Sherwin-Williams and Valspar Postpone Merger Date

On March 21, 2017, Sherwin-Williams (SHW) and Valspar (VAL) extended the closure date of their merger agreement to June 21 from the previously announced March 21, 2017.

March 27 2017, Updated 10:38 a.m. ET

Sherwin-Williams and Valspar postpone merger date

On March 21, 2017, Sherwin-Williams (SHW) and Valspar (VAL) extended the closure date of their merger agreement to June 21 from the previously announced March 21, 2017. The extension was primarily driven by a possible required divestiture in order to get the Federal Trade Commission’s approval to complete the Valspar acquisition. For SHW to acquire Valspar at $113 per share, the divestiture’s annual revenue must be under $650 million.

John Morikis, president and CEO of Sherwin-Williams, said, “We continue to move forward on the divestiture of a single business that we believe will allow us to gain approval from the FTC, and we are in discussions with a number of prospective buyers. We remain confident in our ability to complete the divestiture at a fair price, and we look forward to unlocking the value of the combined business when the Valspar acquisition closes.”

Sherwin-Williams stock price

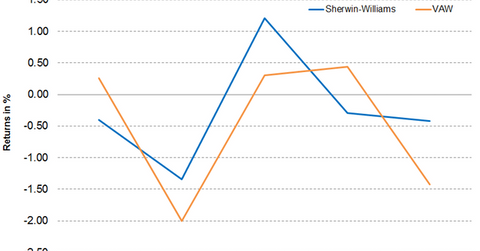

On March 24, 2017, Sherwin-Williams closed at $309.45 with a drop of 1.3% for the week. The Vanguard Materials ETF (VAW), which holds 3.0% in SHW as of March 24, fell 2.4%, underperforming SHW for the week. Sherwin-Williams (SHW) peers PPG Industries (PPG), Valspar (VAL), and RPM International (RPM) dropped 1.3%, 0.5%, and 4.0%, respectively.

SHW stock closed 8.4% above the 100-day moving average price of $285.50, indicating an upward trend in the stock. Analysts expect SHW’s 12-month target price to be at $322.40, implying a potential return of 4.2% over the closing price on March 24, 2017. On a year-to-date (or YTD) basis, SHW has risen 15.5%. SHW’s 14-day relative strength index (or RSI) of 51 indicates that the stock is neither overbought nor oversold. An RSI of 70 indicates the stock is overbought while an RSI of 30 indicates the stock is oversold.