Dow Jones Industrial Average (Dow 30)

Latest Dow Jones Industrial Average (Dow 30) News and Updates

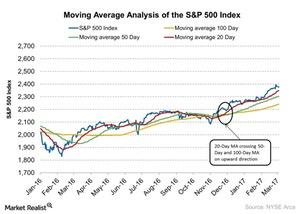

What S&P 500 Index Moving Averages Could Indicate

The S&P 500 Index is trading 1.2% above its 20-day moving average and 6% above its 100-day moving average.

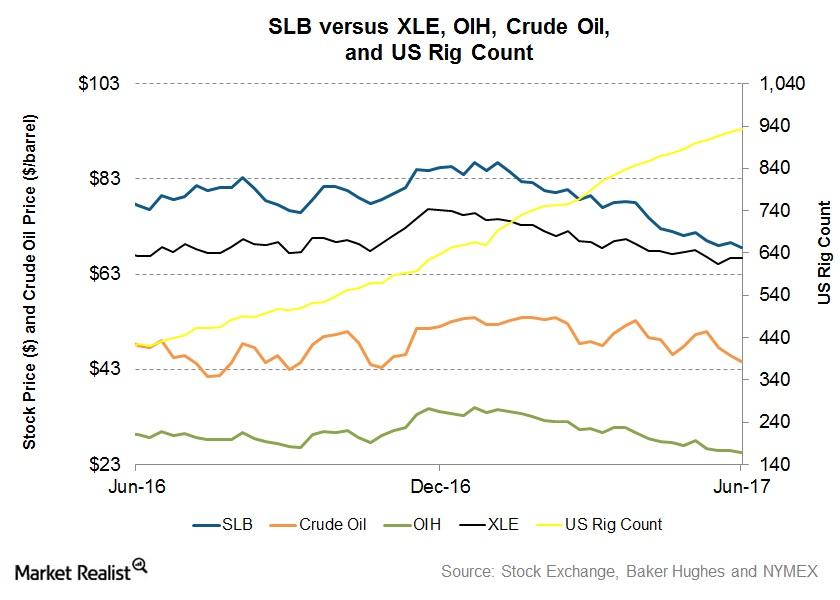

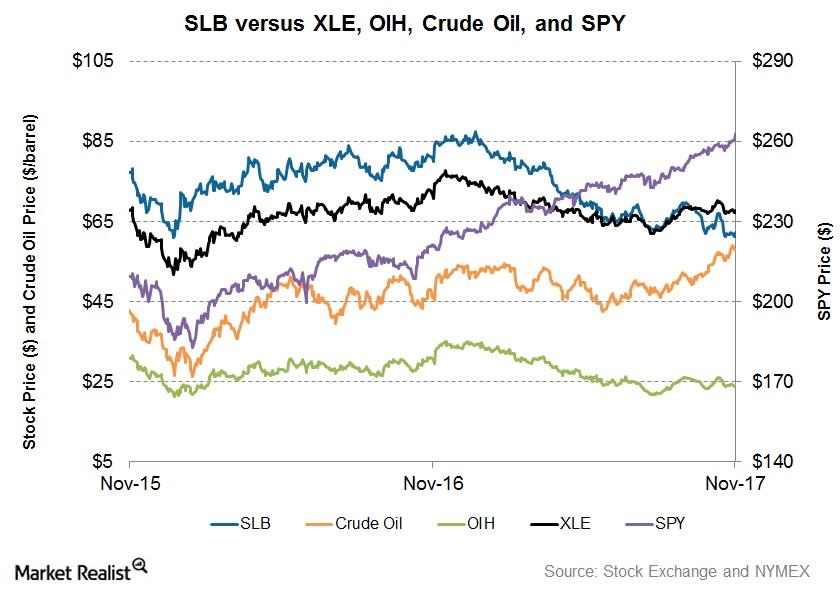

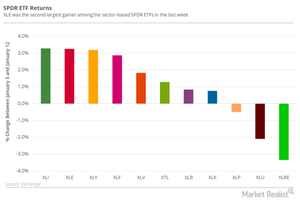

Inside Schlumberger’s 1-Year Returns as of June 16

Schlumberger’s trailing-one-year stock price has fallen 12% as of June 16, 2017, while XLE, the broader energy industry ETF, has fallen 3%.

These Key Economic Indicators Were Released Last Week

In this series, we’ll take a look at the global final manufacturing PMIs and services PMIs for March 2017. These indicators help us understand the business condition of an economy.

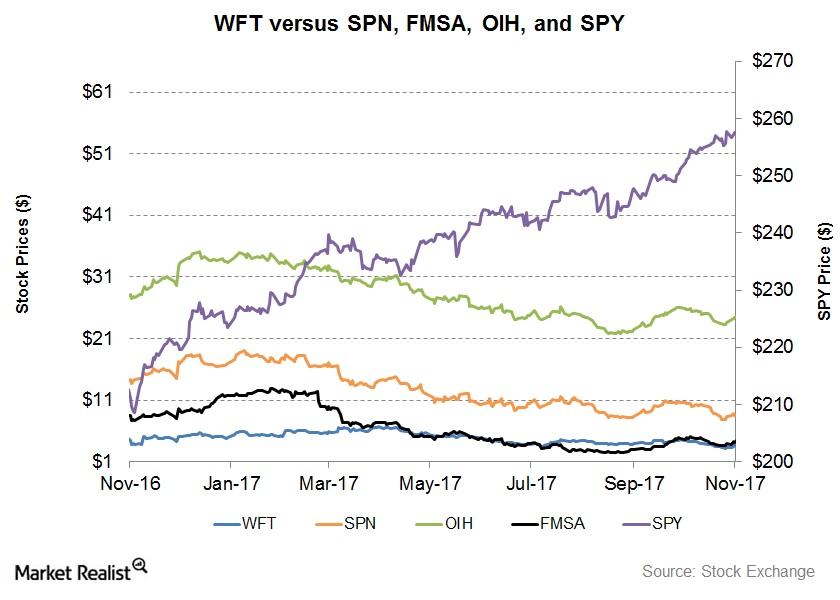

WFT, FMSA, and SPN: Returns and Outlook after 3Q17

WFT, SPN, and FMSA have significantly underperformed the SPDR S&P 500 ETF (SPY), which has produced 23.0% returns since November 3, 2016.

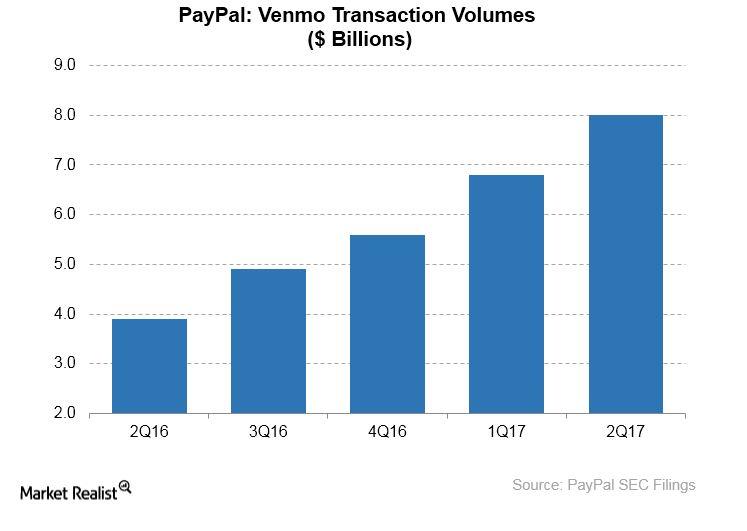

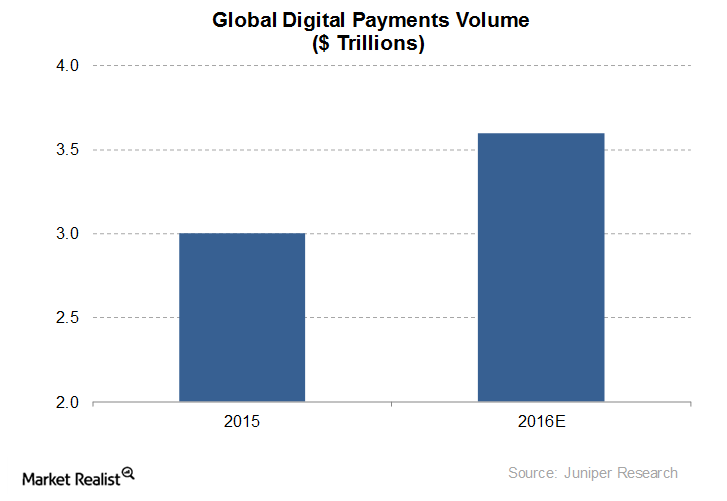

Why BTIG Is Bullish on PayPal

PayPal (PYPL) could have bright prospects despite the competitive threat it faces from Square and Apple in the online payment market, according to equity research firm BTIG.

Why Larry Fink Thinks Markets Could See Some Setbacks

In a recent interview with CNBC, Larry Fink, CEO of BlackRock (BLK), shared his views on market movement, the US economy, and the dangerous impact of the lower interest rates.

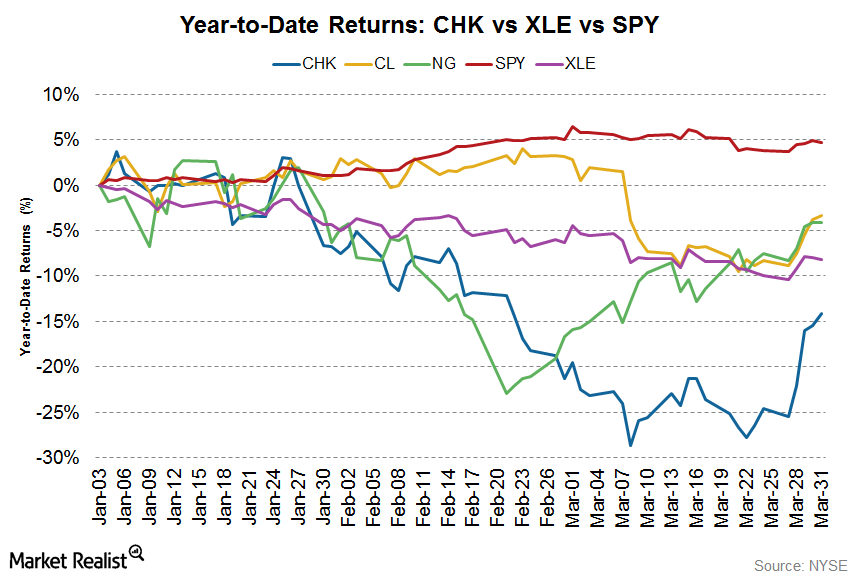

Natural Gas Prices Driving Chesapeake Energy Stock in 2017

Chesapeake Energy’s (CHK) 2016 debt management efforts included a combination of debt exchanges, open market repurchases, and equity-for-debt exchanges.

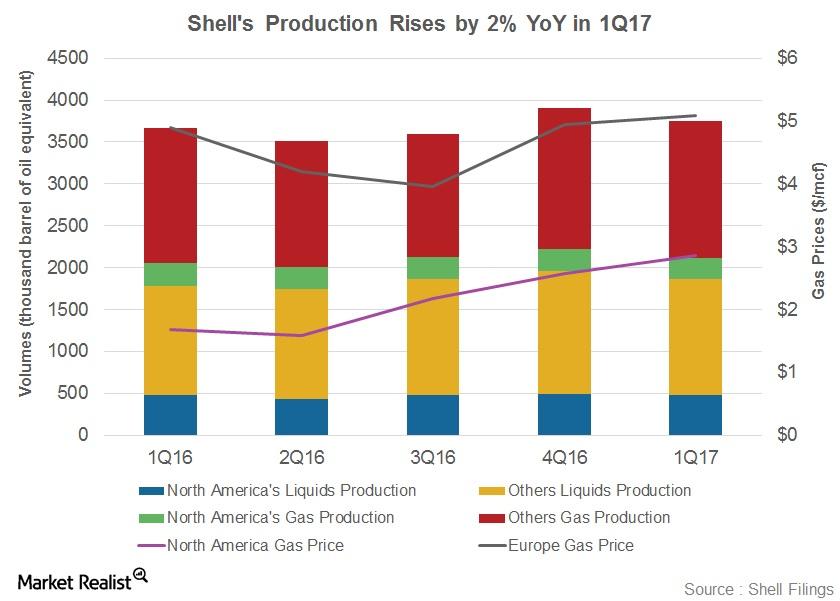

Shell’s Upstream Portfolio: Is it Poised to Grow?

Royal Dutch Shell (RDS.A) produced 3.8 MMboepd in 1Q17 from its worldwide operations, compared to 3.7 MMboepd in 1Q16.

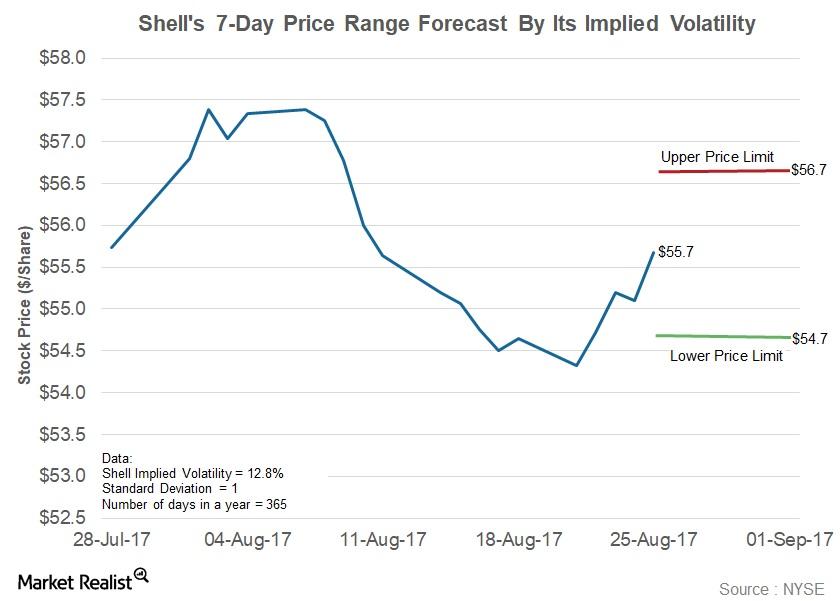

What’s the Forecast for Shell Stock for the Next 7 Days?

Implied volatility in Royal Dutch Shell (RDS.A) has fallen 4.9% since July 3, 2017, to the current level of 12.8%.

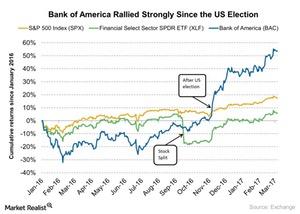

What Goldman Sachs Thinks about Bank of America

Bank of America (BAC) is currently trading at $25.26. Its 52-week high is $25.80 and 52-week low is $12.05.

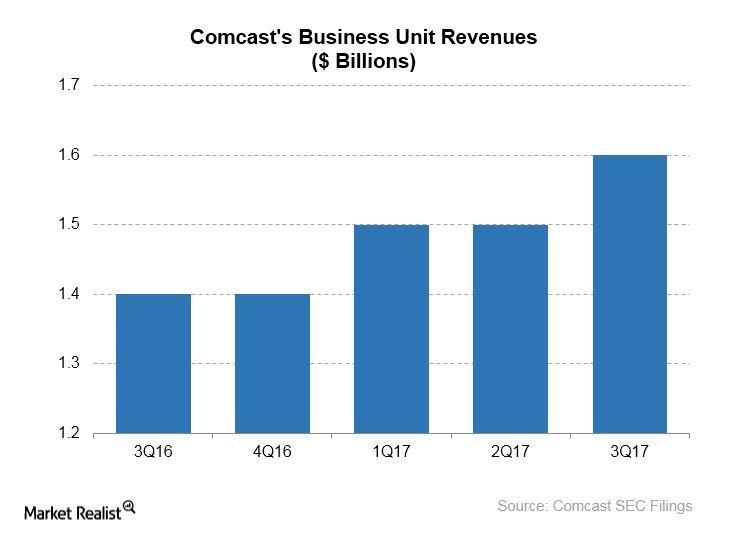

Comcast Moves To Boost Growth In Business Unit

In 3Q17, Comcast’s Business Services segment generated revenues of $1.6 billion, which rose 12.6% year-over-year.

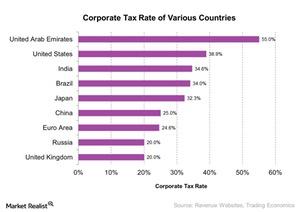

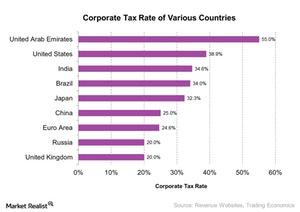

Why Buffett Believes US Businesses Aren’t Really Hurting from the US Corporate Tax

The US economy has been improving gradually, but some businesses in the US have suffered a lot over the years.

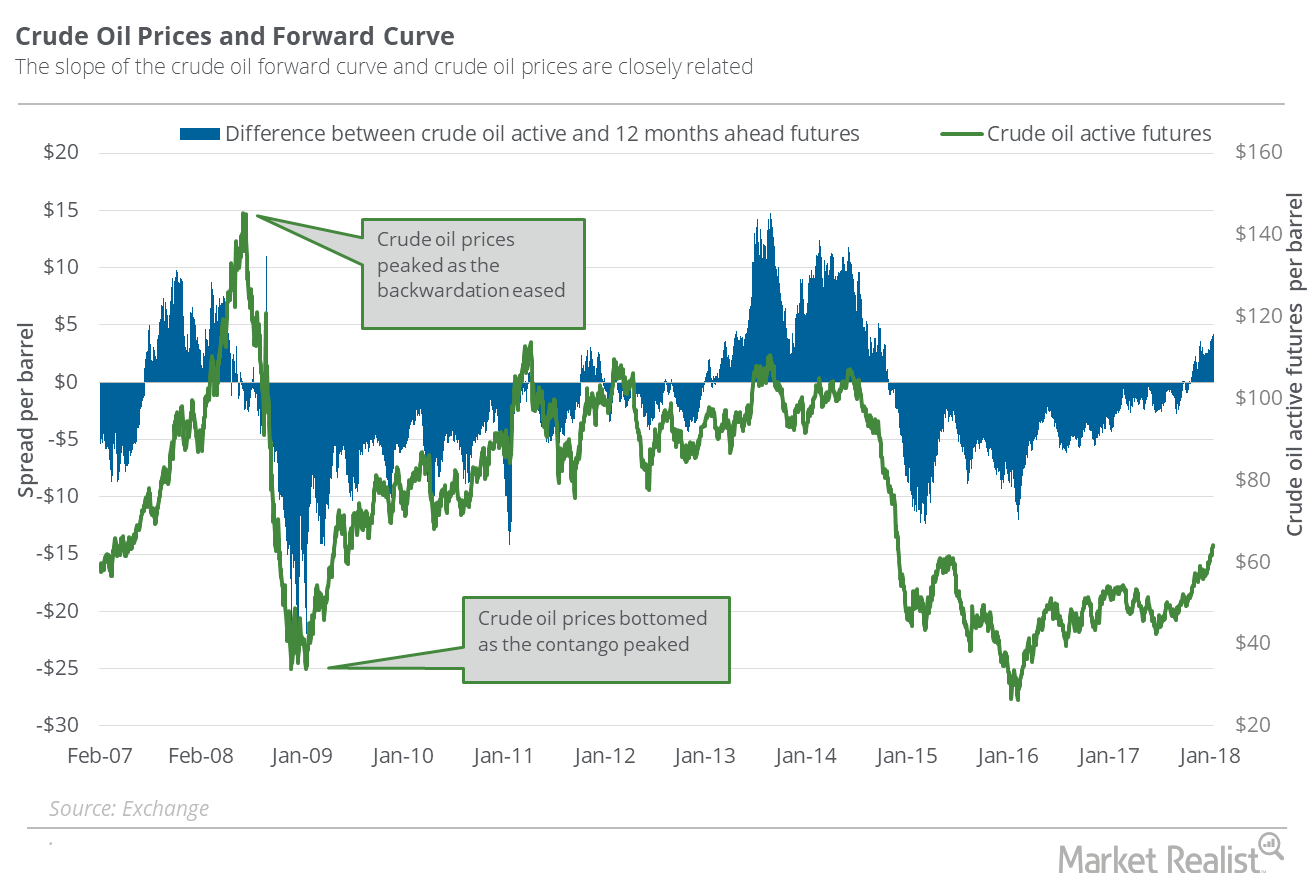

Backwardation: What It Could Mean for Crude Oil Prices

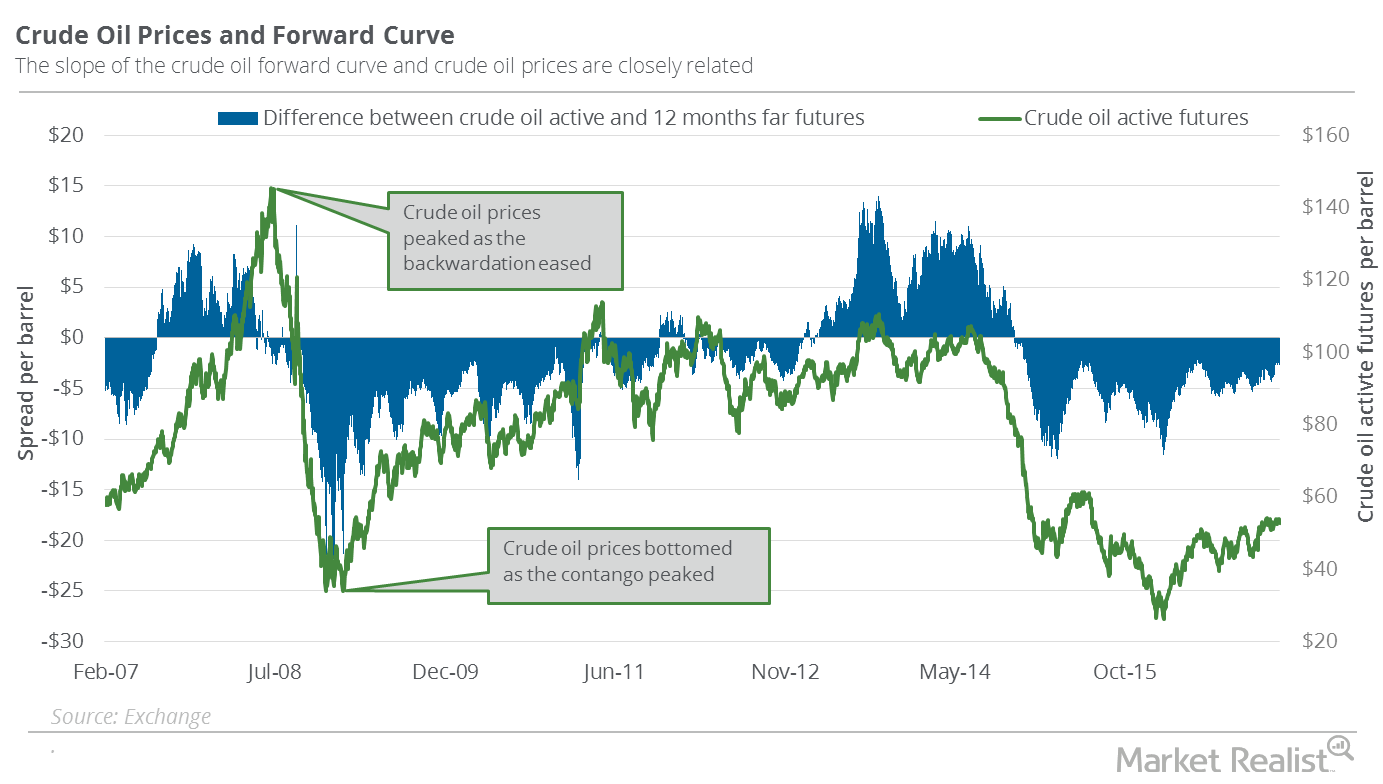

When the crude oil futures forward curve to slopes downwards, the situation in the crude oil futures market is called “backwardation.”

Why Oil Prices Could Increase More

On January 22, 2018, US crude oil active futures were 3.1%, 7.8%, 15.8%, and 23.7% above their 20-day, 50-day, 100-day, and 200-day moving averages.

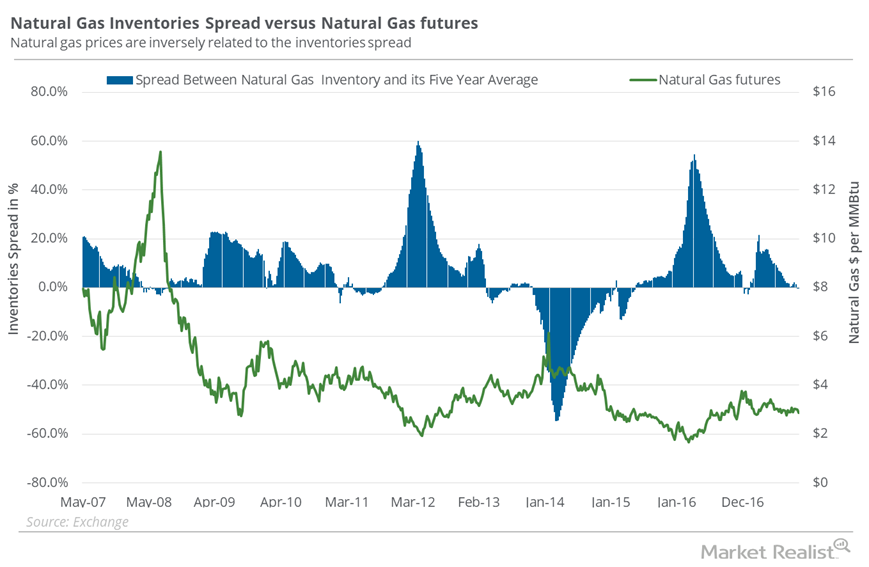

How the Inventory Spread Could Boost Natural Gas Prices

In the week ended October 6, natural gas inventories rose by 87 Bcf (billion cubic feet) to 3,595 Bcf—13 Bcf more than the market expected inventories to rise.

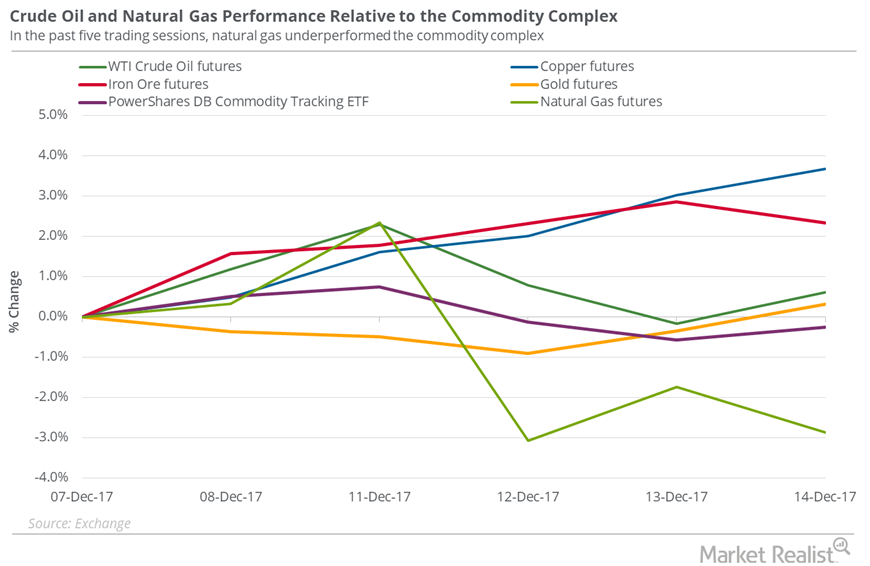

China’s Economic Data Might Drag Oil Prices

On December 14, China reported the November industrial output growth at 5.4% on a year-over-year basis—the lowest growth since early 2016.

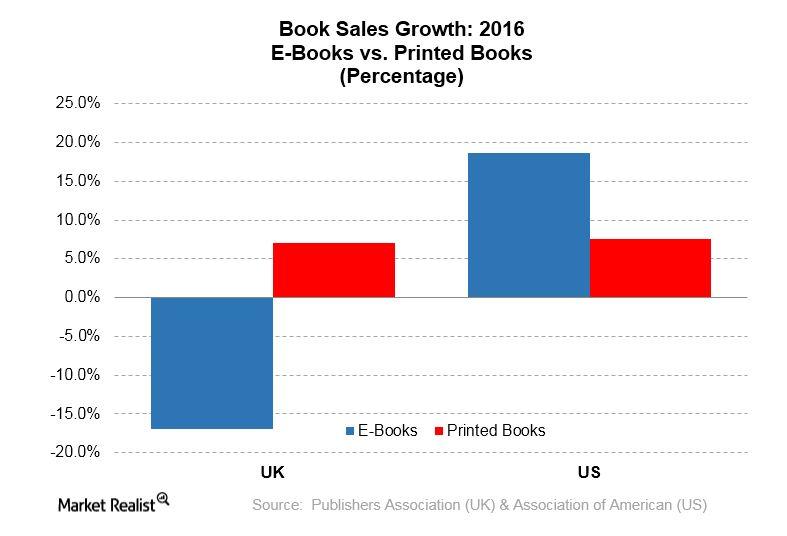

Why Is Amazon Opening Physical Bookstores?

According to PricewaterhouseCoopers, the global book market could grow to $121.1 billion by 2020, up from $114.8 billion in 2016.

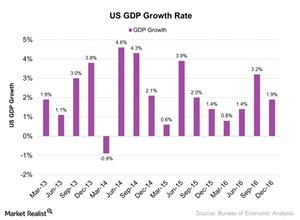

What Does Jack Bogle Predict for US Real GDP?

In 4Q16, US (SPY) (QQQ) (IVV) (VFINX) real GDP grew at an annual rate of 1.9% compared to a 3.5% rise in 3Q16.

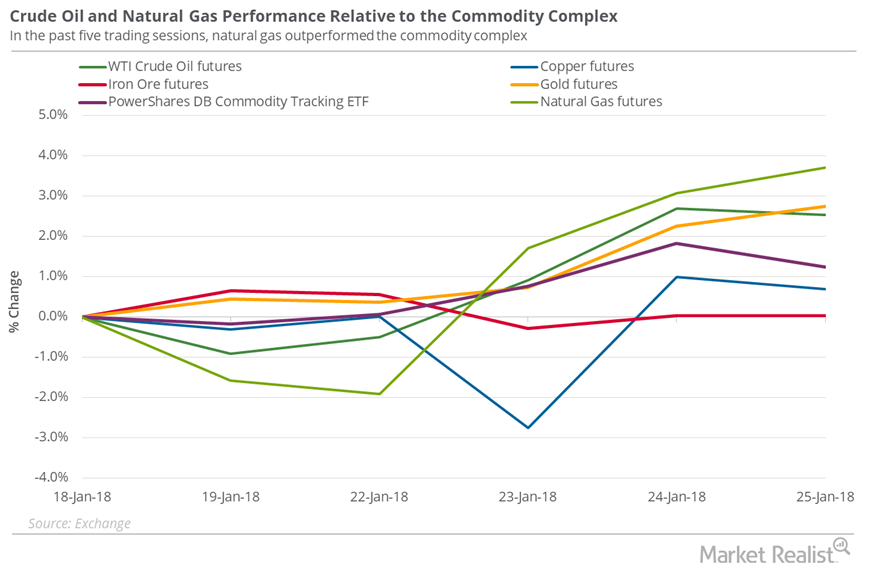

Natural Gas Prices: What Could Happen on January 24?

On January 24, at 5:39 AM EST, natural gas prices have risen 1.7% from the last closing level.

Why Oil Prices Could Lose Momentum

On January 25, 2018, US crude oil’s (USO) (USL) March 2018 futures fell 0.2% and settled at $65.51 per barrel.

What Are Schlumberger’s SPM Project Plans?

In the past one year, SLB has performed nearly in line with the industry ETF and has hugely underperformed the broader market index.

Why Is the Risk in Oil Prices Rising?

On December 5, 2017, US crude oil (USO) (USL) January 2018 futures rose 0.3%. The API’s oil inventory data might have supported oil prices on the same day.

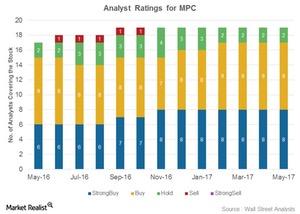

Why Most Analysts Are Calling Marathon Petroleum a ‘Buy’

Marathon Petroleum (MPC) has been rated by 19 Wall Street analysts. Seventeen analysts (or 89%) have rated it as a “buy” so far in May 2017.

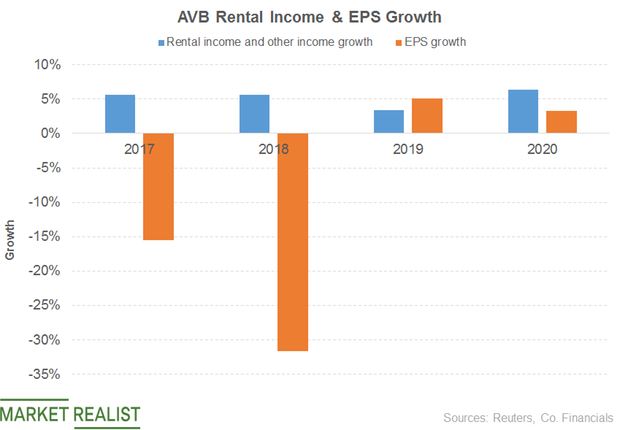

AvalonBay: What’s Driving the Dividend and Valuations?

AvalonBay’s revenue grew 7% in the first quarter, driven by rental and other income.

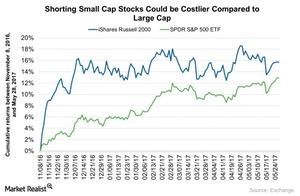

Will George Soros’s Position in IWM Provide a Strong Return?

According to the recent 13F filings, Soros Fund Management has increased its position in the iShares Russell 2000 ETF (IWM) by 36% in 1Q17 compared to the previous quarter.

Is IBM Plotting to Put PayPal Out of Business?

IBM (IBM) announced in February 2017 that it was teaming up with Visa (V) to enable people to pay for goods and services through virtually any connected device.

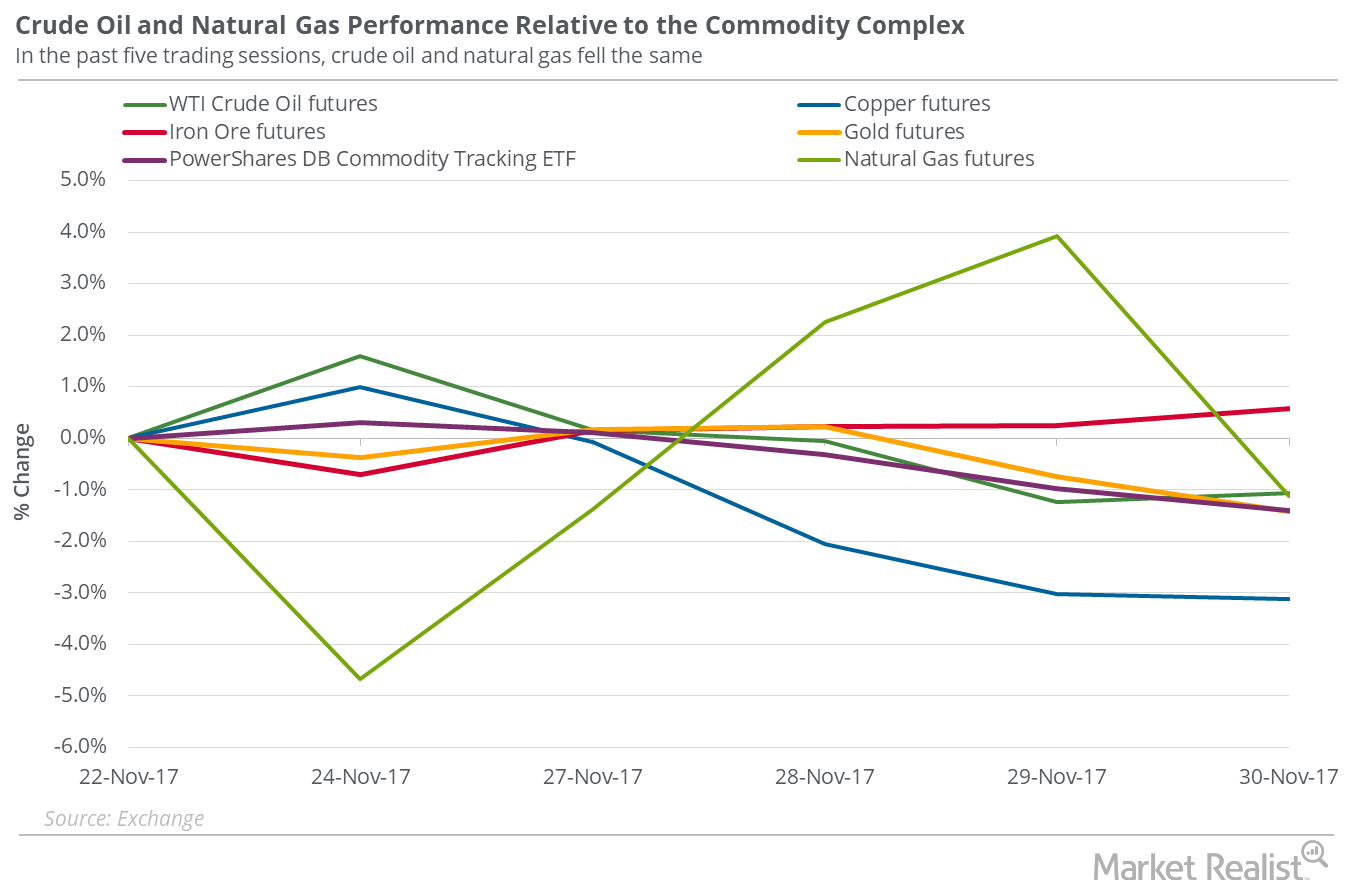

Why Oil Traders Should Stay Cautious after OPEC Meeting

On November 30, 2017, US crude oil (USO) (USL) active futures rose just 0.2% and closed at $57.4 per barrel.

Will Non-OPEC Oil Supply Dominate Oil Prices in 2018?

On December 14, 2017, US crude oil (USO) (USL) January 2018 futures rose 0.8% and closed at $57.04 per barrel.

Oil Market Could Be Pricing in a Supply Deficit

The rise in the premium, along with the rise in oil prices in the trailing week, could mean that the market expects a supply deficit in the oil market.

Why Inventory Data Might Boost Oil Prices

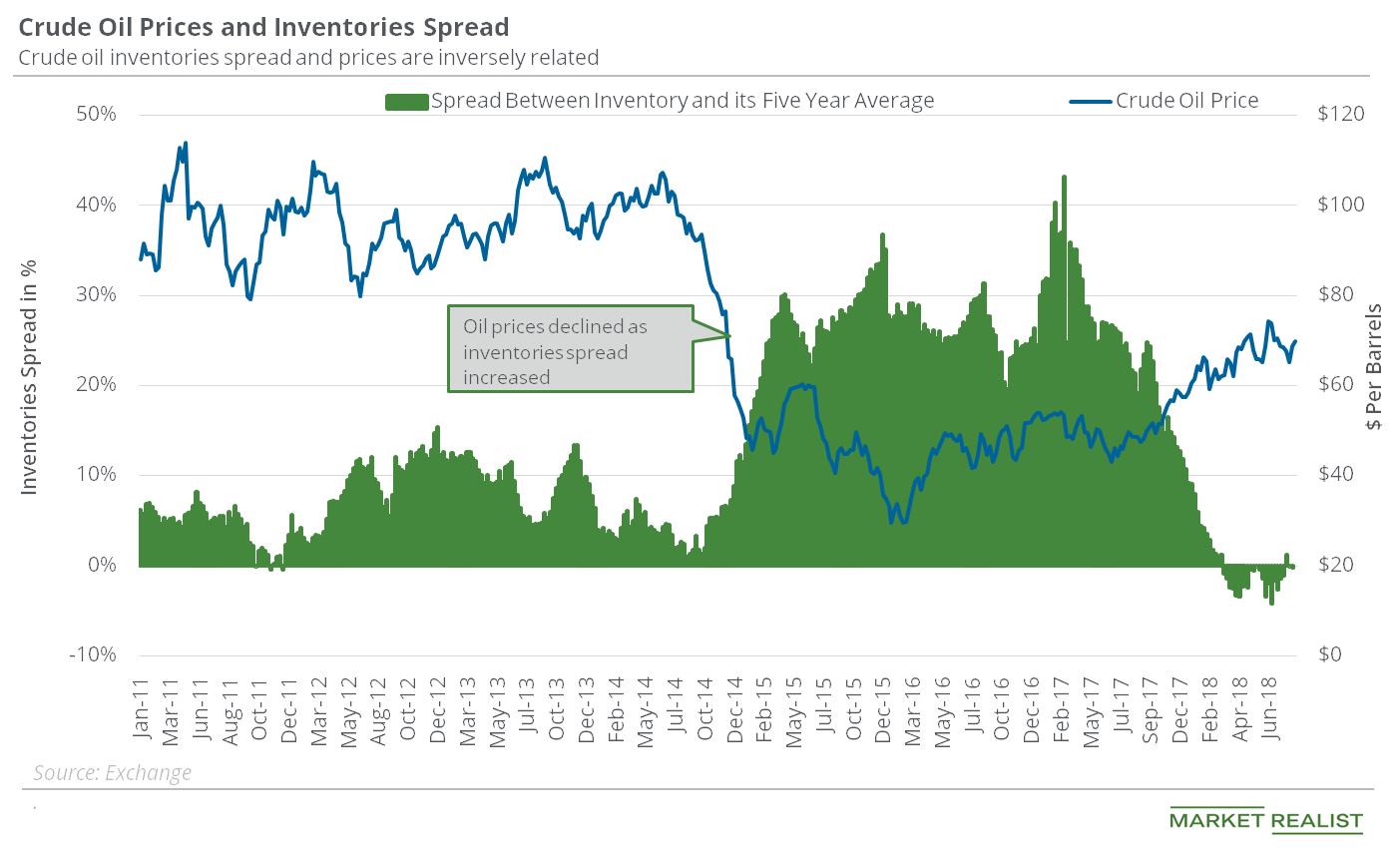

In the week ended August 31, 2018, US crude oil inventories were almost on par with their five-year average.

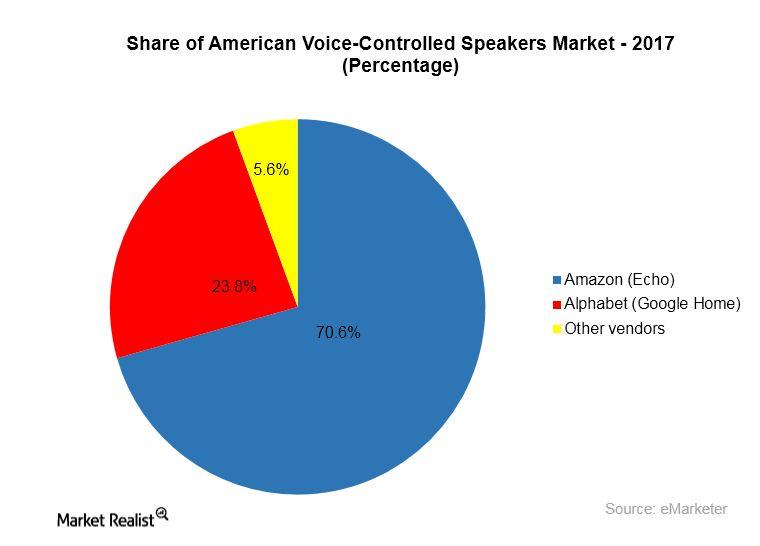

Understanding the Economic Sense behind Amazon’s Echo Show

Amazon (AMZN) has a brand new Echo smart speaker called Echo Show. Including Echo Show, there are now five variants of Echo-branded products.

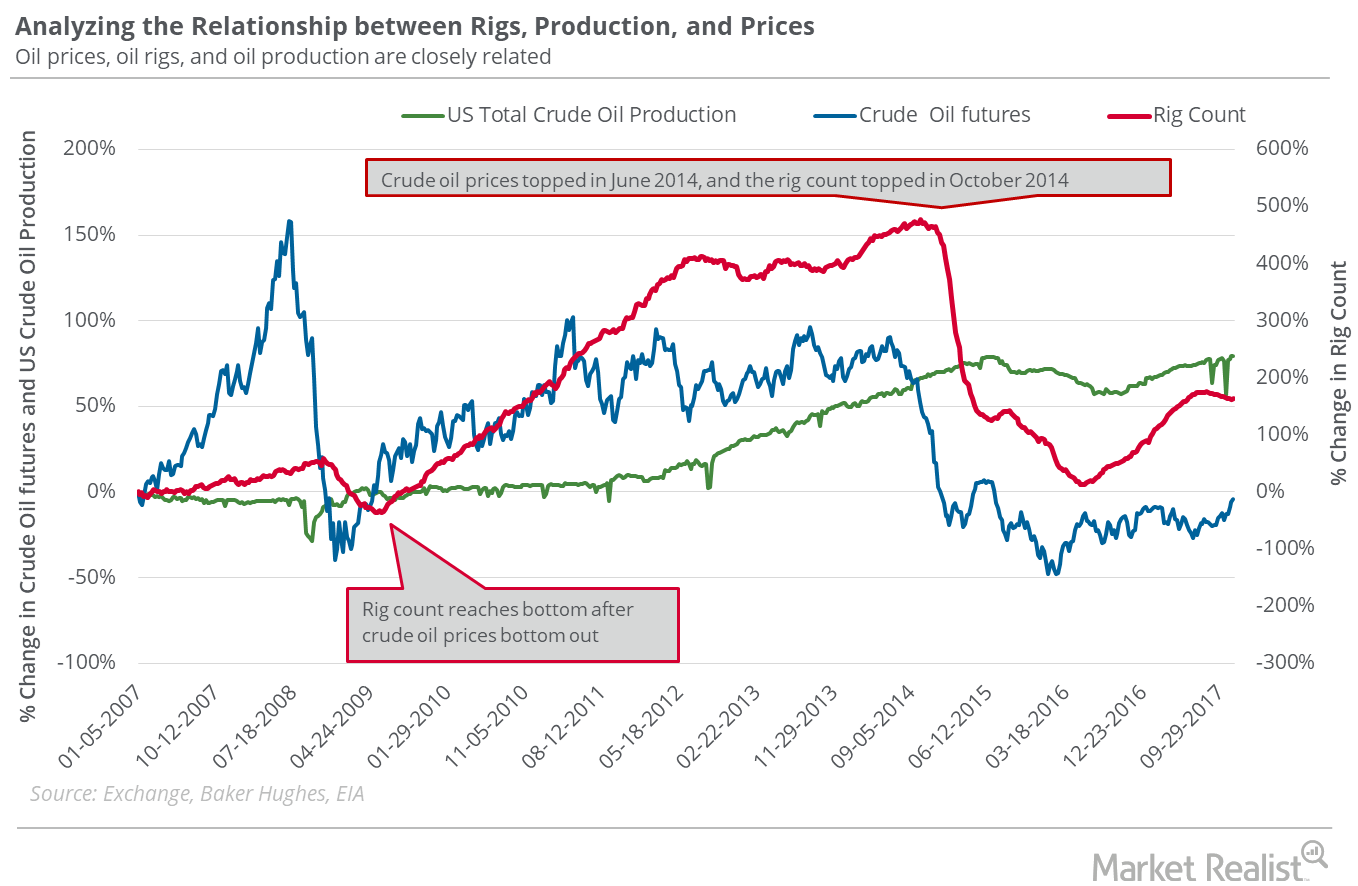

Bullish Oil Traders Must Count the Oil Rigs

On November 24, 2017, US crude oil settled at the highest closing price in 2017. The oil rig count could be at a three-year high by May 2018.

Is It Worth Risking Long Trades in Oil?

On November 24–December 1, 2017, US crude oil (USO) (USL) January futures fell 1%. On December 1, US crude oil January futures closed at $58.36 per barrel.

What’s Holding US Crude Oil below $60?

On December 11, US crude oil January 2018 futures rose 1.1%. The 2% rise in Brent crude oil prices could have supported the gain in US crude oil prices.

What to Watch when Oil’s at a 3-Year High

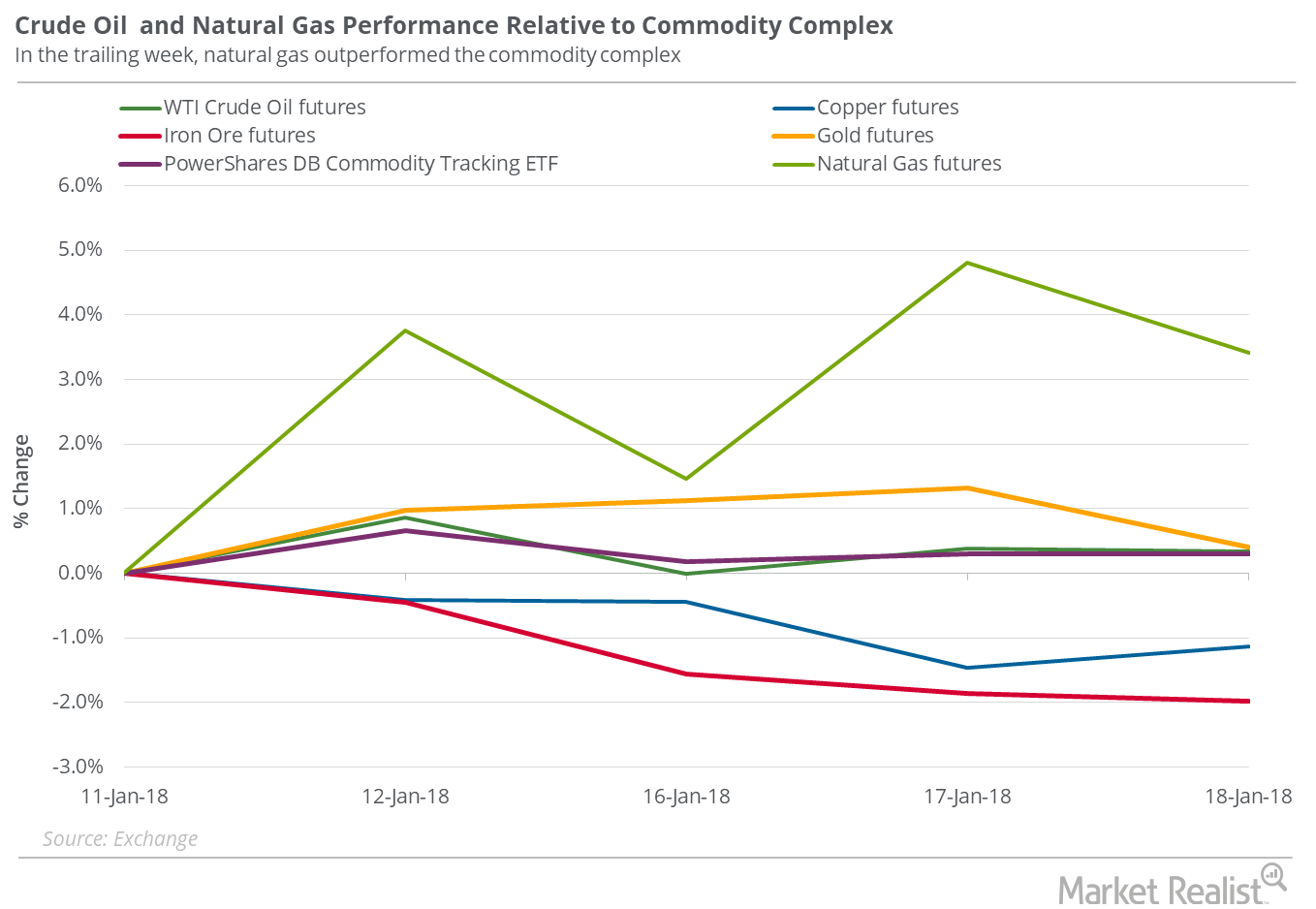

From January 5 to January 12, 2018, US crude oil February futures rose 4.7%. On January 12, US crude oil futures closed at $64.3 per barrel, their highest closing price since December 8, 2014.

Why Oil Prices Have Been Relatively Flat

On January 18, 2018, US crude oil (USO) (USL) March 2018 futures were almost unchanged at $63.89 per barrel.

Why Schlumberger’s Stock Price Is Bearish

In the past year, Schlumberger’s stock price rose until January 2017. Schlumberger’s revenue fell slowly in the four quarters leading up to 1Q17.

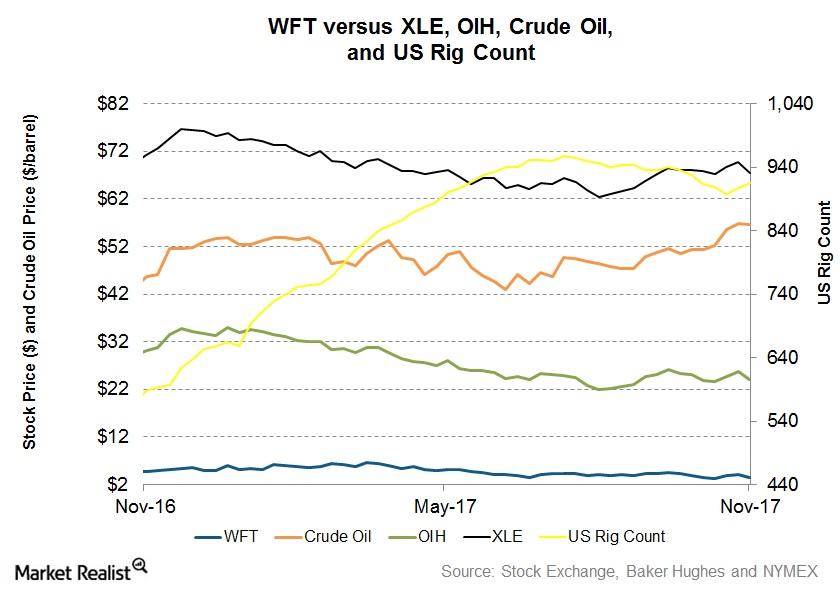

How Weatherford Stock Moved in the Week Ended November 17

Weatherford International (WFT) stock fell 16.0% in the week ended November 17, 2017. The VanEck Vectors Oil Services ETF (OIH) generated a return of -6.0% during this period.

Oil: Famous Recession Indicator Might Be a Concern

On January 2, US crude oil active futures settled at $46.54 per barrel—2.5% higher than the last closing level due to short covering.

Why Oil Prices Could Move Higher

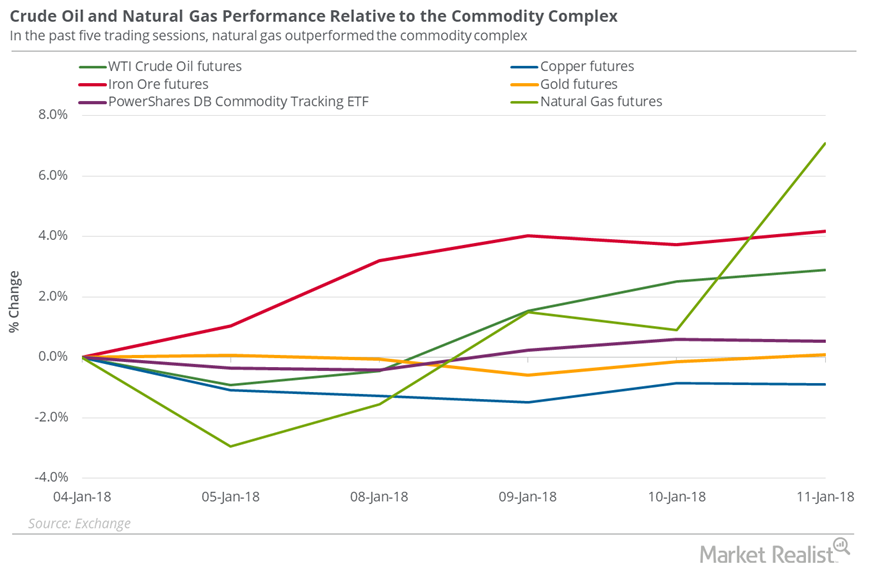

On January 12, 2018, US crude oil (USO) (USL) February 2018 futures gained 0.8% and settled at $64.3 per barrel—a three-year high.

Could La Niña Save Natural Gas Bulls?

On October 4, 2017, natural gas (UNG) November futures closed at $2.94 per MMBtu (million British thermal units), a rise of 1.6% from the last trading session.

Are Supply Concerns Pushing Oil Higher?

On January 11, 2018, US crude oil’s (USO) (USL) February 2018 futures gained 0.4% and settled at $63.80 per barrel, a new three-year high.

Is Oil Set to Make Record Highs in 2018?

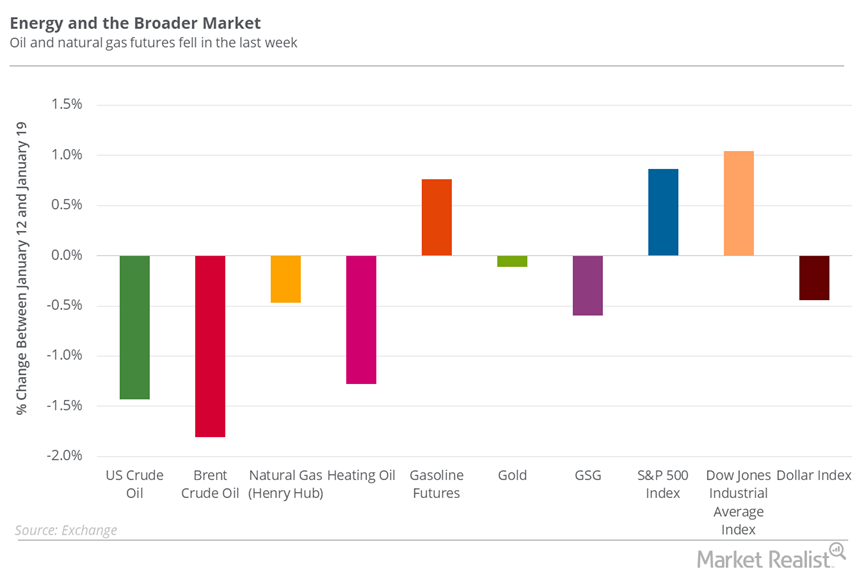

Between January 12 and January 19, 2018, US crude oil (USO) (USL) March futures fell 1.4%.

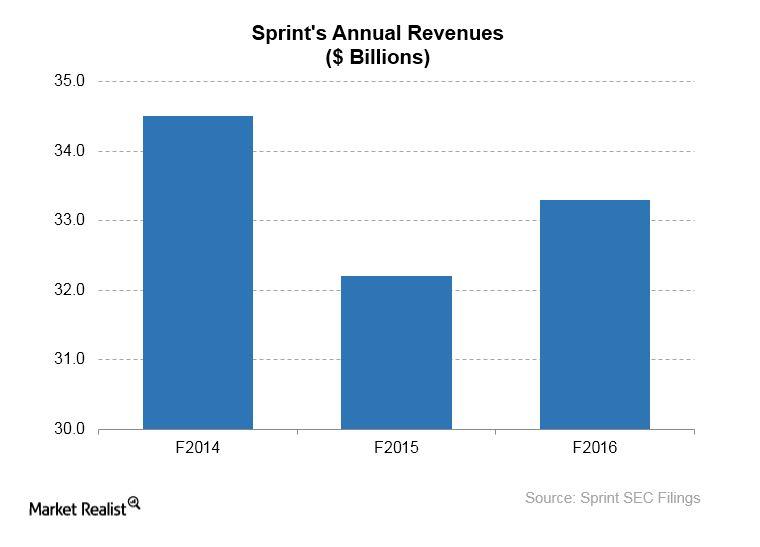

A Sprint Promotion Draws Analyst Attention

Verizon lost 289,000 postpaid customers in 1Q17, and AT&T shed 191,000 postpaid subscribers in the same quarter.

What Could Impact Oil Prices in 2018?

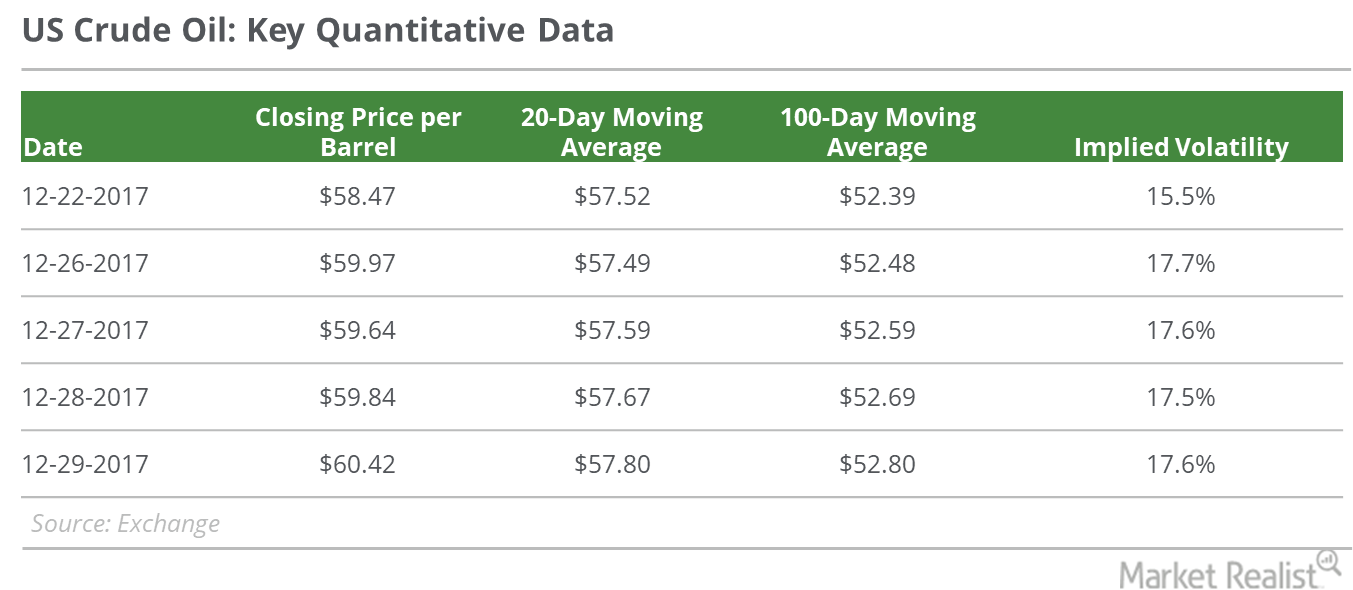

On December 29, 2017, US crude oil’s (USO) (USL) February 2018 futures rose 1% and closed at the 2017 highest closing price of $60.42 per barrel.

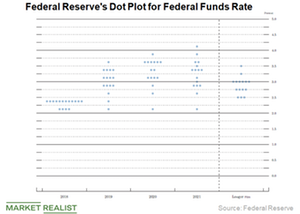

Is the Market Worried about an Overheating US Economy?

Federal Reserve Chair Jerome Powell’s speech did little to assuage investors’ concerns regarding the overheating of the US economy.

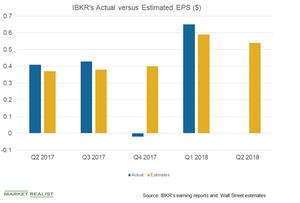

Brokerages in 2018: What to Expect

The final week of the second quarter might help brokerages, primarily because of higher client participation.

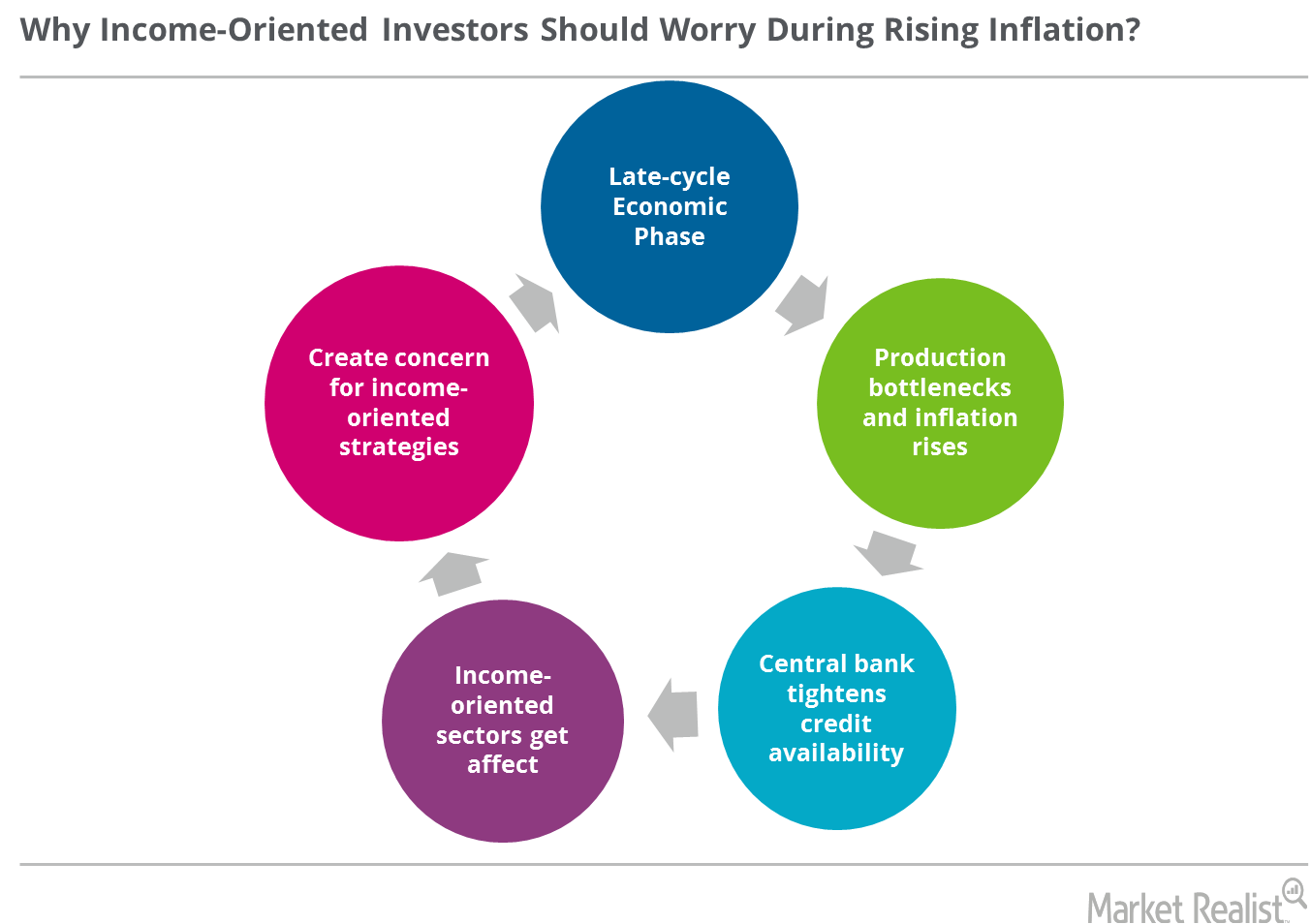

Bernstein: Income-Oriented Investors Should Worry about Inflation

In the late-cycle phase, production activity shows blockages, inflation shoots up, and the central bank tightens credit availability.

Inflation and Retail Sales: Their Effect on the Economy

In this series, we’ll analyze UK inflation and US inflation for January 2018. We’ll also analyze retail sales for that month.

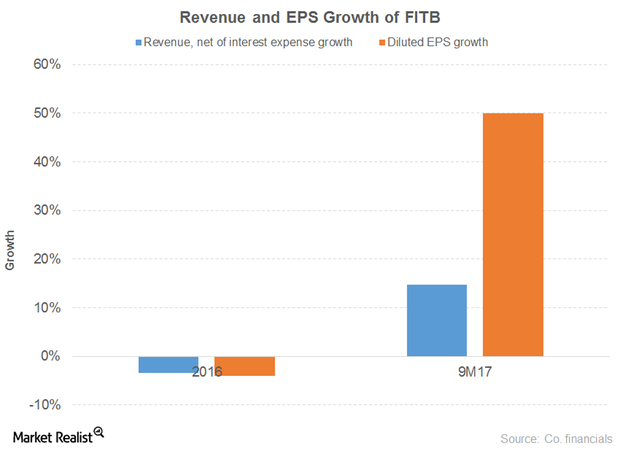

How Fifth Third Bancorp Has Performed Recently

Fifth Third Bancorp has an impressive free cash flow position.