Cleveland-Cliffs Inc

Latest Cleveland-Cliffs Inc News and Updates

Is There More Upside Left in CLF and U.S. Steel (X) Stock?

Steel stocks have bounced back and Cleveland-Cliffs (CLF) and U.S. Steel (X) look strong this week. Is there more upside left in the stocks?

CLF Misses Q2 Earnings Estimates: Is the Stock a Buy or Sell Now?

CLF released its second-quarter earnings on July 22. The stock fell sharply on the earnings miss. Should you buy or sell the stock now?

CLF Stock Is Popular on WallStreetBets, Solid Pick for Investors

Cleveland-Cliffs stock has come off its highs. Why is the stock falling and will it go back up on pumping from Reddit group WallStreetBets?

CLF Stock Forecast: How High Can It Go Amid Reddit Short Squeeze?

CLF is the latest entrant to the Reddit group WallStreetBets. What's the forecast for CLF stock and how high can it go in the short squeeze?

Analysts Say Hold on Cleveland-Cliffs Stock, Reddit Investors Say Buy

Recently, Wall Street analysts downgraded the buy rating on Cleveland-Cliffs stock. Now, they recommend holding Cleveland-Cliffs.

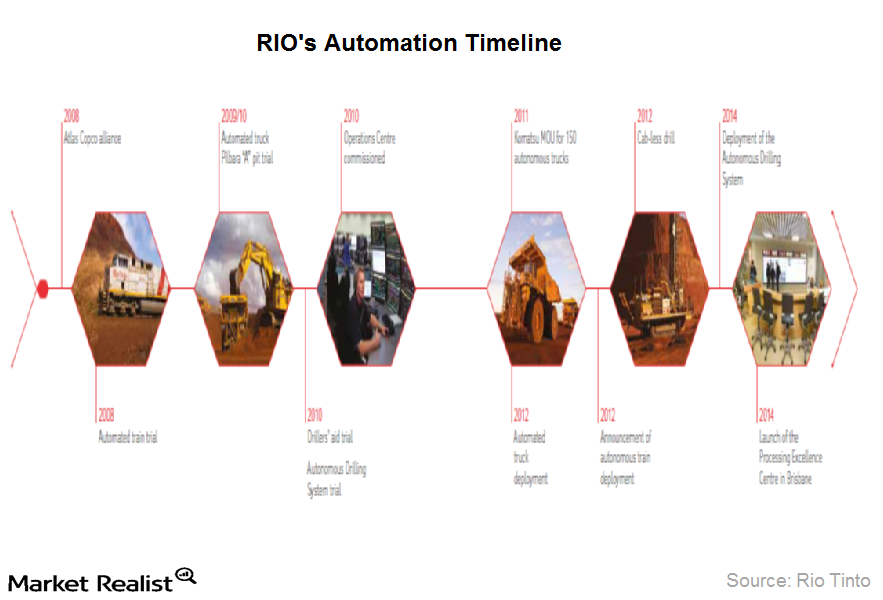

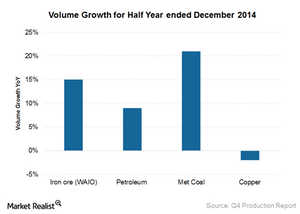

Why Rio Tinto has key advantages over its peers

Rio is the largest owner and operator of autonomous—driverless—trucks in the world. These initiatives are part of Rio’s “Mine of the Future” program.

CLF Stock Is a Good Buy as the U.S. Steel Cycle Nears Its Peak

Cleveland-Cliffs (CLF) stock is scheduled to post its earnings on April 22. What is CLF stock's forecast and will it rise after the earnings?

Why U.S. Steel and Cleveland-Cliffs Upgraded Their Earnings Guidance

Recently, X and CLF upgraded their earnings guidance due to strong end market demand and rising U.S. steel prices. Is there more upside to these stocks?

Cleveland Cliffs (CLF) Stock Is a Buy for Investors on the Pullback

Cleveland-Cliffs (CLF) stock has lost 23 percent in the last few days. Looking at its future prospects, is CLF a good stock to buy now?

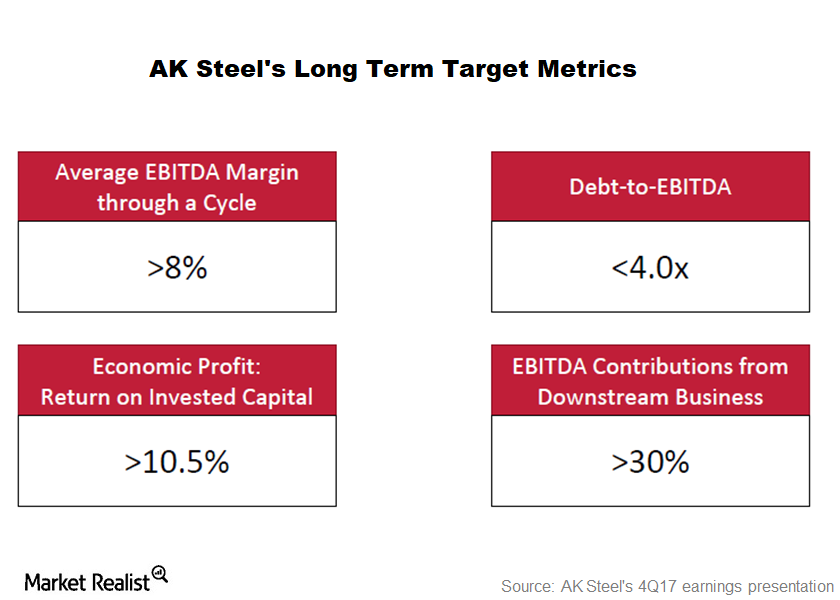

AK Steel Could Face Challenges in Meeting Its Goals

AK Steel is working towards stable margins throughout the business cycle. AK Steel has deliberately lowered its exposure to spot markets (X) (CLF).

Will President Trump’s Pressure Tactics Work Out?

In March 2018, President Donald Trump imposed a tariff of 25% on steel imports. What’s happened since?

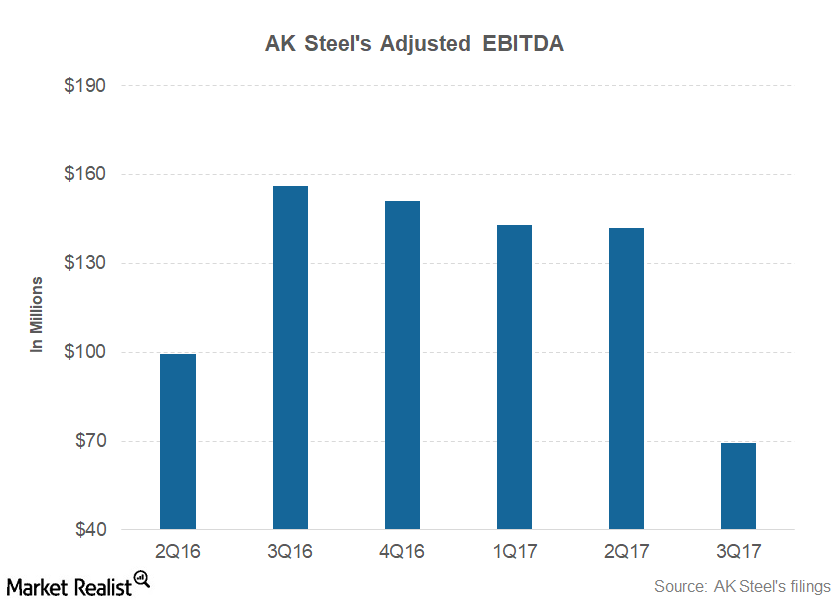

What Weighed down AK Steel’s 3Q17 Performance?

AK Steel (AKS) reported adjusted EBITDA of $69.2 million in 3Q17, compared with $142 million in 2Q17 and $157 million in 3Q16.Materials Why the demerger of non-core assets makes sense for BHP

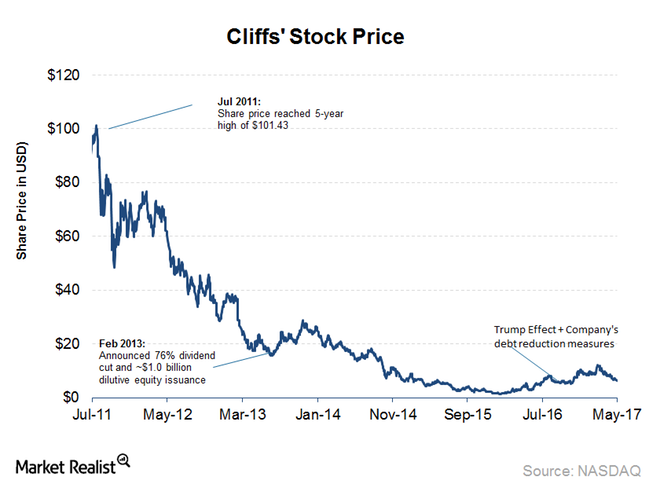

BHP had been contemplating whether to sell the non-core assets or go for a demerger. Finally, the company decided in favor of a demerger on August 15. The proposed company will likely have assets in the range of $12–$20 billion.Materials Why did the Cliff’s share price rally?

Iron ore prices are down 19% year-over-year (or YoY) and coal prices are down 30% YoY—volumes were also down YoY, but the stock rallied 7% in a single trading session the next day of the earnings call and up 3% the subsequent trading day.

Why the Outlook for US Steel Prices Is Bright beyond 4Q17

While US steel prices rose to a high of $660 per ton in March 2017, they fell to $580 per ton in June.

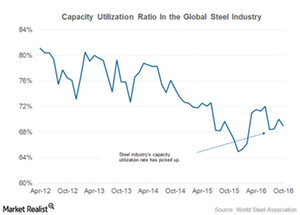

Do Steel Capacity Cuts in China Bode Well for Iron Ore Miners?

China has been reeling under its overcapacity in the steel industry. In 2016, China planned to cut 45 million tons but wound up cutting 80 million tons.

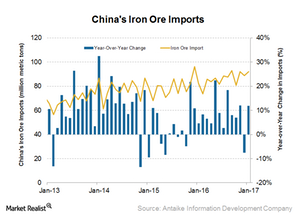

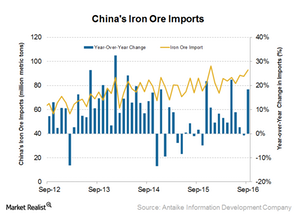

What China’s High Iron Ore Imports Suggest

China imported 92 million tons of iron ore in January 2017—a growth of 12.0% YoY and 3.4% month-over-month.

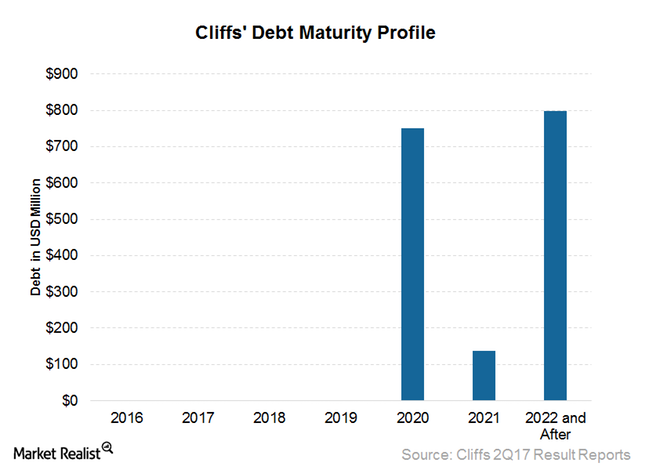

What Cliffs Natural Resources’ Debt Tender Offer Means

On July 31, 2017, Cliffs Natural Resources (CLF) announced a tender offer for a $575.0 million aggregate principal amount of its 5.75% guaranteed notes due in 2025.

What to Expect from Cliffs Natural Resources’ 2Q17 Earnings

In this series, we’ll see what investors could expect from Cliffs Natural Resources’ (CLF) 2Q17 earnings report. CLF stock has gained 23% in the last 15 trading days.

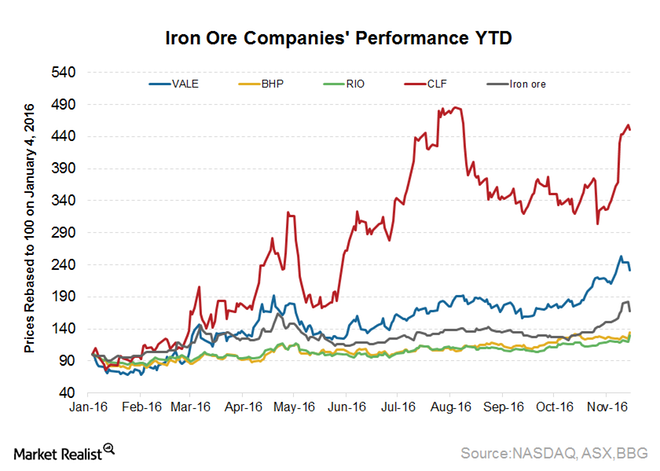

Is the Pullback in Iron Ore Miners Based on Technical Indicators?

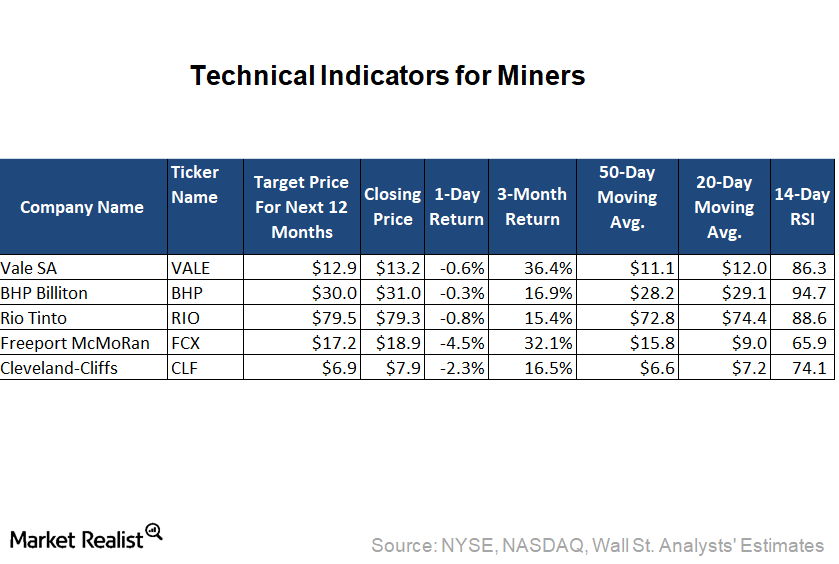

Among the stocks under review in this series, Vale SA (VALE) has given the highest trailing-three-month return of 36.4%, while Rio Tinto (RIO) has generated the lowest return of 15.4%.

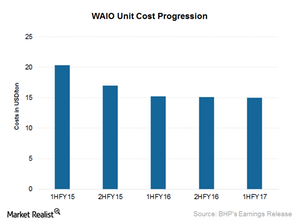

This Could Lead BHP’s Cost-Reduction Efforts in Iron Ore

Iron ore makes up 38% of BHP Billiton’s (BHP) revenues and 42% of its EBITDA.

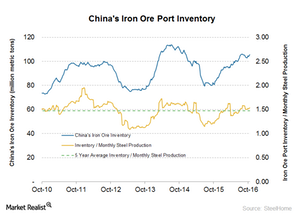

How Price Impacts Iron Ore Inventory

China’s (MCHI) iron ore port inventory is a key indicator that reflects the commodity’s supply-and-demand balance.

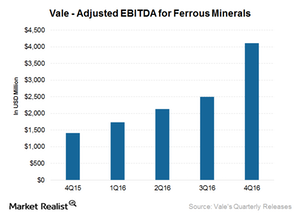

How Vale Reacted to Higher Iron Ore Prices in 4Q16

Iron ore price realization In 4Q16, Vale’s (VALE) ferrous division accounted for ~85.0% of its adjusted EBITDA (earnings before interest, tax, depreciation, and amortization). The company’s EBITDA for ferrous minerals came in at $4.1 billion, which was $1.6 billion higher than 3Q16. Higher realized prices and higher sales volumes led to these rises. The CFR […]Materials Why are iron ore futures downward sloping?

“Backwardation” occurs when futures contracts trade below the spot price, and the futures curve begins to downward slope. This means that the market expects further decline in iron ore prices based on current indicators and fundamentals.

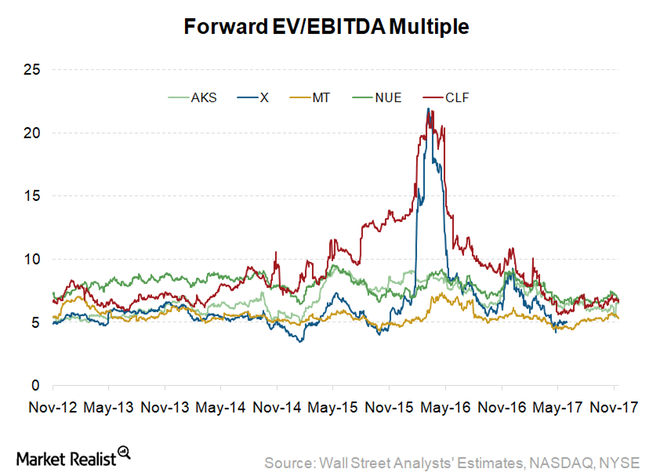

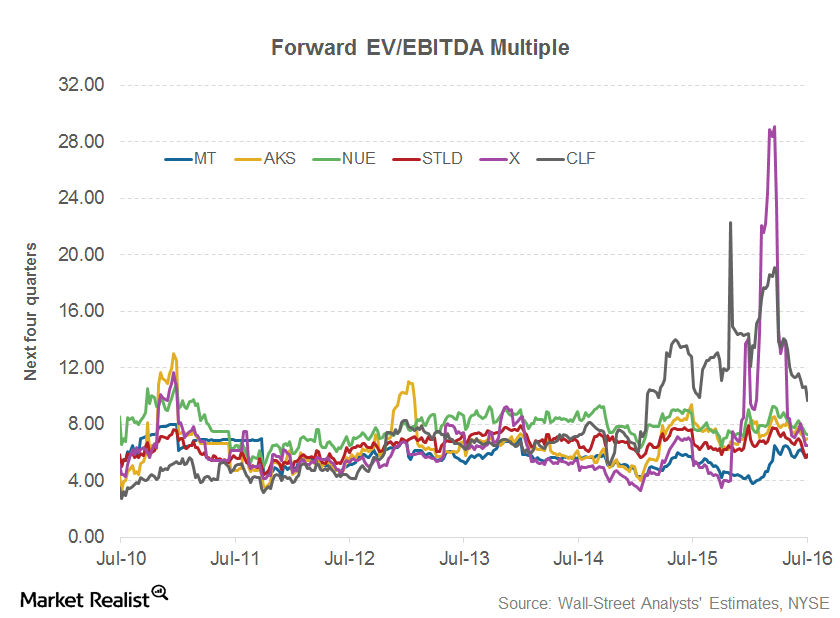

These Factors Could Affect CLF’s Valuation

Among the US steel players (SLX), only Cliffs and U.S. Steel are trading at a discount to their respective last five-year average multiples.

Understanding BHP Billiton’s Earnings Beat in Fiscal 2H17

BHP’s underlying net profit of $3.2 million was a solid improvement, as compared to the profit of $412 million in 4Q15.

Could There Be More Upside to Cliffs Natural Resources’ Valuation?

For companies in cyclical industries such as steel and mining, the EV-to-EBITDA multiple is the preferred valuation metric.

What Led Robust Chinese Iron Ore Imports despite Contrary Views

Contrary to what was suggested by many market participants, the iron ore imports by China increased in September 2016 instead of declining.

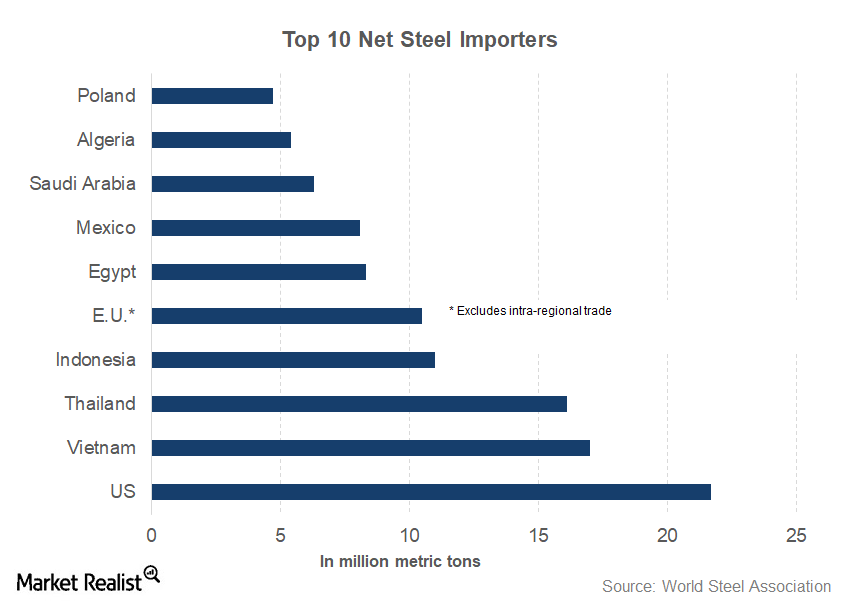

Top 10 Steel Importers: Is US Steel Industry Justified?

The United States is the world’s largest net steel importer. The country’s net steel imports totaled 21.7 million metric tons last year.

Does 2018 Bode Well for US Steel Prices?

Steel prices are the major driver of steelmakers’ earnings and revenues. So it’s important for steel investors and Cleveland-Cliffs (CLF) investors to track the trend in steel prices.

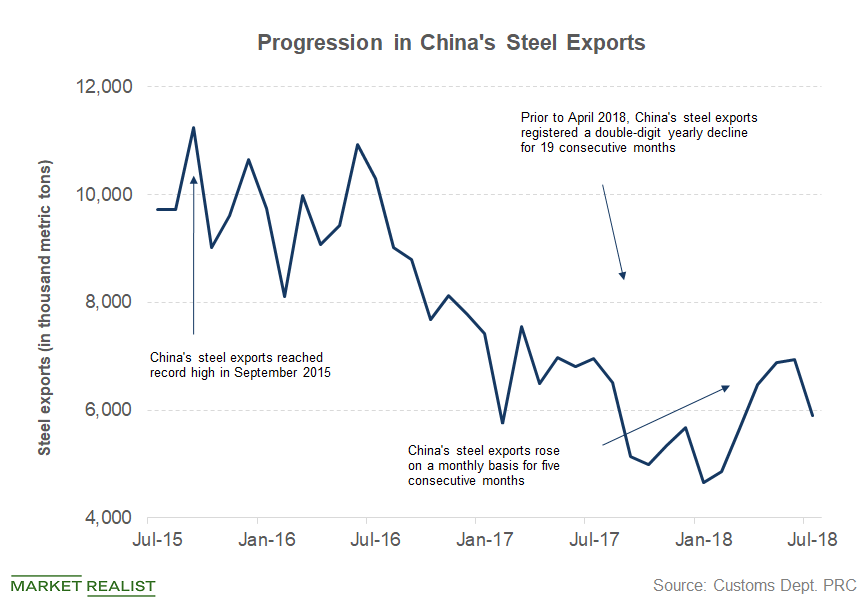

For the US Steel Industry, China’s No Longer the Villain!

For a long time, US steel producers blamed Chinese steel exports for depressing prices. However, Chinese exports have fallen sharply this year.

Are Global Macros Supportive of US Steel Stocks?

Although US steel producers have trade protections in the form of the Section 232 tariffs, the global steel pricing environment still affects US steel prices.

US Steel Industry Pins Hopes on Auto Plant Restarts

US steel demand has fallen sharply due to the COVID-19 pandemic. The automotive sector will start resuming operations, which should support demand.

Should US Steel Mills Halt Production amid Coronavirus?

The AISI asked the Trump administration to classify the steel industry as “essential.” The industry wants to continue production despite the coronavirus.

Why CLF Stock Fell after Its Q4 Earnings Release

CLF reported its fourth-quarter earnings on February 20 before the markets opened. The company generated revenues of $534 million in the quarter.

Could US Steel Stocks Be a Contra Play in 2020?

Overall, 2019 was a mixed year for US steel stocks. However, due to the rally in the fourth quarter, most stocks managed to close the year with gains.

Why US Steel Stock Underperformed Peers in 2019

U.S. Steel stock (X) has underperformed peers so far in 2019. Notably, it’s the only leading US steel name that’s trading with a YTD (year-to-date) loss.

A Look at Analysts’ Top 5 US Steel Stocks

In this overview article, we’ll see how analysts are rating the leading steel stocks, and we’ll also compare performance from the top five steel companies.

CLF Acquires AKS: A Match Made in Heaven?

Yesterday, Cleveland-Cliffs (CLF) announced that it would acquire AK Steel (AKS) at a premium of 16% over both stocks’ December 2 closing prices.

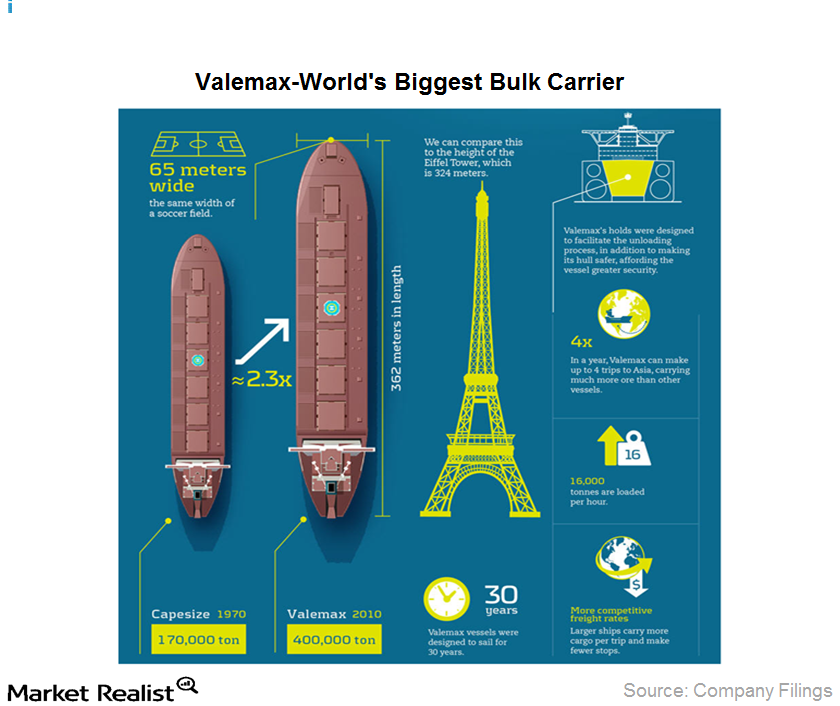

Valemax ships sail Vale SA to cost-effective distribution

Valemax ships are ultra-large vessels, capable of carrying 400,000 dwt (dead weight tons) each. That’s 2.3 times more than traditional Capesize ships. They also emit 35% less CO2 per ton of ore transported.

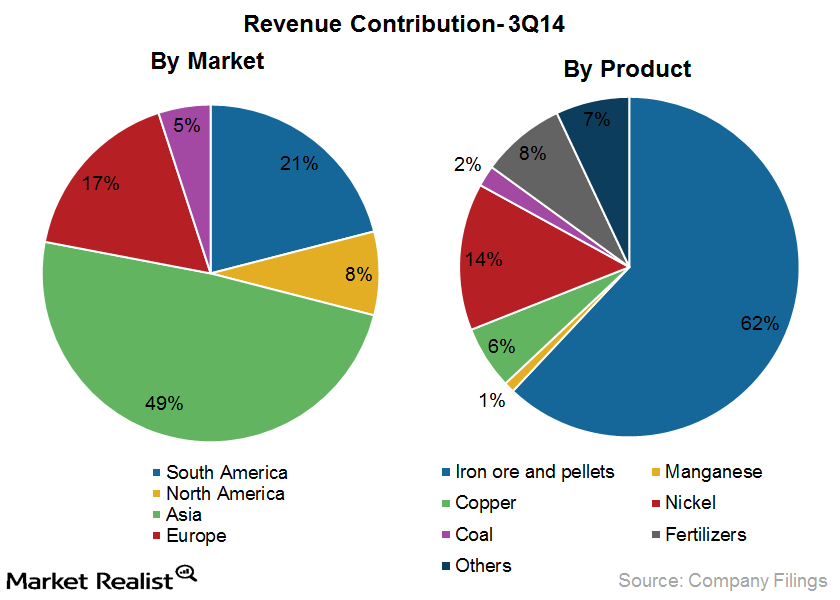

Vale SA: Overview of the world’s largest iron ore company

Vale SA (VALE) is a Brazilian multinational diversified metals and mining company. It is the world’s largest producer of iron ore and iron ore pellets and the world’s second-largest producer of nickel.

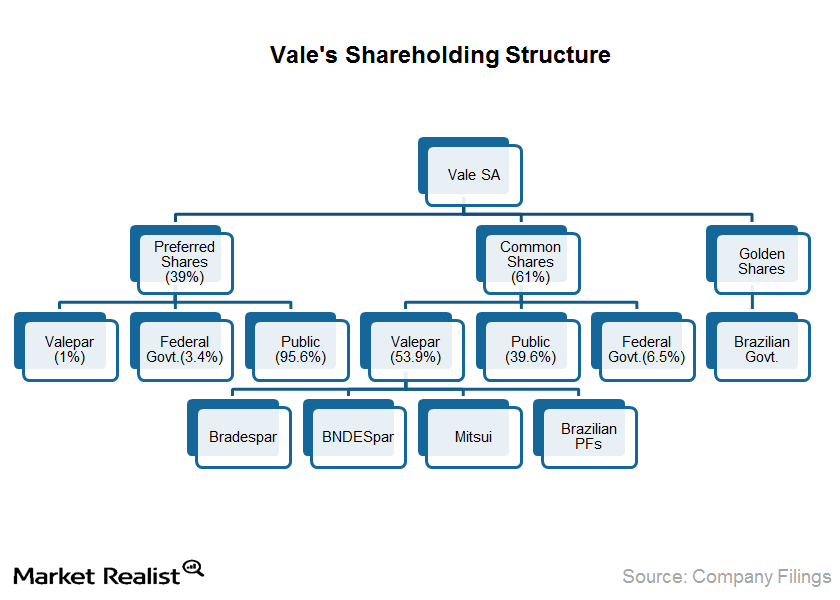

The implications of the Vale SA ownership structure

Although there hasn’t been any recent cause for concern, and the government doesn’t interfere in the day-to-day workings of Vale, there’s always a risk that the company could be pushed into pursuing objectives that aren’t in the best interests of all shareholders.

How Vale SA values its iron ore customers

Vale SA offers technical assistance to its customers and operates sales support offices in several cities. These offices monitor customer requirements and ensure timely deliveries.

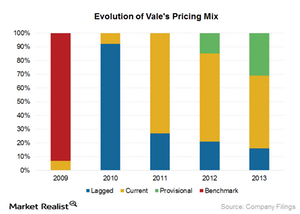

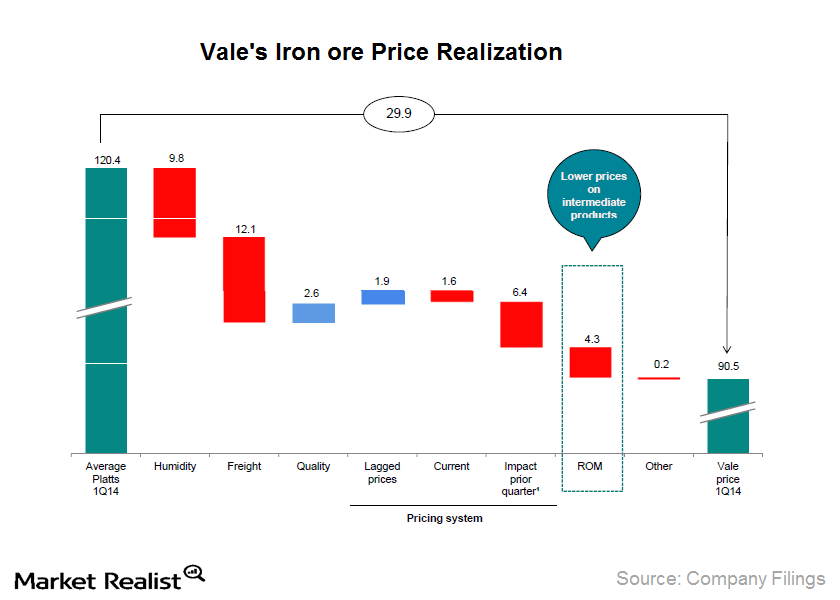

Realized price: The factors impacting Vale SA iron ore

Realized prices for iron ore vary depending on quality, moisture content, freight costs, and pricing mechanisms. ROM sales reduced Vale’s realized price by about $6 per ton in 2013.

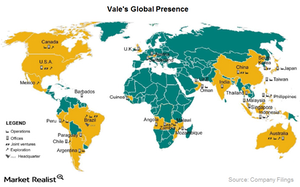

Where Vale SA operates and why

Currently, the the private sector is leading significant expansion and major rehabilitation of Mozambique’s infrastructure. Vale itself is investing in the development of the Nacala infrastructure project.

BHP reports mixed production results and maintains its guidance

Overall, BHP reported mixed 2Q15 results. It recorded a 9% production increase during the December 2014 half-year.

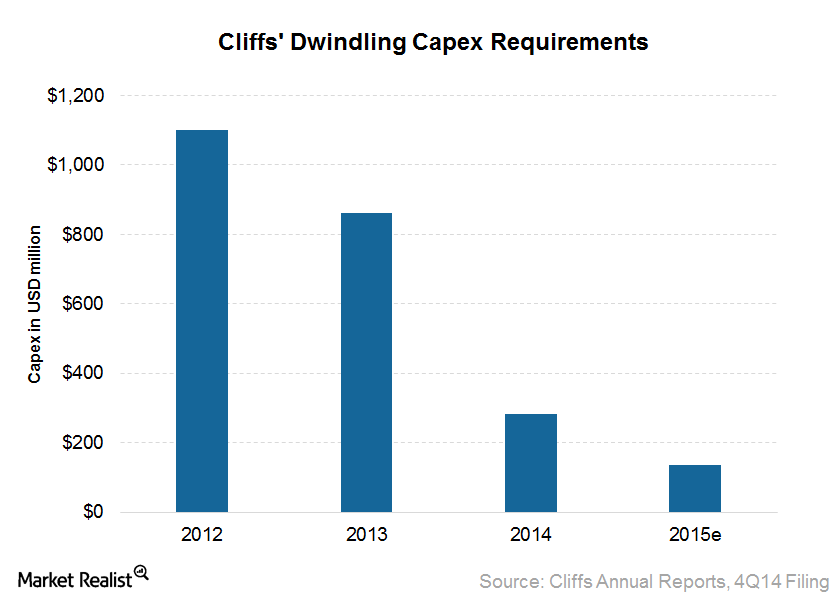

Why Cliffs plans to reduce its capex going forward

Cliffs Natural Resources’ (CLF) estimation for the 2015 annual capital expenditure, or capex, is $125–$150 million.

Is Cleveland-Cliffs or U.S. Steel Stock More Attractive?

Cleveland-Cliffs (CLF) and U.S. Steel (X) stocks have underperformed markets this year. However, U.S. Steel has been strong in November.

Get Real: Musk Confronts Criticism, Earnings Continue

In today’s Get Real, we saw Apple Watch’s performance and another loss for Boeing. Plus, Google’s Fitbit acquisition faces scrutiny from the EU.

Why US Steel Short Sellers Might Lose on Their Bets

Things could turn around for the US steel sector, with mills pushing for price hikes. Earnings results this week could also surprise positively.