Duke Energy Corp.

Latest Duke Energy Corp. News and Updates

Best Hydroelectric Stocks for Renewable Energy Investors in 2021

Renewable energy can come in many forms. Hydroelectricity stocks represent one of the many forms. What are the best hydroelectric stocks in 2021?

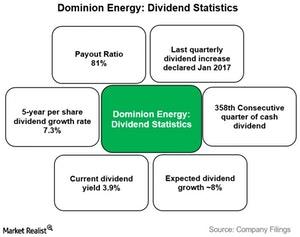

What Investors Should Know about Dominion Energy’s Dividends

Dominion Energy’s (D) payout ratio (the percentage of profit that it gave away in the form of dividends) was 81% in 2016, which is higher than the industry average and slightly on the lower side of its five-year payout average of 85%.

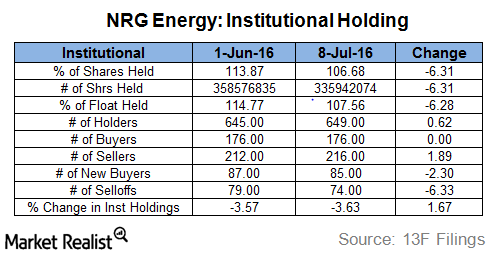

What Are Institutional Investors Doing with NRG Energy?

Institutional investors decreased their positions in NRG Energy (NRG) in June 2016.

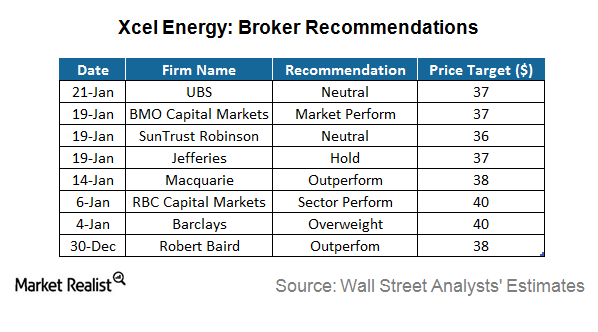

No Analysts Recommend a “Sell” on Xcel Energy

Of the 18 analysts tracking Xcel Energy, 13 recommend it as a “hold,” five recommend it as a “buy,” and none recommend it as a “sell.”

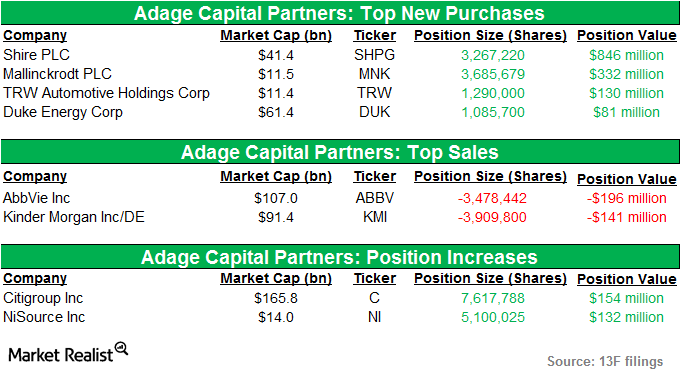

Adage Capital adds a new position in Mallinckrodt

Adage Capital added a new position in Mallinckrodt Plc (MNK) in the third quarter of 2014. The position accounted for 0.82% of the fund’s total portfolio.

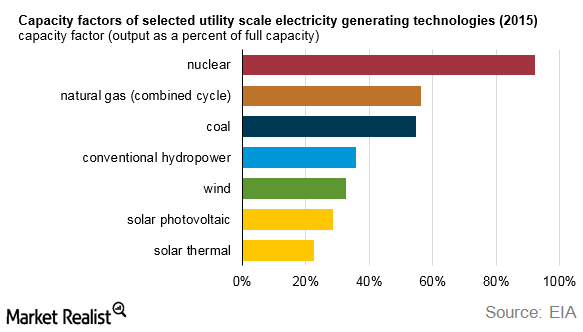

Energy Sources: Capacity Factor and Capacity Additions

Capacity additions in wind power have been quite volatile over the past few years due to uncertainty over tax incentive policies.

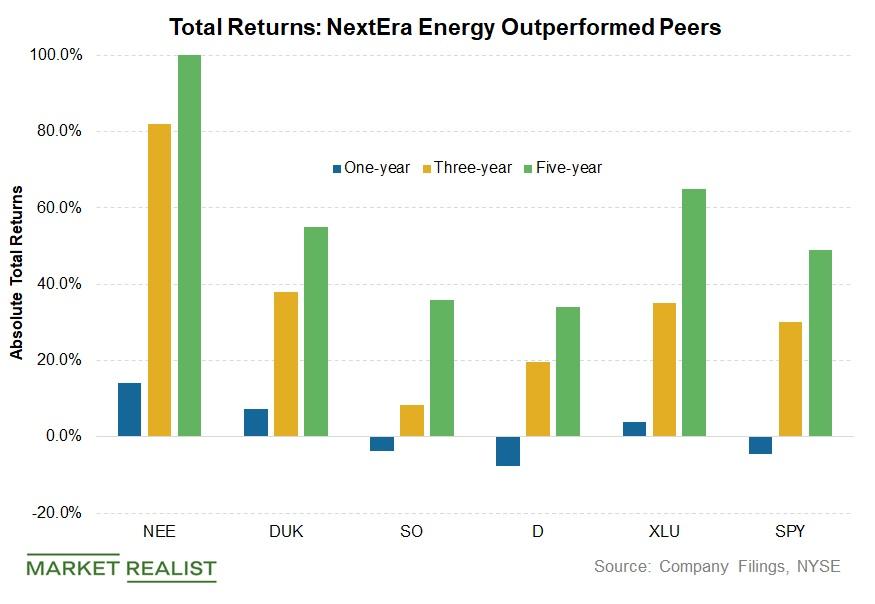

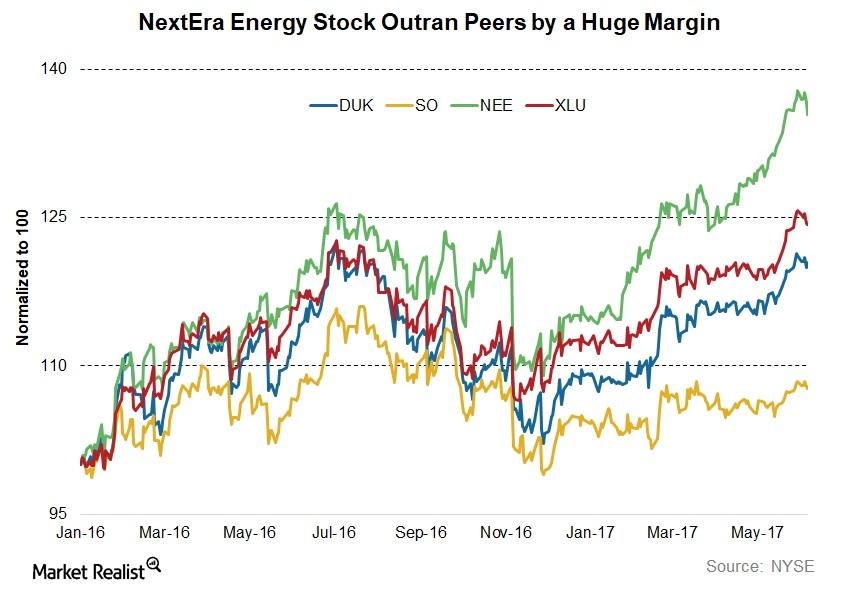

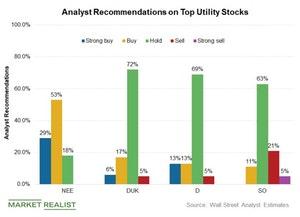

NEE, DUK, SO, and D: Comparing Top Utilities’ Total Returns

NextEra Energy (NEE) beat its peers in terms of returns in the last few years. NextEra Energy returned 14% in 2018.

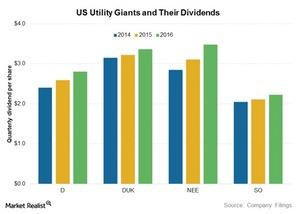

D, DUK, NEE, and SO: Top Utilities’ Dividends

Dominion Resources (D) paid annual dividends of $2.80 in 2016. Duke Energy (DUK) paid dividends of $3.36 per share last year.

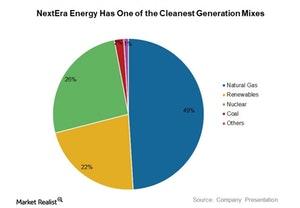

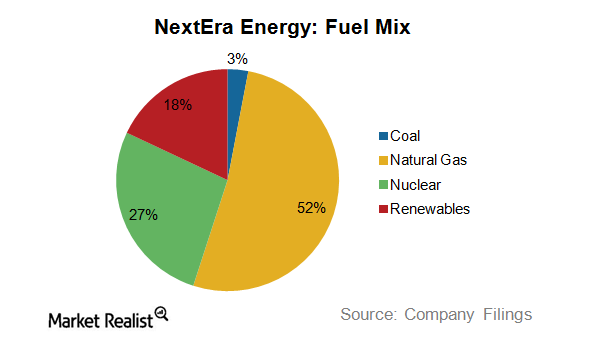

NEE Has One of the Cleanest Generation Mixes in the US

NextEra Energy (NEE) has one of the cleanest generation mixes among peers.

XLU: How US Utilities Are Currently Valued

So far, US utilities have had a decent run this year. The Utilities Select Sector SPDR ETF (XLU) has risen more than 14%.

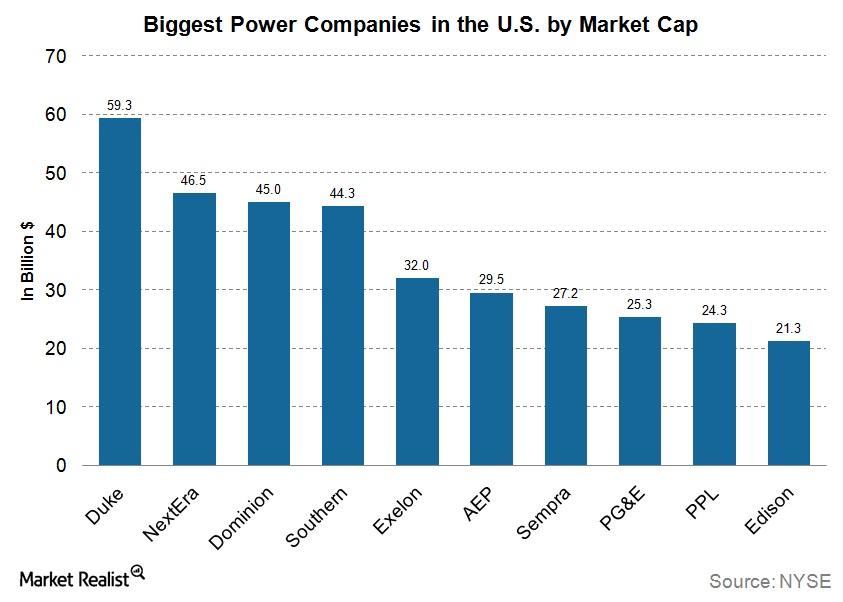

Must-know: US power sector and its indicators

The power sector is the backbone of any economy. All of the other industries depend on it. In the U.S., the power utilities business is characterized by steady dividends and stable earnings.

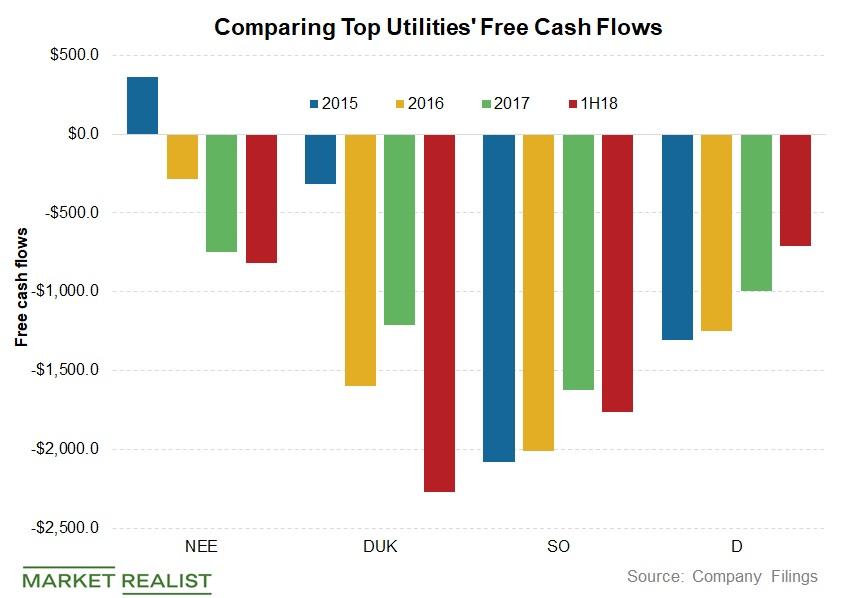

Analyzing Top Utilities’ Free Cash Flow Trends

The top four utilities have failed to generate positive free cash flows in the last few years.

The Best Utility Stock out There: NEE, DUK, or SO?

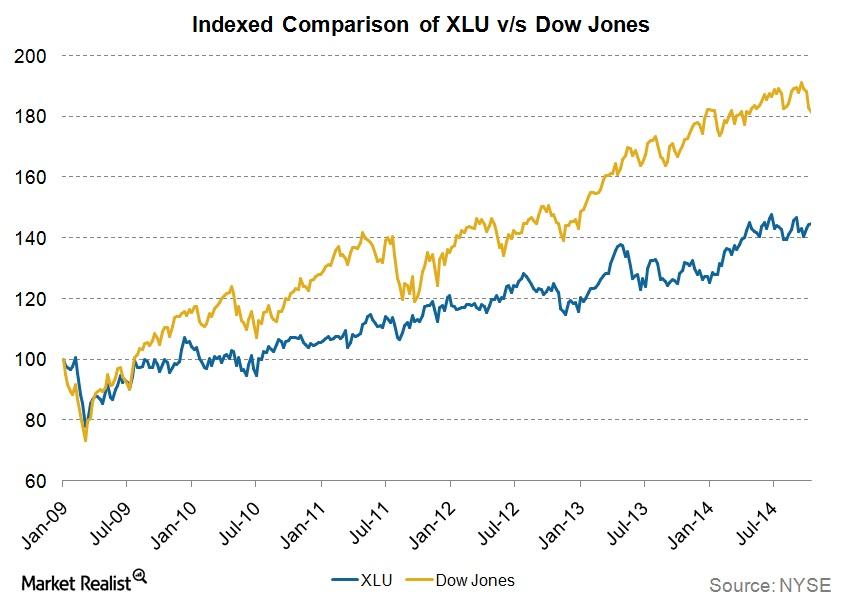

Over the past few years, utility stocks have given enormous returns and have largely followed broader markets.Energy & Utilities Must-know: Understanding Duke’s strategy

In recent years, Duke Energy (DUK) made its intent very clear. It concentrates on its regulated utilities—its core business—instead of other areas. The regulated utilities business is Duke’s strength.

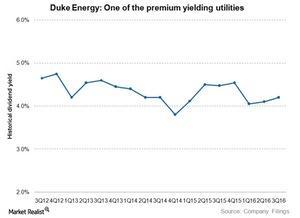

Dividend Faceoff: Southern Company vs Duke Energy

Dividend yields of Southern Company (SO) and Duke Energy (DUK) currently stand at multi-year lows because utility stocks had a solid run this year.

Utilities company overview: NextEra Energy

NextEra Energy (NEE) is the second-largest power company in the US after Duke Energy (DUK) in terms of market capitalization.

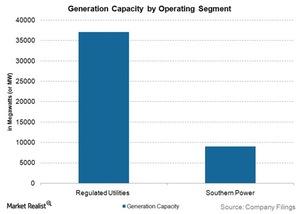

Regulated business is Southern Company’s strength

Southern Company manages its regulated utility business through the following four subsidiary companies: Alabama Power, Georgia Power, Gulf Power, and Mississippi Power. These subsidiaries have a combined power generation capacity of 37,000 megawatts (or MW).

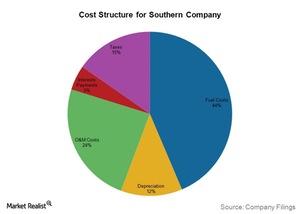

Cost structure sets Southern Company above its competitors

Fuel costs per kWh can be used to evaluate the efficiency of a power producer to produce electricity. Southern Company’s fuel cost per kWh is lower than its competitors’ in the regulated utility business.

A key overview of Adage Capital’s holdings in 3Q14

Adage Capital’s US long portfolio grew from $38.69 billion in 2Q14 to $40.2 billion in 3Q14. The portfolio comprised around 699 stocks.Energy & Utilities Why net capacity additions are important

Capacity is defined as the potential power output that power plants can generate. Each power plant has a shelf life. After the shelf life, they’re replaced with new power plants.

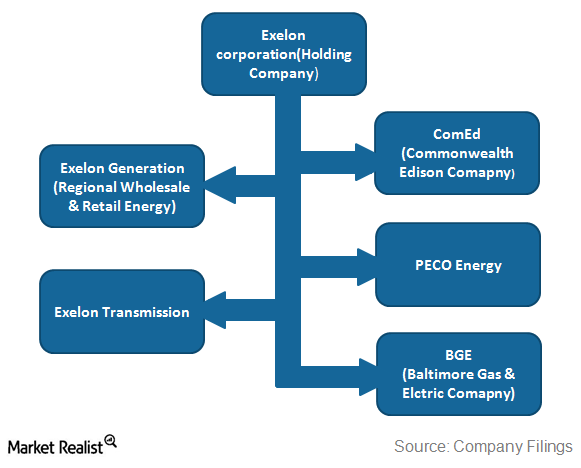

A brief overview of Exelon’s power operations

Power generation is a significant segment for Exelon, generating more than 60% of its total revenue. The energy delivery business provides the other 40% of the company’s revenues.

Southern Company’s Dividends Compared to Its Peers

Southern Company (SO), the top regulated utility, declared a quarterly dividend of $0.62 per share last month. The ex-date for the dividends is Friday.

Utilities Are Back in Focus as the Trade War Escalates

Investors turned to defensive utilities intensified yesterday after President Trump announced 10% tariffs on another $300.0 billion worth of Chinese goods.

Is Joe Biden’s Green New Deal Really Feasible?

Joe Biden has proposed a climate change framework that aims to zero down on carbon emissions and create millions of new jobs by 2050.

Why Utilities Underperformed the Broader Market Last Week

The defensives and utilities sector fell more than 2% last week while broader markets fell just 0.3%. Here’s why.

How Utility Stocks Fared Last Week

Utilities were close to their all-time high and gained 0.4% last week, while broader markets also gained marginally.

Top Utilities’ Stock Price Targets Get Bumped Up

Many top utility stocks’ price targets were changed last week.

A Look at Leaders and Laggards in the Utilities Sector Last Week

Utilities continued their upward march last week and outperformed broader markets.

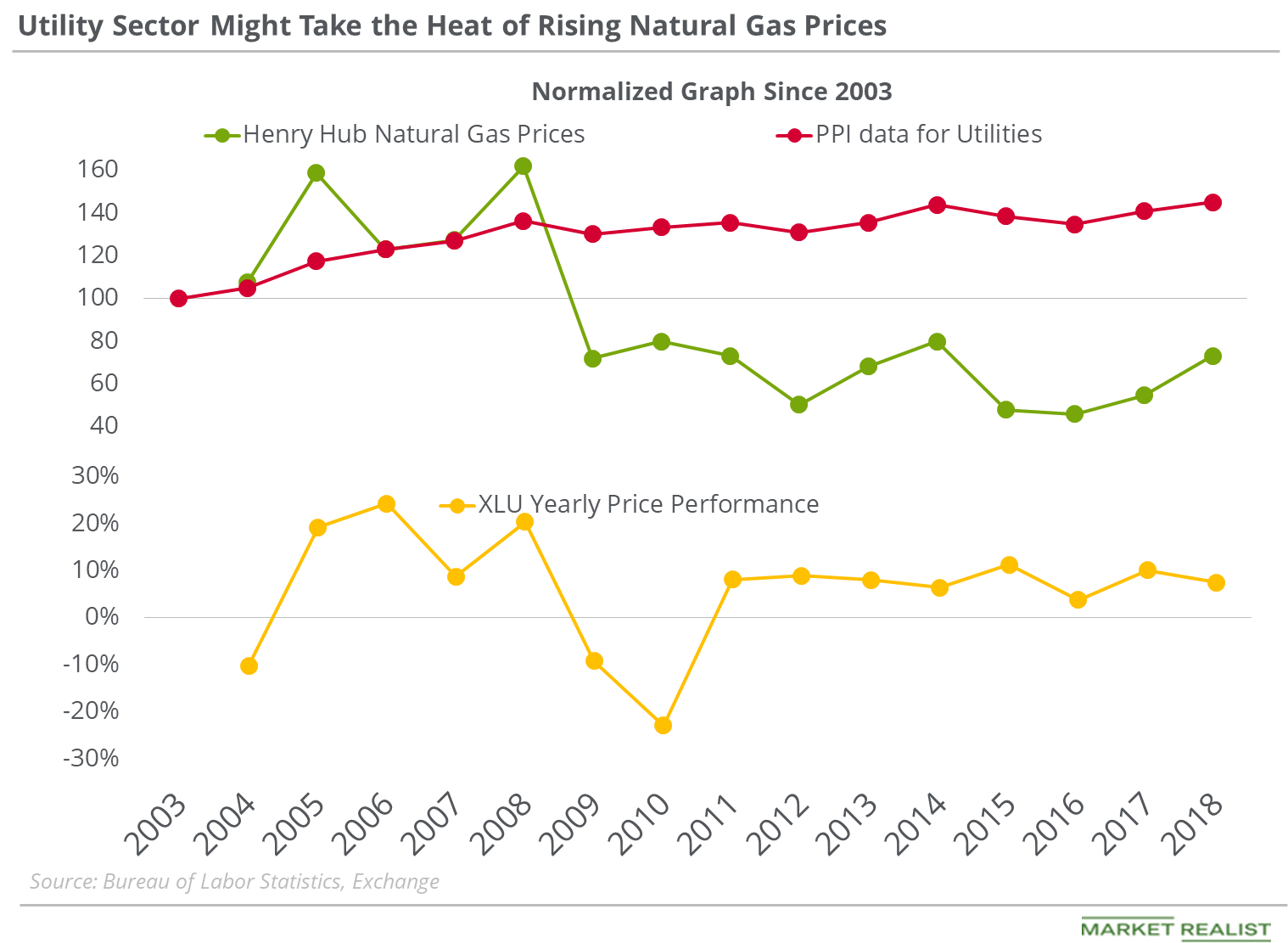

Utilities’ PPI Could Increase with Higher Natural Gas Prices

On March 3, 2016, natural gas active futures were at the lowest closing level in the last 17 years.

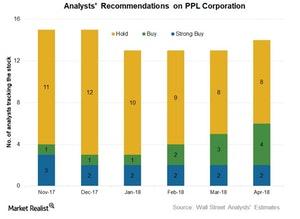

PPL: Analysts’ Views and Target Prices

PPL (PPL) stock offers an attractive potential upside of more than 13% in a year with a mean target price of $32.3. PPL stock is trading at $28.5.

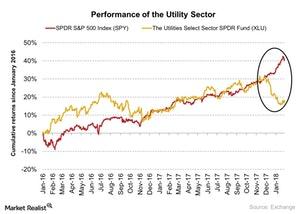

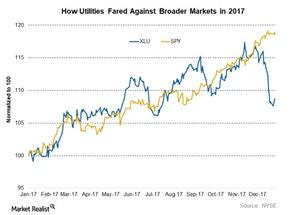

Why Utility Sector Had Inverse Correlation with S&P 500 in January

The Utilities Select Sector SPDR ETF (XLU), which tracks the performance of the utility sector, fell 3.2% in January 2018.

How US Utility Stocks Are Valued for the New Year

US utilities have corrected notably over the past few weeks, and their recent valuations could start attracting new entrants.

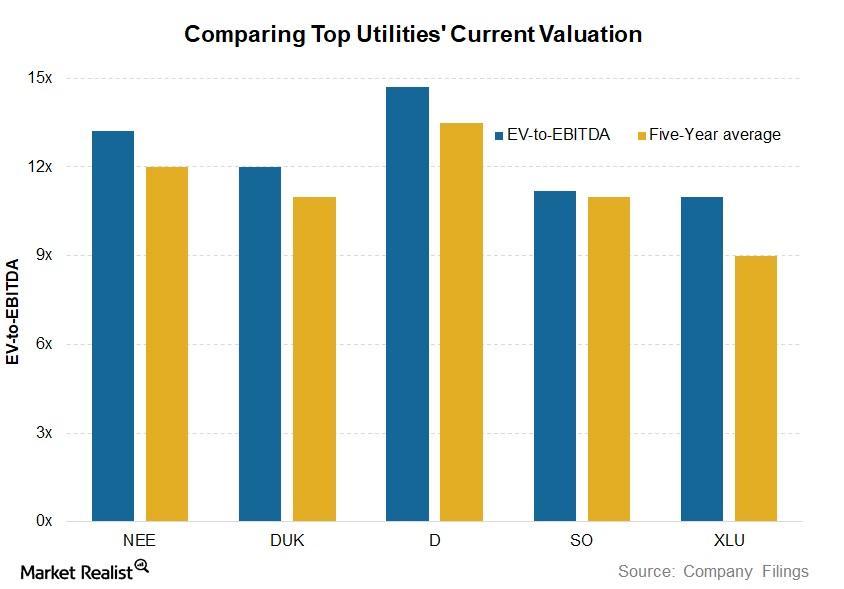

Analyzing Top Utilities’ Current Valuations

The steep fall in utilities in the last couple of weeks seems to have aggravated utilities due to their record high valuations.

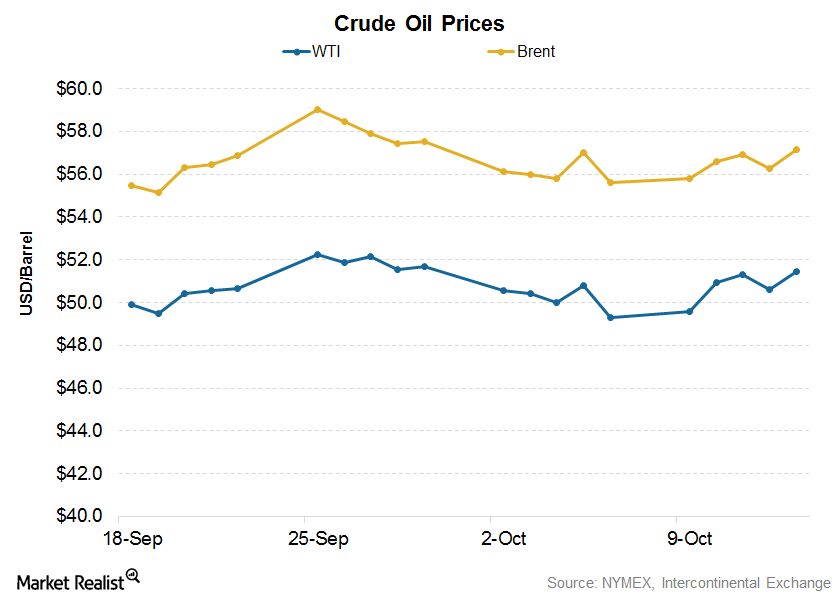

How Higher Crude Oil Prices Impact Coal Producers

On October 13, 2017, Brent crude oil prices settled at $57.17 per barrel, 3% higher than $55.60 reported during the previous week.

Dominion Resources Stock Approaches Peak: What’s Next?

Dominion Resources (D) continues to look interesting from an investor’s perspective as the stock approaches multiyear highs.

Why Does Duke Energy Yield Better Than the Industry Average?

Duke Energy is one of the highest-yielding S&P 500 Utilities stocks. Its large regulated operations fetch stable earnings and offer stable dividends.

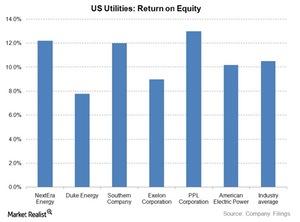

A Look at US Utilities’ Return on Equity

Duke Energy’s (DUK) adjusted return on equity stayed below 8% due to volatile earnings from international operations. This ROE was on the lower side of the industry average.

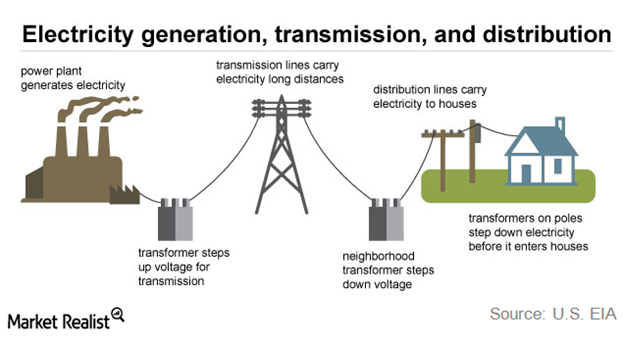

Utilities Overview: How Does the Electricity Supply Chain Work?

The US electric utility industry is a mature business that is growing slowly and steadily. The country’s electric grid consists of 7,300 power plants and 160,000 miles of high-voltage power lines that deliver electricity to more than 145 million customers.

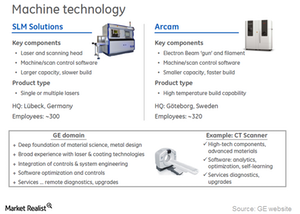

Why Is General Electric Focused on Additive Manufacturing?

General Electric’s focus on 3D printing Earlier in this series, we looked at General Electric’s (GE) expected operating margins and profit in 3Q16. In this part, we’ll look at GE’s plans in the additive manufacturing space. On September 6, 2016, GE acquired two 3D printing companies, Arcam and SLM, for $1.4 billion in cash. General […]

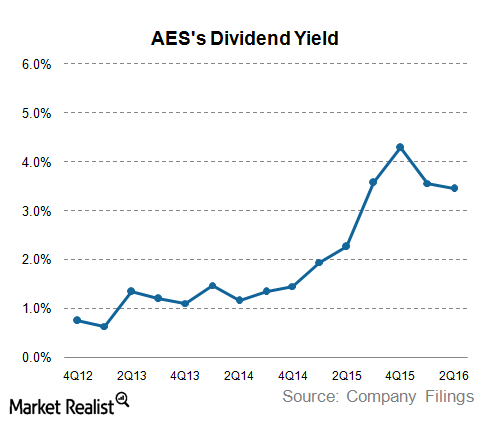

A Look at AES’s Dividend Yield

AES’s (AES) dividend yield has improved significantly in the last couple of years. The 10% fall in dividends in 2016 is among one of the highest in the industry.

How Would an Interest Rate Hike Affect the Stock Market?

A hike in interest rates increases the cost of borrowing for companies. Most publicly traded companies carry at least some debt to fund their operations, and higher borrowing costs can cause their profit margins to contract.

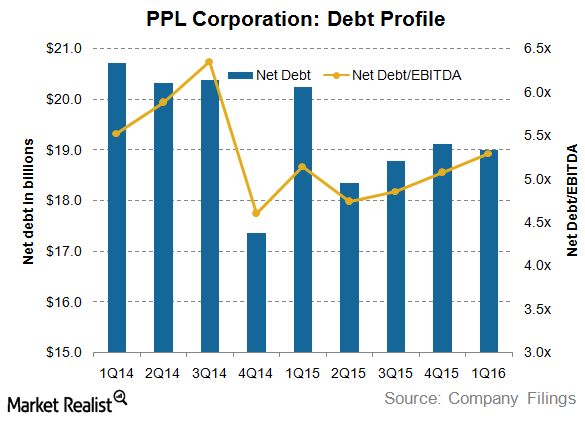

Inside PPL Corporation’s Debt Profile in 1H16

At the end of the first quarter of 2016, PPL’s total debt stood at $19.8 billion. Of this amount, $18 billion was long-term debt.

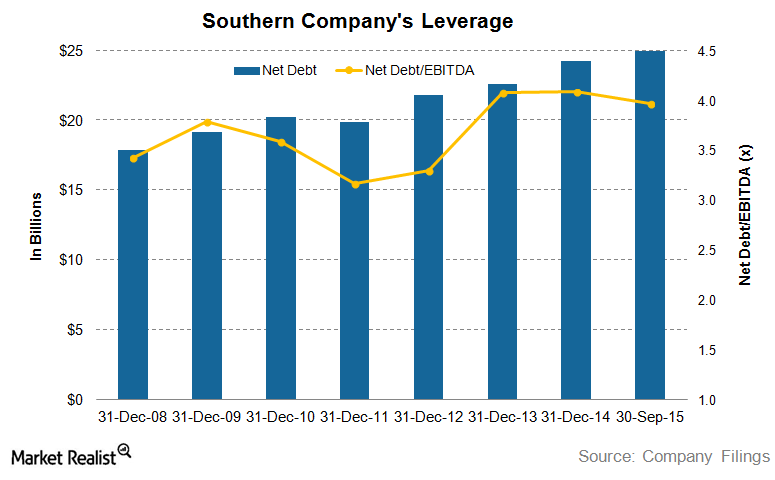

Analyzing Southern Company’s Debt Profile

As of September 30, 2015, Southern Company had total debt of $27 billion against equity of $20.6 billion. Of this, $22.3 billion is long-term debt.

NextEra Energy Seeks Capacity Addition Using Renewables

NEE is further expanding its renewables footprint. In 9M15, it added 225 megawatts of wind capacity and 115 megawatts of solar generation capacity.

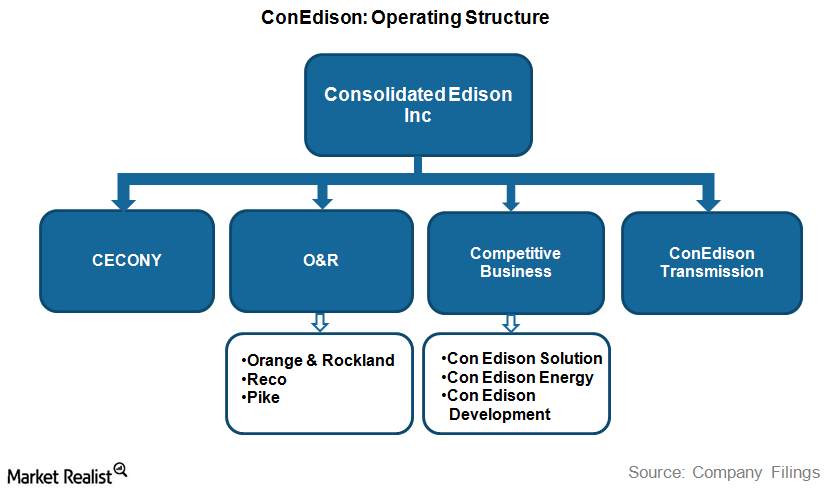

What You Should Know about Con Edison’s Operating Structure

Con Edison handles its competitive energy business through its three wholly-owned subsidiaries: Con Edison Solutions, Con Edison Energy, and Con Edison Development.

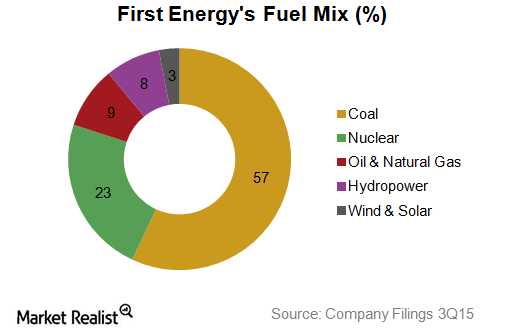

FirstEnergy Relies Heavily on Coal for Power Generation

FirstEnergy generates power from a diverse mix of primary energy sources but is primarily dependent on coal, which accounts for 57% of its power generation.

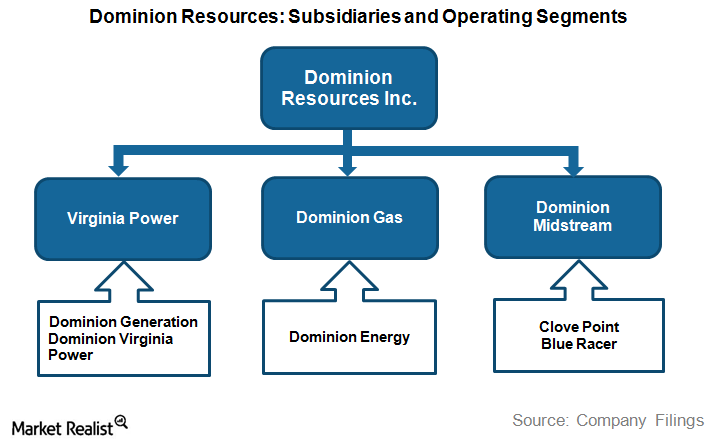

Understanding Dominion Resources’ Corporate Structure

Dominion Resources engages in all stages of the energy value chain, including power generation, transmission, and distribution.

How Exelon’s Hybrid Business Model Provides Balanced Revenues

Exelon (EXC) manages end-to-end operations in the power utilities segment through its subsidiaries.

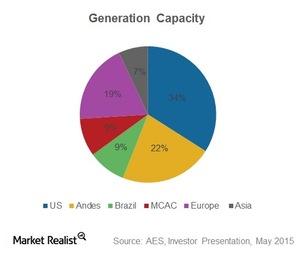

How Does AES Corporation Categorize Its Businesses?

AES Corporation (AES) is a diversified power generation and utility company. It operates its business under six SBUs (strategic business units).

How Does AES Manage Its Businesses across 18 Countries?

AES has businesses spread across 18 countries and has various operating subsidiaries, each focusing on a specific area of business.