Kimberly-Clark Corp

Latest Kimberly-Clark Corp News and Updates

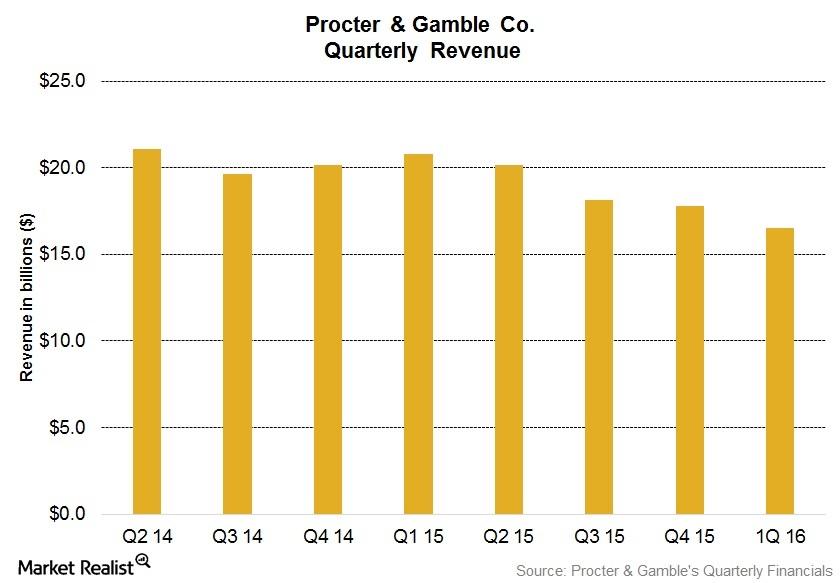

Procter & Gamble Beats Third-Quarter Estimates

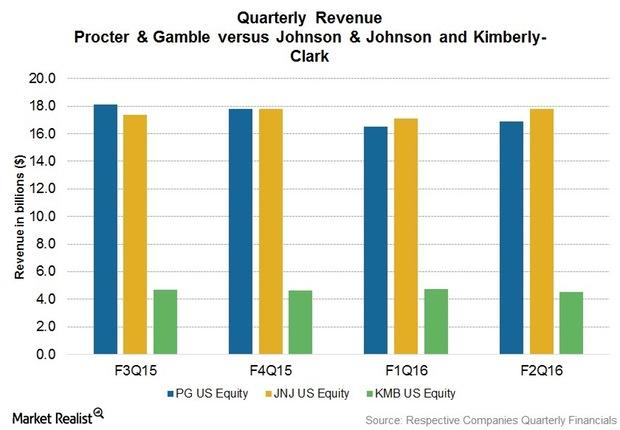

Procter & Gamble (PG) posted stronger-than-expected third-quarter results on Tuesday, April 23.

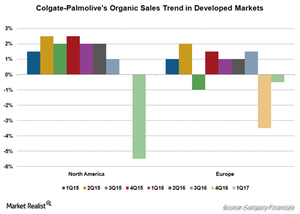

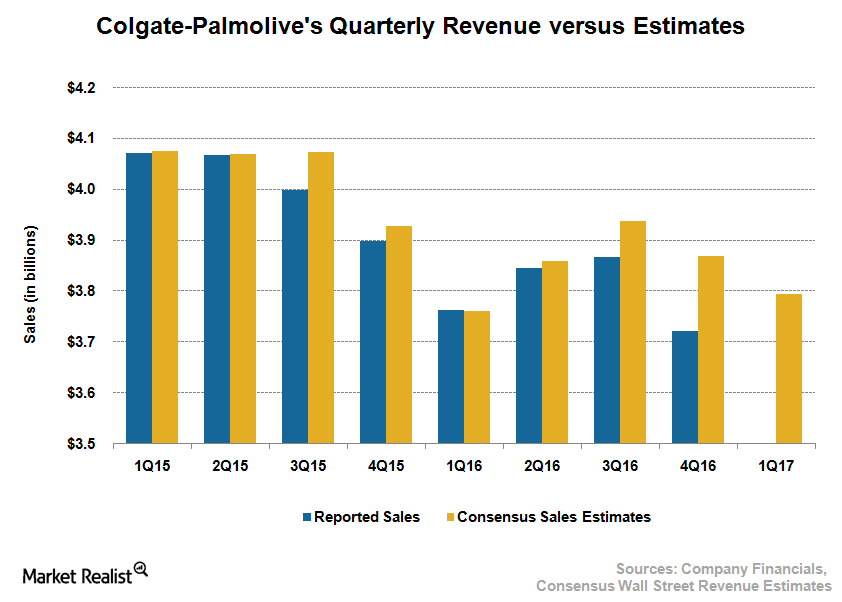

Colgate-Palmolive’s Developed Markets Remained a Drag in 1Q17

Net sales in North America fell 5.0% in 1Q17, reflecting a strong decline in volumes coupled with lower pricing.

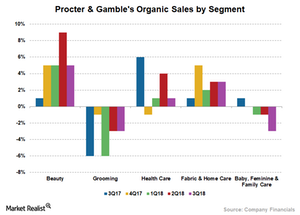

How Procter & Gamble’s Segments Performed in 3Q18

Lower pricing adversely impacted Procter & Gamble’s (PG) sales across product segments amid increased competitive activity.

Henkel Acquired Procter & Gamble’s Haircare Brands

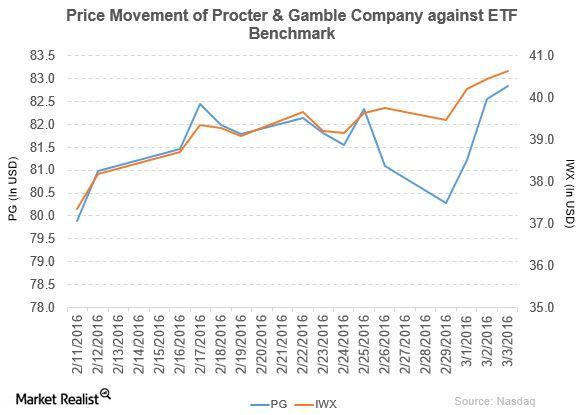

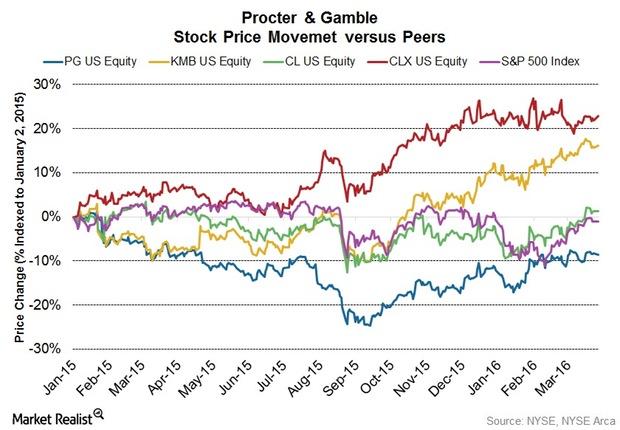

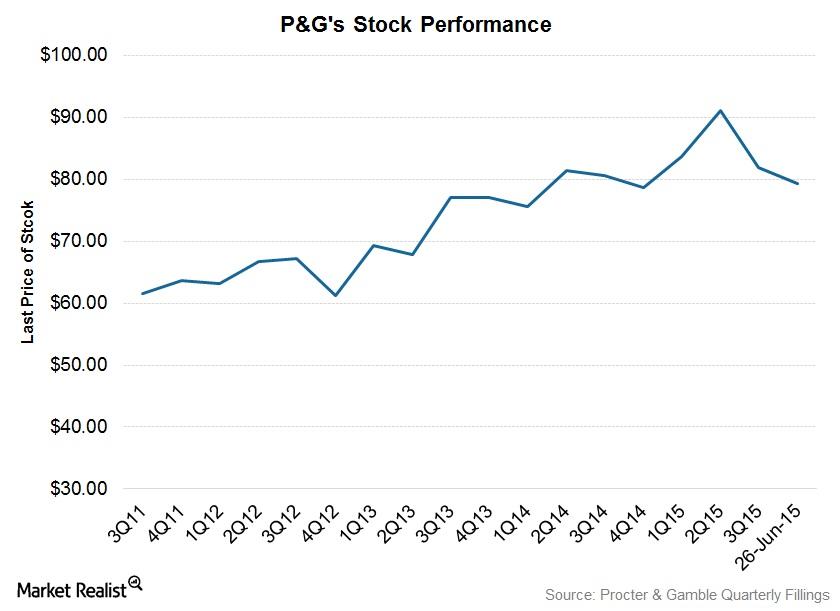

Procter & Gamble (PG) has a market cap of $224.1 billion. PG rose by 0.35% to close at $82.84 per share on March 3, 2016.

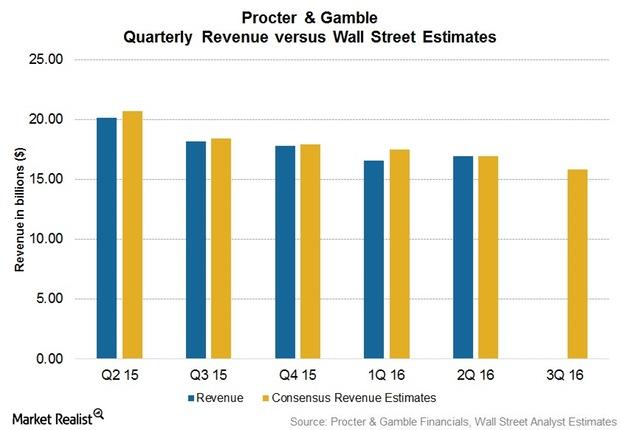

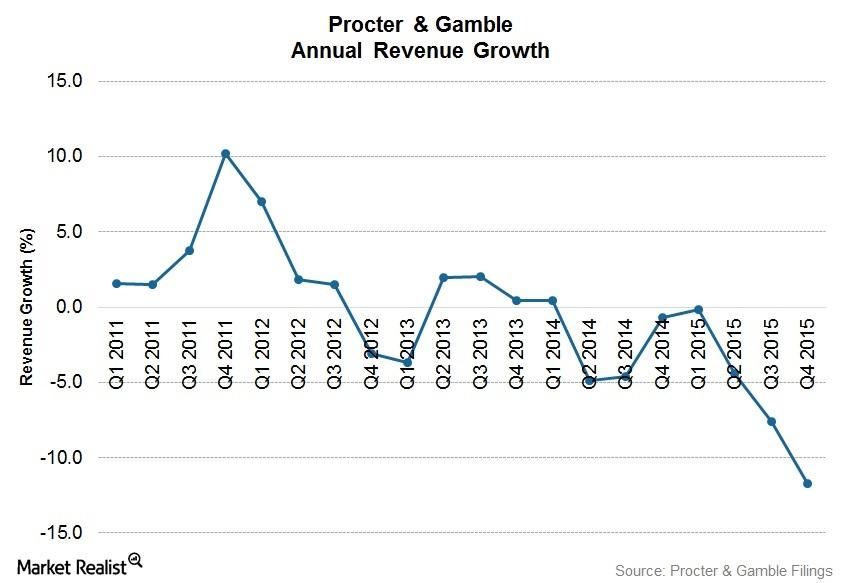

Procter & Gamble: Can Focus on 10 Product Categories Help 3Q16?

Procter & Gamble (PG) is set to release its fiscal 3Q16 earnings before the Markets open on April 26, 2016. In fiscal 2Q16, P&G missed revenue estimates for the fifth consecutive quarter.

How Is Clorox Improving Product Distribution?

For distribution in the United States, Clorox (CLX) sells or markets its products primarily through mass retail outlets, e-commerce channels, wholesale distributors, and medical supply distributors.

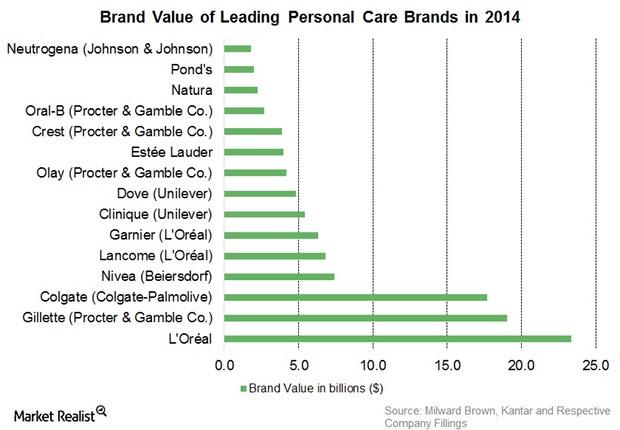

Mega Brands Set to Dominate in P&G’s New Product Portfolio

P&G plans to focus on superior brands in the 10 product categories in its portfolio. It expects one-third of them to surpass $1 billion in annual sales.

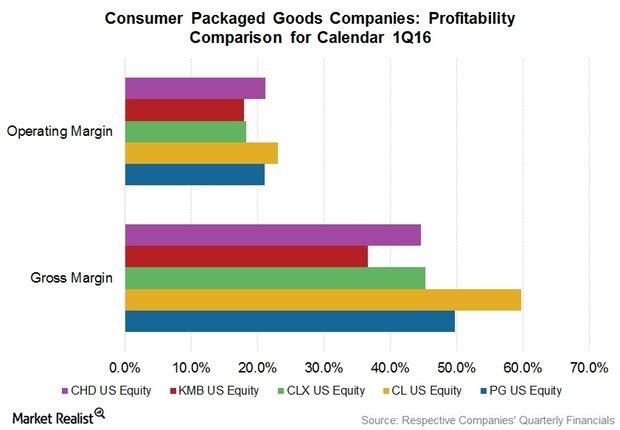

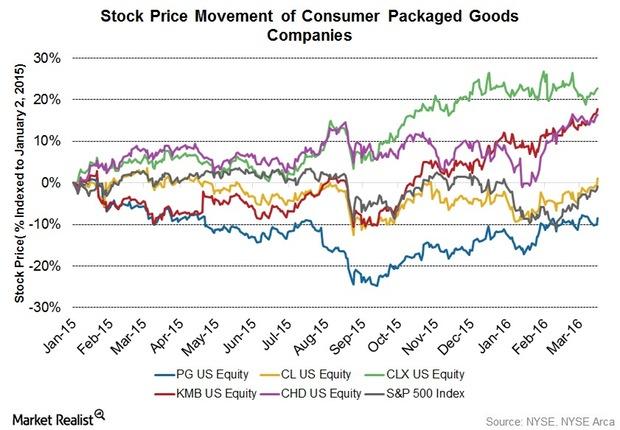

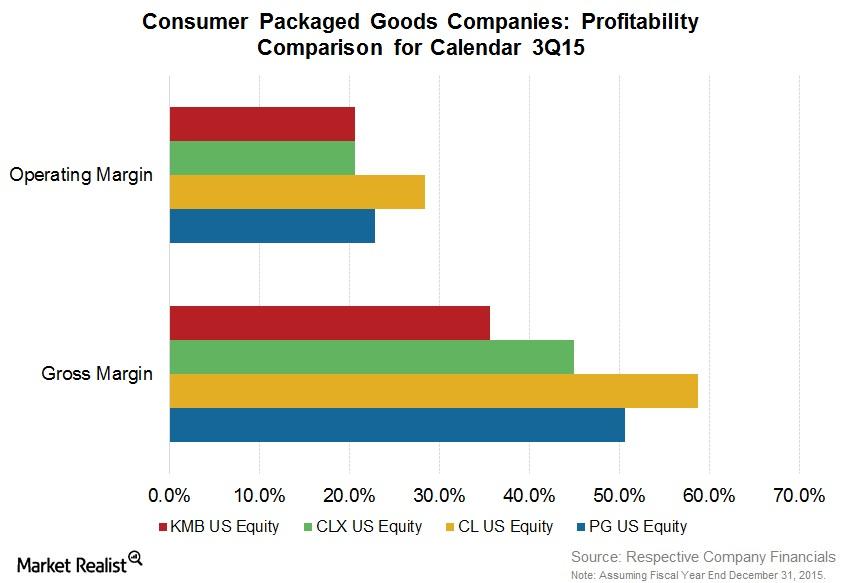

Weak Currencies, but Consumer Packaged Goods Margins Improved

The 1Q16 margins of consumer packaged goods (or CPG) companies sent strong signals. These companies have been investing heavily in innovative products and other growth initiatives.

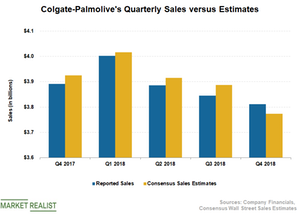

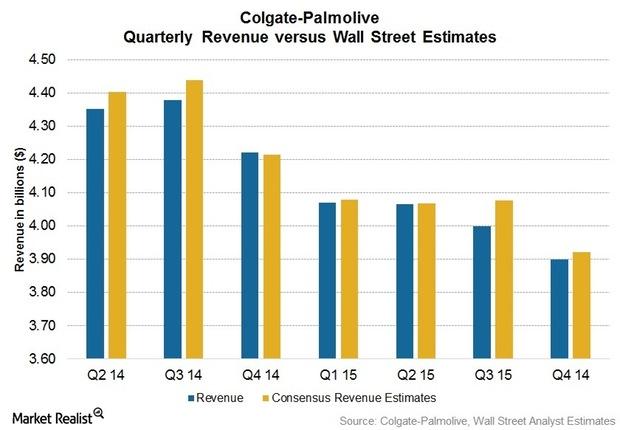

What Dragged Colgate-Palmolive’s Sales Down in Q4?

Colgate-Palmolive (CL) posted net sales of $3.8 billion, a decline of about 2% on a YoY (year-over-year) basis, as unfavorable currency rates hurt the top line by 5%.

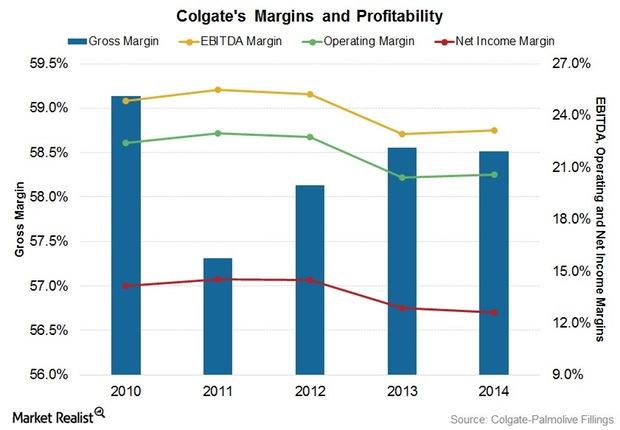

How Colgate Is Maintaining Margins in the Face of Headwinds

Colgate’s worldwide gross profit margin fell to 58.5% in 2014 from 58.6% in 2013.

Will the Rally in Clorox Stock Continue?

The COVID-19 pandemic boosted Clorox’s sales. People started paying more attention to cleaning and sanitizing.

Is Procter & Gamble a Good Bet for Investors?

The defensive nature of Procter & Gamble stock and its strong dividends make it a good buy in a challenging market environment.

Clorox Gets Rating Upgrade, Coronavirus Triggers Demand

Clorox stock rose 4.1% on March 16, even though the US stock market crashed amid the coronavirus pandemic. JPMorgan Chase upgraded its rating.

Why 2019 Wasn’t As Good As 2018 for Church & Dwight Stock

Although Church & Dwight stock is trading in the green, it has lagged its peers and the broader markets. The stock didn’t repeat its 2018 performance.

Procter & Gamble Stock: What’s Fueling the Growth?

Procter & Gamble stock has generated a significant amount of wealth for investors this year. The company boosted shareholders’ returns.

Why Colgate-Palmolive’s Q3 Earnings Failed to Impress

Colgate-Palmolive released its third-quarter earnings results today. The company’s performance was mixed, irking investors.

Kimberly-Clark and Clorox: Barclays Is Bullish and Bearish

On September 23, Barclays analyst Lauren Lieberman upgraded Kimberly-Clark (KMB) stock and downgraded the Clorox Company (CLX) stock.

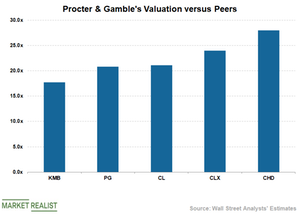

Procter & Gamble Stock: Valuation Limits Upside

Procter & Gamble stock trades at 24.7x its fiscal 2020 estimated core EPS of $4.85. The stock trades at 23.2x its fiscal 2021 estimated core EPS of $5.17.

Church & Dwight Stock: Valuation Overshadows Growth

Church & Dwight (CHD) stock has risen 9.5% on a YTD (year-to-date) basis as of September 13. However, the stock lags its peers by a wide margin.

Procter & Gamble Stock: What’s behind Its Solid Return?

Procter & Gamble stock benefits from its strong organic sales. On average, the company’s organic sales have increased by 5% in the last four quarters.

Why Clorox Stock Is Underperforming Peers

Clorox stock (CLX) is down about 8% since the company posted its third quarter of fiscal 2019 earnings on May 1.

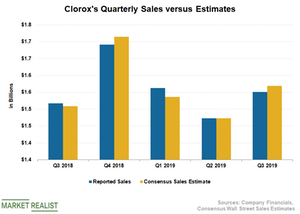

Currency and Competition Hurt Clorox’s Q3 Sales

Clorox (CLX) posted net sales of $1.55 billion, which fell short of Wall Street’s estimate of $1.57 billion.

What Drove Clorox’s Q2 Sales?

Clorox (CLX) posted net sales of $1.47 billion during the second quarter.

Procter & Gamble’s Valuation Compared to Its Peers

Procter & Gamble (PG) stock trades at 20.8x its estimated fiscal 2019 EPS of $4.41, which doesn’t look attractive.

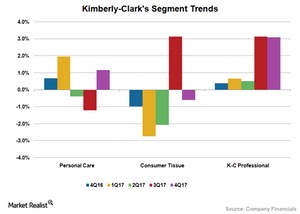

Kimberly-Clark: Segment Performances in 4Q17

Kimberly-Clark’s (KMB) Personal Care segment returned to growth in 4Q17. The segment’s top line increased 1.2% to $2.3 billion.

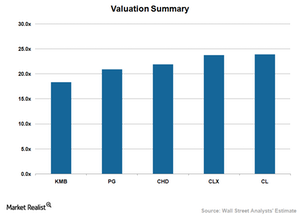

How PG, KMB, CL, CLX, and CHD Compare on Valuation

As of November 24, 2017, Colgate-Palmolive (CL) stock was trading at a forward PE multiple of 24.0x, which is higher than its peers.

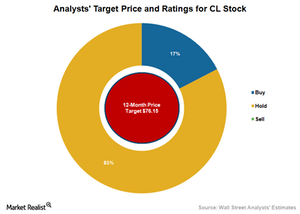

What Analysts Recommend for Colgate-Palmolive

The majority of analysts providing recommendations on Colgate-Palmolive (CL) stock maintain a neutral outlook.

Kimberly-Clark’s Dividend Growth

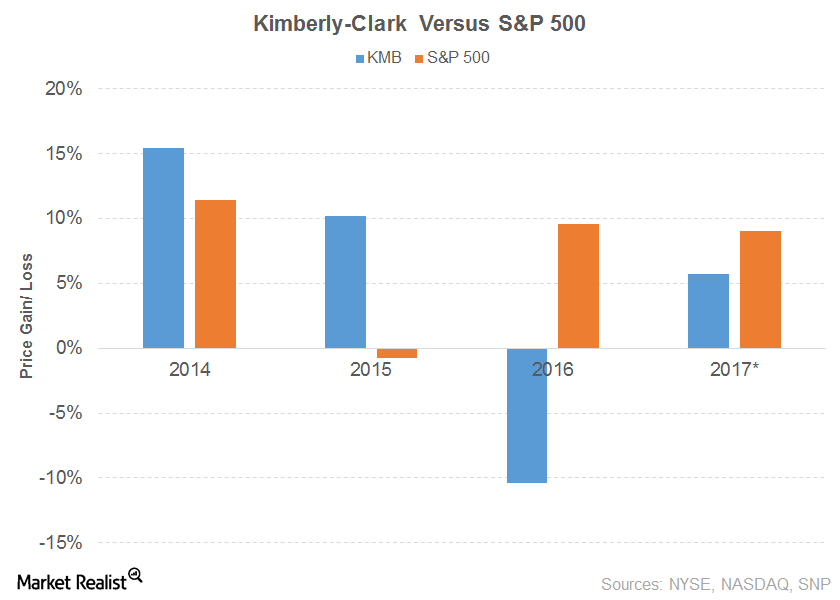

Kimberly-Clark’s (KMB) 2016 net sales fell 2.0% due to declines in every segment.

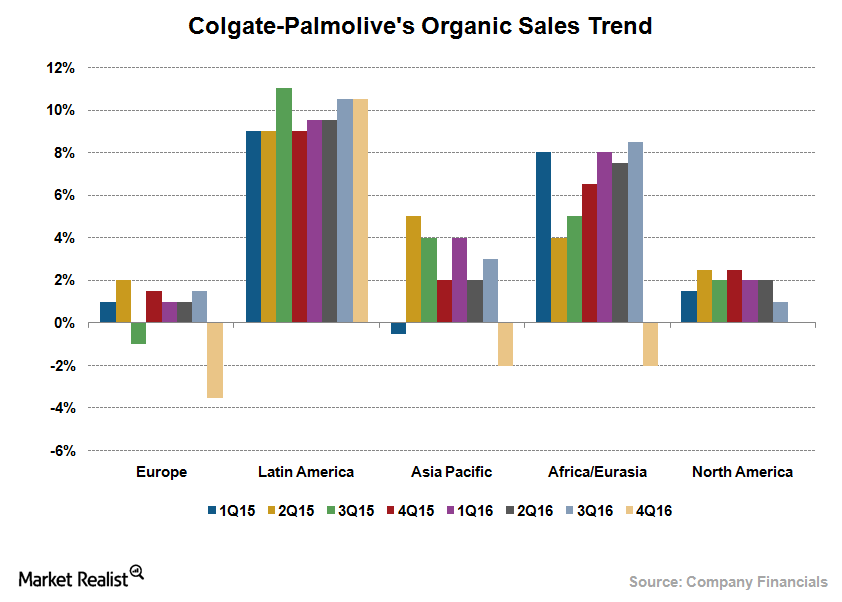

Colgate-Palmolive’s Regional Trends Are Now Headed This Way

CL’s organic sales in its North American segment remained flat in 4Q16. Volume gains in toothpaste were offset by a fall in toothbrushes and liquid hand soap.

Colgate-Palmolive’s Sales Growth: Understanding Analyst Expectations

Analysts expect Colgate-Palmolive (CL) to post revenue of $3.8 billion in 1Q17, which would represent a YoY (year-over-year) growth of 0.8%.

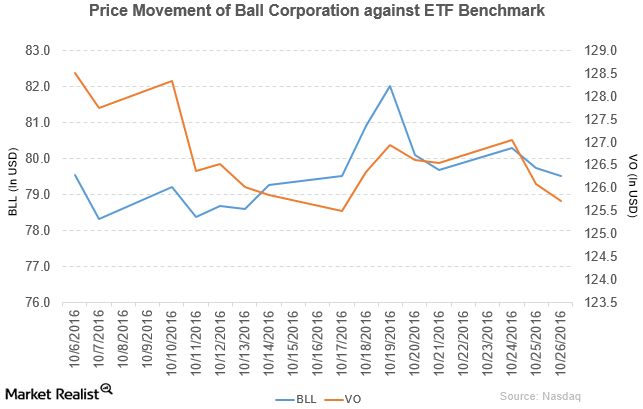

Ball Corporation Declares Dividend of $0.13 per Share

Ball Corporation (BLL) has a market cap of $13.9 billion. It fell 0.28% to close at $79.53 per share on October 26, 2016.

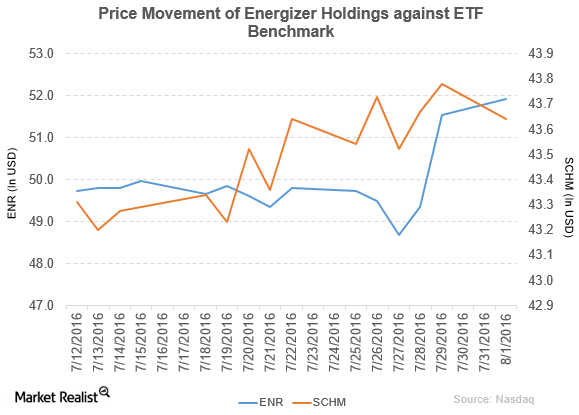

Energizer Holdings Declared a Dividend of $0.25 Per Share

Energizer Holdings (ENR) has a market cap of $3.2 billion. It rose by 0.78% to close at $51.93 per share on August 1, 2016.

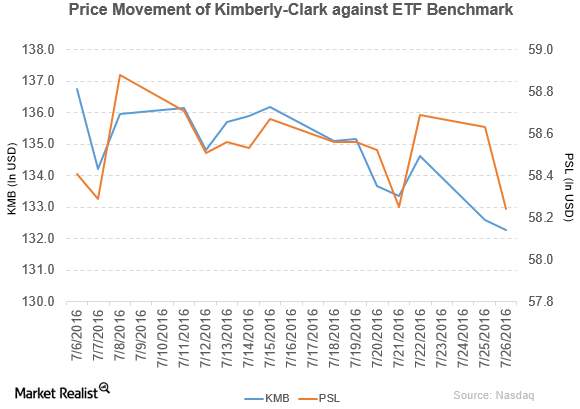

Kimberly-Clark Saw Sales for Personal Care Items Fall in 2Q

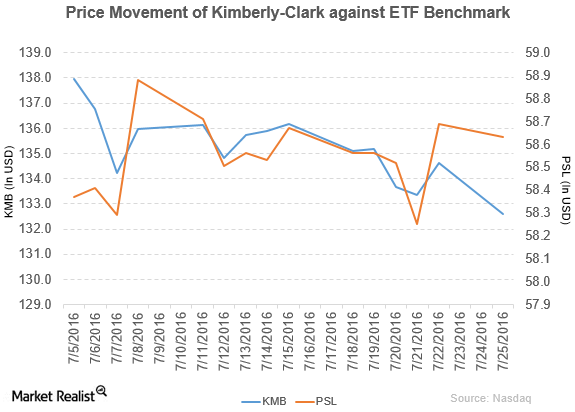

Kimberly-Clark (KMB) has a market cap of $47.7 billion. It fell by 0.23% to close at $132.28 per share on July 26, 2016.

How Did Kimberly-Clark Perform in 2Q16?

Kimberly-Clark fell by 1.5% to close at $132.59 per share on July 25. The stock’s weekly, monthly, and YTD price movements were -1.9%, -1.0%, and 5.6%.

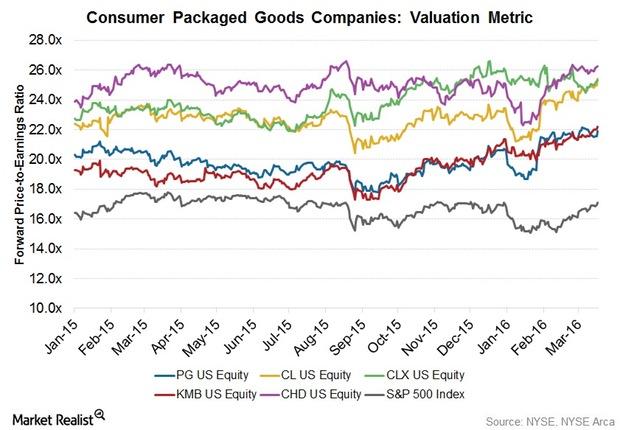

Valuation Multiples Higher for Consumer Packaged Goods in 1Q16

Consumer packaged goods (or CPG) companies are trading at higher valuations compared to the S&P 500 Index (IVV) (SPY) (VOO) and the Dow Jones Industrial Average (DIA).

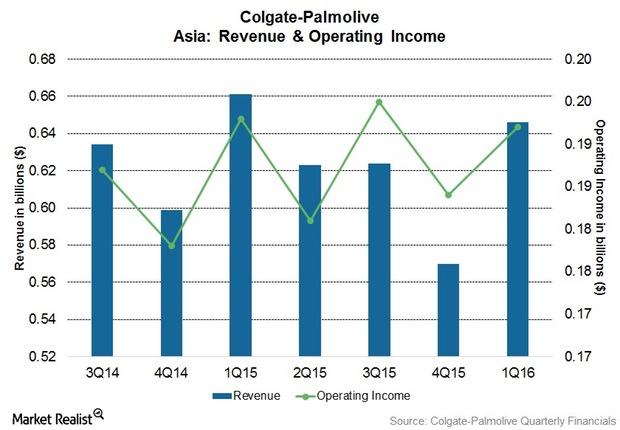

How Colgate Improved Market Share in Its Asia Segment in 1Q16

Colgate’s (CL) Asia segment’s net revenue decreased 2.3% to $0.6 billion in 1Q16.

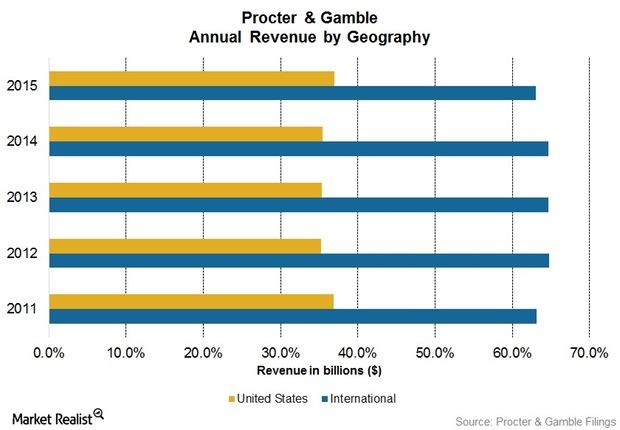

Will Negative Foreign Exchange Affect Procter & Gamble in 3Q16?

Since December 2015, FX (foreign exchange) headwinds have increased $0.3 billion after tax. That includes devaluations in Argentina, Russia, and Mexico.

The Story behind Colgate-Palmolive’s Commercial Strategies

Colgate-Palmolive’s global market share is ~45%. It is the leading toothpaste compared to Oral-B and Close-up, especially in emerging markets like India.

P&G’s Stock Price Reaction to the Old Spice Lawsuit

After a lawsuit was filed against Procter & Gamble (PG), or P&G, for its Old Spice deodorant, P&G’s stock price opened with a fall of 0.4% to $82.46 on March 24, 2016.

Behind CPG Companies’ High Valuation Multiples in 4Q15

As of March 17, 2016, CPG companies were trading at higher valuations relative to the S&P 500 Index (SPY) and the Dow Jones Industrial Average (DIA).

Why Procter & Gamble Is Selling Some of Its Brands

Procter & Gamble is on a mission to trim brands that are holding back its overall financial performance.

Why Does Colgate’s Revenue Keep Falling?

Colgate’s (CL) revenue declined 7.5% to $3.9 billion in 4Q15. The reported revenue was negatively impacted by foreign exchange and divestitures.

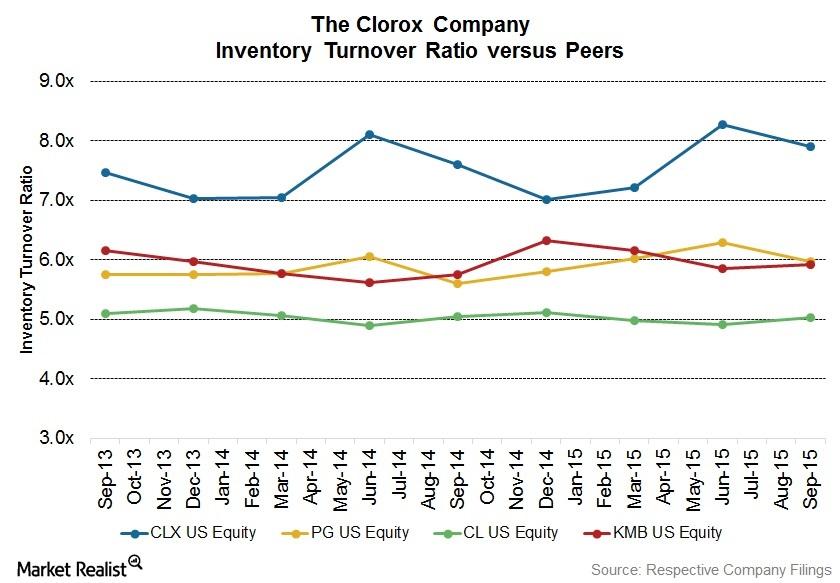

Consumer Packaged Goods Companies Saw Improved Margins

CPG companies’ 3Q15 margins sent strong signals. They have been investing in innovative products and other growth initiatives. This is impacting their margins.

P&G’s Gillette Files a Lawsuit against Dollar Shave Club

P&G alleges that Dollar Shave Club is violating Gillette’s intellectual property by selling its razors.

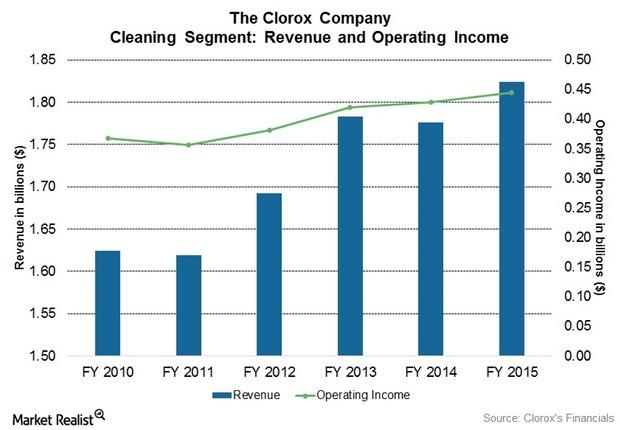

Clorox’s Largest Operating Segment: Cleaning

The Cleaning segment contributed 32.3% to the total consolidated sales of Clorox, the highest among all the segments. The increase was primarily due to higher volume growth.

Colgate’s Efforts to Generate Savings to Fund Growth

Colgate’s funding-the-growth technique is the key component of the company’s financial strategy, according to comments by Ian Cook, the company’s CEO.

What Are Colgate’s Strengths and Opportunities?

A strong market position and brand image are some of Colgate’s chief strengths. Colgate holds 44.4% of the global market share in toothpaste.

Analyzing Colgate’s Competitive Position

As the consumer staples (XLP) sector is highly competitive, Colgate faces local as well as global competition from various local and international players worldwide.

Procter & Gamble: Strategies to Improve Long-Term Profitability

Procter & Gamble continues to look at large developing markets where it thinks it can win enough market share to take a leadership position.

Procter & Gamble: Successes, Weaknesses along the Road to Success

Procter & Gamble aims to harness opportunities in developing countries like China, India, and Russia to enhance its market share as well as stabilize its top-line growth.