Leverage in the US telecom sector

Traditionally, telecom has been a sector with high leverage. As we know, telecom is a highly capital-intensive industry. The companies finance investments through debt.

Jan. 21 2015, Updated 12:13 p.m. ET

Debt repayment capacity

Traditionally, telecom has been a sector with high leverage. As we know, telecom is a highly capital-intensive industry. The companies finance these investments through debt. Therefore, it’s particularly important for investors to look at a telecom company’s capacity to repay its debt.

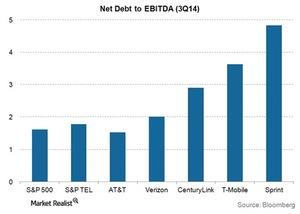

A key metric to gauge companies’ repaying capacity is net debt-to-EBITDA (earnings before interest, tax, depreciation, and amortization). The debt figure in the metrics is calculated net of cash. The metric tells us how many years it will take the company to repay the debt. It will use the cash it generates from its core operations.

US telecom companies’ leverage

As you can see from the above graph, AT&T (T) had the best debt repayment capacity among its peers at the end of 3Q14. It even had the best repayment capacity compared to the average of S&P 500 companies. Please read Why AT&T can maintain the best credit rating among its peers to learn more.

Currently, Verizon (VZ) has a lower repayment debt capacity than AT&T. During 2013–2014, Verizon raised significant financing to fund a cash payment of 58.9 billion to buy Vodafone’s 45% stake in its wireless business. Due to this one-time event, the debt-to-equity ratio increased significantly. It was above six times at the end of 3Q14. Read Verizon optimistic about a credit rating upgrade to learn more.

CenturyLink’s (CTL) debt repayment capacity is under three times the EBITDA. The company has been deploying its free cash flows in share buybacks since 2013.

Sprint’s (S) debt repayment capacity is the worst among its peers. The company’s current operations aren’t able to fund the capital expenditures required to upgrade its network. Please read Why Sprint expects its capital expenditures to decline to learn more.

Sprint is followed by T-Mobile (TMUS). It’s the national carrier that only offers wireless. Like Sprint, T-Mobile faces the challenge of investing more in its network than it can generate from operations.