What’s the Rationale for the Valspar and Sherwin-Williams Merger?

Sherwin-Williams is buying coatings manufacturer Valspar in a $11.3 billion cash transaction. The companies stress that this is a complementary transaction.

March 23 2016, Updated 9:07 a.m. ET

Complementary transaction for Sherwin Williams

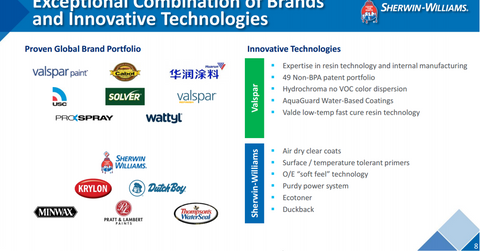

As we saw in the first part of the series, paint company Sherwin-Williams (SHW) is buying coatings manufacturer Valspar (VAL) in a $11.3 billion cash transaction. The companies stress that this is a complementary transaction. However, they’re planning for possible antitrust hurdles.

Management’s comments

John G. Morikis, president and CEO of Sherwin-Williams, said that “Valspar is an excellent strategic fit with Sherwin-Williams. The combination expands our brand portfolio and customer relationships in North America, significantly strengthens our Global Finishes business, and extends our capabilities into new geographies and applications, including a scale platform to grow in Asia-Pacific and EMEA. Customers of both companies will benefit from our increased product range, enhanced technology and innovation capabilities, and the transaction’s clearly defined cost synergies. We have tremendous respect for the expertise and dedication of the Valspar team and we are excited about the opportunities that this combination will provide to both companies’ employees. Sherwin-Williams will continue to be headquartered in Cleveland and we intend to maintain a significant presence in Minneapolis. Sherwin-Williams has a long track record of successfully integrating acquisitions.”

Synergy estimates

The companies anticipate that the transaction will be immediately accretive to cash flow per share excluding one-time merger costs. They anticipate that they will achieve synergies of $280 million in the year after closing. Within two years, they expect to achieve a synergy run rate of $320 million per year.

Other merger arbitrage resources

Other important merger spreads include the Dow Chemical (DOW) and DuPont (DD) deal. It’s slated to close in 2H16. The Apollo-ADT (ADT) merger is another important deal. For a primer on risk arbitrage investing, read Merger arbitrage must-knows: A key guide for investors.

Investors who are interested in trading in the retail sector should look at the Materials Select SPDR (XLB).