Dow Jones Industrial Average (Dow 30)

Latest Dow Jones Industrial Average (Dow 30) News and Updates

A Look at Bank of America’s Key Growth Drivers

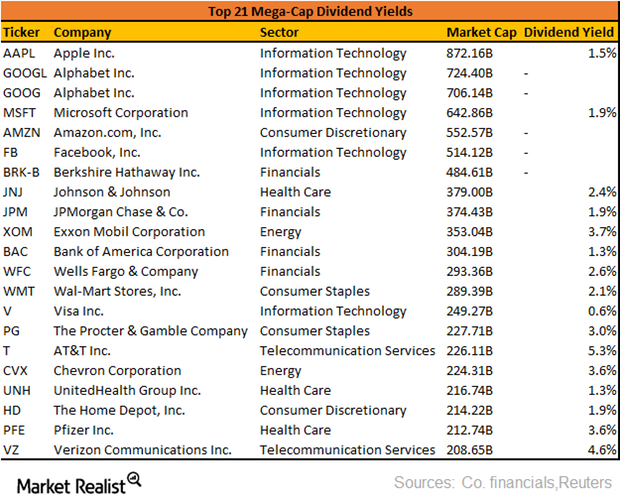

Bank of America’s dividend yield of 1.5% and PE of 20.6x compares to a sector average dividend yield of 2% and PE of 20.7x.

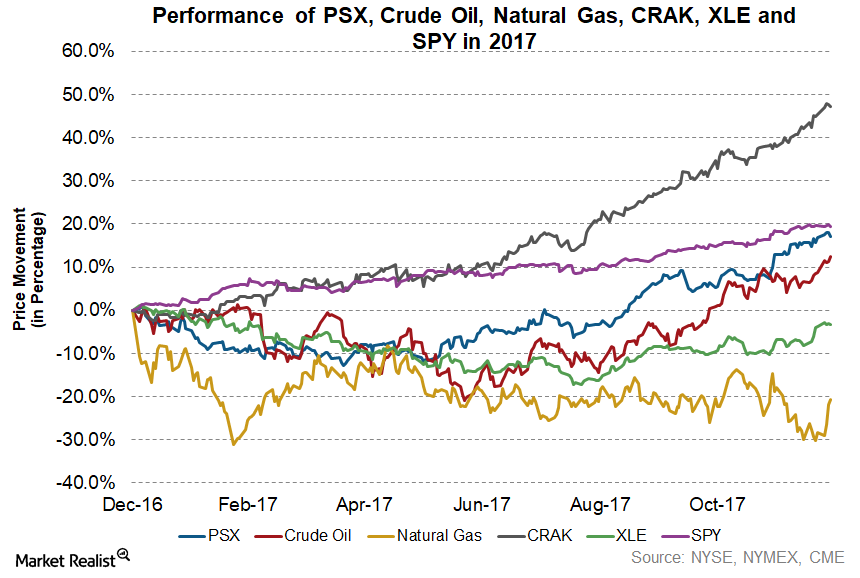

Phillips 66’s Strong Performance in 2017

In 2017, Phillips 66 (PSX) was the fifth-best-performing energy stock of the Energy Select Sector SPDR ETF (XLE).

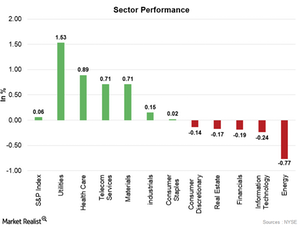

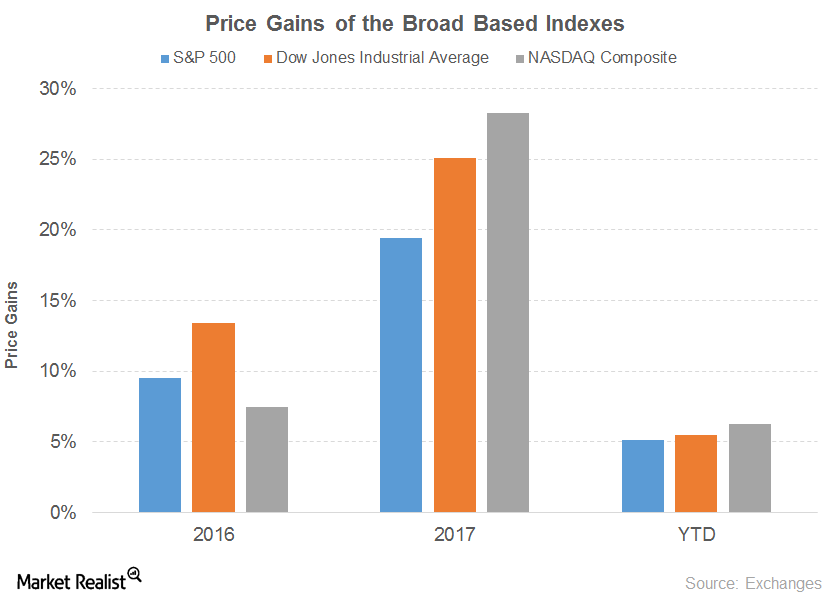

How Did the S&P 500, NASDAQ, and Dow Perform on January 25?

On January 25, six out of the S&P 500’s 11 major sectors moved higher. Strength in the utilities and health care sectors pushed the market higher.

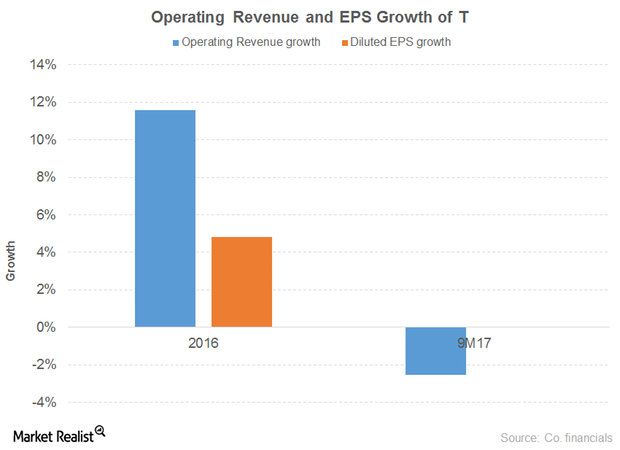

How AT&T Is Preparing for the Price War

AT&T’s cost of revenue rose 15% in 2016 before decreasing 1% in 9M17. That led to a 9% growth in gross profit for 2016 before falling 4% in 9M17.

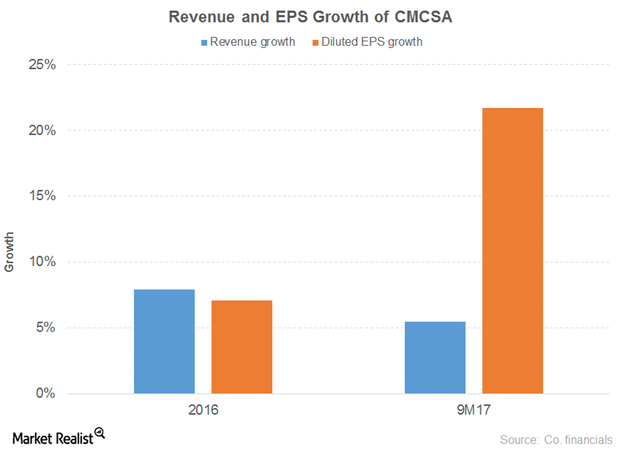

A Look at Comcast’s Strategy

Comcast’s (CMCSA) revenue grew 8% and 5% in 2016 and 9M17, respectively. The broadcast of the Rio Olympics in 3Q16 drove the 2016 numbers.

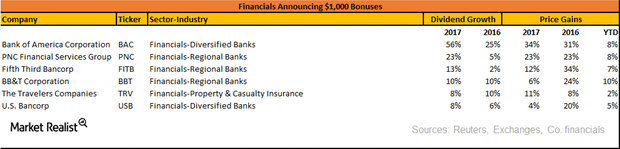

Which Stocks Have Announced $1,000 Bonuses?

In this series, we’ll be taking a look at the companies that have announced $1,000 dollar bonuses, pay raises, increased dividends, and buybacks in the last two months.

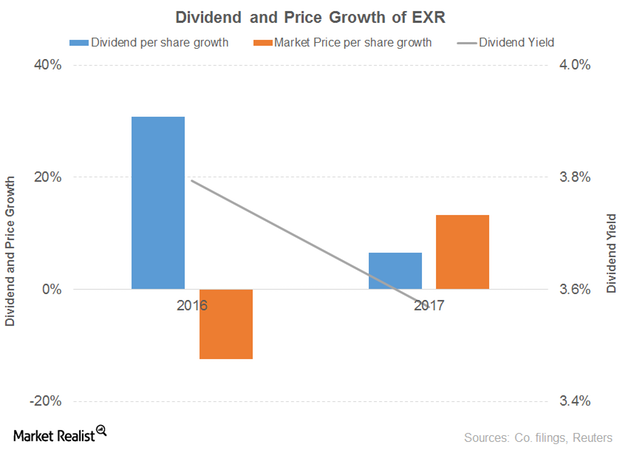

What’s the Outlook for Extra Space Storage?

Extra Space Storage’s (EXR) revenue grew 27% and 13% in 2016 and 9M17, respectively.

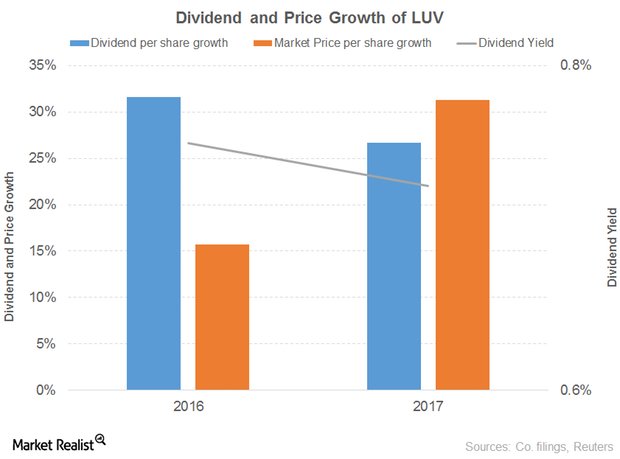

Here’s What Influenced the Outlook for Southwest Airlines

Southwest Airlines’ (LUV) operating revenue grew 3% and 4% in 2016 and 9M17, respectively.

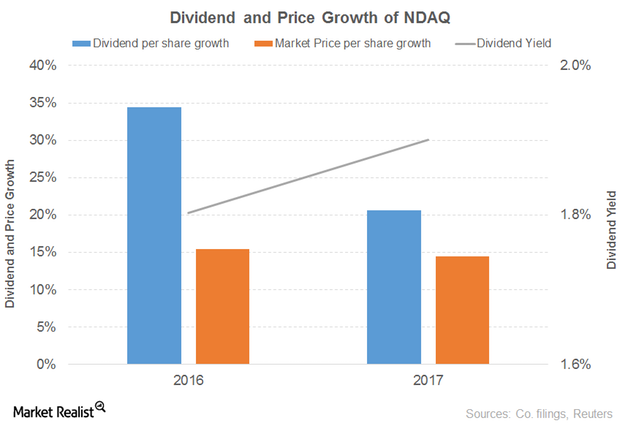

What’s behind the Outlook for Nasdaq?

Nasdaq (NDAQ) revenue rose 9% and 8% in 2016 and 9M17, respectively.

These Factors Are Contributing to Gilead Sciences’ Weak Outlook

Gilead Sciences’ (GILD) revenue fell 7% and 13% in 2016 and 9M17, respectively. The fall was due to lower product sales. Both antiviral products and other products recorded declines in both the periods.

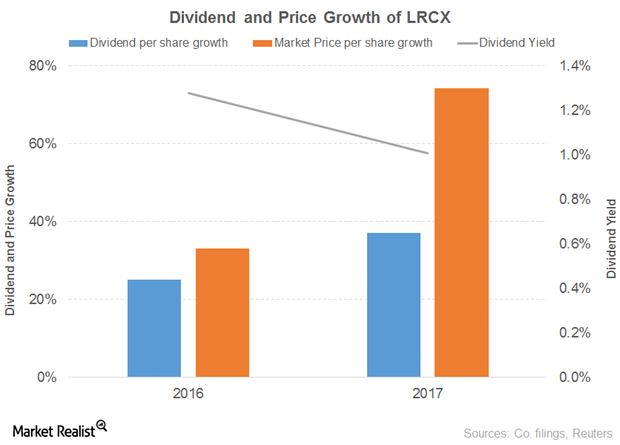

What’s Contributing to Promising Outlook for Lam Research?

Lam Research’s (LRCX) revenue rose 12% and 36% in 2016 and 2017, respectively. It rose 52% in 1Q18.

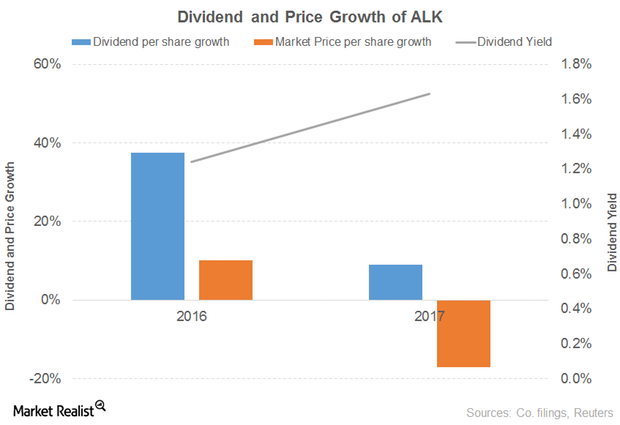

What’s the Outlook for Alaska Air Group?

Alaska Air Group’s (ALK) operating revenue rose 6% and 35% in 2016 and 9M17, respectively.

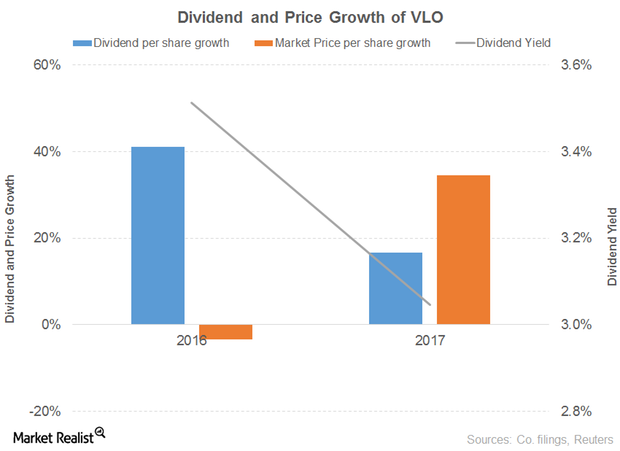

What Has Influenced the Outlook for Valero Energy?

Valero Energy’s operating revenue fell 14% in 2016 before rising 23% in 9M17. Refining revenues drove the decline in 2016, offset by ethanol revenues.

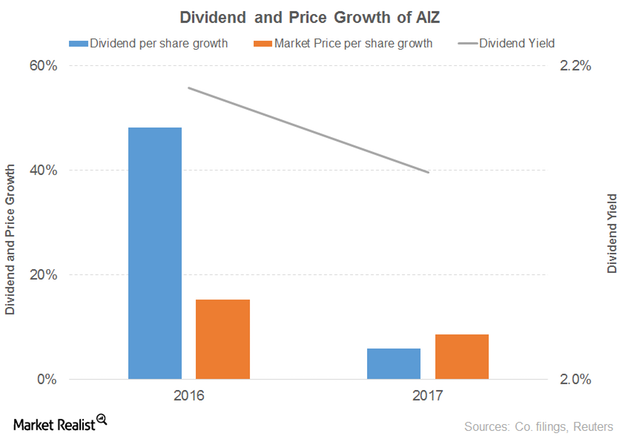

Why Assurant Has a Positive Outlook despite a Weak 2017

Assurant’s (AIZ) revenue fell 27% and 18% in 2016 and 9M17, respectively.

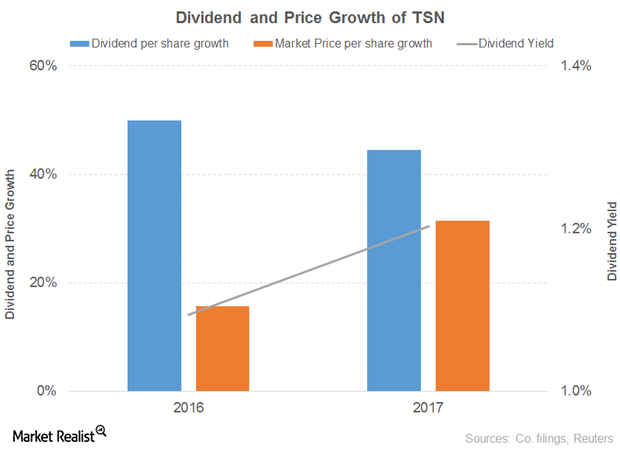

What’s the Outlook for Tyson?

Tyson Foods’ (TSN) sales dropped 11% in 2016 before gaining 4% in 2017.

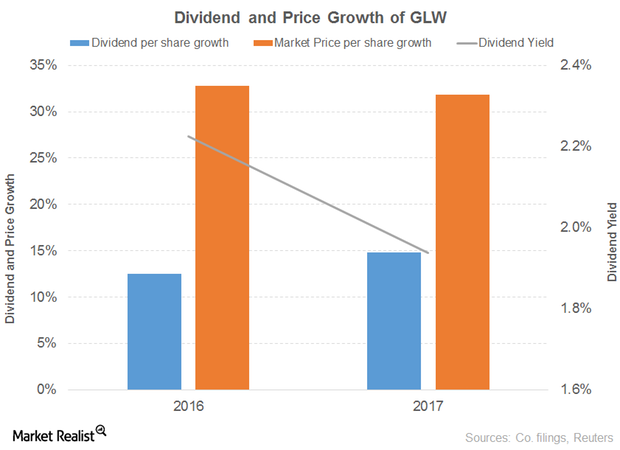

What Are Corning’s Key Growth Drivers?

Corning’s gross margin grew 3% and 9% in 2016 and 9M17, respectively.

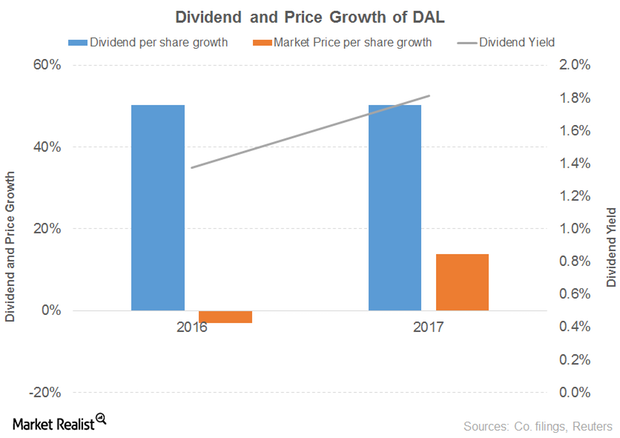

What to Expect from Delta Air Lines

Delta Air Lines’ (DAL) operating revenue fell 3% in 2016 before gaining 3% in 9M17 (or the first nine months of 2017).

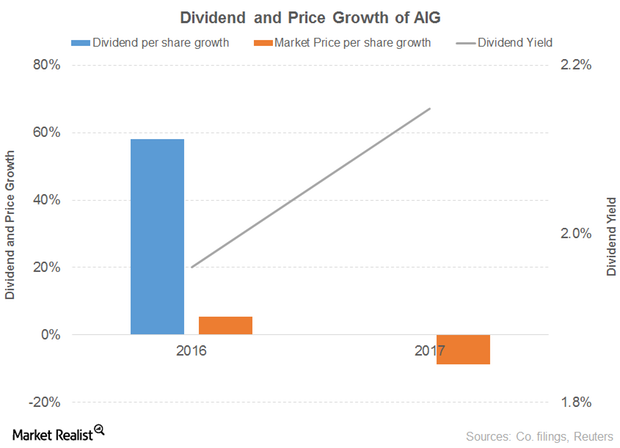

What’s the Outlook for American International Group?

American International Group’s dividend per share rose 58% in 2016 and was flat in 2017.

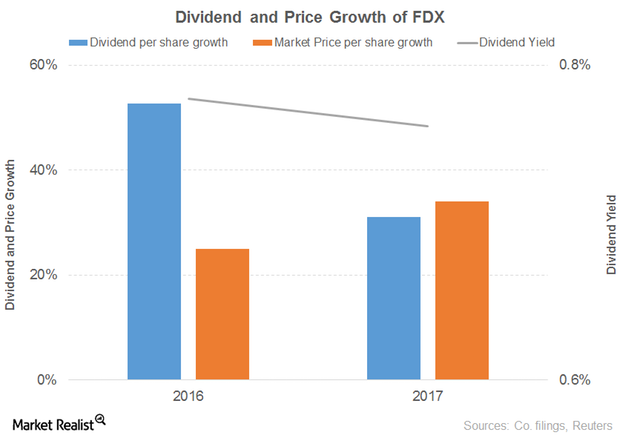

How FedEx’s Performance Influenced Its Outlook

FedEx’s (FDX) revenue grew 6% and 20% in 2016 and 2017, respectively. The FedEx Ground, FedEx Freight, and FedEx Services segments drove the 2016 growth, offset by the FedEx Express segment.

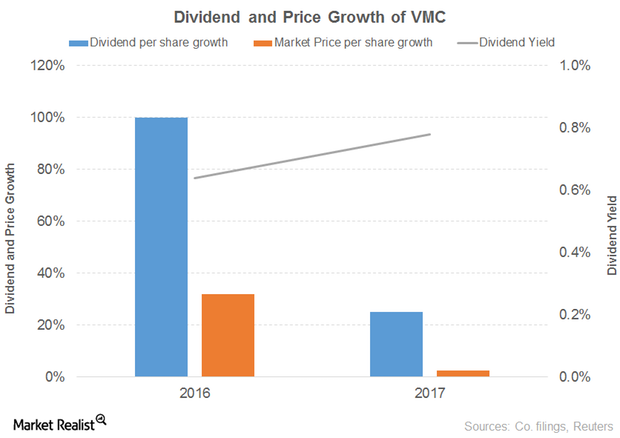

The Outlook for the Vulcan Materials Company

The Vulcan Materials Company’s (VMC) revenue grew 5% and 7% in 2016 and 9M17, respectively. Aggregates, concrete, and calcium drove the growth in 2016, offset by asphalt mix.

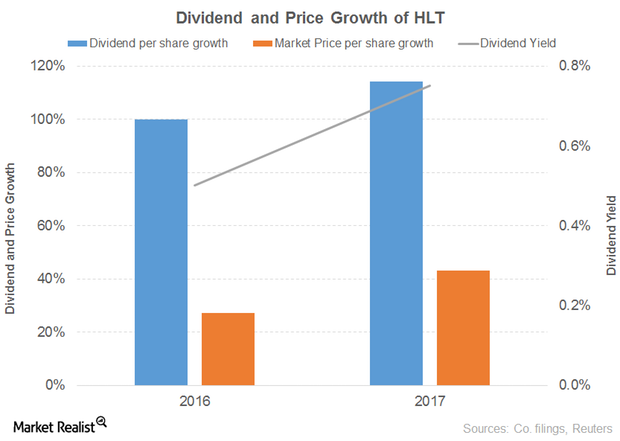

Hilton Worldwide Holdings Looks Promising despite a Tough 2017

Hilton Worldwide Holdings’ (HLT) revenue grew 3% in 2016. Management and franchise fees, timeshare, and other revenues from managed and franchised properties drove the growth in 2016, offset by owned and leased hotels.

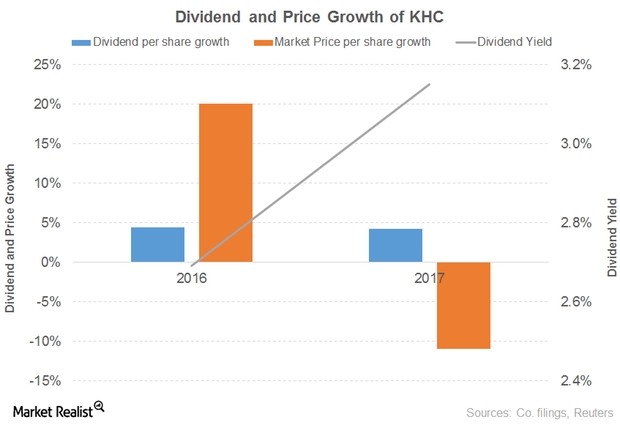

Why The Kraft Heinz Company’s Outlook Still Seems Promising

The Kraft Heinz Company’s (KHC) net sales grew 44% in 2016 before falling 1% in 9M17. Every product category drove the growth in 2016, offset by a decline in the infant and nutrition segments.

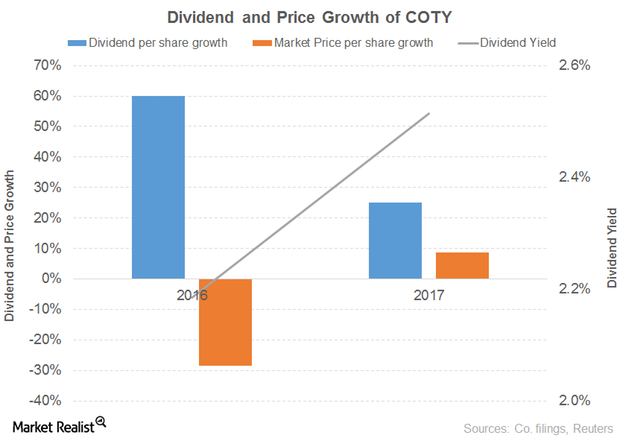

How Coty’s Performance Affected Its Outlook

Coty (COTY) net revenue fell 1% in 2016 before climbing 76% in 2017. The Consumer Beauty segment drove the growth in both years.

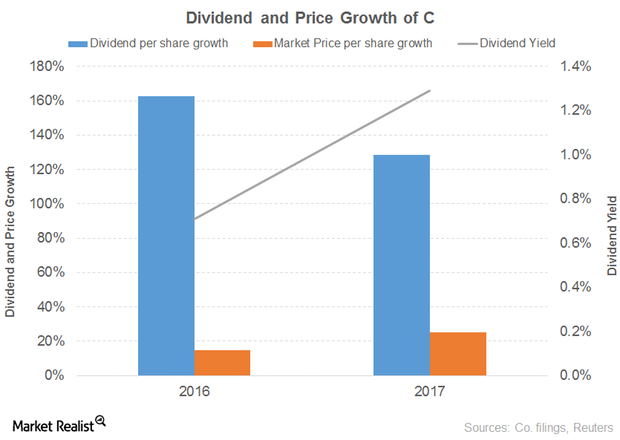

Why Citigroup’s Outlook Seems Promising

Citigroup is projected to grow its revenue 2% and 4% in 2017 and 2018, respectively. The 2017 and 2018 diluted EPS are projected to grow 12% and 14%, respectively.

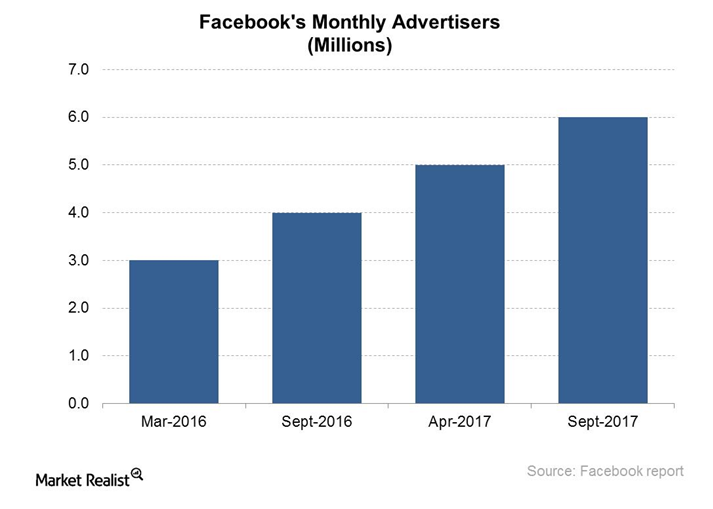

Facebook’s Innovation and Product Development Avalanche

In 3Q17, Facebook (FB) spent roughly $2.1 billion on product development, compared with ~$1.9 billion in 2Q17 and ~$1.5 billion in 3Q16.

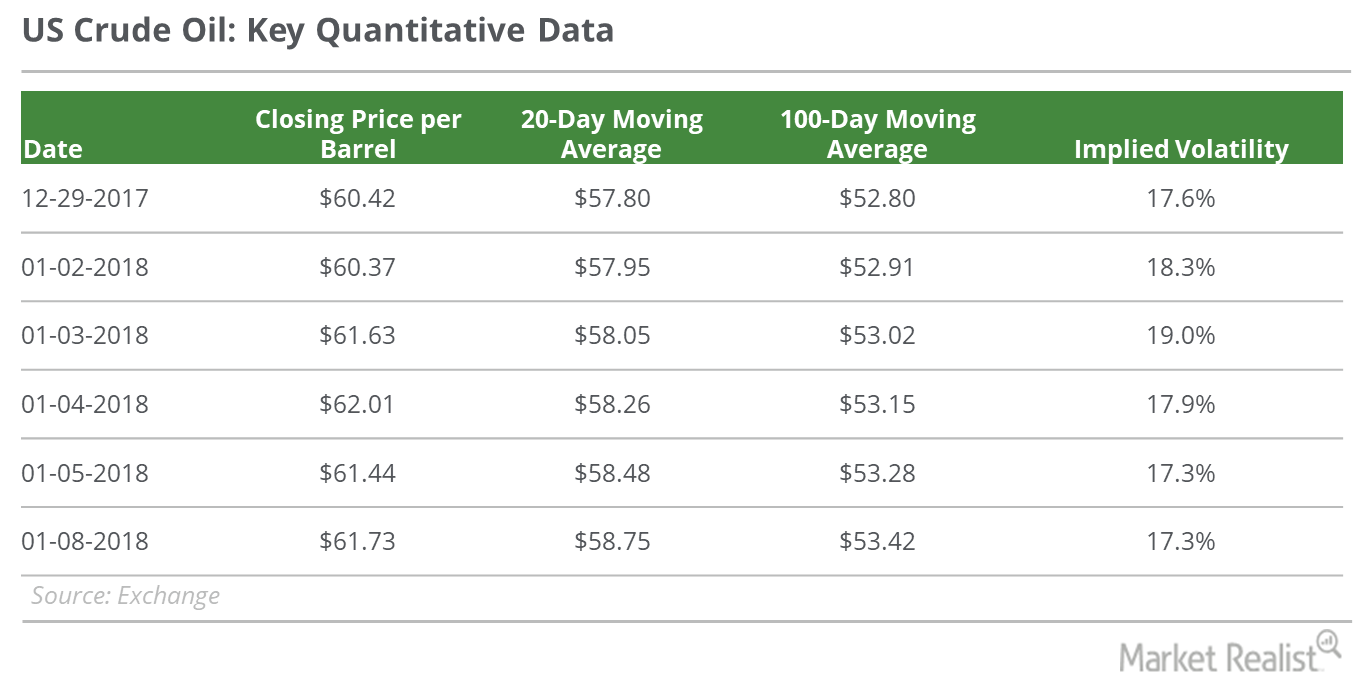

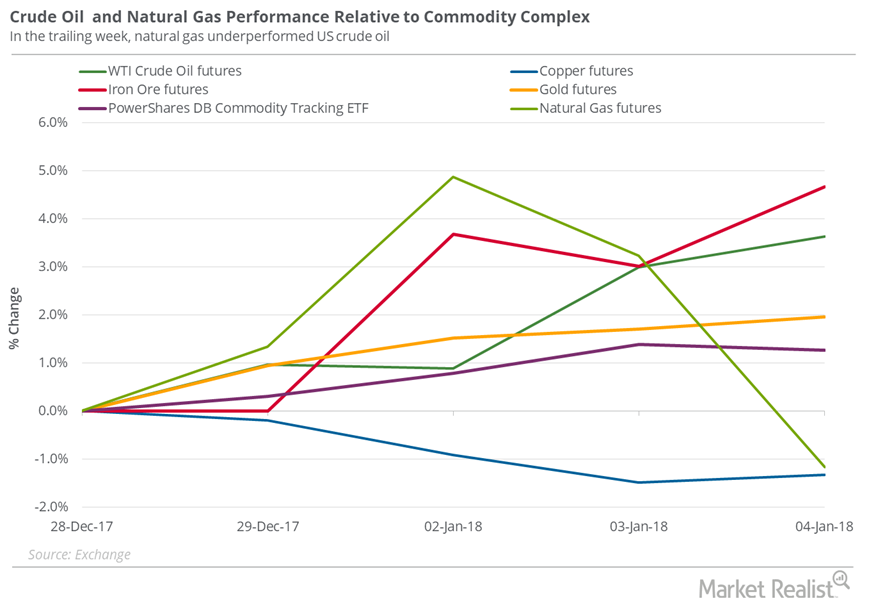

Will US Crude Oil Prices Make a New 3-Year High?

On January 8, 2018, US crude oil (USO) (USL) February 2018 futures rose 0.5% and closed at $61.73 per barrel—0.5% below the three-year high.

Why Oil Reached a 3-Year High

On January 4, 2018, US crude oil (USO) (USL) February 2018 futures rose 0.6% and closed at $62.01 per barrel—a three-year high.

US Crude Oil Closed at 2017 High: Will the Ride Continue?

On December 22–29, US crude oil (USO) (USL) February futures rose 3.3%. On December 29, US crude oil February 2018 futures closed at $60.42 per barrel.

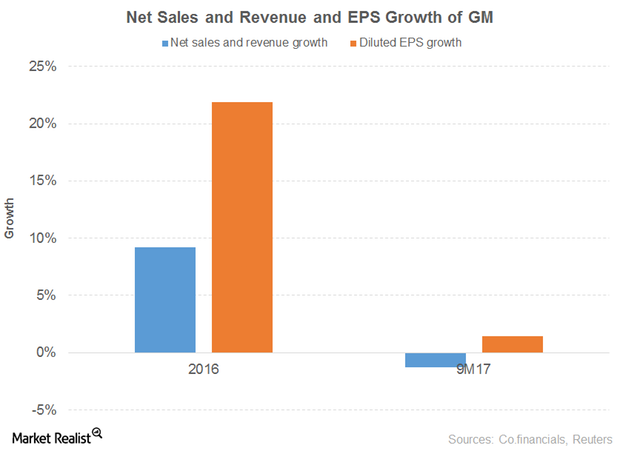

A Look at GM’s Stock Performance

In this part of our focus on the top 18 cheap S&P 500 stocks, we’ll discuss another six stocks: General Motors (GM), Ford Motor (F), Owens-Illinois (OI), The Goodyear Tire & Rubber Company (GT), Navient (NAVI), and Brighthouse Financial (BHF).

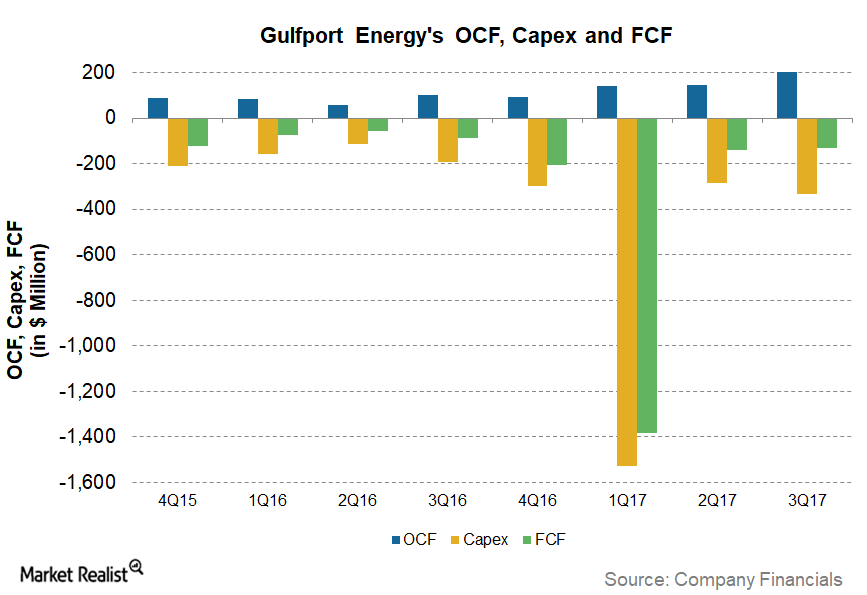

Is Gulfport Energy’s Normalized Free Cash Flow Trending Up?

For 9M17 (the first nine months of 2017), Gulfport Energy (GPOR) had normalized FCF (free cash flow) of -336%, the fourth lowest among the upstream producers we have been tracking.

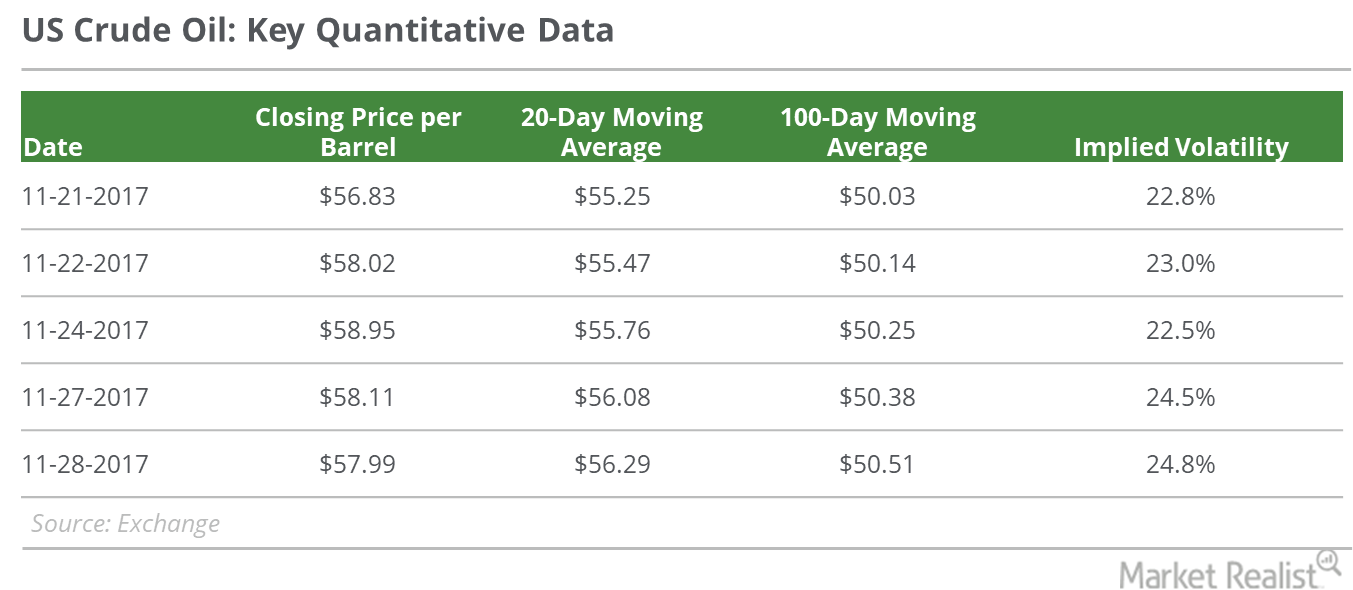

Can US Crude Oil Break Below $57 Next Week?

On December 14, 2017, the implied volatility of US crude oil futures was 18.1%. It was 14.8% below its 15-day average.

What Are the Dividend Yields of the Top 10 Mega-Cap Stocks?

Donald Trump’s promises of financial deregulation, infrastructure spending, and tax cuts played a major role in the stock market rally this year.

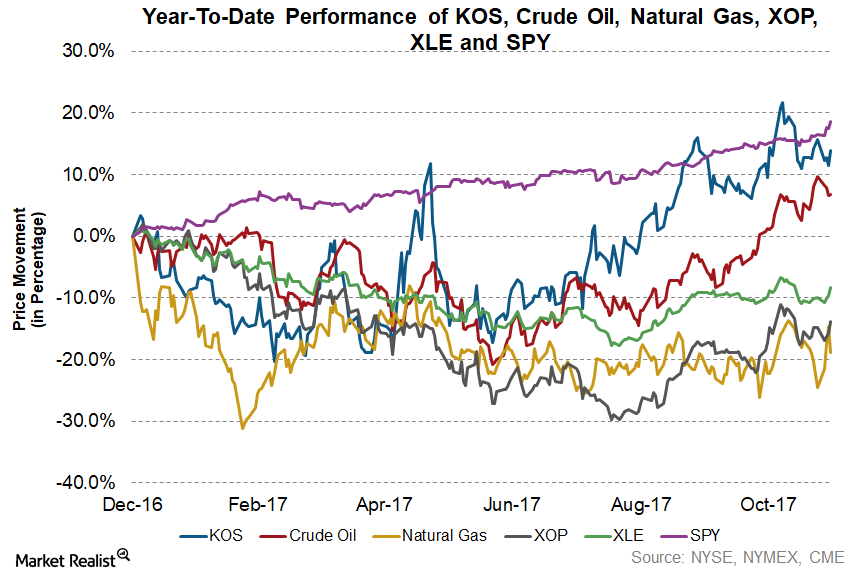

The Fourth-Best-Performing Upstream Stock Year-to-Date

In 9M17, KOS’s production increased ~107.0% to ~7.8 million barrels when compared with 9M16.

Is Oil’s Rise Coming to a Halt?

On November 28, 2017, US crude oil (USO) (USL) active futures fell 0.2% and closed at $57.99 per barrel. All eyes are on the outcome of OPEC’s meeting.

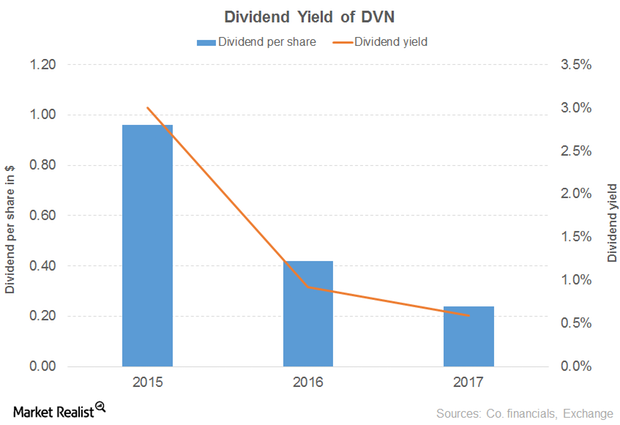

How Did DVN’s Dividend Cut Affect Its Dividend Yield?

Devon Energy Corporation’s 56.0% dividend cut in 2016 was followed by a 43.0% cut in 2017.

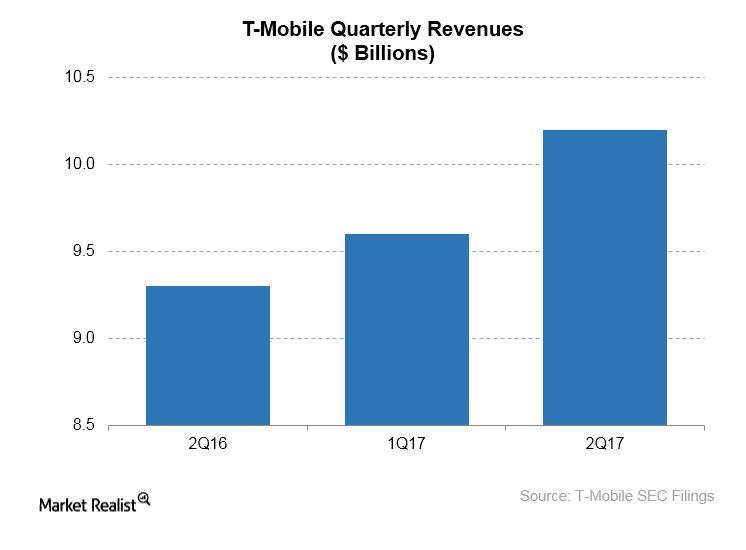

T-Mobile Disrupts an Already Chaotic Scene

T-Mobile puts a twist to unlimited data T-Mobile (TMUS) won’t allow rival wireless network operators any peace. T-Mobile, and to some extent Sprint (S), prompted market leaders AT&T (T) and Verizon (VZ) to bring back unlimited data plans after years of outage. Unlimited data plans hadn’t made much economic sense to them. On September 19, T-Mobile struck again, […]

The Smell of Natural Gas: Ripe for a Pullback?

On October 18, natural gas November futures closed at $2.85 per MMBtu (million British thermal units)—3.6% below the last trading session’s closing price.

Is Natural Gas a Good Short for Bears at $3?

On September 13, natural gas October futures closed at $3.058 per MMBtu (million British thermal units). The same day, natural gas prices rose 1.9%.

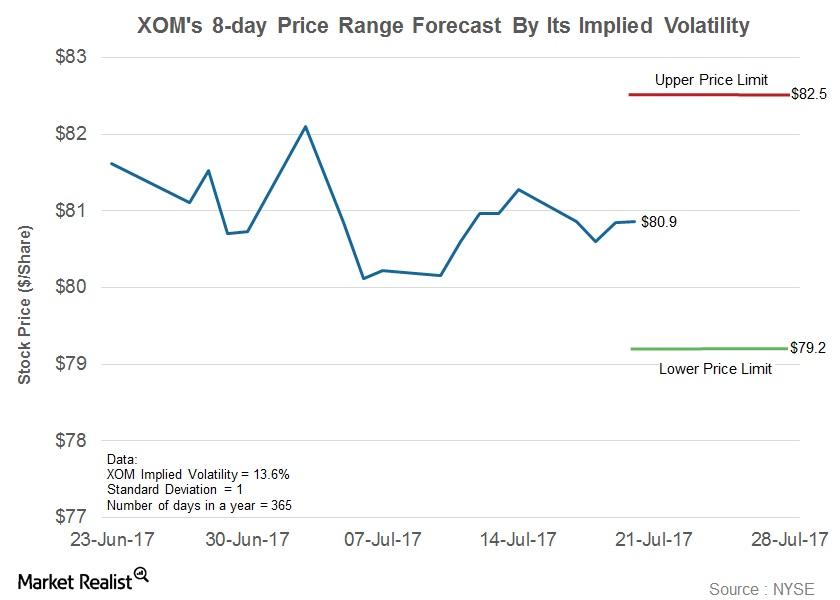

What’s the Forecast for ExxonMobil’s Stock Price?

Implied volatility in ExxonMobil has fallen from 14.9% on April 3, 2017, to 13.6% to date.

What’s Square’s Mission?

With Apple (AAPL) announcing its entry in the peer-to-peer payment market and PayPal (PYPL) stepping up its pursuit of merchant customers, it seems that the competition could suffocate Square (SQ).

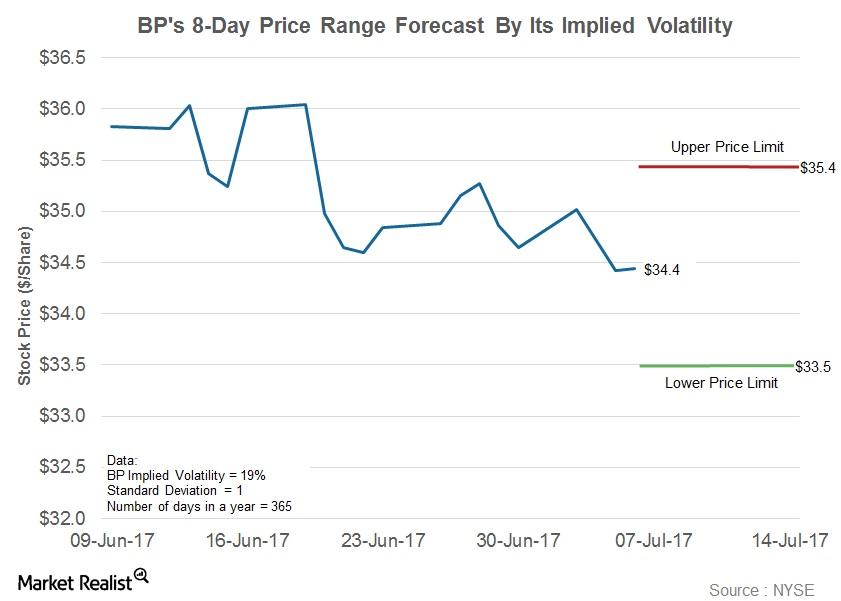

Estimating BP’s Stock Price Using Implied Volatility

What is implied volatility? Volatility gauges changes in a stock’s return over a period. When estimated based on historical stock prices, it is called historical volatility. We can estimate the future volatility, or implied volatility, of security using an option pricing model. A high implied volatility would indicate that a stock price is expected to move […]

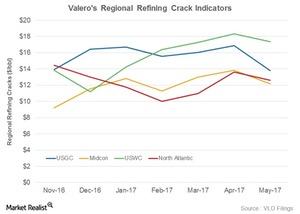

What Valero Needs to Soar in 2Q17

Valero’s crack indicators have fallen in all of these areas in May 2017 (as of May 23) as compared to April 2017.

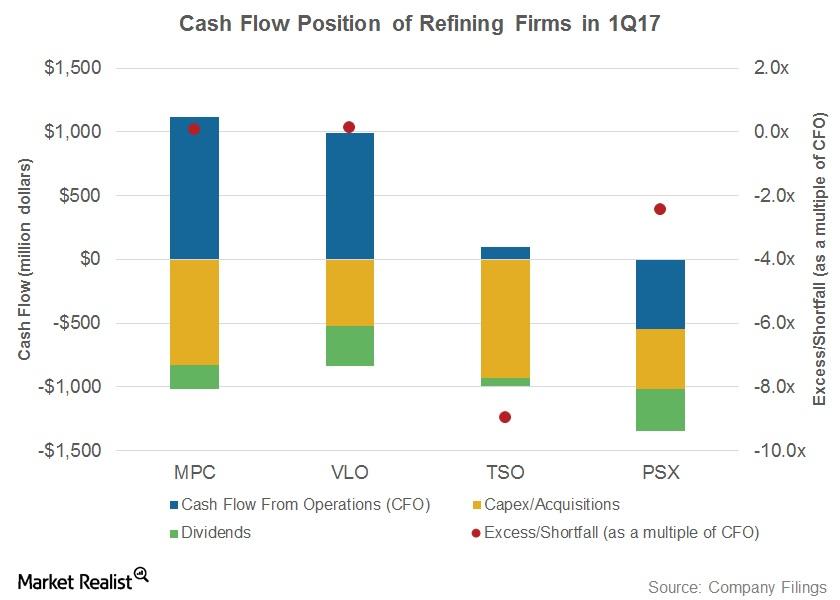

How Major Refiners’ Cash Flows Fared in 1Q17

Refiners’ cash flows have turned volatile over the past few quarters due to volatile refining earnings.

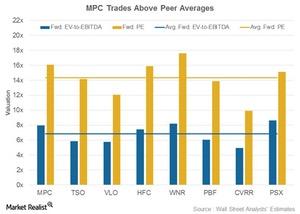

Why MPC’s Valuation Commands a Premium over the Peer Average

MPC’s valuations are above the peer averages likely because it’s now in the process of restructuring its organization to unlock value.

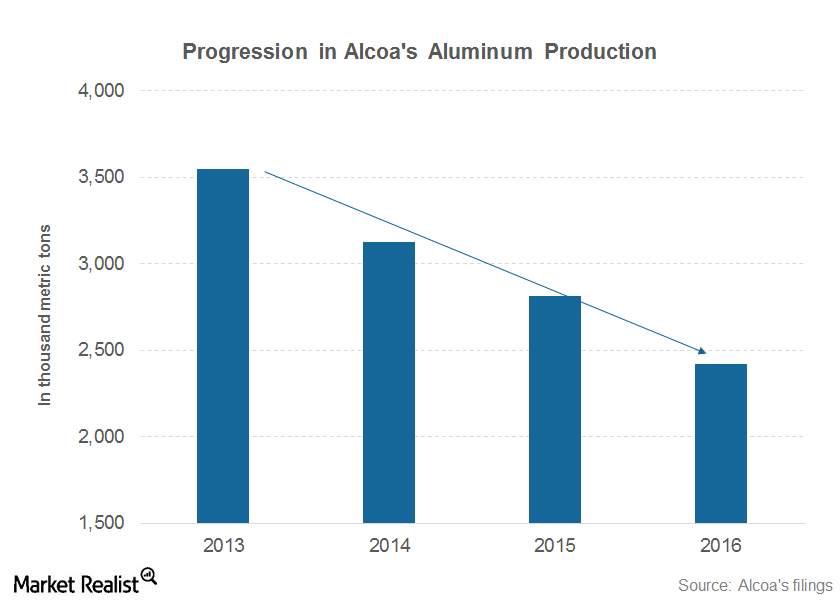

Could Wilbur Ross and Donald Trump Be Alcoa’s Saviors?

Alcoa and Century Aluminum (CENX) survives the commodity price slump by closing their high-cost capacities and negotiating better power deals for several operating plants.

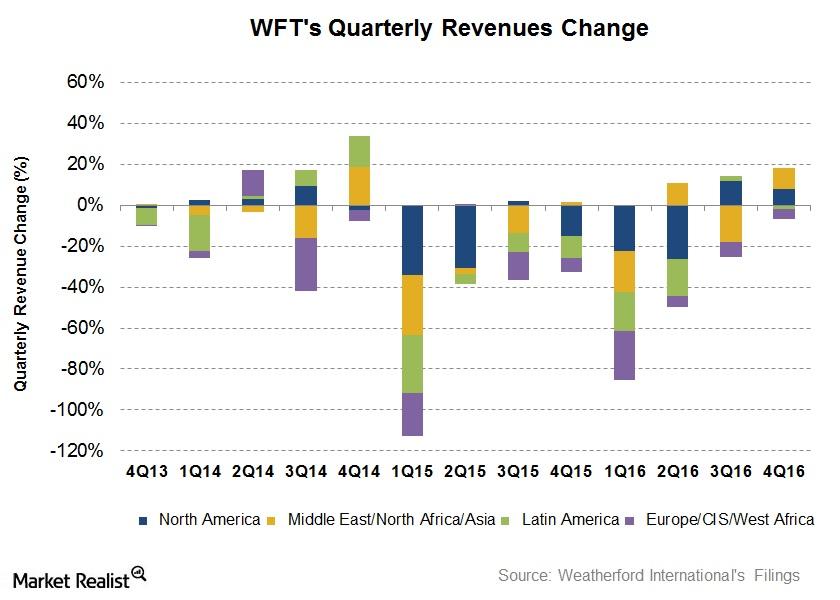

Analyzing Weatherford International’s Growth Drivers in 4Q16

Revenues from Weatherford International’s (WFT) Europe/Sub Saharan Africa/Russia region fell the most with a 36.5% fall from 4Q15 to 4Q16.

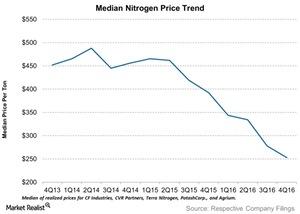

Nitrogen Producers’ Realized Prices: A Key Comparison

In 4Q16, the average price of ammonia for the five producers in our chart fell by an average of 38%.