The Walt Disney Company Discusses Acquisitions and Strategy

At a May 13 MoffettNathanson event, Walt Disney’s (DIS) senior vice president of investor relations, Lowell Singer, discussed the company’s acquisitions.

May 26 2015, Updated 11:07 a.m. ET

Marvel and Pixar’s performance

At a May 13 MoffettNathanson event, The Walt Disney Company’s (DIS) senior vice president of investor relations, Lowell Singer, discussed the company’s acquisitions. Singer said, “And we have been committed to this franchise strategy for a long time. I think there are lots of examples of titles, of IP that we’ve created around the company that we’ve been able to exploit in other businesses. If you go back and look at, let’s just take Marvel and animation as two examples because those are where we’ve invested heavily on the M&A side.”

Pixar Animation Studios and Marvel Studios are some of the company’s key acquisitions. Disney acquired Marvel in 2009. It acquired Pixar in 2006. The company has managed profitability and quality for these two assets post-acquisition.

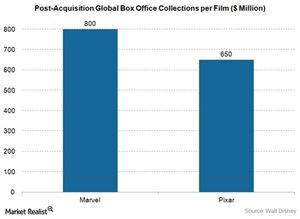

As you can see in the above chart, Marvel has generated an average of ~$800 million in the global box office for the eight films that it produced post–Disney acquisition. According to the company, these films also got around 80% ratings score on Rotten Tomatoes.

Similarly, Pixar, which the company acquired more than a decade ago, has been performing well. Pixar and Disney have generated an average of approximately ~$650 million in the global box office for the 13 films they produced post-acquisition. According to the company, these films got around 85% ratings score on Rotten Tomatoes.

Star Wars: Episode VII – The Force Awakens in December 2015

The company will release Star Wars: Episode VII – The Force Awakens on December 18, 2015. This will be the first Star Wars movie to be released in ten years. Disney acquired Lucasfilm in 2012. The company expects to benefit significantly from the film’s release and plans to monetize new merchandise for the franchise, which will roll out in September 2015.

If you want to take on diversified exposure to Disney, you may invest in the iShares Core S&P 500 ETF (IVV). The ETF held ~0.9% in the company on April 30, 2015. The ETF also held a total of ~1.5% in media companies Comcast (CMCSA), Time Warner (TWX), and Twenty-First Century Fox (FOXA).