Why U.S. Steel Investors Should Look at Steel Price Spreads

The United States is the largest steel importer globally. Steel companies such as U.S. Steel Corporation frequently blame steel imports for the US steel industry’s woes.

Dec. 21 2016, Updated 9:05 a.m. ET

Spreads

The United States is the largest steel importer globally. Steel companies (XLB) such as U.S. Steel Corporation (X), ArcelorMittal (MT), AK Steel (AKS), and Nucor (NUE) frequently blame steel imports for the US steel industry’s woes.

Spreads rose to record highs

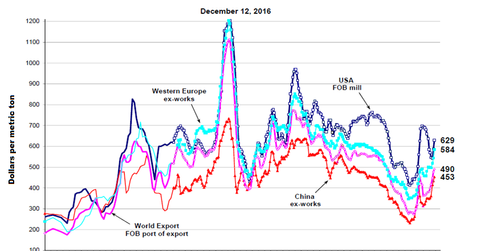

The primary reason the United States is the top steel import destination is the difference between US and international prices. Historically, US steel prices have been higher than international steel prices.

The spread between US and international steel prices widened to record highs in 2Q16. Higher spreads between US and international prices prompted US steel buyers to actively scout international markets. As US steel imports started gradually rising, US steel mills were left with little option but to cut their base selling prices.

While US steel prices fell in 3Q16, they were stable elsewhere. As a result, the spread between US and international steel prices narrowed from its record highs. Narrowing spreads reduced the attractiveness of imported steel products for US steel consumers, prompting them to place orders with domestic steel mills.

Spread reversion

According to SteelBenchmarker, on December 12, 2016, the spread between US and world export prices was ~$139 per metric ton for HRC (hot rolled coil), while the spread for CRC (cold rolled coil) was ~$227 per metric ton.

To put this in context, consider that on September 12, 2016, the spread between US and world export prices was ~$250 per metric ton for HRC, while the spread for CRC was ~$400 per metric ton.

Narrowing spreads between US and international steel prices could support US steel prices in the near term.

Remember that higher Chinese steel prices amid better-than-expected demand have been a key driver of steel prices in 2016. In the next article, we’ll see how China’s steel demand indicators looked last month.