Valspar Corp

Latest Valspar Corp News and Updates

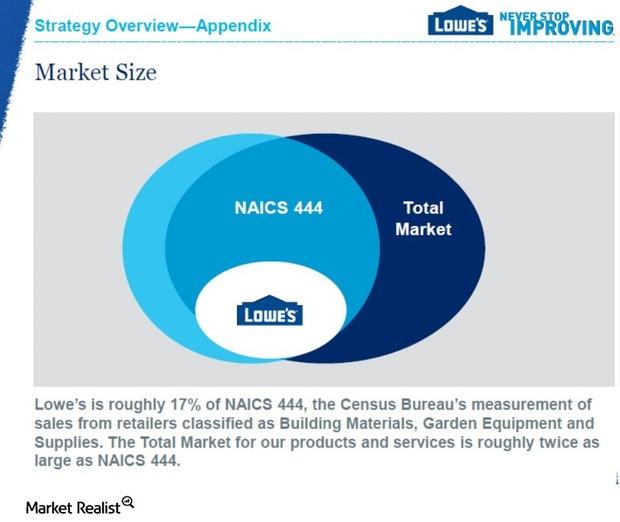

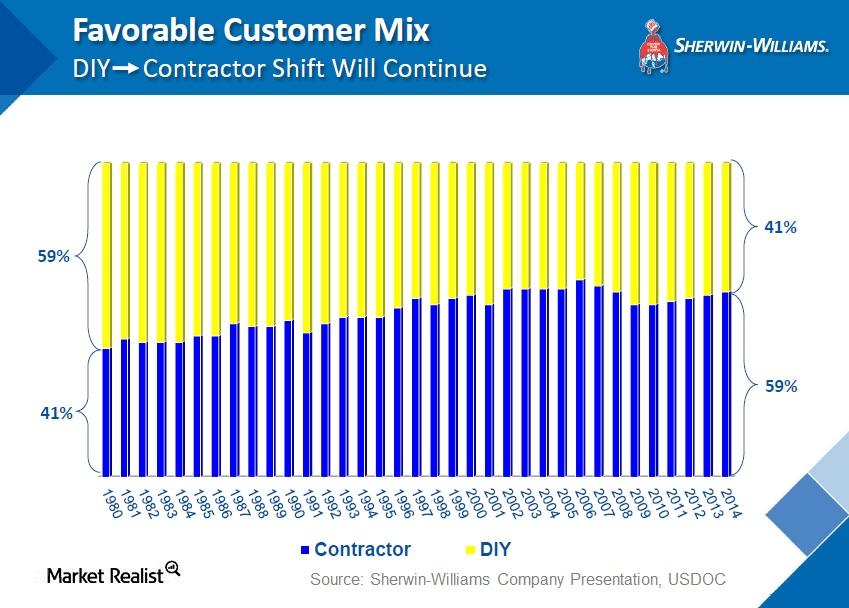

Porter’s 5 Forces: Lowe’s Position in a Competitive Industry

Lowe’s (LOW) operates in the home improvement industry where most products, especially building materials, are largely standardized and undifferentiated.

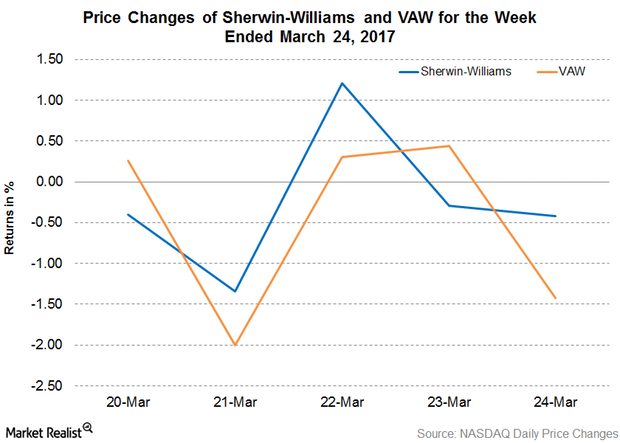

Sherwin-Williams and Valspar Postpone Merger Date

On March 21, 2017, Sherwin-Williams (SHW) and Valspar (VAL) extended the closure date of their merger agreement to June 21 from the previously announced March 21, 2017.

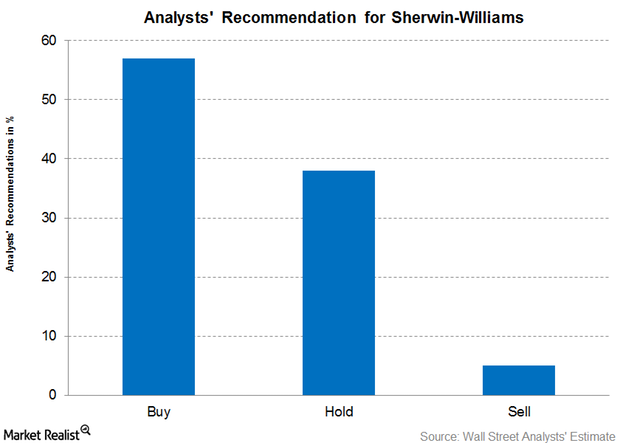

Analysts’ Latest Recommendations for Sherwin-Williams

As of February 27, 21 brokerage firms were actively tracking Sherwin-Williams stock—57% gave it a “buy,” 38% gave it a “hold,” and 5% gave it a “sell.”

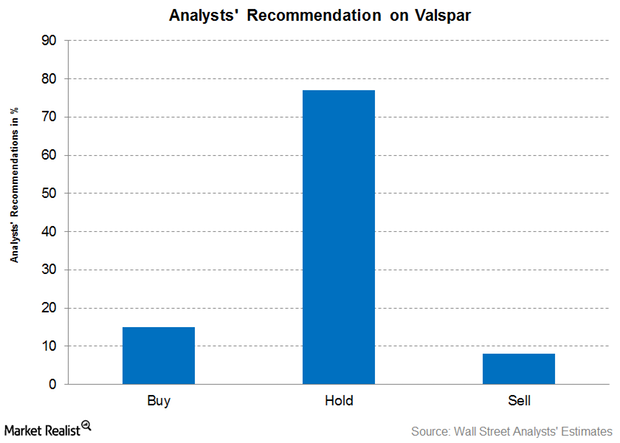

What Does Wall Street Think about Valspar?

As of December 20, 2016, 13 brokerage firms are actively tracking Valspar (VAL)) stock. About 15.0% of those analysts have recommended a “buy” for the stock.

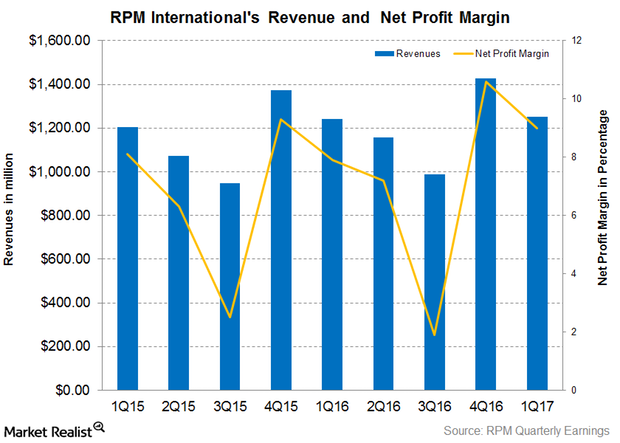

Why Did RPM’s Fiscal 1Q17 Revenues Miss Analyst Estimates?

RPM International (RPM) reported fiscal 1Q17 revenues of $1.25 billion, which missed analysts’ expectation of $1.30 billion.

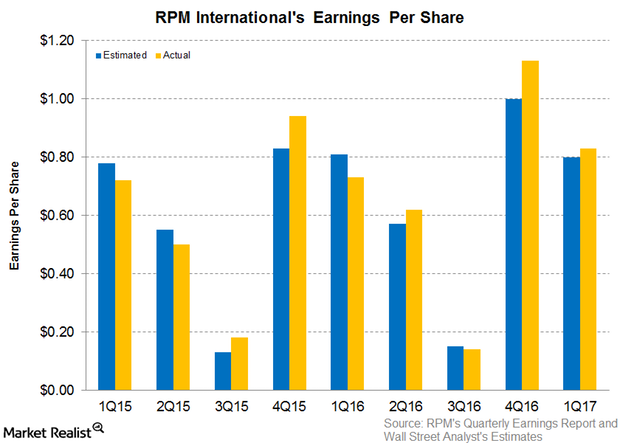

RPM International’s Fiscal 1Q17 Earnings Beat Analysts’ Estimates

RPM International reported adjusted EPS (or earnings per share) of $0.83, which beat analysts’ estimate of $0.80.

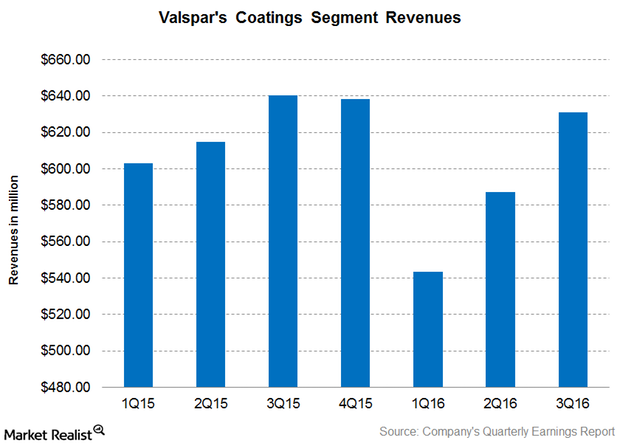

Why Did Valspar’s Coatings Segment Revenue Fall in 3Q16?

Valspar (VAL) reports its revenue under two segments, namely: the coatings segment and paints segment.

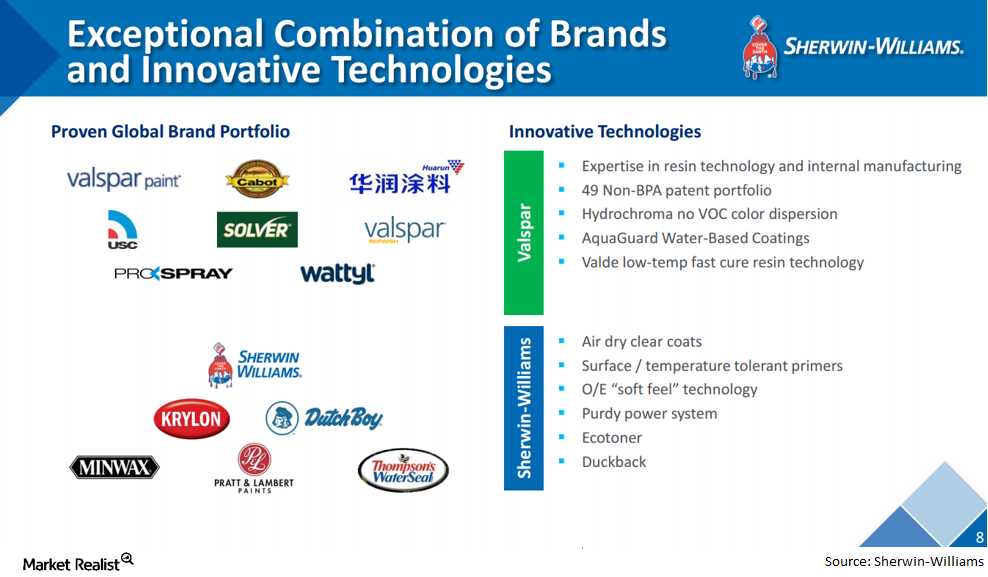

What’s the Rationale for the Valspar and Sherwin-Williams Merger?

Sherwin-Williams is buying coatings manufacturer Valspar in a $11.3 billion cash transaction. The companies stress that this is a complementary transaction.

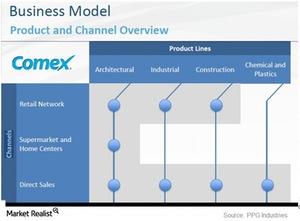

Understanding the Business Models of Specialty Chemical Companies

Companies in the specialty chemical industry have fewer intermediaries in their distribution range as they move from coatings to more specialized chemicals.

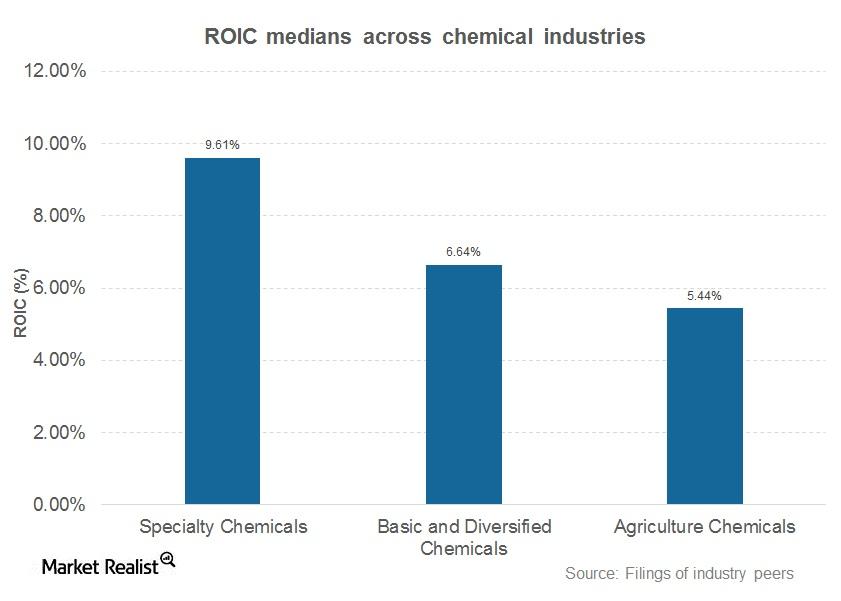

Assessing Returns in the Specialty Chemical Industry

The proprietary products and processes developed by specialty chemical firms command a premium and have enabled companies to post high returns on capital.

Why Paint Companies Are Posting Their Best Gross Margins

Paint companies benefit significantly when titanium dioxide prices enter recessionary cycles.

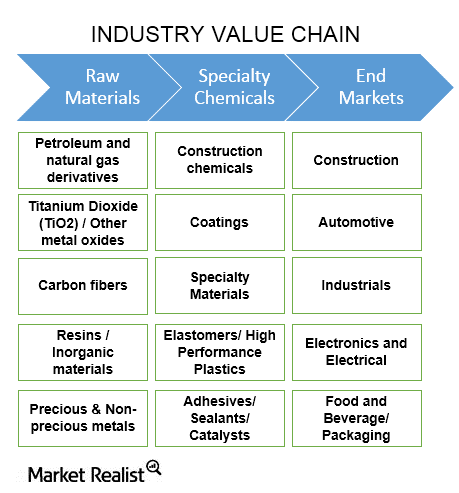

Introducing the Specialty Chemicals Industry: What You May Not Yet Know

The specialty chemicals industry caters to diverse sectors through innovative products that are tailored to the specific requirements of end markets.