Ray Sheffer

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Ray Sheffer

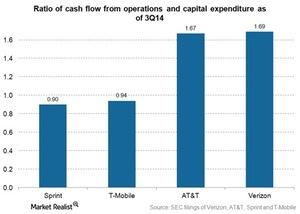

Sprint’s liquidity must be maintained to fund capital investments

Sprint is cutting down on operating costs to manage high capital expenditures. But marginal cash flows aren’t alleviating Sprint’s liquidity concerns.

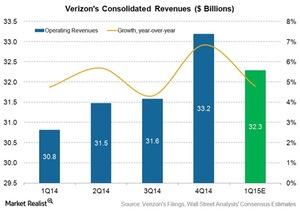

Verizon’s Revenue Growth Should Slow down in 1Q15

Verizon (VZ) will report its 1Q15 results on April 21, 2015. It’s the largest US telecom company. It had a market capitalization of $200.08 billion as of April 13, 2015.

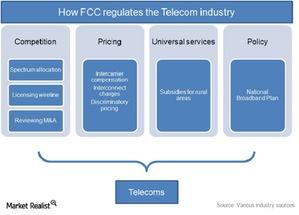

Investors should be aware of regulations in the telecom industry

In the US and around the world, the telecom industry is regulated because market forces can’t maintain competition within the highly capital-intensive industry.

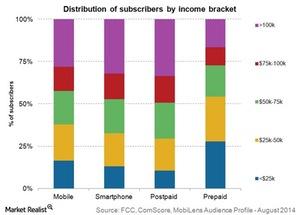

Key customers in the telecom industry

Post-paid users pay telecom companies periodically. The users pay after they received the service. They typically subscribe to plans for a fixed term.

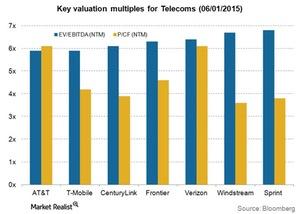

Valuation metrics that investors can use in the telecom industry

Investors often use different metrics to determine telecom companies’ relative valuation. Telecom is a capital-intensive industry with high fixed costs.

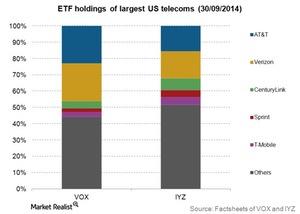

Investment opportunities in the US telecom industry

Investors that like the US telecom industry’s fundamentals—for example, stable cash flows and high dividend yield—may invest in telecom ETFs.

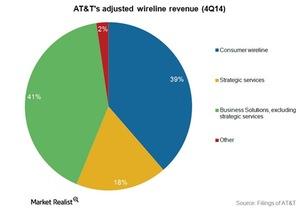

What was the key growth driver for AT&T’s wireline segment?

Adjusted revenue from IP-based strategic services grew by 14.3% YoY in 4Q14. Adjusted consumer wireline revenue increased by 2.4% during the quarter.

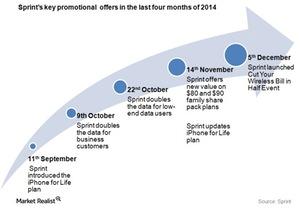

Sprint ramps up promotional efforts to expand customer base

The launch of Apple’s iPhone 6 in September, just before the holiday season, was a key driver for Sprint’s increased promotional efforts during fiscal 3Q14.

What’s Next for Altice after Cablevision Acquisition?

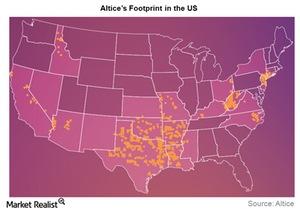

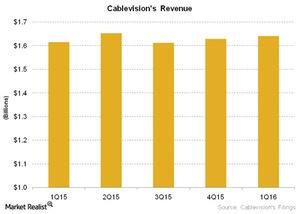

At the end of 1Q16, Suddenlink and Cablevision had ~1.6 million and ~3.1 million customer relationships, respectively.

Verizon and Cablevision: Market Share after the Altice Transaction

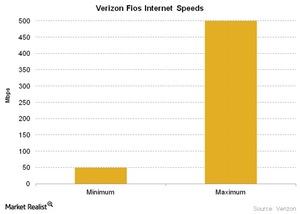

An improving broadband proposition with higher Internet speeds should positively affect Cablevision (CVC), considering the competitive dynamics in its industry.

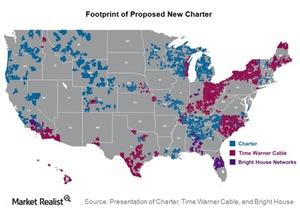

Merger Update: Charter, Bright House, and Time Warner Cable

California is the only state where the merger between Charter Communications, Time Warner Cable, and Bright House Networks has yet to be approved. It could be approved as early as May 12.

What Kind of Growth Does Altice Expect for Cablevision?

On a YoY (or year-over-year) basis, Suddenlink’s revenue rose ~6.7% to reach ~$0.63 billion in 1Q16.

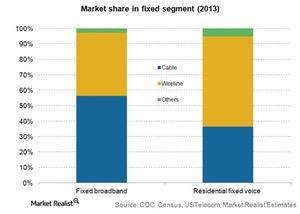

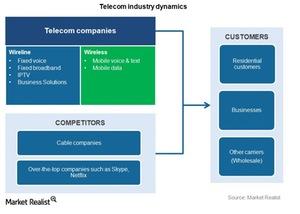

Understanding competition from other industries—cable companies

Telecom companies compete directly with cable companies—particularly in wired voice, data, and TV services. They compete in the residential and small business segments.

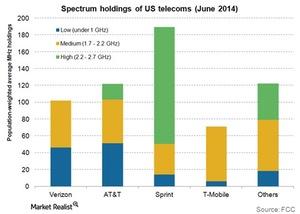

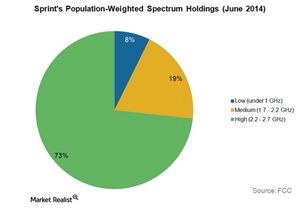

Why spectrum is the lifeblood of a wireless network

We mentioned how wireless phones communicate with cell towers on a frequency band. The band is called a spectrum. It’s the most valuable resource for a wireless company.

How Do Media Networks Make Money?

Media networks face stiff competition for acquisition and distribution of content. Quality and exclusivity add to competition across the media value chain.

What Are the Value Propositions of AT&T and Verizon?

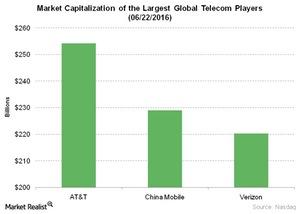

The biggest global telecom company by market capitalization was AT&T as of June 22, 2016.

What Is Verizon’s Value Proposition?

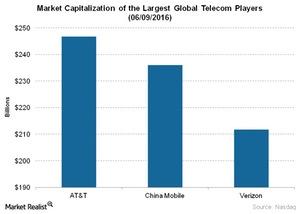

As of June 9, 2016, Verizon is the third-largest global telecom company by market capitalization.

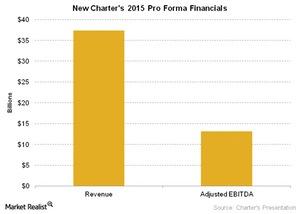

Charter Completes Merger with Bright House and Time Warner Cable

The merger of Charter Communications (CHTR), Time Warner Cable (TWC), and Bright House Networks was completed on May 18, 2016.

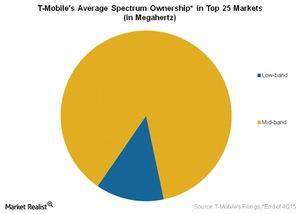

What’s the Significance of T-Mobile’s Low-Band Spectrum?

T-Mobile has been adding low-band spectrum holdings.

What Kind of Value Does Verizon See in Quad-Play Services?

Verizon’s (VZ) Marni Walden talked about how the company currently views quad-play offerings.

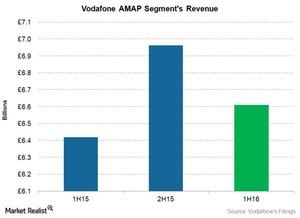

Revenue of Vodafone’s AMAP Segment Continued to Grow

In this part of our series, we’ll look at the performance of Vodafone’s AMAP—short for Africa, the Middle East, and Asia-Pacific—segment in fiscal 1H16.

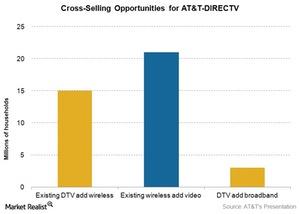

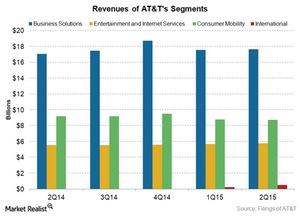

Analyzing AT&T’s New Segment Reporting Structure

AT&T changed its segment reporting structure. Its new segments are Business Solutions, Entertainment and Internet Services, Consumer Mobility, and International.

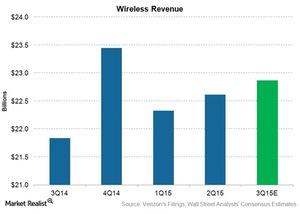

Verizon’s Wireless Revenue in 3Q15

Verizon’s wireline segment revenue decreased ~2.2% year-over-year to ~$9.4 billion during the quarter.

Verizon Sees Demand for Skinny Bundles

Verizon launched its Custom TV service in April. A skinny bundle service, it gives more choices to customers, allowing them to select their TV channels

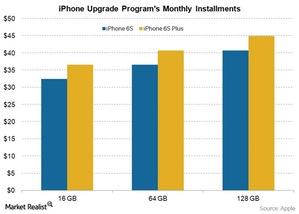

Apple’s iPhone Upgrade Program in the United States

Apple (AAPL) is starting an annual iPhone Upgrade Program for its new iPhone models at Apple’s US retail stores starting September 25, 2015.

AT&T’s All in One Plan Offerings

Since the merger, AT&T has extended bundled video and wireless offerings, such as its All in One Plan, which is being offered to DIRECTV and AT&T customers.

CEO Claure Plans to Harness Sprint Capacity Spectrum Holdings

Sprint plans to implement a considerable densification program to harness its capacity spectrum holdings, making capital expenditures of ~$5 billion in fiscal 2015.

Why Do We Need to Analyze Sprint Promotions?

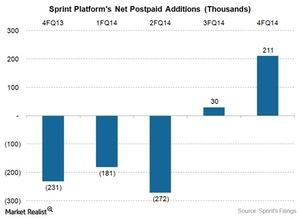

After Sprint CEO Marcelo Claure joined the company, Sprint added ~30,000 postpaid connections in fiscal 3Q14 and ~211,000 postpaid connections in fiscal 4Q14.

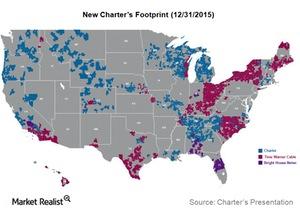

New Charter’s Footprint: Better Position to Reach Customers

New Charter is the proposed merged entity. The company will include networks of some of the largest cable operators in the US.

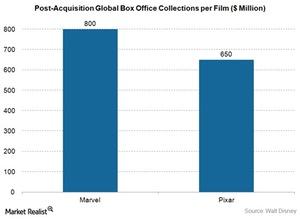

The Walt Disney Company Discusses Acquisitions and Strategy

At a May 13 MoffettNathanson event, Walt Disney’s (DIS) senior vice president of investor relations, Lowell Singer, discussed the company’s acquisitions.

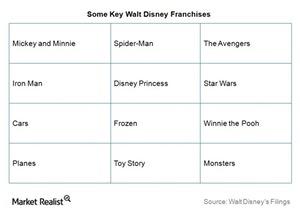

The Walt Disney Company Weighs In on Its Intellectual Properties

In the MoffettNathanson Media & Communications Summit on May 13, the company highlighted its intellectual properties portfolio.

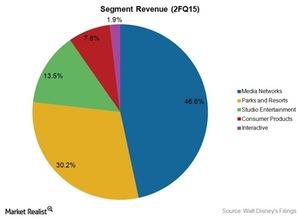

Disney Monetizes Frozen in Multiple Segments in 2Q15

An integrated business model helps Walt Disney (DIS) utilize value created by its intellectual properties such as Frozen across its different segments.

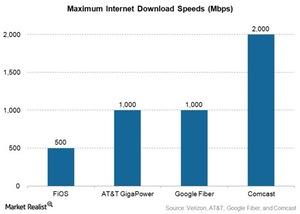

Gigabit Pro: Comcast Internet Offering Delivers up to 2 Gbps

The Gigabit Pro service can provide much faster speeds than those offered by Verizon (VZ) FiOS, AT&T GigaPower, and Google Fiber.

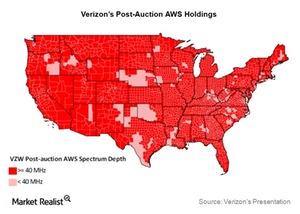

The AWS-3 Acquisition Adds Depth to Verizon’s Spectrum Holdings

According to Verizon, the AWS-3 spectrum acquisition helped it gain depth in its spectrum holdings.

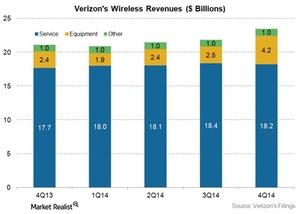

Verizon’s Wireless Revenues Grew in 4Q14

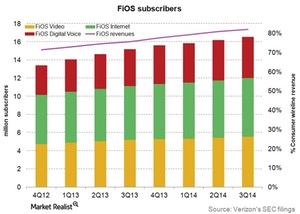

Verizon (VZ) reported its 4Q14 results on January 22, 2015. We’ll analyze the company’s quarterly performance while focusing on Verizon’s wireless revenues.

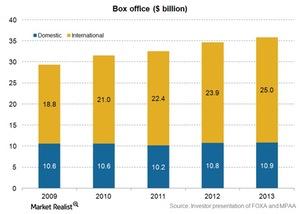

How do the largest studios make money in motion pictures?

The largest studios are owned by conglomerates like 21st Century Fox (FOXA) whose studio had the largest 2014 domestic box office market share.

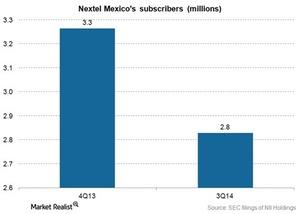

AT&T to acquire Iusacell and Nextel Mexico

AT&T completed the $2.5 billion acquisition of Iusacell in January 2015. Iusacell is a wireless provider with 70% coverage in Mexico.

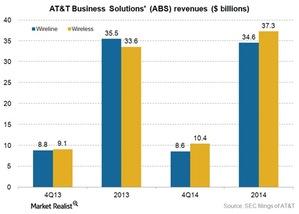

Why AT&T Business Solutions shifts focus to wireless customers

AT&T plans to focus more on business customers in 2015. The company’s Business Solutions segment caters primarily to enterprises, government, wholesale customers, and carriers.

What kind of investors might like the telecom industry?

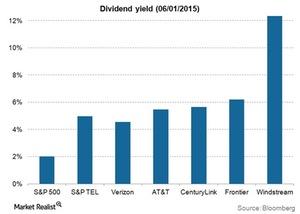

Telecom is a defensive industry. Investors looking for high dividend yield in a low-interest rate environment may like the telecom industry.

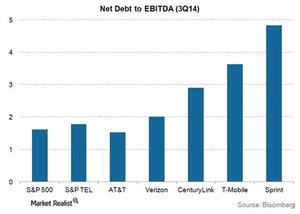

Leverage in the US telecom sector

Traditionally, telecom has been a sector with high leverage. As we know, telecom is a highly capital-intensive industry. The companies finance investments through debt.

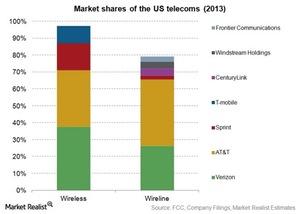

Why there’s high competition in the US telecom industry

The US telecom industry has matured. It reached saturation levels in core voice services. Telecom companies don’t have the opportunity to gain access to new untapped customers.

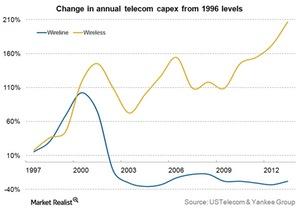

What are the key costs for wireless and wired telecom?

High fixed costs result in high operating leverage. Acquiring new customers significantly increases a telecom company’s profitability.

The wireless telecom network and its technologies

The wireless network is also called the cellular network. It makes your mobile and smartphones work over radio signals.

Analyzing the wireline telecom network and its evolving structure

A wireline network includes interlinked connection and redistribution systems. The network allows information—like voice and data—to travel electronically.

An overview of the US telecom industry

Telecom companies provide fixed and mobile voice, text, and data transmission to consumers, small businesses, enterprises, and government entities.