Cleveland Cliffs (CLF) Stock Is a Buy for Investors on the Pullback

Cleveland-Cliffs (CLF) stock has lost 23 percent in the last few days. Looking at its future prospects, is CLF a good stock to buy now?

March 1 2021, Published 10:58 a.m. ET

Cleveland Cliffs (CLF) has transformed completely over the last year. In September 2020, it agreed to buy ArcelorMittal's U.S. operations for nearly $1.4 billion. In December 2019, it agreed to acquire AK Steel (the acquisition was complete in 2020). By acquiring these two significant operations, Cleveland-Cliffs has transformed into the largest integrated steel manufacturer from an iron ore pellet producer.

The transformation is a part of Cleveland-Cliffs' complete transformation, which has happened over the past few years. The company was on the brink of bankruptcy in 2014. The new management has completely transformed the company. Its stock price has also surged after trading under $1 for some time. Is Cleveland-Cliffs a good stock to buy now?

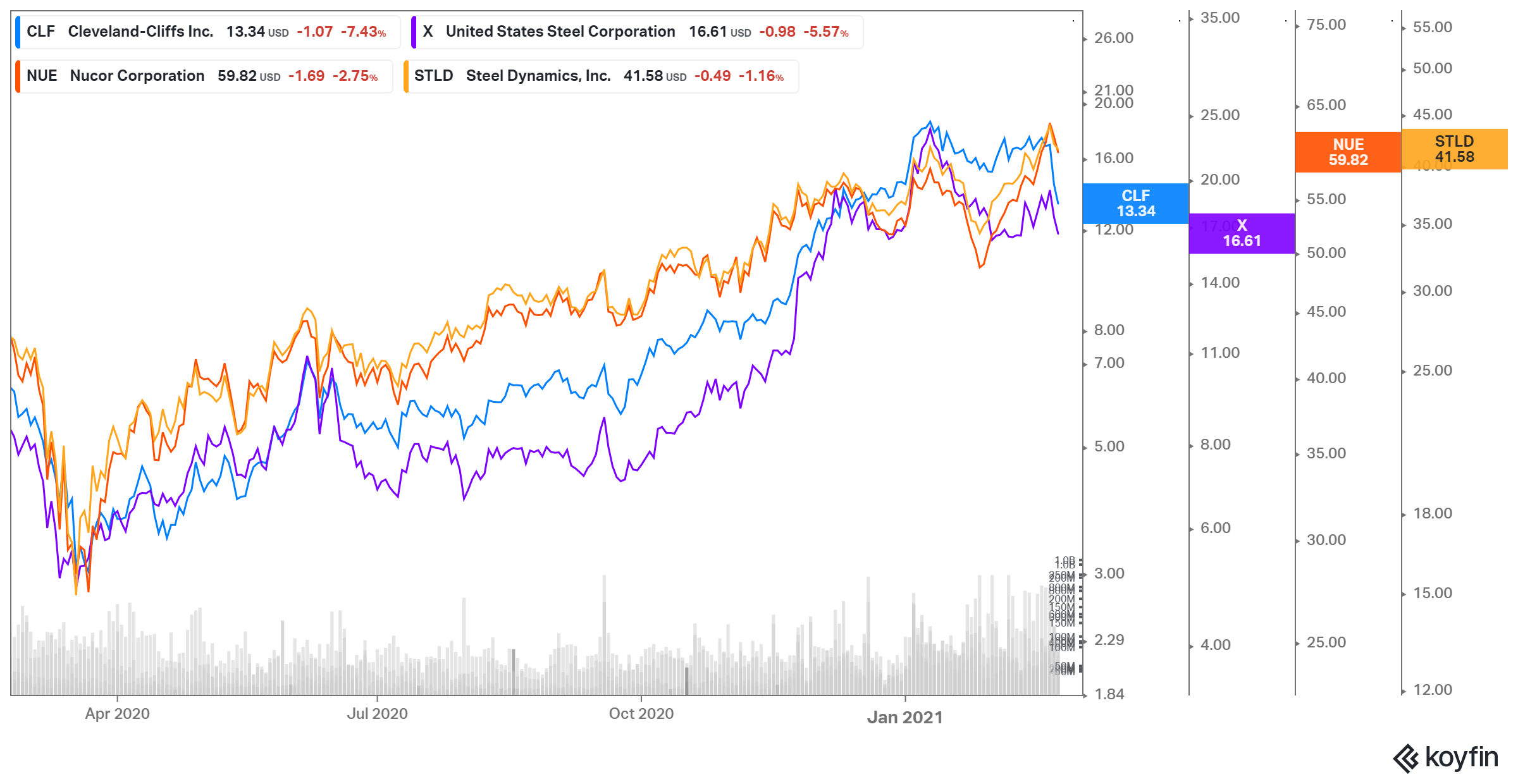

CLF stock has outperformed other steel companies

During the last year, Cleveland Cliffs stock has risen by nearly 107 percent. CLF has outperformed its steel peers during this period. In comparison, U.S. Steel, Nucor, and Steel Dynamics have gained 95 percent, 33 percent, and 54 percent, respectively.

During periods of high steel demand, blast furnaces (operated by CLF and U.S. Steel) can work at a higher capacity. They profit more than companies operating electric arc furnaces (operated by Nucor and Steel Dynamics). The supply cutbacks earlier in 2020 due to the COVID-19 pandemic led to a supply shortage later in the year, which led to higher steel prices. The demand recovery was mainly driven by the automotive industry. Amid the recovery, CLF and U.S. Steel profited more than Nucor and Steel Dynamics, which led to the stock price differential.

Cleveland-Cliffs' HBI Plant

Cleveland-Cliffs was working on the construction of its HBI (hot briquetted iron) plant in Toledo for the last few years. In October 2020, the company announced that the plant’s construction was complete. Late last year, CLF started production at the plant. Its natural gas-based HBI is a cost-competitive premium alternative to imported scrap products. The HBI will also help reduce greenhouse gas emissions.

Currently, Cleveland-Cliffs is making HBI exclusively for its own internal use. The company plans to start shipping the product to third-party customers later in March. The U.S. market has a scarcity of scrap, which should only accelerate new EAF start up. The timing seems favorable for CLF’s HBI plant.

Outlook for U.S. steel companies

Global steel prices, along with U.S. steel prices are soaring. In the U.S., steel is in short supply. According to the Census Bureau, unfilled orders for steel in the last quarter were at the highest level in five years, while the inventories were near a 3.5-year low. The benchmark price for hot-rolled coil steel hit $1,176 per ton this month, which is its highest level in at least 13 years. Can U.S. steel prices keep on pacing higher or have they already hit the peak?

The outlook for U.S. steel prices seems to be bright. Due to last year’s cuts, there's still a shortage in the market, which isn't going to get fulfilled anytime soon from domestic players. Imports are challenging due to tariffs and logistical issues. However, the steel demand continues to hold strong due to the demand for cars and trucks, appliances, and other steel products. The demand-supply gap should keep steel prices buoyant, which is positive for steel companies.

Over the medium to long-term, more capacity will come online. U.S. Steel, Nucor, and Steel Dynamics have already announced several new projects, which will lead to more steel supply in U.S. markets and could pressure prices.

Spreads between U.S. and international prices

The steel spread between the U.S. and international prices is also widening. Reuters reported that U.S. steel prices are 68 percent higher than the global market price and almost double China’s. Even after a 25 percent tariff, it would be cheaper for steel consumers to import than to buy domestically. However, logistical challenges like container shortages and thin overseas supply have kept imports in check, which also keeps the spreads higher.

Biden's policy versus Trump's policy on steel tariffs

Trump was very supportive of the U.S. steel industry. He initiated the tariffs on imported steel citing national security. He invoked Section 232 to impose a 25 percent tariff on steel and a 10 percent tariff on aluminum in 2018. U.S. steel companies enjoyed higher steel prices for a while due to these tariffs. Eventually, the slump in steel demand caused the prices to fall, which negated the benefit.

Currently, steel importers and U.S. steel producers are trying to persuade the Biden administration to side with them. The American Iron and Steel Institute, which represents steelmakers, has been urging Biden to maintain the tariffs to protect the industry from a flood of excess global production. Steel importers are fighting tooth and nail to get the tariffs removed.

Biden has signaled that the tariffs might remain in place. In early February, he reversed a tariff exemption on aluminum imports from the United Arab Emirates maintaining that tariffs on UAE aluminum is “necessary and appropriate in light of our national security interests.”

CLF stock is a buy for investors

CLF has transformed from being the largest U.S. pellet producer to the largest integrated steel manufacturer. The transformation occurred even though the company was on the verge of bankruptcy in 2014. The new management and particularly the CEO have been very far-sighted and have opportunistically bought back debt and low prices, which has led to a comfortable financial position.

Cleveland-Cliffs' acquisition in the steel space enhances the prospects of its iron ore business and adds a high-value proposition to the overall company. CLF is a high-quality stock. The stock has fallen by 23 percent over the last four trading days due to slightly disappointing fourth-quarter results. It's a good opportunity to add the stock on the pullback.