NXP Semiconductors NV

Latest NXP Semiconductors NV News and Updates

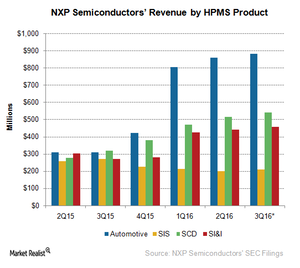

Reviewing What Likely Drove NXP’s 3Q16 Revenue

NXP caters to a broad market, including the automotive, communications infrastructure, mobile, embedded device, industrial, and secure payment spaces.

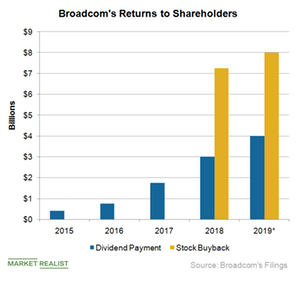

Checking In on Broadcom’s Stock Buyback

Broadcom’s capital allocation policy is to spend 50% of its trailing-12-month free cash flow in dividends and use the remaining for acquisitions and buybacks.

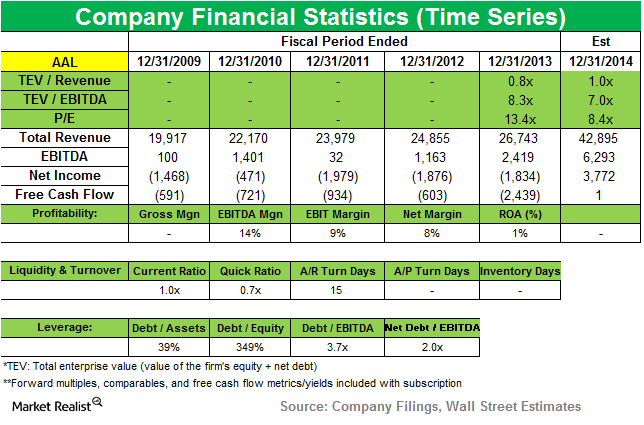

American Airlines gets significantly lower position in Appaloosa

Appaloosa Management significantly lowered its position in American Airlines (AAL) in the third quarter that ended in September 2014. The position accounts for 3.81% of the fund’s total third-quarter portfolio.

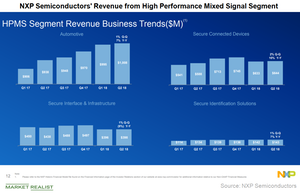

Paul Singer Increased His Holdings in NXP Semiconductor in 3Q17

Paul Singer, the CEO of Elliott Management, increased his holdings in NXP Semiconductor (NXPI) in 3Q17, according to a recent 13F filing report.

Automotive and Connected Devices: NXP’s Key Growth Drivers

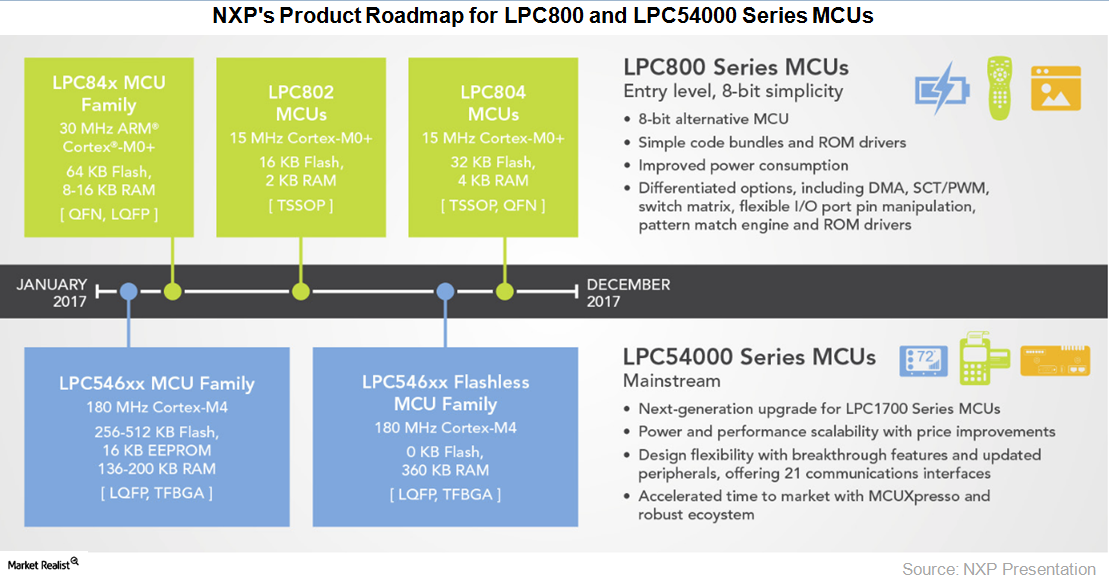

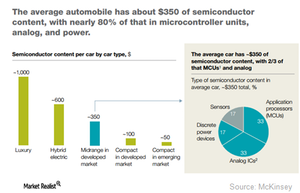

NXP Semiconductors (NXPI), a leader in the automotive chip market, provides HPMS (high-performance mixed-signal) analog, MCU (microcontroller), and sensor solutions.

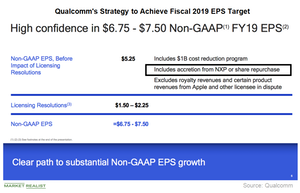

How Successful Has Qualcomm’s $30 Billion Buyback Been?

Qualcomm (QCOM) is a leader in the mobile market, with its chips powering 95% of the world’s smartphones.

What Qualcomm Investors Should Watch For

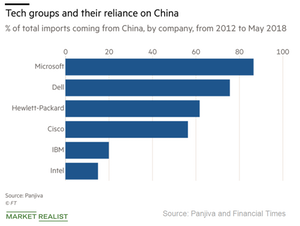

Among semiconductor stocks, Qualcomm (QCOM) may have been hit the hardest by US-China trade tension.

The Impact of a US–China Trade War on Intel

The trade war between the United States and China revolves around the supremacy of 5G technology, which is expected to form the basis for the data economy.

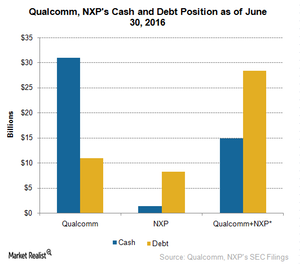

How Would Qualcomm Fund a Possible Acquisition of NXP?

If Qualcomm (QCOM) looks to buy NXP Semiconductors (NXPI), the deal could be valued at just above $30 billion or as high as $46 billion.

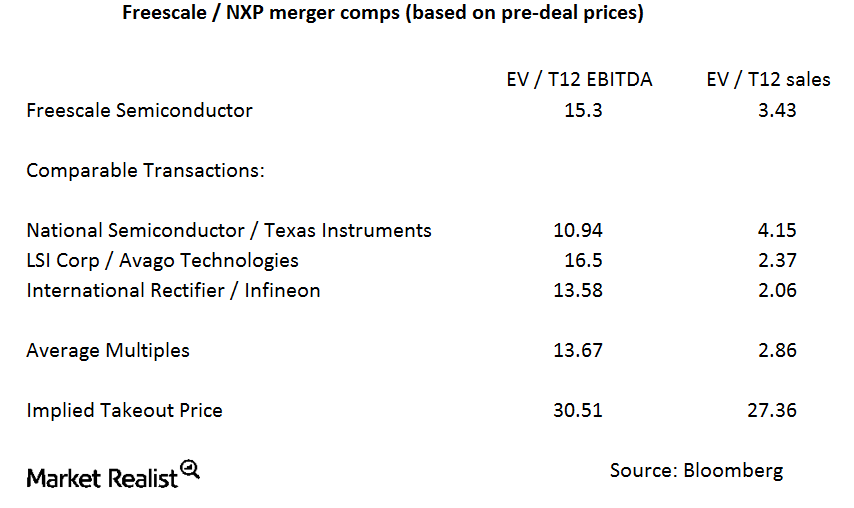

Why is the Freescale–NXP merger premium so low?

The companies were asked about the takeover premium and the background to the transaction on the conference call, but they refused to comment.

NXP Stock Jumps 11% on Acquisition Rumors

NXP Semiconductors (NXPI) stock rose 11% after hours yesterday following rumors of South Korean tech giant Samsung’s (SSNLF) interest in NXP.

Intel-Qualcomm Competition Extends to 5G and Automotive

Qualcomm (QCOM) has already taken the mobile market from Intel (INTC). Qualcomm is now venturing into the server processor market.

Amazon’s VI Initiative: Which Stock To Invest In?

Would you invest in a company that promises a technological utopia? It could be a simple answer – either you invest in it or you don’t.

Amazon Partners with over 30 Companies: VI Initiative

On September 24, Amazon (AMZN) announced the Voice Interoperability Initiative. The announcement was one day before the Amazon hardware event.

Qualcomm Faces Multifold Impact of the Huawei Ban

Qualcomm has been among the hardest hit by the Huawei ban, and now it will suffer the effects of the newest round of tariffs.

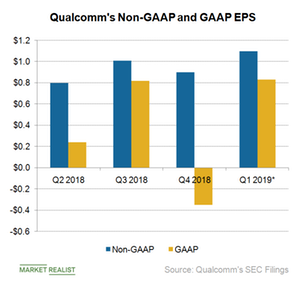

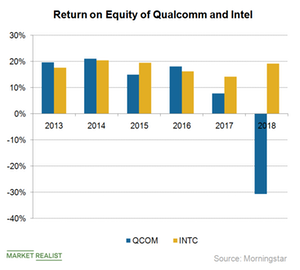

What Qualcomm’s Negative Efficiency Ratios Mean to Investors

As Qualcomm’s investment in the NXP acquisition failed to materialize, its ROI (return on investment) took a big hit.

How Intel Is Using Mobileye for Autonomous Driving

Intel’s (INTC) move toward becoming a data-centric company focuses on network connectivity, deep learning and AI (artificial intelligence) solutions.

What Mergers and Acquisitions Could Open Up for Qualcomm

Qualcomm is looking to venture into automotive, servers, IoT (Internet of Things), and laptops.

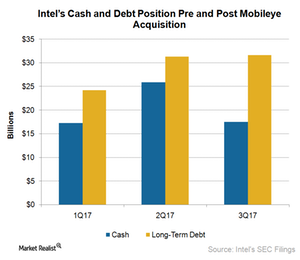

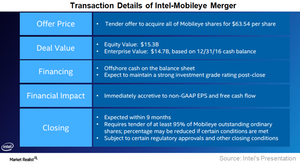

How Did the Mobileye Acquisition Impact Intel’s Balance Sheet?

Intel (INTC) is increasing its earnings through spending discipline and by focusing its expenses on projects with high ROI (return on investment).

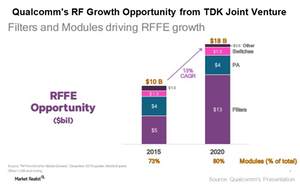

What’s Qualcomm’s Growth Strategy in the Radio Frequency Market?

Qualcomm (QCOM) is not only expanding its end markets, it’s also expanding in related technologies in order to increase its semiconductor content per device.

Dividend Growth for Qualcomm and Crown Castle International

Qualcomm (QCOM) recorded a year-over-year decline in revenues for 2Q17 after growth in the preceding quarter.

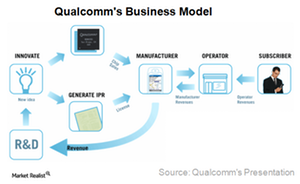

Legal and Regulatory Issues Challenge Qualcomm’s Business Model

Qualcomm (QCOM) has been and continues to be the preferred choice of dividend-seeking investors because of its strong balance sheet and rich cash flows.

What You Need to Know about the Intel-Mobileye Merger

Analysts are criticizing the Intel-Mobileye deal. They think the acquisition price is too high and the synergies from the merger are too low.

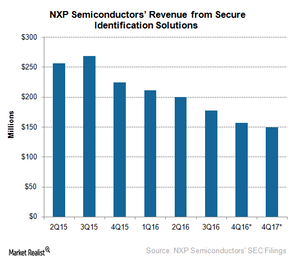

Is Secure Identification Solutions a Dying Segment for NXP?

The SIS segment’s revenues fell 11% sequentially in fiscal 3Q16 and is expected to fall another 14% to 16% in fiscal 4Q16 to ~$151.3 million.

What Is NXP Semiconductors’s Product Roadmap for Automotive?

At CES 2017, NXP Semiconductors (NXPI) demonstrated its RoadLINK platform it developed in collaboration with Delphi (DLPH) and Savari.

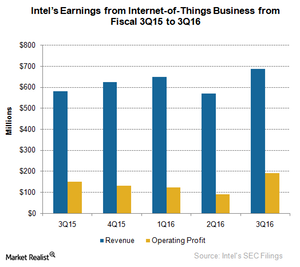

How Is Intel Placed among Competitors in the IoT Space?

Intel’s IoT group revenues grew 19% year-over-year to $689 million in fiscal 3Q16, driven by strong demand from retail, video, and transportation.

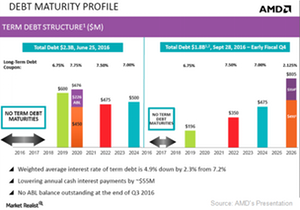

AMD Amazes with Comeback from Near Bankruptcy

As of September 30, 2016, AMD’s cash reserves stood at $1.3 billion as against long-term debt of $1.6 billion.

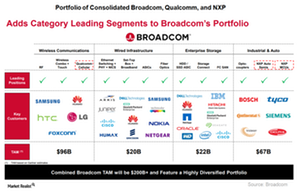

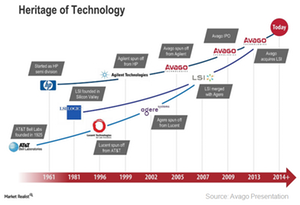

Broadcom: A Product of Several Mergers and Acquisitions

Mergers and acquisitions aren’t new for Broadcom. It has a history of successful M&As, and the most recent Avago-Broadcom merger is its biggest deal to date.

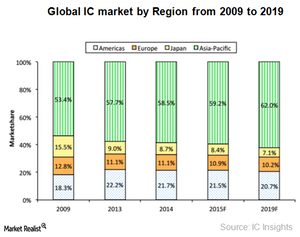

Britain Contributes Little to the Global Semiconductor Industry

Europe accounted for only 10% of global semiconductor sales in April 2016, according to World Semiconductor Trade Statistics.

What Is Analog Devices’ Acquisition Strategy?

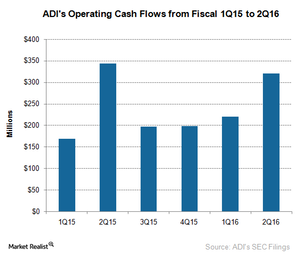

Analog Devices (ADI) has been using M&A (mergers and acquisitions) to rapidly expand its technology offerings and boost its revenue.

Automotive: The Next Big Thing for Texas Instruments

Texas Instruments (TXN) has increased its exposure in the automotive, industrial, and communications segments, which accounted for 64% of the company’s revenue in fiscal 1Q16.

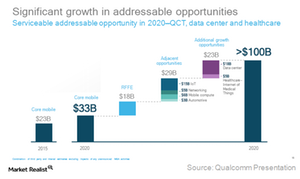

Qualcomm Is Targeting a $100 Billion Market by 2020

Qualcomm (QCOM) has stated that its total SAM (serviceable addressable market) is expected to grow from $23 billion in 2015 to about $100 billion in 2020.

Gauging the Impact of the Microchip-Atmel Merger on Atmel Shareholders

On September 20, 2015, Dialog Semiconductor agreed to buy Atmel for ~$4.6 billion. But in December, Microchip made a competing bid of nearly $3.6 billion.

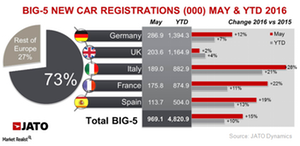

Germany to Drive Growth in European Semiconductor Industry

Despite growth in Europe’s semiconductor industry, it’s unlikely to grow as fast as its Asian counterparts. The EC launched its “10/100/20” strategy in 2013.

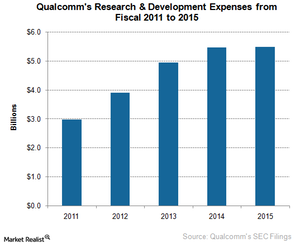

What’s Qualcomm’s Plan for Its QCT Business?

QCT is Qualcomm’s (QCOM) core business, generating close to 67% of revenues in fiscal 2015. But the capital-intensive nature of the business makes it less profitable.

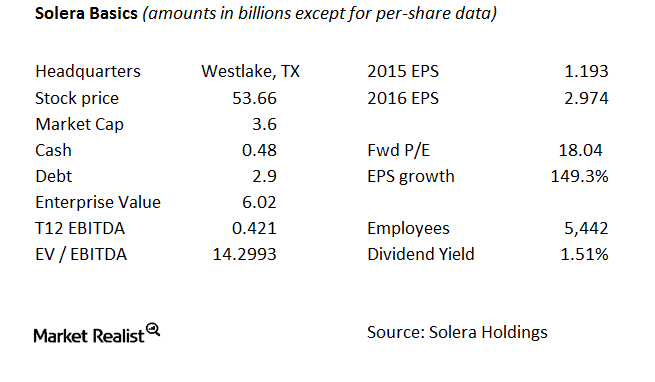

The Basics of Solera

Solera connects insurers and auto service providers. Its software is used by auto insurance companies, auto dealers, collision repair facilities, assessors, auto recyclers, and various other entities.

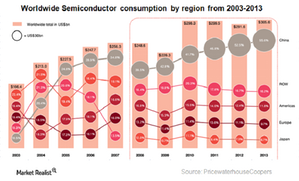

China Emerges as New Competition in Semiconductor Industry

China is looking to reduce its dependence on foreign technology. Its government plans to invest up to $161 billion over the next decade to promote domestic chip manufacturers.