Reviewing What Likely Drove NXP’s 3Q16 Revenue

NXP caters to a broad market, including the automotive, communications infrastructure, mobile, embedded device, industrial, and secure payment spaces.

Dec. 4 2020, Updated 10:53 a.m. ET

NXP Semiconductors’ business segments

NXP Semiconductors (NXPI) manufactures chips that convert analog data into digital data. It caters to a broad market, including the automotive, communications infrastructure, mobile, embedded device, industrial, and secure payment spaces.

The company has divided its business into two broad divisions by product: HPMS (High-Performance Mixed-Signal) and STDP (Standard Products). The company will likely sell its STDP division, which accounts for 13% of its revenue, to JAC Capital by 1Q17.

HPMS segment

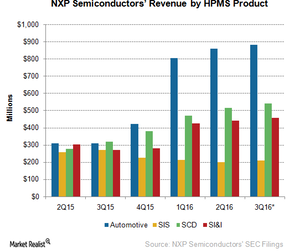

The HPMS segment accounts for 85% of NXP’s revenue and 90% of its operating profit. HPMS’s advanced technology gives NXP a competitive advantage, helping it to demand higher prices for these chips.

HPMS comprises four subsegments: Automotive, SIS (Secure Identification Solutions), SCD (Secure Connected Devices), and SI&I (Secure Interface & Infrastructure). In 2Q16, the company witnessed the highest sequential rise of 9.1% in SCD, followed by a rise of 6.6% in Automotive and a rise of 4.5% in SI&I.

Automotive

NXP’s Freescale merger doubled the size of its automotive segment and made it a leader in car infotainment, secure car access, in-vehicle networks, two-way secure entry products, and powertrain applications. The company earns 36% of its revenue from the automotive space, where it caters to the top nine automakers in the world.

If we assume the segment’s revenue contribution to remain unchanged, it could report revenue of $882 million in 3Q16, representing a sequential rise of 2.8%.

SCD

SCD is the only segment that’s been growing steadily over the past five quarters. It includes NXP’s NFC (near-field communication) technology, which enables secure mobile transactions by creating a secure wireless interaction between phones and payment terminals. NXP powers Apple (AAPL) and Samsung’s (SSNLF) mobile payment services.

SCD is the company’s second-largest segment, accounting for 22% of its revenue. If SCD’s revenue contribution remains unchanged, it could report revenue of $539 million in 3Q16, representing a sequential rise of 5%.

SI&I

The SI&I segment delivers digital networking processors, secure interface and system management products, smart antennae solutions, and high-performance radio frequency power amplifiers. This segment accounts for 18.7% of NXP’s revenue.

Assuming that its revenue contribution remains unchanged, the segment could report revenue of $458 million in 3Q16, representing a sequential rise of 3.6%. However, it’s likely to report stronger sequential growth driven by bulk orders from Apple.

SIS

The SIS business delivers security and privacy solutions to the banking, transportation, and e-government markets and accounts for 8.5% of the company’s revenue. Assuming the segment’s revenue contribution remains unchanged, it could report revenue of $208 million in 3Q16, representing 4% sequential growth.

Next, let’s see how the company’s profit margins may look in 3Q16.