CLF Stock Is Popular on WallStreetBets, Solid Pick for Investors

Cleveland-Cliffs stock has come off its highs. Why is the stock falling and will it go back up on pumping from Reddit group WallStreetBets?

July 6 2021, Published 11:36 a.m. ET

Cleveland-Cliffs (CLF) is among the top 20 discussion topics on Reddit group WallStreetBets. While the stock has dropped in terms of popularity, most WallStreetBets members are bullish on the stock. The stock was falling in early trade on July 6. Should you buy the stock now and will it go back up towards its 52-week highs?

CLF is an integrated steel and iron ore company. The company acquired AK Steel and ArcelorMittal’s U.S. assets and went for forward integration. Both of these companies accounted for most of Cleveland-Cliffs’ revenues before it acquired them.

CLF stock looks undervalued

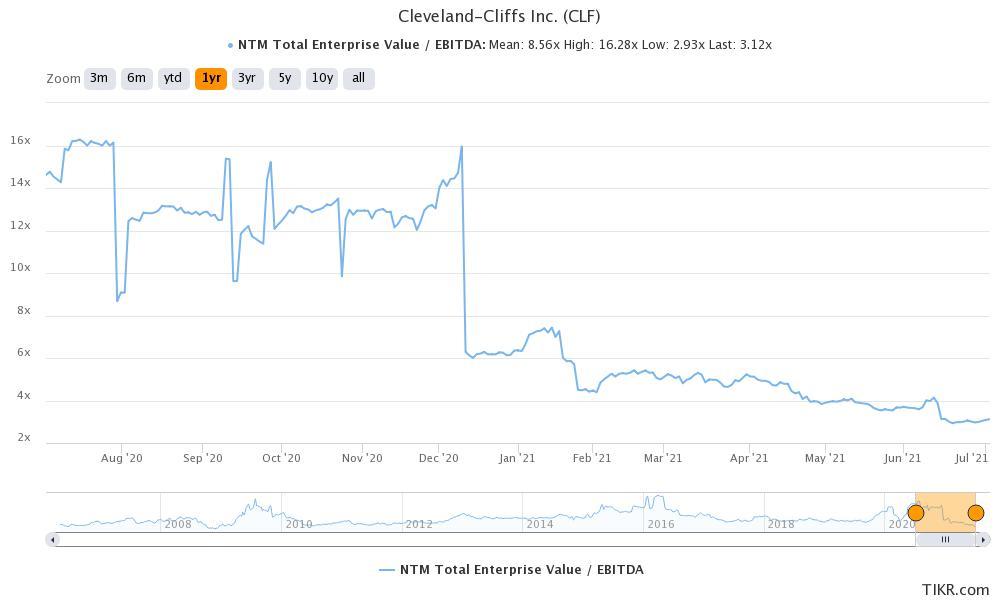

Cleveland-Cliffs expects to post an adjusted EBITDA of $5 billion in 2021. The company has an EV (enterprise value) of around $17.5 billion, which means a 2021 EV-to-EBITDA of 3.5x. The multiples look attractive even though investors should be read with a pinch of salt. The valuation multiples of cyclical stocks are the lowest at their peak.

The multiples still look attractive based on the strong undercurrent in the steel markets. While U.S. steel prices seemed to have peaked, they should settle at a higher level. The Biden administration is pursuing an accommodative fiscal policy that bodes well for the economy and U.S. steel stocks.

The massive infrastructure investments that the Biden administration is planning will help buoy the demand for steel and other metals. There is a strong undercurrent in global steel markets despite inflationary concerns, which should help support a rally in CLF stock.

CLF stock looks undervalued

Why CLF stock looks a good buy now

Apart from the positive macro environment, CLF looks well placed on the company-specific level also. The company gets a large chunk of its revenues from automotive companies whose steel demand should rebound in the second half of 2021 amid the improving chip shortage situation. CLF’s HBI (hot-briquetted iron) facility would be another driver and add shareholder value in the medium to long term.

CLF’s exposure to value-add steel products also bodes well and makes it relatively immune to the threat of higher imports. Automotive companies usually prefer the stability of suppliers over cheap imports.

CLF stock on WallStreetBets

Most of the members of WallStreetBets are positive on CLF stock. A post on the group talked about taking CLF stock to the moon, in the typical WallStreetBets lingo. A member Name-Initial with over 17,600 comment karma commented that the outlook for U.S. steel prices looks strong and also pointed to the infrastructure bill that will help lift demand for U.S. steel mills.

Another user by the name Im_Drake with over 14,200 comment karma termed CLF a "blend of growth and value." Another user by the name winstonmacgregor with almost 28,000 comment karma said that CLF is the only stock on the group that can make money.

Will Cleveland-Cliffs stock go back up?

In the past, I have disagreed with the opinion of Reddit traders especially in meme names like GameStop and AMC Entertainment. Currently, I'm on the same page with the group when it comes to CLF stock. The stock was trading lower in early trading on July 6 and is now down almost 14 percent from the peaks. However, the stock should go back up looking at the tepid valuations and the strength of U.S. steel markets.