Debt Remains Netflix’s Prime Source of Financing

Netflix (NFLX) considers debt its main source to finance content, given its lower cost of capital.

Aug. 3 2018, Updated 10:30 a.m. ET

Higher content investments are driving debt

Netflix (NFLX) considers debt its main source to finance content, given its lower cost of capital. It anticipates content investment in fiscal 2018 to be $7.5 billion–$8 billion, which is almost the same as last year. It believes it will continue to fund its content through debt as long as it reaches the stage where it’s generating enough free cash flow.

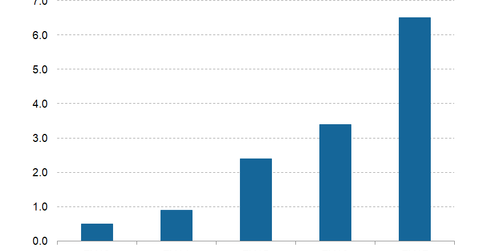

From the graph above, you can see that in the last five years, Netflix’s debt has increased significantly. In the same period, its investment in content has also seen strong growth.

The company exited fiscal Q2 2018 with $8.3 billion in debt. Its streaming content obligations were $18.4 billion at the end of Q2 2018. So on a combined basis, Netflix’s total debt was ~$26.7 billion at the end of the quarter.

The need for higher content investment

From the graph above, you can also see that in the last three years, Netflix’s debt level has increased rapidly, driven by its investment in original content. It continues to downplay competition from other low-cost streaming players due to its huge original content collection, which costs more than normal content. Its strategy to tap the European and Asian markets has prompted it to invest heavily in local content.

Impact of rising debt

Mounting debt is also hurting Netflix’s free cash flow. It continues to see negative free cash flow. Its interest expense is also rising, which in turn may impact its net profit margin.

However, Netflix’s debt-to-market-capital ratio is quite low at 5% against media peers Time Warner (TWX) and CBS (CBS) at 11% and 39%, respectively.