Time Warner Inc

Latest Time Warner Inc News and Updates

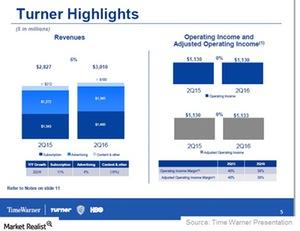

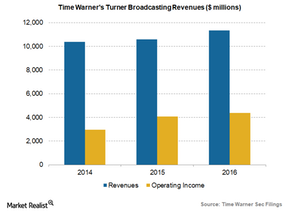

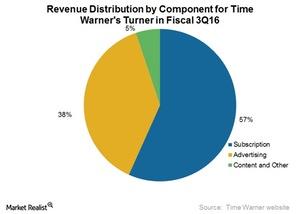

What’s the Outlook for Time Warner’s Advertising Business?

At the start of 2016, Time Warner said it intended to reduce ad loads on Turner’s TNT channel. It also intends to reduce ads on TNT’s three new dramas set to premiere this year.

Why Time Warner Intends to Pull Its HBO Programming from Amazon

Time Warner announced at its fiscal 1Q17 earnings call that it most likely won’t extend its agreement with Amazon beyond 2018.

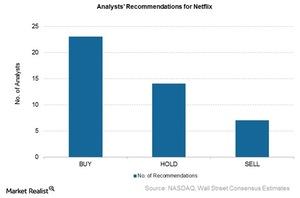

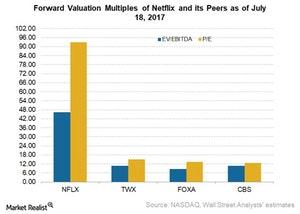

Trading at a Discount, Netflix Has Mixed Recommendations

Of the 44 analysts covering Netflix, 23 have given it a “buy” recommendation, seven have given it a “sell” recommendation, and 14 have given it a “hold” recommendation.

A Look at Time Warner’s Key Metrics

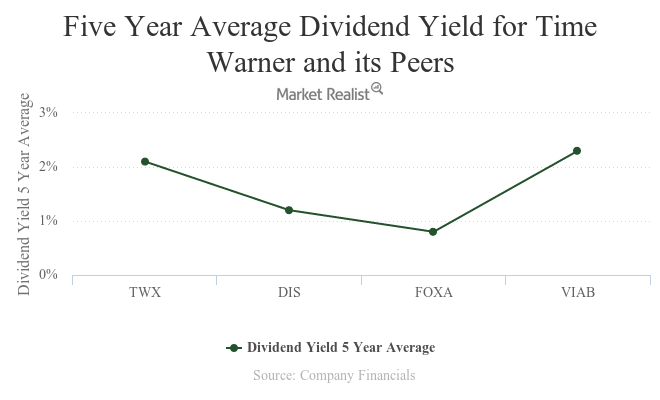

In fiscal 1Q16, Time Warner bought back $700 million worth of shares. Including dividends, it has returned around $1.3 billion to its shareholders year-to-date.Technology & Communications An assessment: Viacom versus its media peers

Viacom, despite being undervalued by analysts, is expected to see growth from its media networks segment especially with its digital partnership deals.

The Impact of the AT&T–Time Warner Merger

Analyst Craig Moffett believes that AT&T has an 80% chance of prevailing in court in its proposed merger with Time Warner.

How Do Media Networks Make Money?

Media networks face stiff competition for acquisition and distribution of content. Quality and exclusivity add to competition across the media value chain.

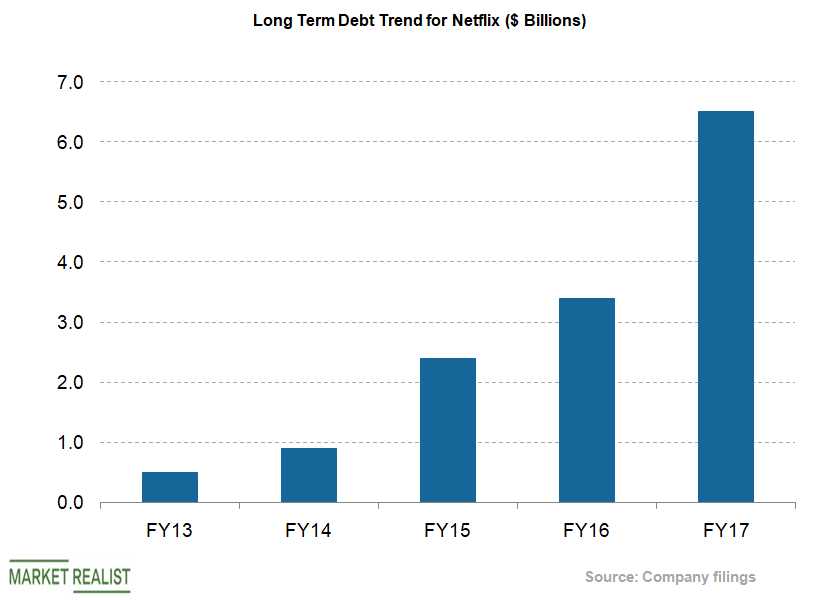

Debt Remains Netflix’s Prime Source of Financing

Netflix (NFLX) considers debt its main source to finance content, given its lower cost of capital.

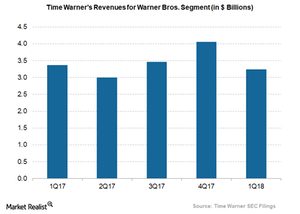

Understanding Time Warner’s Warner Bros. Revenue Trends

Time Warner’s (TWX) studio segment, Warner Bros., had a weak 1Q18, with both its revenue and operating income falling.

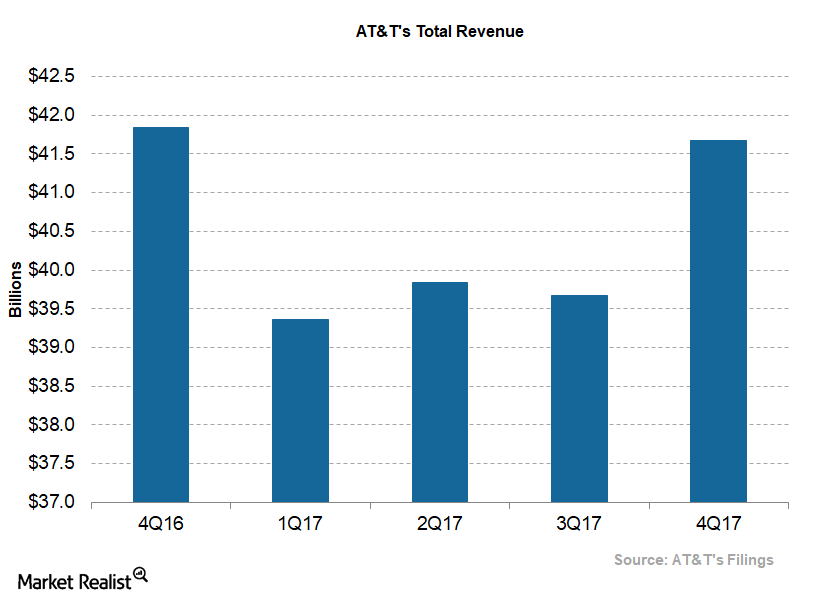

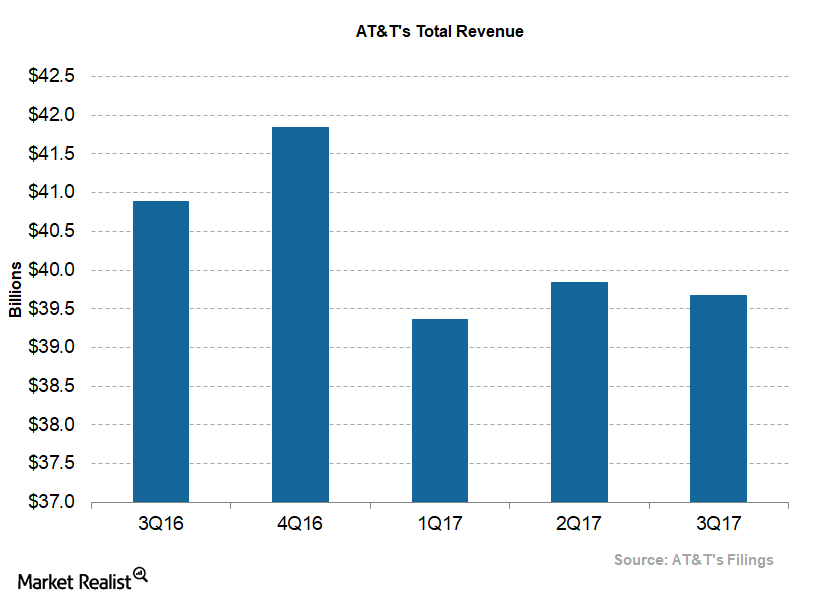

What Are AT&T’s Top Priorities for 2018?

AT&T’s management stated that in 2018, the company’s top priority would be closing the Time Warner (TWX) deal.

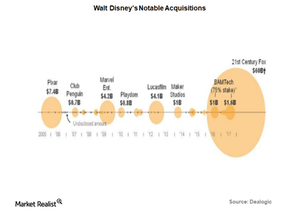

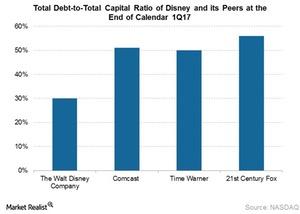

Understanding Walt Disney’s Deal with 21st Century Fox

In December 2017, the Walt Disney Company (DIS) announced its plans to buy some of the assets of 21st Century Fox (FOXA) for an equity value of ~$52.4 billion.

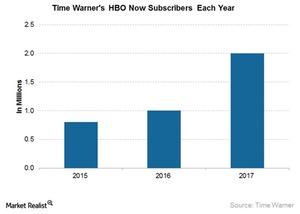

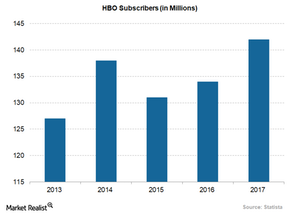

Behind Time Warner’s Growing HBO Subscribers

n 4Q17, Time Warner’s HBO segment reported quarterly revenue growth of 13% at $1.7 billion. HBO contributes ~19.5% of Time Warner’s total revenues.

What Prompted AT&T to Merge with Time Warner?

In October 2016, AT&T (T) signed an agreement to acquire Time Warner (TWX), in which it agreed to pay $107.50 per share to Time Warner’s shareholders.

Will AT&T Agree to Sell CNN or DIRECTV for Time Warner Buyout?

Amid rising competition in the wireless space, AT&T (T) has its hopes in the proposed acquisition of leading content provider Time Warner (TWX).

The Aims of the AT&T-Time Warner Merger

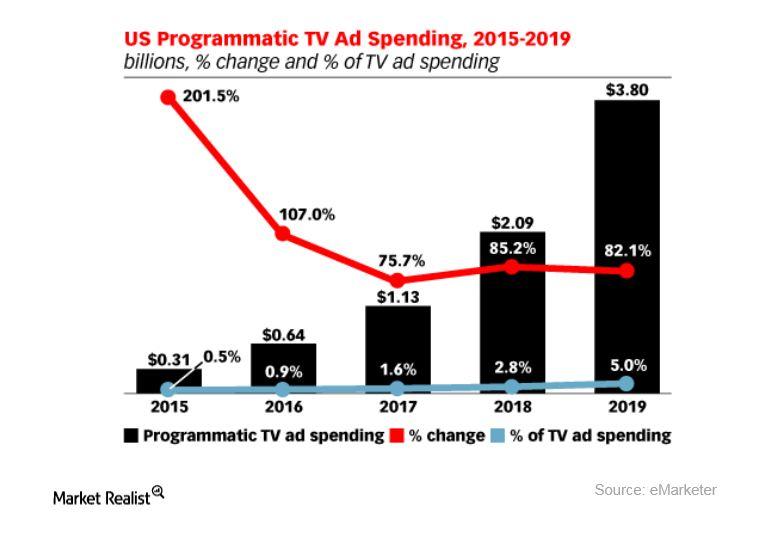

Better TV audience targeting In seeking to merge with Time Warner (TWX), AT&T (T) is motivated by advertising prospects. For AT&T, combining Time Warner’s media assets, especially high-quality content, with its technology and massive user data should make a huge difference in its advertising business. For example, AT&T hopes that the combination will enable it […]

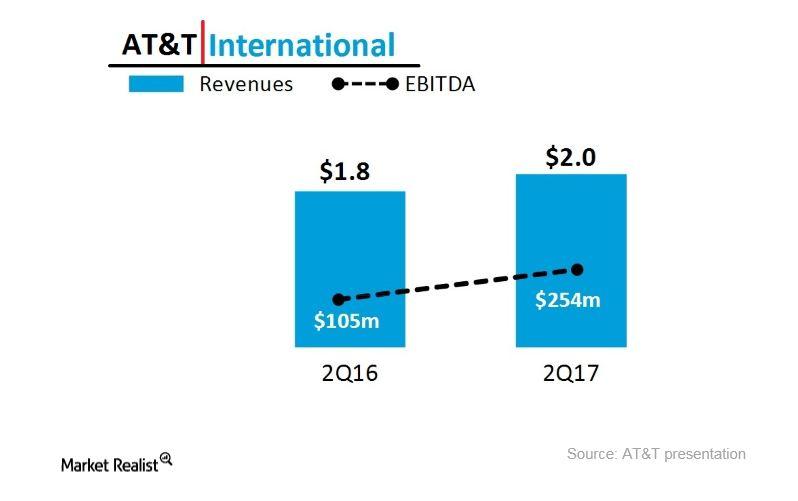

Analysis of AT&T’s International Business

Regulators are reviewing AT&T’s proposal to merge with Time Warner in a transaction valued at $85.4 billion.

Comparing Netflix’s Valuation Metrics with Its Peers

Netflix’s stock price closed at $183.60 on July 18. The company had a market capitalization of $79.4 billion on July 18 with an enterprise value of $81.8 billion.

Understanding Disney’s Capital Allocation Strategy

Disney stated at the conference that it will keep investing in its businesses not just for growth but also to give superior returns to shareholders.

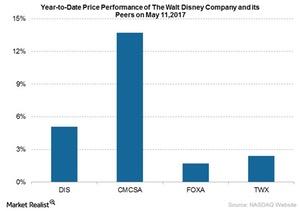

Disney’s Stock Price: Identifying the Key Drivers

The Walt Disney Company (DIS) announced its fiscal 2Q17 results on May 9. The company’s stock price closed at $109.58 on May 11, 2017.

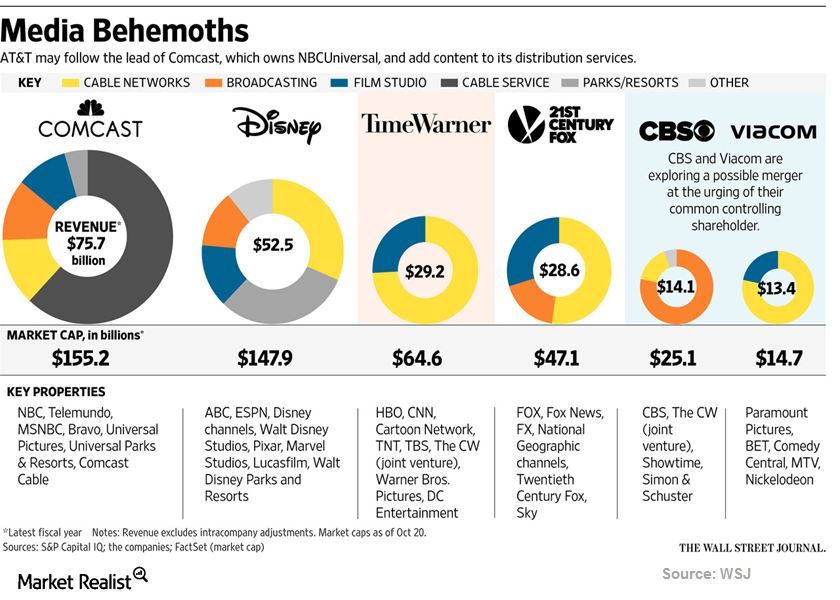

How Comcast Benefits from NBCUniversal Acquisition

M&A activity seems to be driving the media industry towards consolidation.

Analyzing the Concentration of US Media Ownership

Time Warner (TWX) has high-quality content assets, and AT&T (T) has extensive customer relationships across the wireless, video, and fixed broadband platforms.

Disney’s Cable Networks: What You Can Expect for Affiliate Fees

Media companies like The Walt Disney Company (DIS) mainly derive their revenues from affiliate fees and advertising.

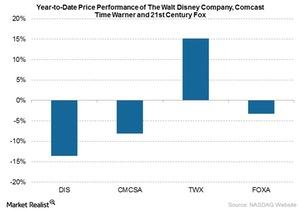

What Factors Could Be Impacting Disney’s Stock?

On November 2, 2016, The Walt Disney Company’s (DIS) stock closed at $92.39. The company’s stock price has fallen 13.6% year-to-date (or YTD) and 3.3% in the past three months.

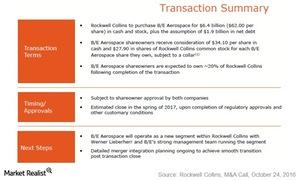

Rockwell Collins Acquires B/E Aerospace in a Deal-Making Weekend

On October 23, Rockwell Collins (COL) announced that it intends to acquire B/E Aerospace (BEAV) for a total consideration of $8.3 billion. Within Rockwell Collins, B/E Aerospace will operate as its new Aircraft Interior Systems segment.

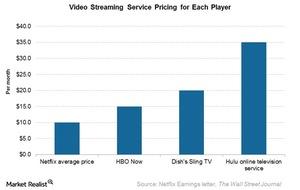

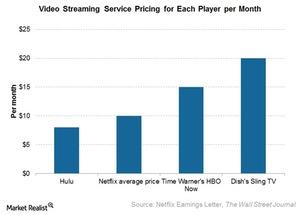

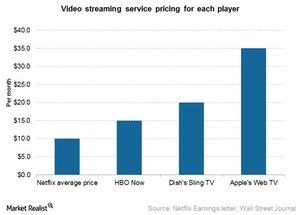

What Is the Netflix Pricing Strategy?

Netflix offers its subscribers a variety of price tiers so they can choose the tier they want. It offers more value at the higher-priced and middle tiers.

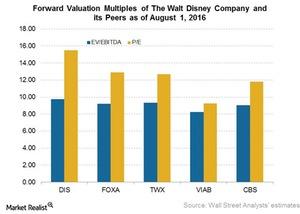

How Disney Is Managing Its Valuation Metrics

Disney stands out from its competitors in the media industry due to its large amount of intellectual property.

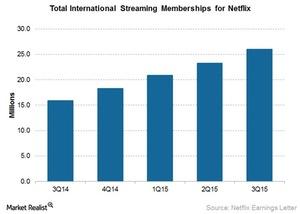

How Could Foreign Regulations Impact Netflix?

Netflix and Amazon’s Prime Instant Video service could be forced to ensure that 20% of their content catalogs consist of European content.

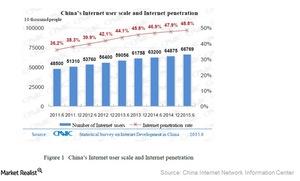

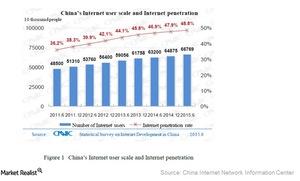

Why Is Time Warner Increasing Its Focus on China?

Time Warner stated at a Deutsche Bank (DB) investor conference early last month that it expects the number of movie screens in China to increase by about 30% in the next two years.

Key Valuation Metrics for Disney: How Do They Compare?

Disney stands out from its competitors in the media industry because of its vast intellectual property.

Key Valuation Metrics of the Media Sector

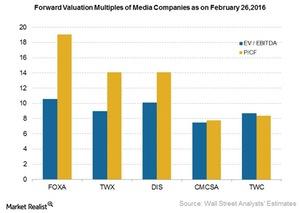

We prefer EV-to-EBITDA and PCF over the other multiples when comparing valuation of media conglomerates with different structures.

Low Theatrical Revenues Pull Down Warner Bros. Revenue

Time Warner’s (TWX) Warner Bros. had revenues of $13 billion in fiscal 2015, up by 4% year-over-year. However, Warner Bros. had a 13% year-over-year decrease in revenues in fiscal 4Q15.

Why Is Comcast Offering Products Based on Market Segmentation?

By offering different products like triple-play services, Comcast is catering to millennials, who want different content and can be heavy video viewers.Technology & Communications Must-know factors that could drive future growth at Disney

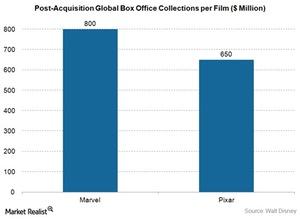

Disney considers itself a creative content company, and creative excellence is the key to its success. It expects to continue to invest both organically and inorganically.

Why Is Hulu Shying Away from International Markets?

Hulu CEO Mike Hopkins said at an industry conference in Cannes, France, that Hulu was not looking to expand into international markets any time soon.

Hulu’s Reinvention of Itself: A Closer Look at Business Strategy

Currently, Hulu’s free service is ad-supported while its $7.99-per-month service provides content with fewer ads.

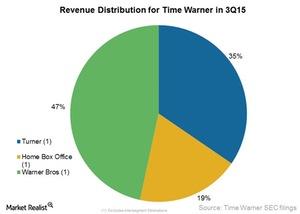

Time Warner: 3Q15 Business Segment Performance

Time Warner announced its 3Q15 results on November 4, 2015. Warner Bros. was a major contributor to the revenue of Time Warner in 3Q15, accounting for 47%.

Hulu: Change of Business Strategy

Hulu is planning to launch an ad-free service priced at $12–$14 per month later this year. Hulu is also looking at programmatic ad buying to better monetize its content.

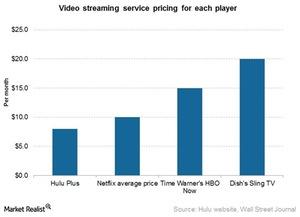

Netflix Is Slaying the Competition with Pricing

Netflix pricing is the lowest among all video streaming service players. Its basic plan of $7.99 is propelling the company’s streaming membership growth in the United States.

The Walt Disney Company Discusses Acquisitions and Strategy

At a May 13 MoffettNathanson event, Walt Disney’s (DIS) senior vice president of investor relations, Lowell Singer, discussed the company’s acquisitions.

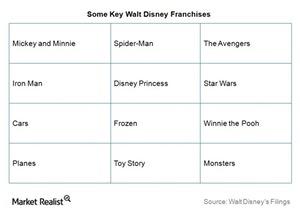

The Walt Disney Company Weighs In on Its Intellectual Properties

In the MoffettNathanson Media & Communications Summit on May 13, the company highlighted its intellectual properties portfolio.

Disney Monetizes Frozen in Multiple Segments in 2Q15

An integrated business model helps Walt Disney (DIS) utilize value created by its intellectual properties such as Frozen across its different segments.

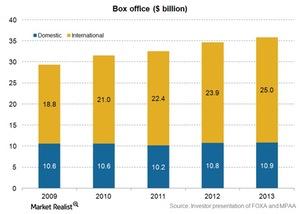

How do the largest studios make money in motion pictures?

The largest studios are owned by conglomerates like 21st Century Fox (FOXA) whose studio had the largest 2014 domestic box office market share.Technology & Communications A guide to Disney’s Consumer Products and Interactive Media segment

The businesses in the Consumer Products segment generate royalty revenue by licensing characters from its film, television, and other properties to third parties.

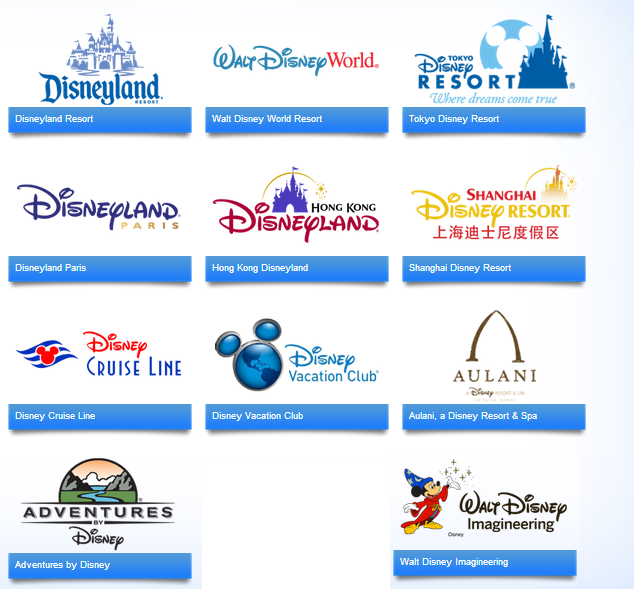

Why Disney’s Parks and Resorts business is a valuable growth driver

In 2013, Parks and Resorts revenues increased 9%, to $14.1 billion, and segment operating income increased 17%, to $2.2 billion

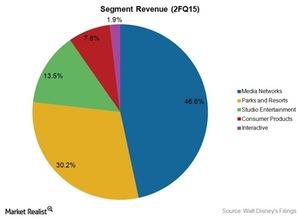

Exploring revenue and profitability drivers at Disney

For the fiscal year ended September 28, 2013, the company reported record results, with an 8% increase in diluted EPS, to $3.38 compared to $3.13 in the prior year.