Cleveland-Cliffs Inc

Latest Cleveland-Cliffs Inc News and Updates

These Variables Could Drive Cleveland-Cliffs Higher

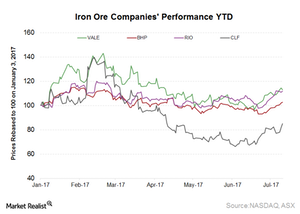

After experiencing a great 2016, US steel stocks are having a tepid 2017.

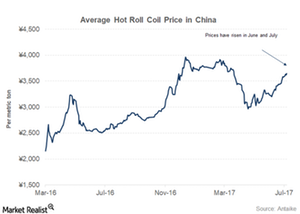

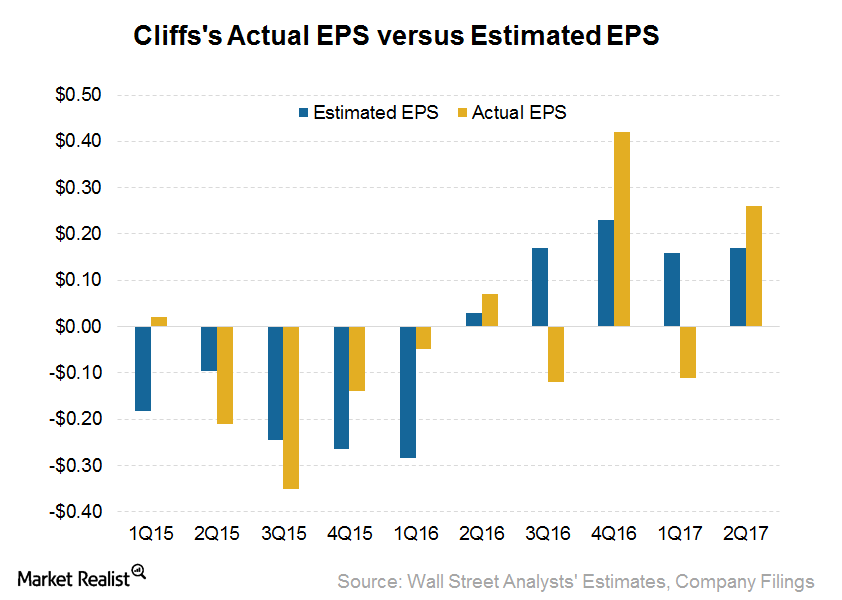

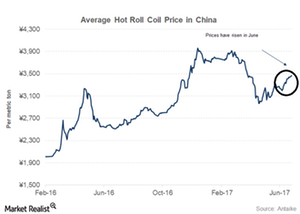

China Steel Prices Are Touching Higher Highs: Impact on Iron Ore

According to Reuters, the September 2017 steel rebar futures contract on the Shanghai Futures Exchange has risen 40% year-to-date.

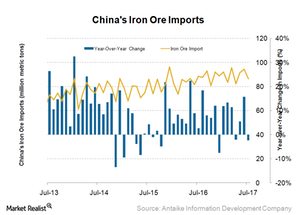

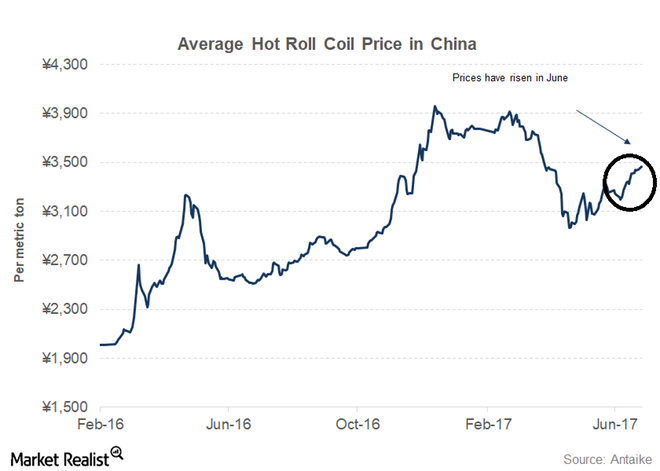

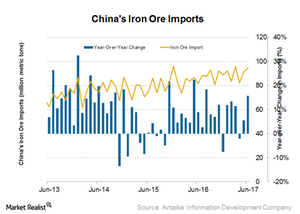

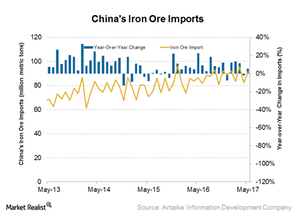

Why China’s Lower Iron Ore Imports in July Could Be a One-Off

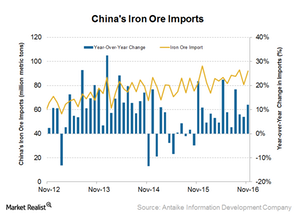

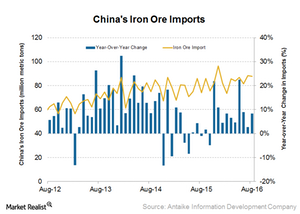

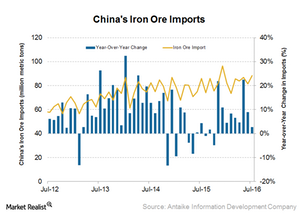

China’s iron ore imports for July 2017 fell 2.4% over July 2016 to 86.3 million tons.

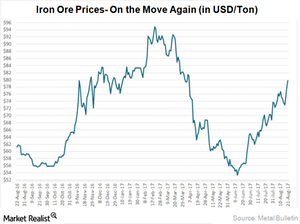

Does BHP Billiton Expect to Sustain Iron Ore Price Momentum?

BHP Billiton (BHP) attributed the rise in iron ore prices to higher pig iron production in China, the preference for higher grade materials, and improved steel margins.

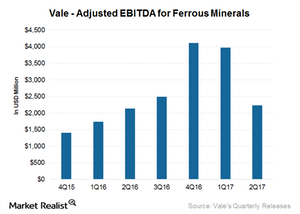

What’s the Outlook for Vale’s Iron Ore Division?

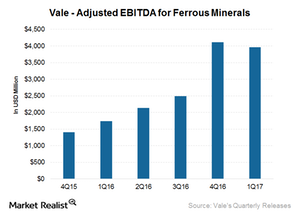

Vale’s (VALE) ferrous division accounted for ~82%.0% of its adjusted EBITDA (earnings before interest, tax, depreciation, and amortization) in 2Q17.

These Factors Could Affect Vale Stock in 2H17

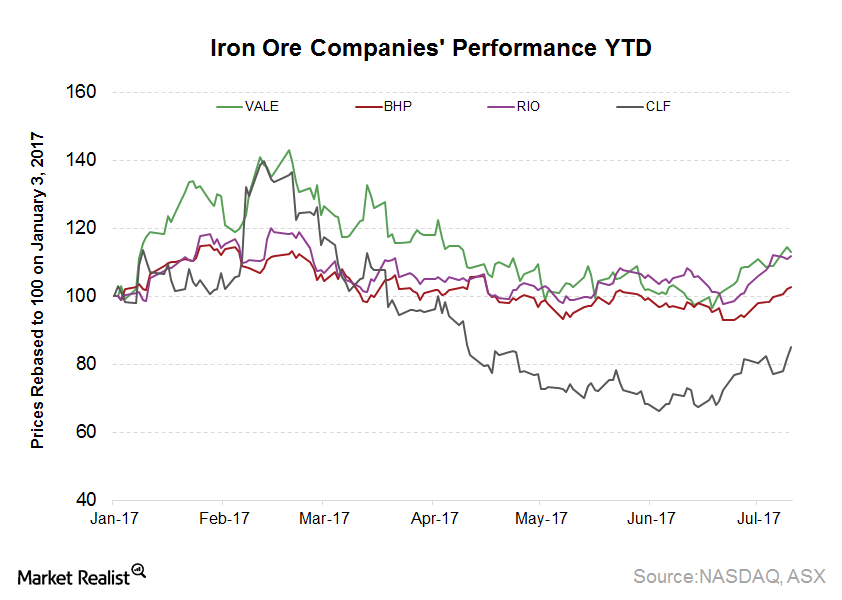

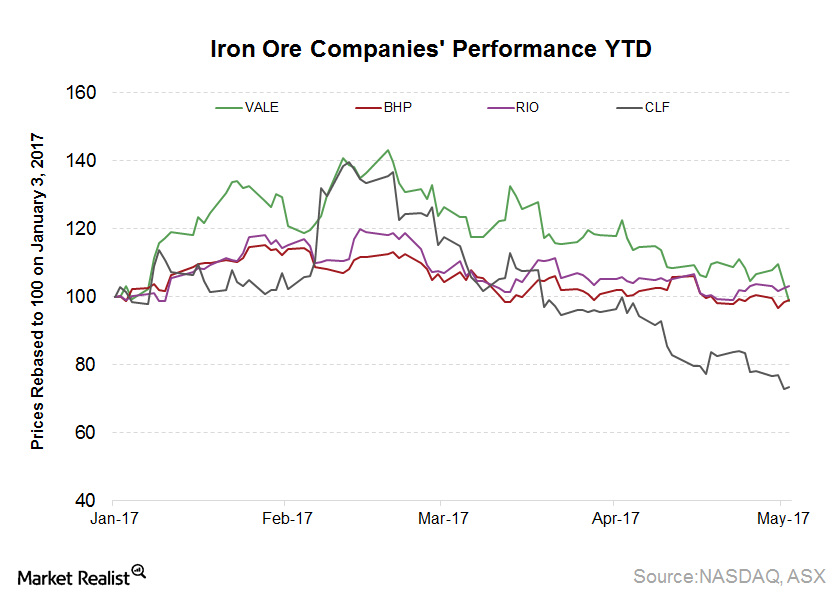

After significantly outperforming its peers in 1Q17, Vale’s (VALE) performance deteriorated in 2Q17.

US Steel Prices: The Outlook for Cliffs Natural Resources

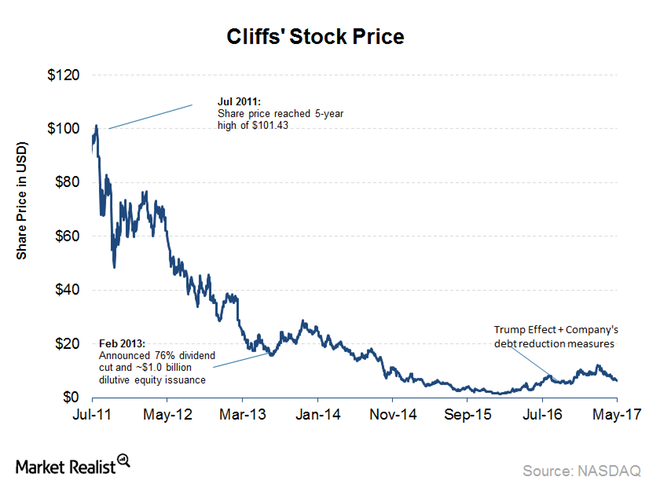

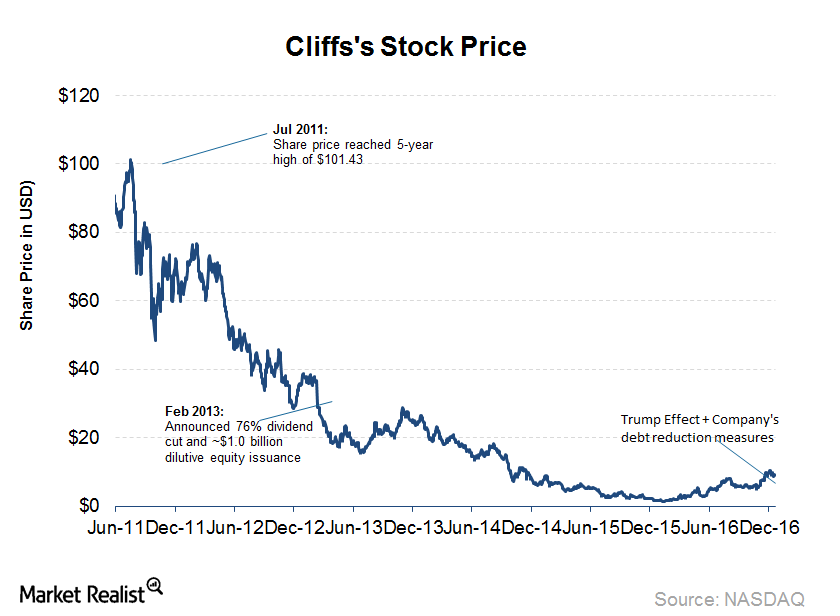

Cliffs Natural Resources (CLF) downgraded its EBITDA and net earnings guidance for 2017 due to weaker-than-expected YTD averages of US HRC and seaborne iron ore prices.

Cliffs Natural Resources: What Will Drive Performance after 2Q17?

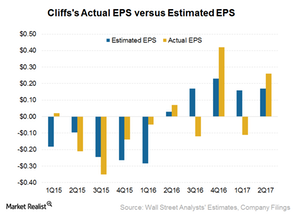

The 2Q17 earnings season for US-based steel companies is now over. Cliffs Natural Resources (CLF) released its 2Q17 results on July 27, 2017, before the market opened.

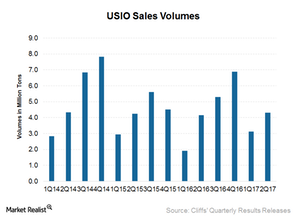

What Could Drive Cliffs Natural Resources’ US Volumes in 2H17

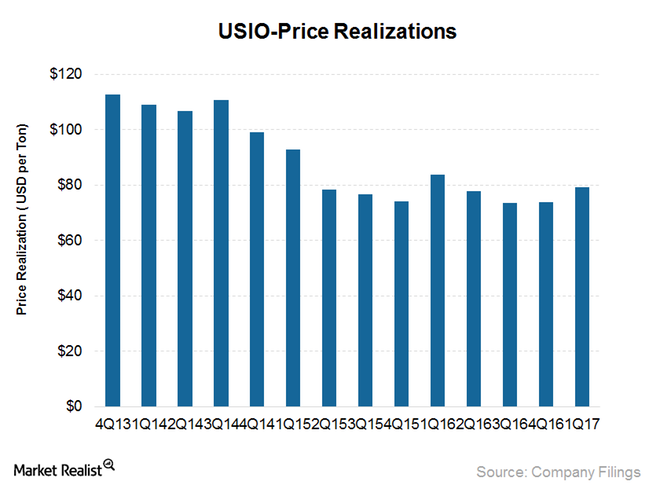

US iron ore (or USIO) is the main driver for Cliffs Natural Resources’ (CLF) top and bottom lines. The top line, in turn, is driven by volumes and realized prices.

Key Highlights from Cliffs Natural Resources’ 2Q17 Results

Cliffs Natural Resources (CLF) achieved revenues of $569 million for 2Q17, an increase of 15% year-over-year (or YoY).

Why Cliffs Natural Resources’ Stock Fell despite an Earnings Beat

Cliffs Natural Resources (CLF) released its 2Q17 results on July 27, 2017, before the market opened. Here’s what you need to know.

Chinese Steel Prices Are Surging—Can They Keep the Momentum?

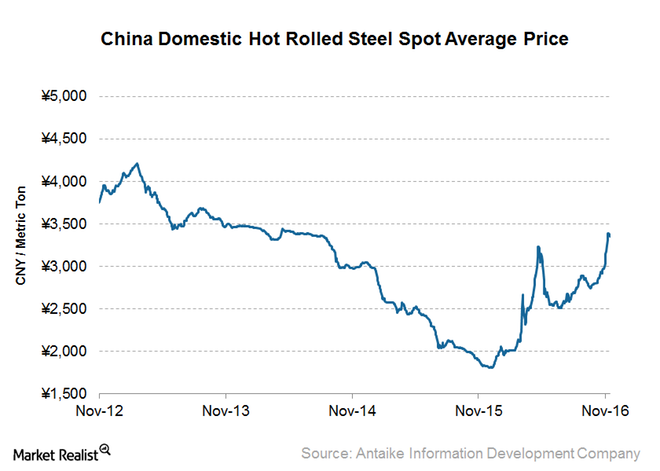

Chinese steel production has been hitting one record after another. This renewed vigor in the Chinese steel industry is due to higher steel prices.

China’s Iron Ore Imports Surged in June—Where Will They Go Next?

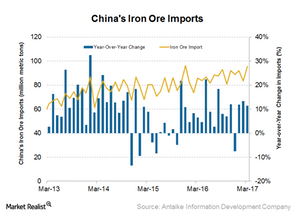

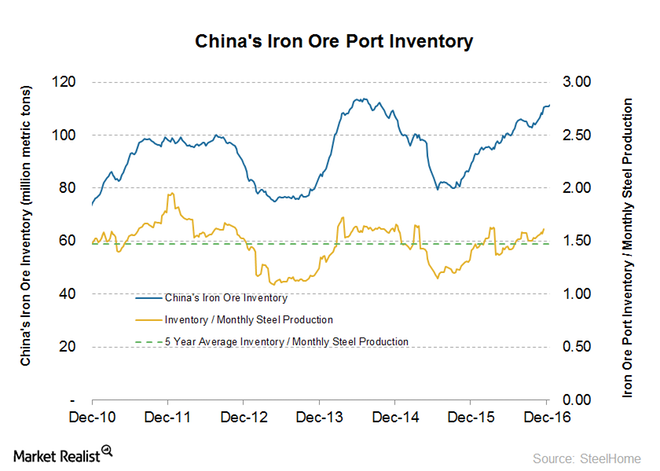

It’s important for investors to keep track of China’s iron ore import data because they provide a clue regarding the demand patterns for imported iron ore among Chinese mills and traders.

Can Iron Ore Miners’ Supply Discipline Lead to a Price Upside?

Rio Tinto (RIO) released its operational update for 1H17 on July 18, 2017. Rio’s iron ore shipments fell 6% year-over-year (or YoY) to 77.7 million tons in 2Q17.

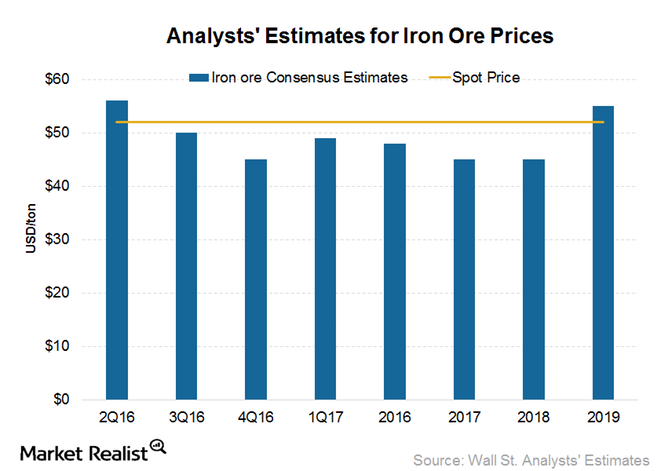

Analysts’ Views: What Iron Ore Price Could Bring Balance?

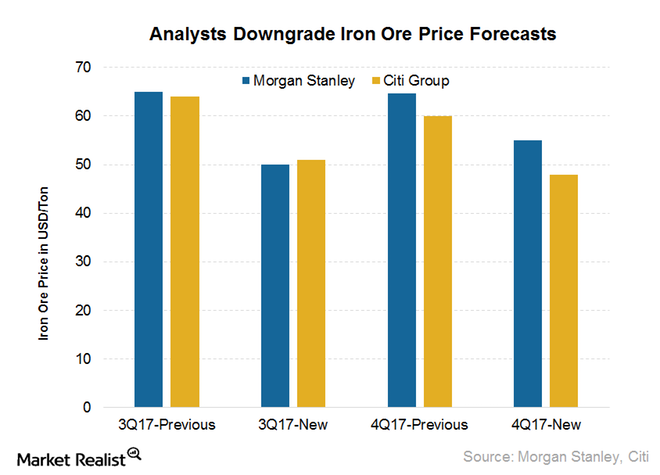

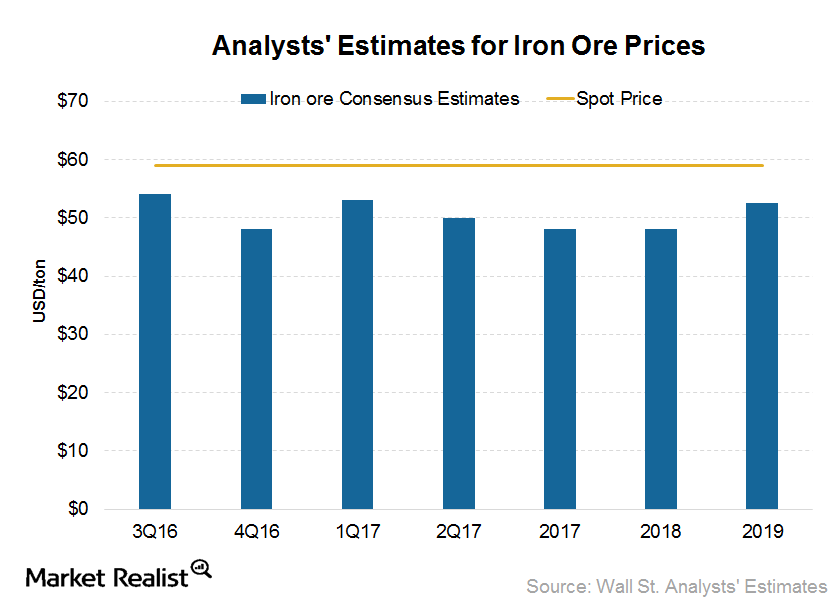

While iron ore prices have rebounded recently, analysts are still skeptical about the long term. Morgan Stanley has reduced its iron ore price forecast for 3Q17 by 23% to $50 per ton.

CLF and Peers in Overbought Territory: What Triggered It?

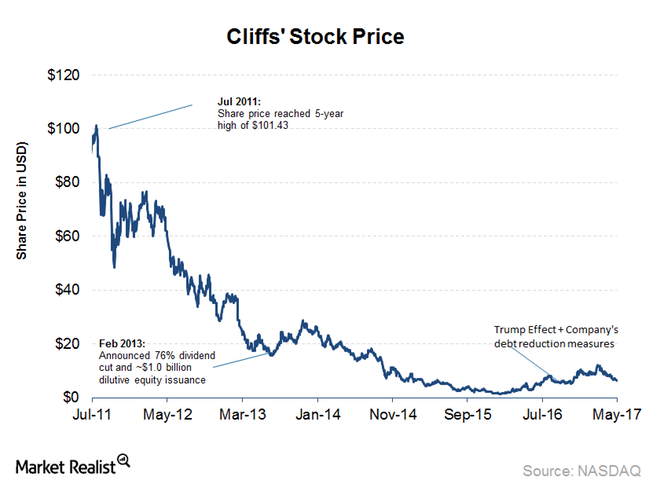

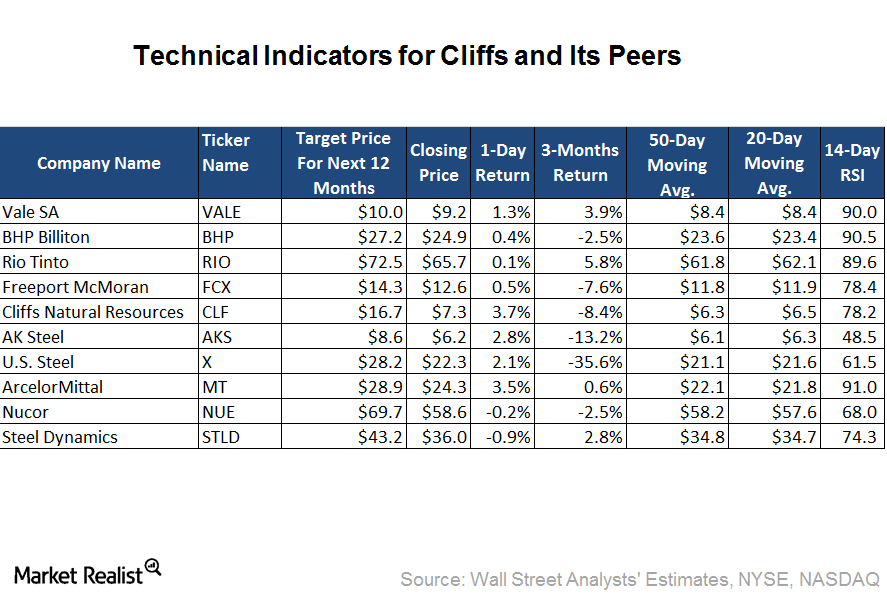

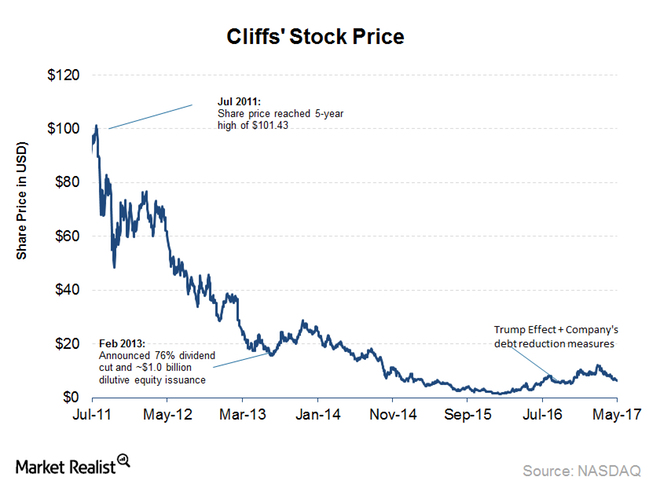

Based on its June 12, 2017, closing price, Cliffs Natural Resources is trading 15.2% and 11.9% higher than its 50-day and 20-day moving averages, respectively.

Jefferies Recommends a ‘Buy’ for CLF—What Do Other Analysts Think?

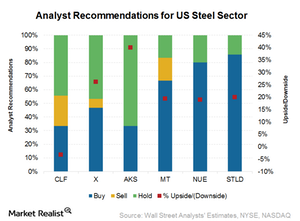

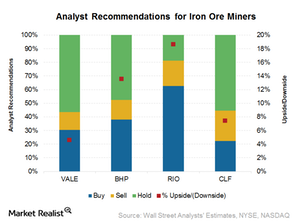

According to the consensus compiled by Thomson Reuters, 22% of the analysts covering Cliffs Natural Resources (CLF) recommended a “sell” for the stock, 33% recommend a “buy,” and 44% recommend a “hold” for the stock.

Can CLF’s Realized Prices See an Uptick in the US Segment?

Compared to 1Q16, Cliffs Natural Resources’ average realized prices fell 5% year-over-year to $79.30 per ton in 1Q17.

Can the Rebound in Chinese Steel Prices Support Iron Ore Miners?

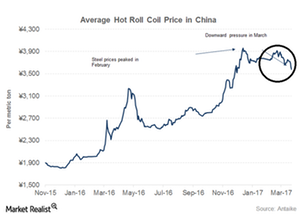

One of the major factors that led to the iron ore price rally in 2016 and 1Q17 was stronger-than-expected Chinese steel prices.

Why China’s June Iron Ore Import Outlook Is Strong

China’s iron ore imports recovered from a six-month low in April by importing 91.5 million tons in May 2017.

Cliffs Natural Resources’ First HBI Plant: What You Need to Know

The estimated investment needed for Cliffs Natural Resources’ (CLF) HBI (hot briquetted iron) plant is ~$700 million.

What Will Drive Vale SA’s Iron Ore Division Going Forward?

In 1Q17, Vale’s (VALE) ferrous division accounted for ~89.0% of its adjusted EBITDA (earnings before interest, tax, depreciation, and amortization).

These Factors Led to Weakness in Vale Stock after 1Q17

In 1Q17, Vale (VALE) significantly outperformed its major peers with a rise of ~25%.

How’s the Industry Outlook for Cliffs for the Rest of 2017?

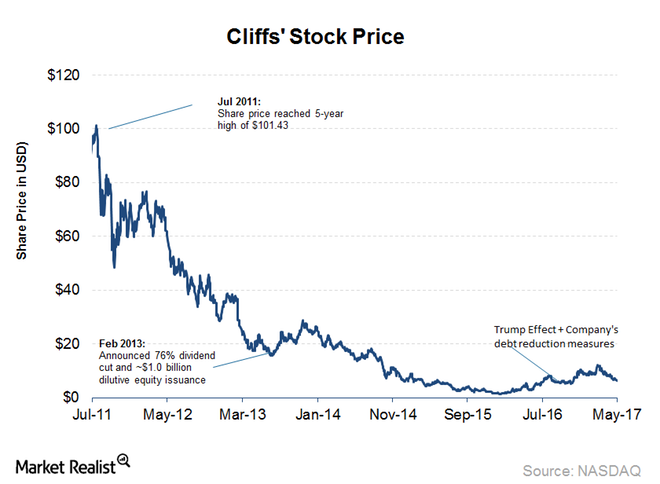

May 2017 was quite a volatile month for Cliffs Natural Resources (CLF) and its peers. Cliffs fell 12.4% in May alone, bringing its year-to-date losses to 30%.

China’s Iron Ore Imports Remain Strong: What’s the Outlook?

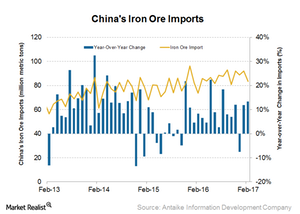

Strong Chinese iron ore imports China imported 95.6 million tons of iron ore in March, compared with 83.5 million tons in February 2017. This figure implies a strong growth of 11% year-over-year (or YoY). This number is also the second-highest monthly amount on record. China imported 96.3 million tons of iron ore in December 2015. […]

Should Cliffs Worry about Chinese Steel Price Trends?

Among the most dominant factors driving the recent iron ore price rally are higher steel production and the rise of steel prices in China (FXI).

Inside Iron Ore Miners’ Price Targets: Gauging Their Upside Potential

Among the iron ore miners (PICK), analysts are most bullish on Rio Tinto (RIO), with 63% “buy” and 19% “hold” ratings.

What China’s Resilient Iron Ore Imports Mean for Miners

China imported a total of 83.5 million tons of iron ore in February 2017, which represents a growth of 13% YoY (year-over-year) and -9.2% month-over-month.

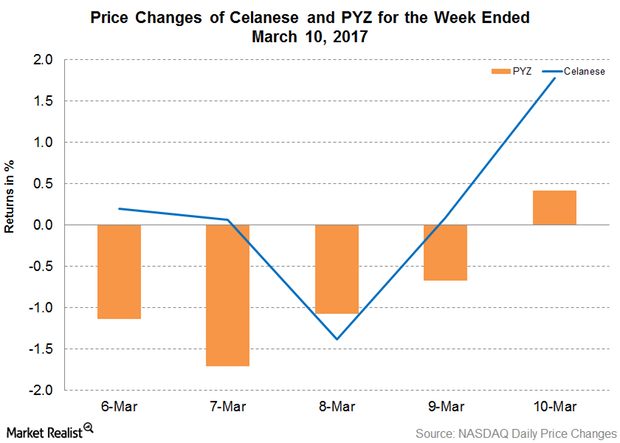

Celanese Increases Vinyl Acetate Monomer Prices in Asia

On March 7, 2017, Celanese (CE) announced a price increase for VAM (vinyl acetate monomer) in Asia. The increase is effective immediately.

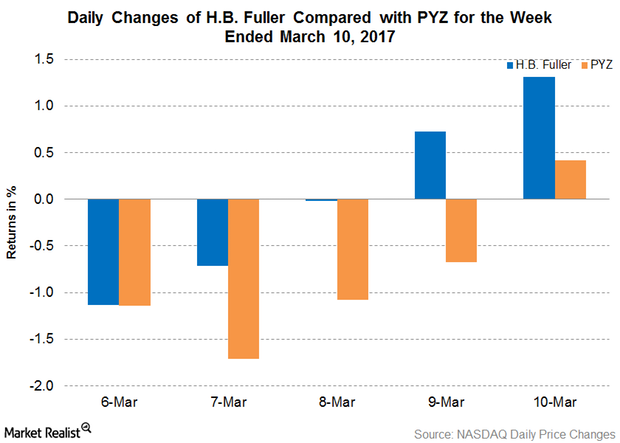

H.B. Fuller Has Another Round of Price Hikes

On March 7, 2016, H.B. Fuller (FUL) announced another round of price hikes for its products. It came on the back of other price hikes the week before.

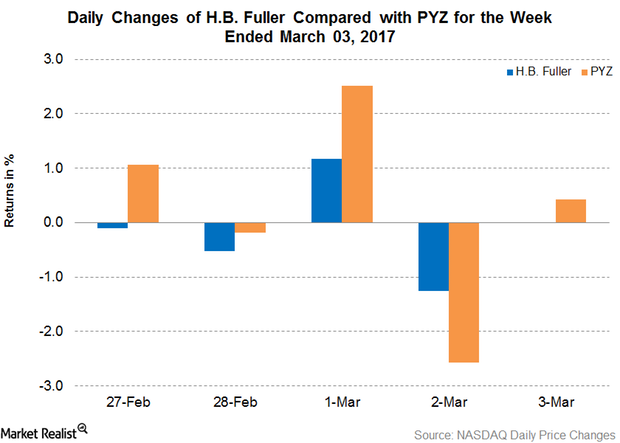

H.B. Fuller Increases Price for Adhesives in North America

On March 3, 2017, H.B. Fuller (FUL) announced price increases for its adhesives in the North American region.

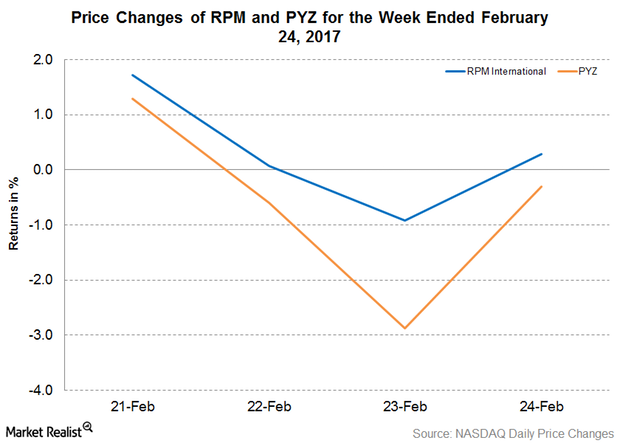

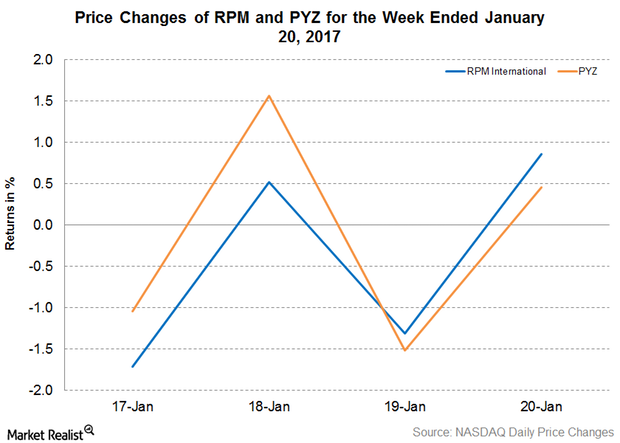

Ratner Leaves RPM International’s Board of Directors

On February 24, 2017, RPM International (RPM) announced that Charles Ratner would be retiring from RPM’s board of directors after serving the company for 12 years.

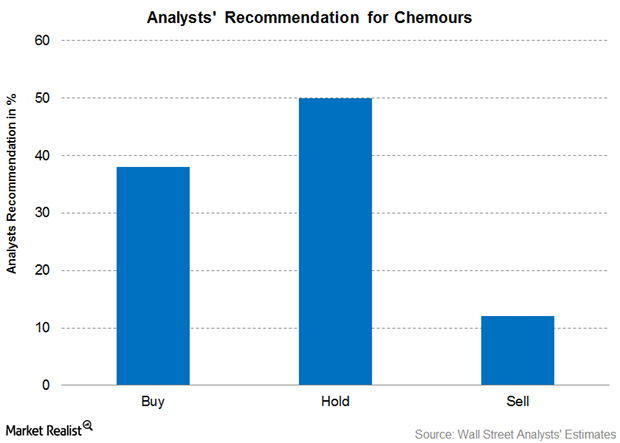

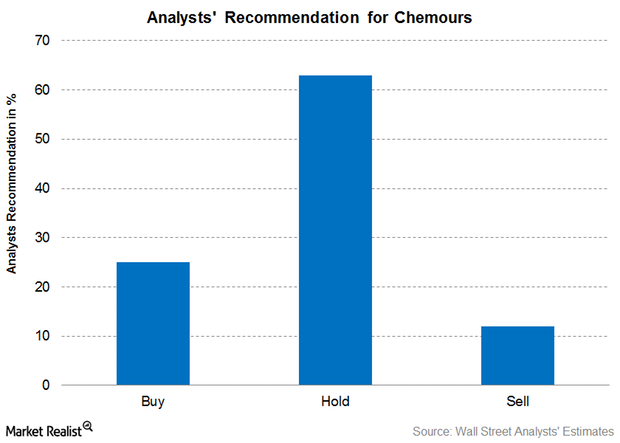

What Are Analysts’ Recommendations for Chemours?

After Chemours’ 4Q16 earnings, 38.0% of the analysts recommended a “buy” for the stock, 50.0% recommended a “hold,” and 12.0% recommended a “sell.”

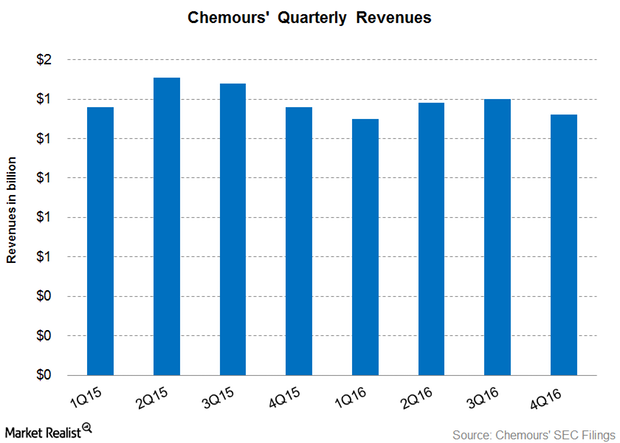

Chemours Beat Analysts’ 4Q16 Revenue Estimates

Chemours (CC) reported its 4Q16 results on February 15, 2017, after the markets closed. Chemours reported 4Q16 revenue of $1.32 billion.

What Are Analysts Recommending for Chemours ahead of 4Q16?

As of February 9, 2017, eight brokerage firms are actively tracking Chemours (CC) stock. About 25.0% of them have recommended a “buy” for the stock.

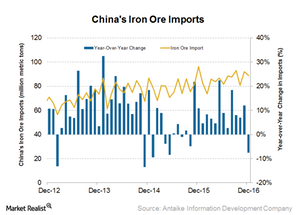

China Imported Record Iron Ore in 2016: How’s the 2017 Outlook?

China’s iron ore imports were robust in 2016. While the country’s imports fell 7.6% year-over-year (or YoY) in December 2016, they hit a yearly record in 2016.

RPM International Has Acquired Prime Resins

On January 17, 2017, RPM International (RPM) announced that it has acquired Prime Resins. The acquisition will be integrated into RPM’s USL Group.

What Could Impact Chinese Steel Prices in 2017?

Since China is the world’s largest steel producer and exporter, it’s important for investors to keep track of Chinese steel prices.

What Could Affect Iron Ore Prices in 2017?

Chinese demand is the key driver of iron ore prices, as the country accounts for more than two-thirds of seaborne demand (CLF) (BHP).

Can Cliffs Natural Resources Scale Greater Heights in 2017?

Cliffs Natural Resources (CLF) was trading at $8.85 on December 23, 2016, which represents a 46% rise since Donald Trump’s win in the US presidential election. That brings the year-to-date rise to a whopping 430.0%.

What’s the Outlook for Chinese Iron Ore Imports?

Contrary to what’s been suggested by many market participants, China’s iron ore imports have been robust in 2016. In November, imports were 92.0 million tons.

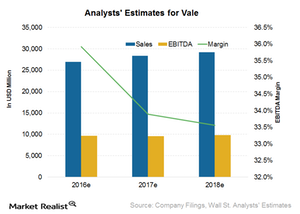

Why Analysts Significantly Raised Vale’s Earnings Estimates

Wall Street analysts covering Vale are projecting sales of $27.0 billion for 2016. That implies a revenue change of 4.4% year-over-year.

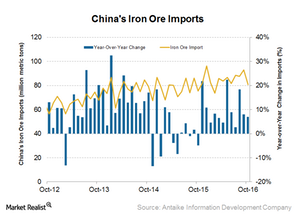

Why Were Chinese Iron Ore Imports Weak in October?

China’s weaker iron ore imports Contrary to what’s been suggested by many market participants, China’s iron ore imports have been robust in 2016. In October, however, the imports were at their lowest since February, at 80.8 million tons, down 13% month-over-month. On a year-over-year basis, the imports rose 7%. In the first ten months of […]

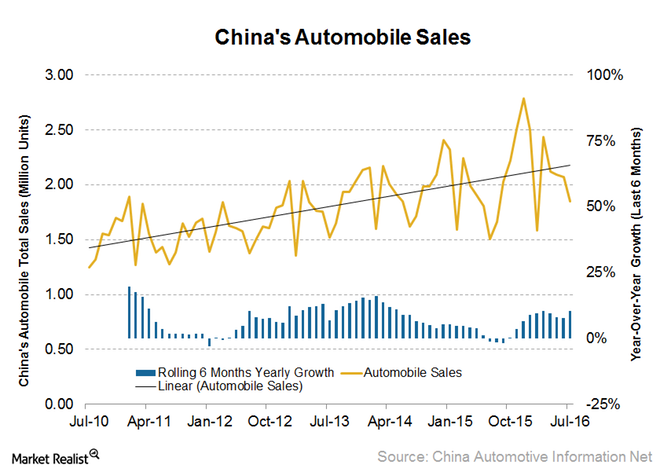

The Outlook for China’s Automobile Sales and Why It Matters

China’s passenger car sales rose 26% year-over-year in August. This is the fourth consecutive month that car sales have risen in the double digits.

Could China’s Iron Ore Imports Pull Back in the Near Term?

In August 2016, China’s iron ore imports came in at 87.7 million tons, a rise of 18.3% compared to 74.1 million tons in August 2015 but a slight fall of 0.8% compared to July 2016.

Morgan Stanley, Citibank Doubt Longevity of Iron Ore Price Rally

Morgan Stanley is bearish on the future prospects of iron ore prices. The broker estimates that the iron ore prices will fall to $40 per ton in 2H16 and $35 per ton in 4Q16.

Why China’s Iron Ore Imports May See a Near-Term Pullback

In July 2016, China’s iron ore imports came in at 88.4 million tons. This was a rise of 2.7% compared to 86.1 million tons in July 2015 and 81.6 million tons in June 2016.

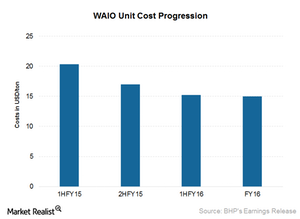

How Much Lower Can BHP Billiton Push Its Costs in Iron Ore?

BHP’s total iron ore production increased by 2% in fiscal 2016 to a record 227 million tons.

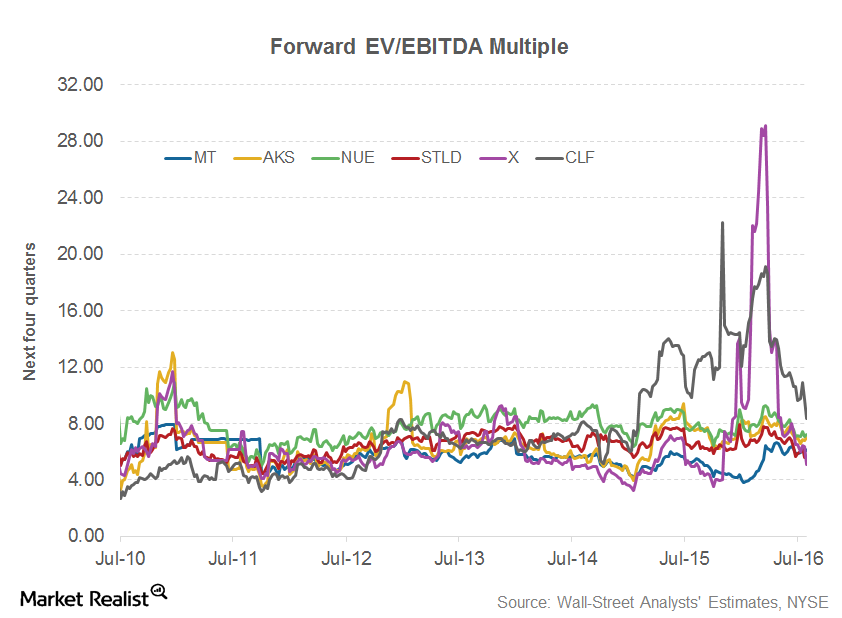

What’s Been Driving Cliffs Natural Resources’ Valuation

Valuations Valuation multiples are key metrics that investors consider carefully. With the help of relative valuations, we can compare a company’s valuation with its closest peers’ valuations. There are several valuation metrics that we can use. For companies in cyclical industries such as steel and mining, the EV/EBITDA (enterprise value to earnings before interest, taxes, depreciation, and amortization) […]

What Analysts Have to Say about Iron Ore Prices

Analysts have increased their short-term iron ore price forecasts due to stronger-than-expected temporary factors.