U.S. Steel or Cleveland-Cliffs: Which Is the Best Steel Stock to Buy?

X is the best performing stock among the four steel names that we are discussing. It has gained 44 percent YTD based on March 12 closing prices.

March 15 2021, Published 3:52 p.m. ET

Nucor (NUE), Cleveland-Cliffs (CLF), U.S. Steel Corporation (X), and Steel Dynamics (STLD) are the top four steel producers in the U.S. X and CLF mainly produce steel through blast furnaces, while NUE and STLD produce steel in EAFs (electric arc furnaces). Which of these is the best steel stock to buy?

U.S. steel stocks have been on an uptrend this year led by the sharp rise in steel prices. While President Trump claimed that the U.S. steel industry was “thriving” under his watch, steel stocks underperformed during his tenure. However, they have risen sharply since Joe Biden won the presidential election.

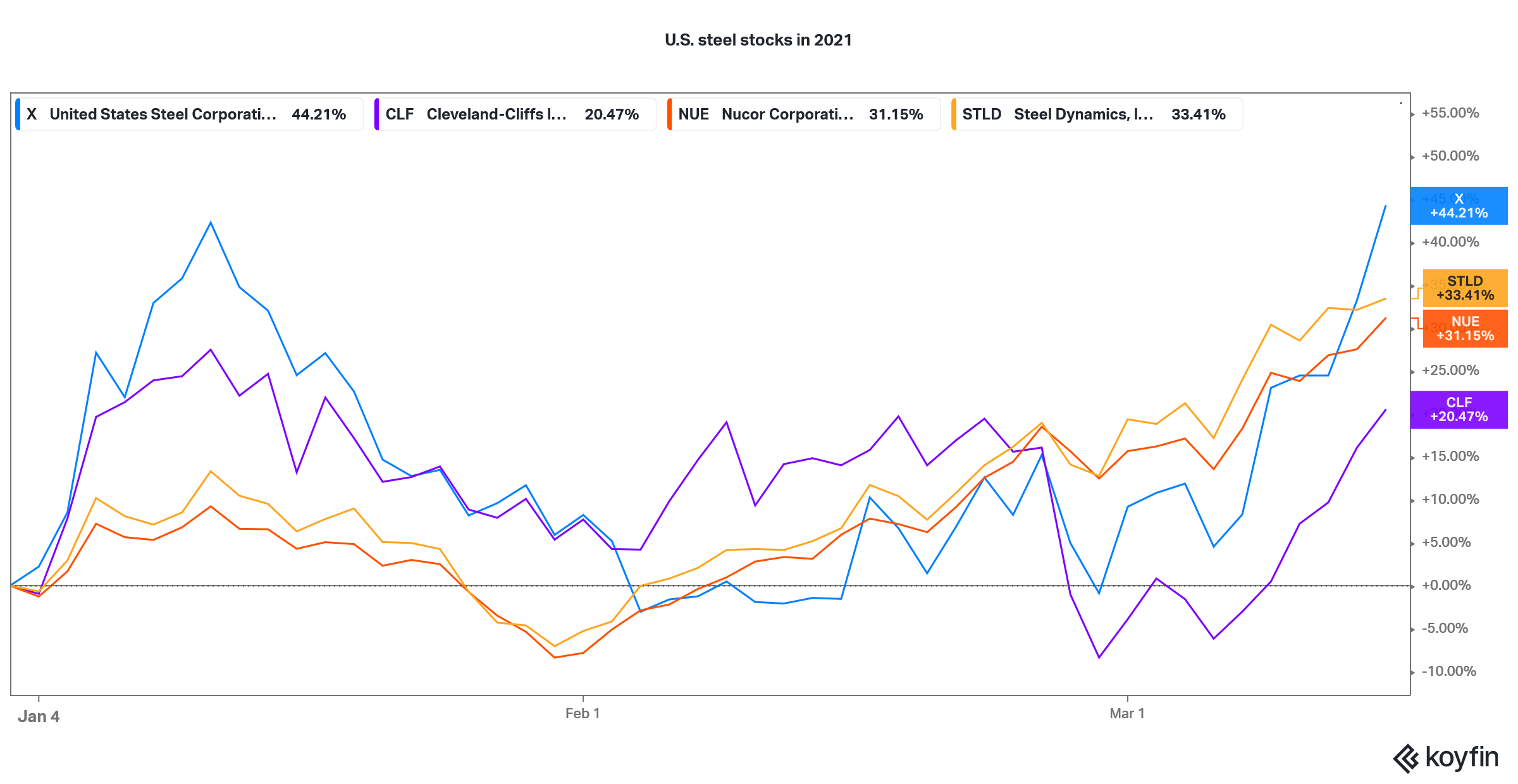

Looking at the YTD price action, X is the best performing stock among the four steel names that we are discussing. It has gained 44 percent YTD based on March 12 closing prices. STLD, NUE, and CLF are up 33 percent, 31 percent, and 20 percent, respectively.

X has outperformed steel peers in 2021

Best steel stocks to buy

Before we analyze the best steel stocks to buy, we need to familiarize ourselves with the difference between blast furnaces and EAFs. Blast furnaces have high operating leverage and companies producing steel in these tend to have a high fixed cost structure.

Generally, the earnings and stock prices of steel companies that produce steel in blast furnaces tend to be more volatile than those that produce steel in EAFs, which have a lower fixed cost structure. Steelmakers that produce steel in blast furnaces tend to outperform in an upcycle, which we currently have.

Mini-mills versus integrated steel companies

However, steel companies like NUE and STLD tend to outperform when the steel cycle turns for the worse. Having a variable cost structure helps them manage the downcycle, which is more of a norm than an exception in the cyclical steel industry—better than companies that produce steel in blast furnaces.

X, which has been producing steel in blast furnaces over the last century, is also investing in EAFs now in a bid to diversify away from the blast furnaces and to have a more variable cost structure like mini-mills. X also acquired Big River Steel, which produces steel in EAF.

Looking at the current upswing in steel markets, investors might be better off in X and CLF, which produce steel in blast furnaces and are integrated steel companies with iron ore operations. Which out of these is the better steel stock to buy?

Is X or CLF a better steel stock to buy?

CLF was an iron ore company before it acquired AK Steel and ArcelorMittal's U.S. operations. Together, both of these companies accounted for most of CLF’s iron ore sales. After acquiring these, CLF has become a vertically integrated steel company like X.

CLF has also constructed the HBI (hot briquetted iron) plant in Toledo. While it's utilizing the HBI internally at first, it intends to start selling HBI soon, which is a raw material for steel companies, to third parties. HBI can be a good revenue opportunity for CLF, especially under the current scenario where steel and hence steel scrap are at elevated levels.

As for X, the company has taken several steps over the last four years to structurally lower its costs. These measures will start reflecting in its earnings in the coming years. Once these investments are complete, X’s cash flow position would also look better.

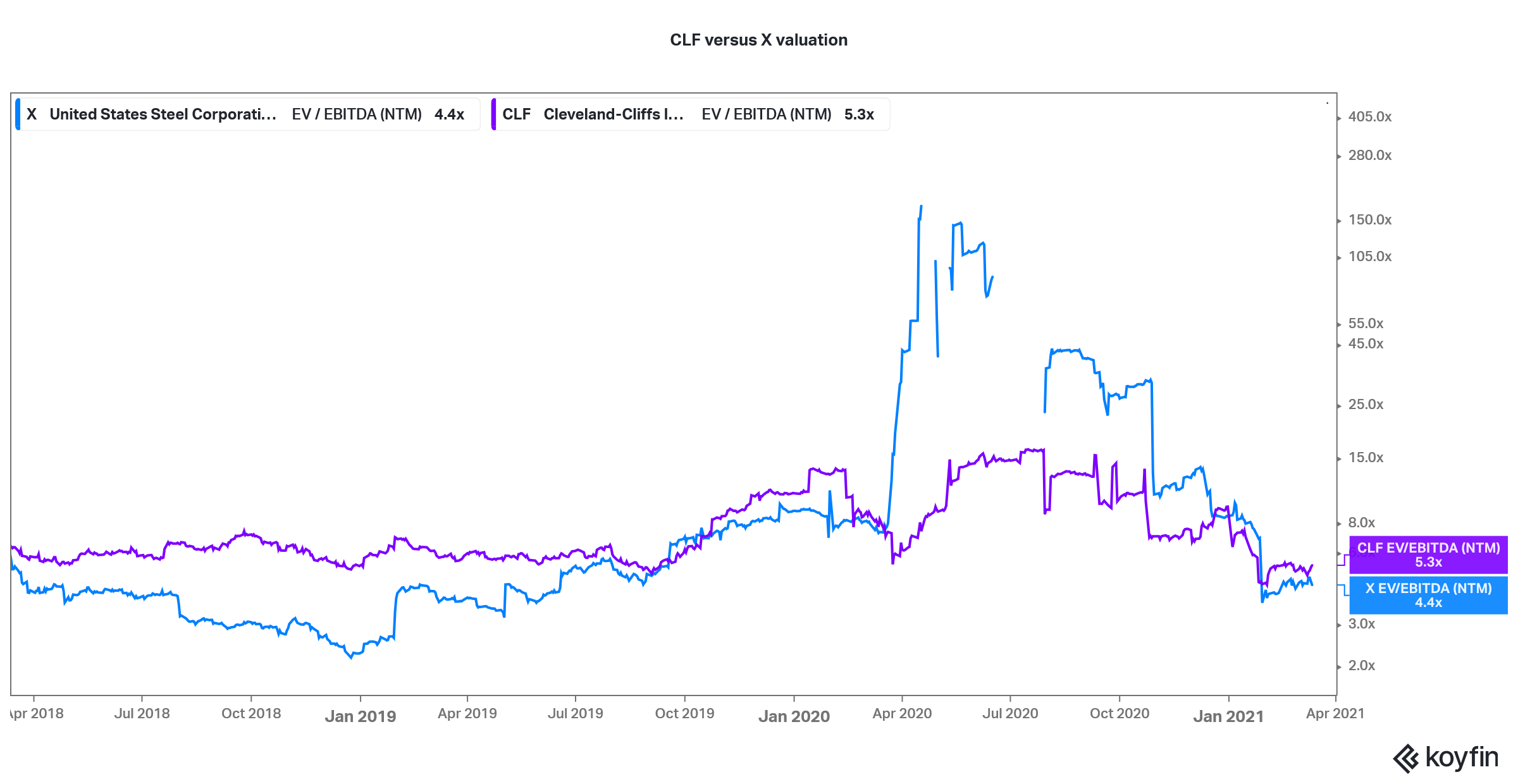

X versus CLF valuation

Looking at valuations, X trades at an NTM EV-to-EBITDA multiple of 4.4x, while CLF trades at an NTM EV-to-EBITDA of 5.3x. Historically, CLF has traded at a premium to X. Both of the stocks look attractively priced even though the valuation of cyclical companies is the lowest at the peaks, which we seem to be approaching.

Meanwhile, if you are looking at the better stock out of X and CLF, you can consider X given the structural earnings improvement story after it completes its asset revitalization program. Also, the company’s Tubular segment could see better days amid the upswing in crude oil prices.