Materials Select Sector SPDR® ETF

Latest Materials Select Sector SPDR® ETF News and Updates

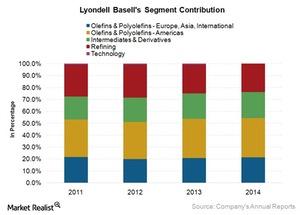

LyondellBasell: A Leading Manufacturer of Olefins and Polyolefins

LyondellBasell is one of the world’s leading producers of olefins and polyolefins. After Dow Chemical, LYB is the second largest company by revenue and EBITDA in the US.

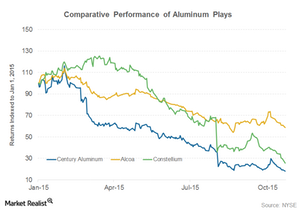

Will Century Aluminum Post a Larger-Than-Expected Loss in 3Q15?

Analysts expect Century Aluminum (CENX) to post a loss when it releases its 3Q15 results on October 29, 2015. Earnings season for the aluminum industry has started on a dull note.

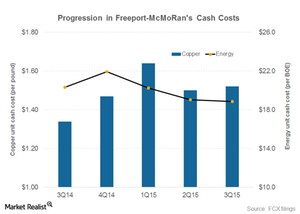

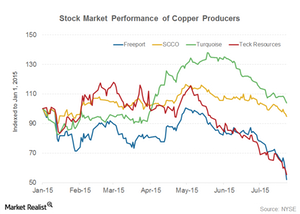

Is Freeport-McMoRan Doing Enough to Contain Its Costs?

In this part of ours series, we’ll explore the trend in Freeport-McMoRan’s unit production costs.

Short-Term Outlook: Freeport-McMoRan, Copper Could Drift Lower

Although copper prices have recovered from sub-$5,000 levels, the worst doesn’t seem to be over for copper or Freeport-McMoRan (FCX).

U.S. Steel Recovers from 52-Week Low: But Is It out of the Woods?

U.S. Steel has bounced back from its 52-week low. In fact, most steel company earnings have been better than analyst expectations.

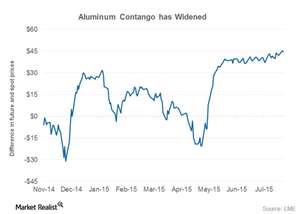

Aluminum Contango Widens as Market Expects Prices to Recover

A wider contango is generally associated with a short-term oversupply in the market. Aluminum market dynamics took a beating as China’s aluminum exports are reaching alarming levels.

Freeport-McMoRan: 2Q15 Earnings, Outlook Fail to Cheer Investors

Freeport-McMoRan (FCX) released its 2Q15 earnings on July 23. It reported a net loss of $1.85 billion, which was largely attributable to the $2 billion write-down of its oil and gas assets.

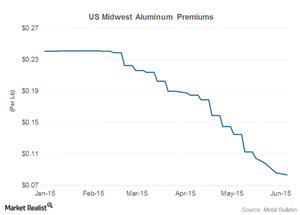

US Midwest Aluminum Premiums Are Still Caught in a Downtrend

Year-to-date, aluminum prices have lost ~9%, while physical aluminum premiums in the US have lost almost 60%.

Key Investor Takeaways from US Steel’s 1Q Earnings Release

US Steel’s 1Q earnings results came in lower than analyst estimates, and the company’s share price tanked more than 10%.

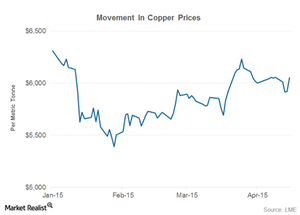

Supply Disruptions in 2015 Support Copper Prices

Copper prices have traded largely sideways in April. Copper prices fell sharply in January but have recovered smartly since then. Year-to-date, copper prices are down ~4%.

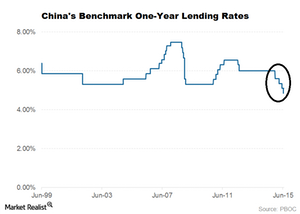

Why Freeport Investors Should Track China’s Automobile Industry

China is the world’s biggest automotive market, where close to 22 million vehicles are sold each year. A mid-sized vehicle has ~50 pounds of copper content.

Copper Prices Hold Steady Amid Commodity Carnage

The trend in copper prices has been clearly uneven this year. Higher copper prices benefit copper producers like Freeport-McMoRan.

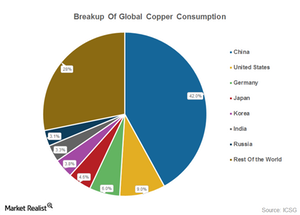

An Investor’s Guide To The Chinese Copper Industry

China overtook the US and Japan as the premier manufacturing location. China doesn’t have sufficient copper reserves, leading to the global copper trade.