CenturyLink Inc

Latest CenturyLink Inc News and Updates

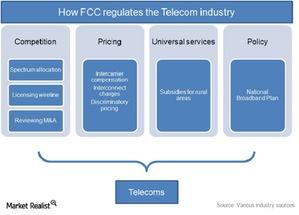

Investors should be aware of regulations in the telecom industry

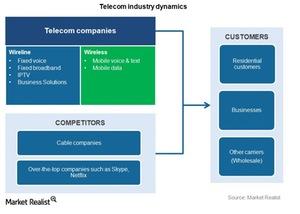

In the US and around the world, the telecom industry is regulated because market forces can’t maintain competition within the highly capital-intensive industry.

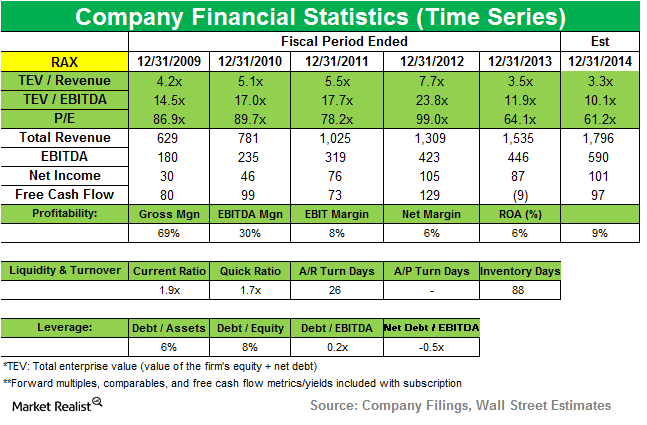

JANA Partners starts a new position in Rackspace Hosting

JANA Partners added a stake in Rackspace Hosting Inc. (RAX). The position accounted for 1.18% of the fund’s total third-quarter portfolio.

Analyzing CenturyLink’s Revenue Trends in 2019

CenturyLink’s (CTL) top line has been declining in the last few quarters. In the first quarter, the company reported net revenues of $5.6 billion—a fall of 5.0% on a year-over-year basis.

Frontier Communications: Analysts’ Expectations in Q1

Frontier Communications (FTR) is scheduled to report its first-quarter earnings results on April 30.

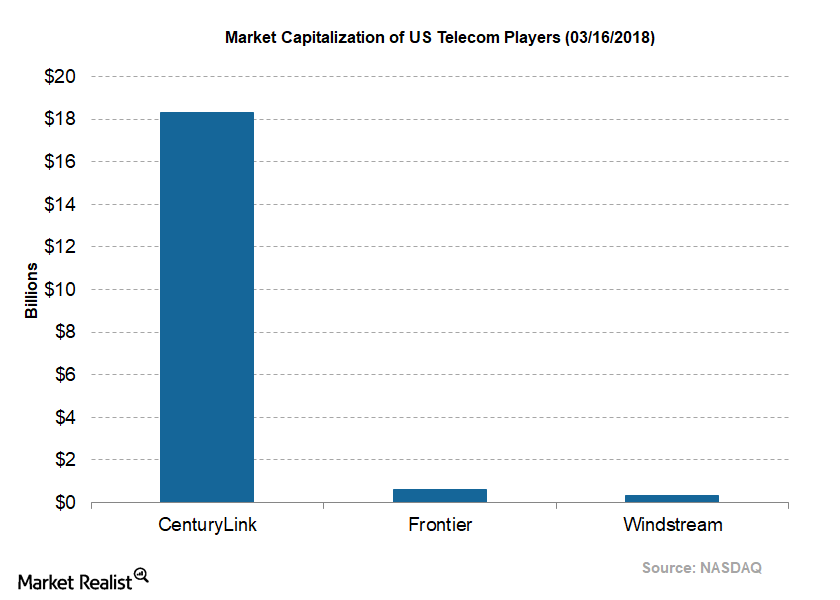

How CenturyLink’s Valuation Compares

As of March 16, 2018, AT&T (T) was the largest US telecom player, with a market capitalization of ~$227.2 billion.

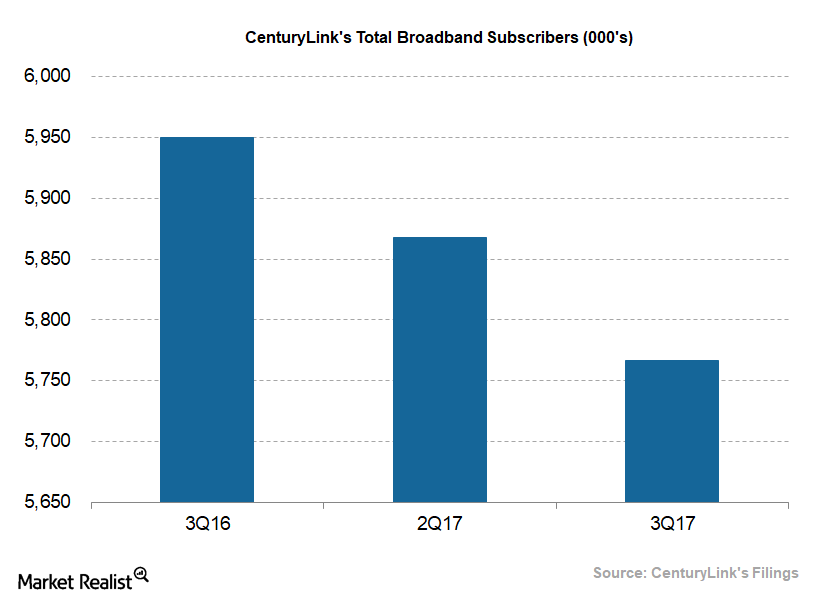

Why CenturyLink Reported Broadband Subscriber Losses in 3Q17

The top cable companies continue to show strong momentum in the US broadband market with Comcast (CMCSA) and Charter (CHTR) adding the most broadband customers in 3Q17 given the higher speeds.

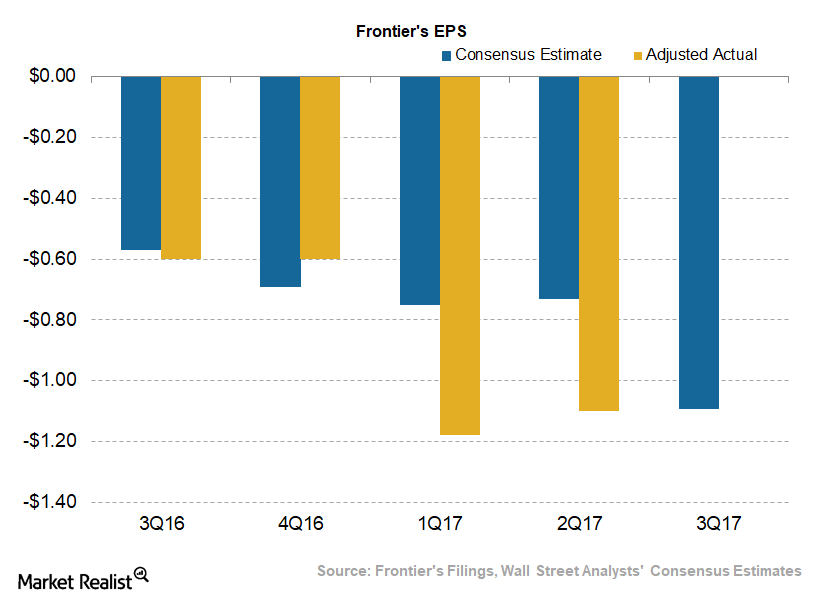

What Analysts Expect from Frontier’s 3Q17 Earnings

Frontier Communications (FTR) will publish its 3Q17 results on October 31, 2017. Analysts expect Frontier’s EPS (earnings per share) to fall $1.09 in 3Q17.

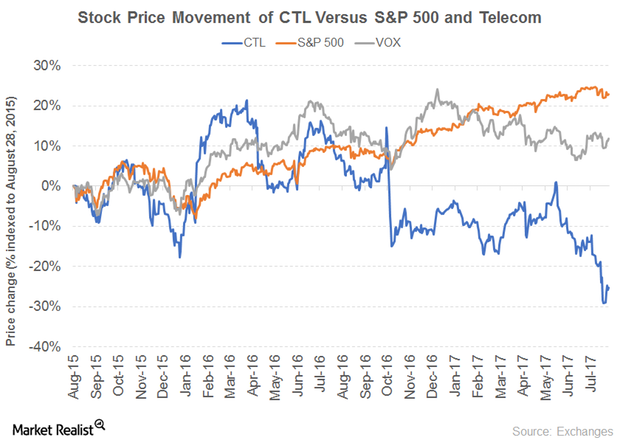

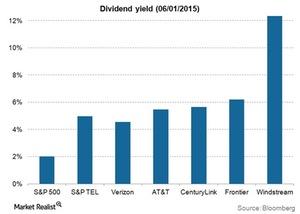

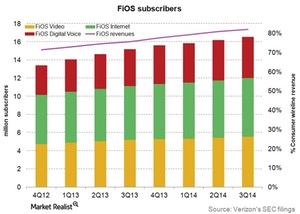

How CenturyLink is Maintaining Its Dividend Yield

The story behind CenturyLink’s 8% yield Another acquisition-driven telecom company is CenturyLink (CTL). The cohesive communications company provides a wide range of services to its residential and business customers. Like Frontier, it has been impacted by the slowing traditional phone business. The company’s operating metrics, excluding those of Prism TV, are trending downwards. This trend has […]

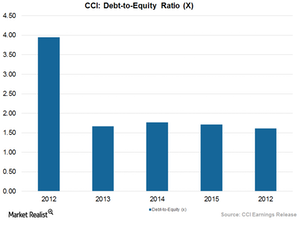

How Well Is Crown Castle Leveraging Its Balance Sheet?

It’s extremely important for REITs to maintain optimum debt levels, and managers work constantly to leverage balance sheets in the best possible ways.

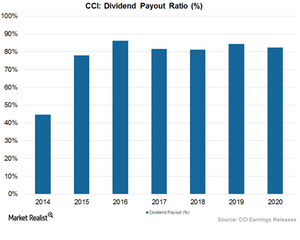

Why Some Are Investors Are Bullish on Crown Castle

REITs (real estate investment trusts) typically have to pay 90% of their taxable income to shareholders to qualify as an equity.

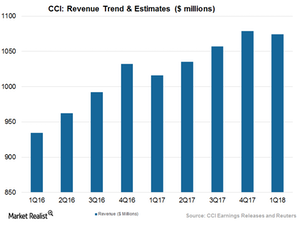

Why Crown Castle Expects to See Revenue Growth

Crown Castle is expected to keep riding high on its current growth trajectory, driven by strategic investments and exposure to the booming small cell business.

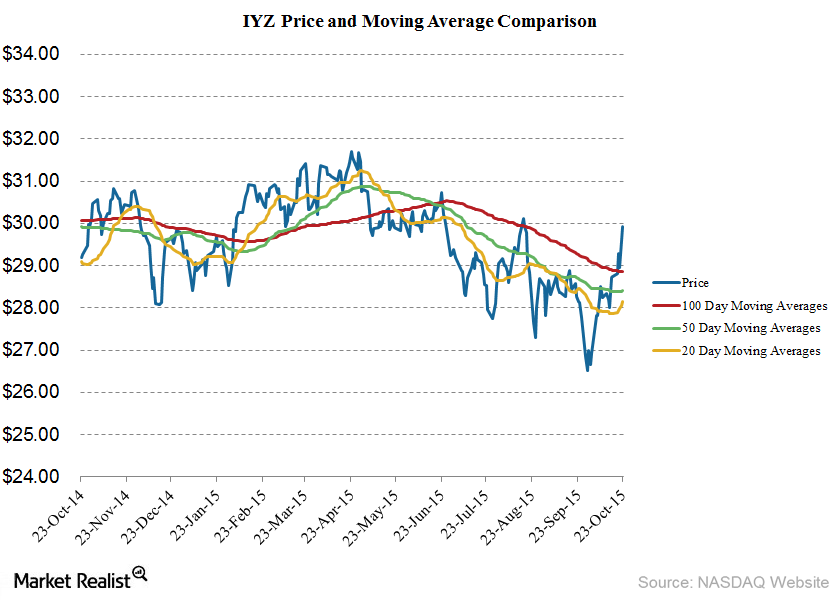

IYZ Sees -$143.8 Million in Fund Outflows in the Trailing 12 Months

The IYZ ETF generated investor returns of 4.3% in the trailing-12-month period, 5.2% in the trailing-one-month period, and 7.9% in the trailing three years.

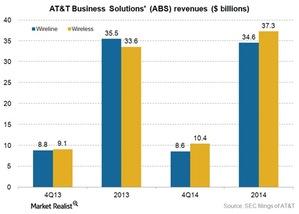

Why AT&T Business Solutions shifts focus to wireless customers

AT&T plans to focus more on business customers in 2015. The company’s Business Solutions segment caters primarily to enterprises, government, wholesale customers, and carriers.

What kind of investors might like the telecom industry?

Telecom is a defensive industry. Investors looking for high dividend yield in a low-interest rate environment may like the telecom industry.

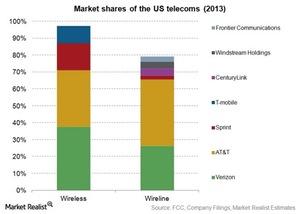

Why there’s high competition in the US telecom industry

The US telecom industry has matured. It reached saturation levels in core voice services. Telecom companies don’t have the opportunity to gain access to new untapped customers.

Analyzing the wireline telecom network and its evolving structure

A wireline network includes interlinked connection and redistribution systems. The network allows information—like voice and data—to travel electronically.

An overview of the US telecom industry

Telecom companies provide fixed and mobile voice, text, and data transmission to consumers, small businesses, enterprises, and government entities.