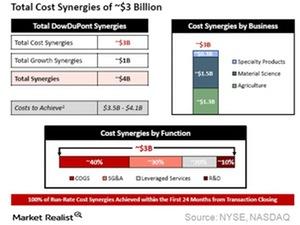

Will the Dow Chemical and DuPont Merger Have Operational Synergy?

With corporate changes, the combined company is expected to generate total cost savings of $3 billion over the next two years after the merger.

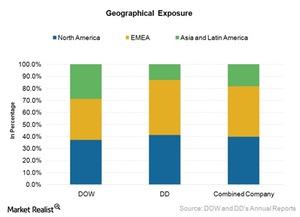

Will the Merger Have Geographical Synergy for the New Company?

After the merger, the merged entity is expected to have a better geographical presence than its individual global presence.

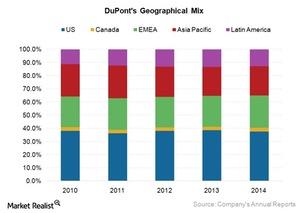

How Is DuPont’s Geographical Sales Exposure and Global Presence?

DuPont is a global company with operations in more than 90 countries. In 2014, the company’s North America region contributed 41% to its total revenue.