What are the key costs for wireless and wired telecom?

High fixed costs result in high operating leverage. Acquiring new customers significantly increases a telecom company’s profitability.

Jan. 19 2015, Updated 10:13 a.m. ET

High fixed costs

Telecom is a capital-intensive industry. It requires an extensive network infrastructure to provide fixed line and wireless services. According to USTelecom, since 1996, telecom companies in the US invested $1.1 trillion in the industry. High investment requirements restrict new entrants in the industry.

High fixed costs result in high operating leverage. Acquiring new customers significantly increases a telecom company’s profitability. Losing customers results in a steeper decline in profits. High operating leverage makes the telecom industry focus on customer acquisition and retention.

Operating leverage and retaining existing customers impacts a telecom company’s profitability. It impacts established wireless companies more than traditional wireline companies. Please read Why Sprint continues to lose subscribers in 2014 to understand how losing customers impacts a wireless telecom company.

The cycle of upgrading networks is shorter for wireless companies. The cycle is shorter due to reasons ranging from technological innovations to managing increased network traffic. So, they have to recoup their network investments—in shorter intervals of time—to redeploy them for the next upgrading cycle of networks.

Recurring capital expenditure for wireless

Due to high fixed costs, telecom companies in mature markets—like the US—have to manage their profitability and cash flows by controlling their variable costs—like workforce and marketing costs.

Wireless players have more recurring capital investments—compared to established wireline telecom companies. Wireline telecom companies already invested significantly—particularly in their extensive legacy networks.

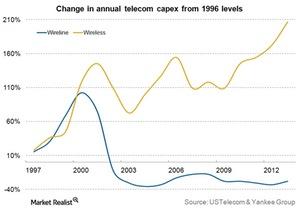

As you can see in the above graph, after a period of significant investment until 2000, additional wireline investments declined initially. They remained mostly flat in the last decade. Wireline invested $409 billion from 1996 to 2003. Wireless invested $412 billion in 17 years—from 1996 to 2013.

In wireless, the structure of the network makes the initial fixed investments relatively lower than setting up a new wired telecom network. However, unlike wireline, where fixed costs are driven by the number of customers, wireless companies’ fixed costs are based on network traffic. So, wireless companies have to make ongoing investments. They have to upgrade their network to increase capacity as the traffic for voice, and particularly data, increases.

Ever since the advent of smartphones—like Apple’s (AAPL) iPhone—users’ data needs increased significantly. This requires upgrading the networks. These recurring fixed costs affect wireless companies—like T-Mobile (TMUS)—and telecom companies’ wireless segments—like Sprint (S), AT&T (T), and Verizon (VZ).